CrowdBureau Online Lending and

Disclosure: The information provided on this page is for illustrative purposes only and is not intended to serve as investment advice. The information provided is as of a particular time and subject to change at any time without notice.

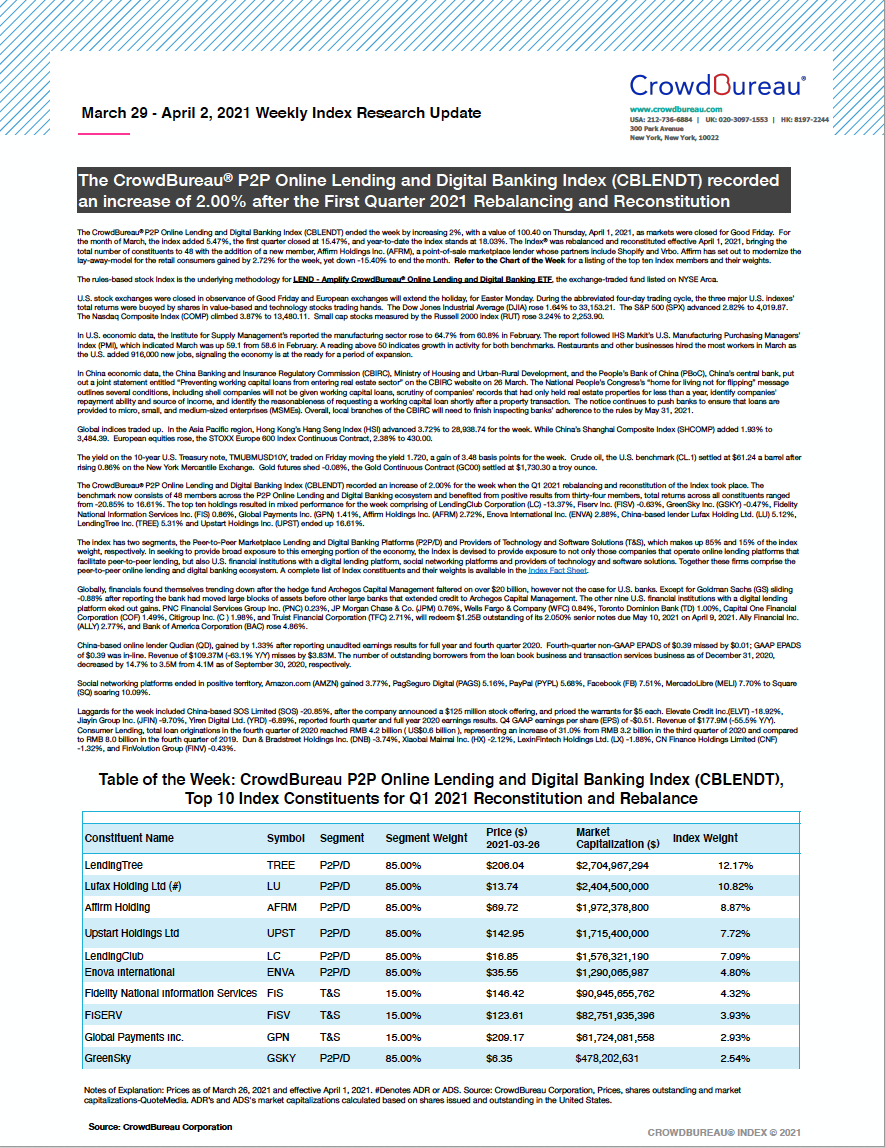

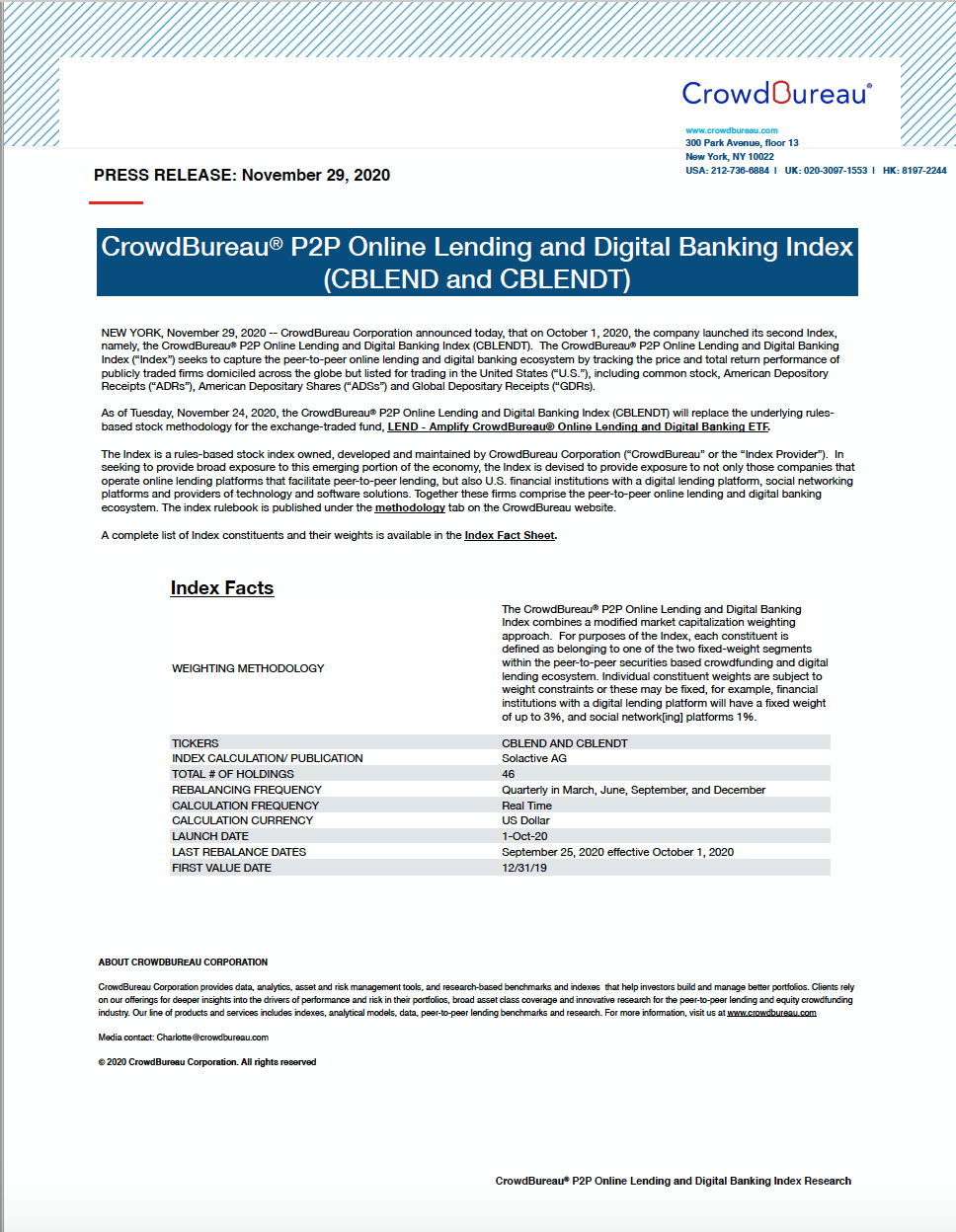

INDEX DEFINITION

The CrowdBureau® P2P Online Lending and Digital Banking Index (“Index”) seeks to capture the peer-to-peer online lending and digital banking ecosystem by tracking the price and total return performance of publicly traded firms domiciled across the globe but listed for trading in the United States (“U.S.”), including common stock, American Depository Receipts (“ADRs”), American Depositary Shares (“ADSs”) and Global Depositary Receipts (“GDRs). The Index is designed to be used as the underlying index for financial products such as exchange traded funds and managed account platforms.

The Index is a rules-based stock index owned, developed and maintained by CrowdBureau Corporation (“CrowdBureau” or the “Index Provider”). In seeking to provide broad exposure to this emerging portion of the economy, the Index is devised to provide exposure to not only those companies that operate online lending platforms that facilitate peer-to-peer lending, but also U.S. financial institutions with a digital lending platform, social networking platforms and providers of technology and software solutions. Together these firms comprise the peer-to-peer online lending and digital banking ecosystem.

INDEX TRENDS

INDEX RESEARCH

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) shed -0.89%, to end the trading session

July 23, 2021

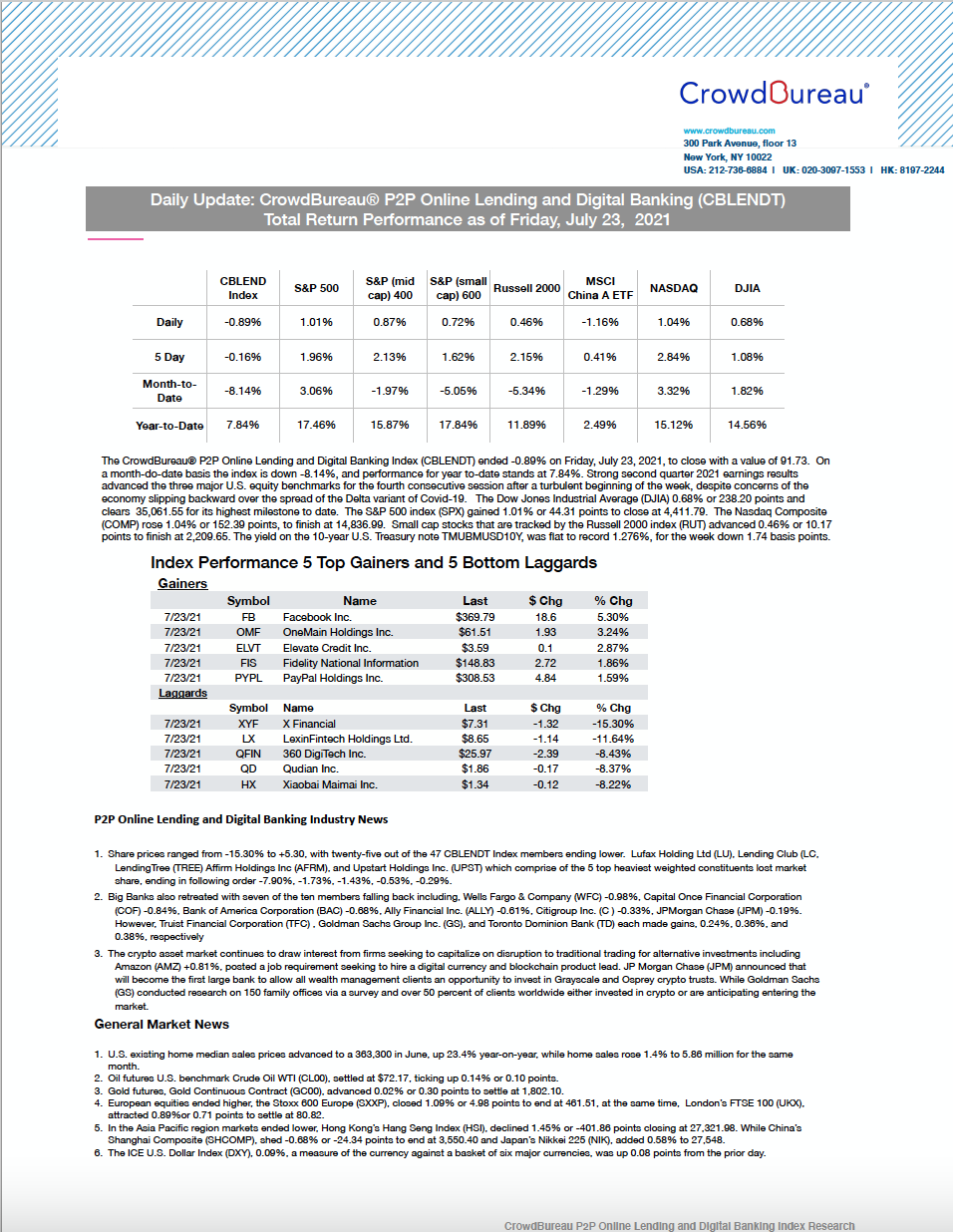

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) ended -0.89% on Friday, July 23, 2021, to close with a value of 91.73. Strong second quarter 2021 earnings results advanced the three major U.S. equity benchmarks for the fourth consecutive session after a turbulent beginning of the week, despite concerns of the economy slipping backward over the spread of the Delta variant of Covid-19.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) dropped -2.42%

July 13, 2021

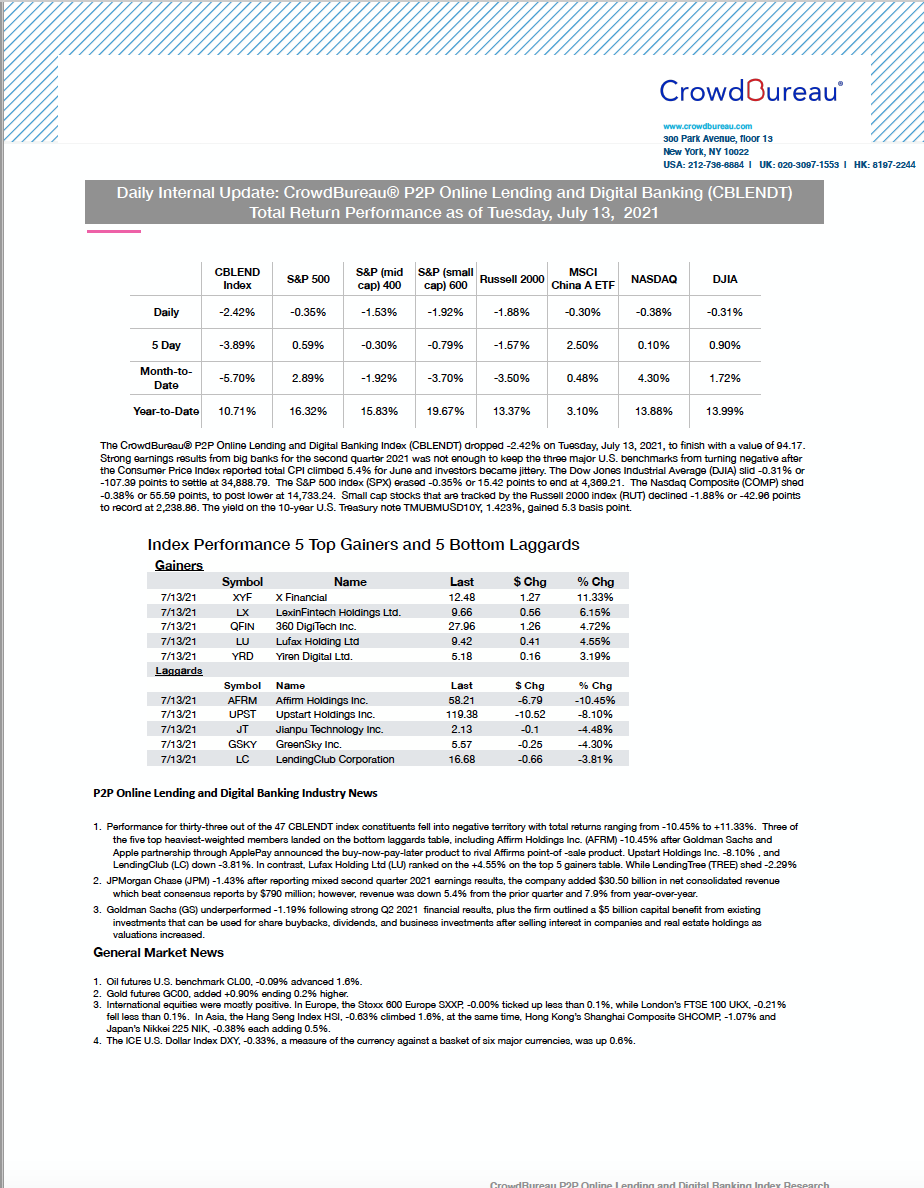

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) dropped -2.42% on Tuesday, July 13, 2021, to finish with a value of 94.17. Strong earnings results from big banks for the second quarter 2021 was not enough to keep the three major U.S. benchmarks from turning negative after the Consumer Price Index reported total CPI climbed 5.4% for June and investors became jittery.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ticked down, -0.04%

July 12, 2021

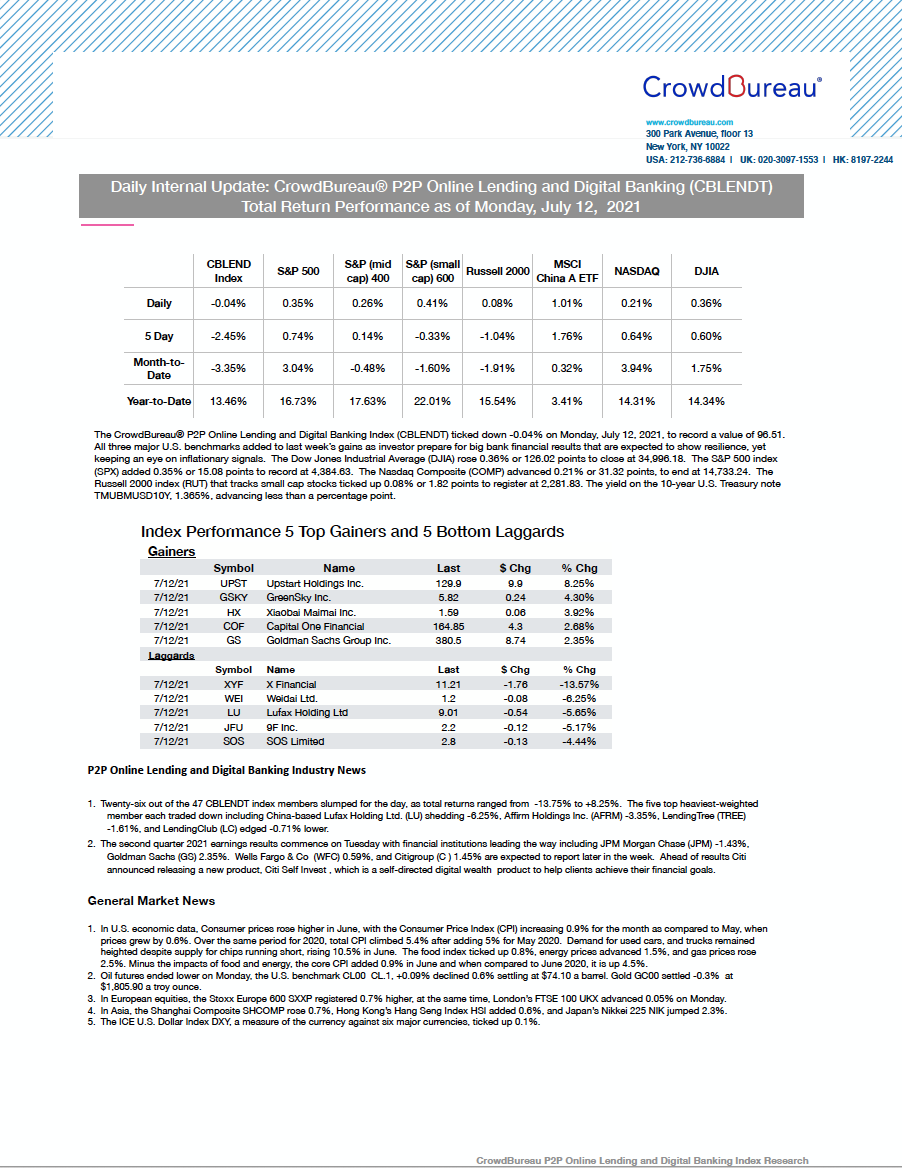

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) ticked down -0.04% on Monday, July 12, 2021, to record a value of 96.51. All three major U.S. benchmarks added to last week’s gains as investor prepare for big bank financial results that are expected to show resilience, yet keeping an eye on inflationary signals.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rebounded, adding 2.58% to end the trading cycle

July 9, 2021

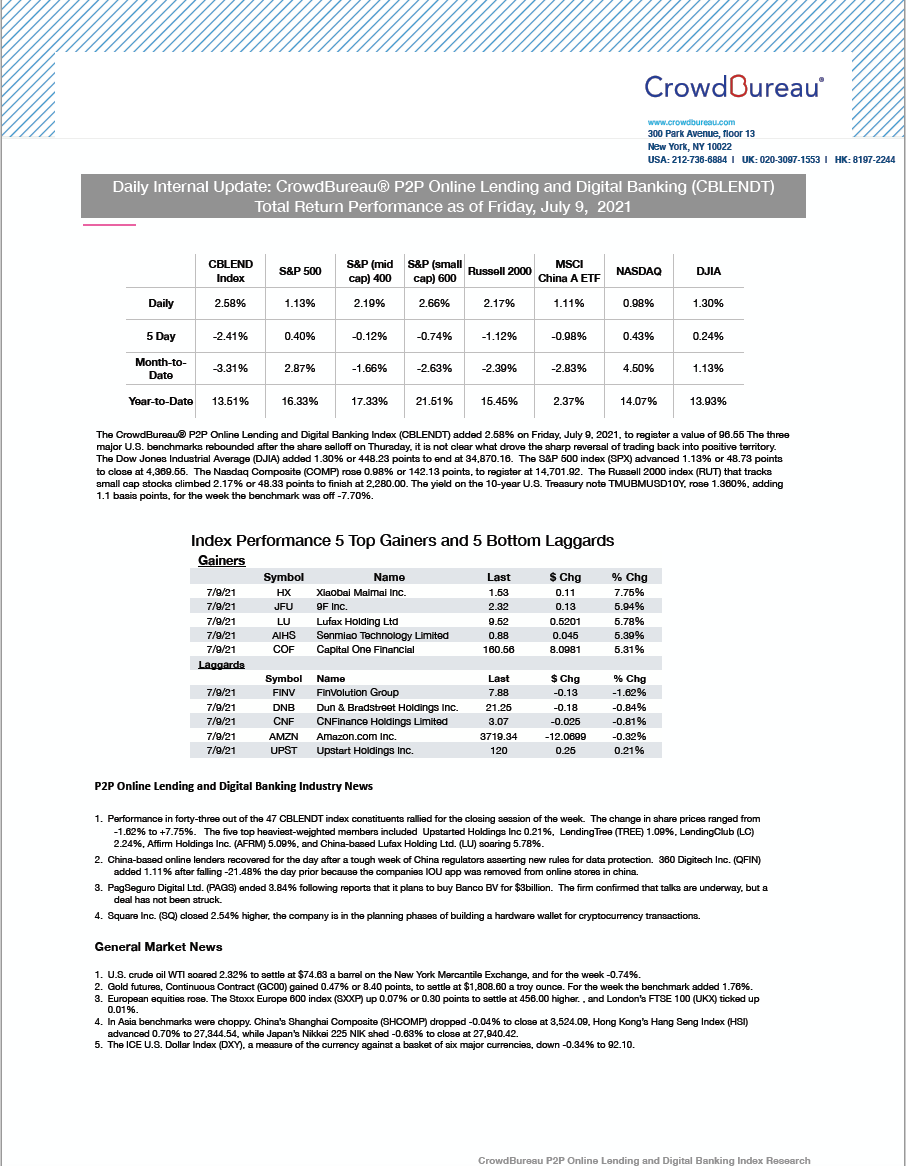

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 2.58% on Friday, July 9, 2021, to register a value of 96.55. The three major U.S. benchmarks rebounded after Thursday’s sell-off, and it is not clear what drove the sharp reversal of trading back into positive territory.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) tumbled -2.67%

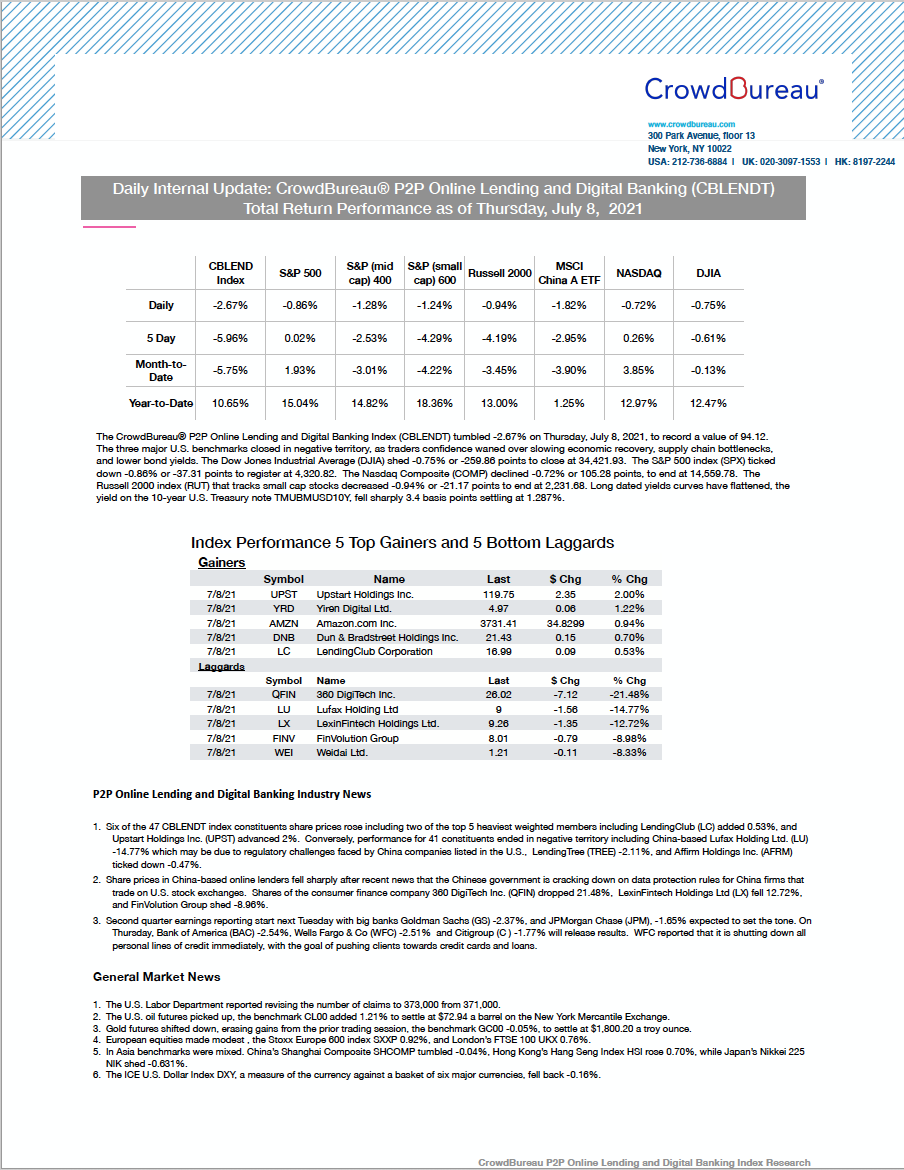

July 8, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) tumbled -2.67% on Thursday, July 8, 2021, to record a value of 94.12. The three major U.S. benchmarks closed in negative territory, as traders confidence waned over slowing economic recovery, supply chain bottlenecks, and lower bond yields.

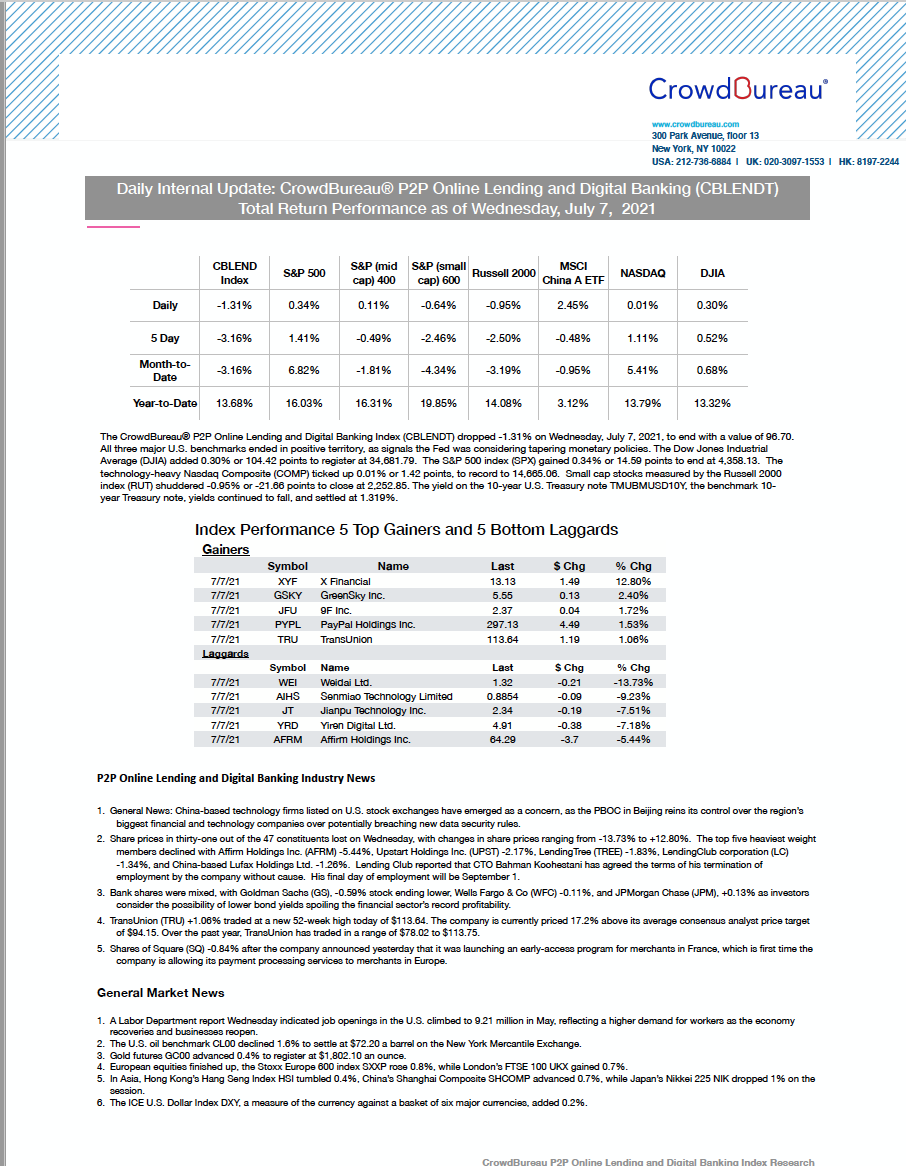

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) lost -1.31%, dropping lower for the trading session

July 7, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) dropped -1.31% on Wednesday, July 7, 2021, to end with a value of 96.70. All three major U.S. benchmarks ended in positive territory, as signals the Fed is considering tapering monetary policies ensued.

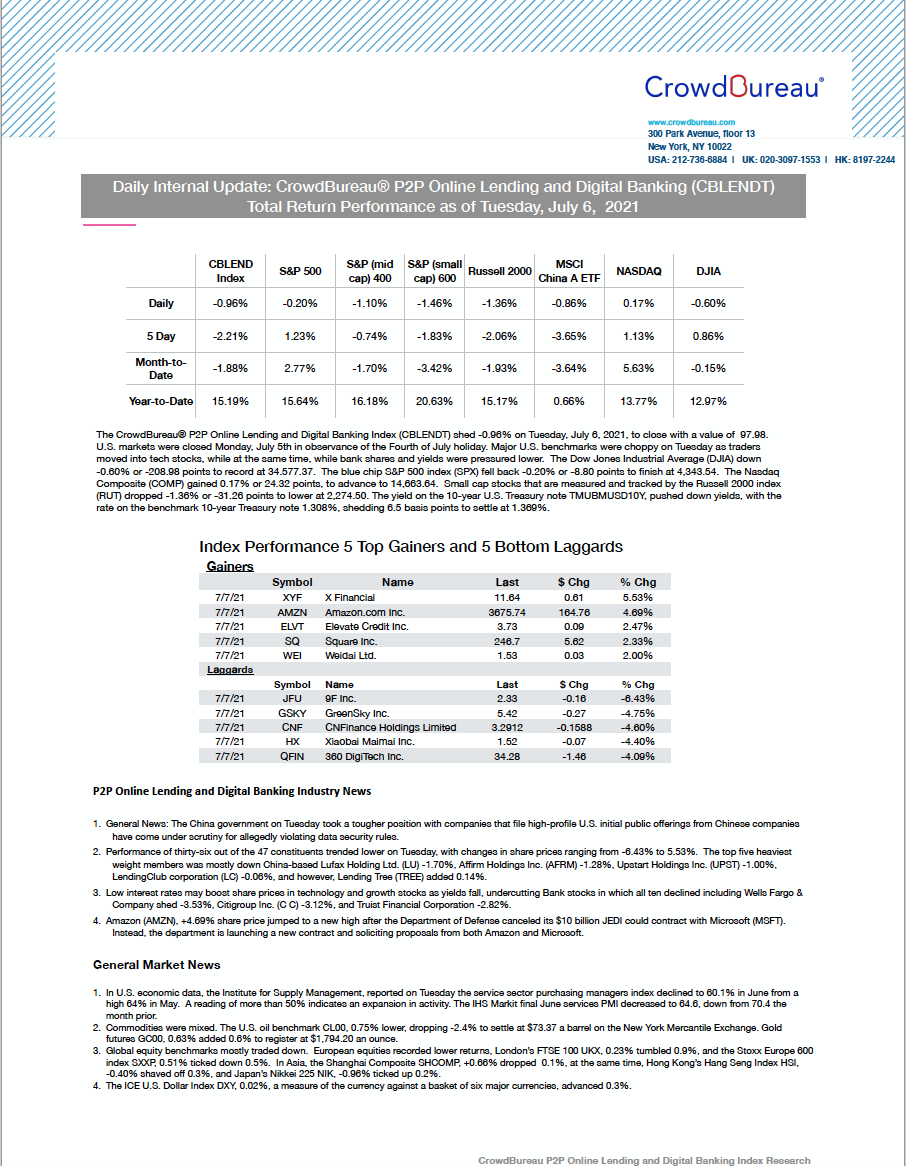

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) shed -0.96%, to close lower

July 6, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) shed -0.96% on Tuesday, July 6, 2021, to close with a value of 97.98. U.S. markets were closed Monday, July 5th in observance of the Fourth of July holiday. Major U.S. benchmarks were choppy on Tuesday as traders moved into tech stocks, while at the same time, bank shares and yields were pressured lower.

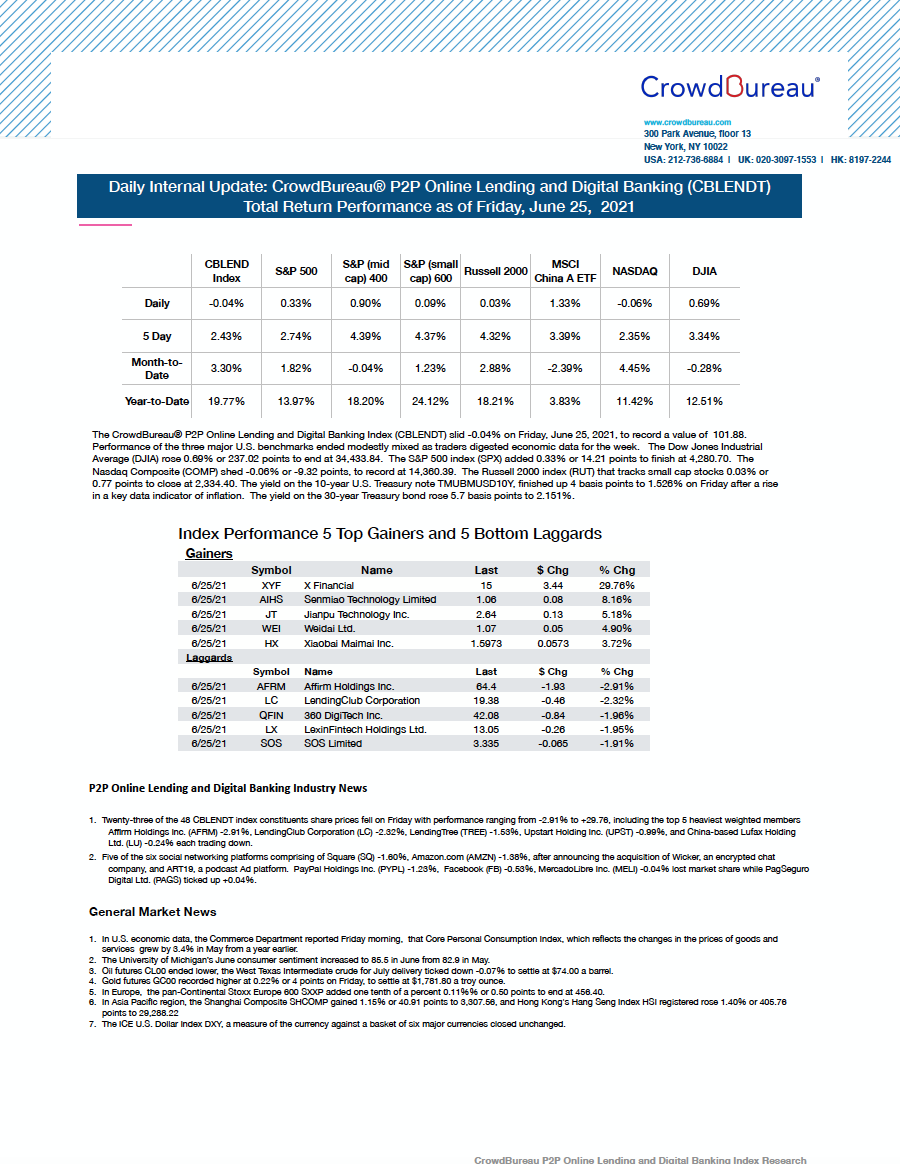

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) nudged down -0.04%, to end the trading session

June 25, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) slid -0.04% on Friday, June 25, 2021, to record a value of 101.88. Performance of the three major U.S. benchmarks ended modestly mixed as traders digested economic data for the week.

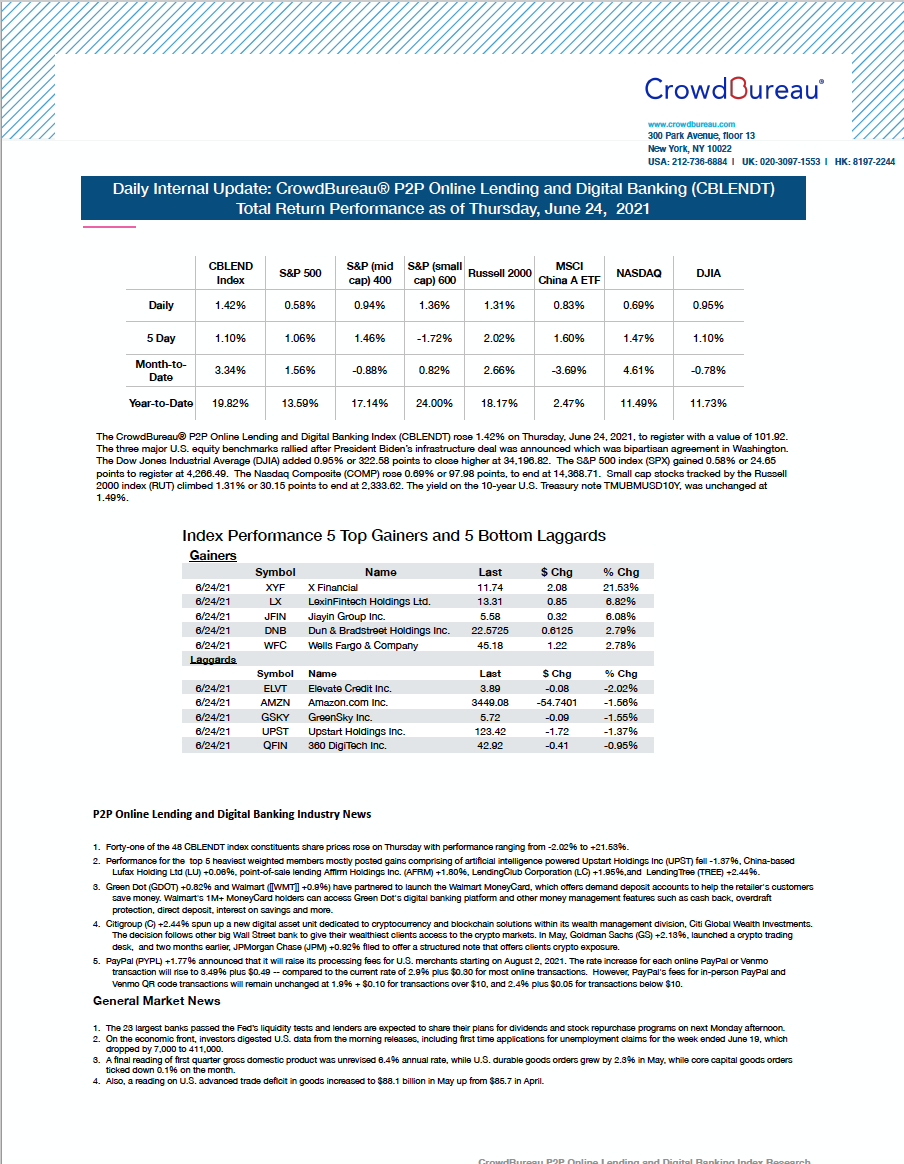

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +1.42%

June 24, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 1.42% on Thursday, June 24, 2021, to register with a value of 101.92. The three major U.S. equity benchmarks rallied after President Biden’s infrastructure deal was announced which was bipartisan agreement in Washington.

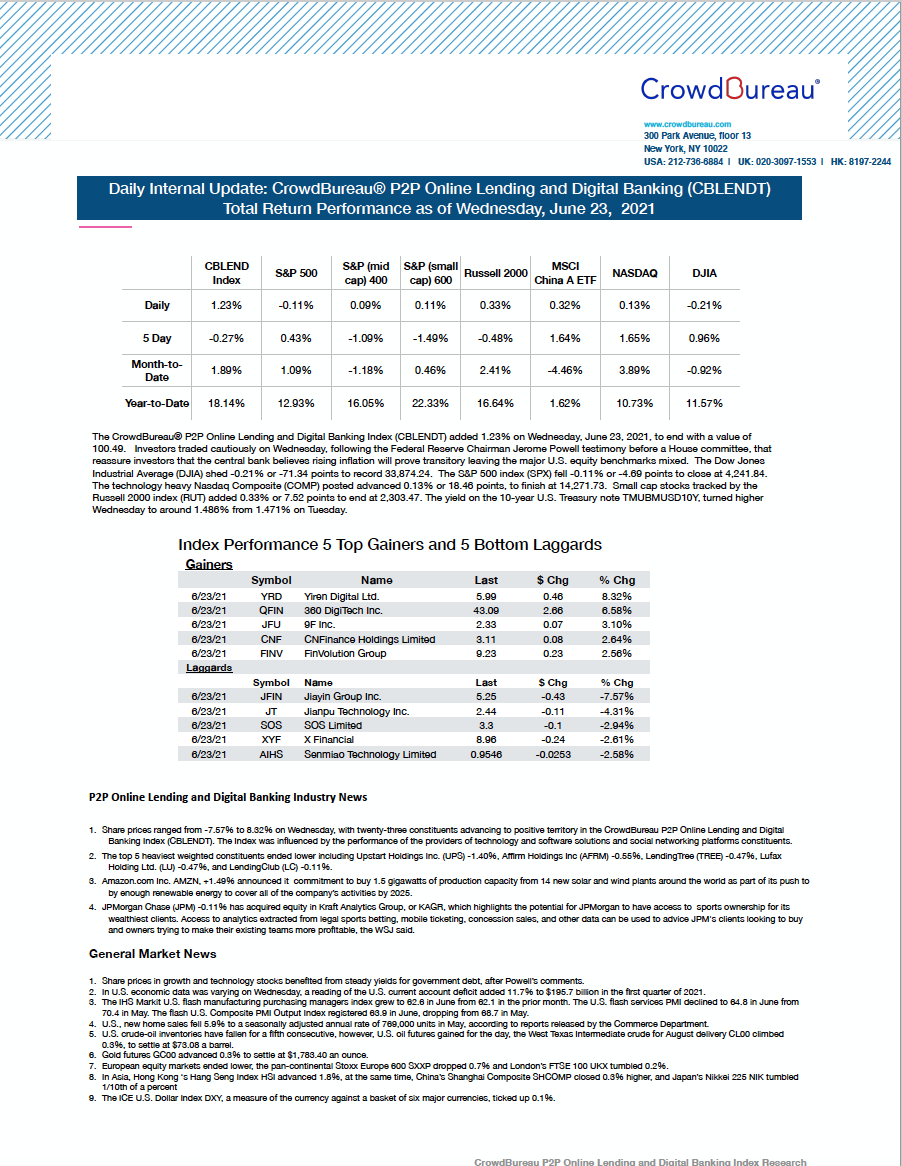

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added 1.23%

June 23, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 1.23% on Wednesday, June 23, 2021, to end with a value of 100.49. Investors traded cautiously on Wednesday, following the Federal Reserve Chairman Jerome Powell testimony before a House committee, that reassure investors that the central bank believes rising inflation will prove transitory leaving the major U.S. equity benchmarks mixed.

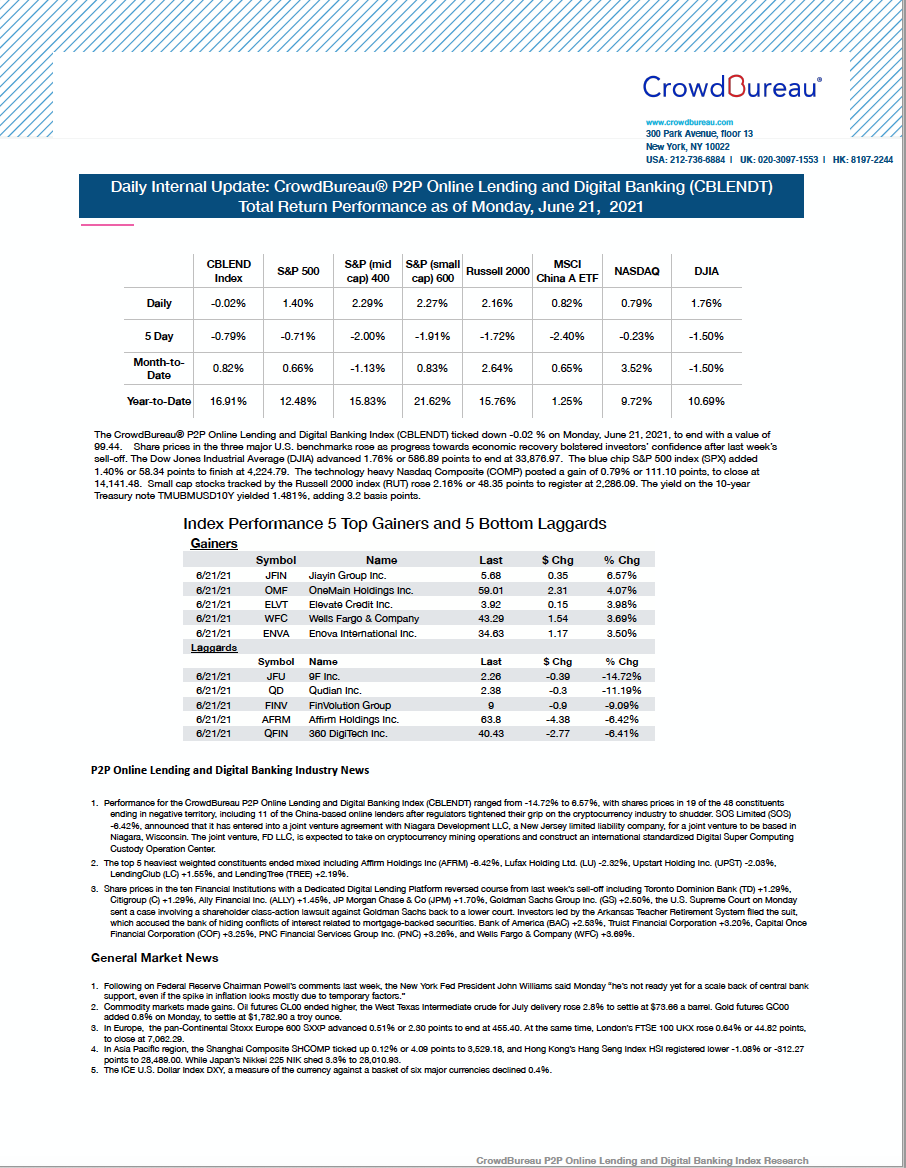

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ended slightly lower, ticking down -0.02%

June 21, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) ticked down -0.02% on Monday, June 21, 2021, to end with a value of 99.44. Share prices in the three major U.S. benchmarks rose as progress towards economic recovery bolstered investors’ confidence after last week’s sell-off.

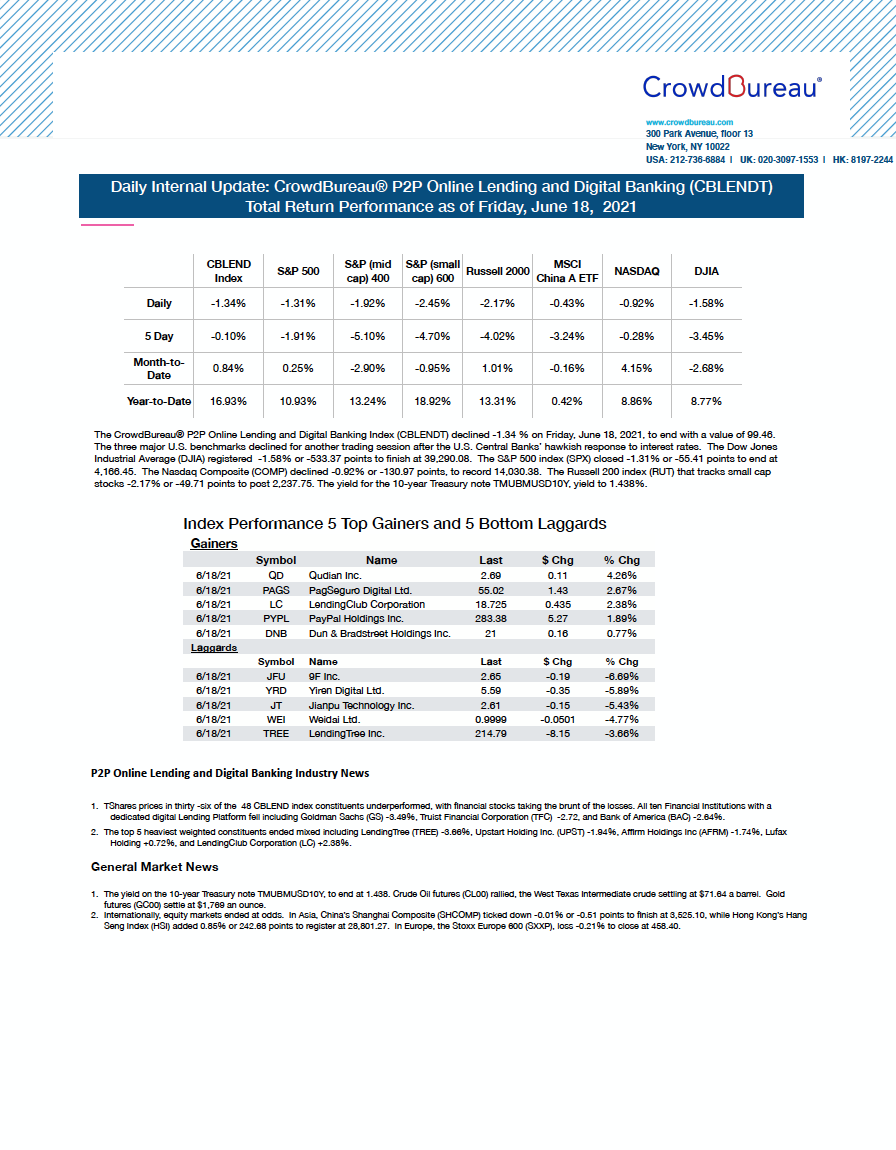

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) declined -1.34%

June 18, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) declined -1.34 % on Friday, June 18, 2021, to end with a value of 99.46. The three major U.S. benchmarks declined for another trading session after the U.S. Central Banks’ hawkish response to interest rates.

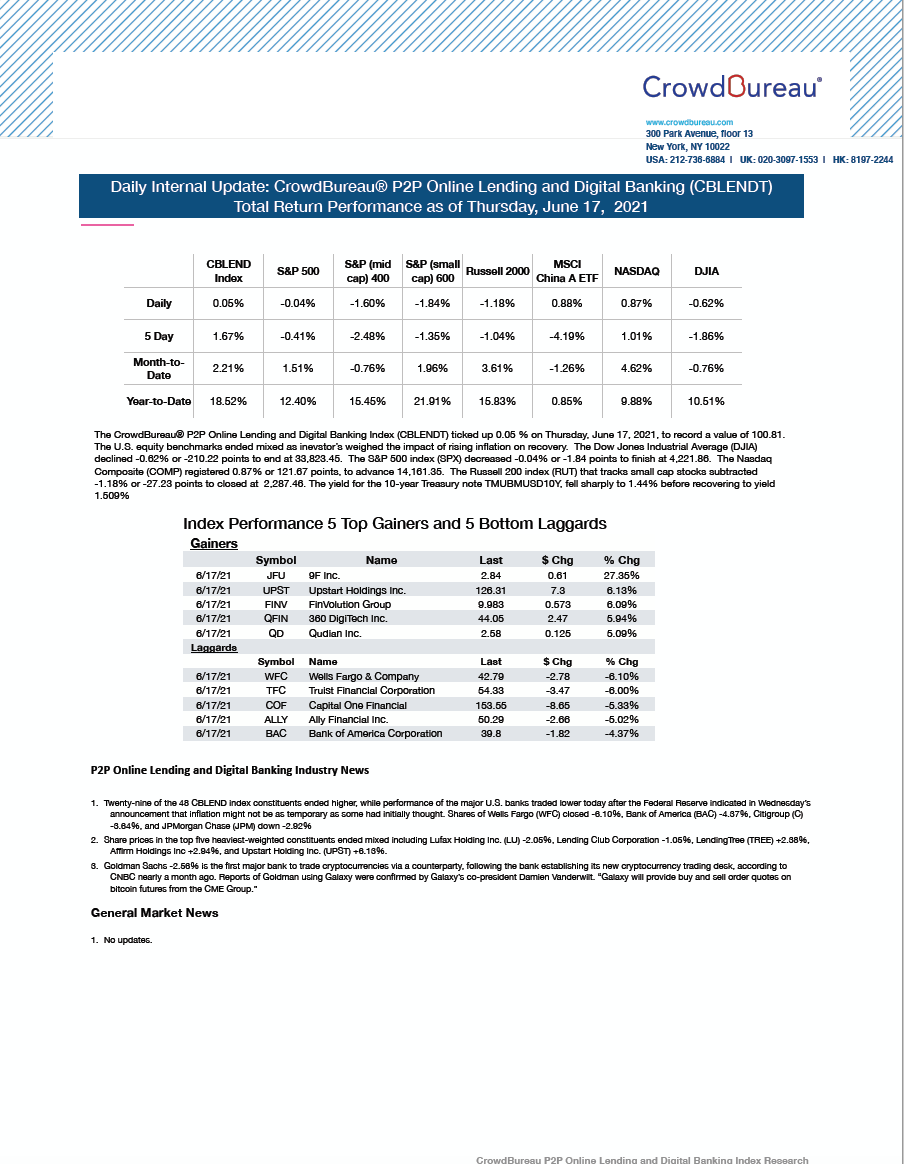

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ticked up +0.05%

June 17, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) ticked up 0.05 % on Thursday, June 17, 2021, to record a value of 100.81. The U.S. equity benchmarks ended mixed as investor’s weighed the impact of rising inflation on the U.S. economic recovery given interest rates are expected to remain low until 2023.

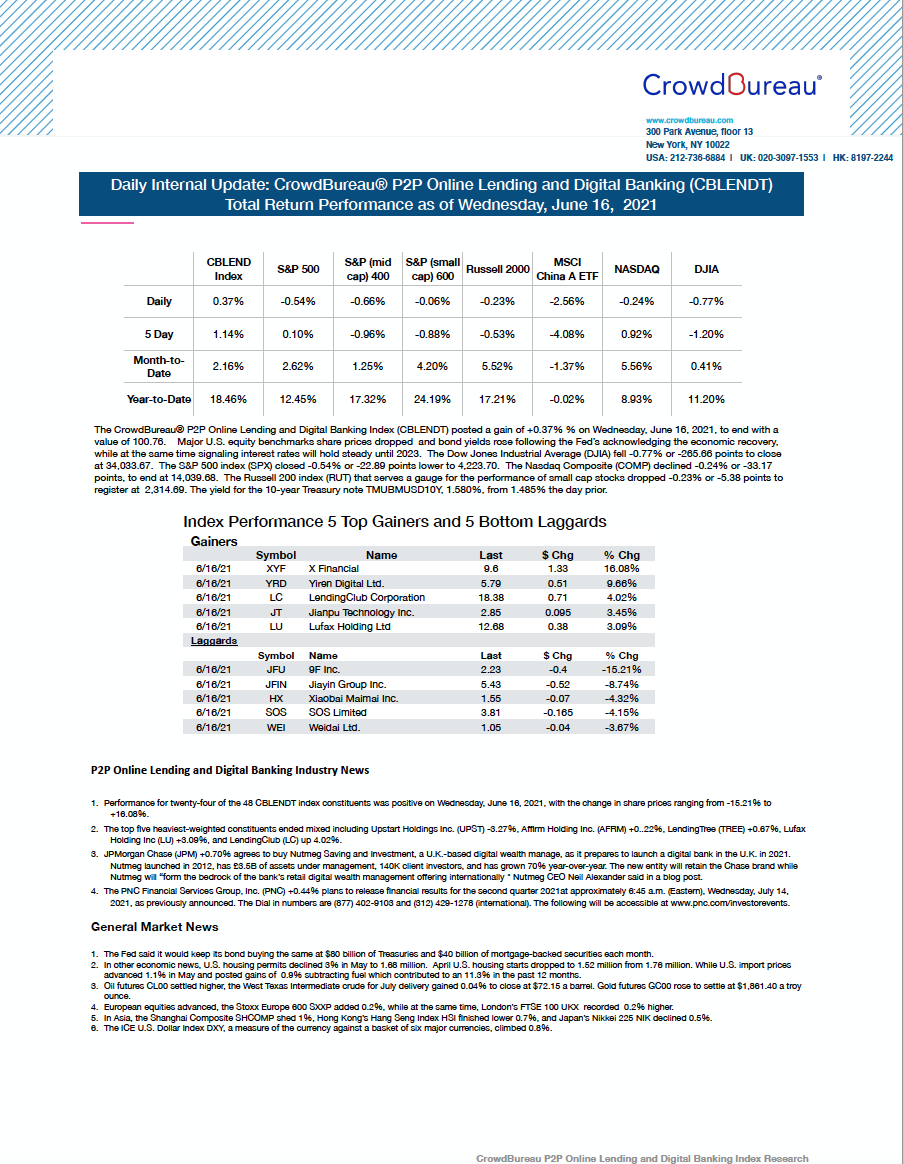

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) posted a gain of +0.37%

June 16, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) posted a gain of +0.37% on Wednesday, June 16, 2021, to end with a value of 100.76. Major U.S. equity benchmarks share prices dropped and bond yields rose following the Fed’s acknowledging the economic recovery, while at the same time signaling interest rates will hold steady until 2023.

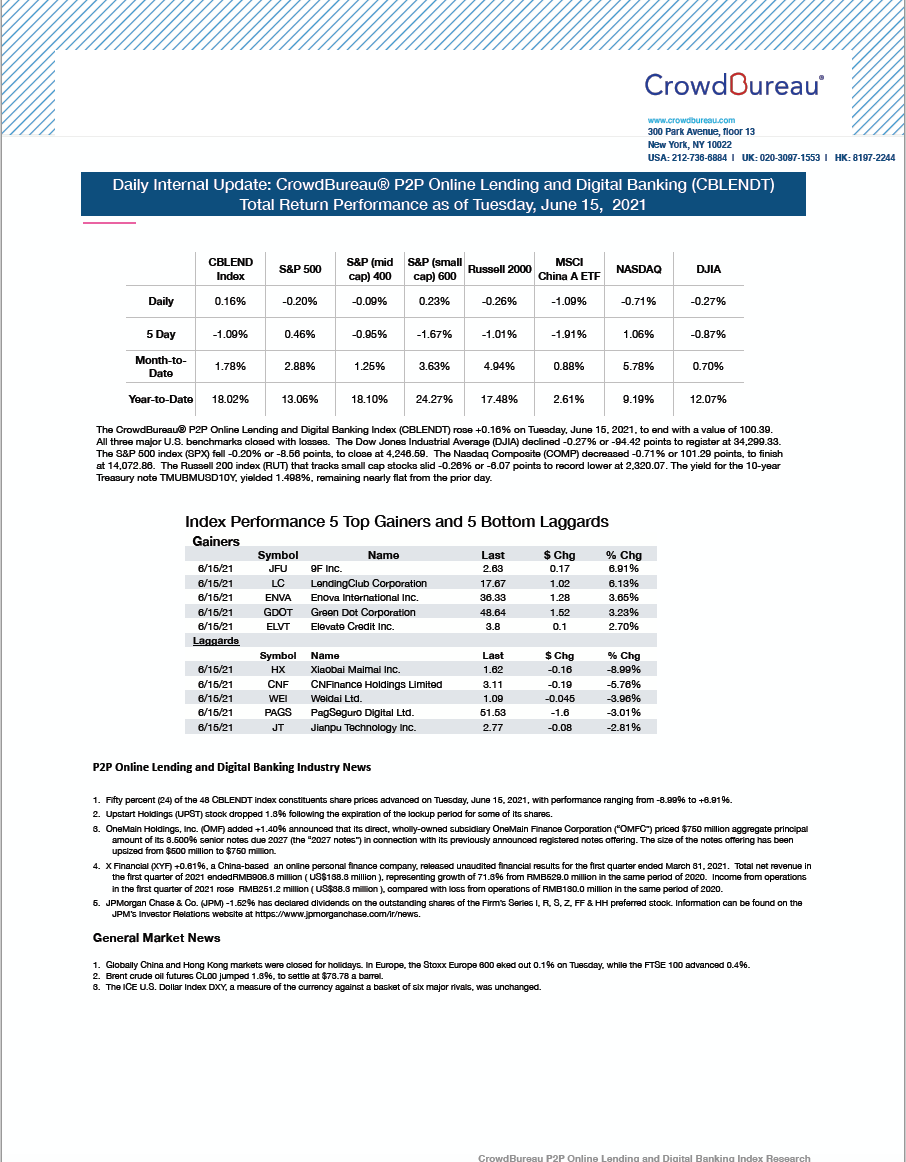

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +016%, to rise for a second consecutive day

June 15, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose +0.16% on Tuesday, June 15, 2021, to end with a value of 100.39. All three major U.S. benchmarks closed with losses.

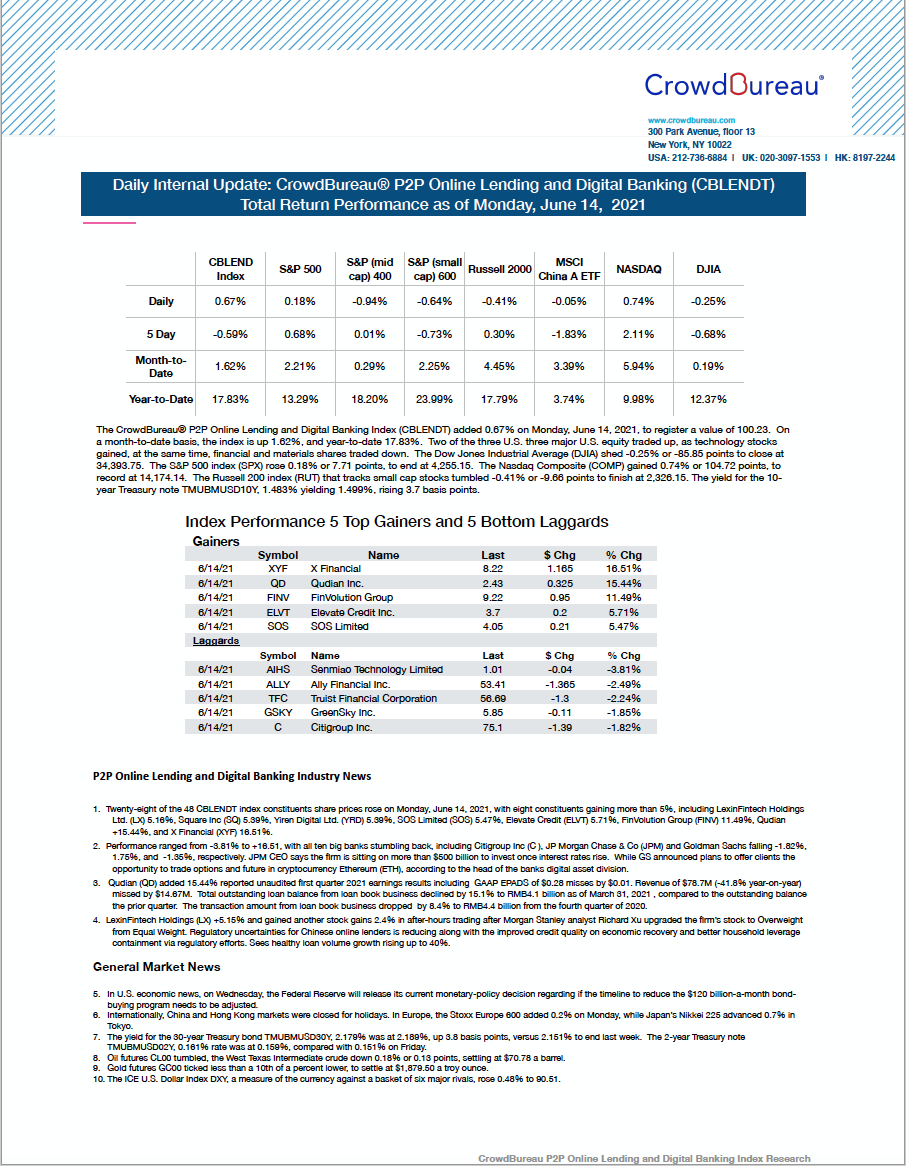

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +0.67%

June 14, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 0.67% on Monday, June 14, 2021, to register a value of 100.23. On a month-to-date basis, the index is up +1.62%, and year-to-date +17.83%. Two of the three U.S. three major benchmarks traded up, as technology stocks gained at the same time, financial and materials shared traded down.

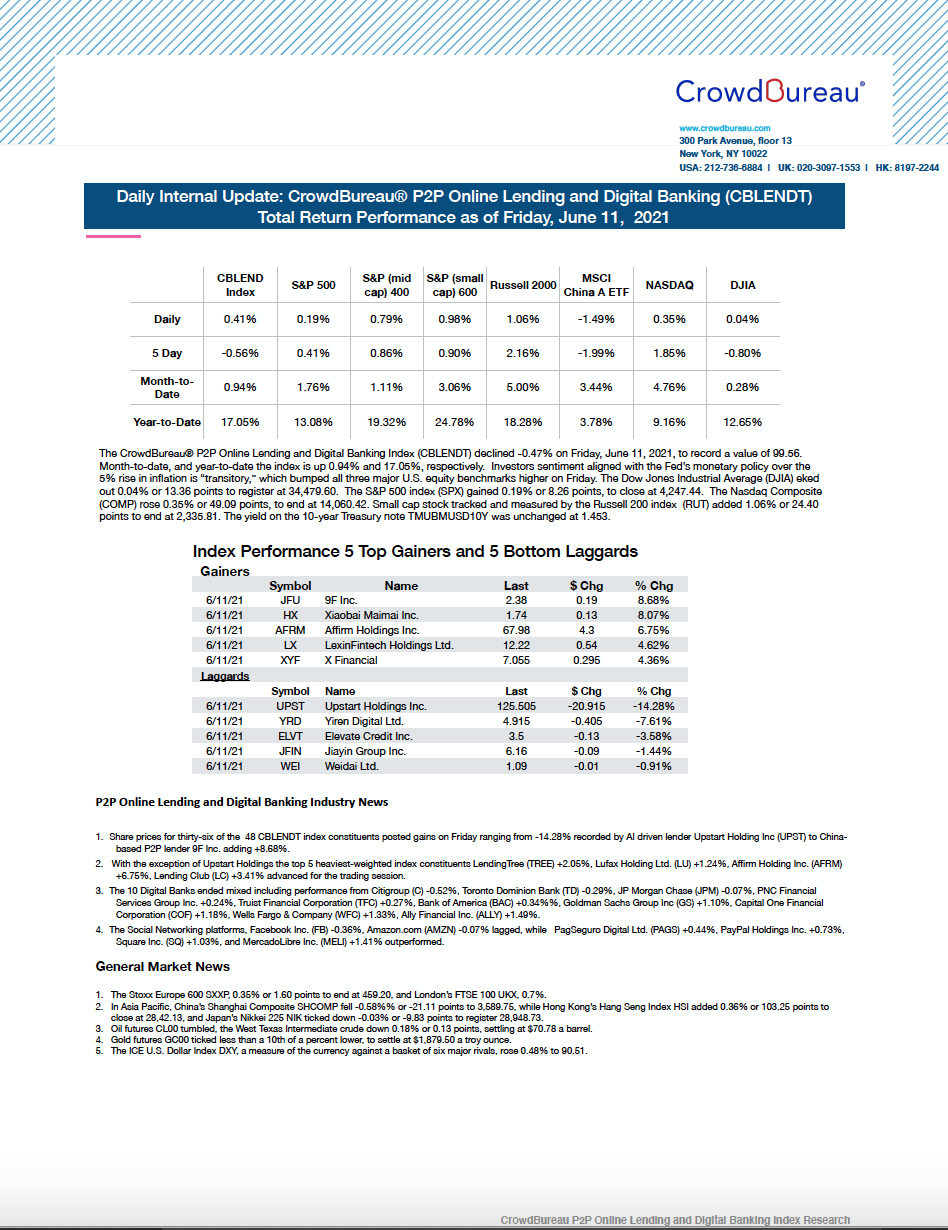

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +0.41%, to end in positive territory

June 11, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose +0.41% on Friday, June 11, 2021, to record a value of 99.56. Investors sentiment was unshaken over the 5% rise in inflation, amid the Fed’s monetary policy comments, “that inflation is transitory.” All three major U.S. equity benchmarks inched higher on Friday.

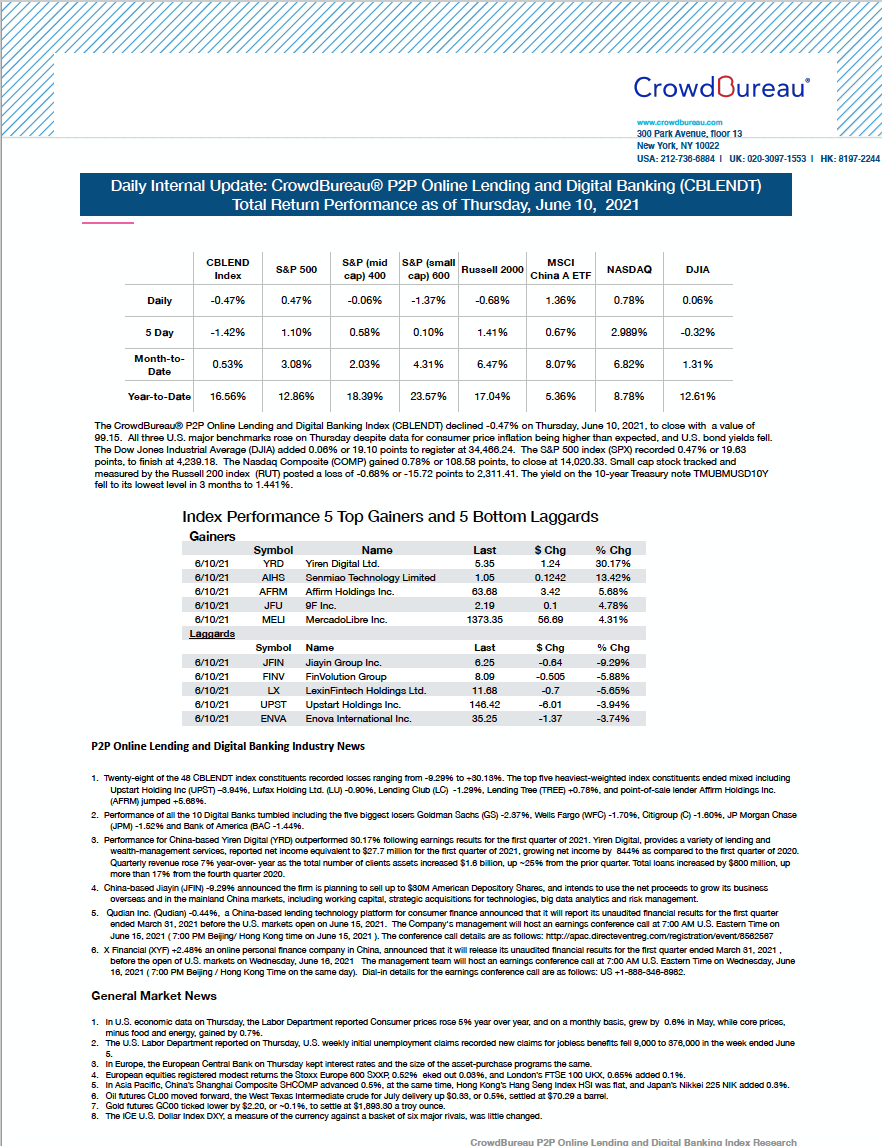

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) declined -0.47%

June 10, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) declined -0.47% on Thursday, June 10, 2021, to close with a value of 99.15. All three U.S. major benchmarks rose on Thursday despite data for consumer price inflation being higher than expected, and U.S. bond yields fell.

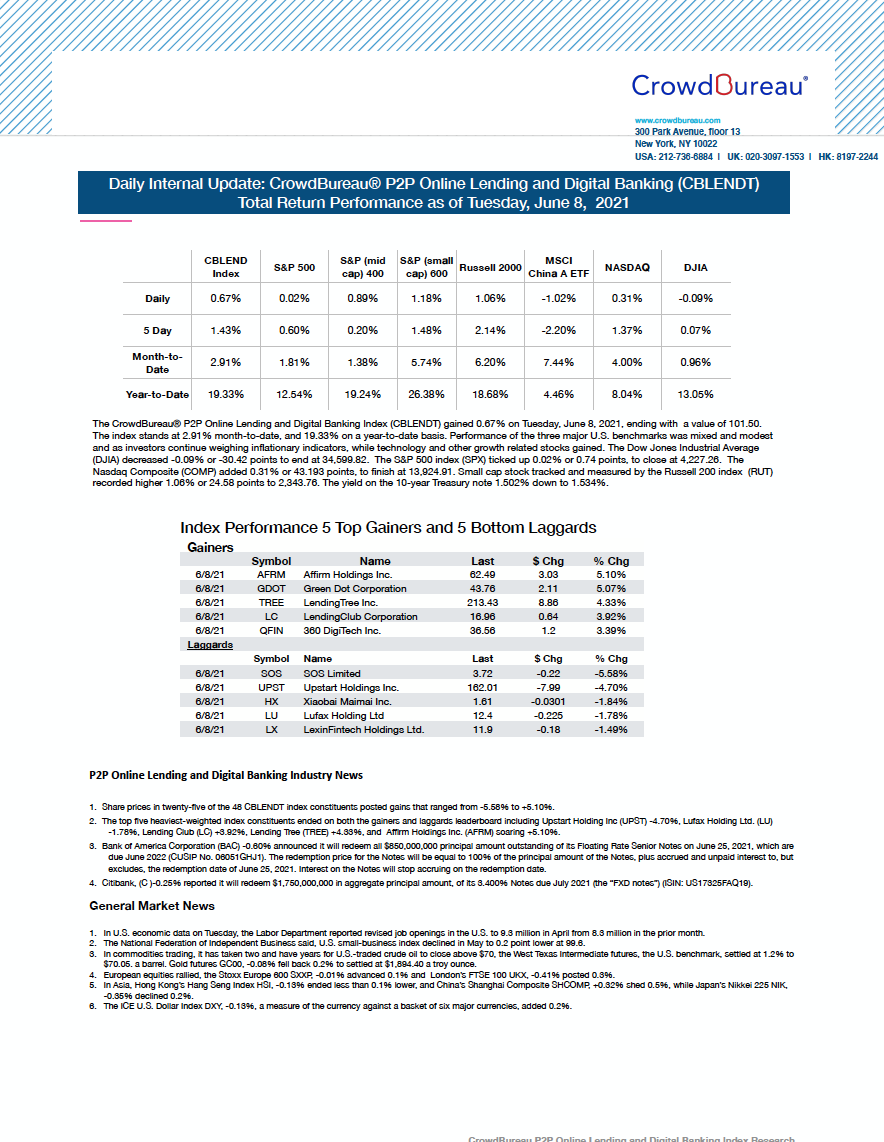

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) posted a gain of +0.67%

June 8, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) gained 0.67% on Tuesday, June 8, 2021, ending with a value of 101.50. The index stands at 2.91% month-to-date, and 19.33% on a year-to-date basis. Performance of the three major U.S. benchmarks was modest and as investors continue weighing inflationary indicators, while technology and other growth related stocks gained.

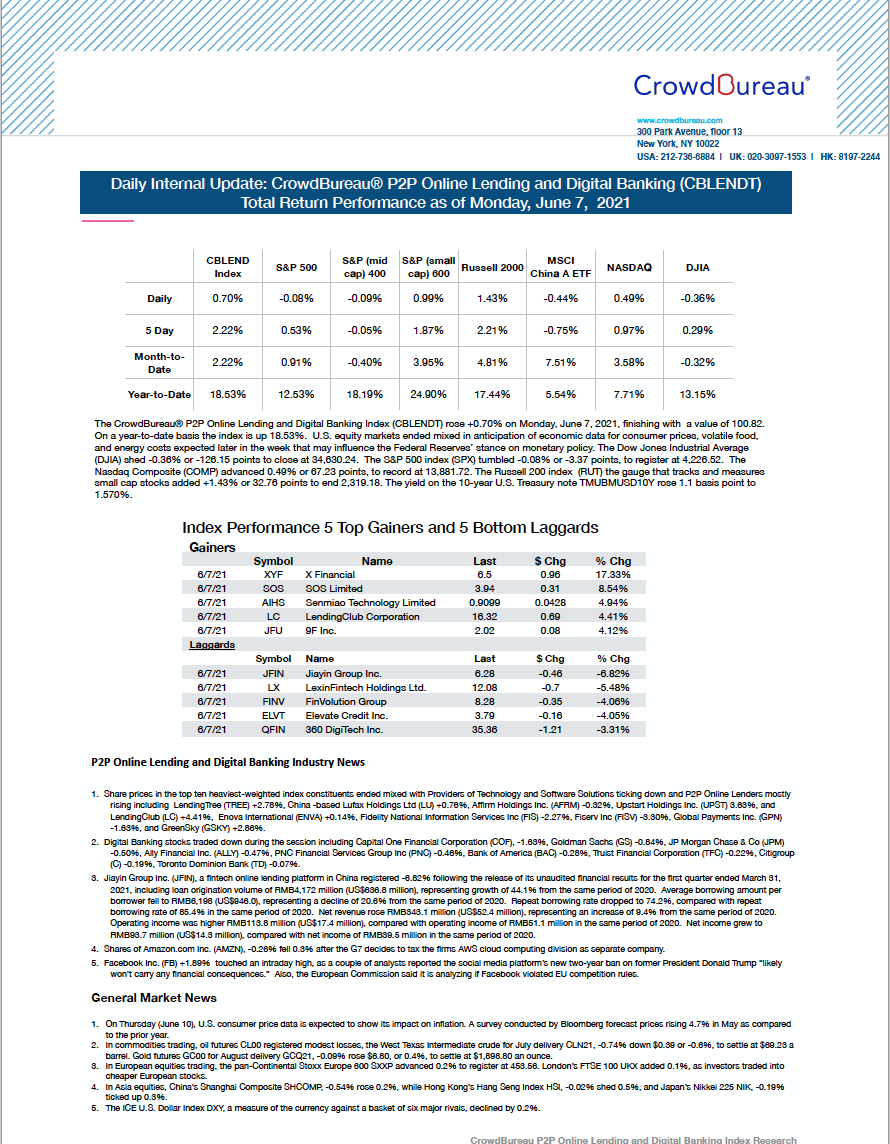

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +0.70%, to end the trading session

June 7, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose +0.70% on Monday, June 7, 2021, finishing with a value of 100.82. On a year-to-date basis the index is up 18.53%. U.S. equity markets ended mixed in anticipation of economic data for consumer prices, volatile food, and energy costs expected later in the week that may influence the Federal Reserves’ stance on monetary policy.

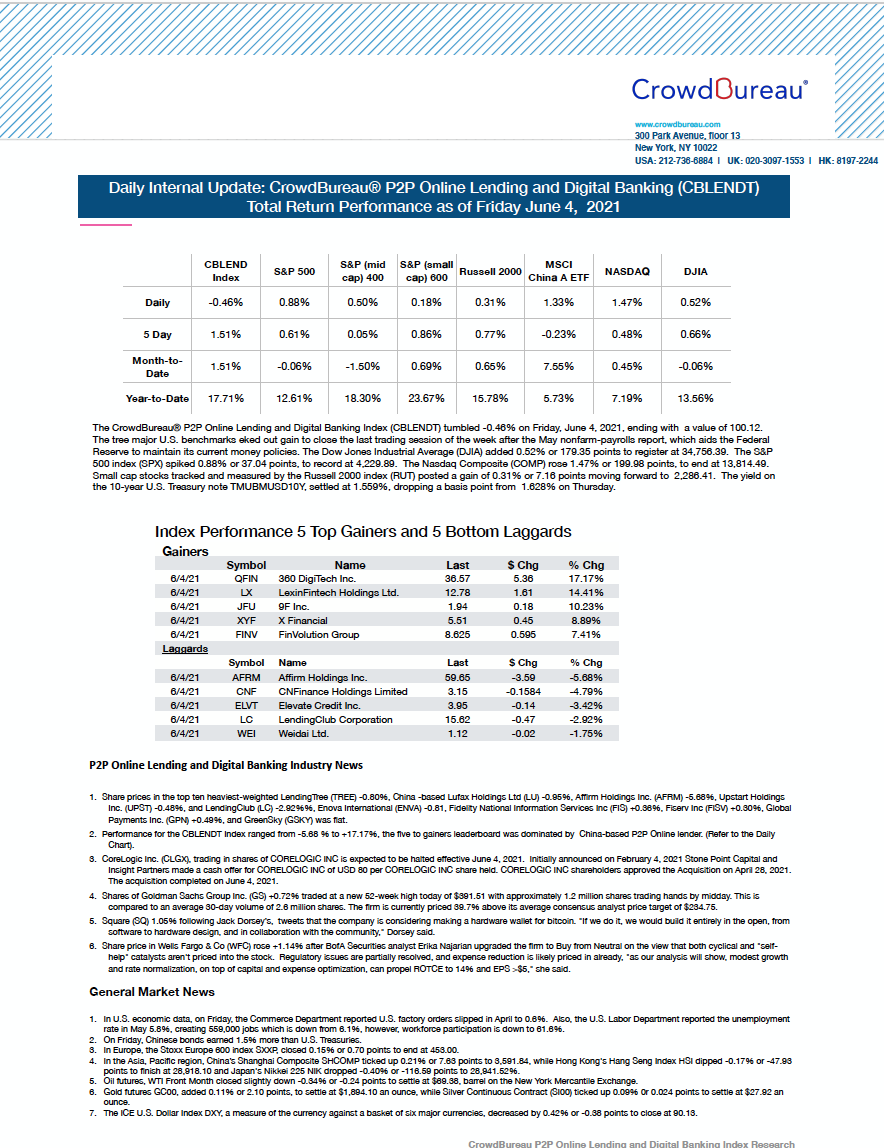

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) tumbled -0.46%

June 4, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) tumbled -0.46% on Friday, June 4, 2021, ending with a value of 100.12. The three major U.S. benchmarks eked out gains to close the last trading session of the week after the May nonfarm-payrolls report slightly lower-than -expected results, which may aid the Federal Reserve in maintaining its current money policies.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) shed -0.76%, to end lower

June 3, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) shed -0.76% on Thursday, June 3, 2021, to close with a value of 100.58. The three major U.S. benchmarks traded mixed as investors anticipated unemployment data.

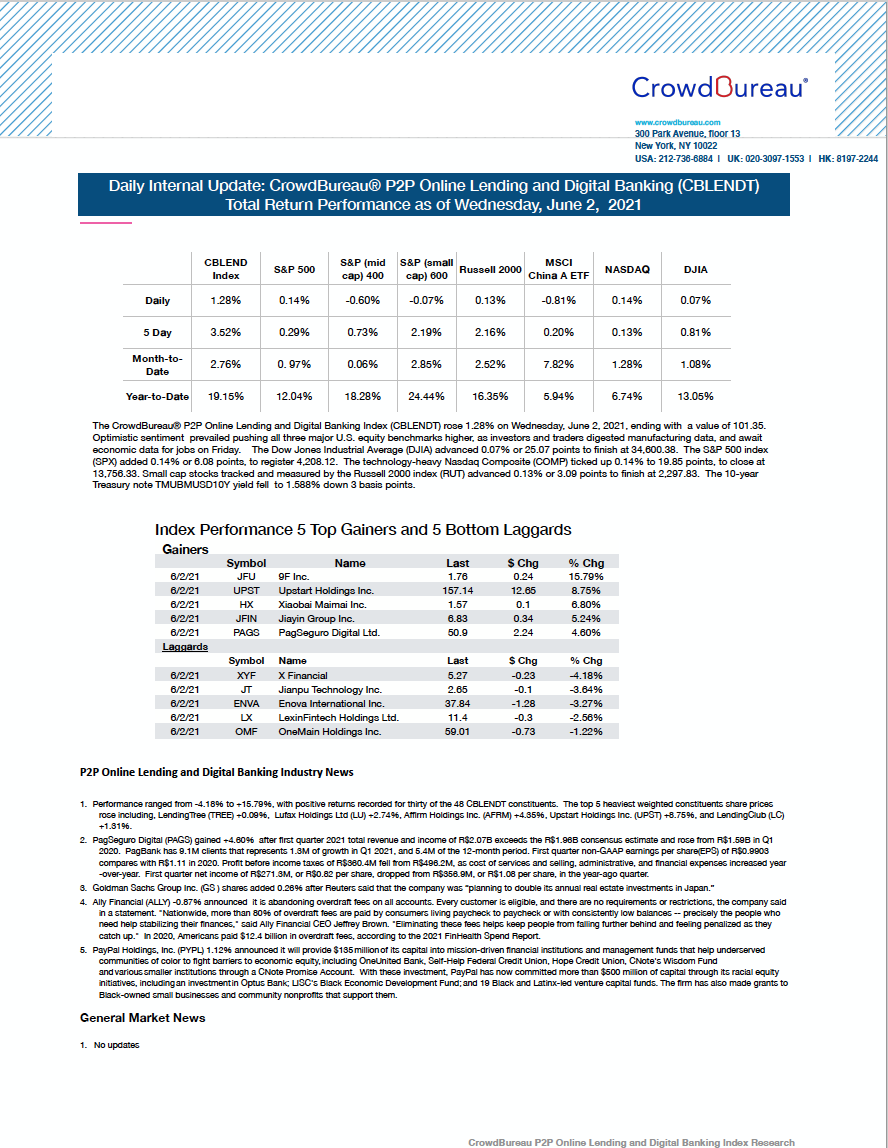

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +1.28%

June 2, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 1.28% on Wednesday, June 2, 2021, ending with a value of 101.35. Optimistic sentiment prevailed pushing all three major U.S. equity benchmarks higher, as investors and traders digested manufacturing data, and await economic data for jobs on Friday.

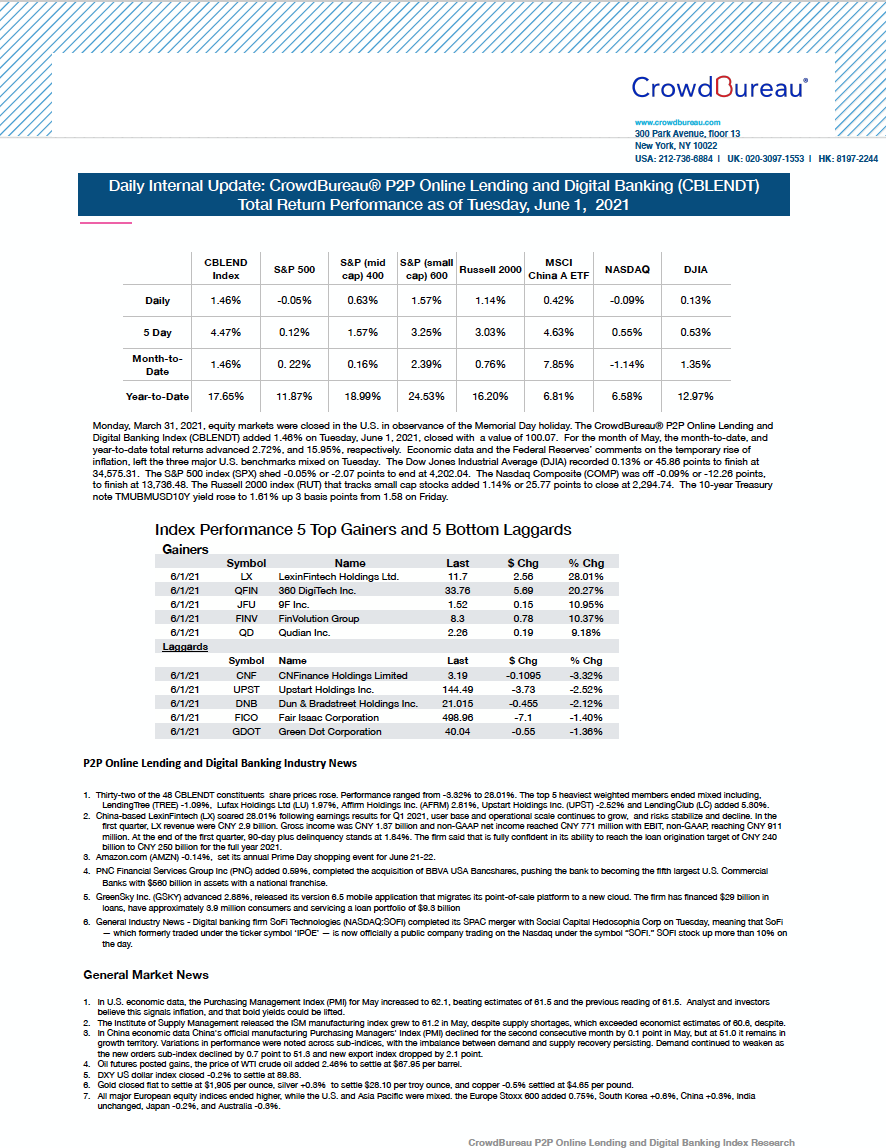

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +1.46% to start the month of June

June 1, 2021

Monday, March 31, 2021, equity markets were closed in the U.S. in observance of the Memorial Day holiday. The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 1.46% on Tuesday, June 1, 2021, closed with a value of 100.07. For the month of May, the month-to-date, and year-to-date total returns advanced 2.72%, and 15.95%, respectively. Economic data and the Federal Reserves’ comments on the temporary rise of inflation, left the three major U.S. benchmarks mixed on Tuesday.

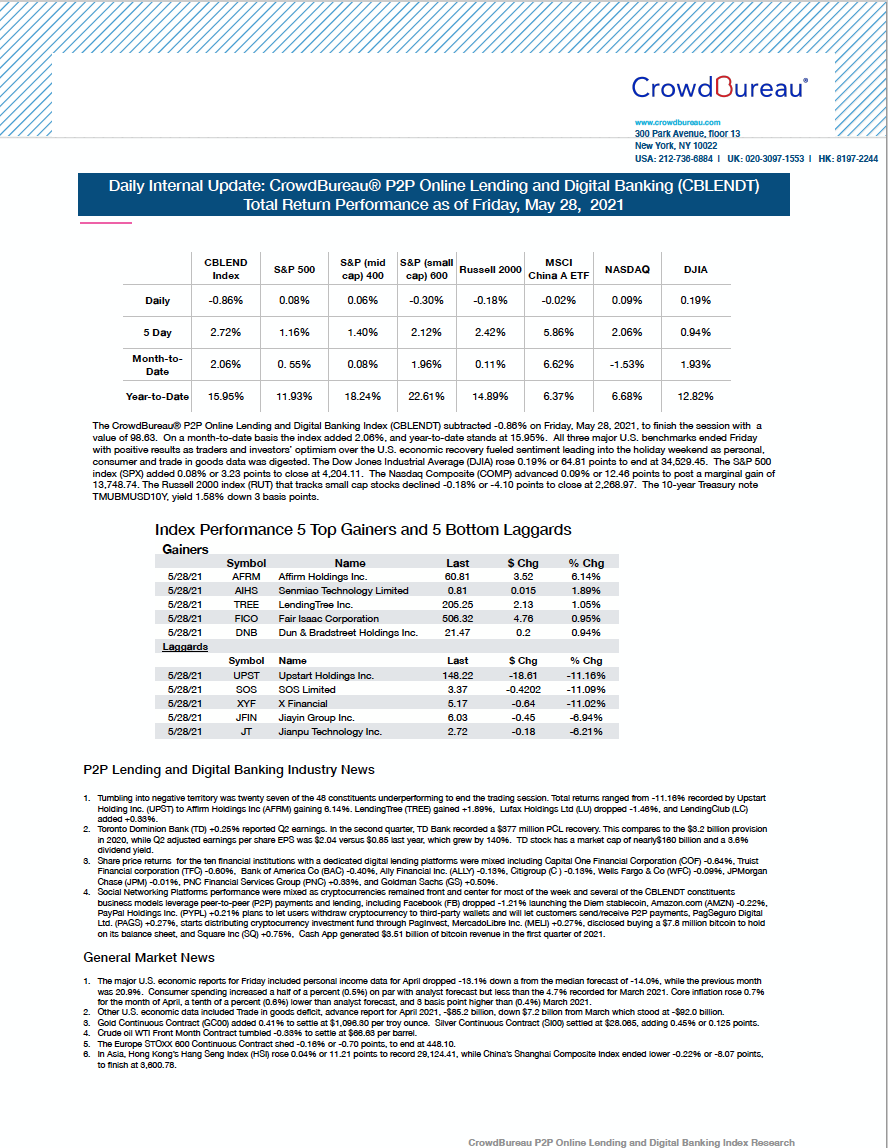

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) subtracted -0.86% to finish the session

May 28, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) subtracted -0.86% on Friday, May 28, 2021, to finish the session with a value of 98.63. All three major U.S. benchmarks ended Friday with positive results as traders and investors’ optimism over the U.S. economic recovery fueled sentiment leading into the holiday weekend as personal, consumer and trade in goods data was digested.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +1.62%

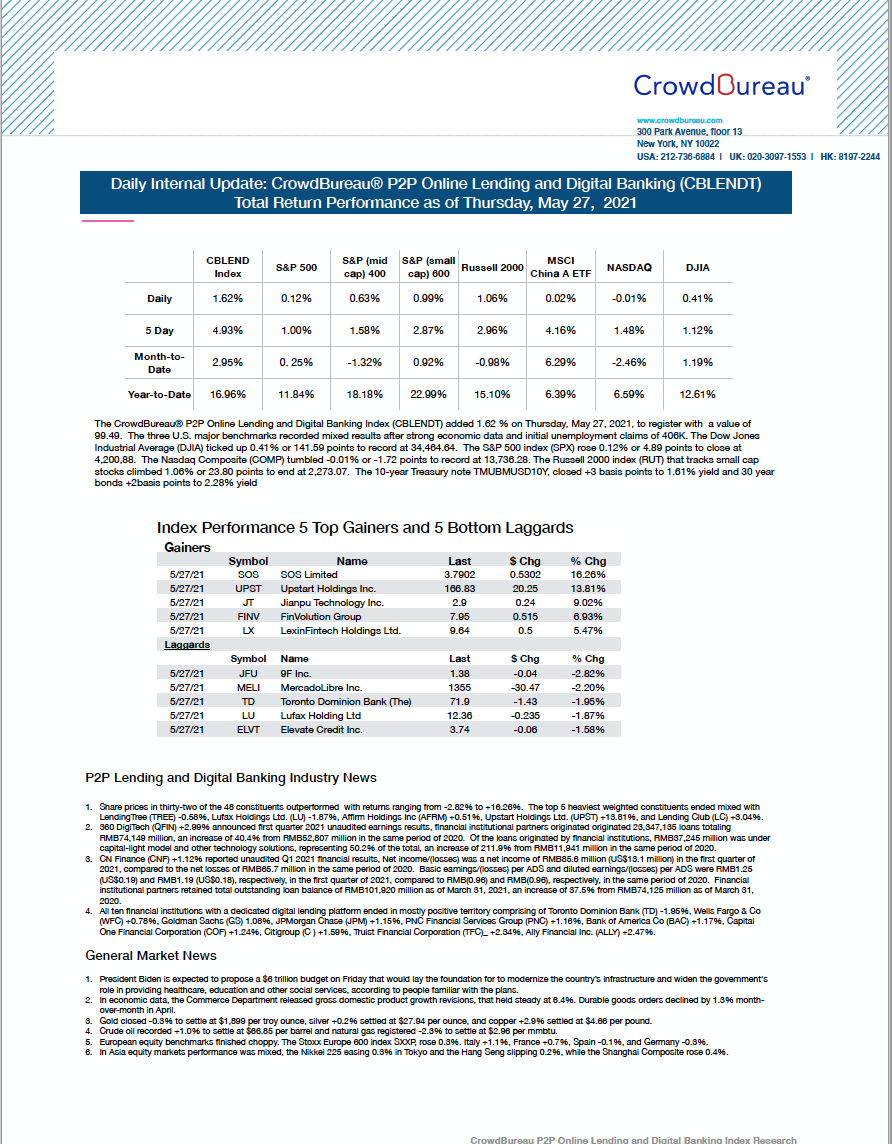

May 27, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 1.62 % on Thursday, May 27, 2021, to register with a value of 99.49. The three U.S. major benchmarks recorded mixed results after strong economic data and initial unemployment claims of 406K.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) climbed +2.20%

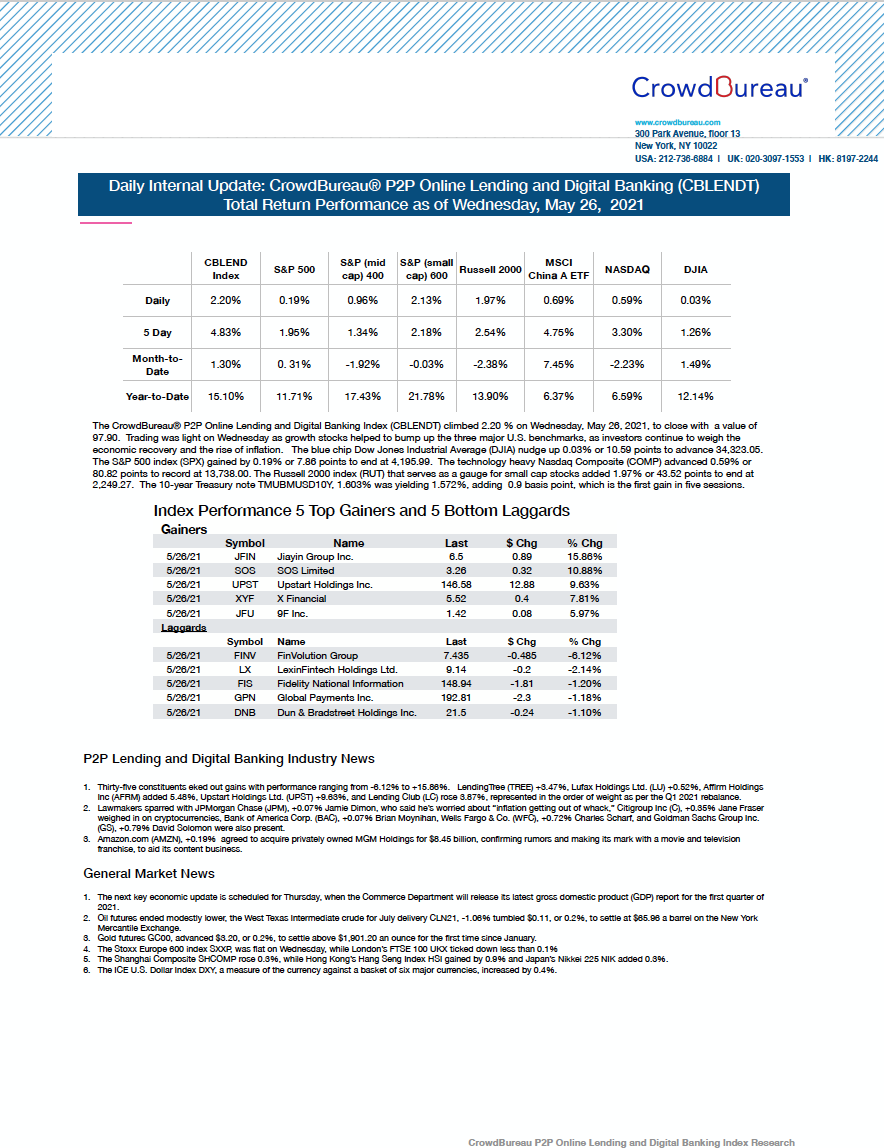

May 26, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) climbed 2.20 % on Wednesday, May 26, 2021, to close with a value of 97.90. Trading was light on Wednesday as growth stocks helped to bump up the three major U.S. benchmarks, as investors continue to weigh the economic recovery and the rise of inflation.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ticked down -0.35% to end the session

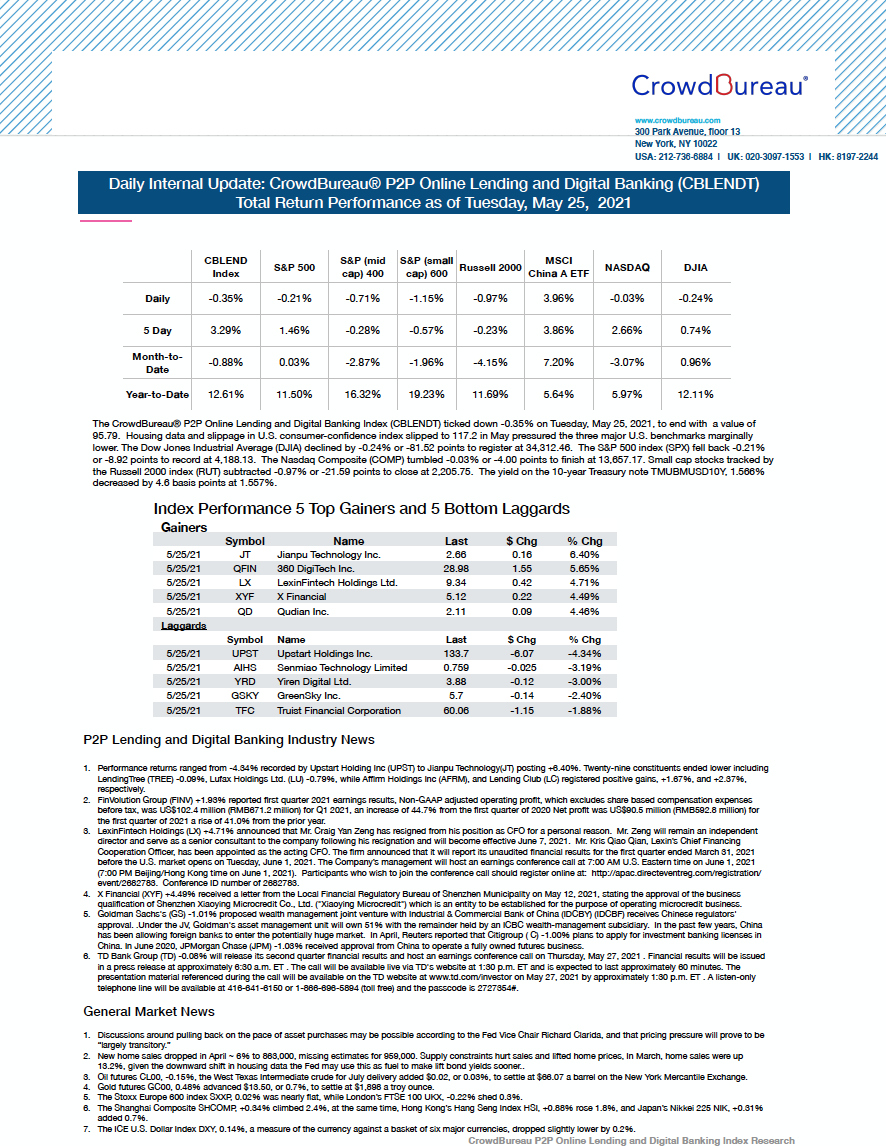

May 25, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) ticked down -0.35% on Tuesday, May 25, 2021, to end with a value of 95.79. Housing data and slippage in U.S. consumer-confidence index slipped to 117.2 in May pressured the three major U.S. benchmarks marginally lower.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +0.11%

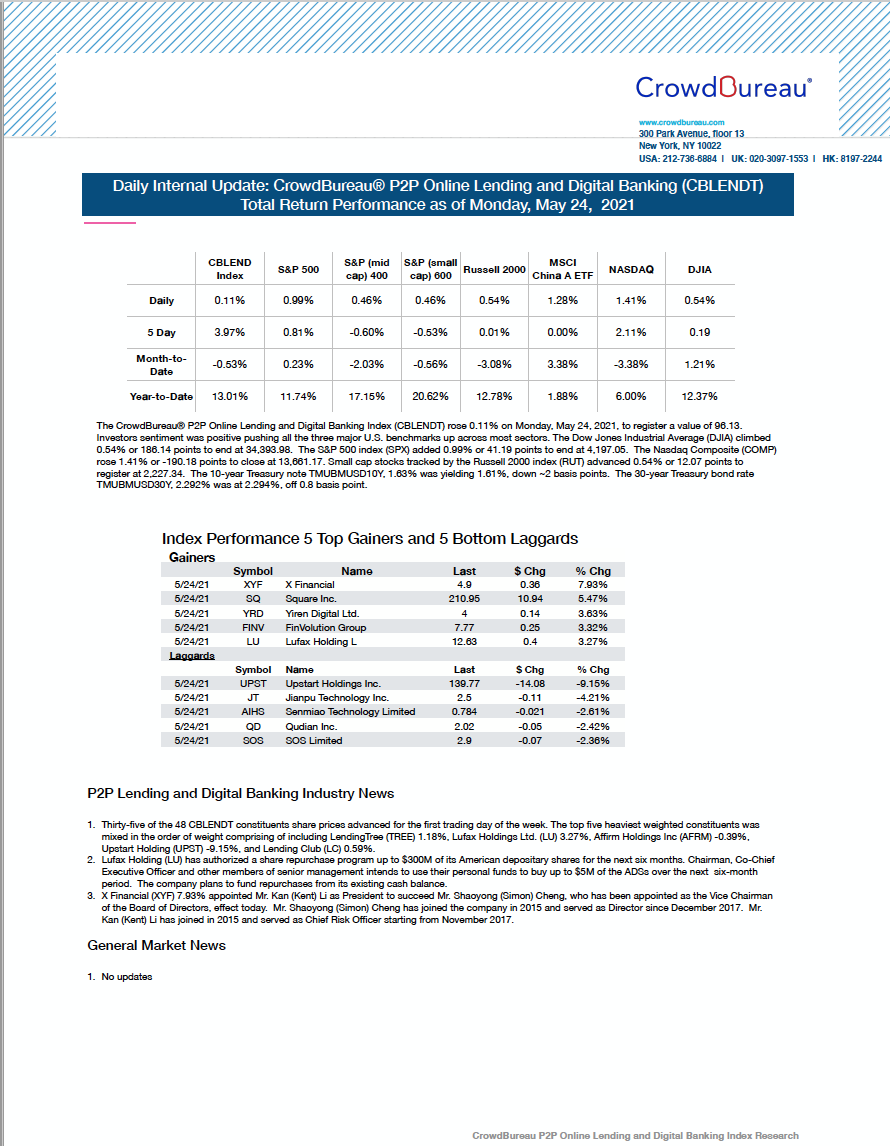

May 24, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 0.11% on Monday, May 24, 2021, to register a value of 96.13. Investors sentiment was positive pushing all the three major U.S. benchmarks up across most sectors.

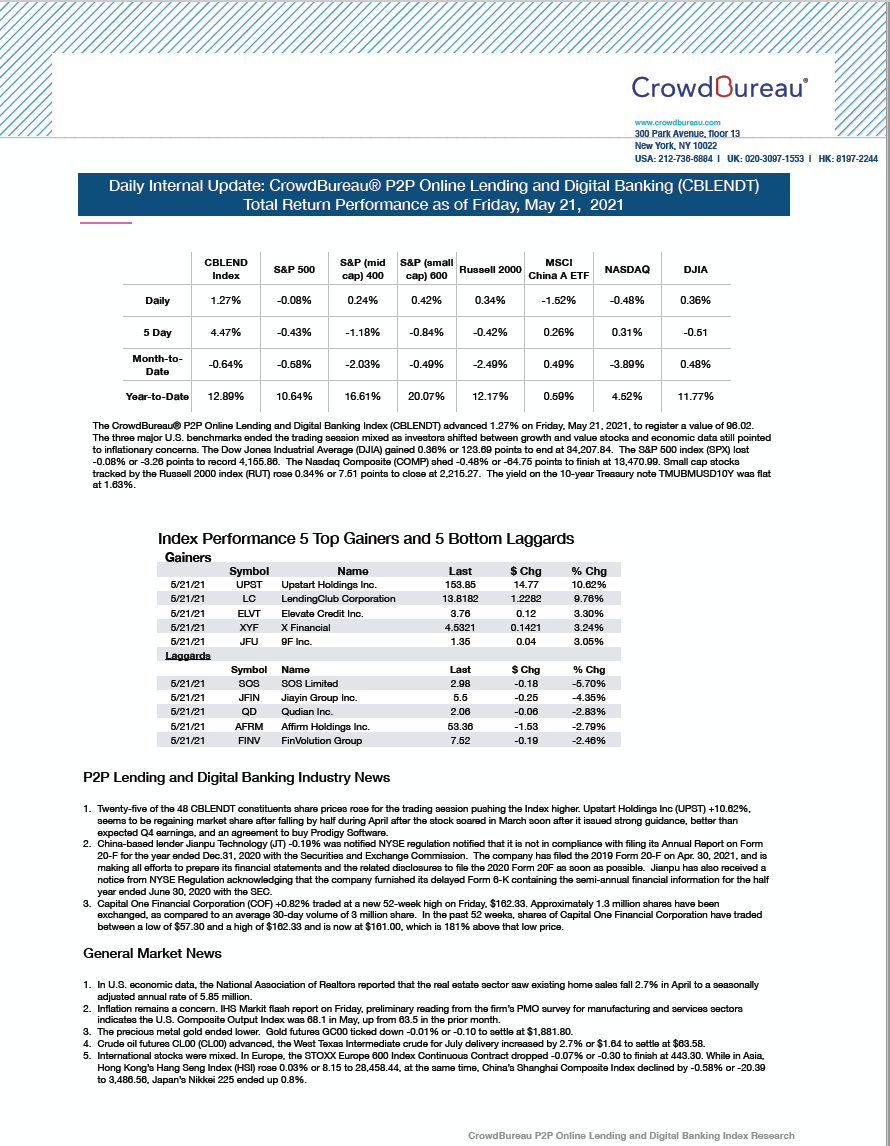

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) advanced +1.27%, rising for 5 straight sessions

May 21, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced 1.27% on Friday, May 21, 2021, to register a value of 96.02. The three major U.S. benchmarks ended the trading session mixed as investors shifted between growth and value stocks and economic data still pointed to inflationary concerns.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) eked out +1.53%

May 20, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 1.53% on Thursday, May 20, 2021, to register a value of 94.82. Investors rotation back into technology stocks and upbeat employment report fueled positive returns for the three major U.S. benchmarks.

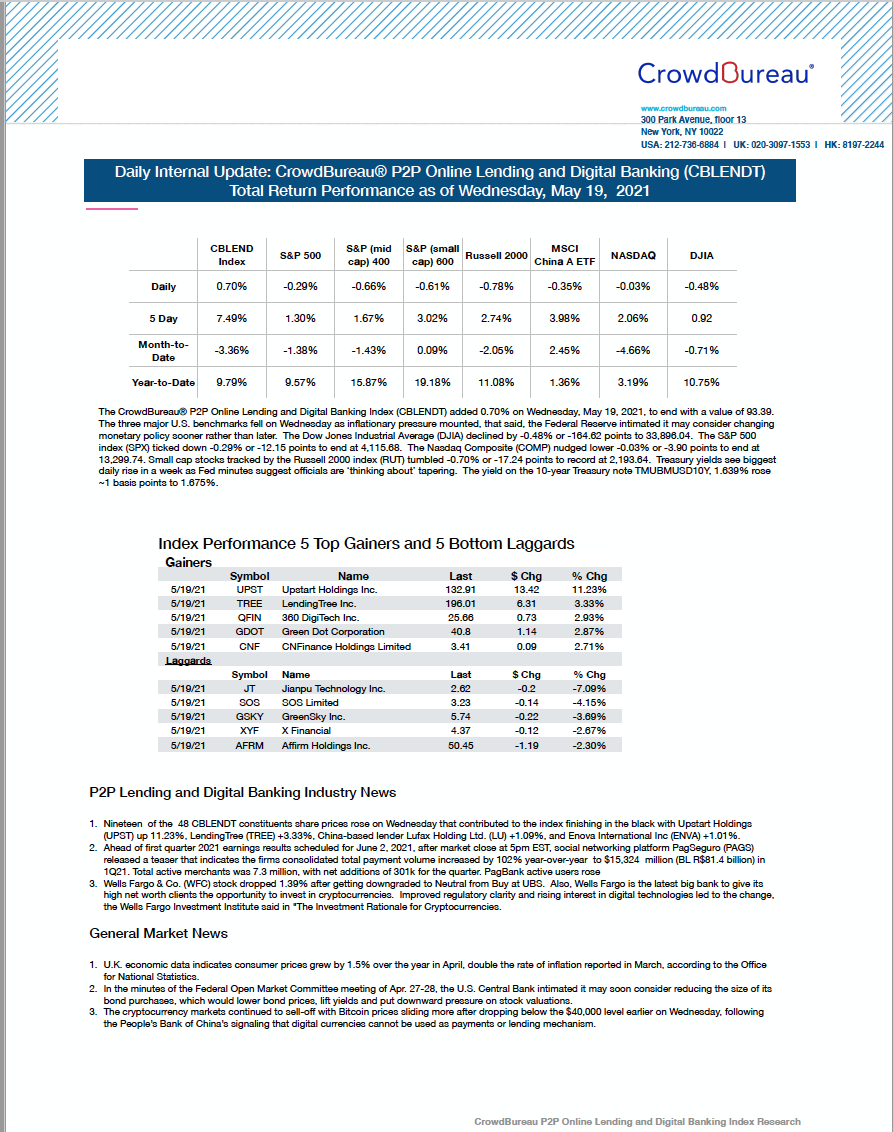

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose for the third straight session, adding +0.30%

May 19, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 0.70% on Wednesday, May 19, 2021, to end with a value of 93.39. The three major U.S. benchmarks fell on Wednesday as inflationary pressure mounted, that said, the Federal Reserve intimated it may consider changing monetary policy sooner rather than later.

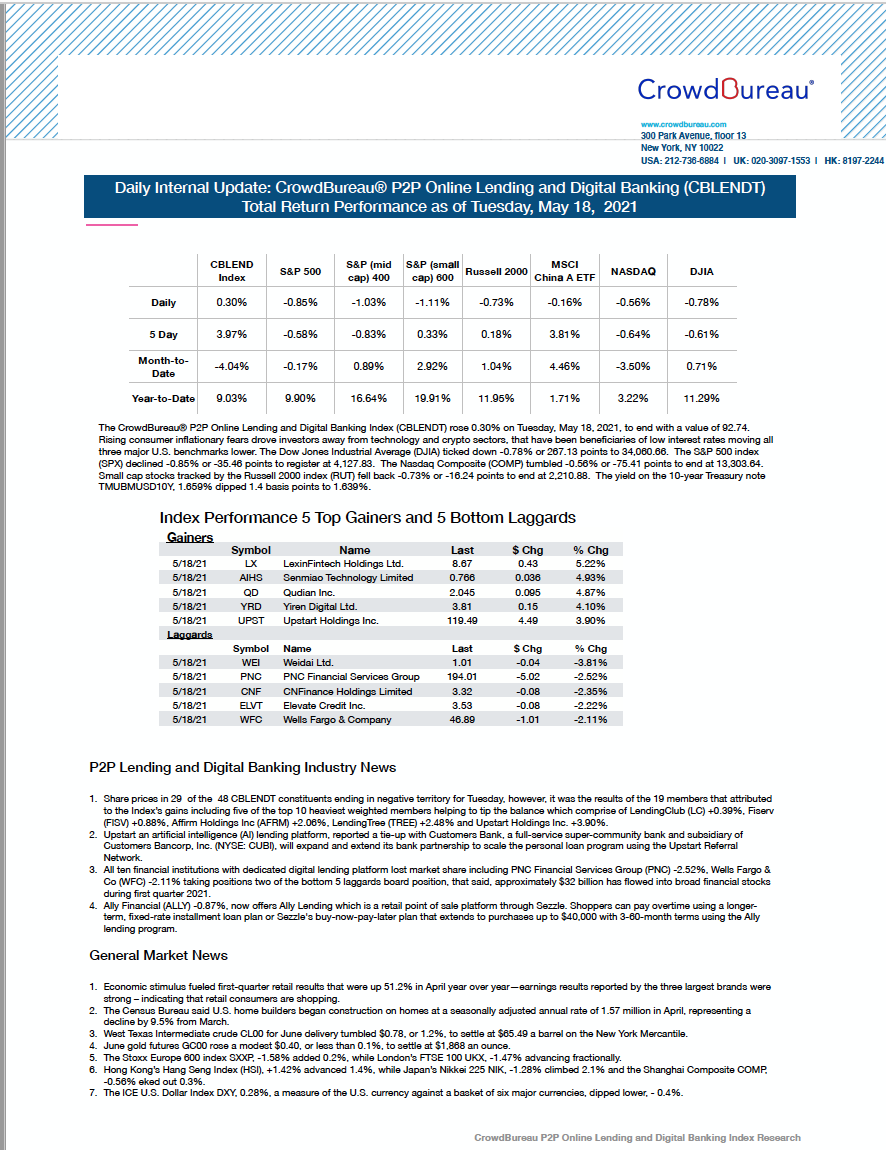

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +0.30%

May 18, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 0.30% on Tuesday, May 18, 2021, to end with a value of 92.74. Month-to-date, the index is down -4.04% and up +9.03%, year-to-date. Rising consumer inflationary fears drove investors away from technology and crypto sectors, that have been beneficiaries of low interest rates moving all three major U.S. benchmarks lower.

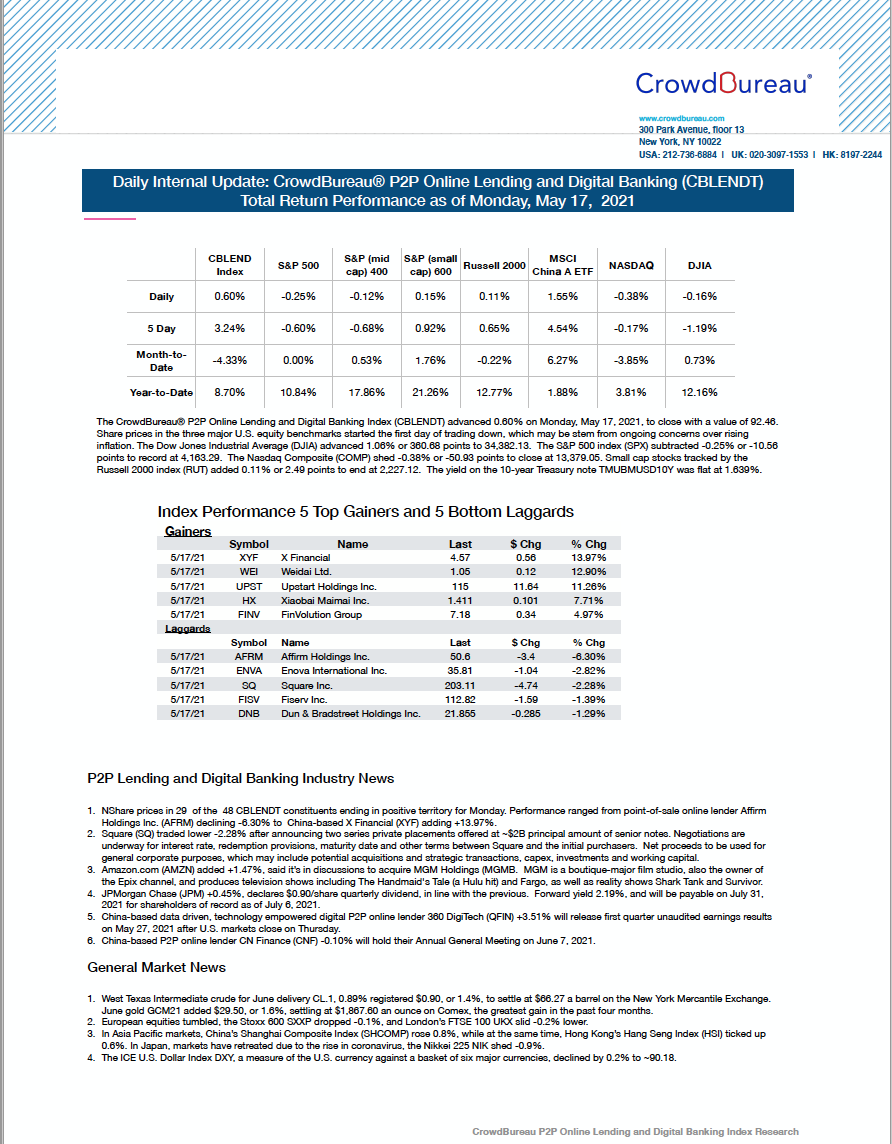

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) advanced +0.60%

May 17, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced 0.60% on Monday, May 17, 2021, to close with a value of 92.46. Share prices in the three major U.S. equity benchmarks started the first day of trading down, which may stem from ongoing concerns over rising inflation.

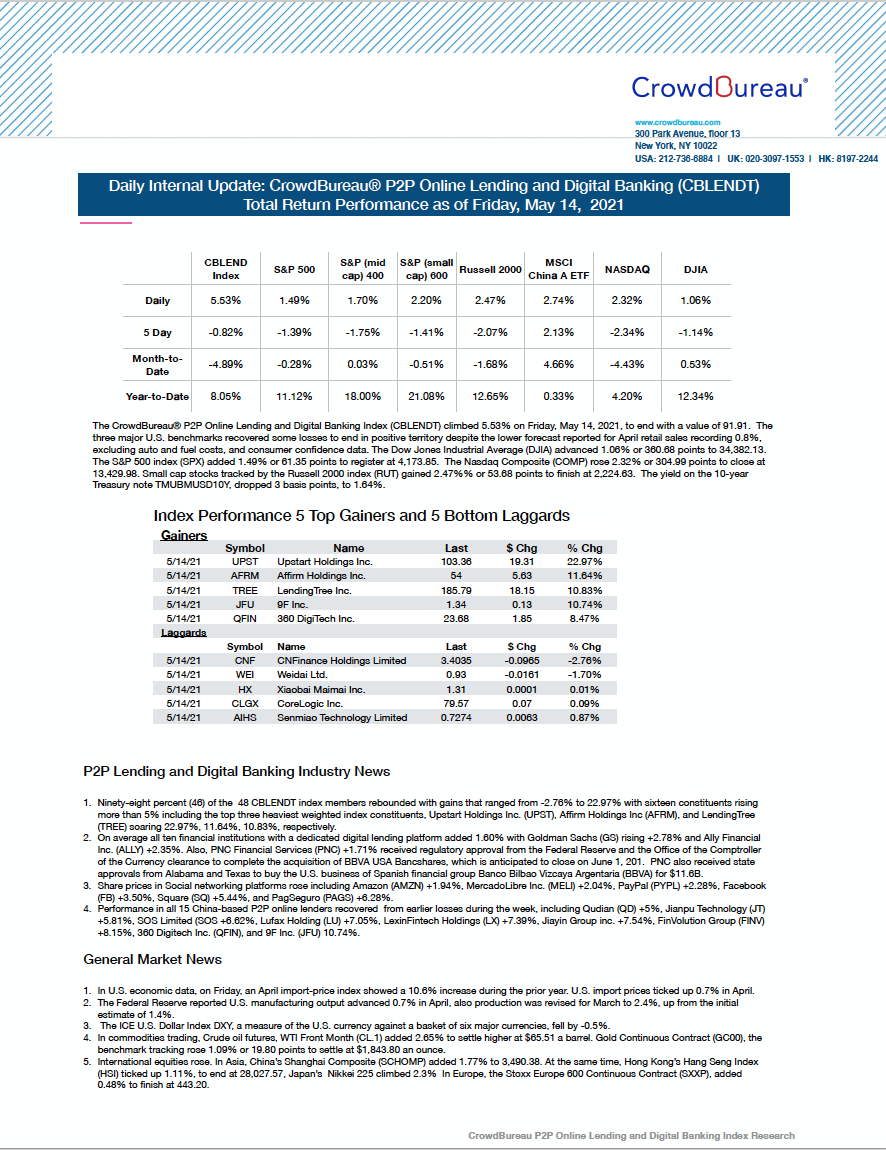

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) climbed +5.53% to end the trading session

May 14, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) climbed 5.53% on Friday, May 14, 2021, to end with a value of 91.91. The three major U.S. benchmarks recovered some losses to end in positive territory despite the lower forecast reported for April retail sales recording 0.8%, excluding auto and fuel costs, and consumer confidence data.

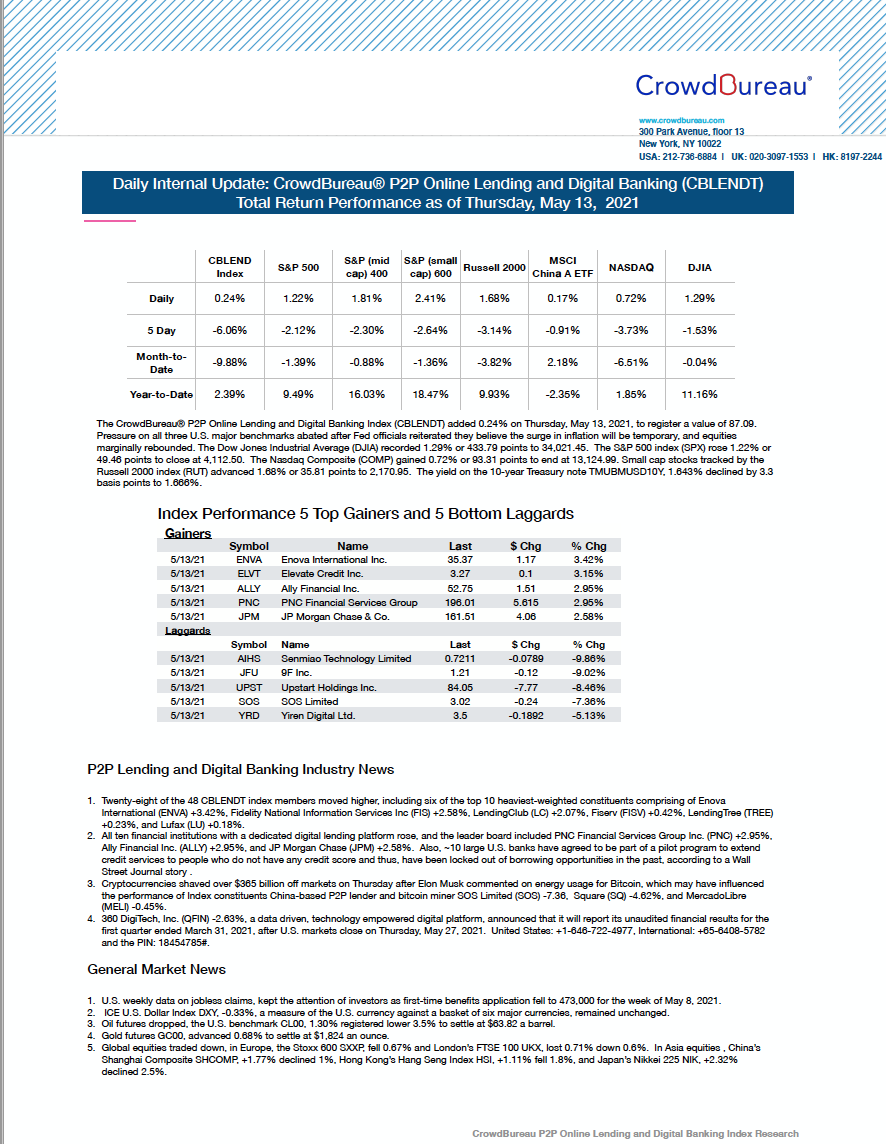

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +0.24%

May 13, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 0.24% on Thursday, May 13, 2021, to register a value of 87.09. Pressure on all three U.S. major benchmarks abated after Fed officials reiterated they believe the surge in inflation will be temporary, and equities marginally rebounded.

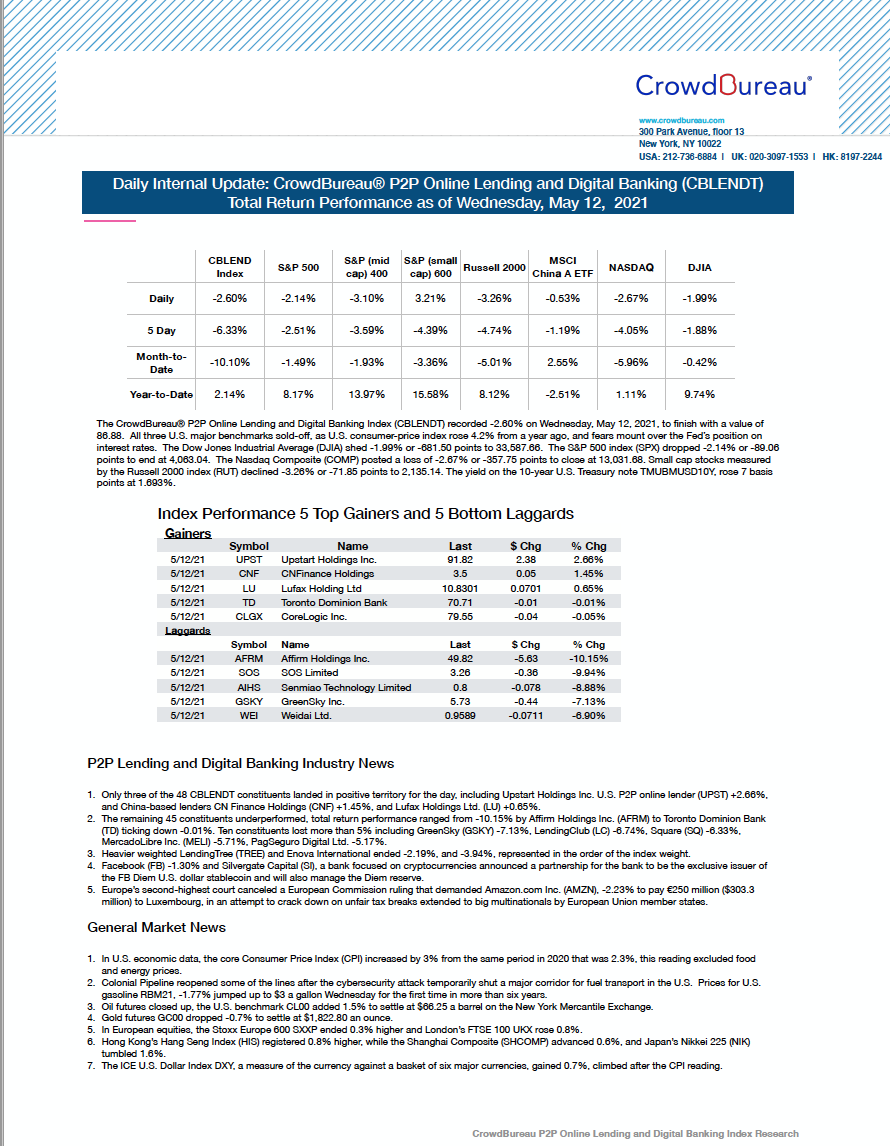

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) recorded -2.60% lower

May 12, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) recorded -2.60% on Wednesday, May 12, 2021, to finish with a value of 86.88. All three U.S. major benchmarks sold-off, as U.S. consumer-price index rose 4.2% from a year ago, and fears mount over the Fed’s position on interest rates.

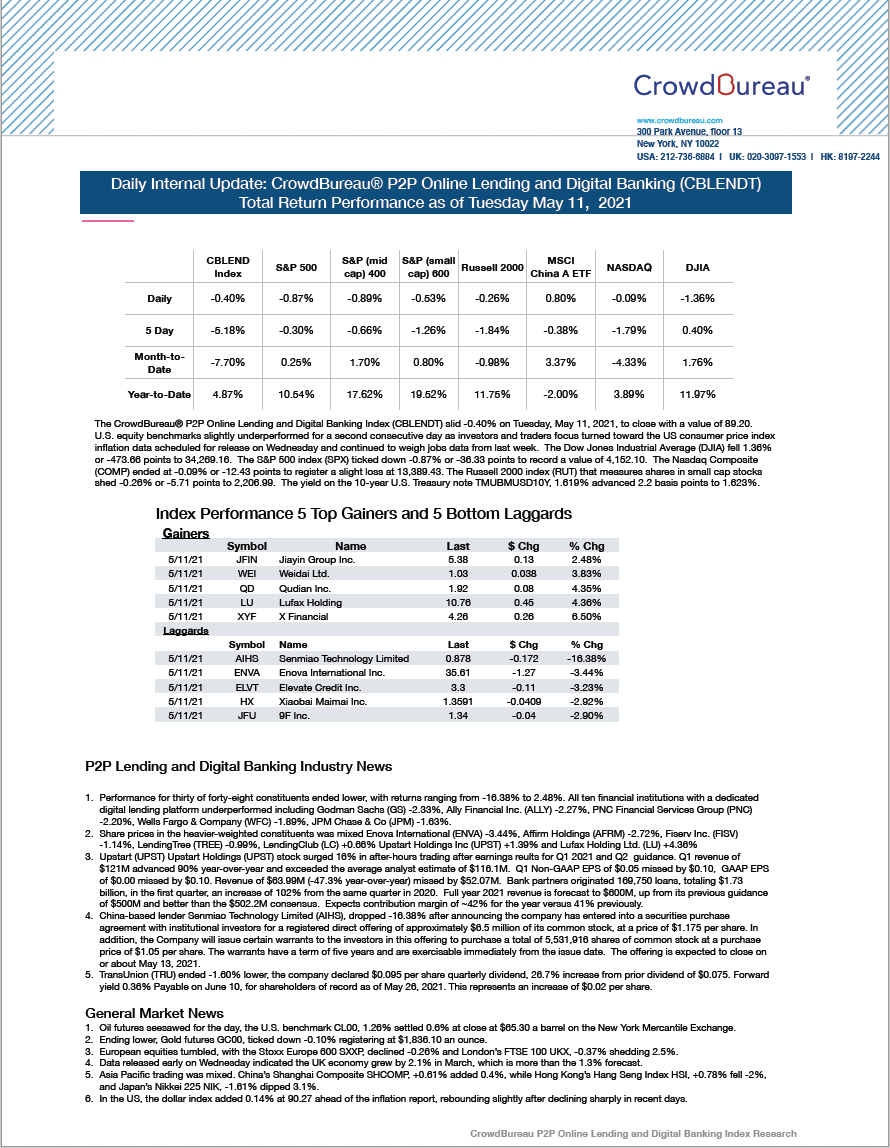

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) slid -0.40%

May 11, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) slid -0.40% on Tuesday, May 11, 2021, to close with a value of 89.20. U.S. equity benchmarks slightly underperformed for a second consecutive day as investors and traders focus turned toward the US consumer price index inflation data scheduled for release on Wednesday, and continued to weigh jobs data from last week.

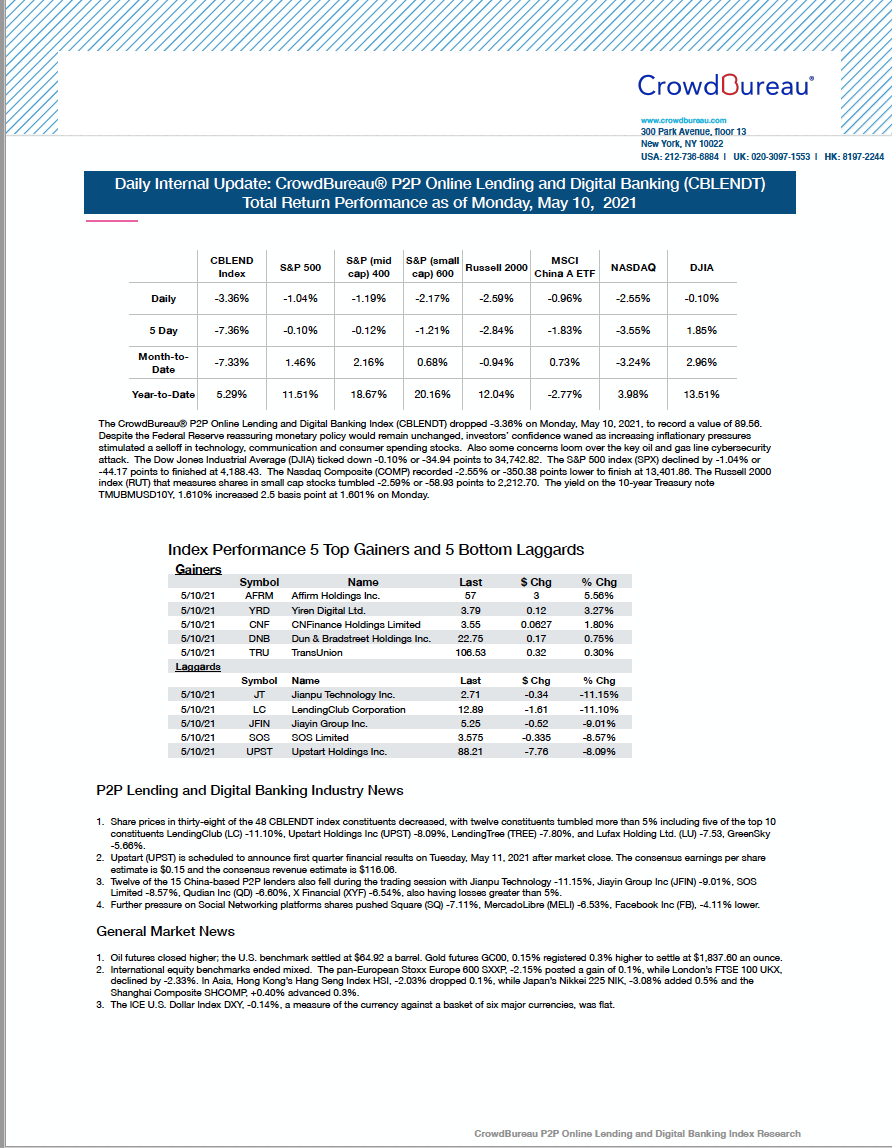

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) started the week trading -3.36% lower

May 10, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) dropped -3.36% on Monday, May 10, 2021, to record a value of 89.56. Despite the Federal Reserve reassuring monetary policy would remain unchanged, investors’ confidence waned as increasing inflationary pressures stimulated a selloff in technology, communication and consumer spending stocks. Also some concerns loom over the key oil and gas line cybersecurity attack.

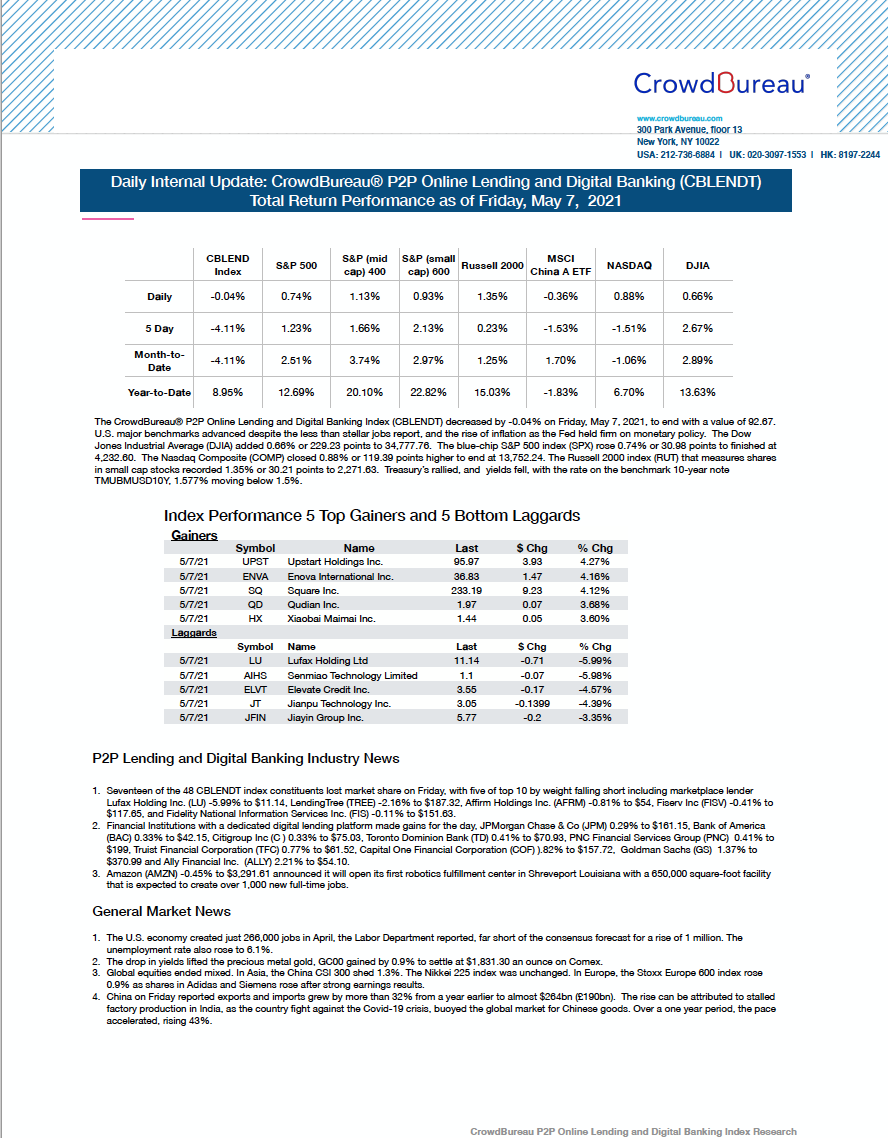

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) decreased by -0.04%, its fourth consecutive daily loss

May 7, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) decreased by -0.04% on Friday, May 7, 2021, to end with a value of 92.67. U.S. major benchmarks advanced despite the less than stellar jobs report, and the rise of inflation as the Fed held firm on monetary policy.

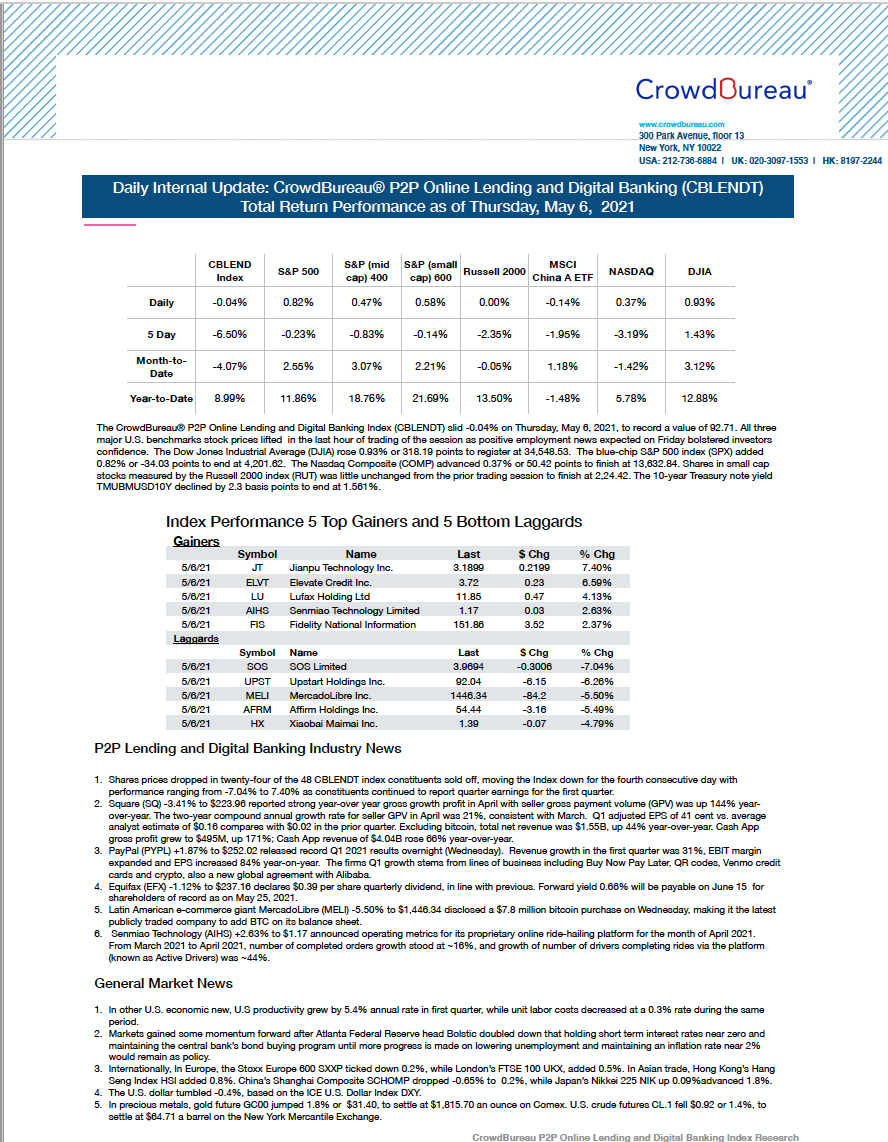

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) slid -0.04%, its third consecutive daily loss

May 6, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) slid -0.04% on Thursday, May 6, 2021, to record a value of 92.71. All three major U.S. benchmarks stock prices lifted in the last hour of trading the session as positive employment news expected on Friday bolstered investors confidence.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) declined -1.41%

May 5, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) declined -1.41% on Wednesday, May 5, 2021, recording a value of 92.75. Two of the three U.S. major benchmarks advanced during the session as technology and small cap stock sold off.

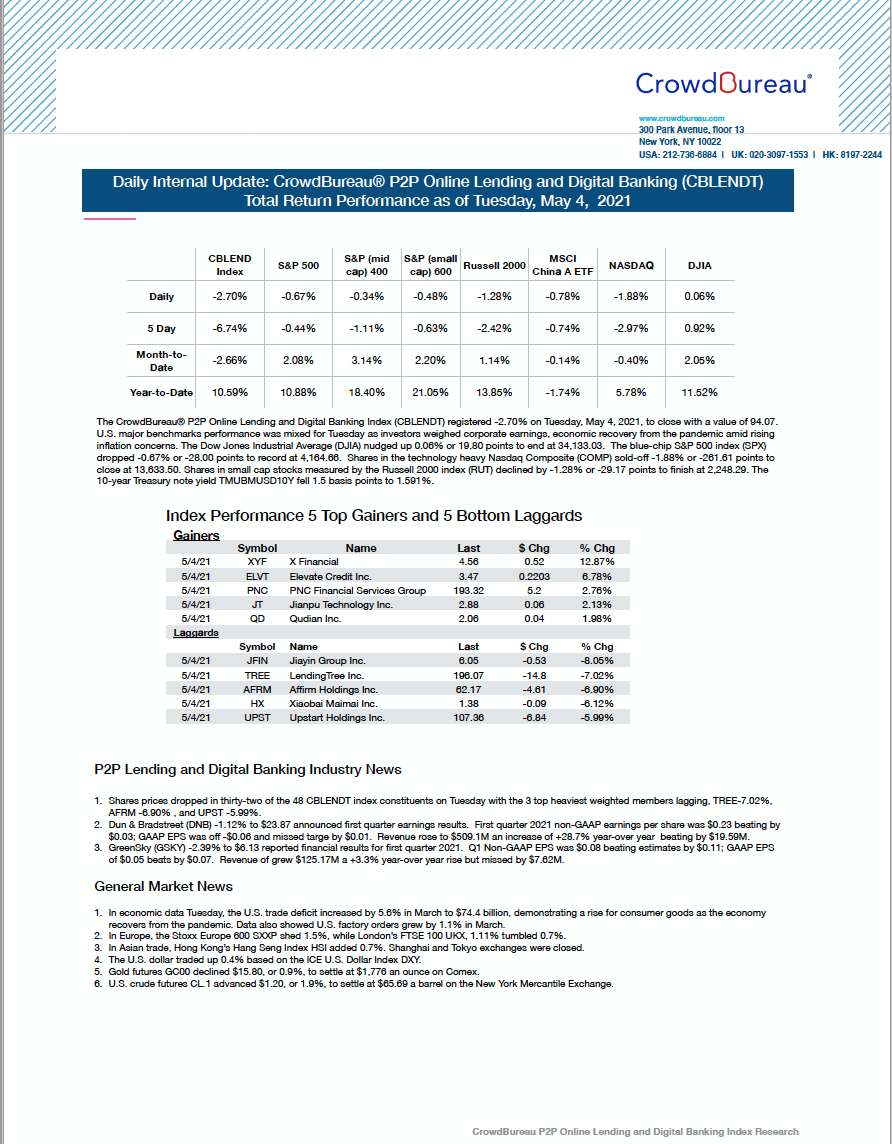

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) registered a loss of -2.70%

May 4, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) registered -2.70% lower on Tuesday, May 4, 2021, to close with a value of 94.07. U.S. major benchmarks performance was mixed for Tuesday as investors weighed corporate earnings, economic recovery from the pandemic amid rising inflation concerns.

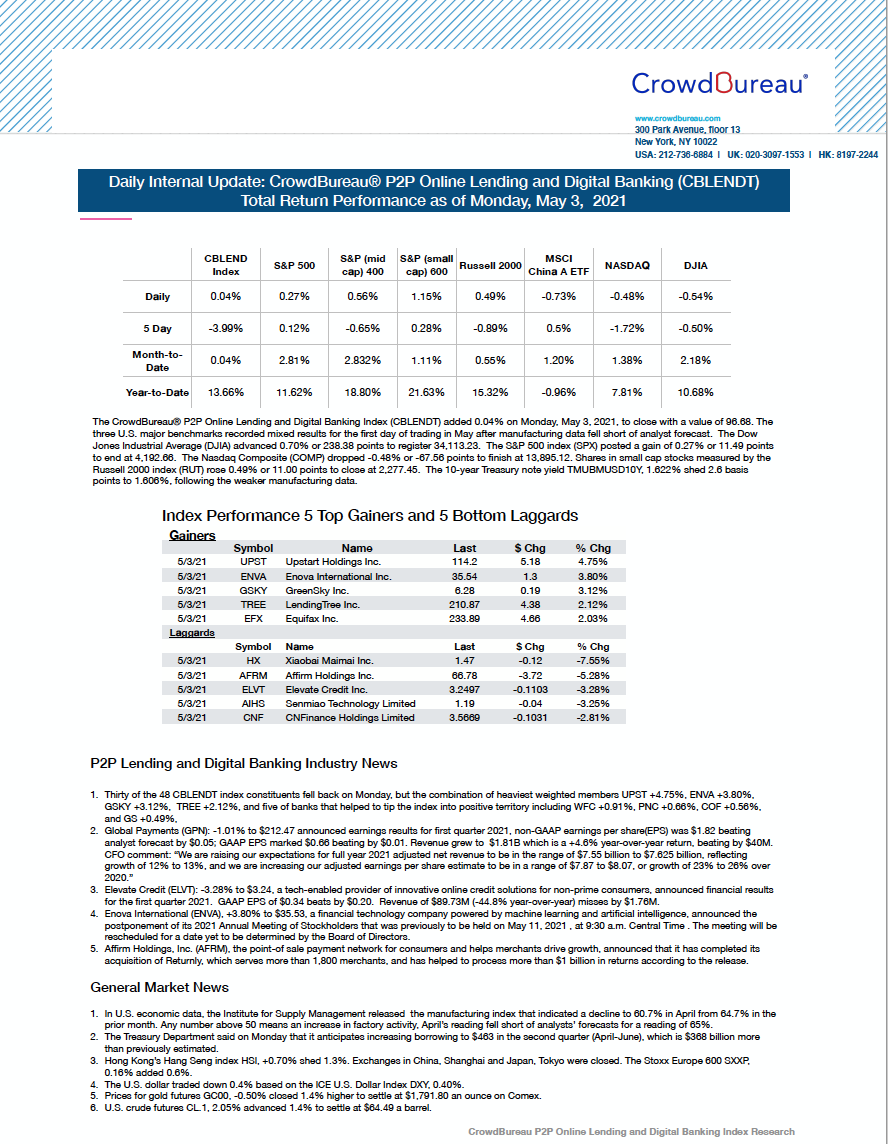

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added 0.04% on first day of trading for May

May 3, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 0.04% on Monday, May 3, 2021, to close with a value of 96.68. The three U.S. major benchmarks recorded mixed results for the first day of trading in May after manufacturing data fell short of analyst forecast.

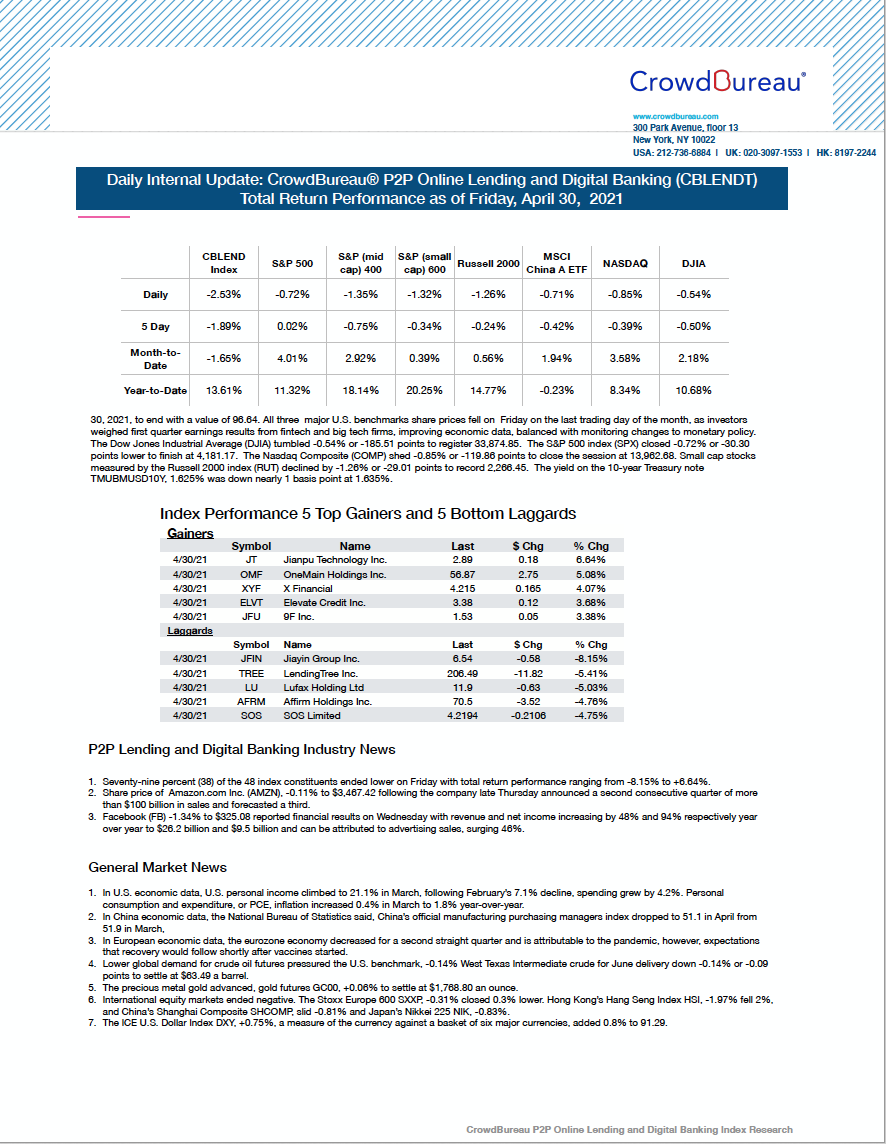

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) dropped -2.53%

April 30, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) dropped -2.53% on Friday, April 30, 2021, to end with a value of 96.64. All three major U.S. benchmarks share prices fell on Friday. the last trading day of the month, as investors weighed first quarter earnings results from fintech and big tech firms, improving economic data, balanced with monitoring changes to monetary policy.

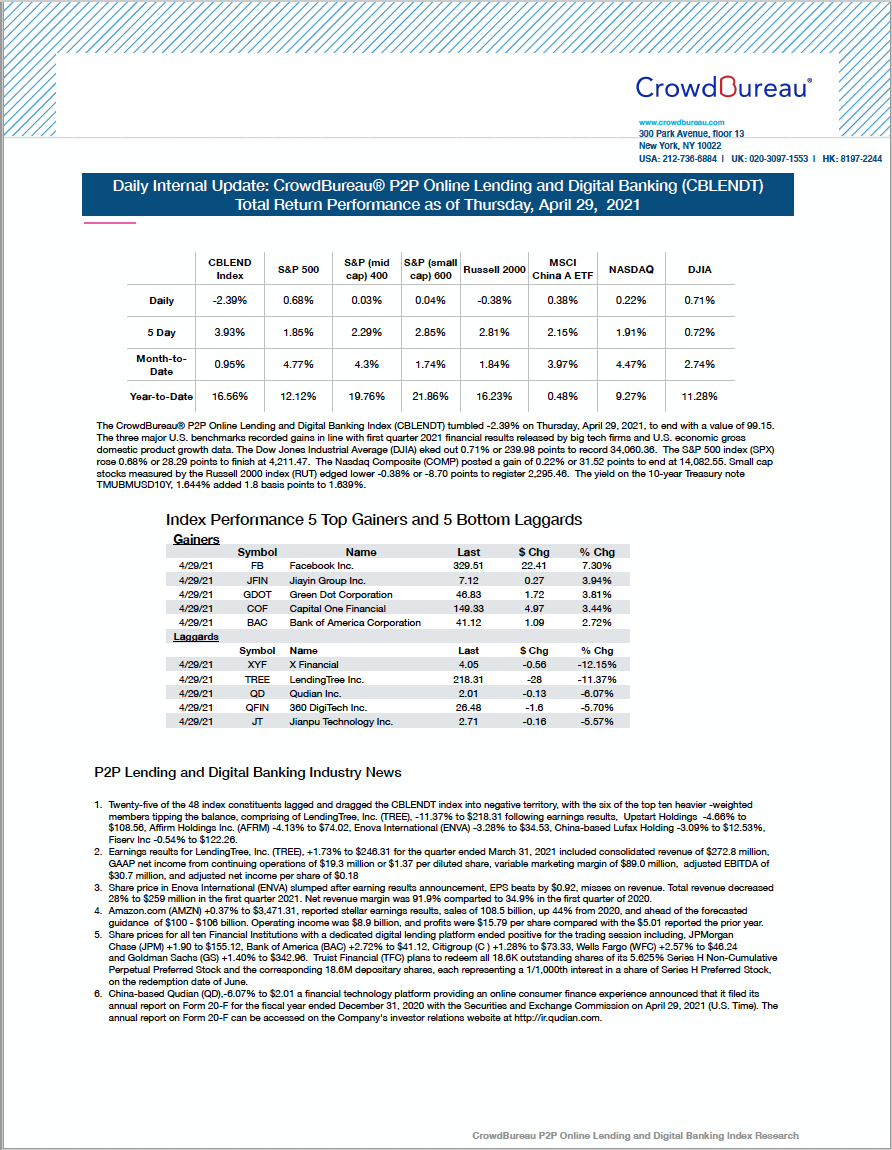

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course, tumbling -2.39%

April 29, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) tumbled -2.39% on Thursday, April 29, 2021, to end with a value of 99.15. The three major U.S. benchmarks recorded gains in line with first quarter 2021 financial results released by big tech firms and U.S. economic gross domestic product growth data.

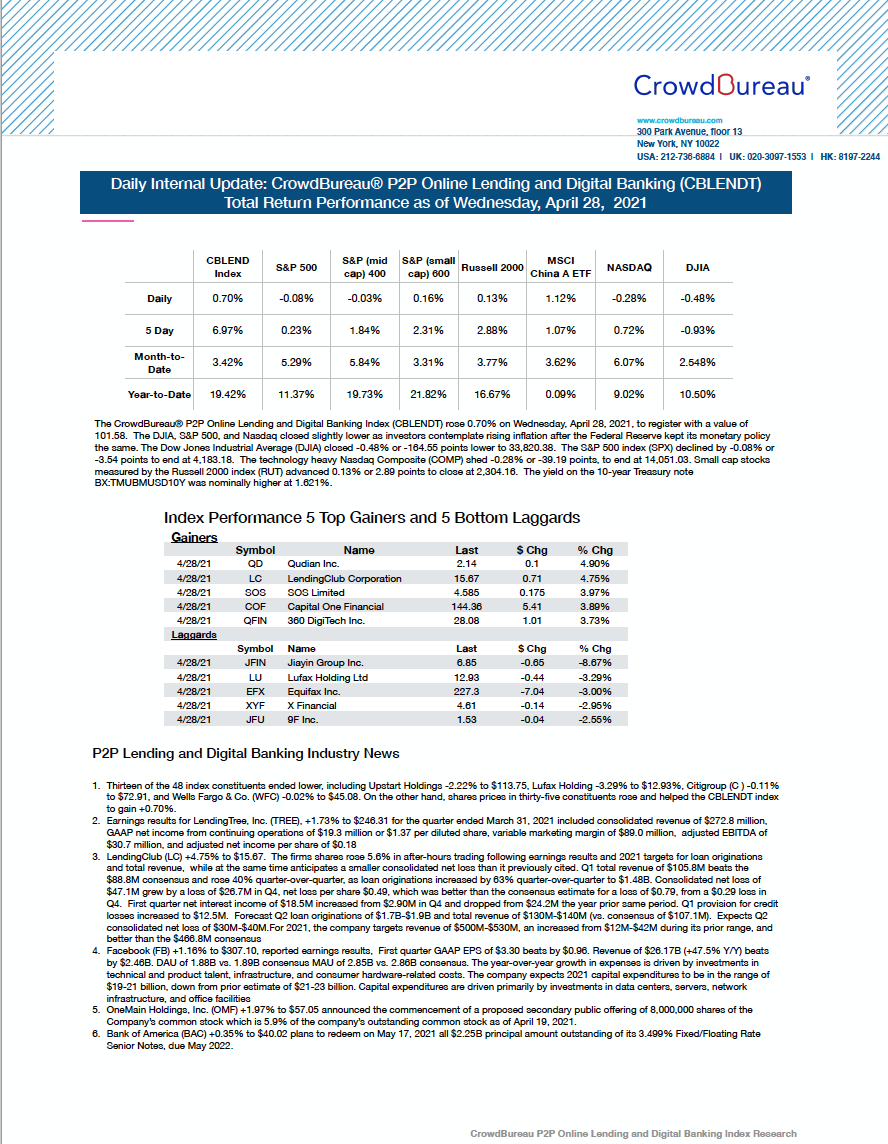

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +0.70%

April 28, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 0.70% on Wednesday, April 28, 2021, to register with a value of 101.58. The DJIA, S&P 500, and Nasdaq closed slightly lower as investors contemplate rising inflation after the Federal Reserve kept its monetary policy the same.

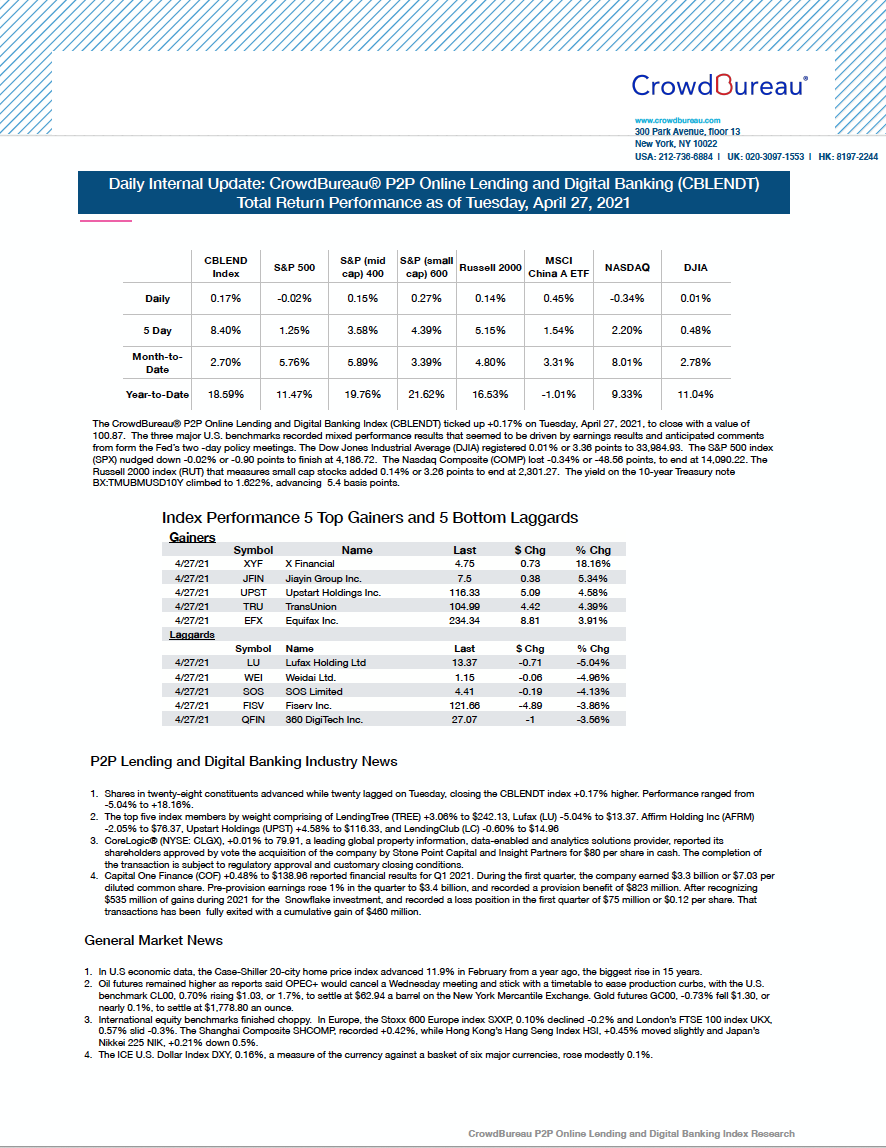

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ticked up +0.17%

April 27, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) ticked up +0.17% on Tuesday, April 27, 2021, to close with a value of 100.87. The three major U.S. benchmarks recorded mixed performance results that seemed to be driven by earnings results and anticipated comments from form the Fed’s two -day policy meetings.

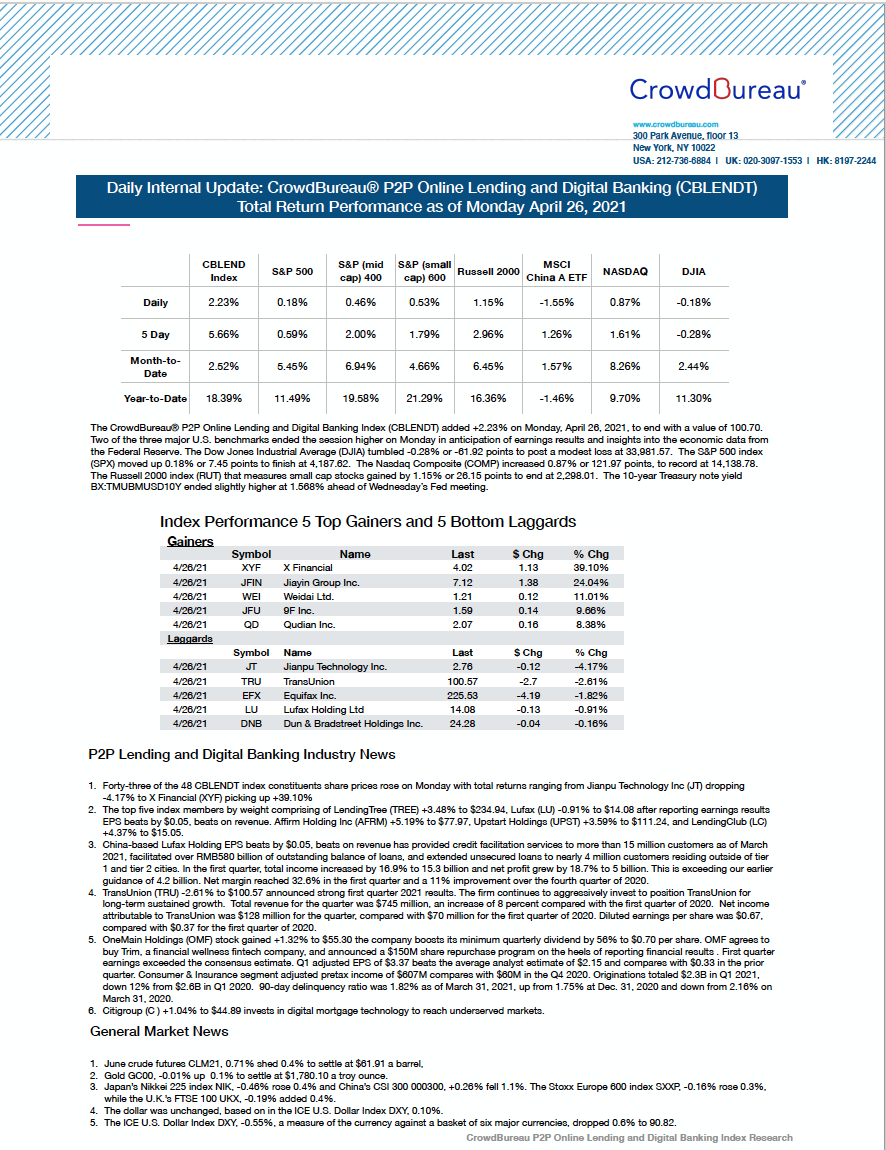

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +2.23% to start the week

April 26, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added +2.23% on Monday, April 26, 2021, to end with a value of 100.70. Two of the three major U.S. benchmarks ended the session higher on Monday in anticipation of earnings results and insights into the economic data from the Federal Reserve.

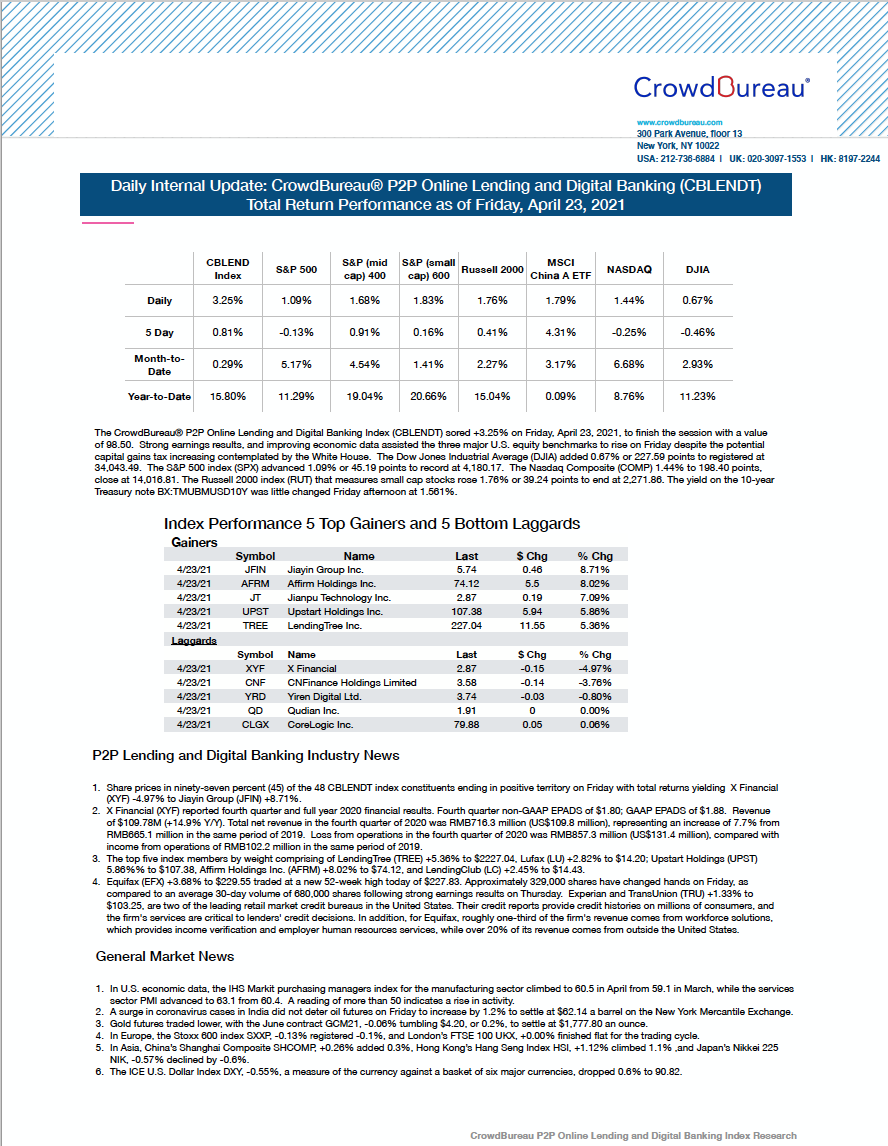

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) soared +3.25% pulling the index forward

April 23, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) soared +3.25% on Friday, April 23, 2021, to finish the session with a value of 98.50. Strong earnings results, and improving economic data assisted the three major U.S. equity benchmarks to rise on Friday despite the potential for capital gains tax to increase.

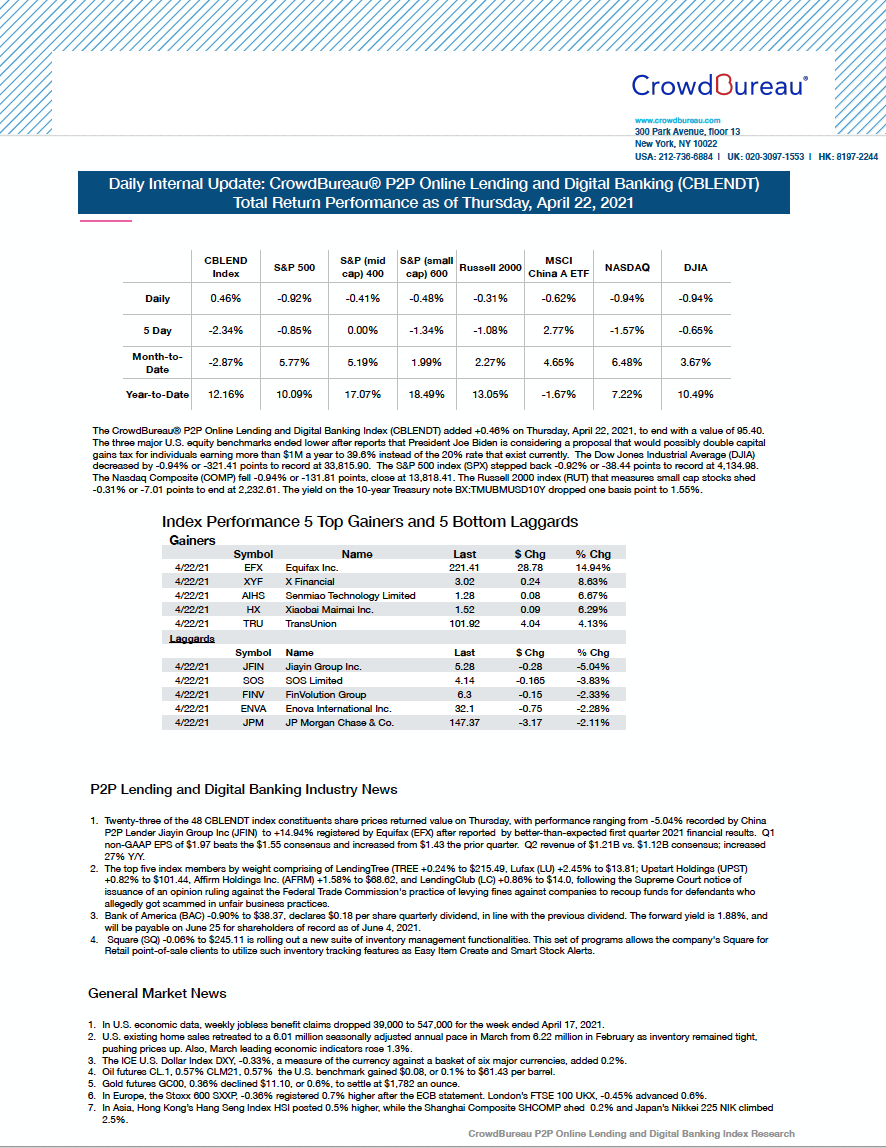

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +0.46%

April 22, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added +0.46% on Thursday, April 22, 2021, to end with a value of 95.40. The three major U.S. equity benchmarks ended lower after reports that President Joe Biden is considering a proposal that would possibly double capital gains tax for individuals earning more than $1M a year to 39.6% instead of the 20% rate that exist currently.

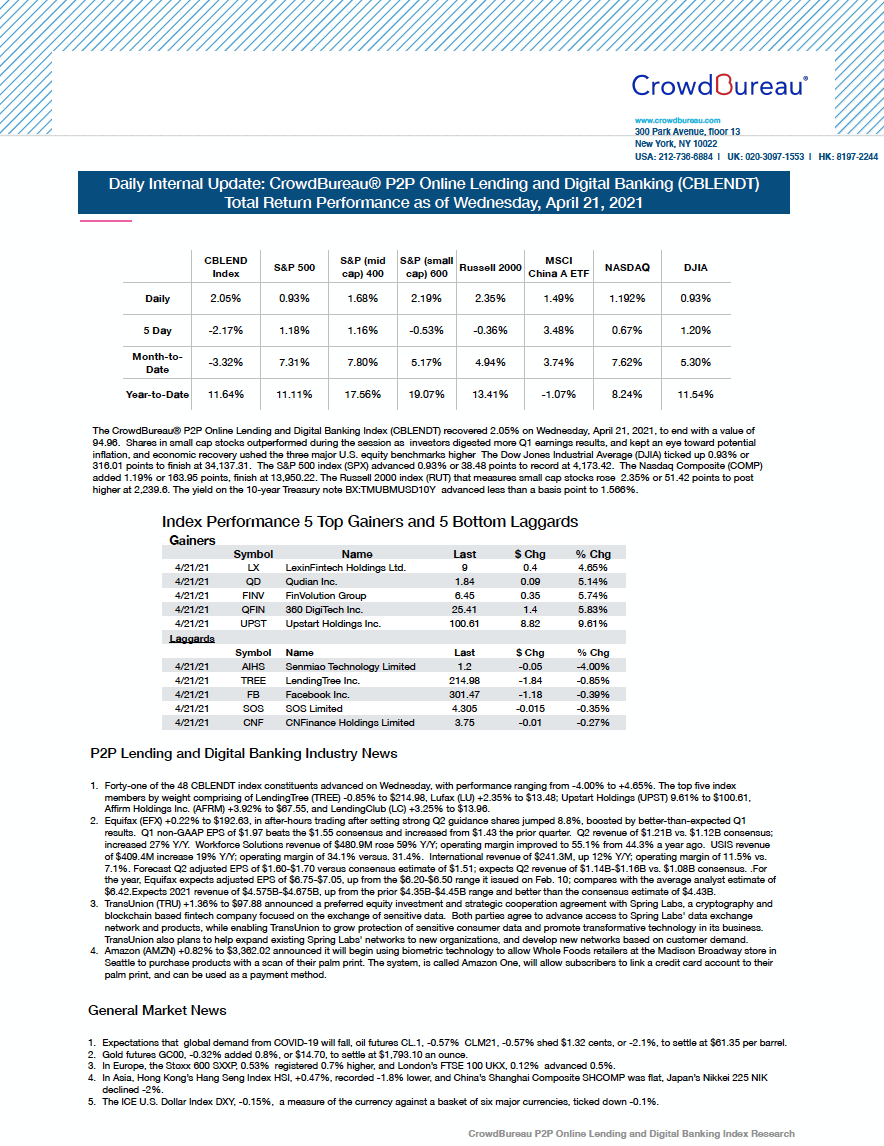

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) recovered +2.05%

April 21, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) recovered 2.05% on Wednesday, April 21, 2021, to end with a value of 94.96. Shares in small cap stocks outperformed during the session as investors digested more Q1 earnings results, and kept an eye toward potential inflation, and economic recovery ushered the three major U.S. equity benchmarks higher.

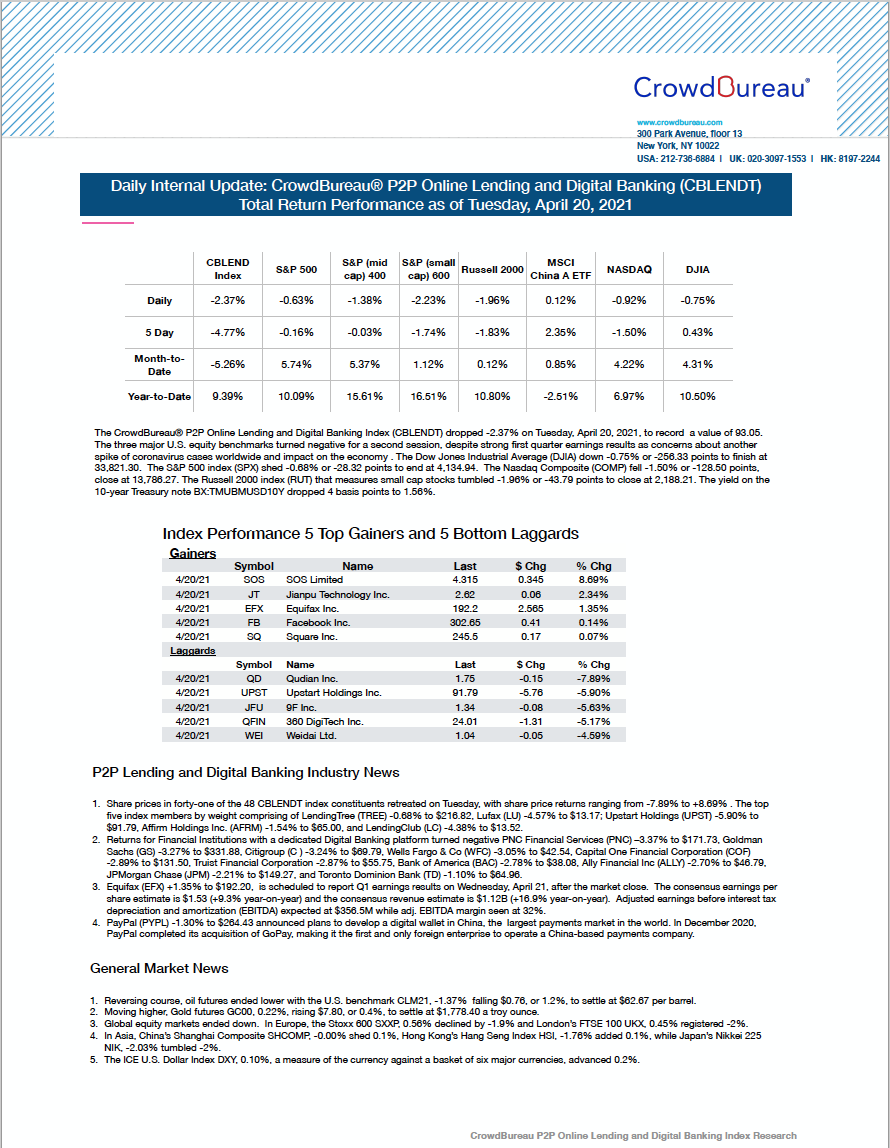

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) dropped -2.37%, ending lower for the session

April 20, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) dropped -2.37% on Tuesday, April 20, 2021, to record a value of 93.05. The three major U.S. equity benchmarks turned negative for a second session, despite strong first quarter earnings results as concerns about another spike of coronavirus cases worldwide and impact on the economy.

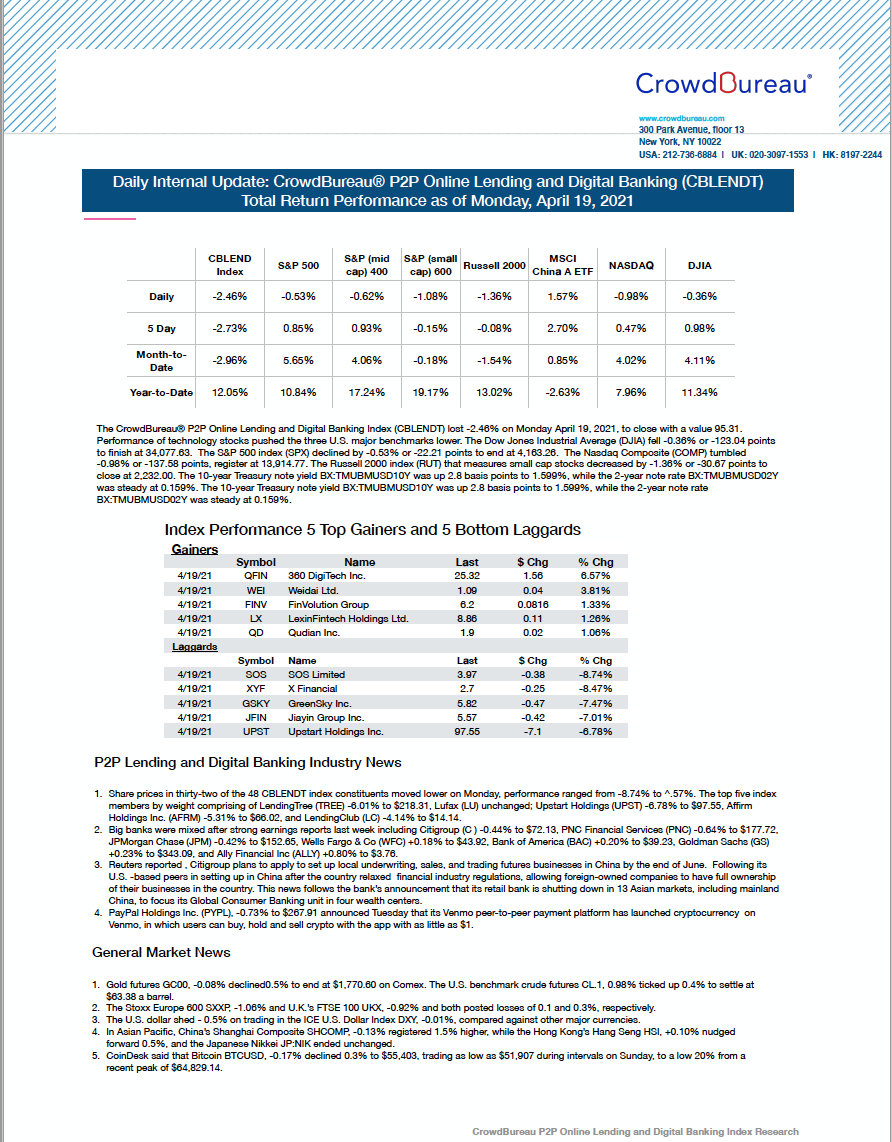

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) lost -2.46% for the session

April 19, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) lost -2.46% on Monday April 19, 2021, to close with a value 95.31. Performance of technology stocks pushed the three U.S. major benchmarks lower.

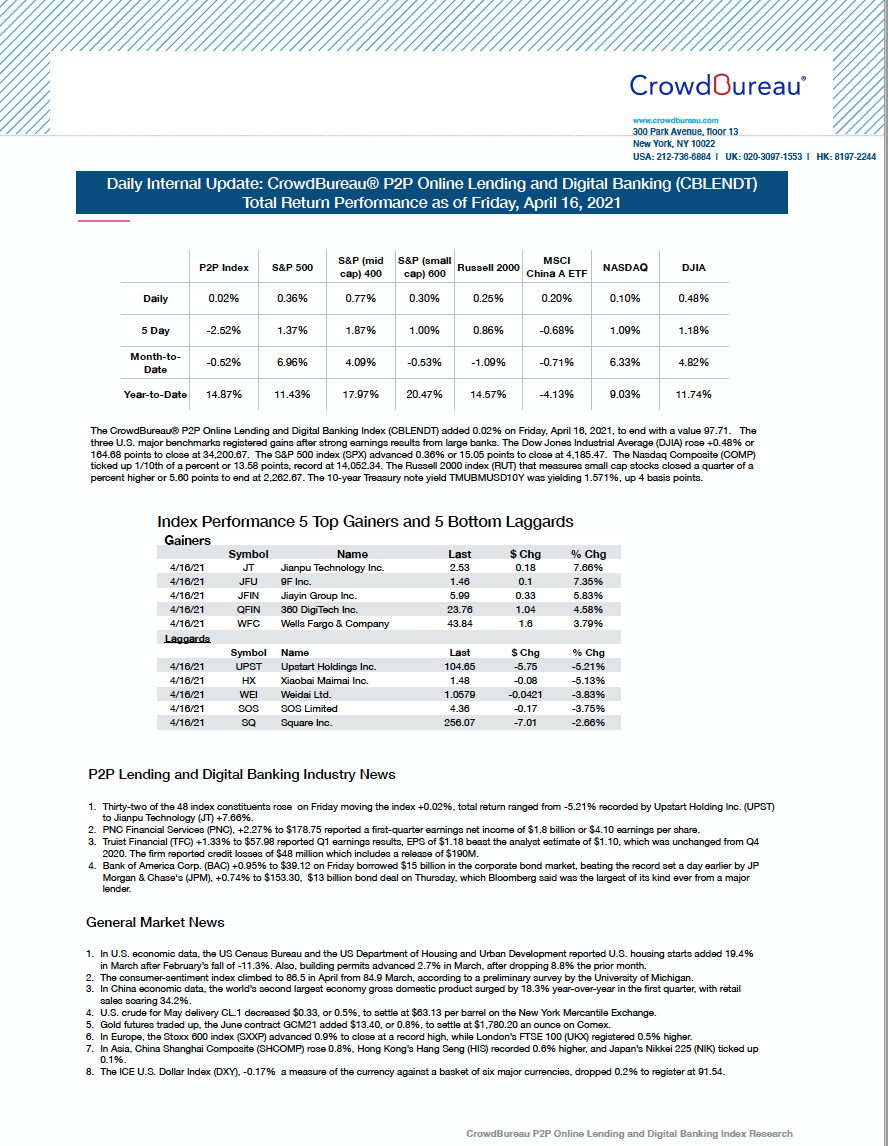

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added less than a percent, +0.02%

April 16, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 0.02% on Friday, April 16, 2021, to end with a value 97.71. The three U.S. major benchmarks registered gains after strong earnings results from large banks and positive economic data.

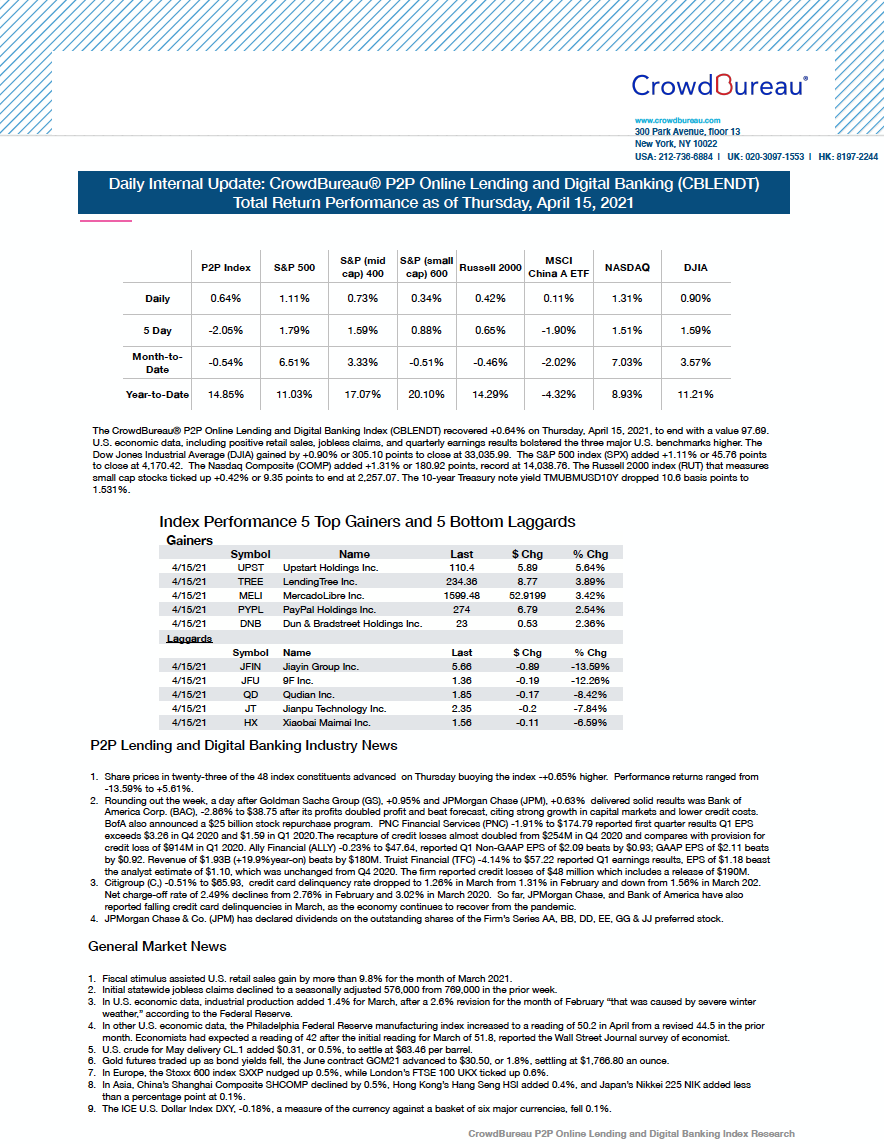

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +0.64%, to recover at the end of the session

April 15, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) recovered +0.64% on Thursday, April 15, 2021, to end with a value 97.69. U.S. economic data, including positive retail sales, jobless claims, and quarterly earnings results bolstered the three major U.S. benchmarks higher.

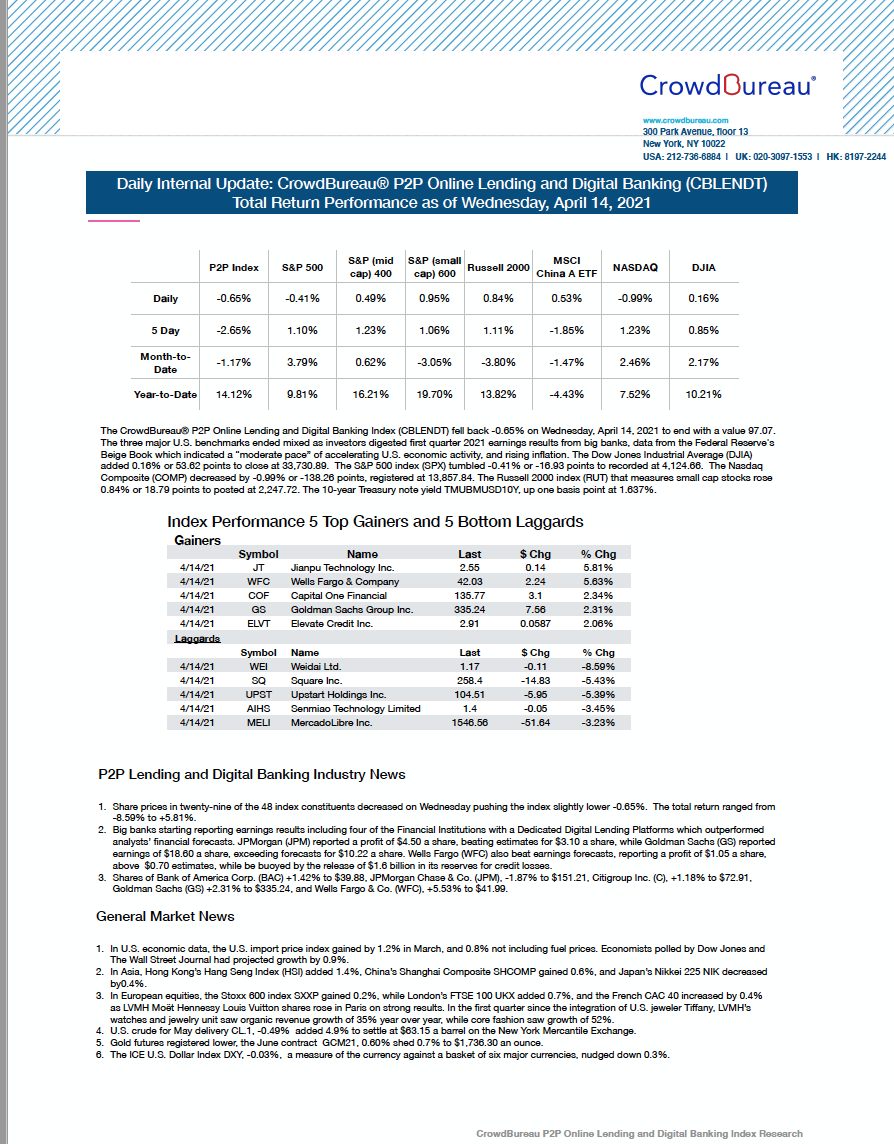

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) fell back -0.65%

April 14, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) fell back -0.65% on Wednesday, April 14, 2021 to end with a value 97.07. The three major U.S. benchmarks ended mixed as investors digested first quarter 2021 earnings results from big banks, data from the Federal Reserve’s Beige Book which indicated a “moderate pace” of accelerating U.S. economic activity, and rising inflation.

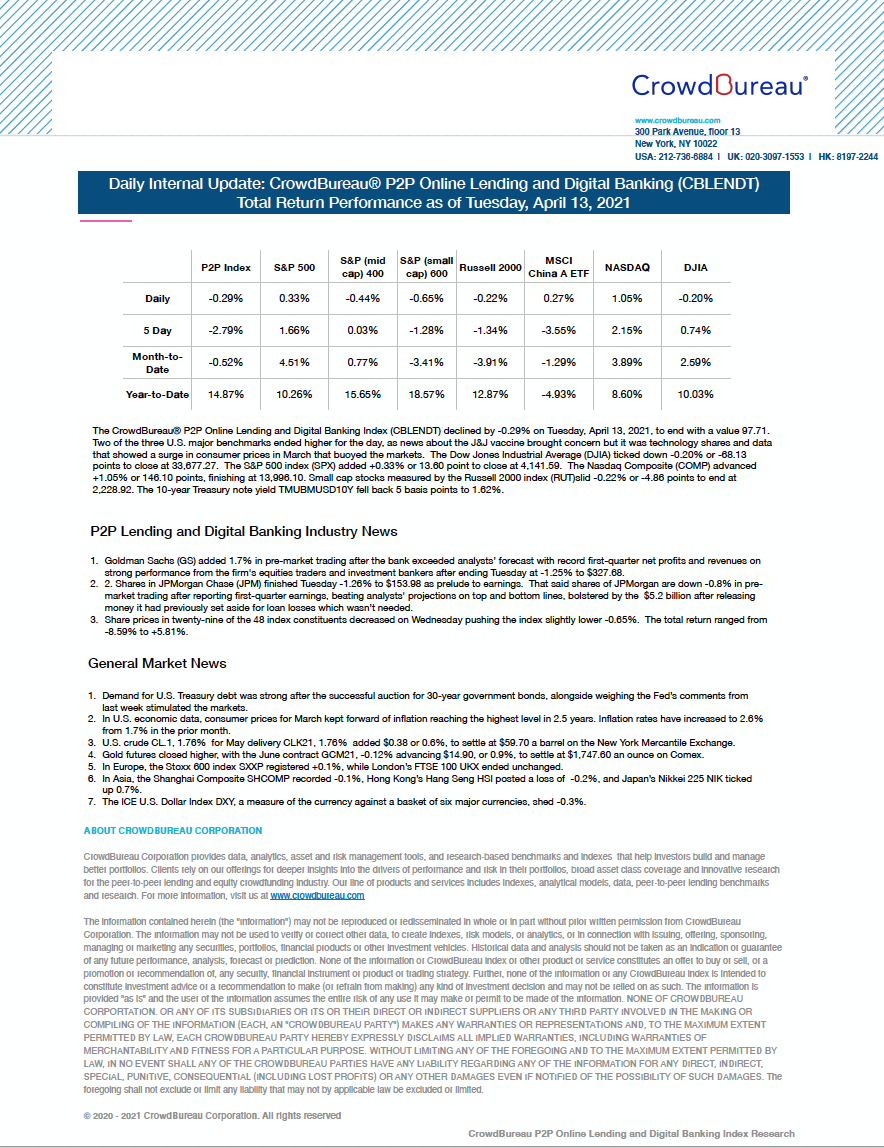

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) declined by -0.29%

April 13, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) declined by -0.29% on Tuesday, April 13, 2021, to end with a value 97.71. Two of the three U.S. major benchmarks ended higher for the day, as news about the J&J vaccine brought concern but it was technology shares and data that showed a surge in consumer prices in March that buoyed the markets.

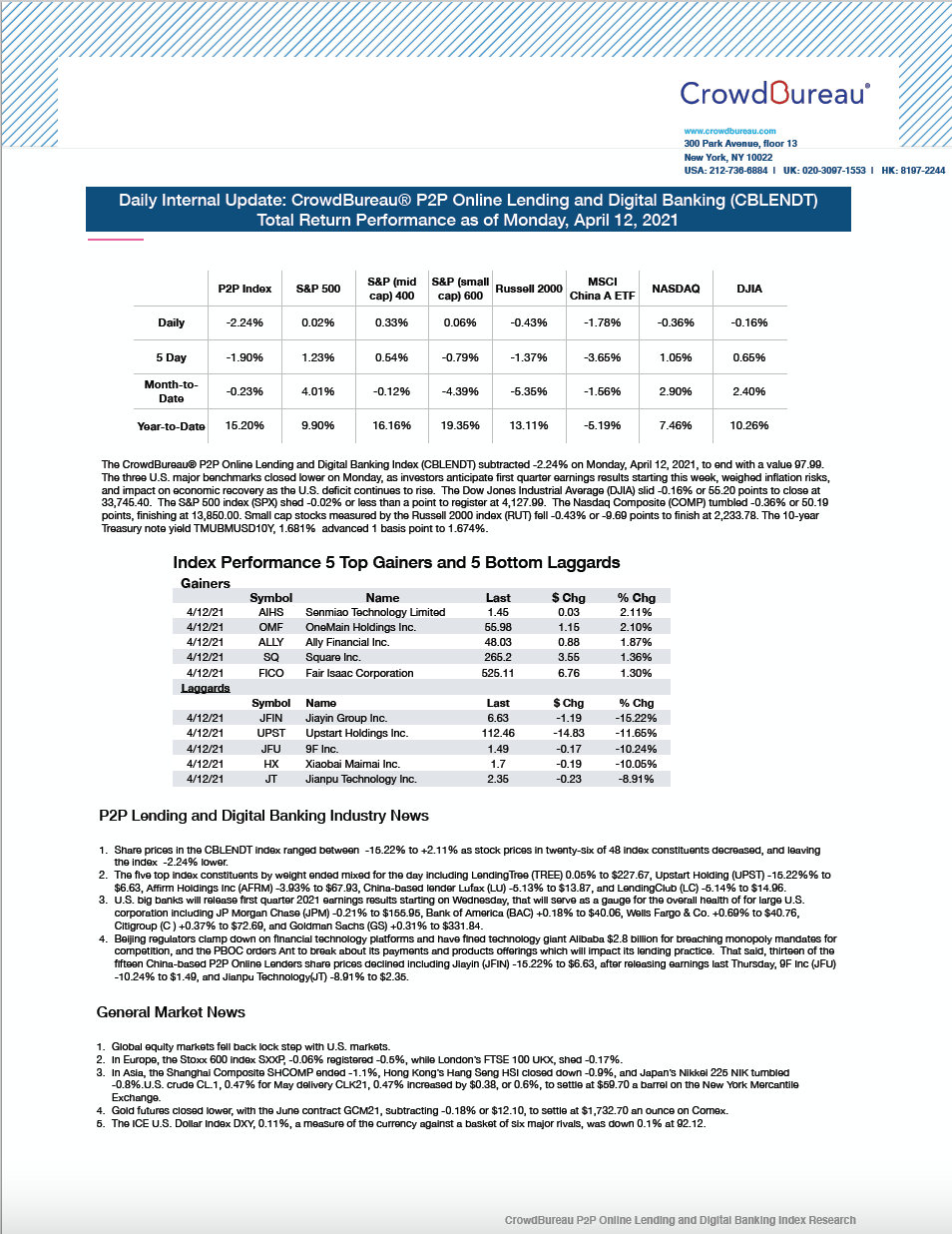

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) started the week lower, substracting -2.24%

April 12, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) subtracted -2.24% on Monday, April 12, 2021, to end with a value 97.99. The three U.S. major benchmarks closed lower on Monday, as investors anticipate first quarter earnings results starting this week, weighed inflation risks, and impact on economic recovery as the U.S. deficit continues to rise.

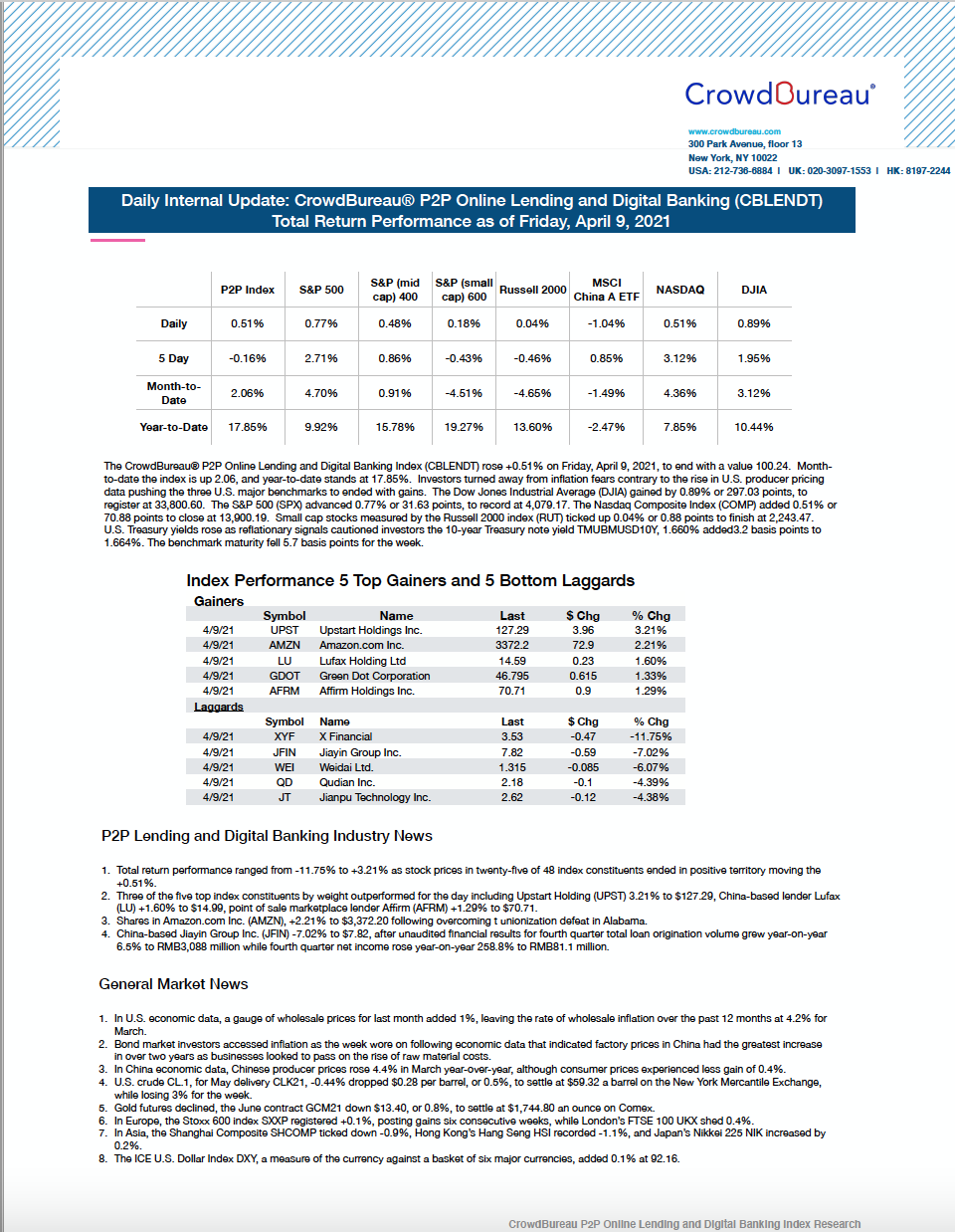

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +0.51%

April 9, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose +0.51% on Friday, April 9, 2021, to end with a value 100.24. Investors turned away from inflation fears contrary to the rise in U.S. producer pricing data pushing the three U.S. major benchmarks to end with gains.

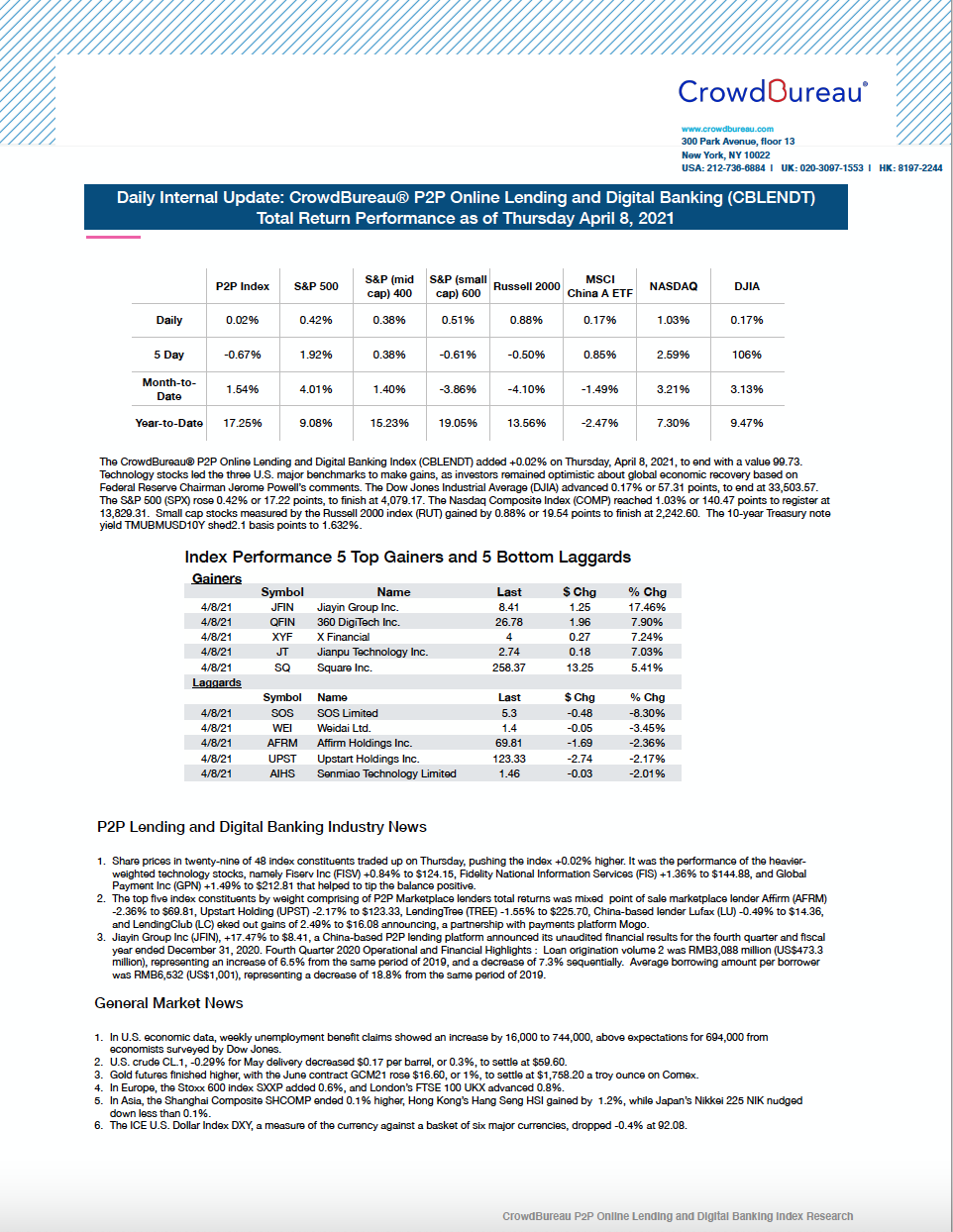

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ticked up +0.02%

April 8, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added +0.02% on Thursday, April 8, 2021, to end with a value 99.73. Technology stocks led the three U.S. major benchmarks to make gains, as investors remained optimistic about global economic recovery based on Federal Reserve Chairman Jerome Powell’s comments.

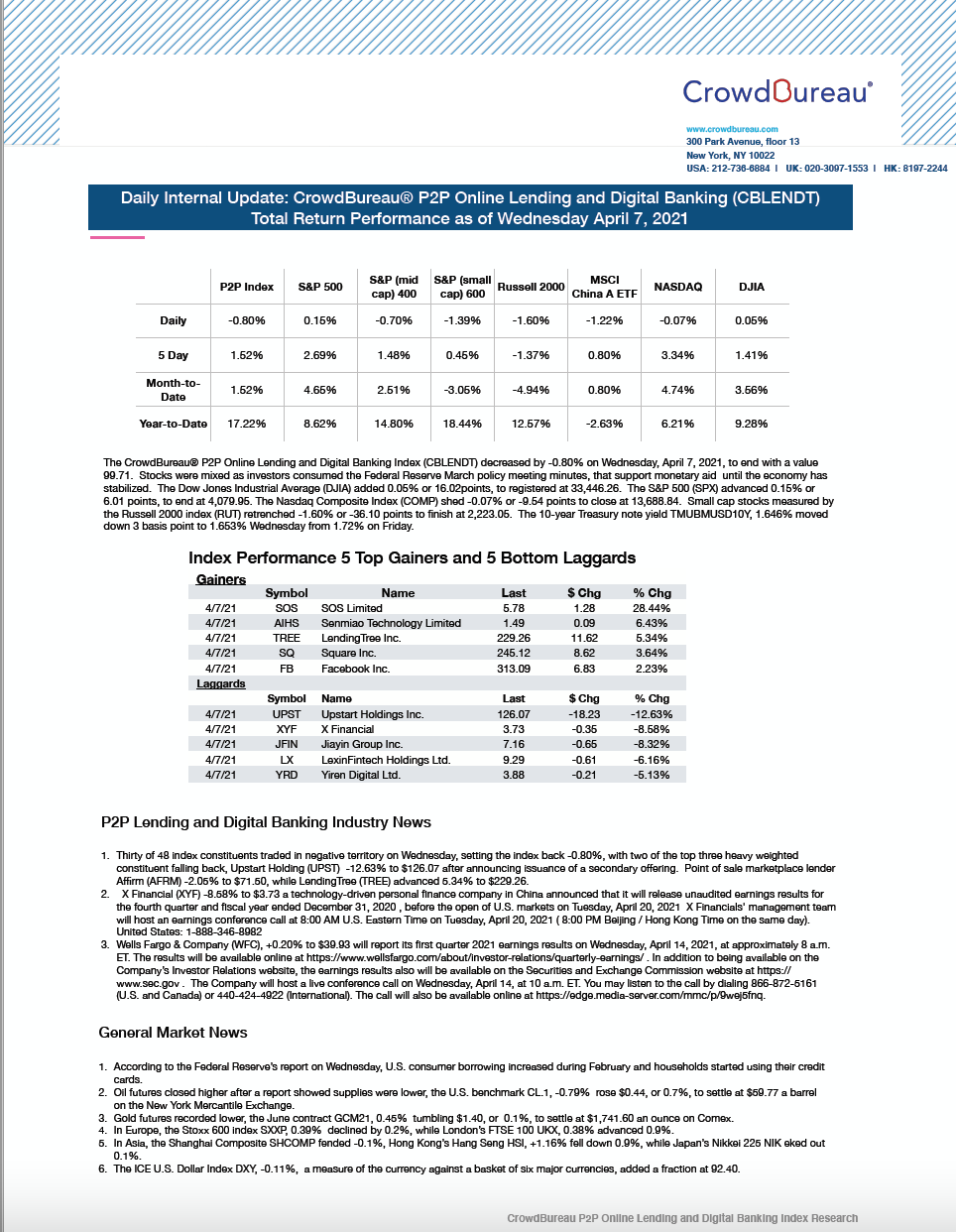

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) decreased by -0.80%

April 7, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) decreased by -0.80% on Wednesday, April 7, 2021, to end with a value 99.71. Stocks were mixed as investors consumed the Federal Reserve March policy meeting minutes, that support monetary aid until the economy has stabilized.

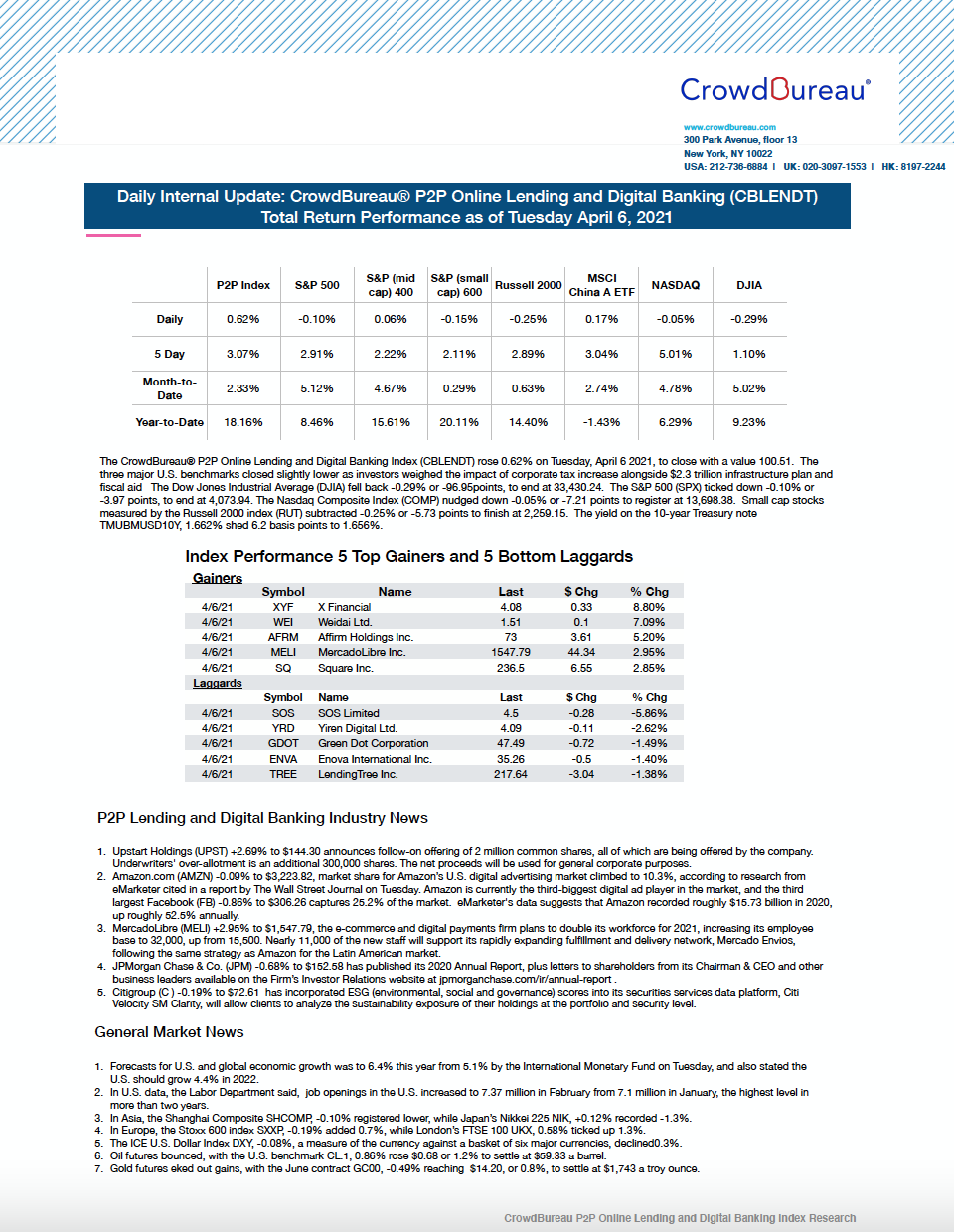

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +0.62%

April 6, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 0.62% on Tuesday, April 6 2021, to close with a value 100.51. The three major U.S. benchmarks closed slightly lower as investors weighed the impact of corporate tax increase alongside the $2.3 trillion infrastructure plan and fiscal aid.

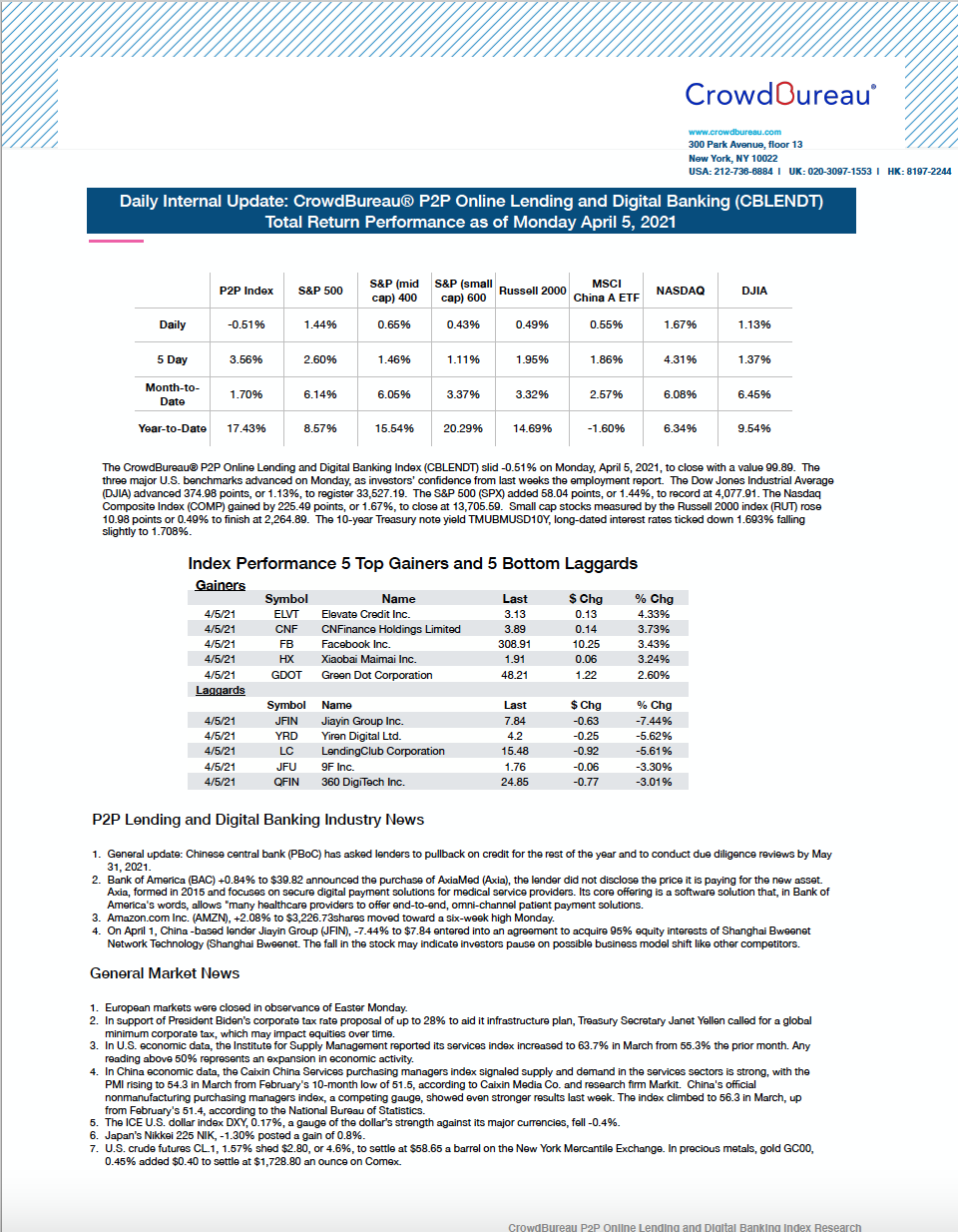

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) slid -0.51%

April 5, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) slid -0.51% on Monday, April 5, 2021, to close with a value 99.89. The three major U.S. benchmarks advanced on Monday, as investors’ confidence was bolstered by last weeks the employment report.

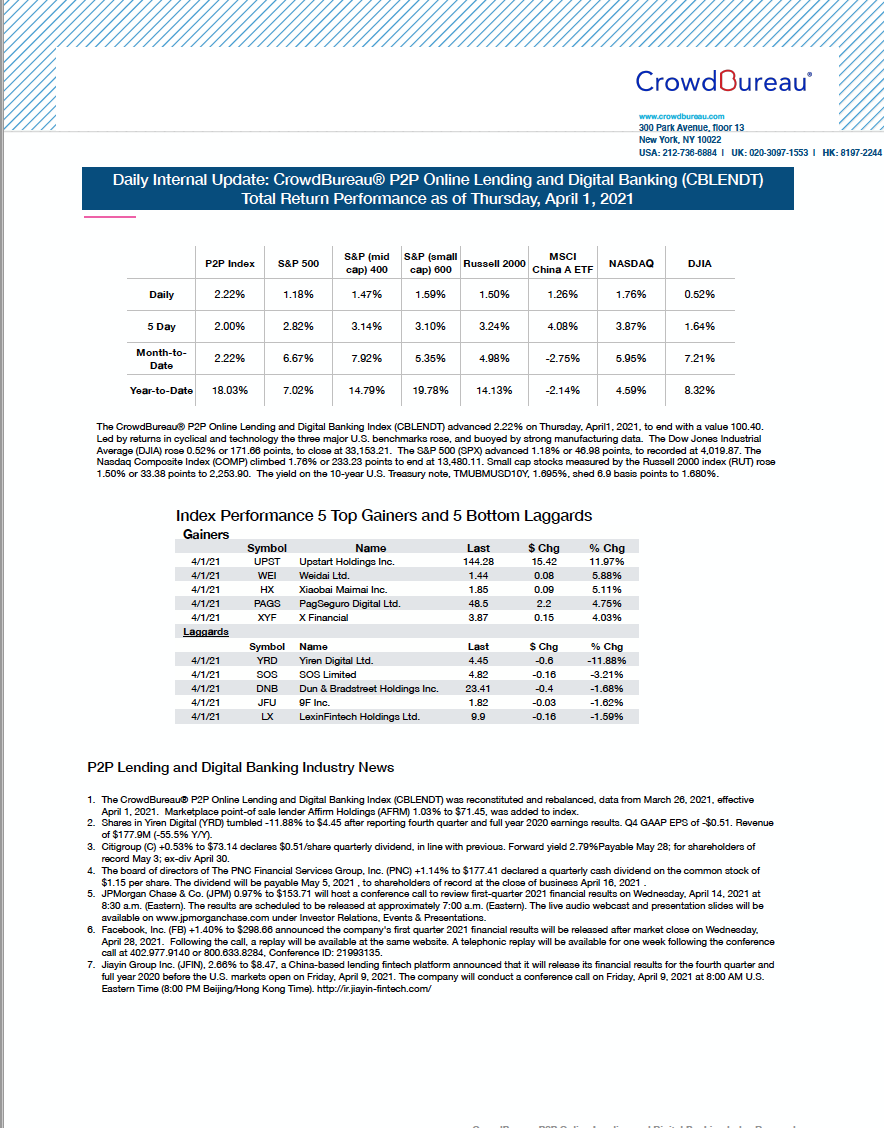

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) advanced +2.22%

April 1, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced 2.22% on Thursday, April 1, 2021, to end with a value 100.40. Led by returns in cyclical and technology the three major U.S. benchmarks rose, and buoyed by strong manufacturing data.

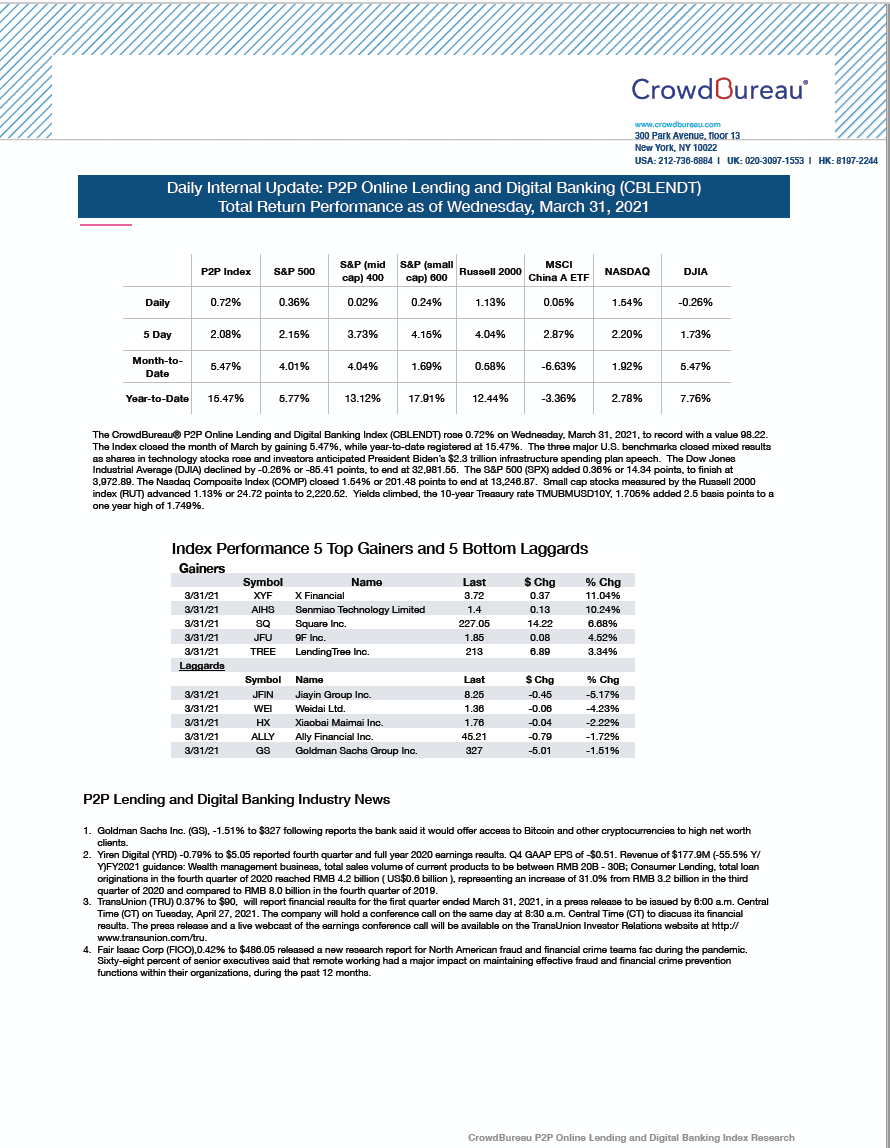

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) closed higher, rising +0.72% to end the session

March 31, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 0.72% on Wednesday, March 31, 2021, to record with a value 98.22. The Index closed the month of March by gaining 5.47%, while year-to-date registered at 15.47%. The three major U.S. benchmarks closed mixed results as shares in technology stocks rose and investors anticipated President Biden’s $2.3 trillion infrastructure spending plan speech.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course by advancing +1.10%

March 30, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced 1.10% on Tuesday, March 30, 2021, to close with a value 97.52. On a month-to-date and year-to-date basis, the index is recording 4.71% and 14.65%, respectively. The three major U.S. benchmarks reversed course and closed in negative territory as bond yields rose and investors weighed the potential of inflation against the economy’s recovery.

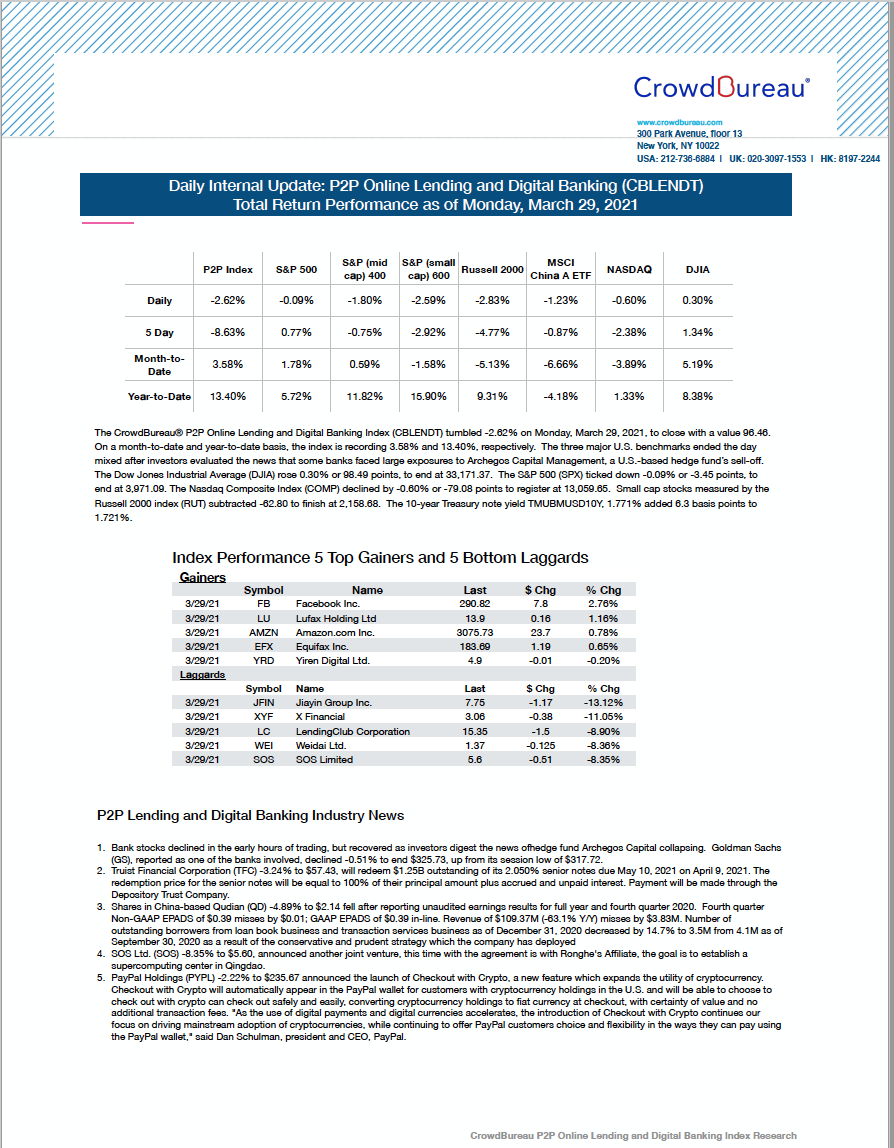

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) started the week by tumbling -2.62%

March 29, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) tumbled -2.62% on Monday, March 29, 2021, to close with a value 96.46. The three major U.S. benchmarks ended the day mixed after investors evaluated the news that some banks faced large exposures to Archegos Capital Management, a U.S.-based hedge fund’s sell-off.

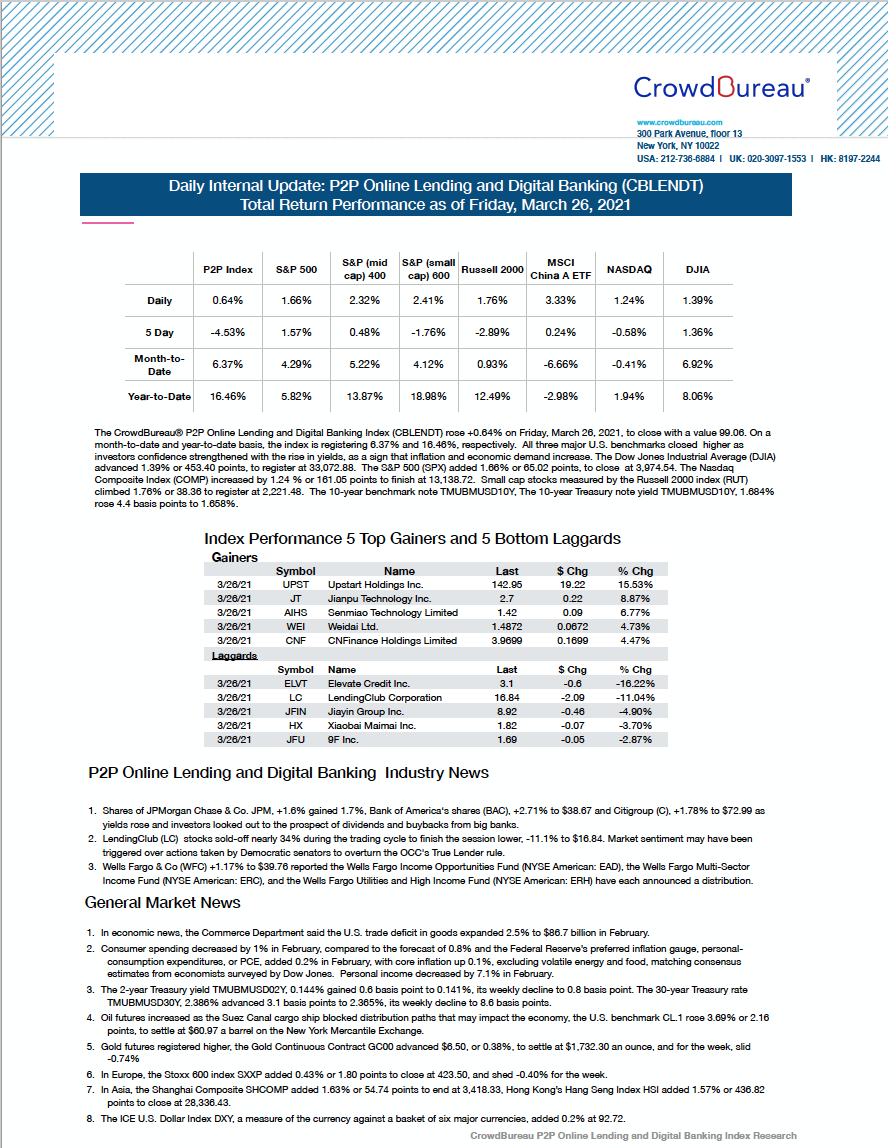

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +0.64%, to end higher

March 26, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose +0.64% on Friday, March 26, 2021, to close with a value 99.06. On a month-to-date and year-to-date basis, the index is registering 6.37% and 16.46%, respectively. All three major U.S. benchmarks closed higher as investors confidence strengthened with the rise in yields, as a sign that inflation and economic demand.

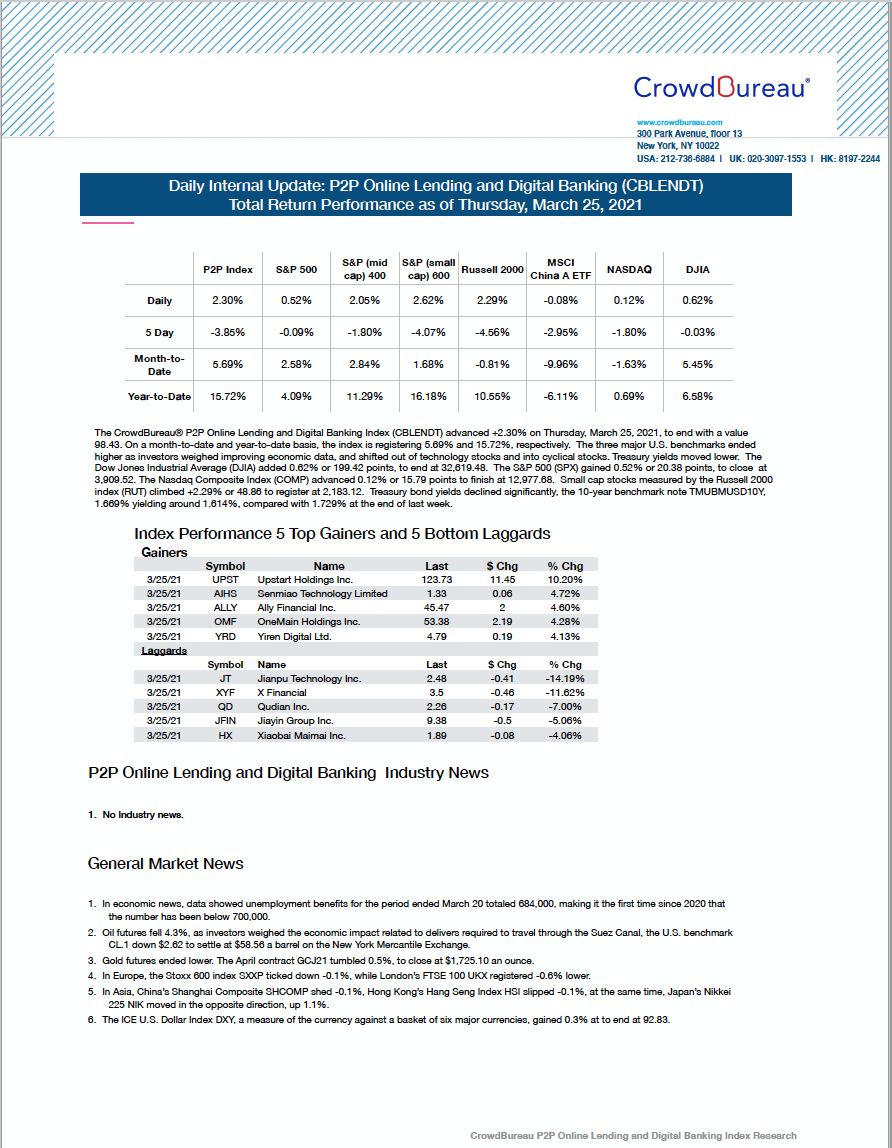

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) advanced +2.30%, to close Thursday higher

March 25, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced +2.30% on Thursday, March 25, 2021, to end with a value 98.43. The three major U.S. benchmarks ended higher as investors weighed improving economic data, and shifted out of technology stocks and into cyclical stocks. Treasury yields moved lower.

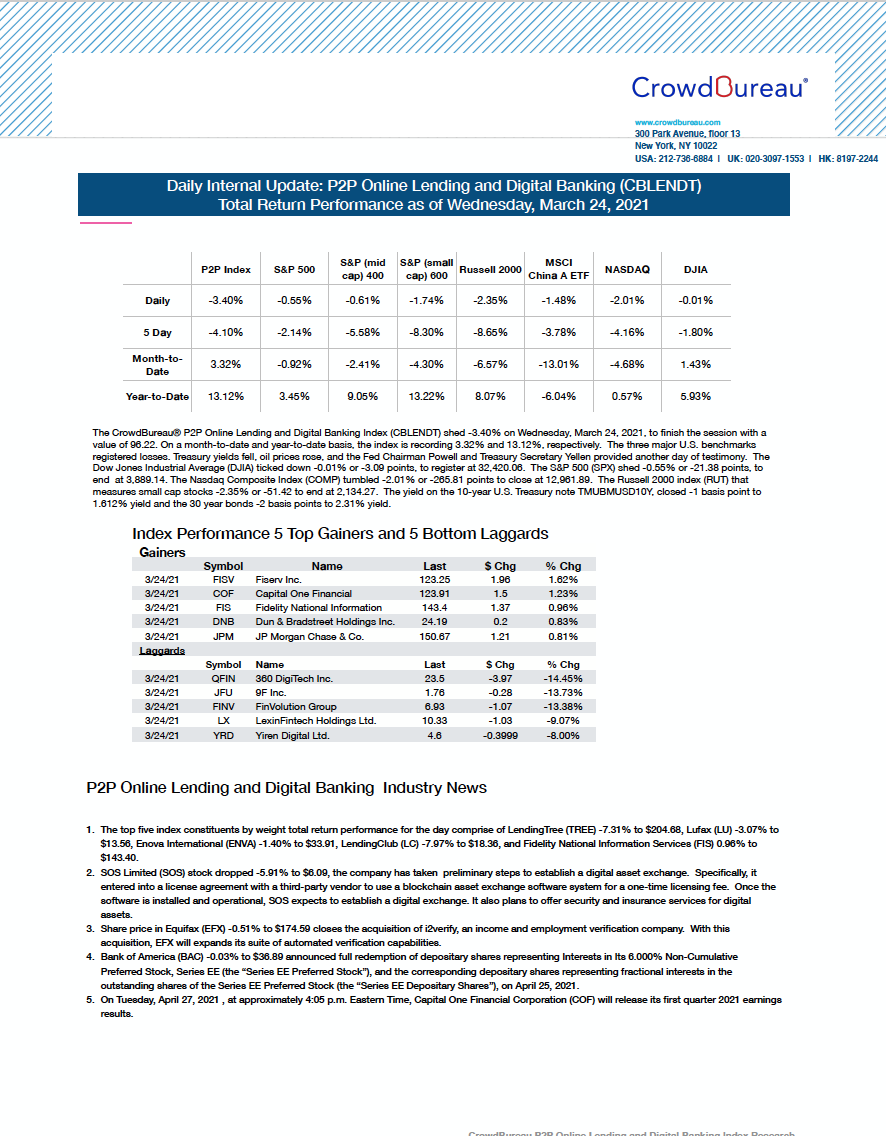

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) shed -3.40%, to end the session

March 24, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) shed -3.40% on Wednesday, March 24, 2021, to finish the session with a value of 96.22. On a month-to-date and year-to-date basis, the index is recording 3.32% and 13.12%, respectively. The three major U.S. benchmarks registered losses. Treasury yields fell, oil prices rose, and the Fed Chairman Powell and Treasury Secretary Yellen provided another day of testimony.

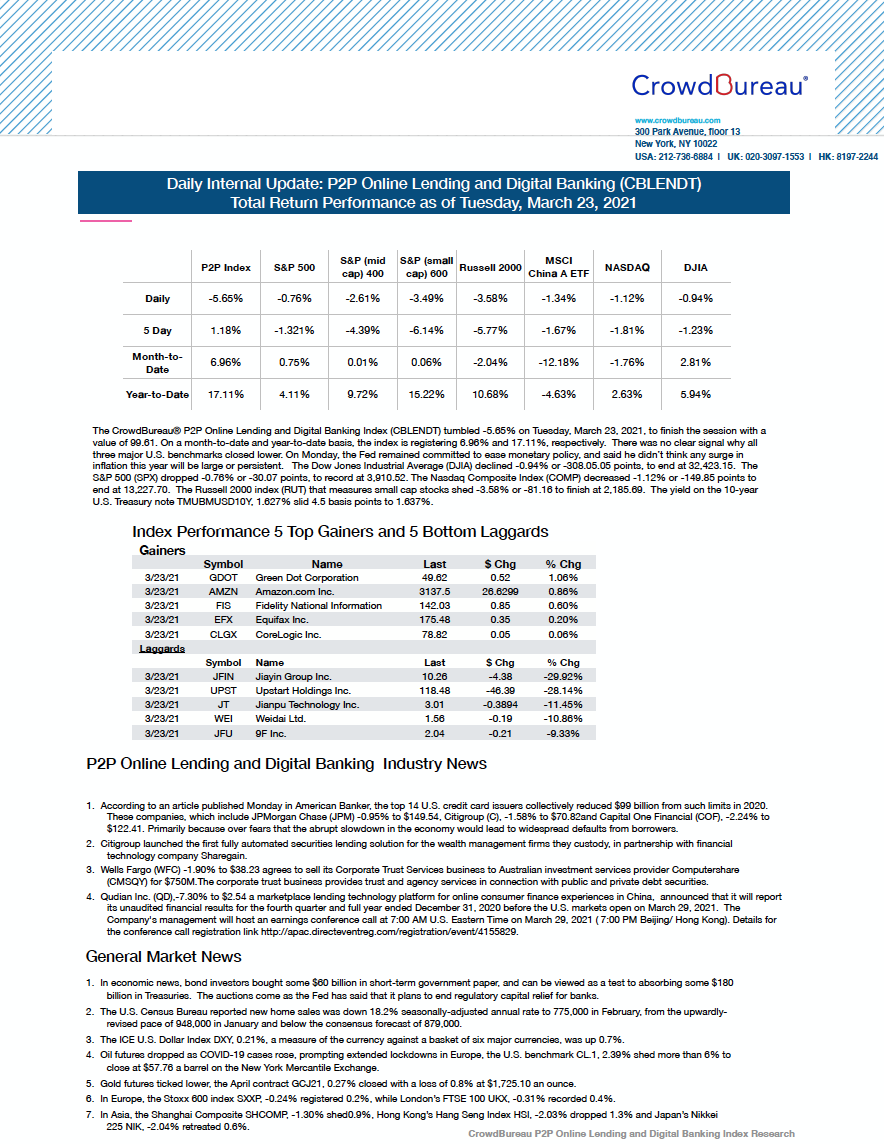

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course, to tumble -5.65%

March 23, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) tumbled -5.65% on Tuesday, March 23, 2021, to finish the session with a value of 99.61. On a month-to-date and year-to-date basis, the index is registering 6.96% and 17.11%, respectively. There was no clear signal why all three major U.S. benchmarks closed lower. On Monday, the Fed remained committed to ease monetary policy, and said he didn’t think any surge in inflation this year will be large or persistent.

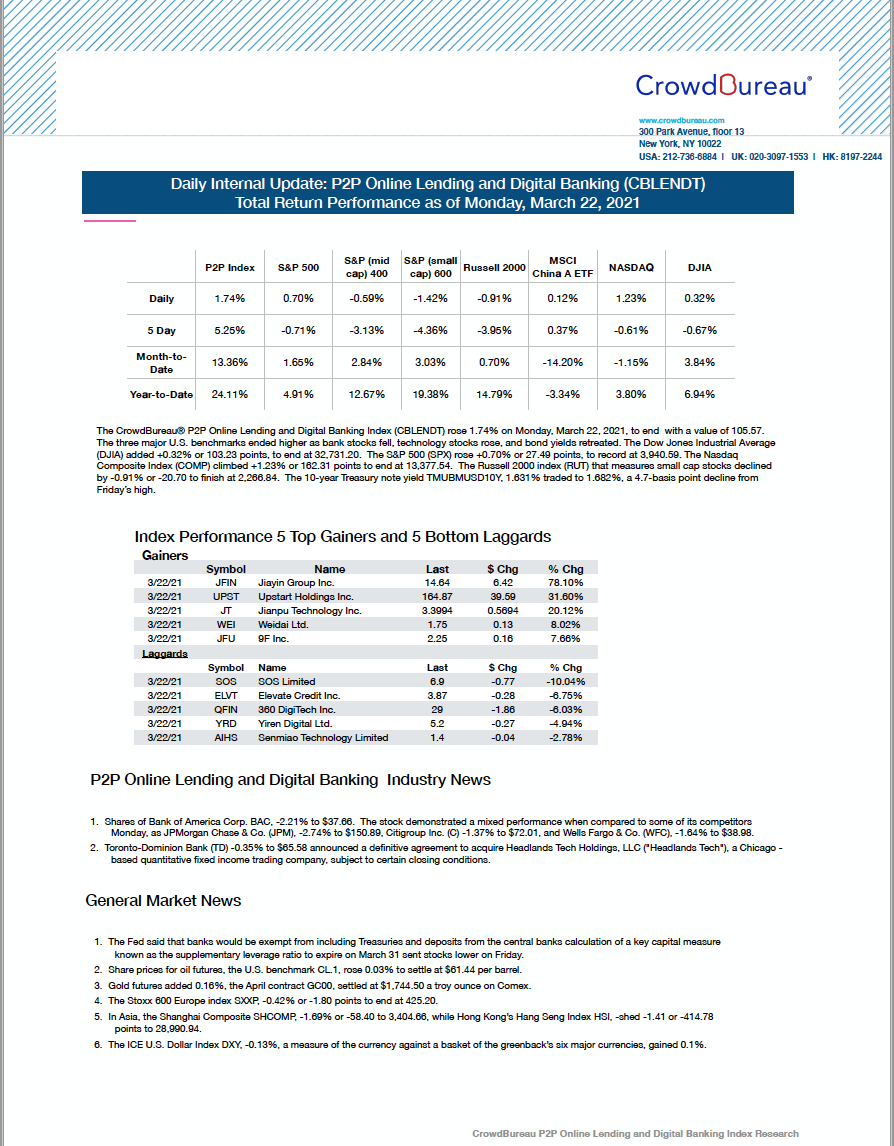

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +1.74% to start the week in positive territory

March 22, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 1.74% on Monday, March 22, 2021, to end with a value of 105.57. The three major U.S. benchmarks ended higher as bank stocks fell, technology stocks rose, and bond yields retreated.

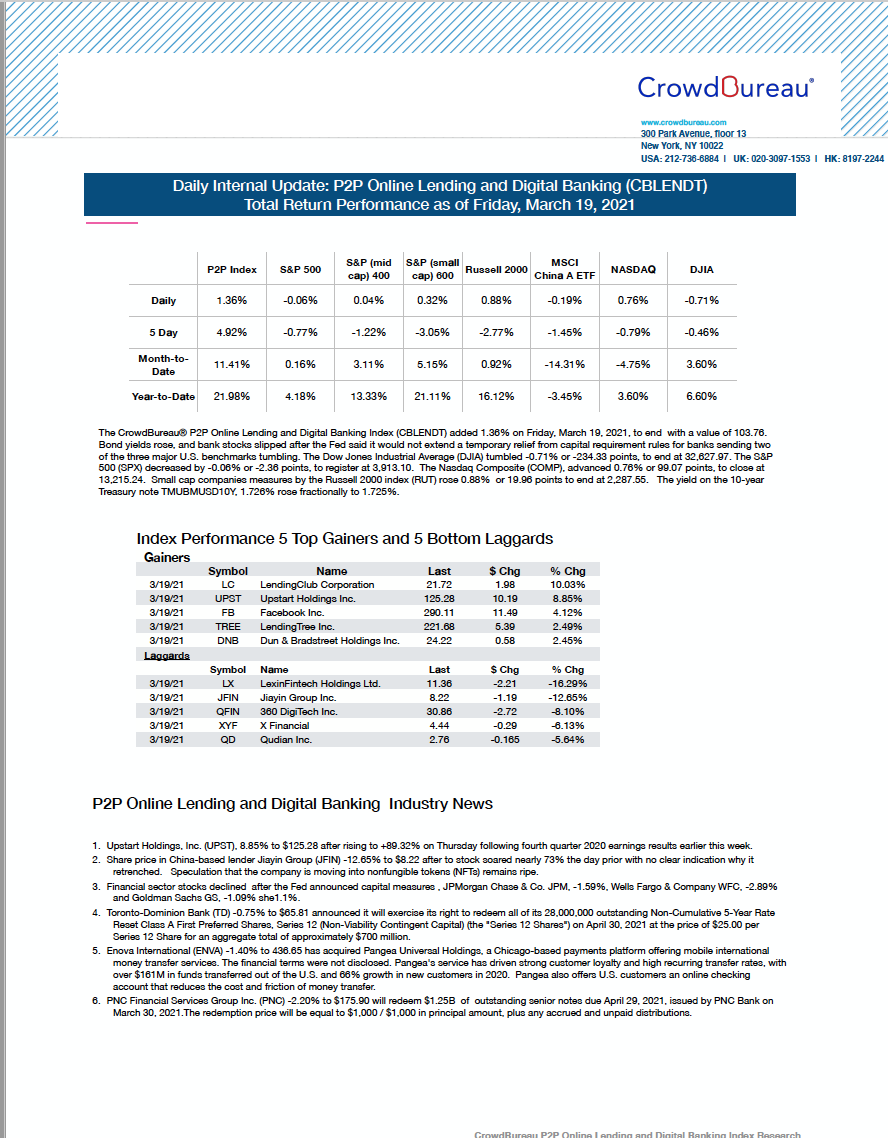

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +1.36%, to end the trading session

March 19, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 1.36% on Friday, March 19, 2021, to end with a value of 103.76. Bond yields rose, and bank stocks slipped after the Fed said it would not extend a temporary relief from capital requirement rules for banks sending two of the three major U.S. benchmarks tumbling.

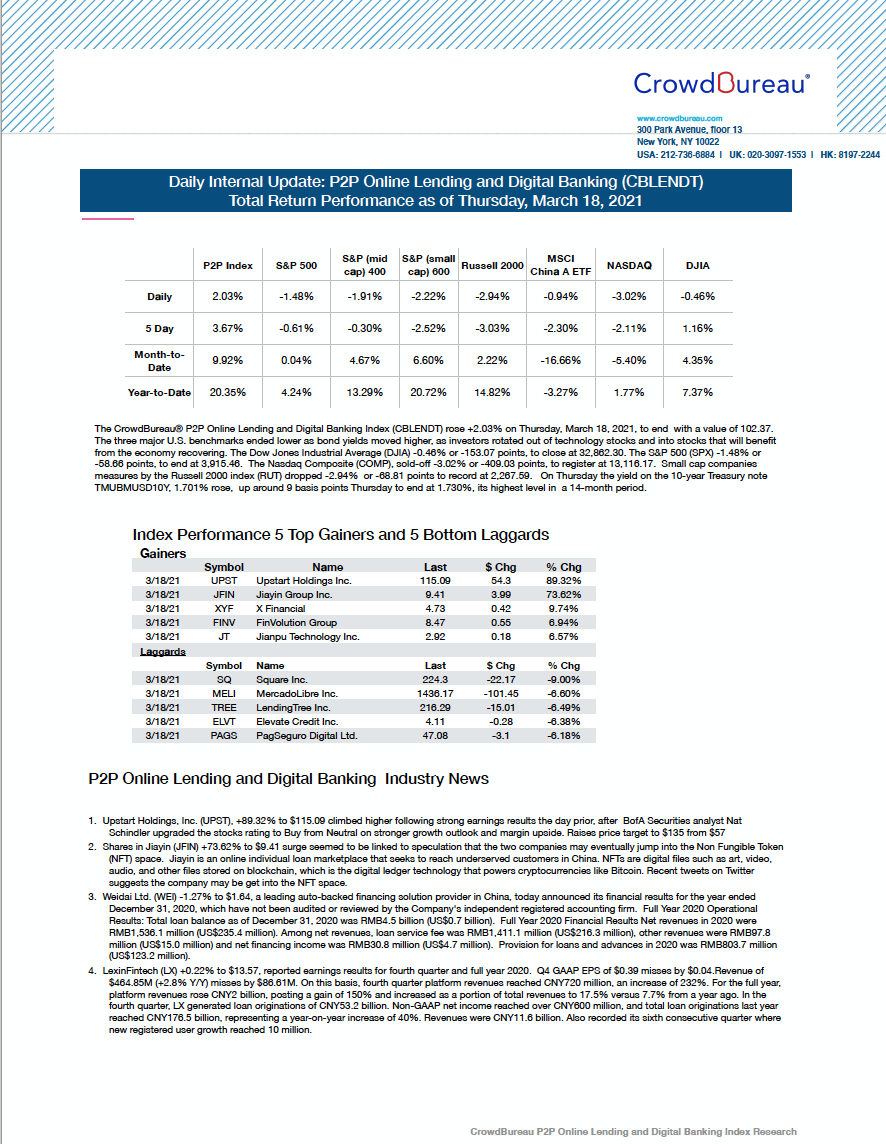

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) moved in the opposite direction to the three major U.S. benchmarks, rising +2.03%

March 18, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose +2.03% on Thursday, March 18, 2021, to end with a value of 102.37. The three major U.S. benchmarks ended lower as bond yields moved higher, as investors rotated out of technology stocks and into stocks that will benefit from the economy recovering.

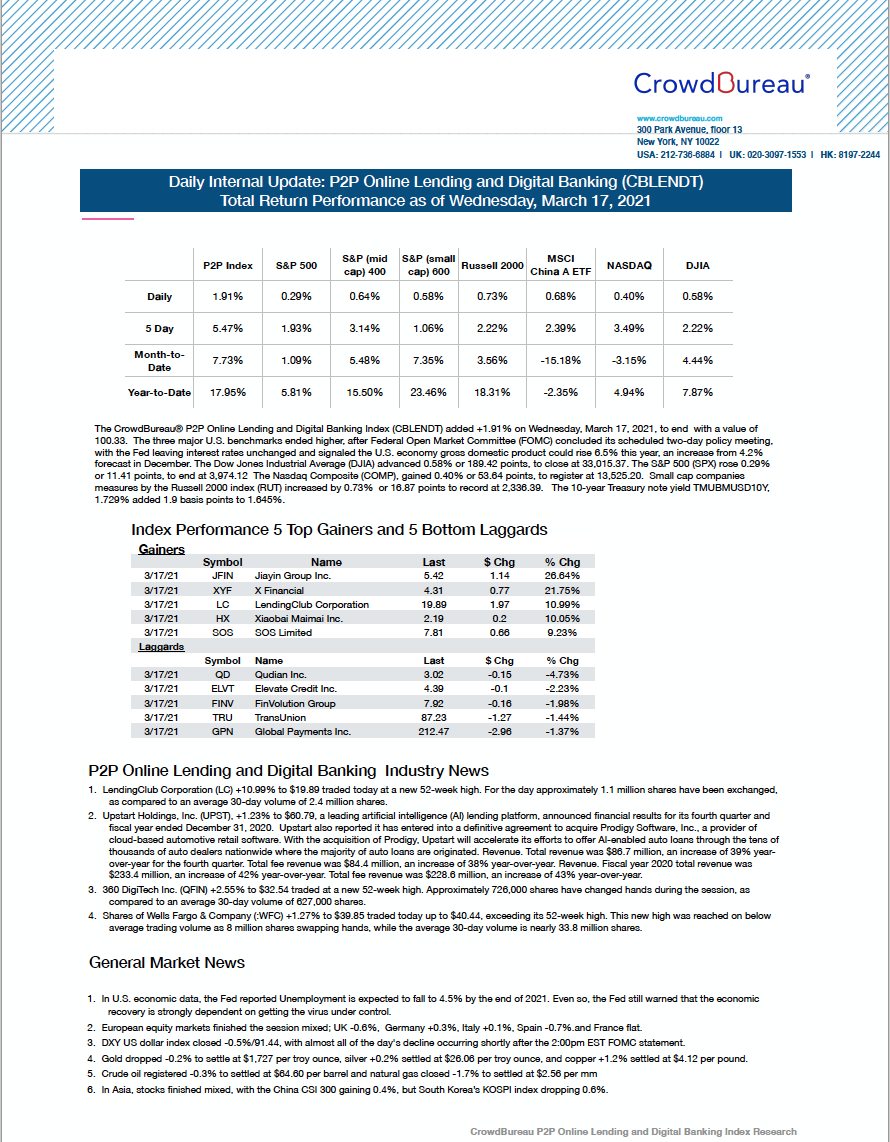

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +1.91%

March 17, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added +1.91% on Wednesday, March 17, 2021, to end with a value of 100.33. The three major U.S. benchmarks ended higher, after Federal Open Market Committee (FOMC) concluded its scheduled two-day policy meeting, with the Fed leaving interest rates unchanged and signaled the U.S. economy gross domestic product could rise 6.5% this year, an increase from 4.2% forecast in December.

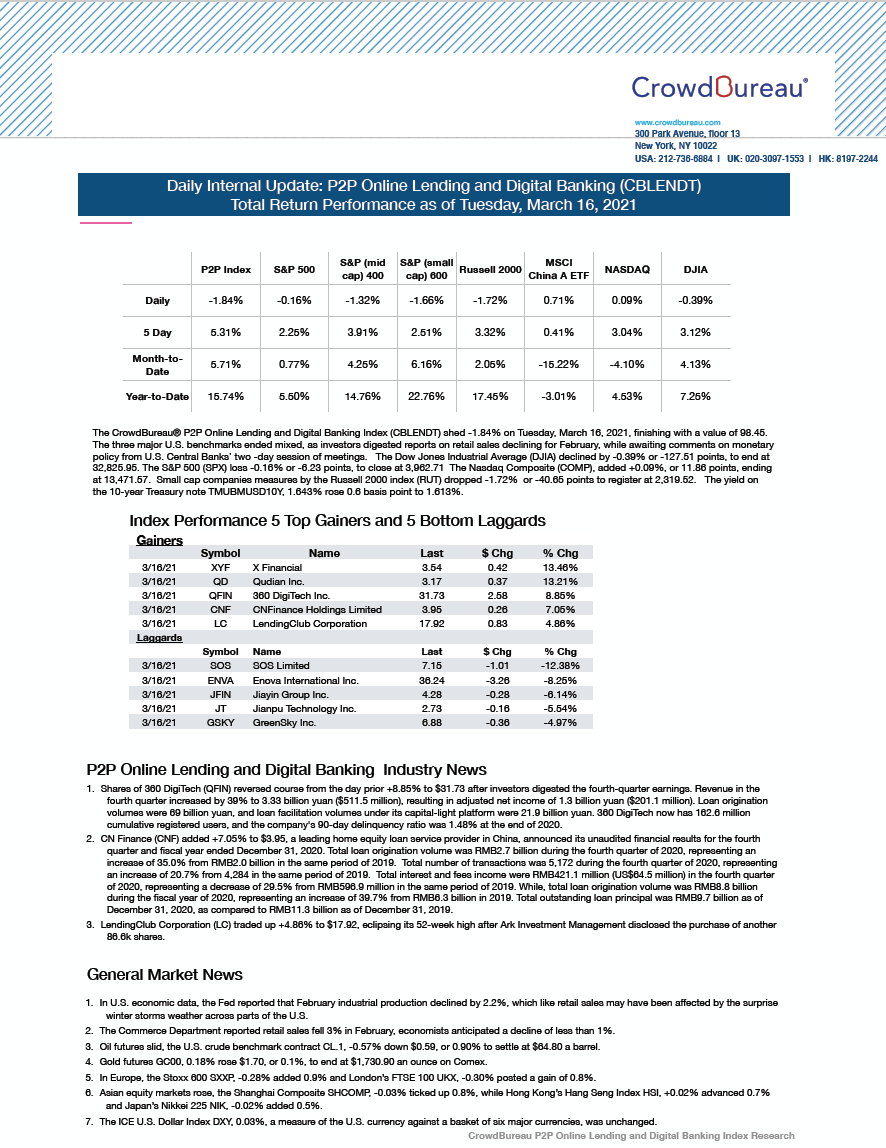

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course, shedding -1.84%

March 16, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) shed -1.84% on Tuesday, March 16, 2021, finishing with a value of 98.45. The three major U.S. benchmarks ended mixed, as investors digested reports on retail sales declining for February, while awaiting comments on monetary policy from U.S. Central Banks’ two -day session of meetings.

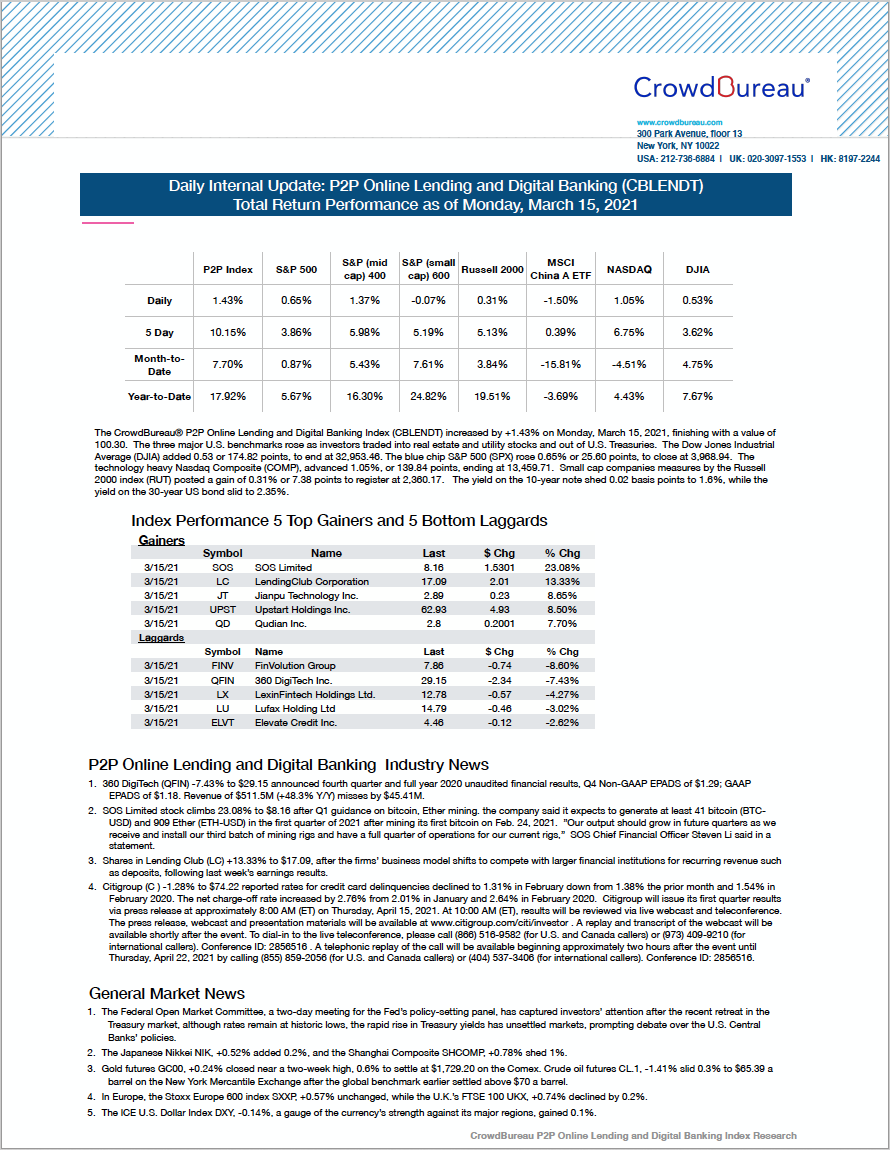

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) increased by +1.43% to start the week

March 15, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) increased by +1.43% on Monday, March 15, 2021, finishing with a value of 100.30. The three major U.S. benchmarks rose as investors traded into real estate and utility stocks and out of U.S. Treasuries.

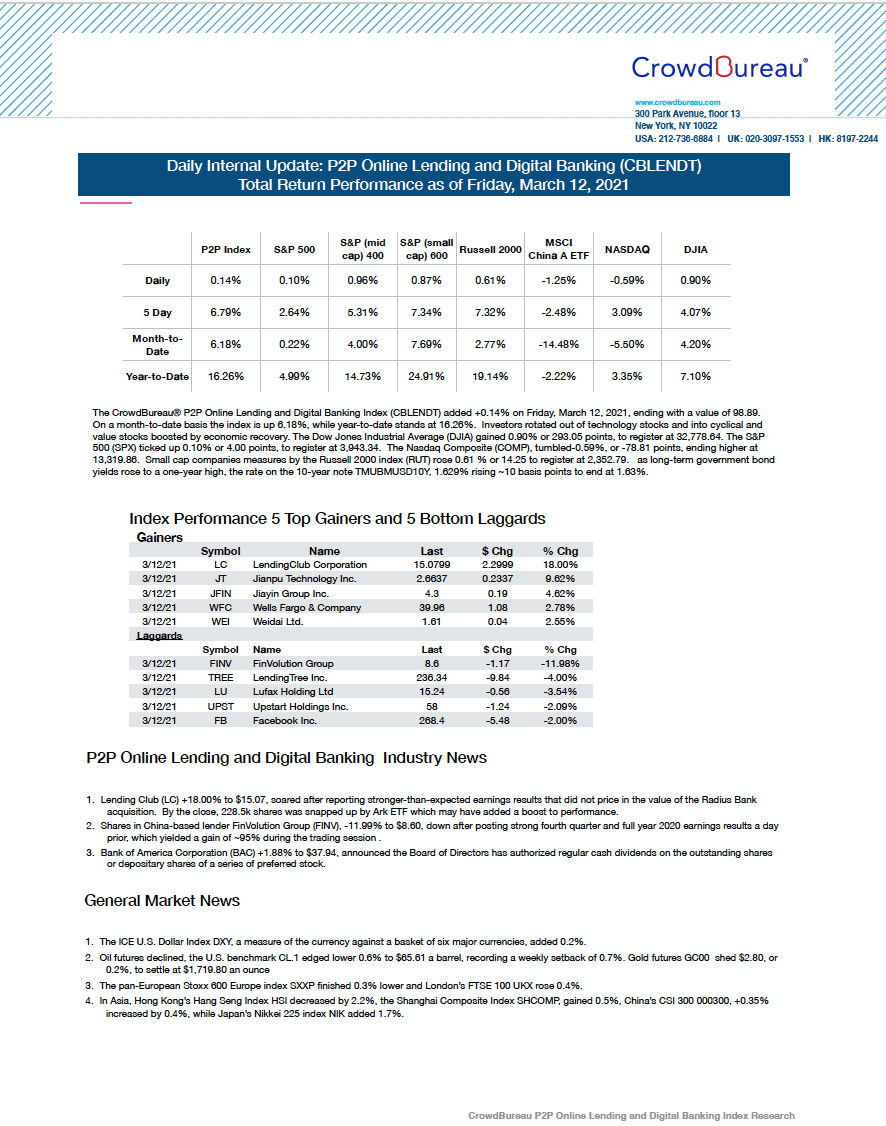

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +0.14%

March 12, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added +0.14% on Friday, March 12, 2021, ending with a value of 98.89. On a month-to-date basis the index is up 6.18%, while year-to-date stands at 16.26%. Investors rotated out of technology stocks and into cyclical and value stocks boosted by economic recovery.

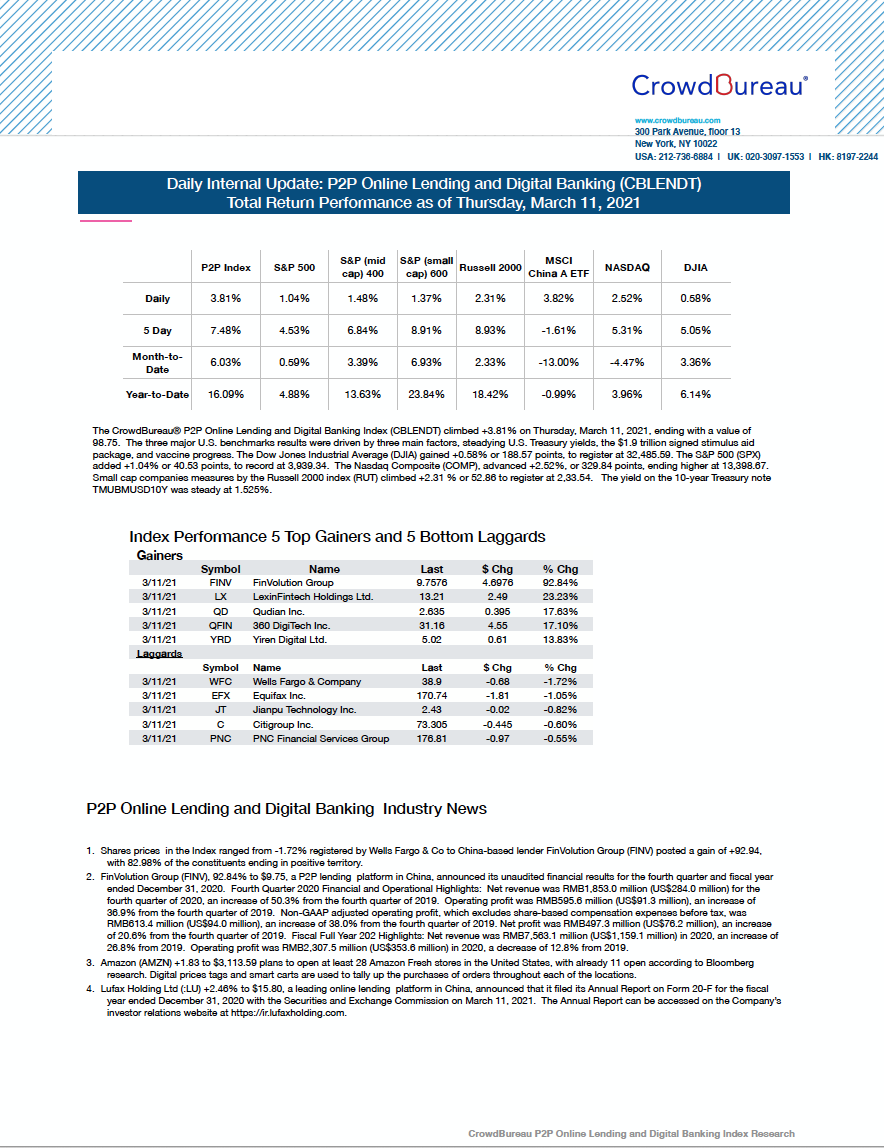

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) climbed +3.81% higher to finish the session

March 11, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) climbed +3.81% on Thursday, March 11, 2021, ending with a value of 98.75. The three major U.S. benchmarks results were driven by three main factors, steadying U.S. Treasury yields, the $1.9 trillion signed stimulus aid package, and vaccine progress.

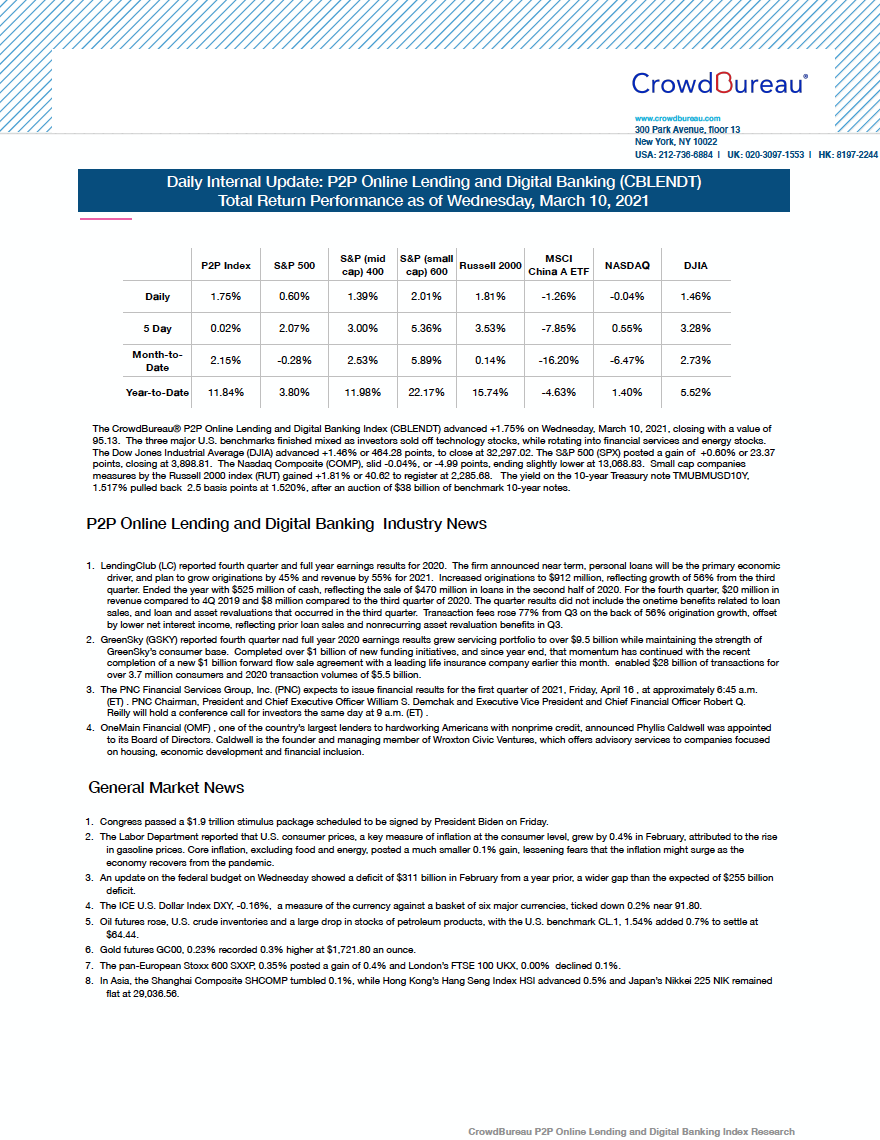

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) advanced +1.75% to end the day in positive territory

March 10, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced +1.75% on Wednesday, March 10, 2021, closing with a value of 95.13. The three major U.S. benchmarks finished mixed as investors sold off technology stocks, while rotating into financial services and energy stocks.

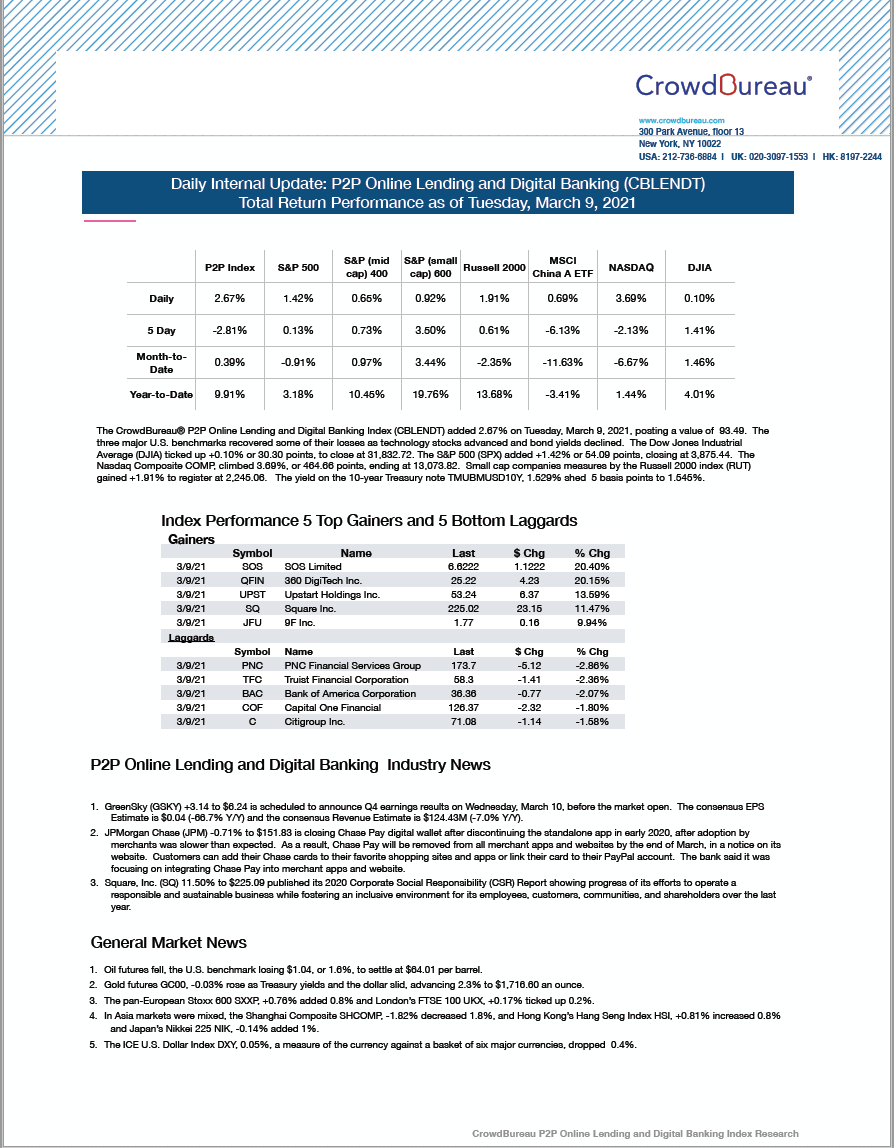

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +2.67%

March 9, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 2.67% on Tuesday, March 9, 2021, posting a value of 93.49. The three major U.S. benchmarks recovered some of their losses as technology stocks advanced and bond yields declined.

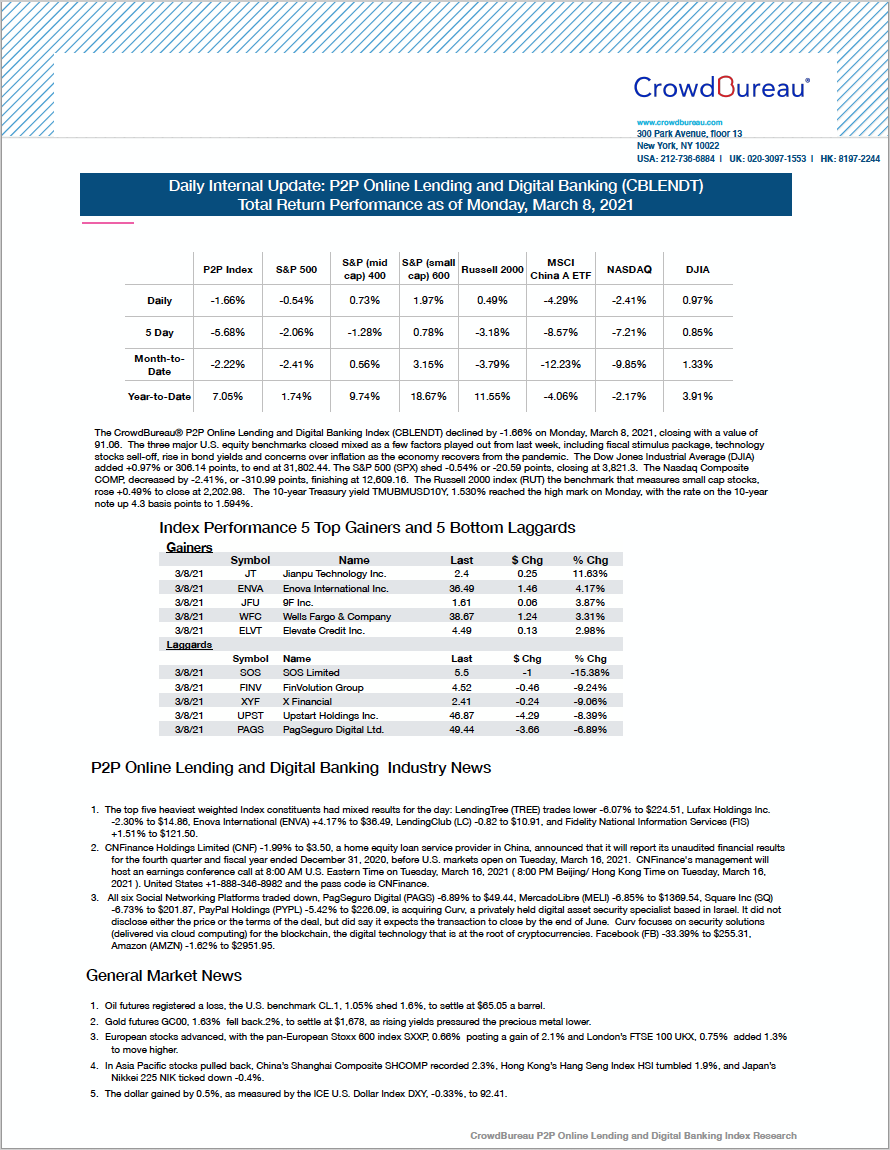

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) declined by -1.66% to close the trading session

March 8, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) declined by -1.66% on Monday, March 8, 2021, closing with a value of 91.06. The three major U.S. equity benchmarks closed mixed as a few factors played out from last week, including fiscal stimulus package, technology stocks sell-off, rise in bond yields and concerns over inflation as the economy recovers from the pandemic.

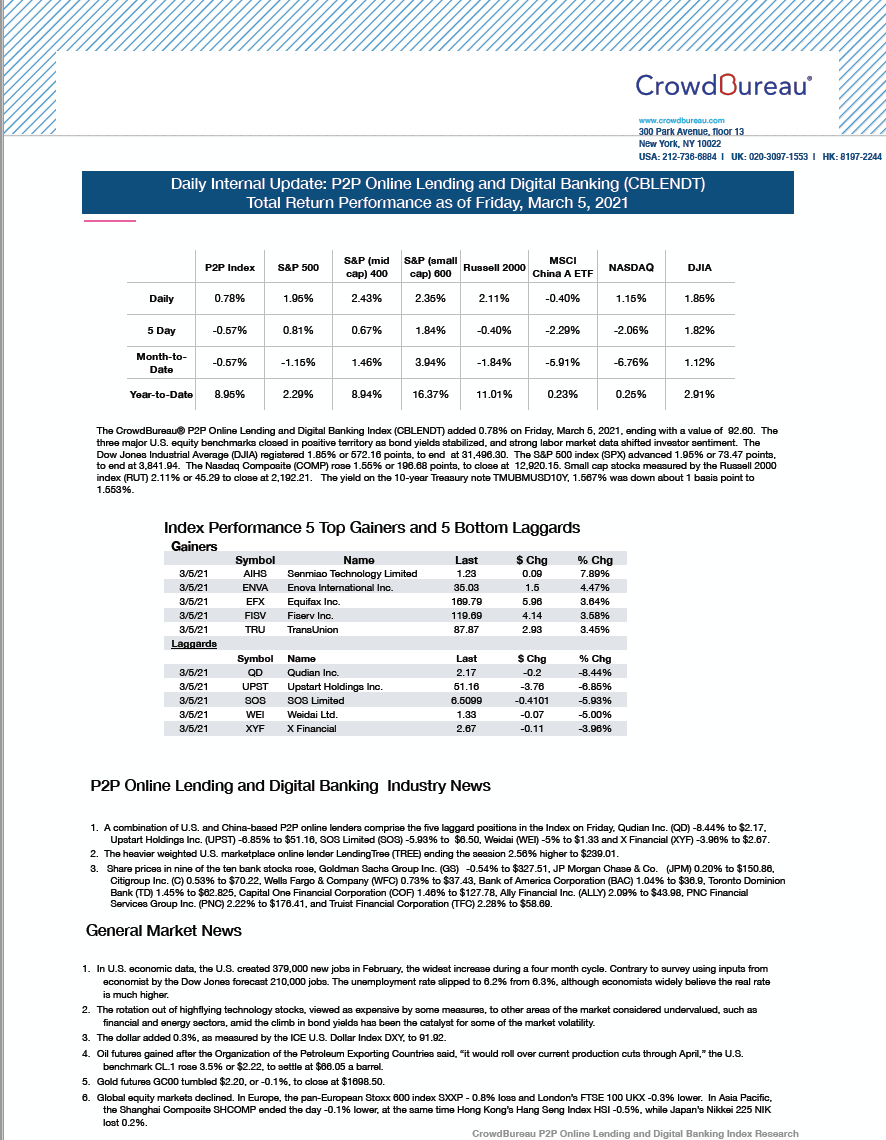

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course, adding +0.78%

March 5, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 0.78% on Friday, March 5, 2021, ending with a value of 92.60. The three major U.S. equity benchmarks closed in positive territory as bond yields stabilized, and strong labor market data shifted investor sentiment.

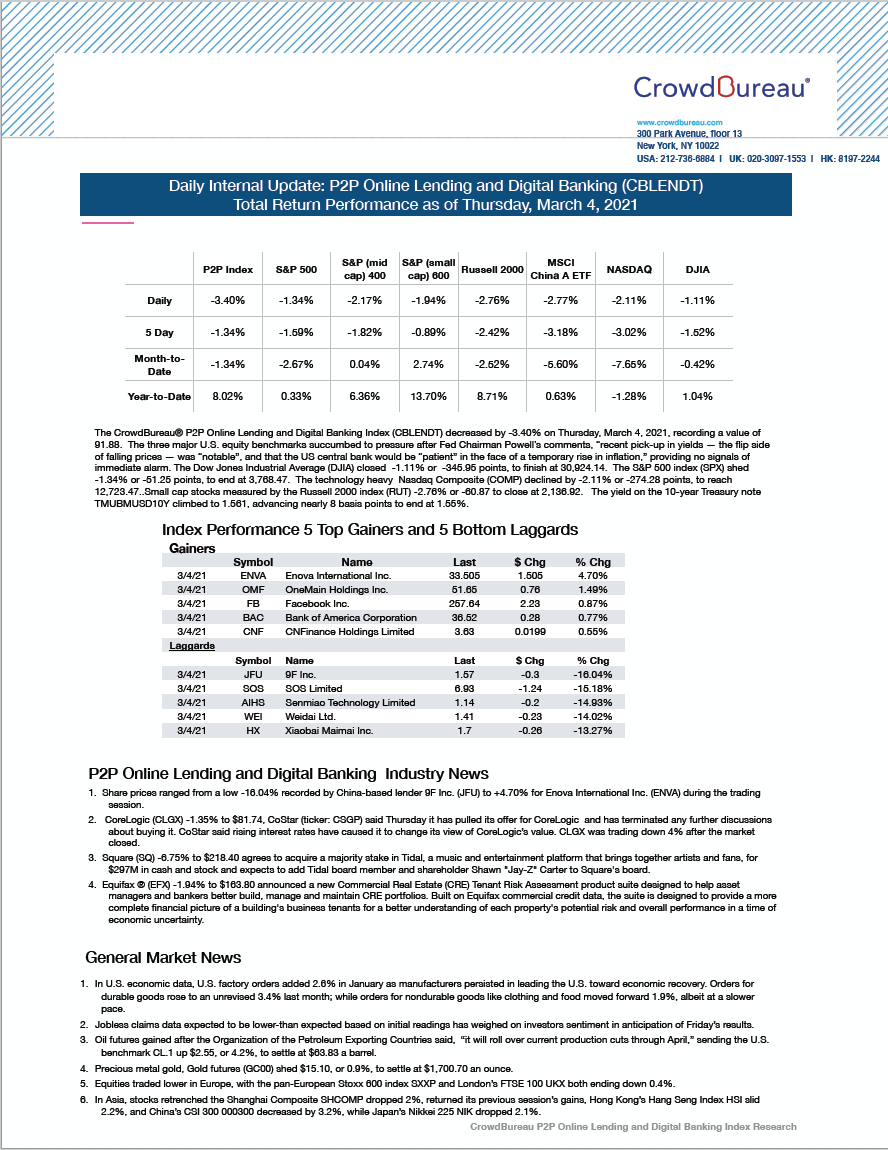

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) decreased for the third consecutive day, ending at -3.40%

March 4, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) decreased by -3.40% on Thursday, March 4, 2021, recording a value of 91.88. The three major U.S. equity benchmarks succumbed to pressure after Fed Chairman Powell’s comments, “recent pick-up in yields — the flip side of falling prices — was “notable”, and that the US central bank would be “patient” in the face of a temporary rise in inflation,” providing no signals of immediate alarm.

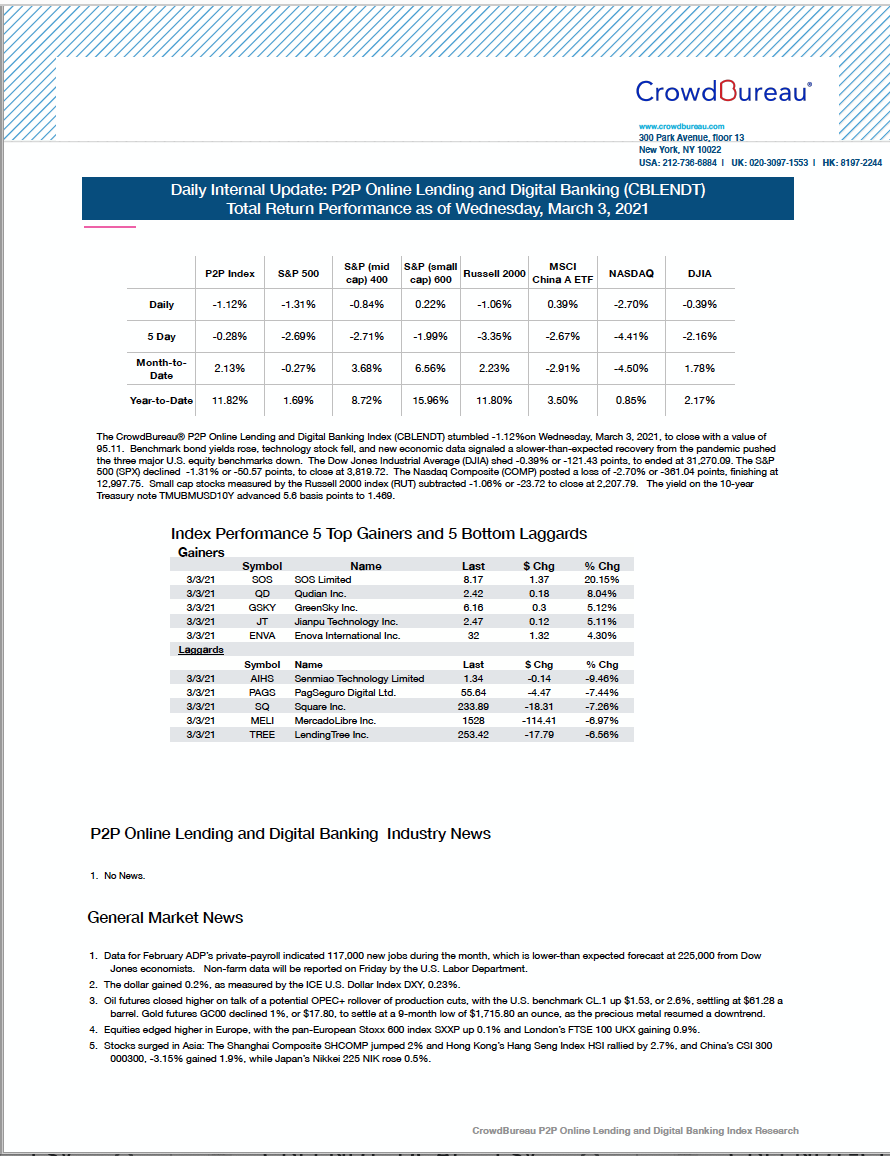

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) stumbled -1.12%, closing lower

March 3, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) stumbled -1.12% on Wednesday, March 3, 2021, closing with a value of 95.11. Benchmark bond yields rose, technology stocks fell, and new economic data signaled a slower-than-expected recovery from the pandemic pushed the three major U.S. equity benchmarks down.

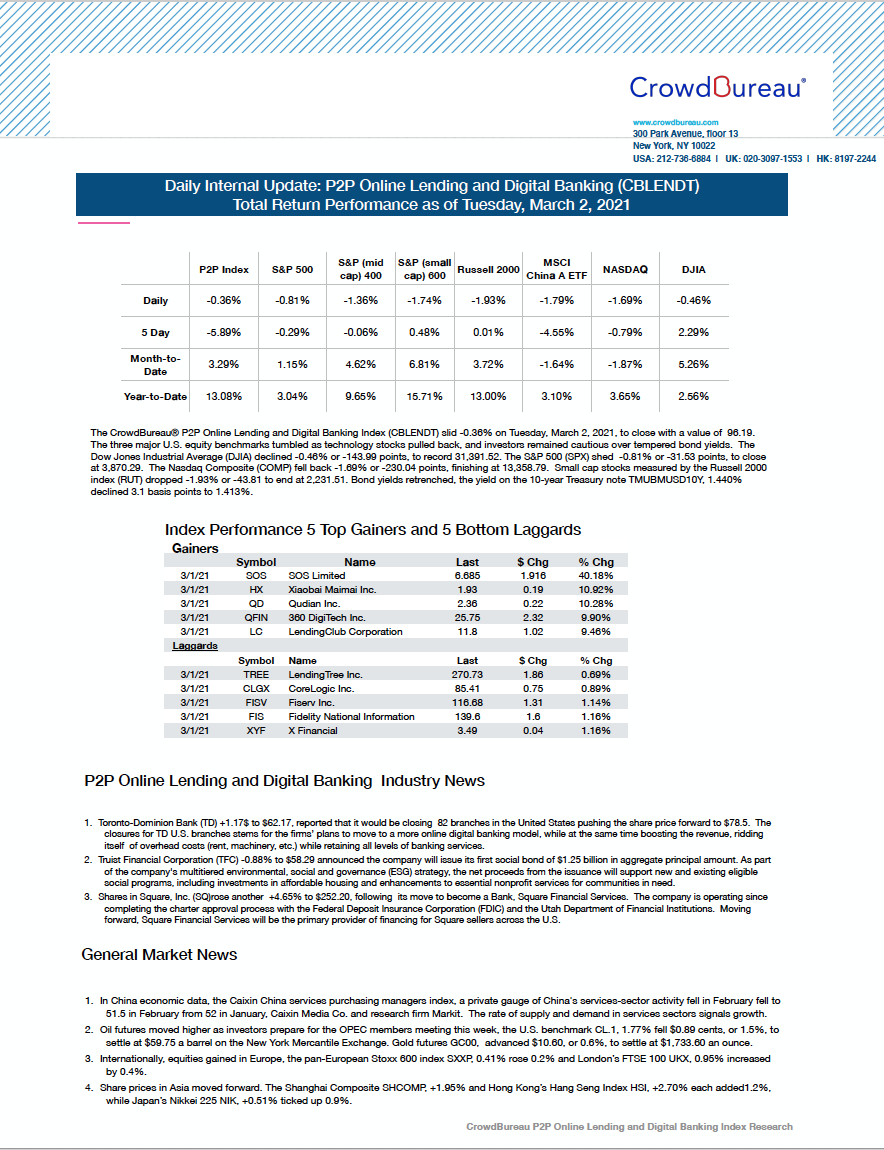

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) slid -0.36% to end Tuesday slightly lower

March 2, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) slid -0.36% on Tuesday, March 2, 2021, to close with a value of 96.19. The three major U.S. equity benchmarks tumbled as technology stocks pulled back, and investors remained cautious over tempered bond yields.

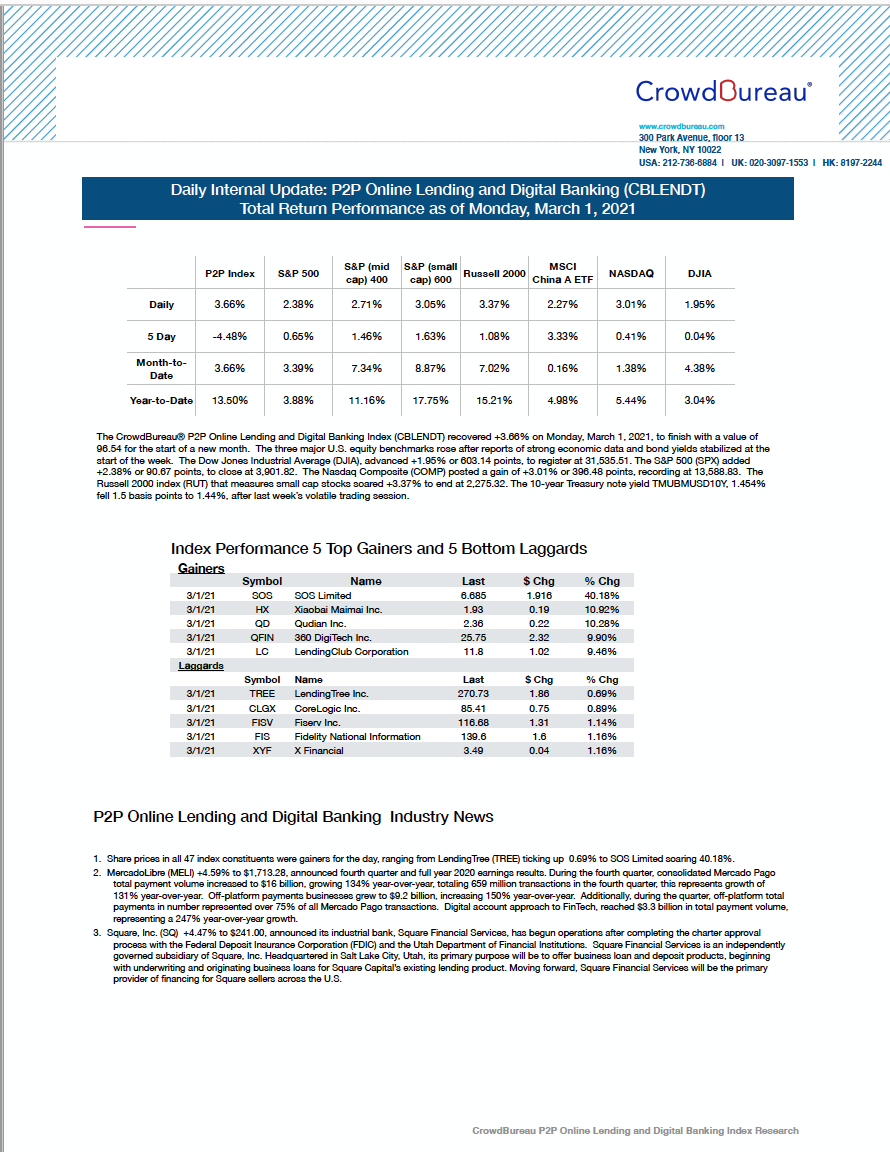

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course, adding +3.66% to start the week

March 1, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) recovered +3.66% on Monday, March 1, 2021, to finish with a value of 96.54 for the start of a new month. The three major U.S. equity benchmarks rose after reports of strong economic data and bond yields stabilized at the start of the week.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ended lower, tumbling -2.36%

February 26, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) tumbled -2.36% on Friday, February 26, 2021, to end with a value of 93.13. The index ended the month of February up 2.36%, while at the same time retained positive returns year-to-date to end at 9.49%. The three major benchmarks finished the day mixed as economic data suggested an improving economy, but concerns over rising prices and interest rates fueled investor sentiment.

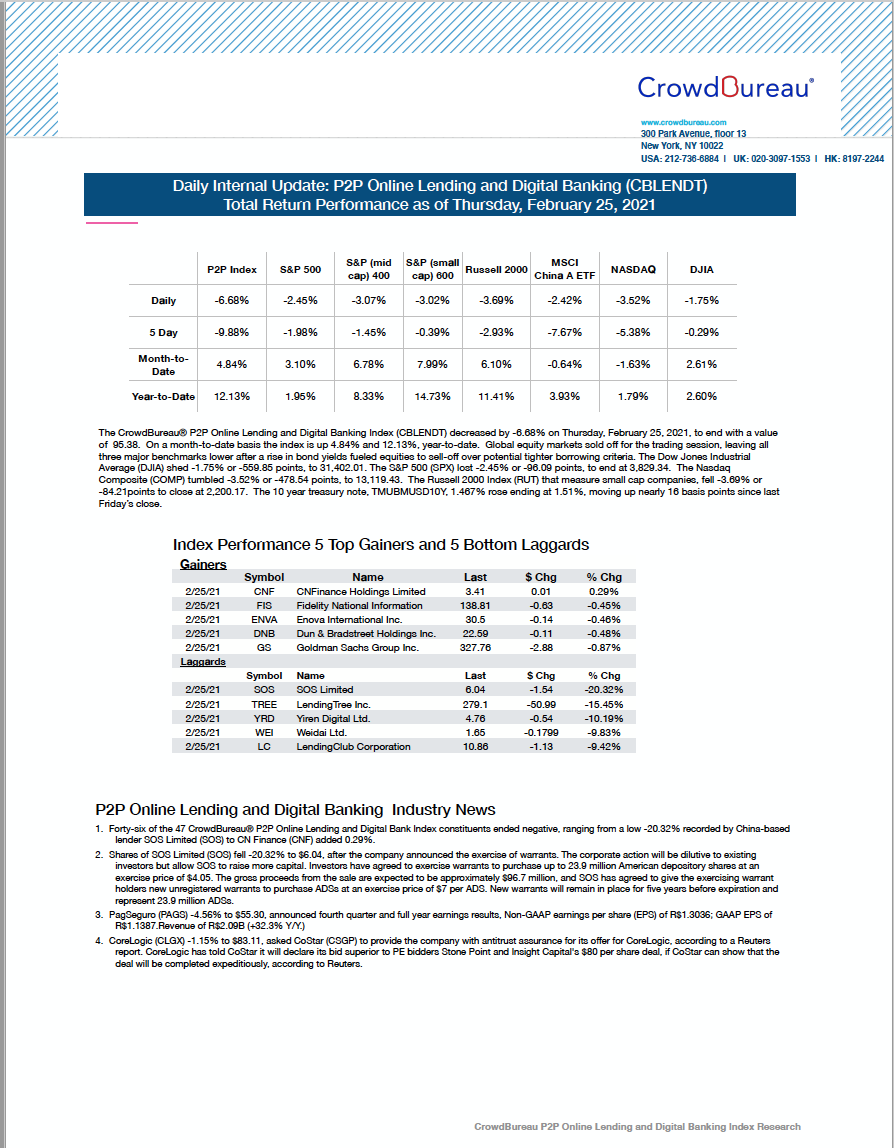

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) sold off -6.68% to end lower

February 25, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) decreased by -6.68% on Thursday, February 25, 2021, to end with a value of 95.38. On a month-to-date basis the index is up 4.84% and 12.13%, year-to-date. Global equity markets sold off for the trading session, leaving all three major benchmarks lower after a rise in bond yields fueled equities to sell-off over potential tighter borrowing criteria.

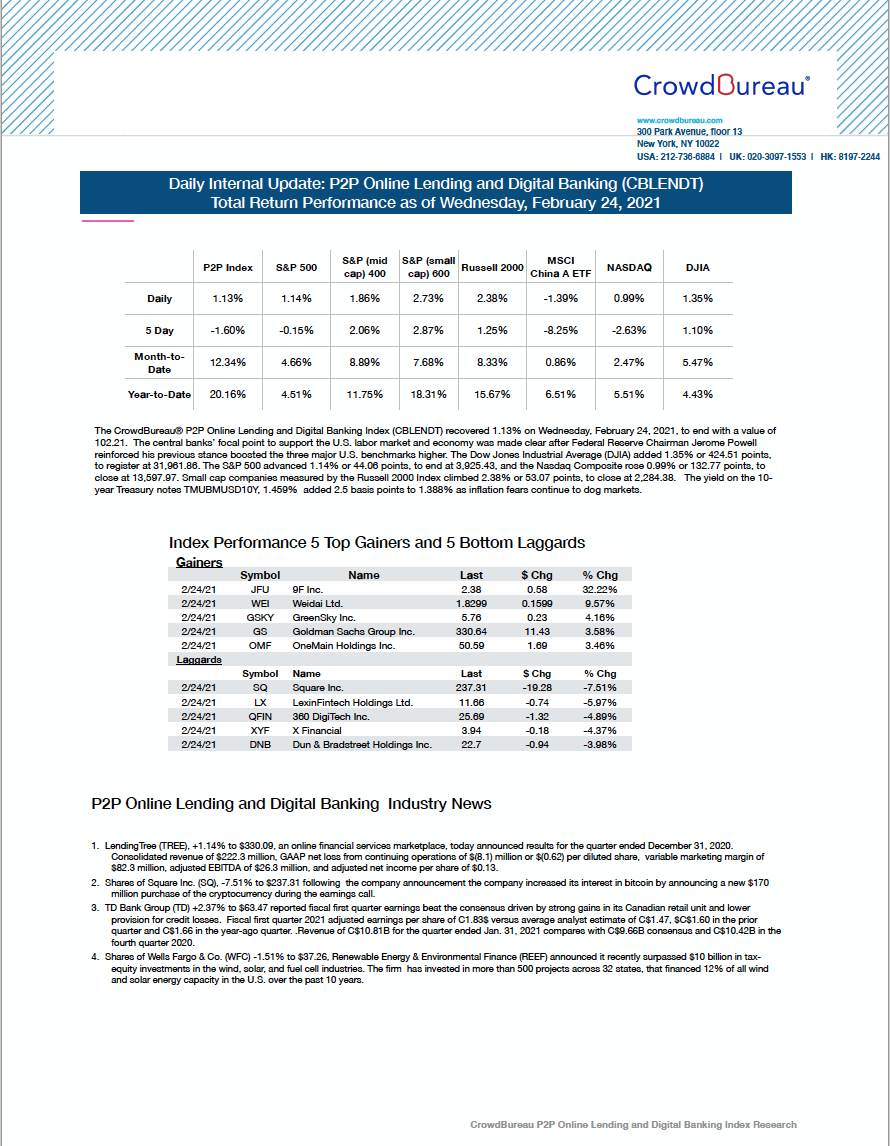

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) recovered +1.13% to finish higher

February 24, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) recovered +1.13% on Wednesday, February 24, 2021, to end with a value of 102.21. The central banks’ focal point to support the U.S. labor market and economy was made clear after Federal Reserve Chairman Jerome Powell reinforced his previous stance boosted the three major U.S. benchmarks higher.

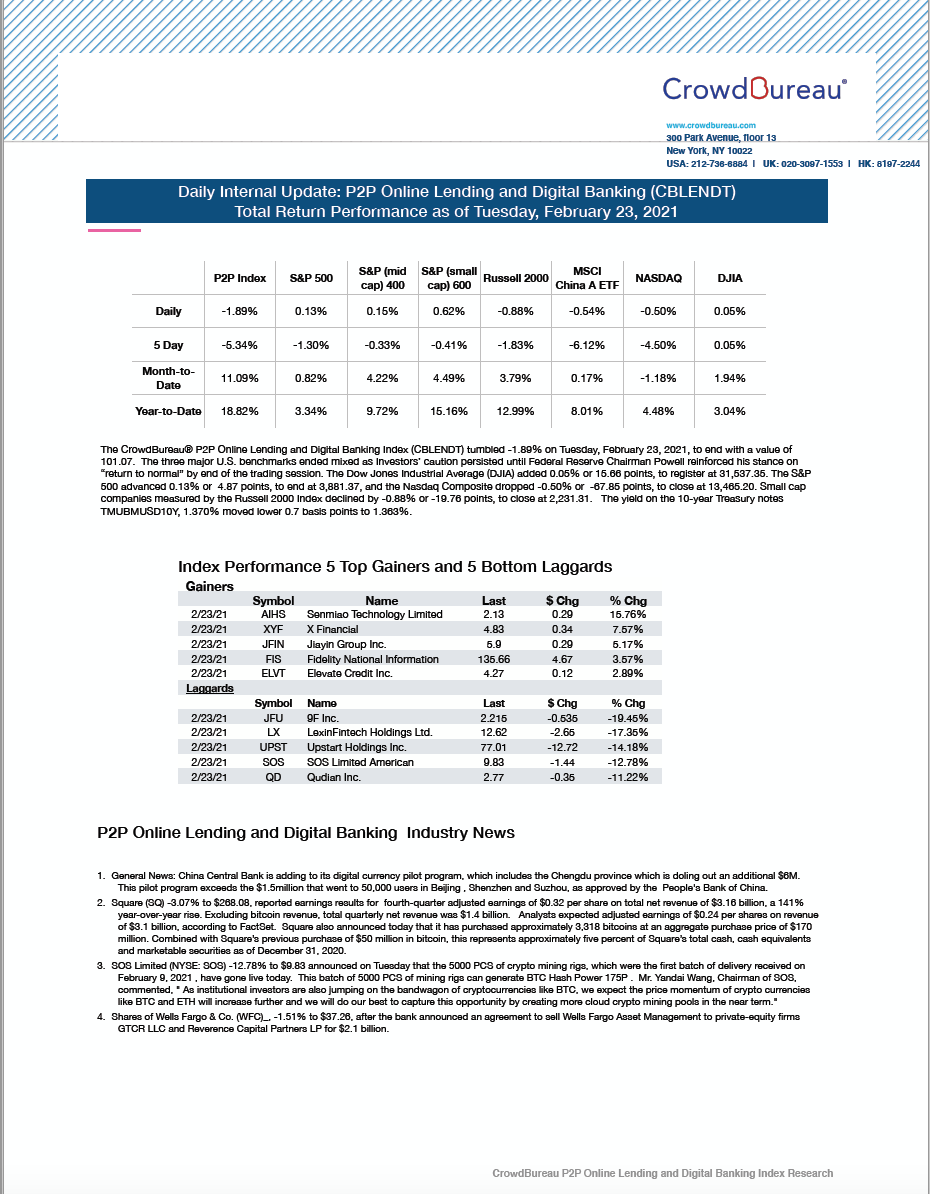

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) tumbled -1.89% to end lower

February 23, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) tumbled -1.89% on Tuesday, February 23, 2021, to end with a value of 101.07. The three major U.S. benchmarks ended mixed as Investors’ caution persisted until Federal Reserve Chairman Powell reinforced his stance on “return to normal” by end of the trading session.

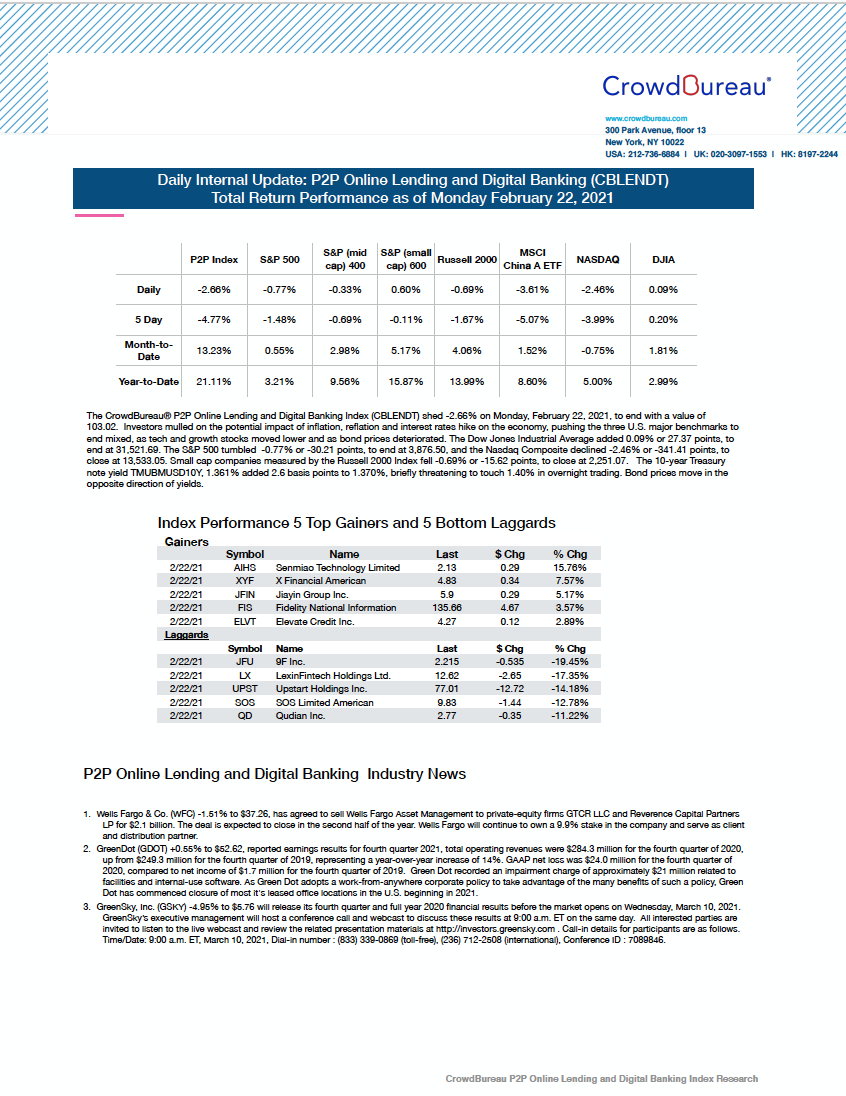

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course, shedding -2.66% to close Monday

February 22, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) shed -2.66% on Monday, February 22, 2021, to end with a value of 103.02. Investors mulled on the potential impact of inflation, reflation and interest rates hike on the economy, pushing the three U.S. major benchmarks to end mixed, as tech and growth stocks moved lower and as bond prices deteriorated.

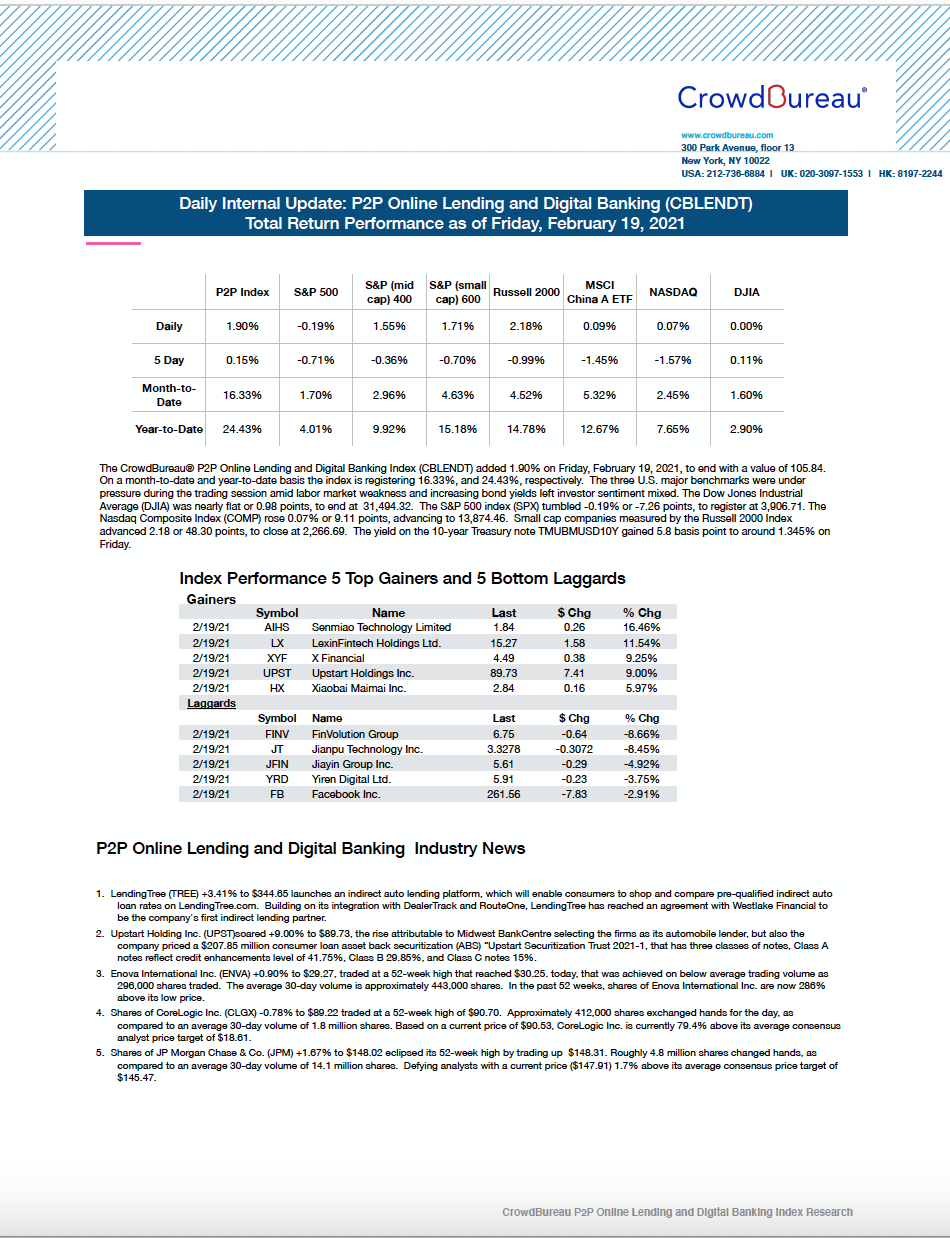

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added to its total return, posting a gain of +1.90%

February 19, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 1.90% on Friday, February 19, 2021, to end with a value of 105.84. On a month-to-date and year-to-date basis the index is registering 16.33%, and 24.43%, respectively. The three U.S. major benchmarks were under pressure during the trading session amid labor market weakness and increasing bond yields left investor sentiment mixed.

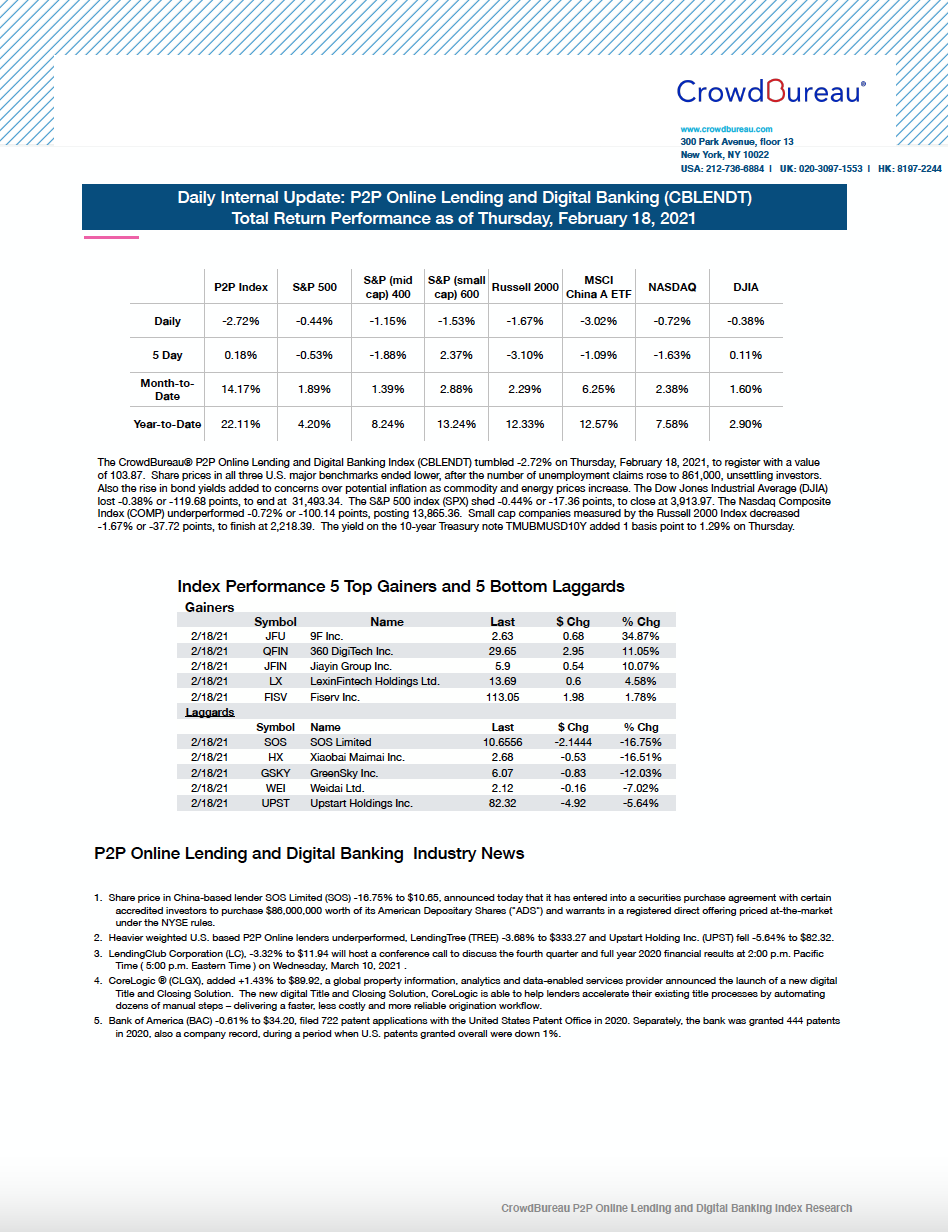

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course for a second consecutive day, tumbling -2.72%

February 18, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) tumbled -2.72% on Thursday, February 18, 2021, to register with a value of 103.87. Share prices in all three U.S. major benchmarks ended lower, after the number of unemployment claims rose to 861,000, unsettling investors. Also the rise in bond yields added to concerns over potential inflation as commodity and energy prices increase.

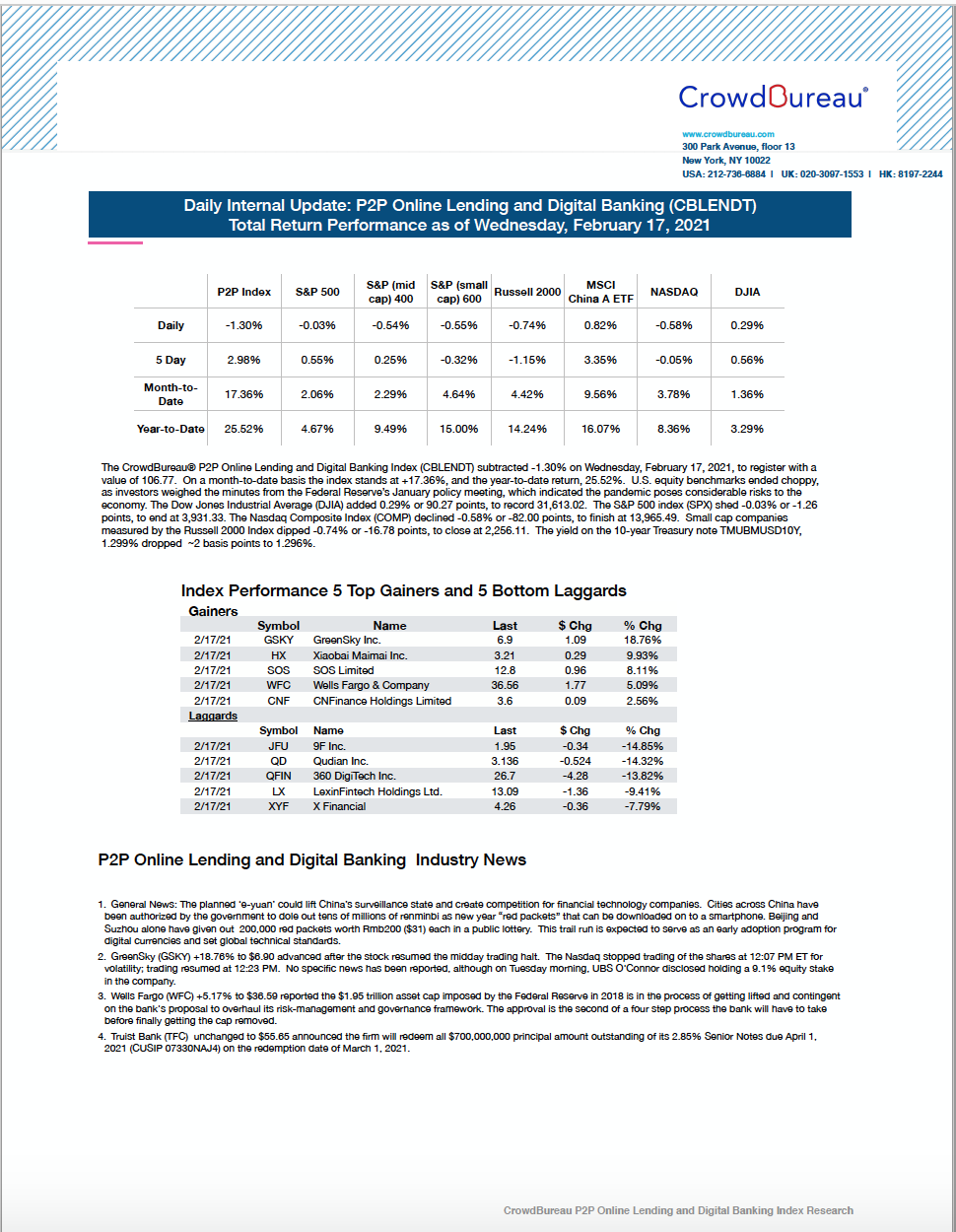

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) fell back, subtracting -1.30% to end the trading session

February 17, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) subtracted -1.30% on Wednesday, February 17, 2021, to register with a value of 106.77. U.S. equity benchmarks ended choppy, as investors weighed the minutes from the Federal Reserve’s January policy meeting, which indicated the pandemic poses considerable risks to the economy.

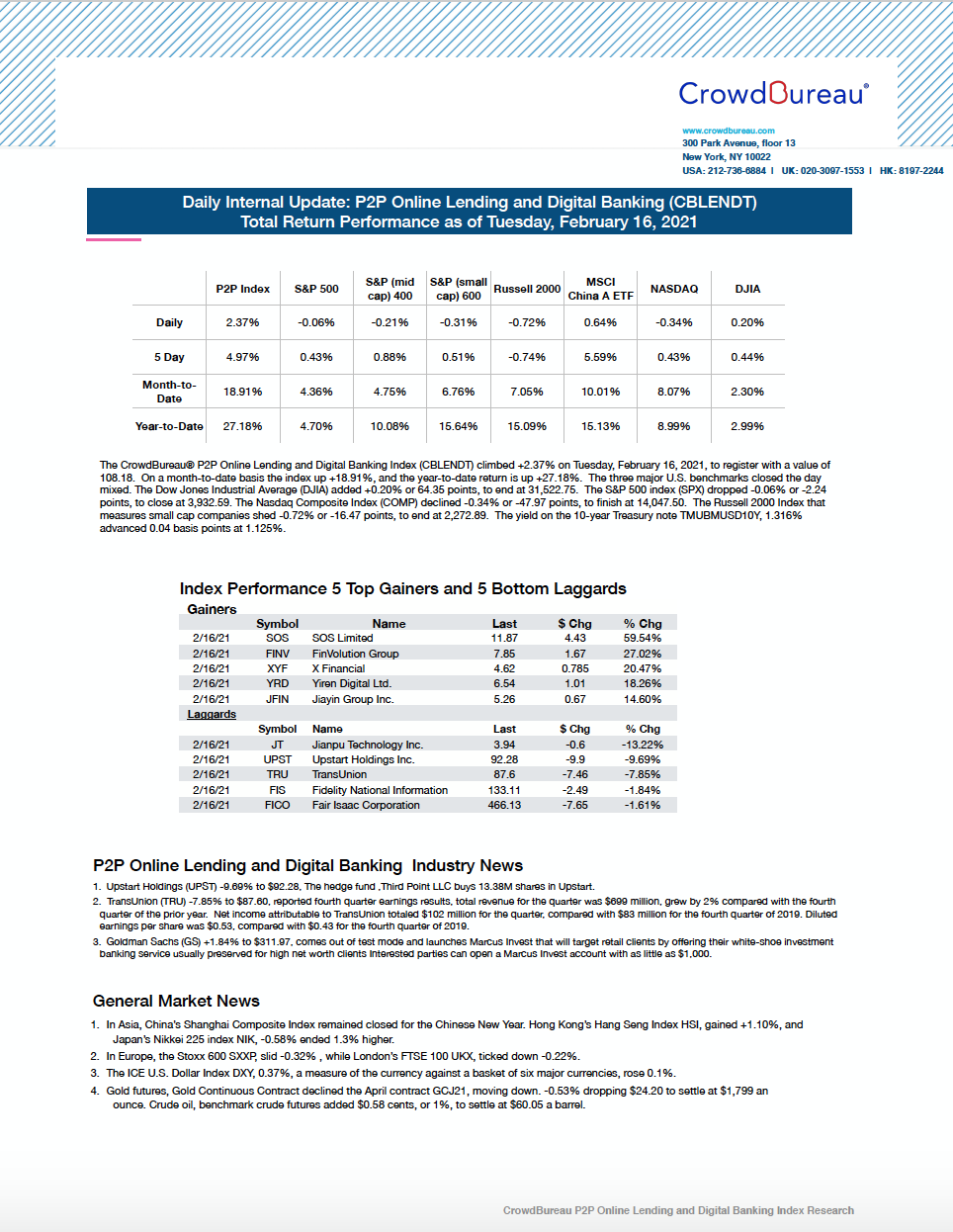

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) registered +2.37% higher

February 16, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) climbed +2.37% on Tuesday, February 16, 2021, to register with a value of 108.18. On a month-to-date basis the index up +18.91%, and the year-to-date return is up +27.18%. The three major U.S. benchmarks closed the day mixed.

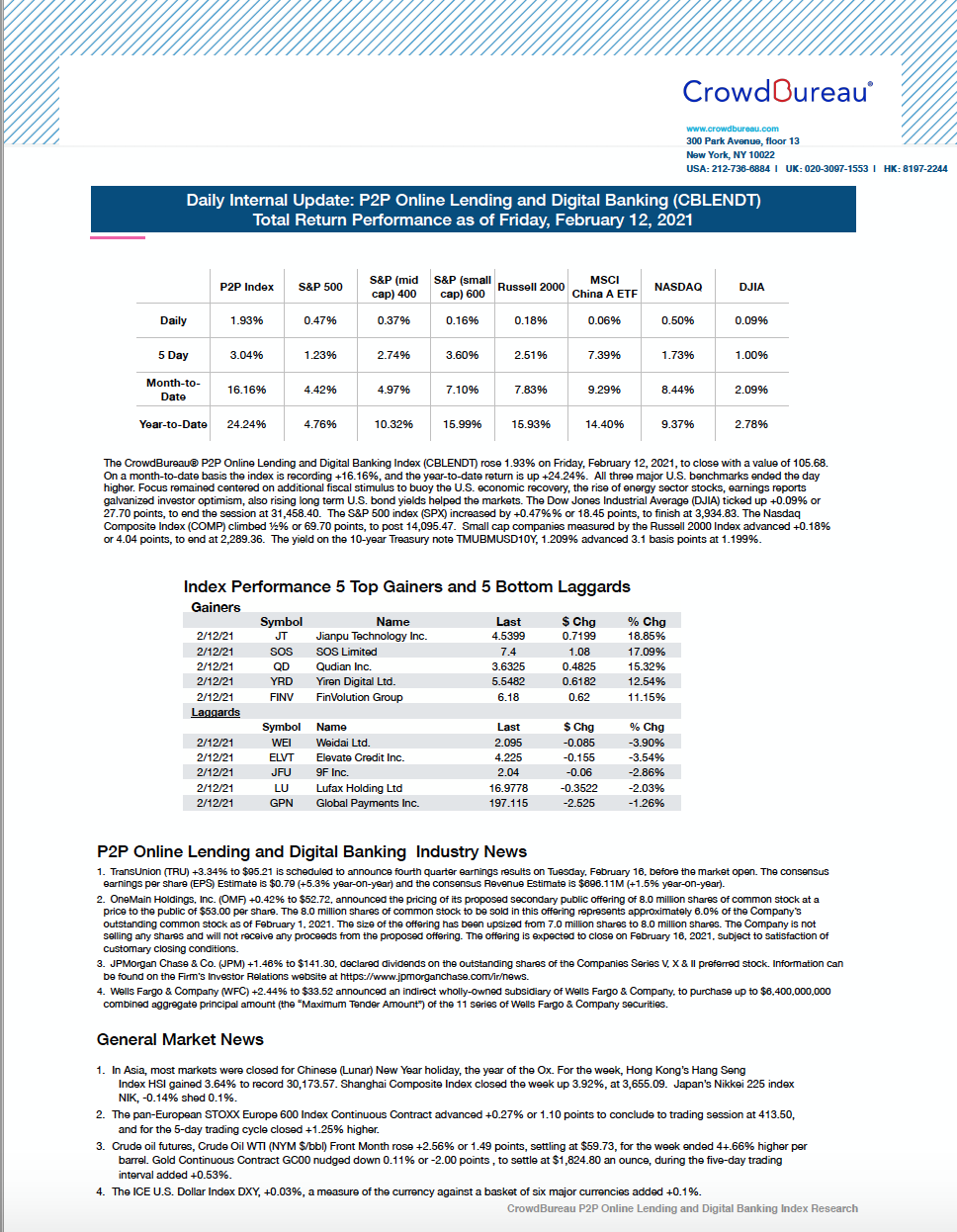

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +1.93% higher to close the trading session

February 12, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 1.93% on Friday, February 12, 2021, closing with a value of 105.68. On a month-to-date basis the index is recording +16.16%, and the year-to-date return is up +24.24%. All three major U.S. benchmarks ended the day higher.

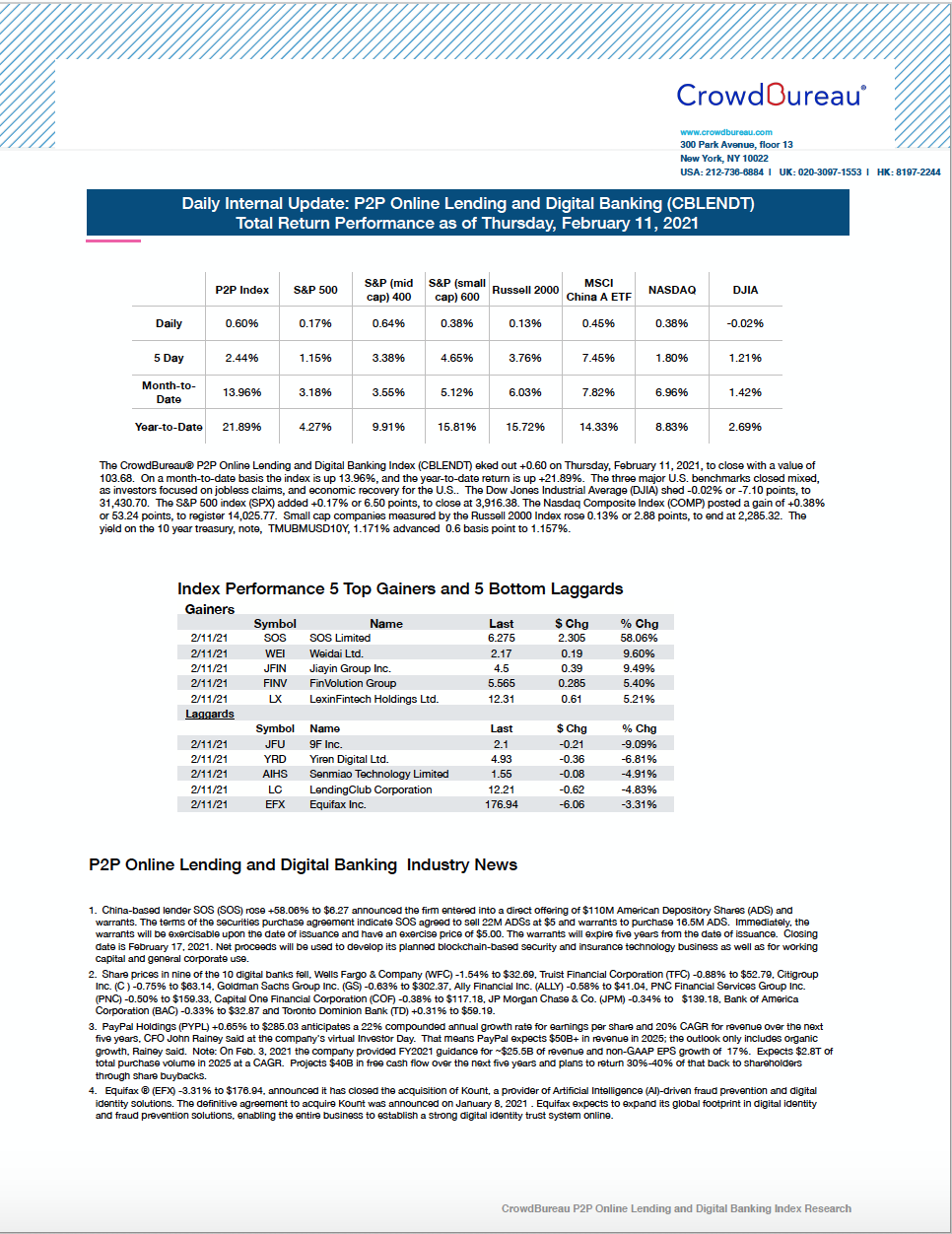

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) eked out +0.60%

February 11, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) eked out +0.60 on Thursday, February 11, 2021, to close with a value of 103.68. On a month-to-date basis the index is up 13.96%, and the year-to-date return is up +21.89%. The three major U.S. benchmarks closed mixed, as investors focused on jobless claims, and economic recovery for the U.S..

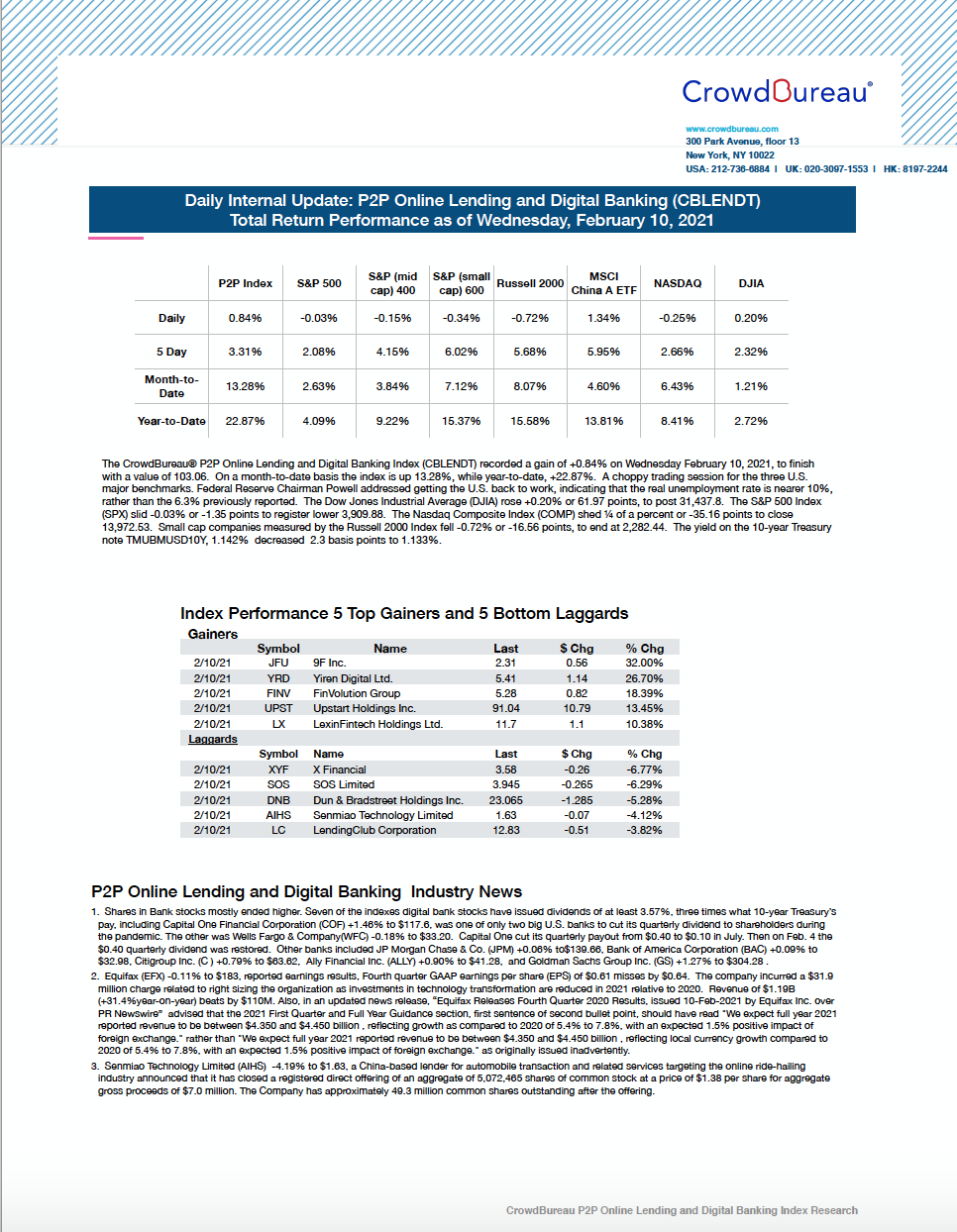

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) recorded a gain of +0.84% for the day

February 10, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) recorded a gain of +0.84% on Wednesday, February 10, 2021, to finish with a value of 103.06. On a month-to-date basis the index is up 13.28%, while year-to-date, [note correction] +21.16%. A choppy trading session for the three U.S. major benchmarks. Federal Reserve Chairman Powell addressed getting the U.S. back to work, indicating that the real unemployment rate is nearer 10%, rather than the 6.3% previously reported.

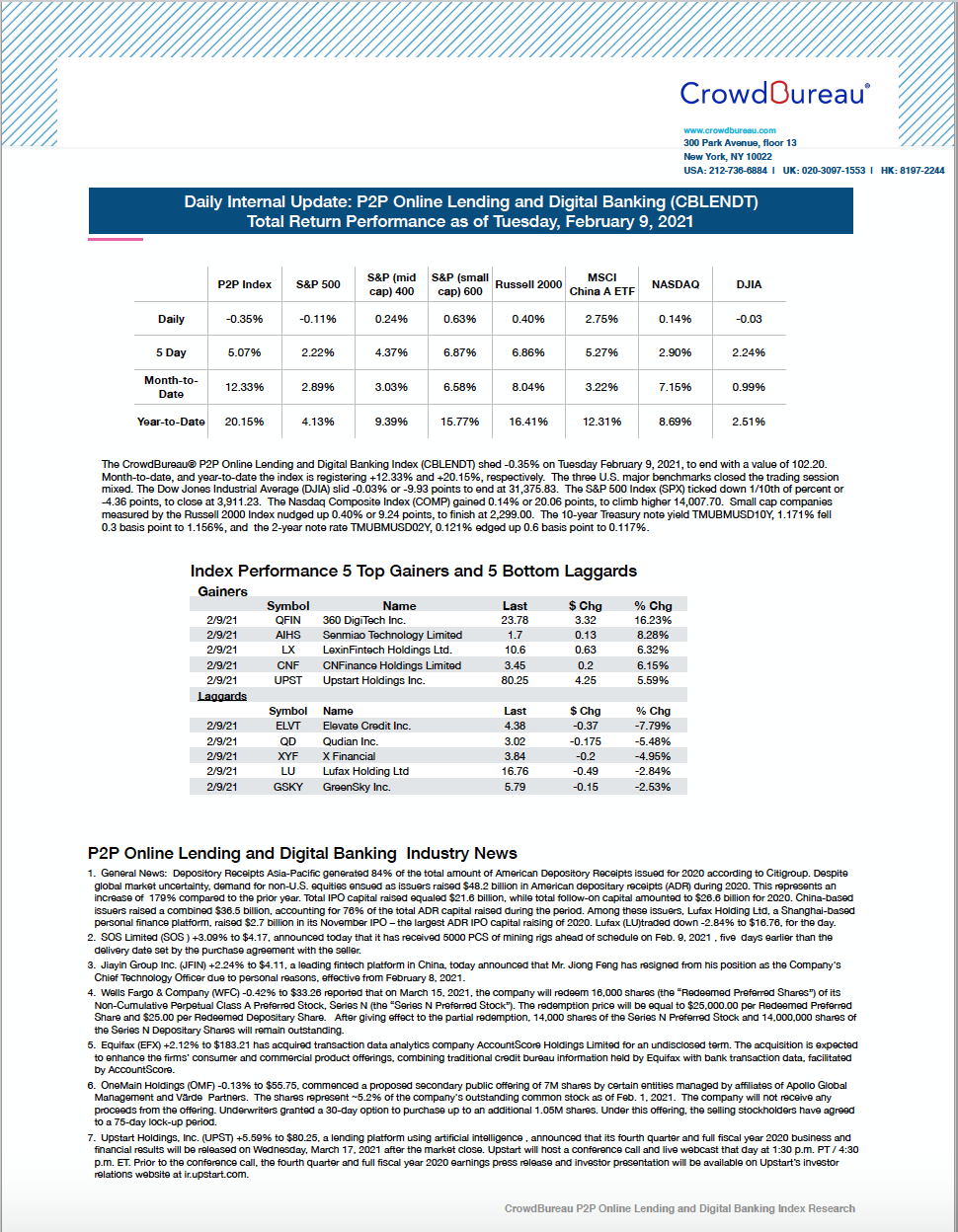

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course, traded down -0.35%

February 9, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) shed -0.35% on Tuesday February 9, 2021, to end with a value of 102.20. Month-to-date, and year-to-date the index is registering +12.33% and +20.15%, respectively. The three U.S. major benchmarks closed the trading session mixed.

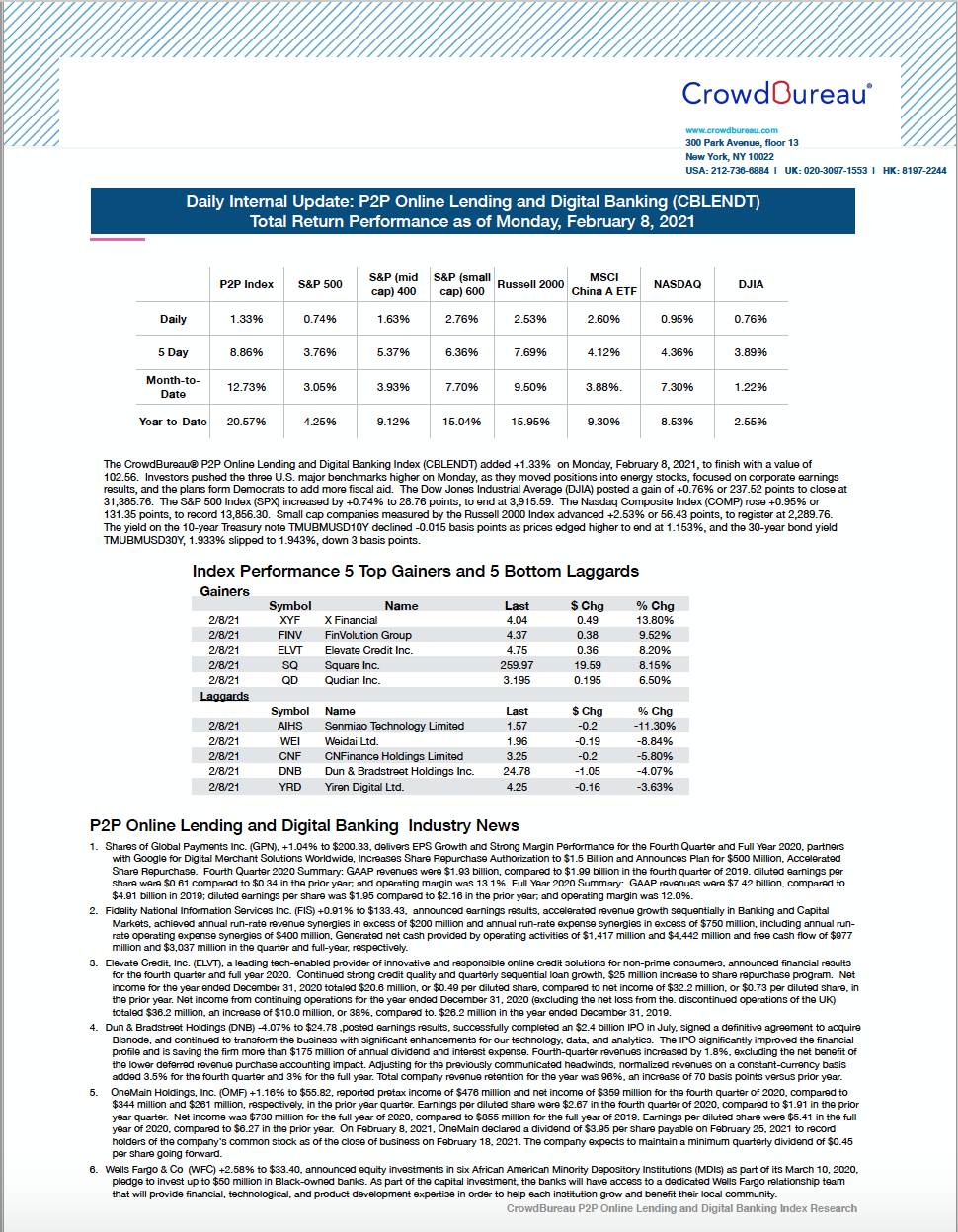

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +1.33% to start the week in positive territory

February 8, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added +1.33% on Monday, February 8, 2021, to finish with a value of 102.56. Investors pushed the three U.S. major benchmarks higher on Monday, as they moved positions into energy stocks, focused on corporate earnings results, and plans expected from Democrats to add more fiscal aid.

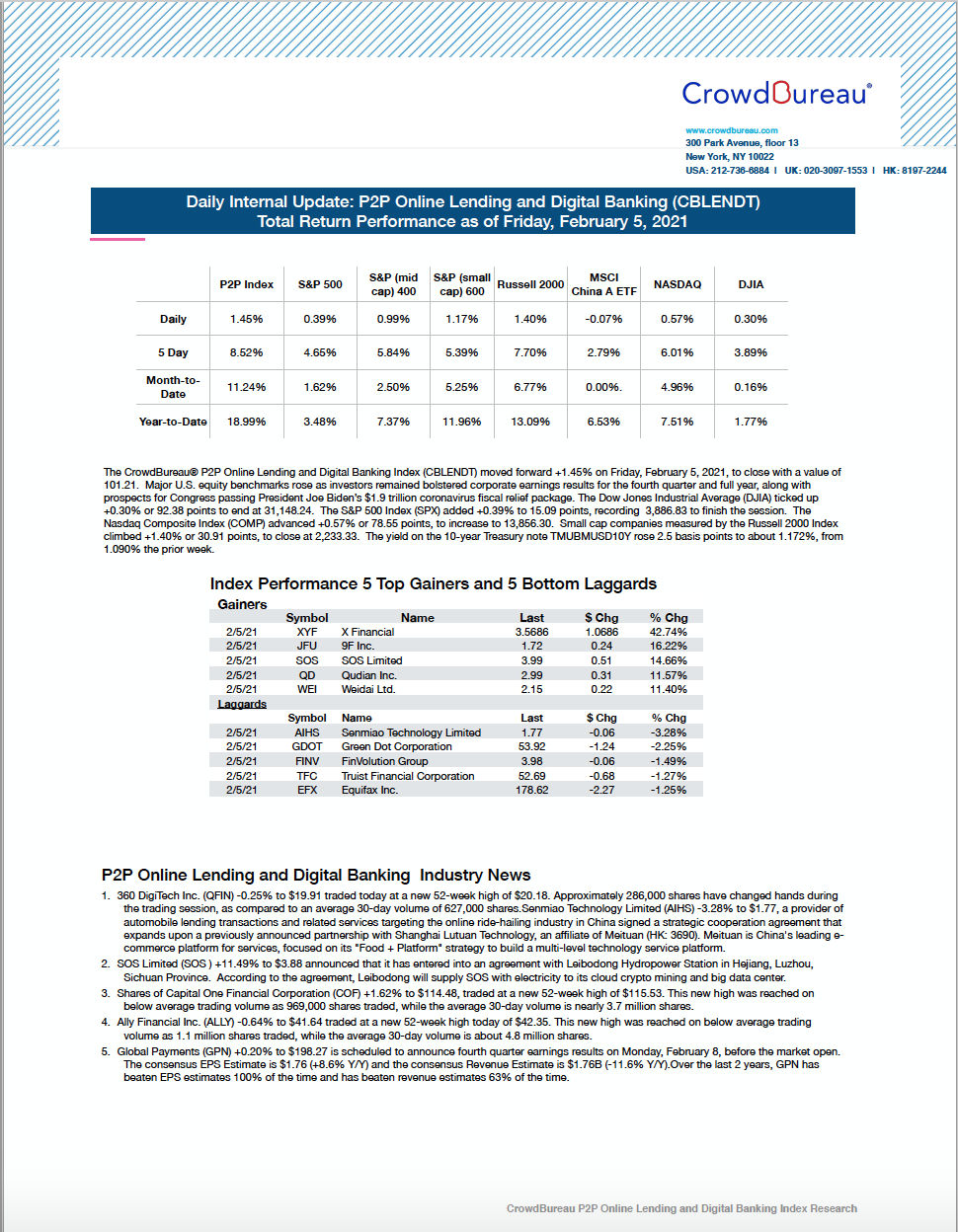

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) moved forward +1.45% to end Friday, the last trading session for the week

February 5, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) moved forward +1.45% on Friday, February 5, 2021, to close with a value of 101.21. Major U.S. equity benchmarks rose as investors remained bolstered corporate earnings results for the fourth quarter and full year, along with prospects for Congress passing President Joe Biden’s $1.9 trillion coronavirus fiscal relief package.

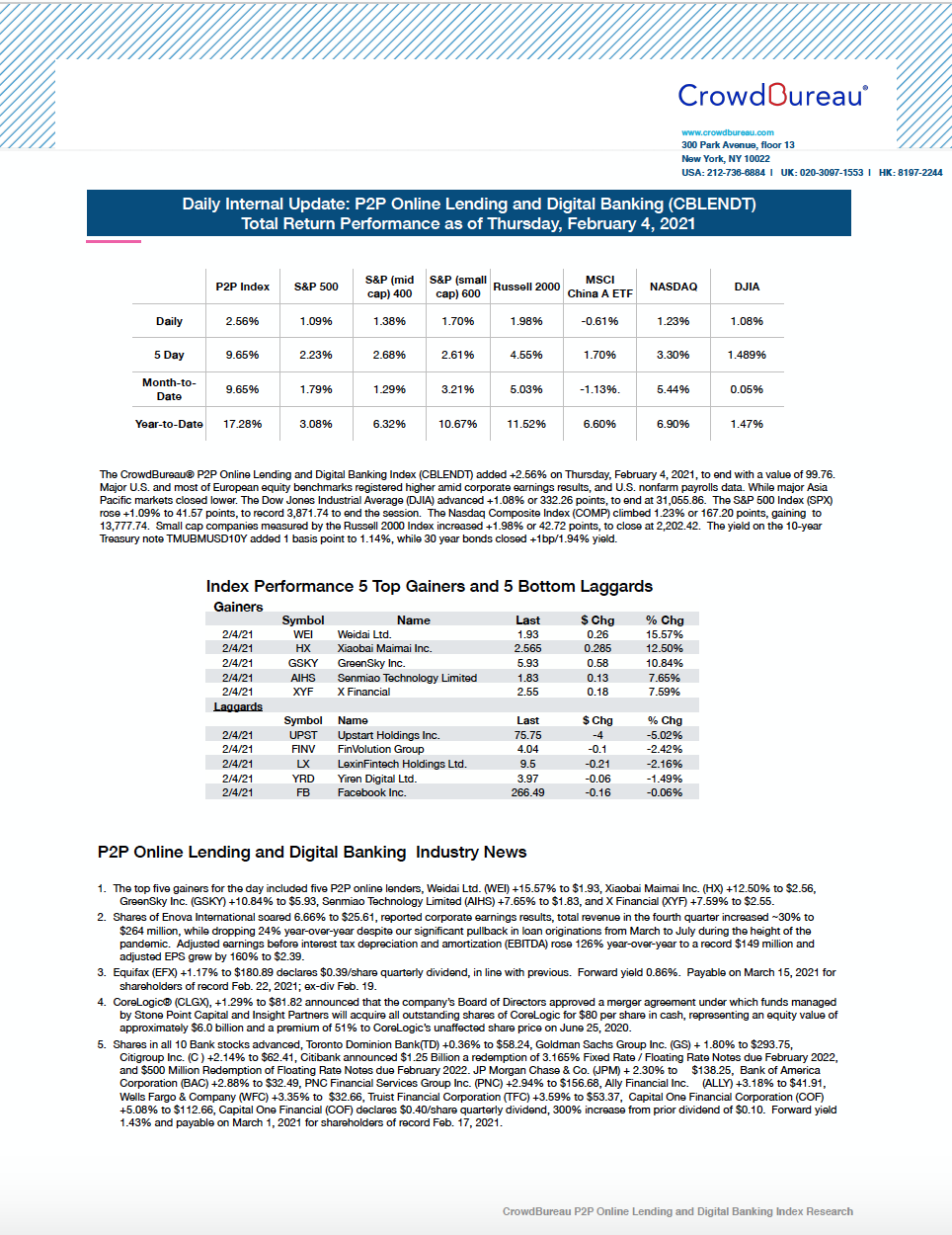

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +2.56%

February 4, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added +2.56% on Thursday, February 4, 2021, to end with a value of 99.76. Major U.S. and most of European equity benchmarks registered higher amid corporate earnings results, and U.S. nonfarm payrolls data. While major Asia Pacific markets closed lower.

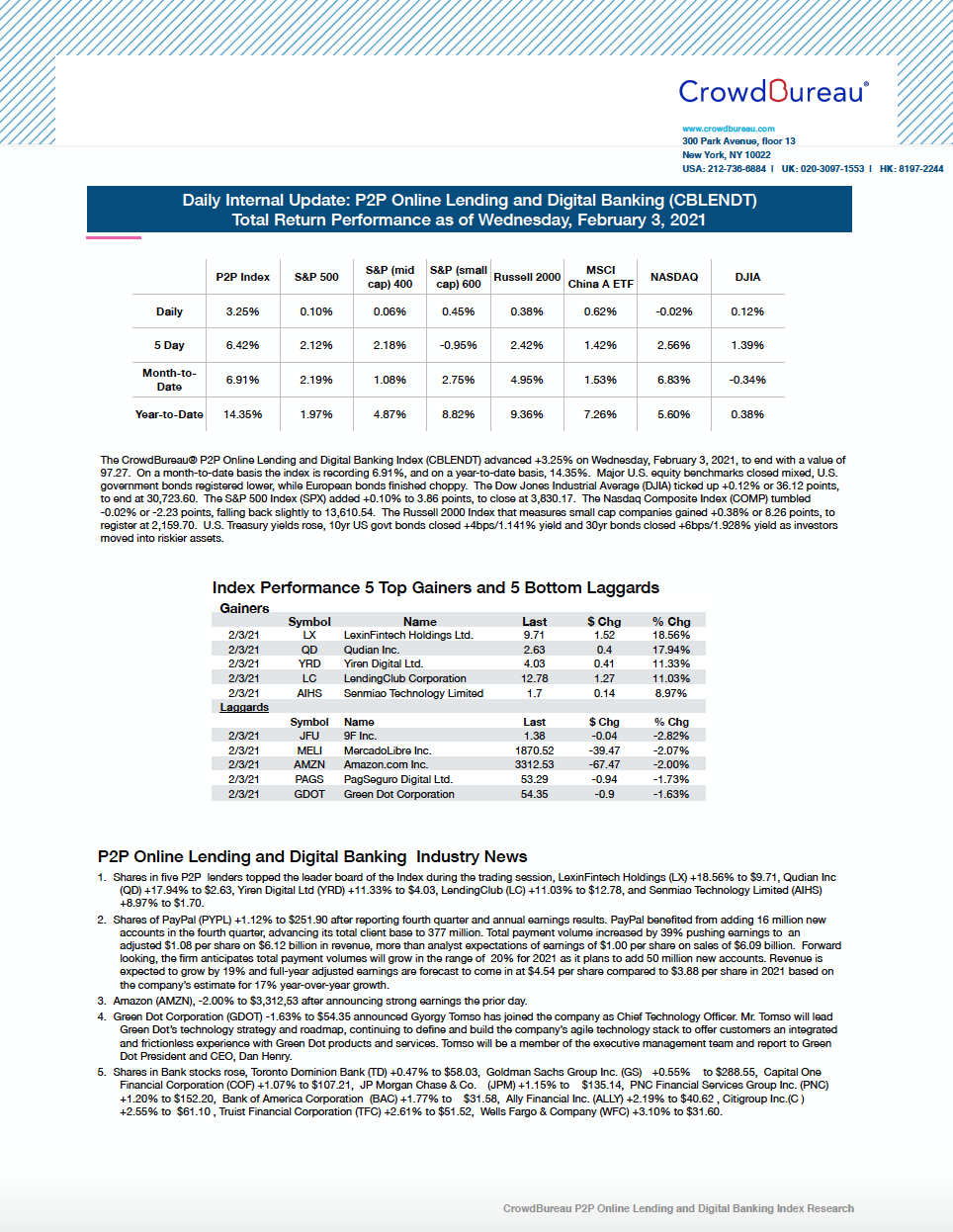

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) advanced +3.25%, at the close of trading session

February 3, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced +3.25% on Wednesday, February 3, 2021, to end with a value of 97.27. On a month-to-date basis the index is recording 6.91%, and on a year-to-date basis, 14.35%. Major U.S. equity benchmarks closed mixed, U.S. government bonds registered lower, while European bonds finished choppy.

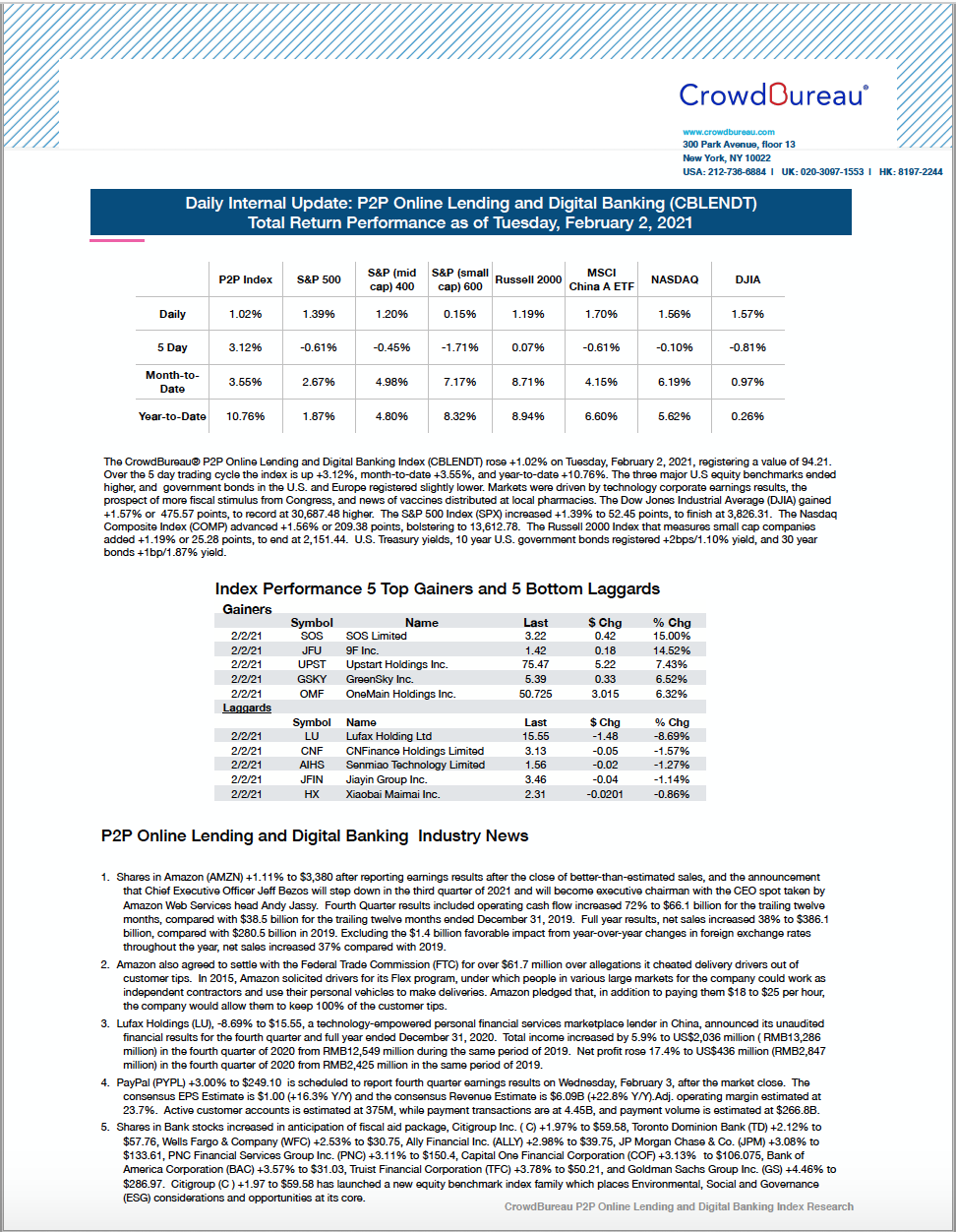

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +1.02%, moving the index higher

February 2, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose +1.02% on Tuesday, February 2, 2021, registering a value of 94.21. Over the 5 day trading cycle the index is up +3.12%, month-to-date +3.55%, and year-to-date +10.76%. The three major U.S equity benchmarks ended higher, and government bonds in the U.S. and Europe registered slightly lower.

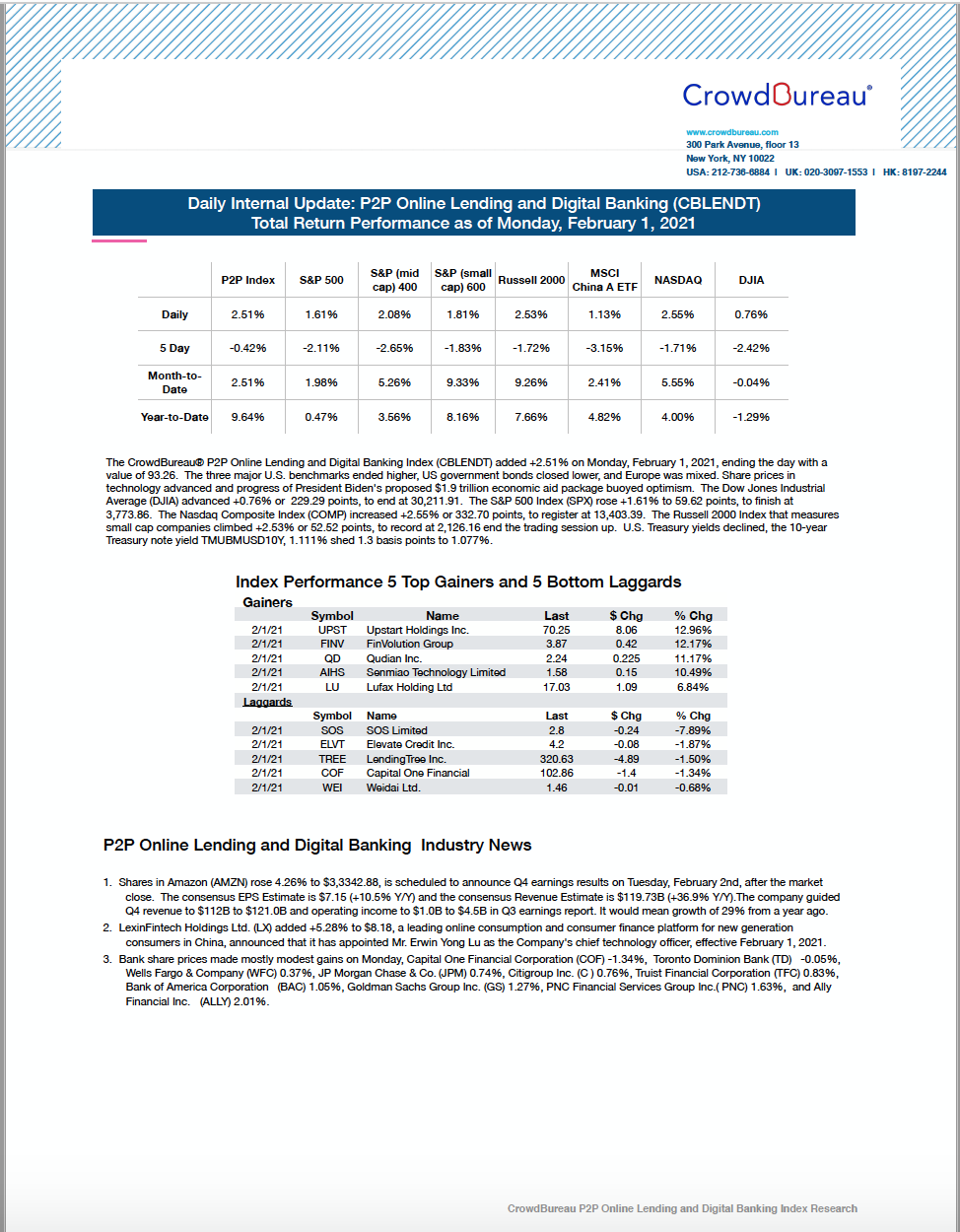

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +2.51%, bolstering the total return

February 1, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added +2.51% on Monday, February 1, 2021, ending the day with a value of 93.26. The three major U.S. benchmarks ended higher, US government bonds closed lower, and Europe was mixed. Share prices in technology advanced and progress of President Biden’s proposed $1.9 trillion economic aid package buoyed optimism.

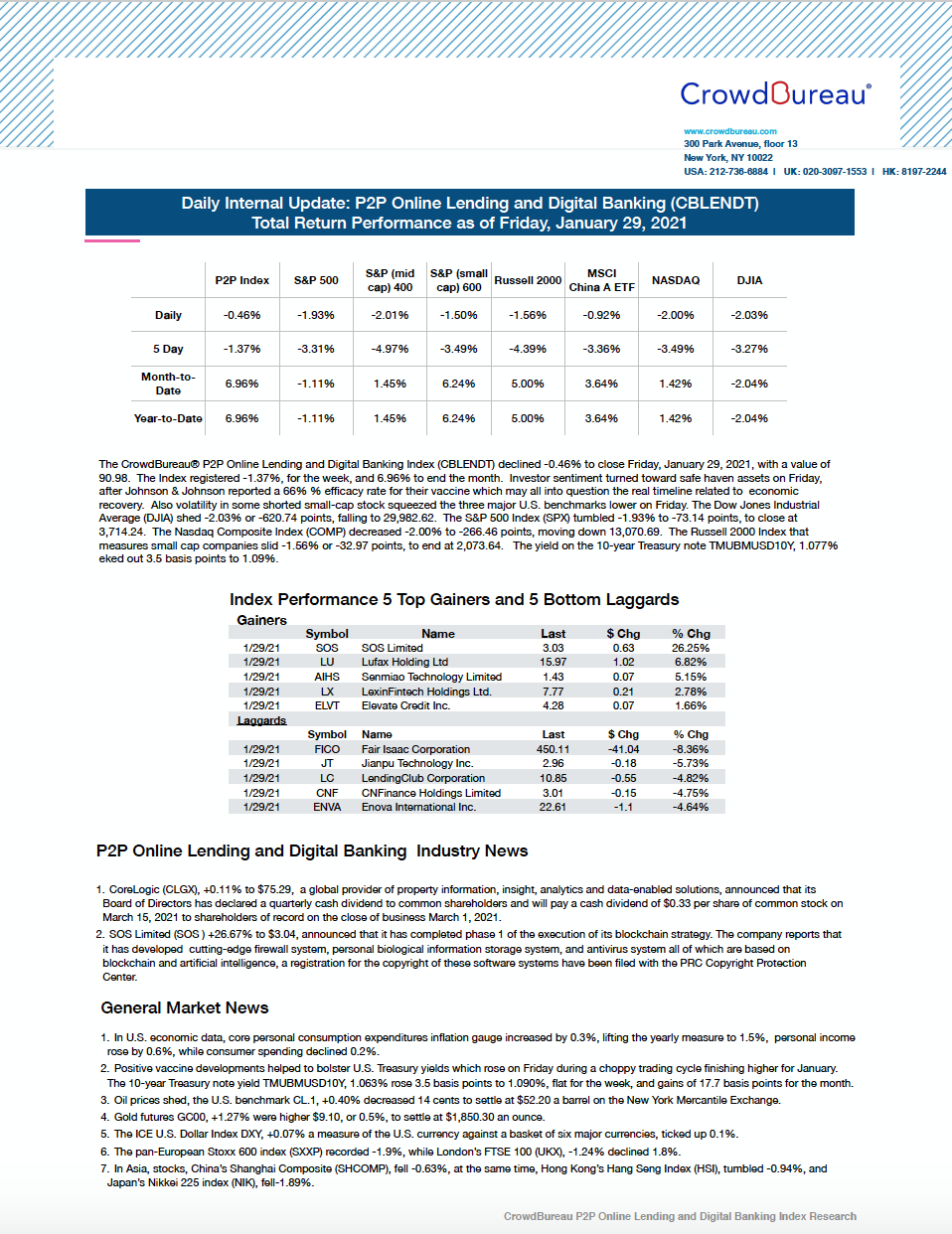

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) closed the day lower, declining -0.46%

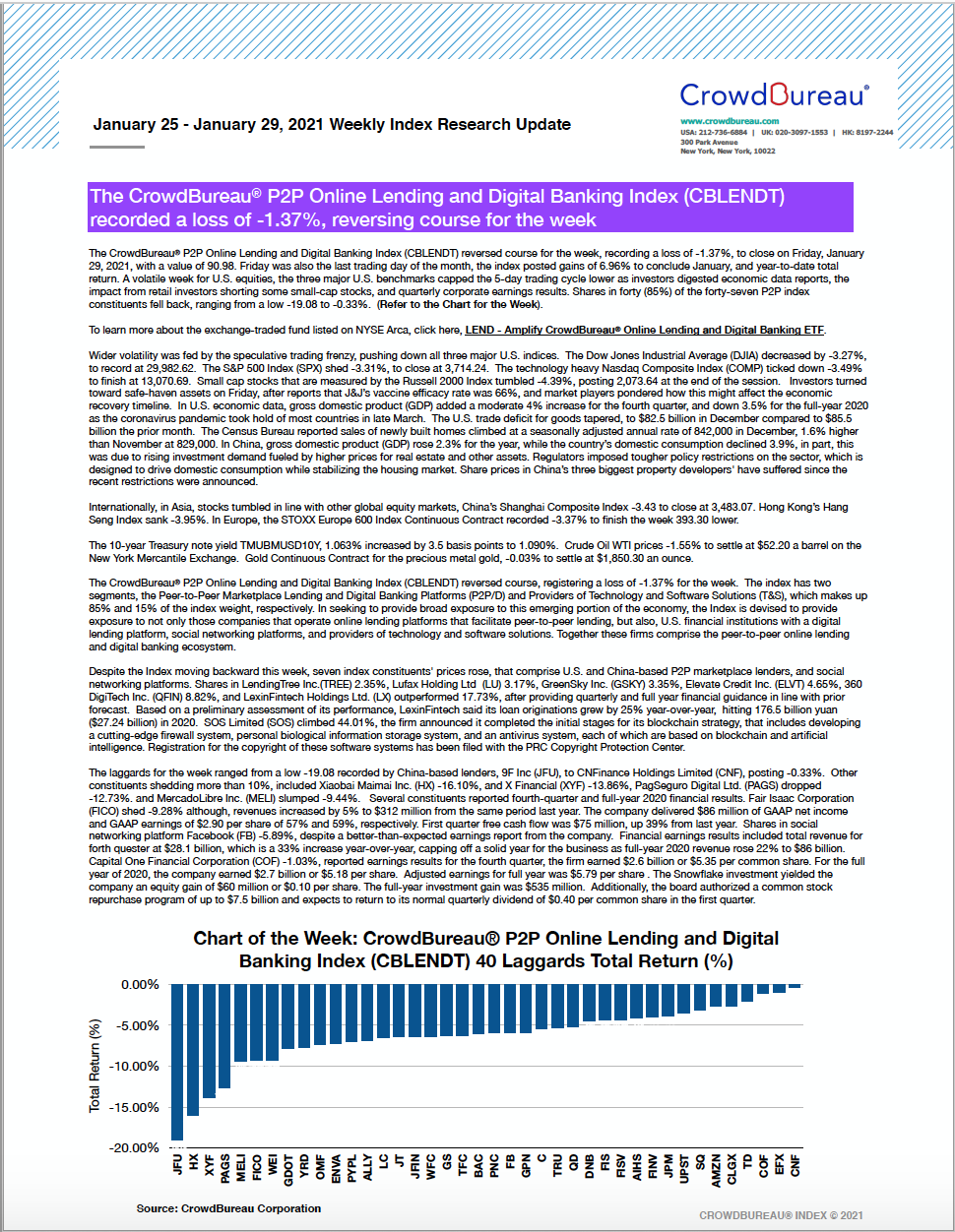

January 29, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) declined -0.46% to close Friday, January 29, 2021, with a value of 90.98. The Index registered -1.37%, for the week, and 6.96% to end the month. Investor sentiment turned toward safe haven assets on Friday, after Johnson & Johnson reported a 66% % efficacy rate for their vaccine which may call into question the impact to the economic recovery timeline. Also volatility in some shorted small-cap stock squeezed the three major U.S. benchmarks lower on Friday.

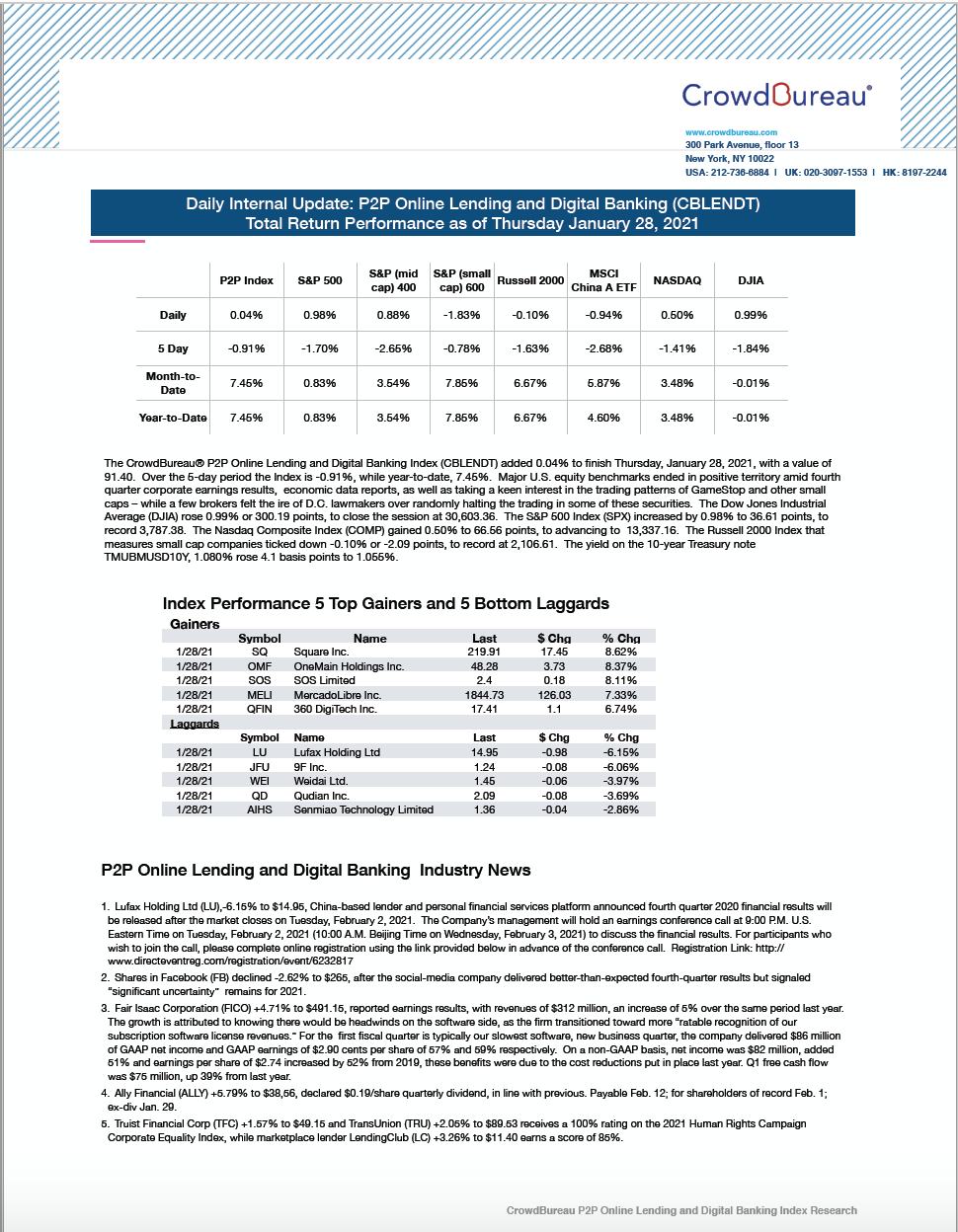

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +0.04%

January 28, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 0.04% to finish Thursday, January 28, 2021, with a value of 91.40. Major U.S. equity benchmarks ended in positive territory amid fourth quarter corporate earnings results, economic data reports, as well as taking a keen interest in the trading patterns of GameStop and other small caps – while a few brokers felt the ire of D.C. lawmakers over randomly halting the trading in some of these securities.

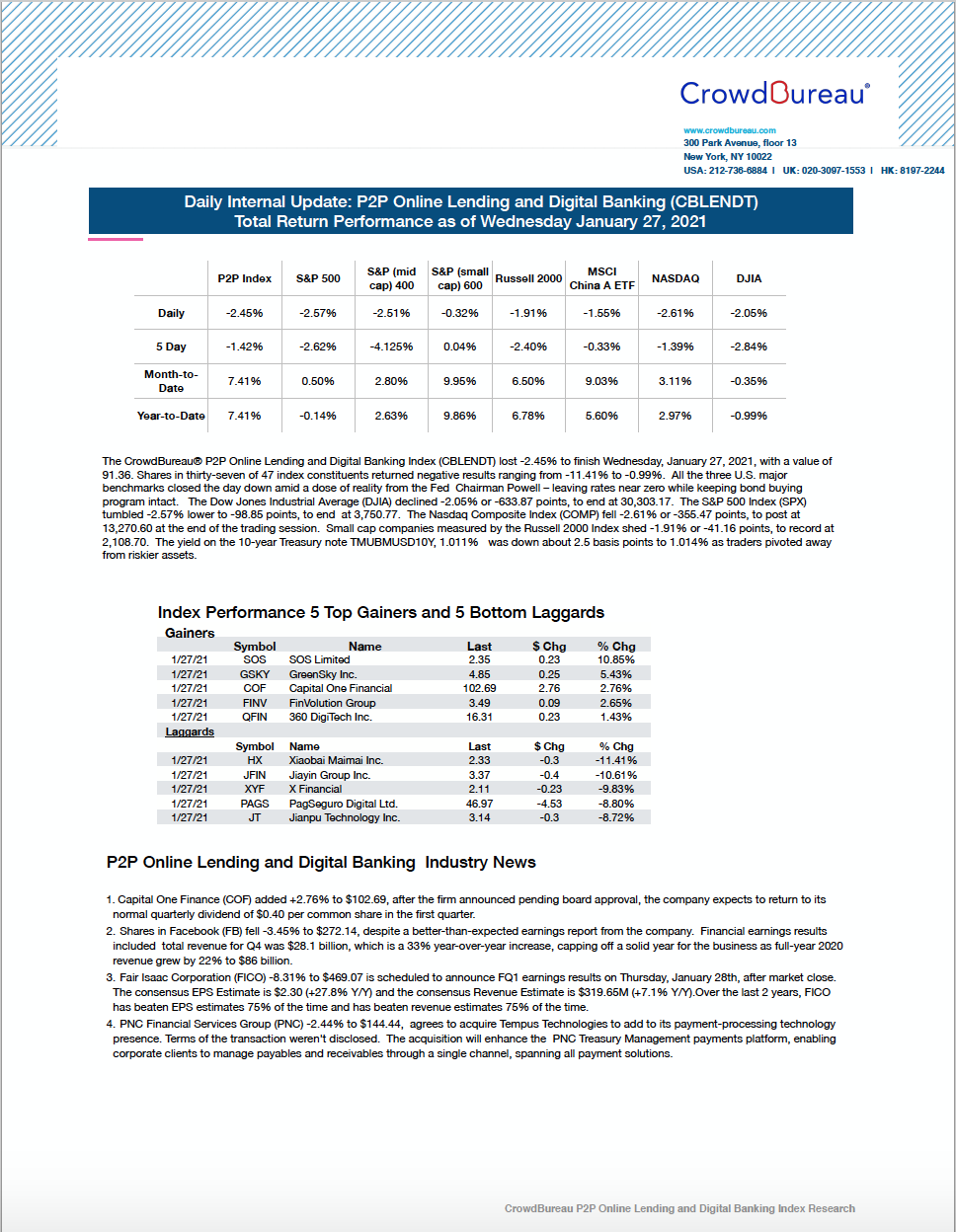

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) finished the trading session -2.45% lower

January 27, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) lost -2.45% to finish Wednesday, January 27, 2021, with a value of 91.36. Shares in thirty-seven of 47 index constituents returned negative results ranging from -11.41% to -0.99%. All the three U.S. major benchmarks closed the day down amid a dose of reality from the Fed Chairman Powell – leaving rates near zero while keeping bond buying program intact.

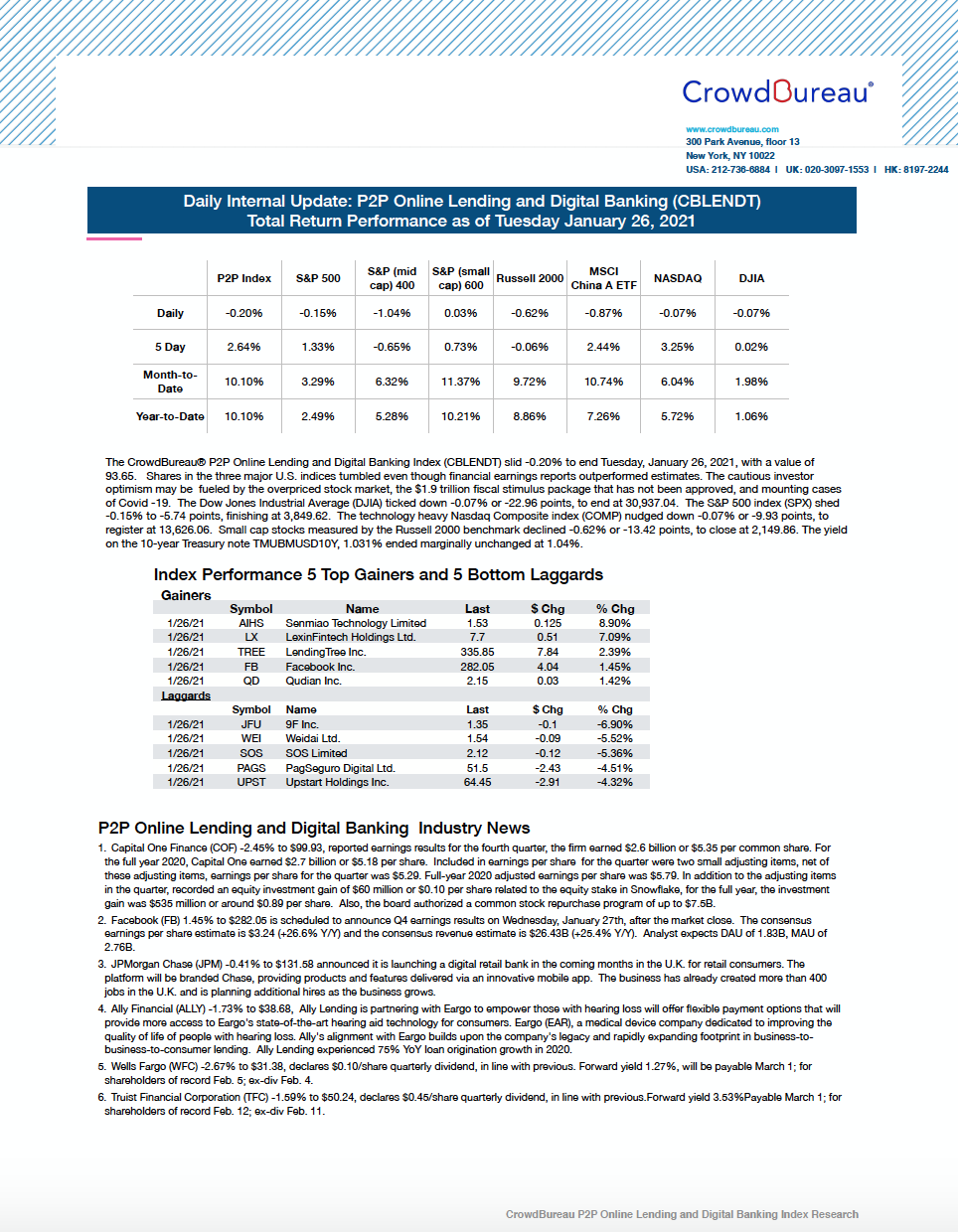

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) slid -0.20%

January 26, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) slid -0.20% to end Tuesday, January 26, 2021, with a value of 93.65. Shares in the three major U.S. indices tumbled even while financial earnings reports outperformed estimates. The cautious investor optimism may be fueled by the overpriced stock market, the $1.9 trillion fiscal stimulus package that has not been approved, and mounting cases of Covid -19.

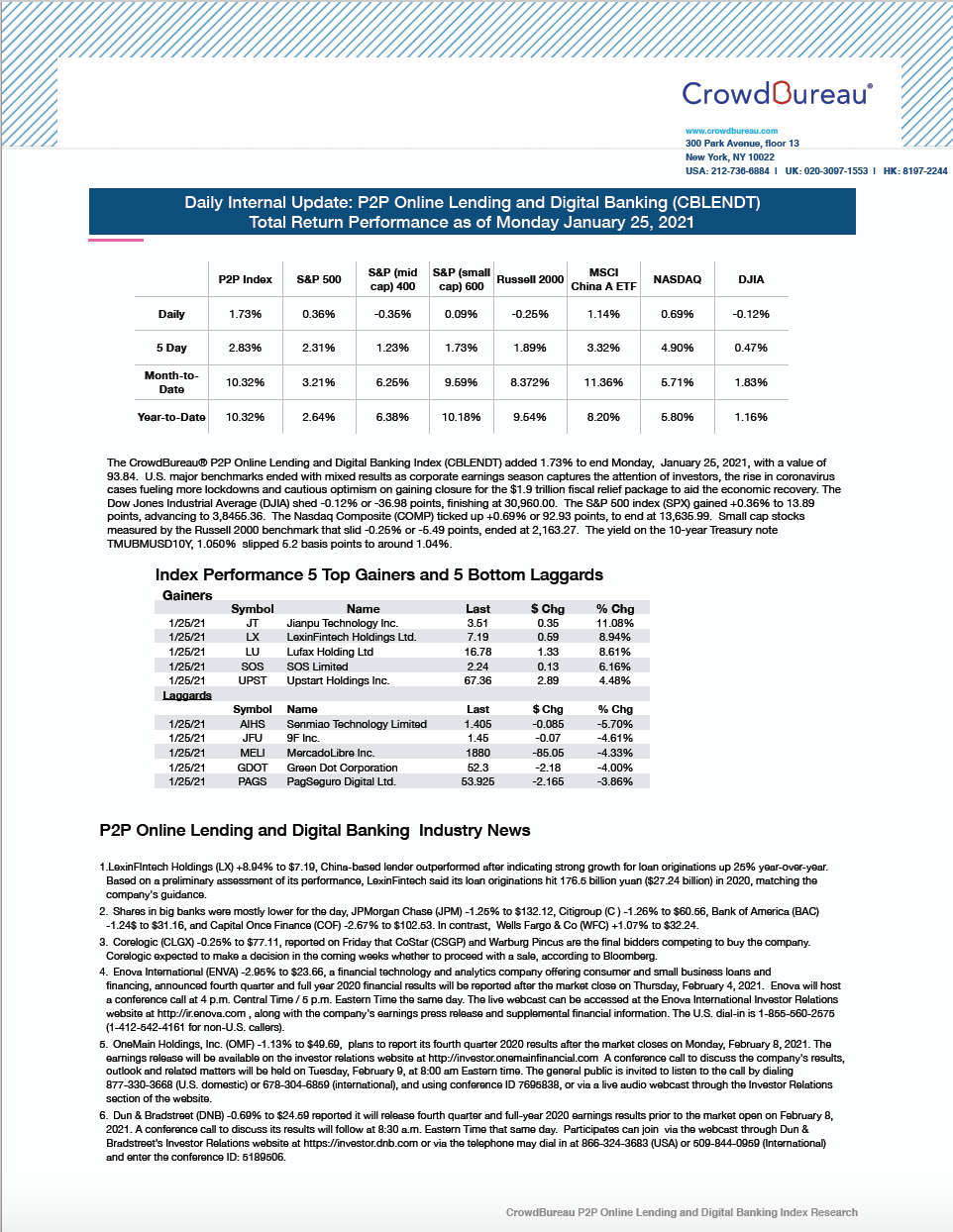

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) started the week, by adding +1.73% total return

January 25, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 1.73% to end Monday, January 25, 2021, with a value of 93.84. The index is up 2.83% for the five-day period, while month-to-date gains are up 10.32%. U.S. major benchmarks ended with mixed results as corporate earnings season captures the attention of investors.

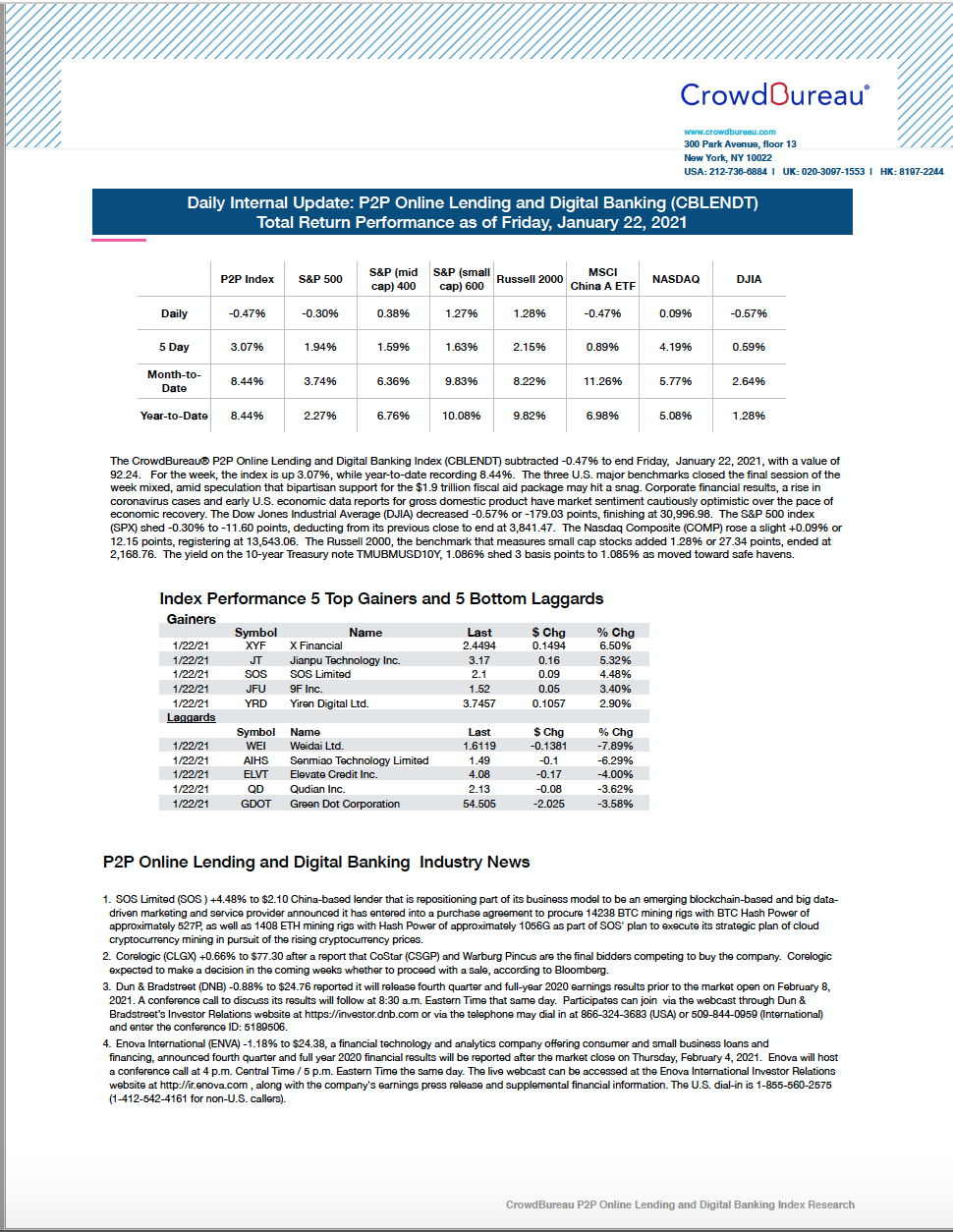

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ended lower after subtracting -0.47% at the close

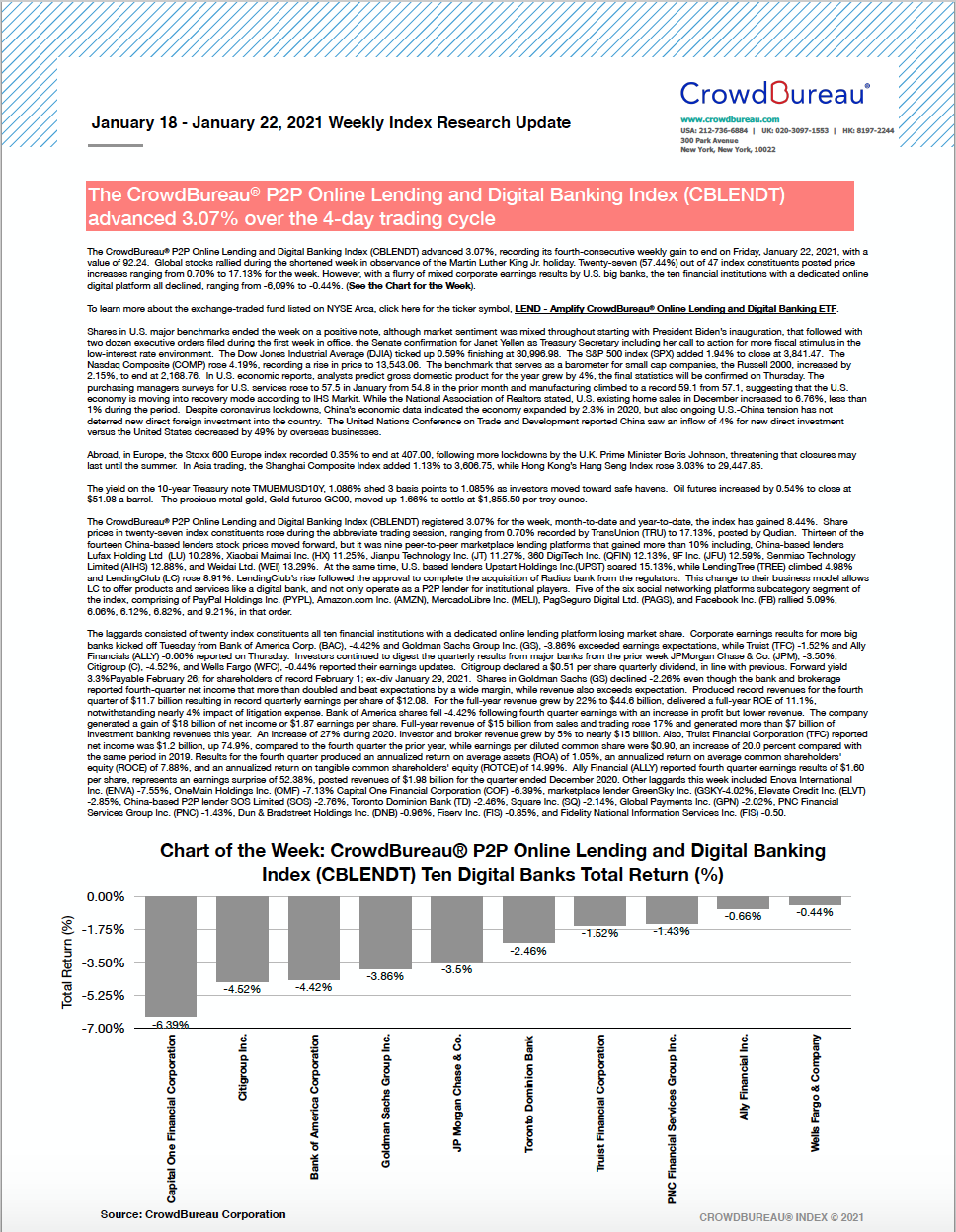

January 22, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) subtracted -0.47% to end Friday, January 22, 2021, with a value of 92.24. For the week, the index is up 3.07%, while year-to-date recording 8.44%. The three U.S. major benchmarks closed the final session of the week mixed, amid speculation that bipartisan support for the $1.9 trillion fiscal aid package may hit a snag in the Senate.

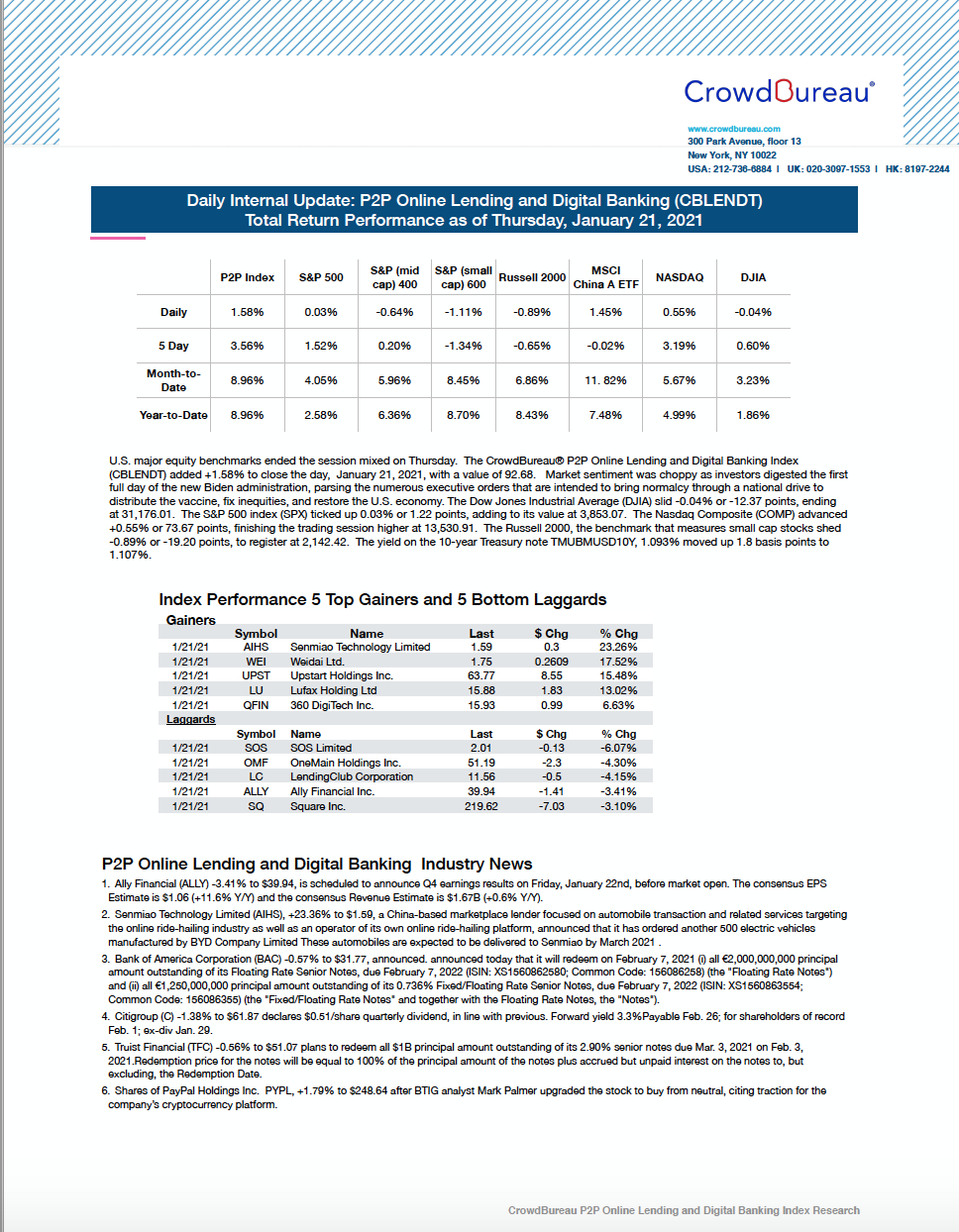

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added +1.58 to finish higher

January 21, 2021

U.S. major equity benchmarks ended the session mixed on Thursday. The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added +1.58% to close the day, January 21, 2021, with a value of 92.68. Market sentiment was choppy as investors digested the first full day of the new Biden administration, parsing the numerous executive orders that are intended to bring normalcy through a national drive to distribute the vaccine, fix inequities, and restore the U.S. economy.

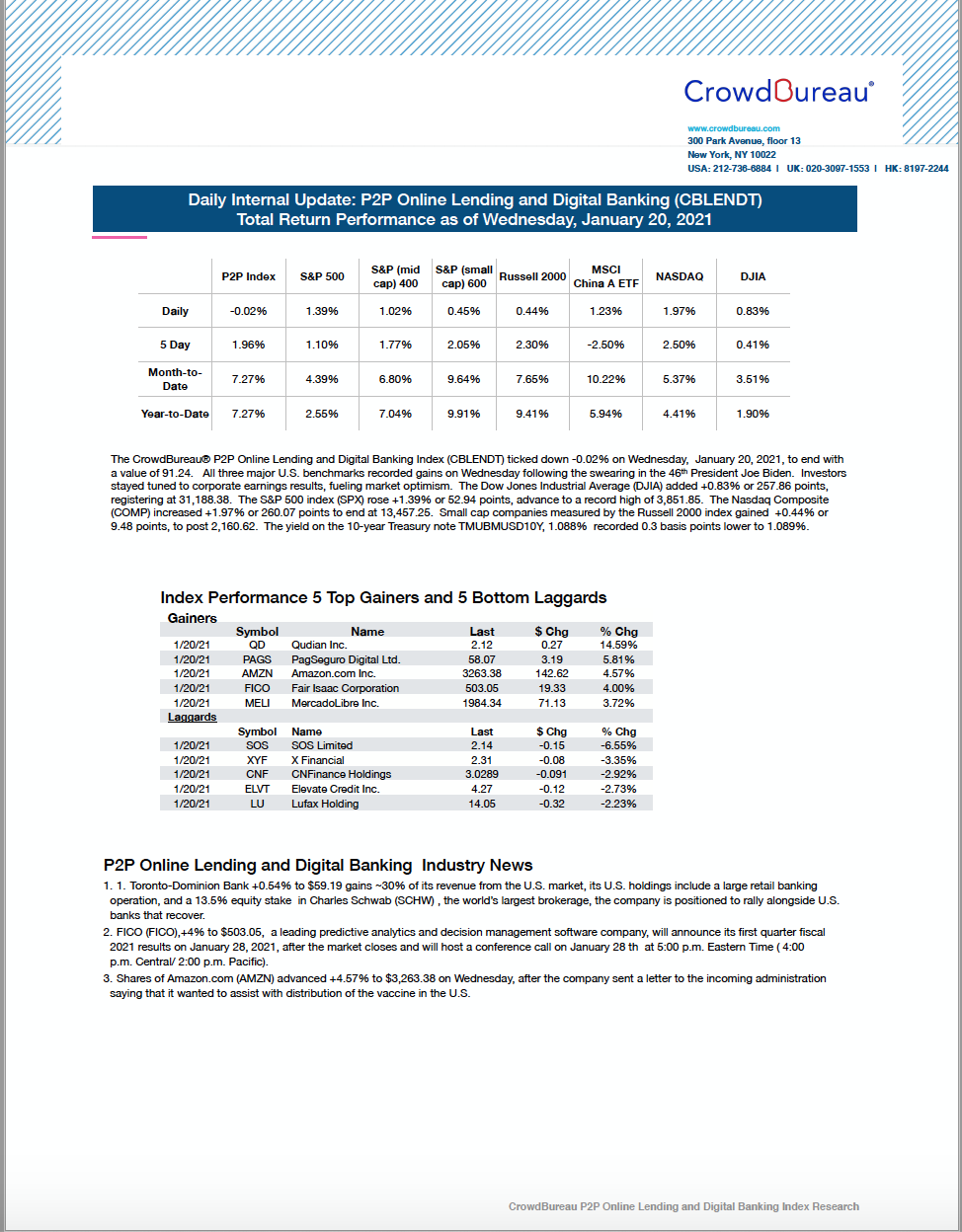

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ticked down -0.02% on Wednesday

January 20, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) ticked down -0.02% on Wednesday, January 20, 2021, to end with a value of 91.24. All three major U.S. benchmarks recorded gains on Wednesday following the swearing in the 46th President Joe Biden. Investors stayed tuned to corporate earnings results, fueling market optimism.

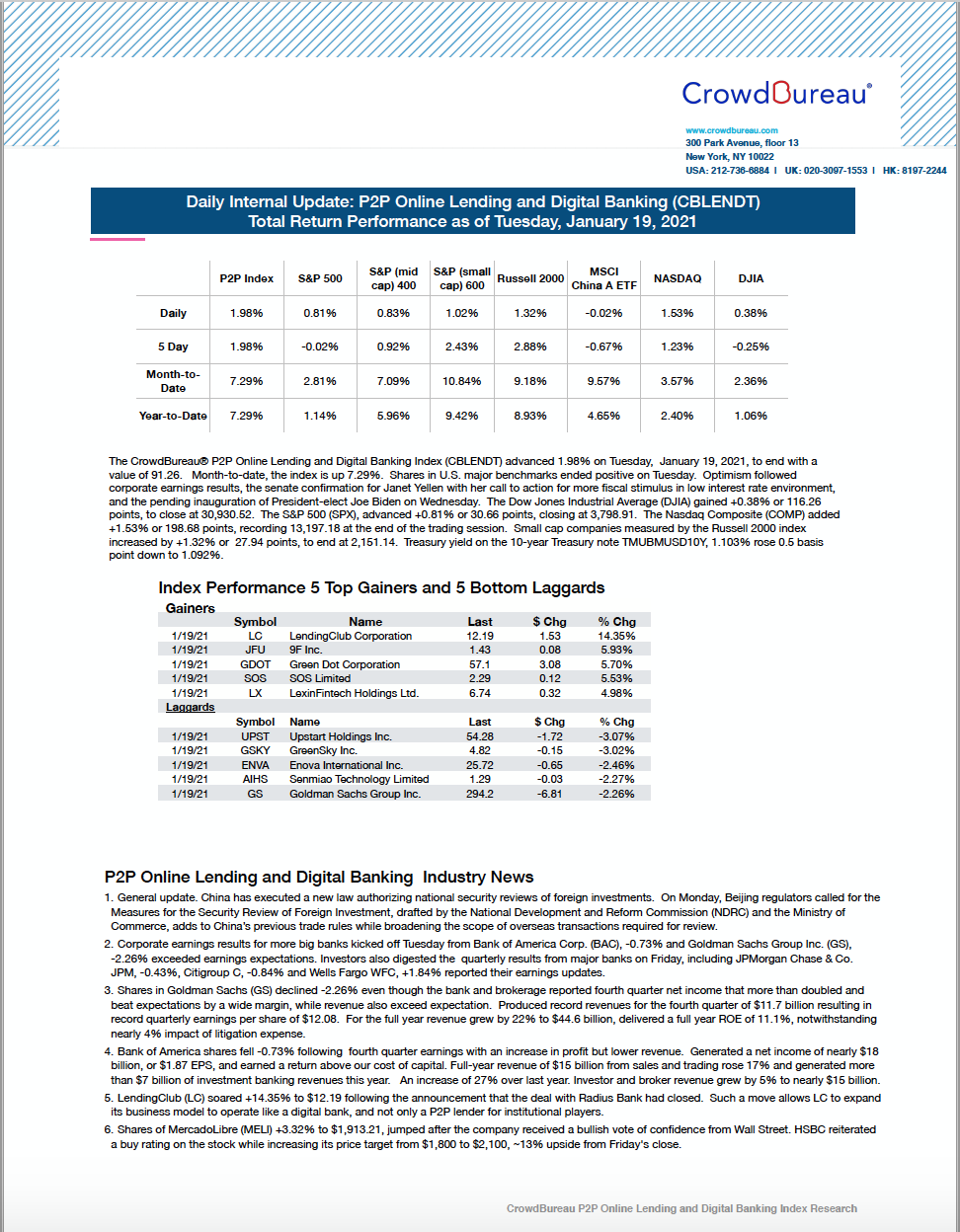

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) advanced 1.98%

January 19, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced 1.98% on Tuesday, January 19, 2021, to end with a value of 91.26. Month-to-date, the index is up 7.29%. Shares in U.S. major benchmarks ended positive on Tuesday following the Martin Luther King holiday on Monday with markets closed. Optimism followed corporate earnings results, the senate confirmation for Janet Yellen with her call to action for more fiscal stimulus in low interest rate environment, and the pending inauguration of President-elect Joe Biden on Wednesday.

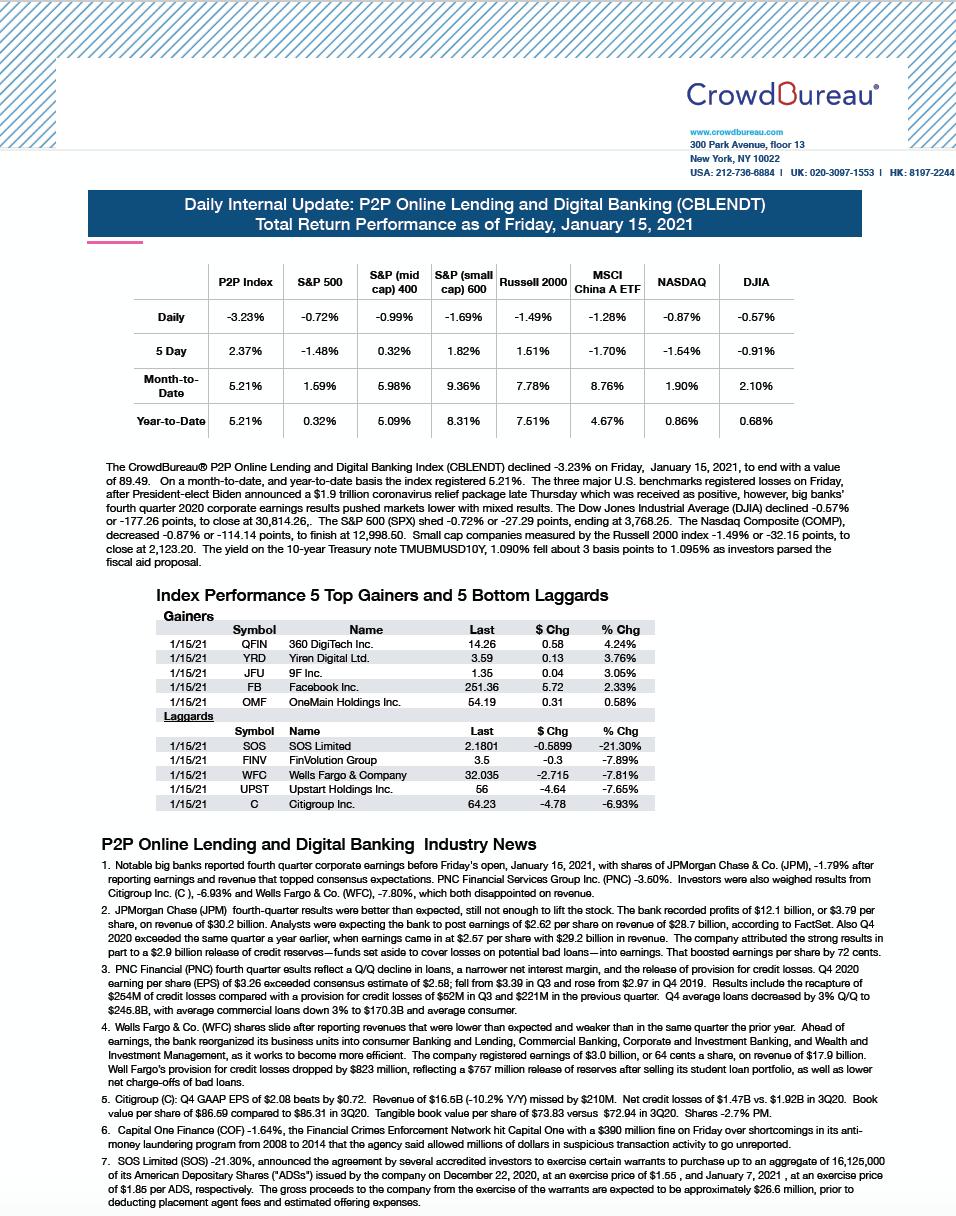

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) declined -3.23% to close the last trading session for the week

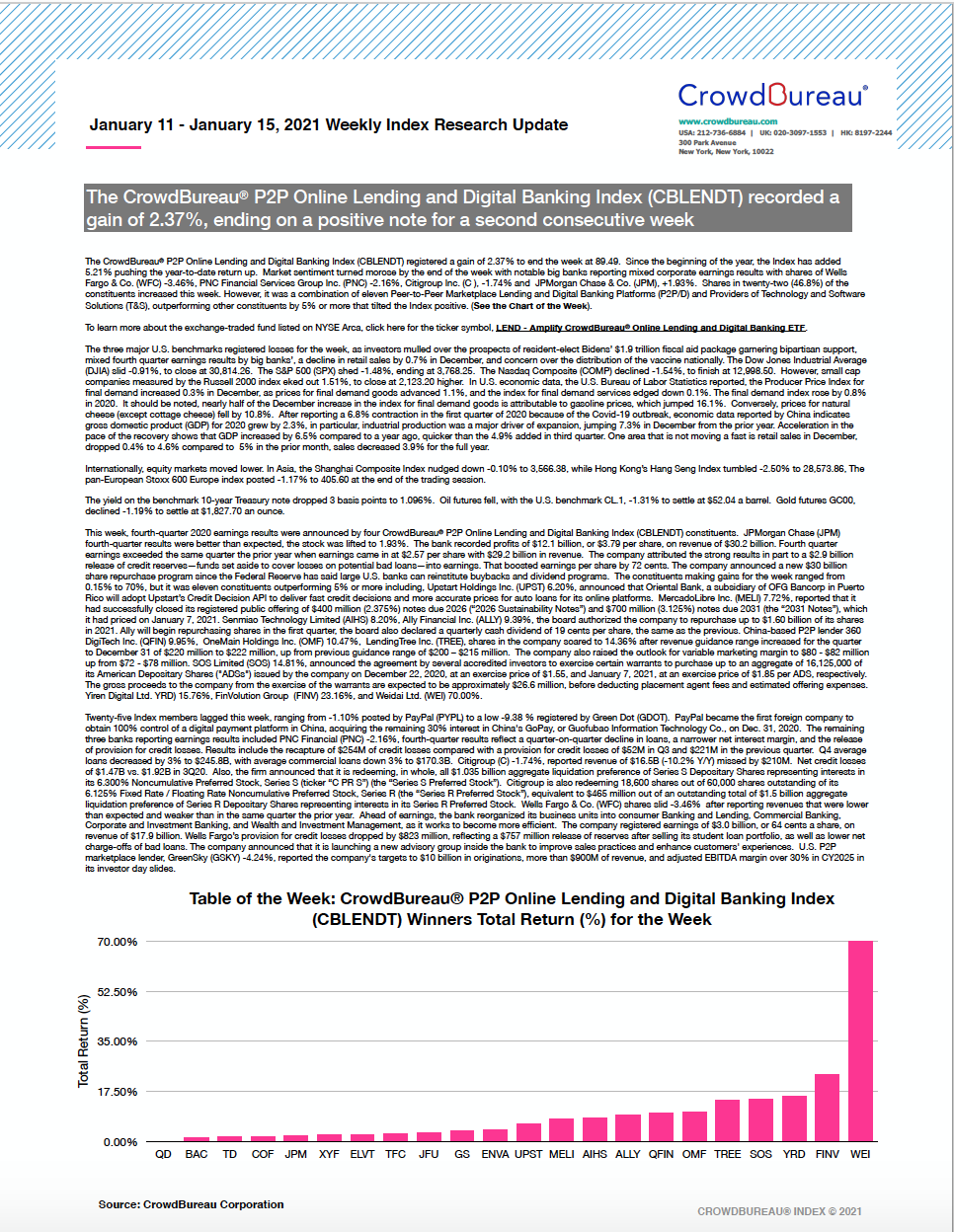

January 15, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) declined -3.23% on Friday, January 15, 2021, to end with a value of 89.49. On a month-to-date, and year-to-date basis the index registered 5.21%. The three major U.S. benchmarks registered losses on Friday, after President-elect Biden announced a $1.9 trillion coronavirus relief package late Thursday which was received as positive.

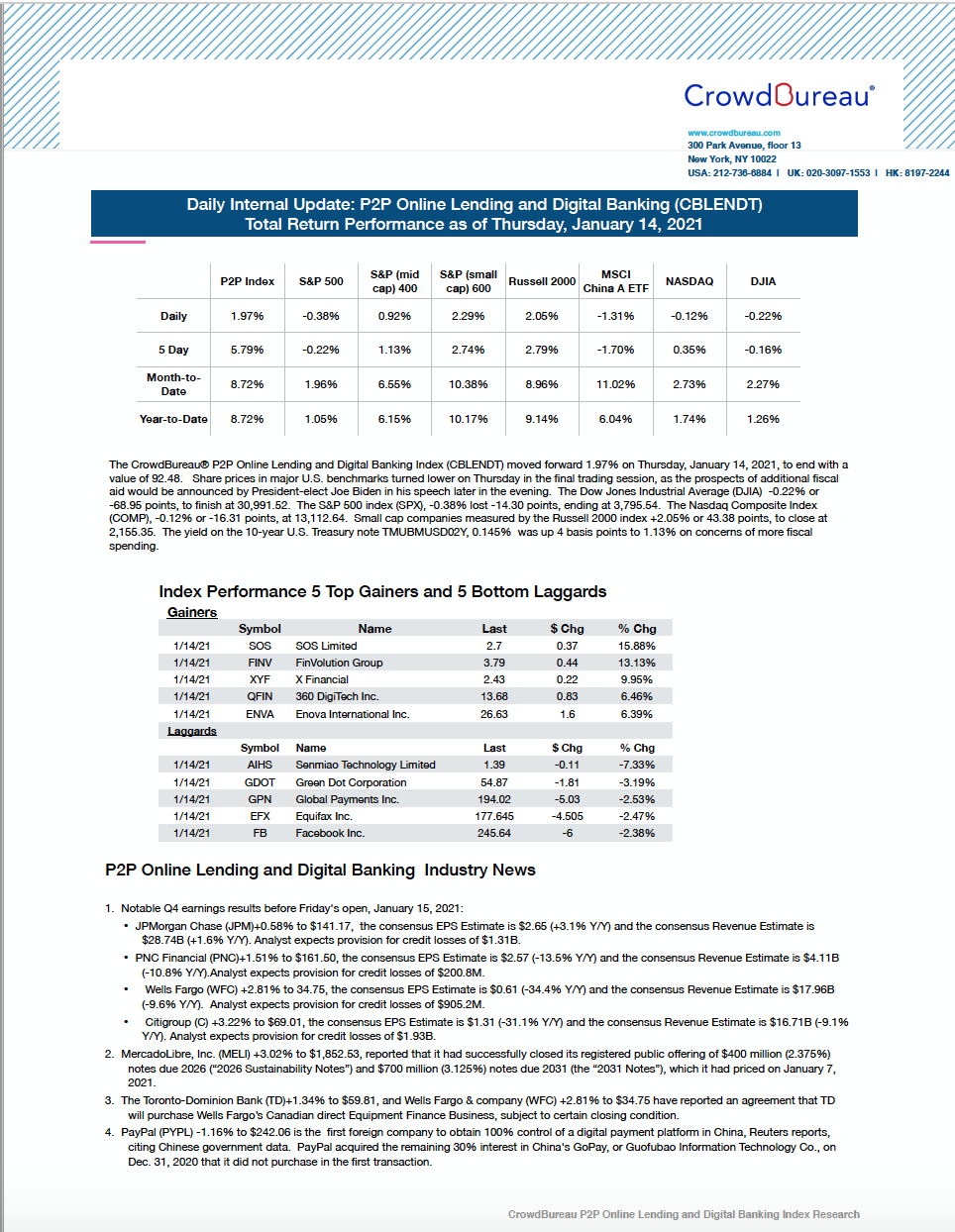

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course, moving forward +1.97% to finish the day

January 14, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) moved forward 1.97% on Thursday, January 14, 2021, to end with a value of 92.48. Share prices in major U.S. benchmarks turned lower on Thursday in the final trading session, in anticipation of additional fiscal aid would be announced by President-elect Joe Biden in his speech later in the evening.

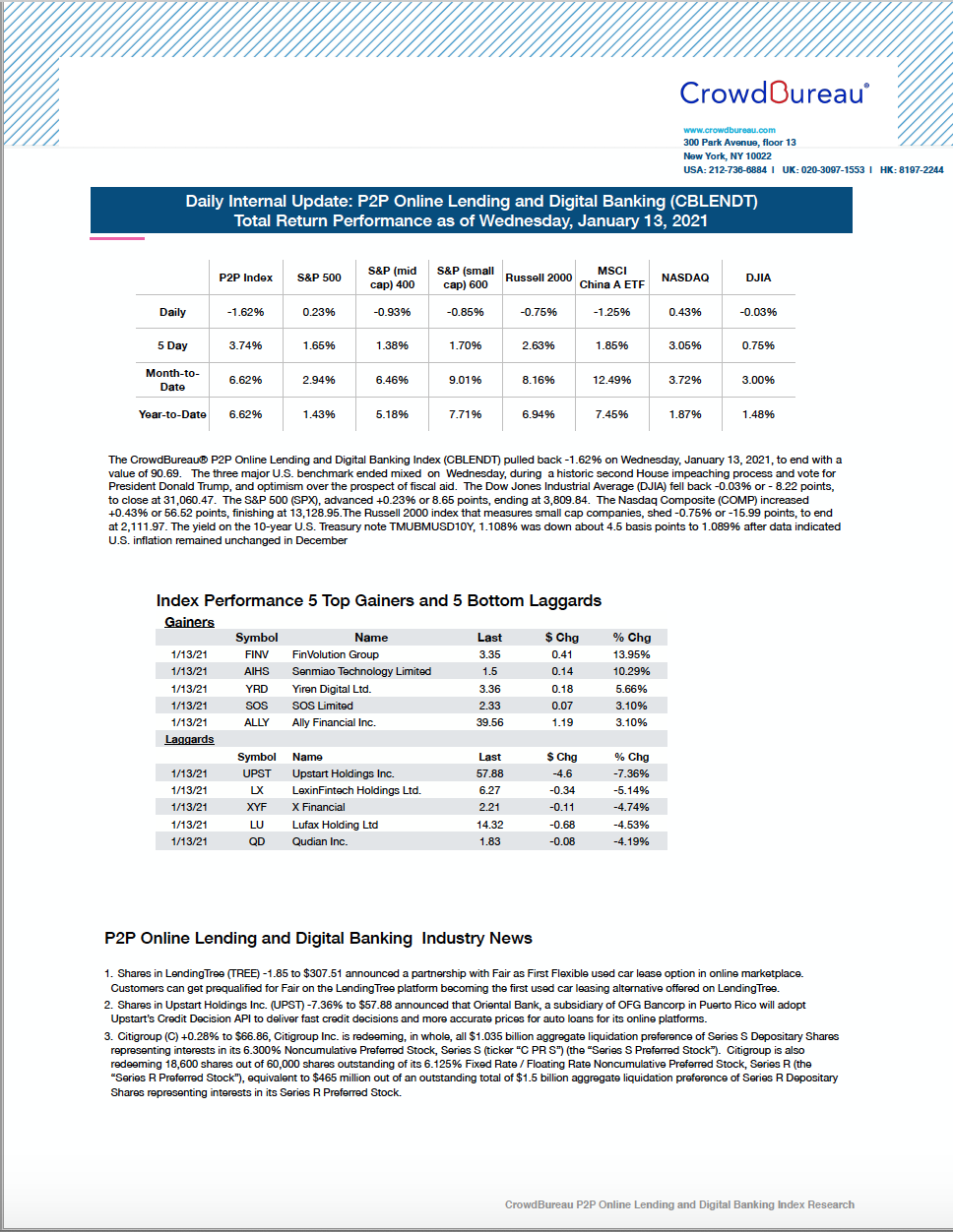

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) pulled back -1.62% to close the trading session

January 13, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) pulled back -1.62% on Wednesday, January 13, 2021, to end with a value of 90.69. The three major U.S. benchmark ended mixed on Wednesday, during a historic second House impeaching process and vote for President Donald Trump, and optimism over the prospect of additional fiscal aid.

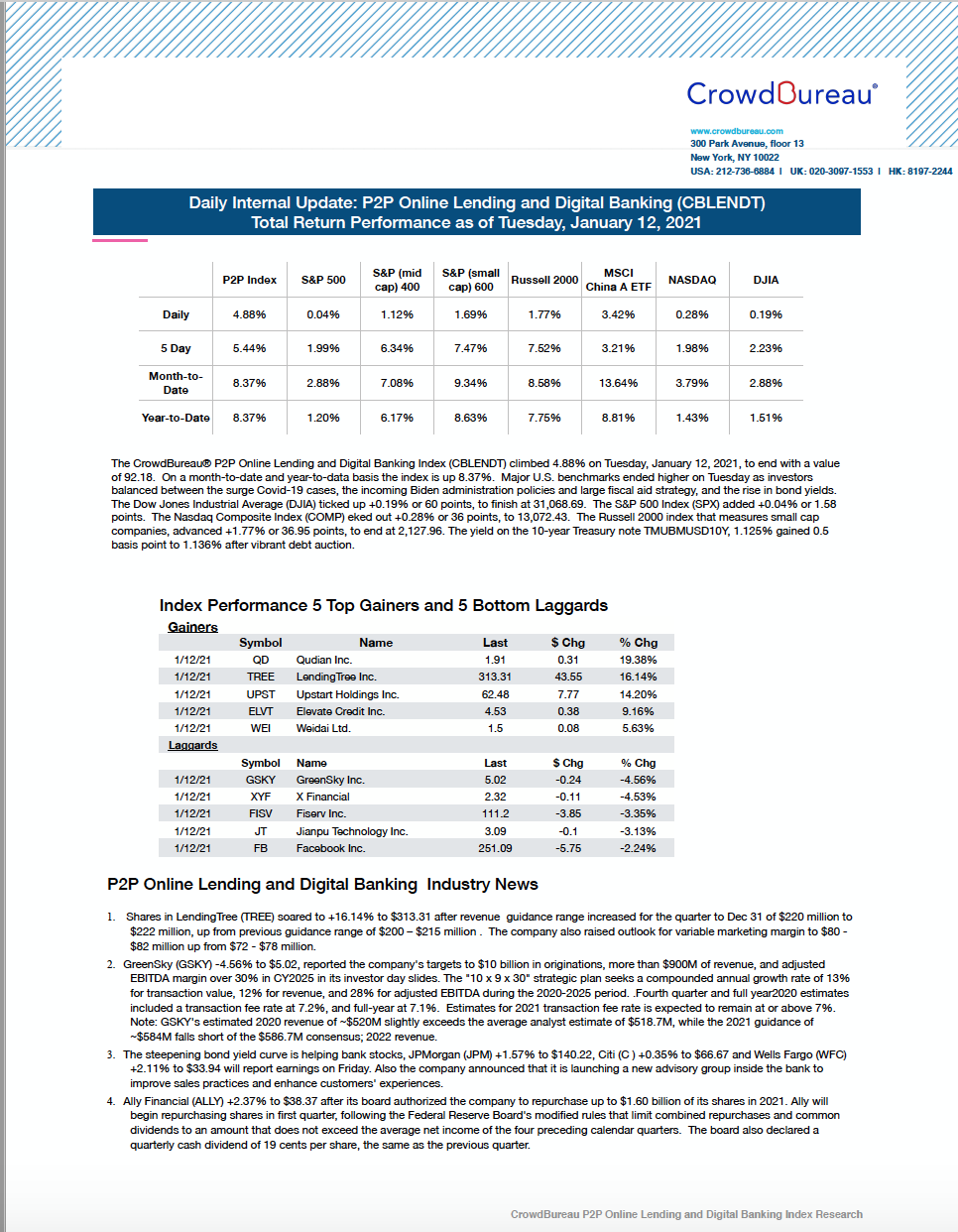

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) soared on Tuesday, climbing +4.88%

January 12, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) climbed 4.88% on Tuesday, January 12, 2021, to end with a value of 92.18. On a month-to-date and year-to-data basis the index is up 8.37%. Major U.S. benchmarks ended higher on Tuesday as investors balanced between the surge Covid-19 cases, the incoming Biden administration policies and large fiscal aid strategy, and the rise in bond yields.

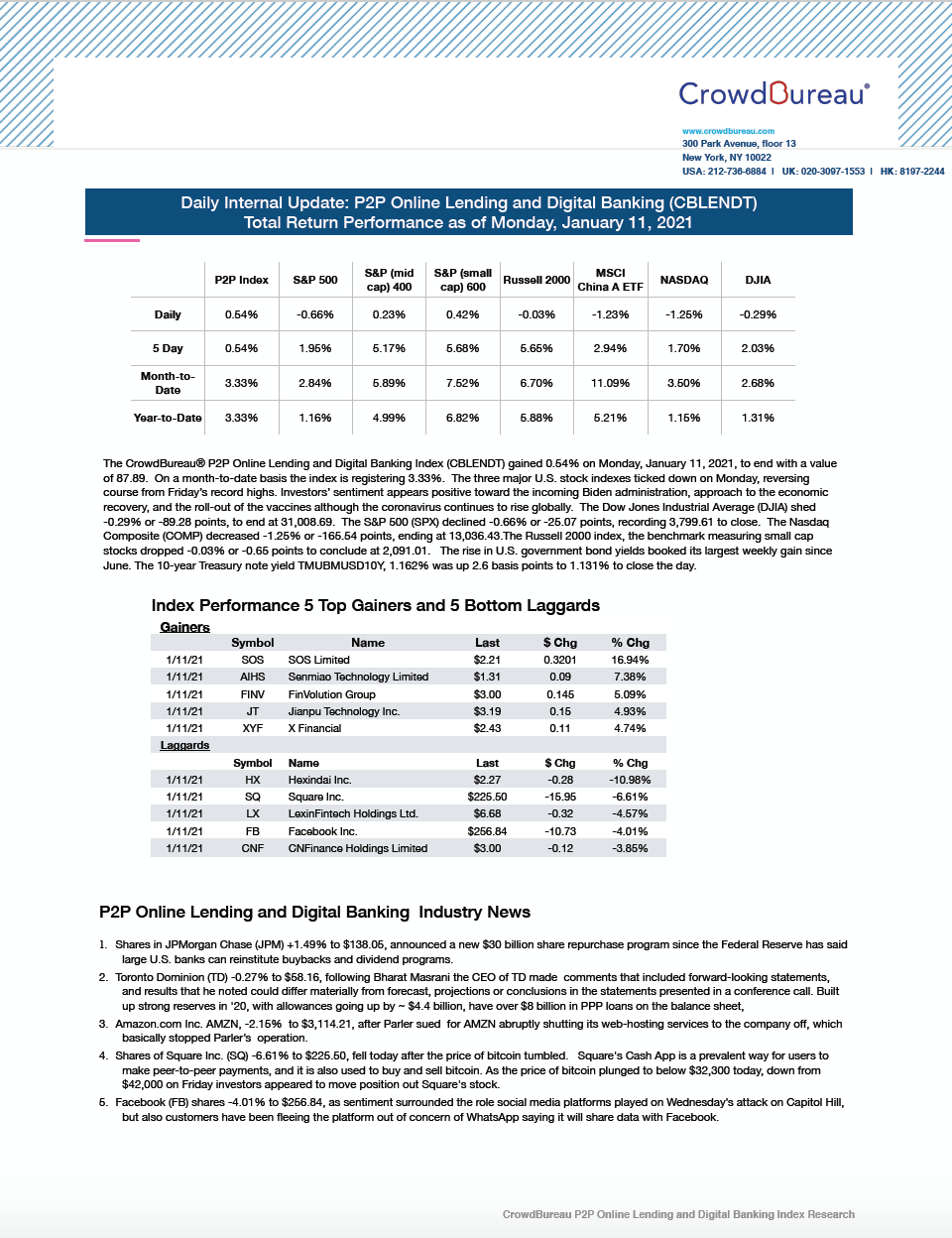

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) gained 0.54% to close the trading session

January 11, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) gained 0.54% on Monday, January 11, 2021, to end with a value of 87.89. On a month-to-date basis the index is registering 3.33%. The three major U.S. stock indexes ticked down on Monday, reversing course from Friday’s record highs.

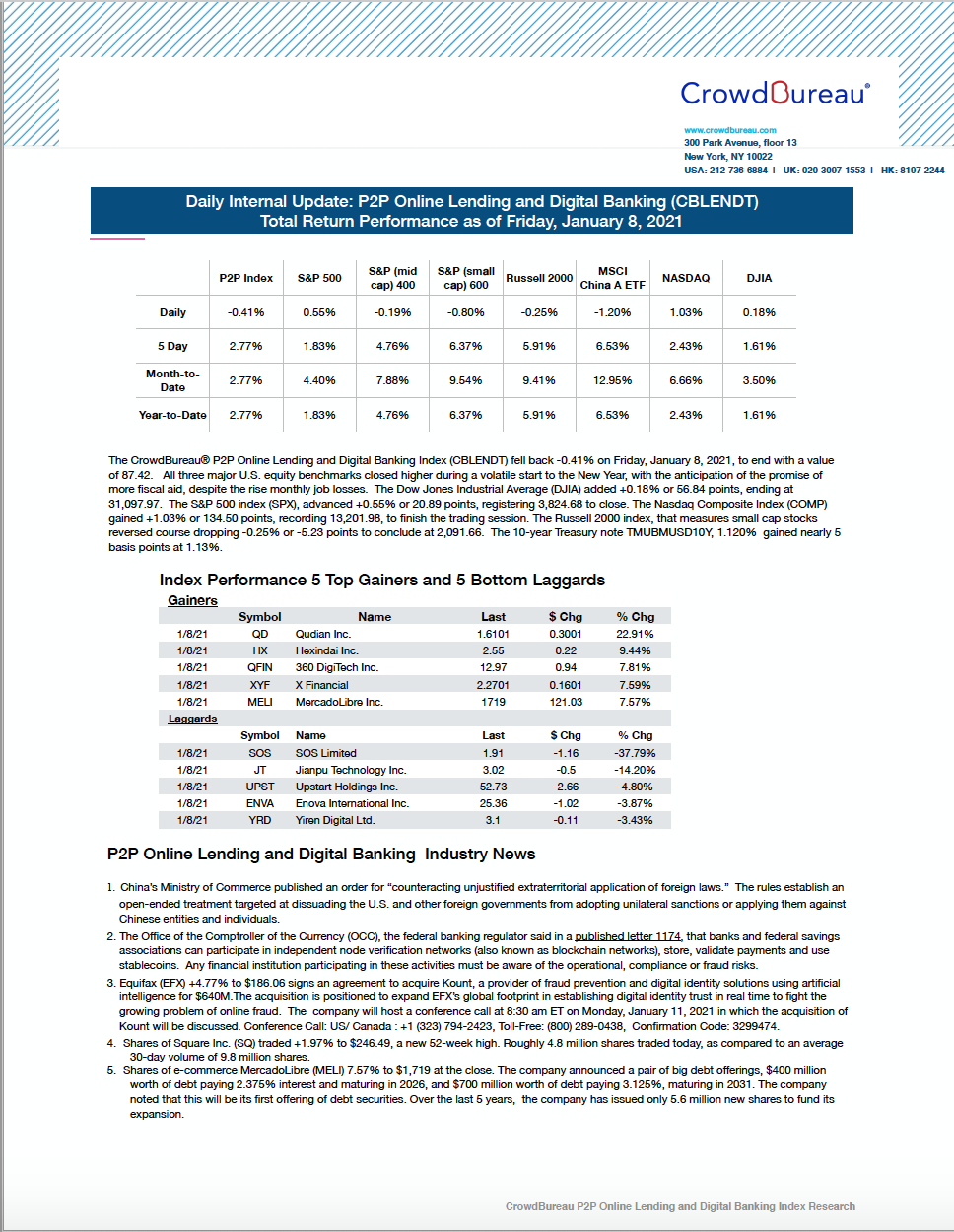

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course, falling back -0.41% to end Friday

January 8, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) fell back -0.41% on Friday, January 8, 2021, to end with a value of 87.42. All three major U.S. equity benchmarks closed higher during a volatile start to the New Year, with the anticipation of the promise of more fiscal aid, despite the rise monthly job losses.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose 3.28%, climbing higher to close the session

January 7, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced 3.28% on Thursday, January 7, 2021, to end with a value of 87.78. Major U.S. benchmarks ended at higher on Thursday. The confirmation of President elect Biden by Congress, and investor sentiment toward an aggressive fiscal package to aid economic recovery fueled the markets’ performance.

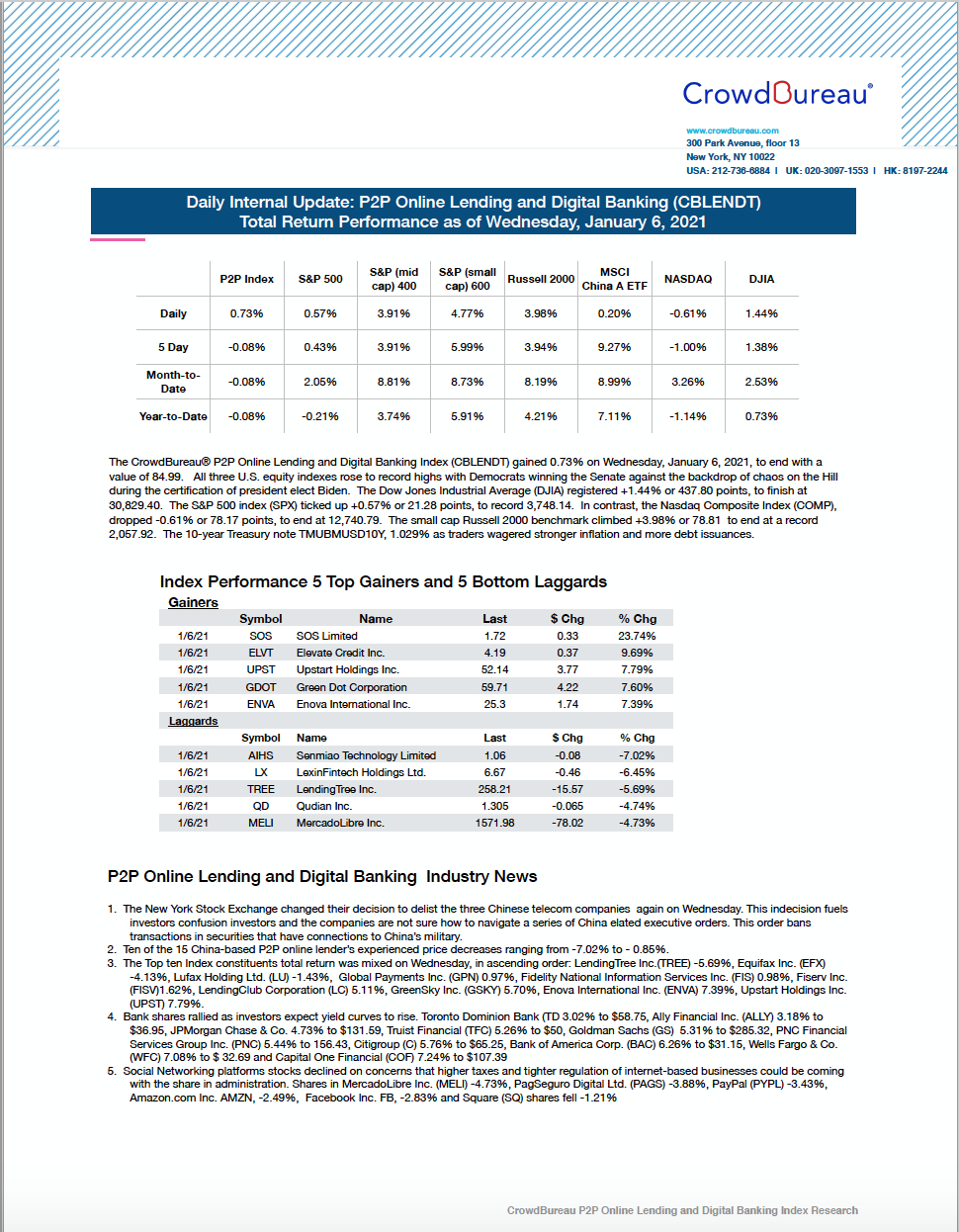

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) eked out 0.73%, ending with gains for the second consecutive day

January 6, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) gained 0.73% on Wednesday, January 6, 2021, to end with a value of 84.99. All three U.S. equity indexes rose to record highs with Democrats winning the Senate against the backdrop of chaos on the Hill during the certification of president elect Biden.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course, rising 0.58% to finish the day

January 5, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 0.58% on Tuesday, January 5, 2021, to end with a value of 84.37. The three major U.S. equity benchmarks finished higher on Tuesday with investors tuned in to the Georgia Senate elections, results may provide more aggressive fiscal policy to aid the economic recovery, also concern over the transmission of Covid-19 persists.

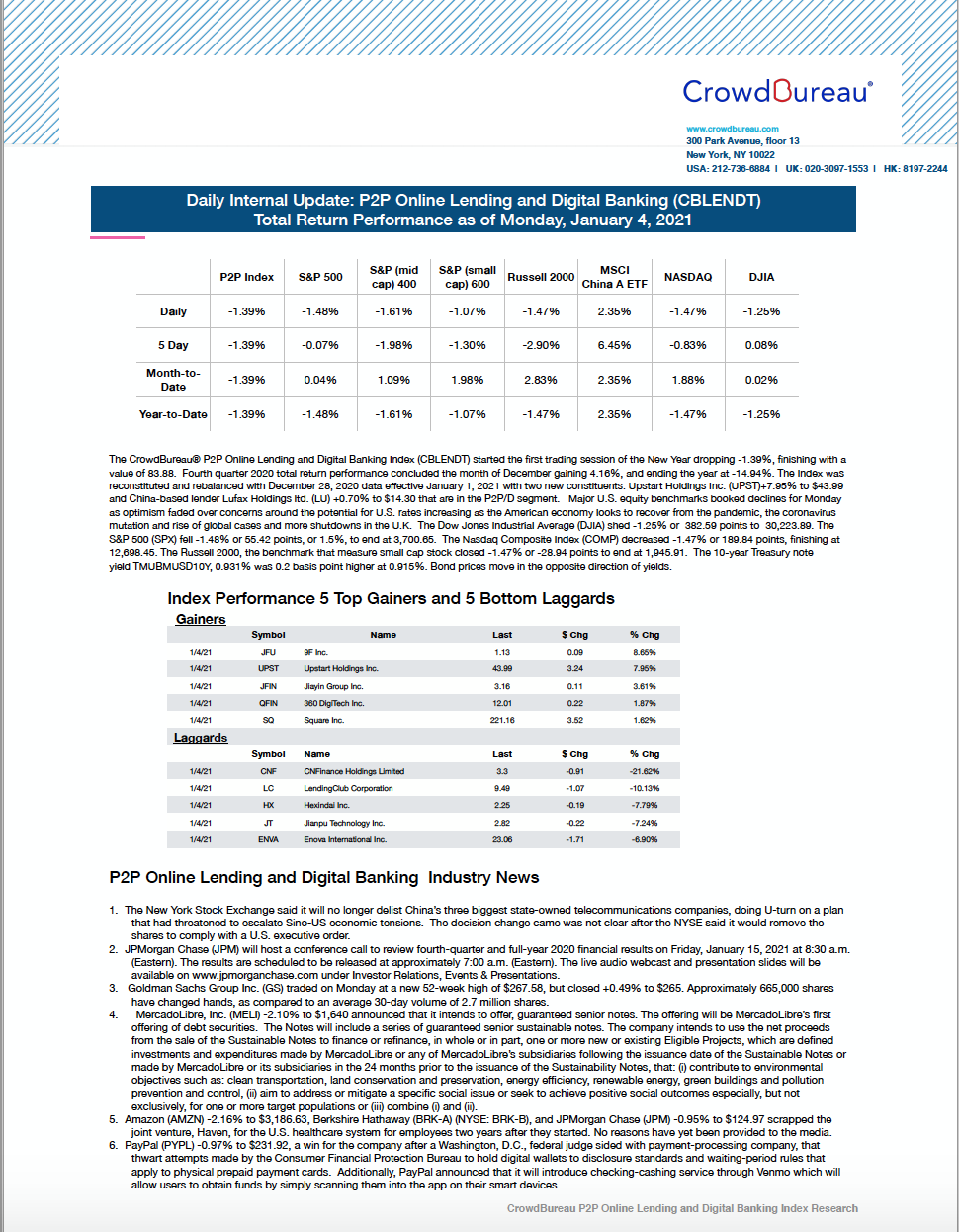

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) posted -1.39% to start the first trading session of the New Year 2021

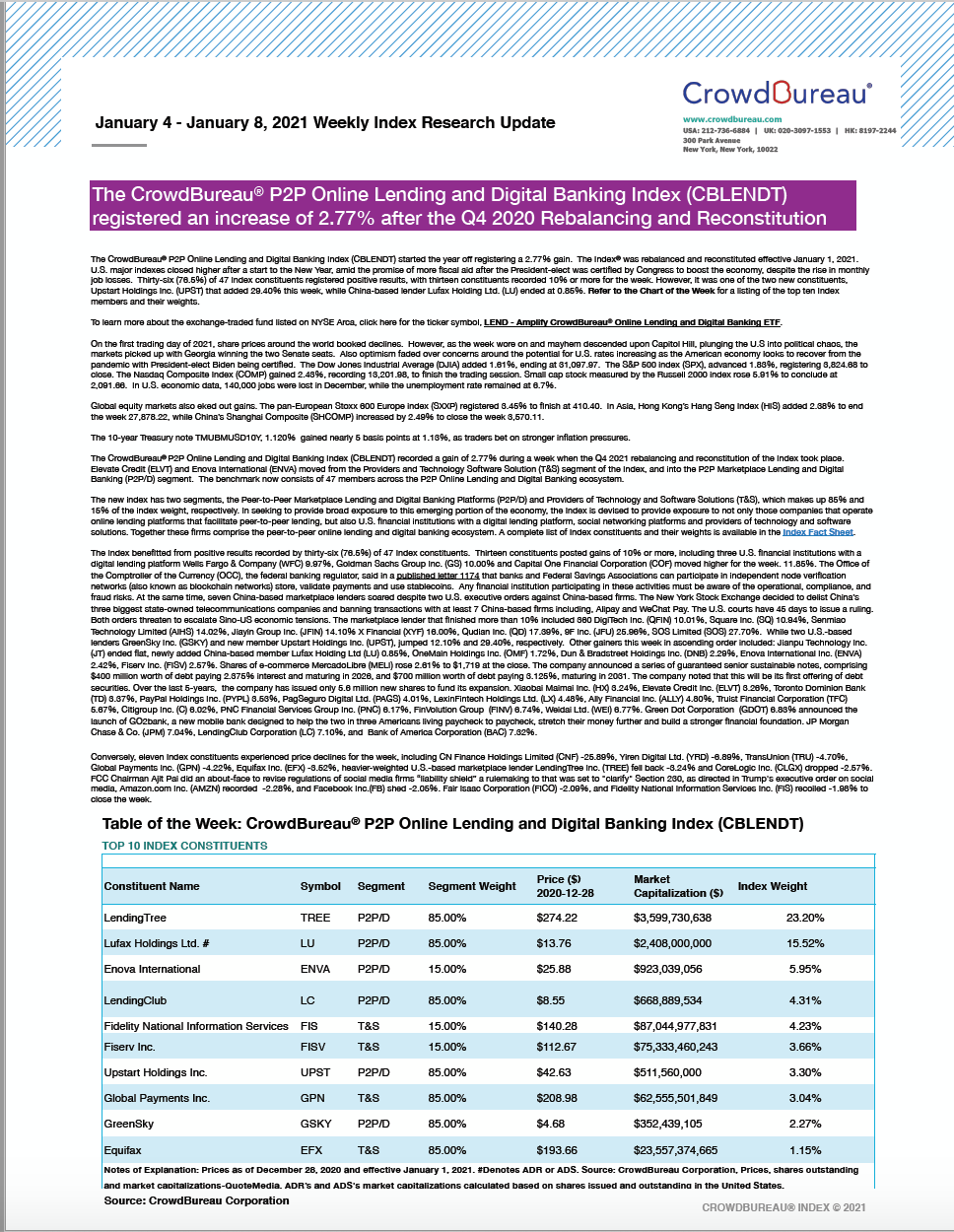

January 4, 2021

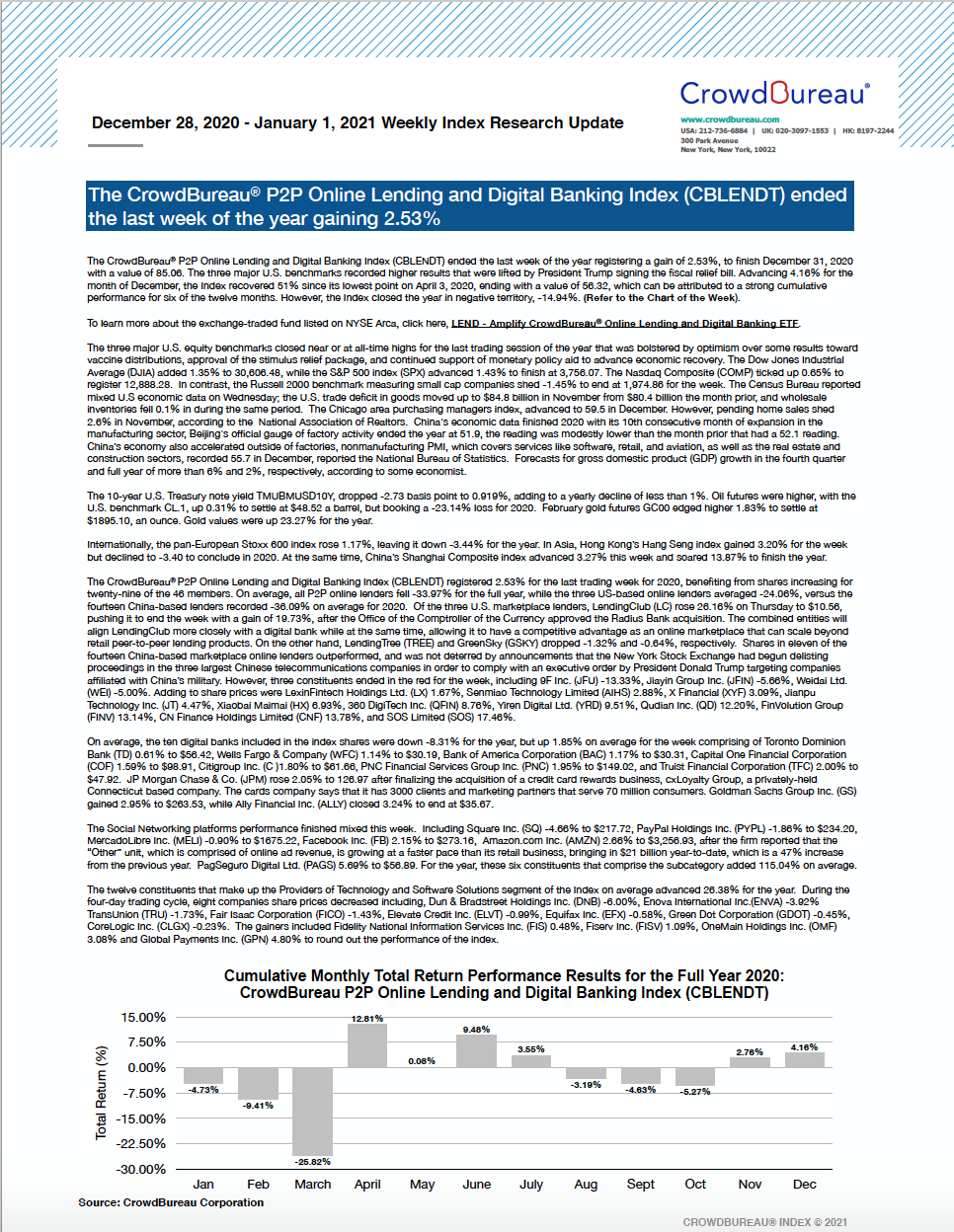

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) started the first trading session of the New Year dropping -1.39%, finishing with a value of 83.88. Fourth quarter 2020 total return performance concluded the month of December gaining 4.16%, and ending the year at -14.94%. The Index was reconstituted and rebalanced with December 28, 2020, data effective January 1, 2021 with two new constituents and now the index has 47 constituents. Upstart Holdings Inc. (UPST)+7.95% to $43.99 and China-based lender Lufax Holdings ltd. (LU) +0.70% to $14.30 are included in the P2P/D segment.

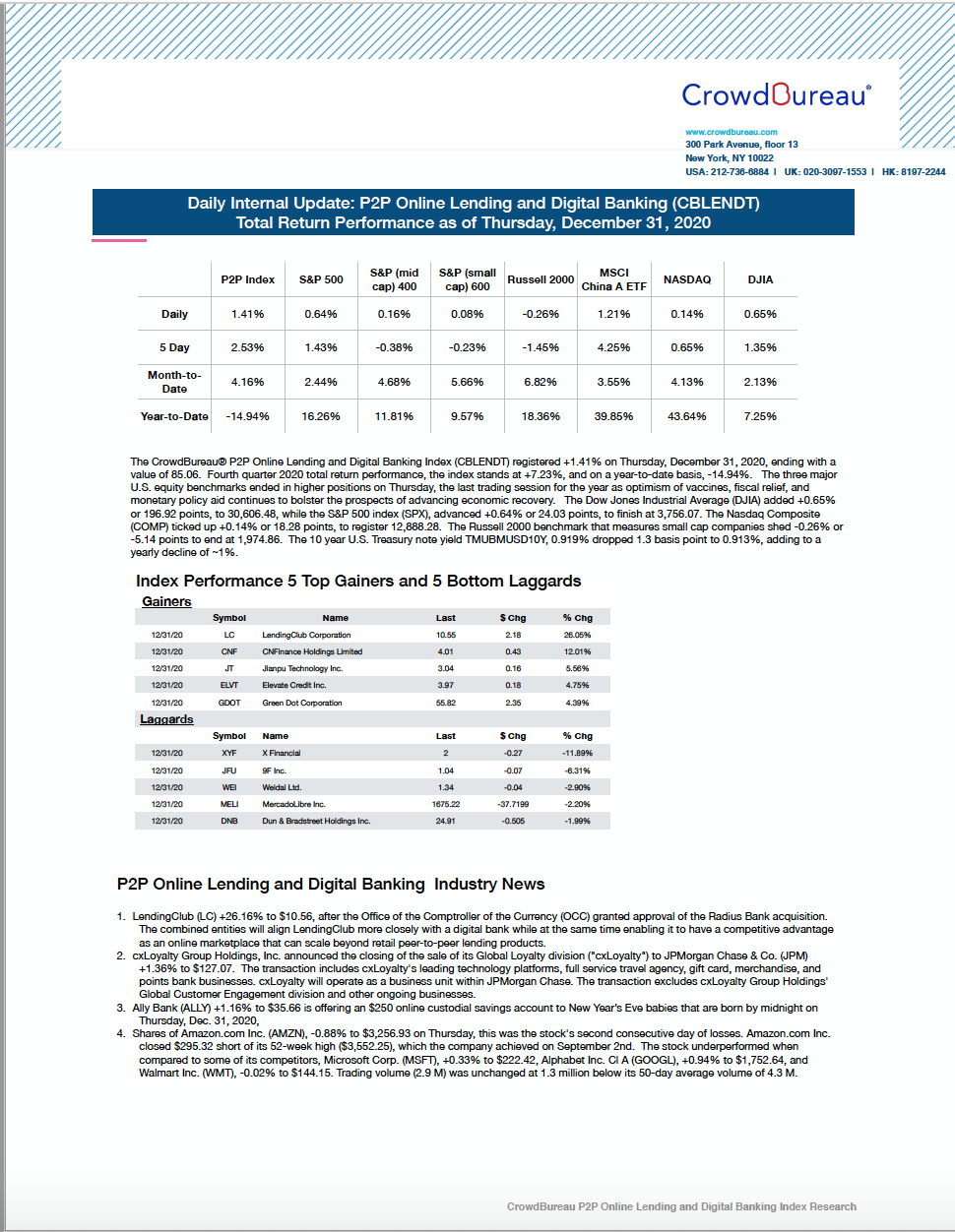

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) registered +1.41% to end the last trading session for 2020.

December 31, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) registered +1.41% on Thursday, December 31, 2020, ending with a value of 85.06. Fourth quarter 2020 total return performance, the index stands at +7.23%, and on a year-to-date basis, -14.94%. The three major U.S. equity benchmarks ended in higher positions on Thursday, the last trading session for the year as optimism of vaccines, fiscal relief, and monetary policy aid continues to bolster the prospects of advancing economic recovery.

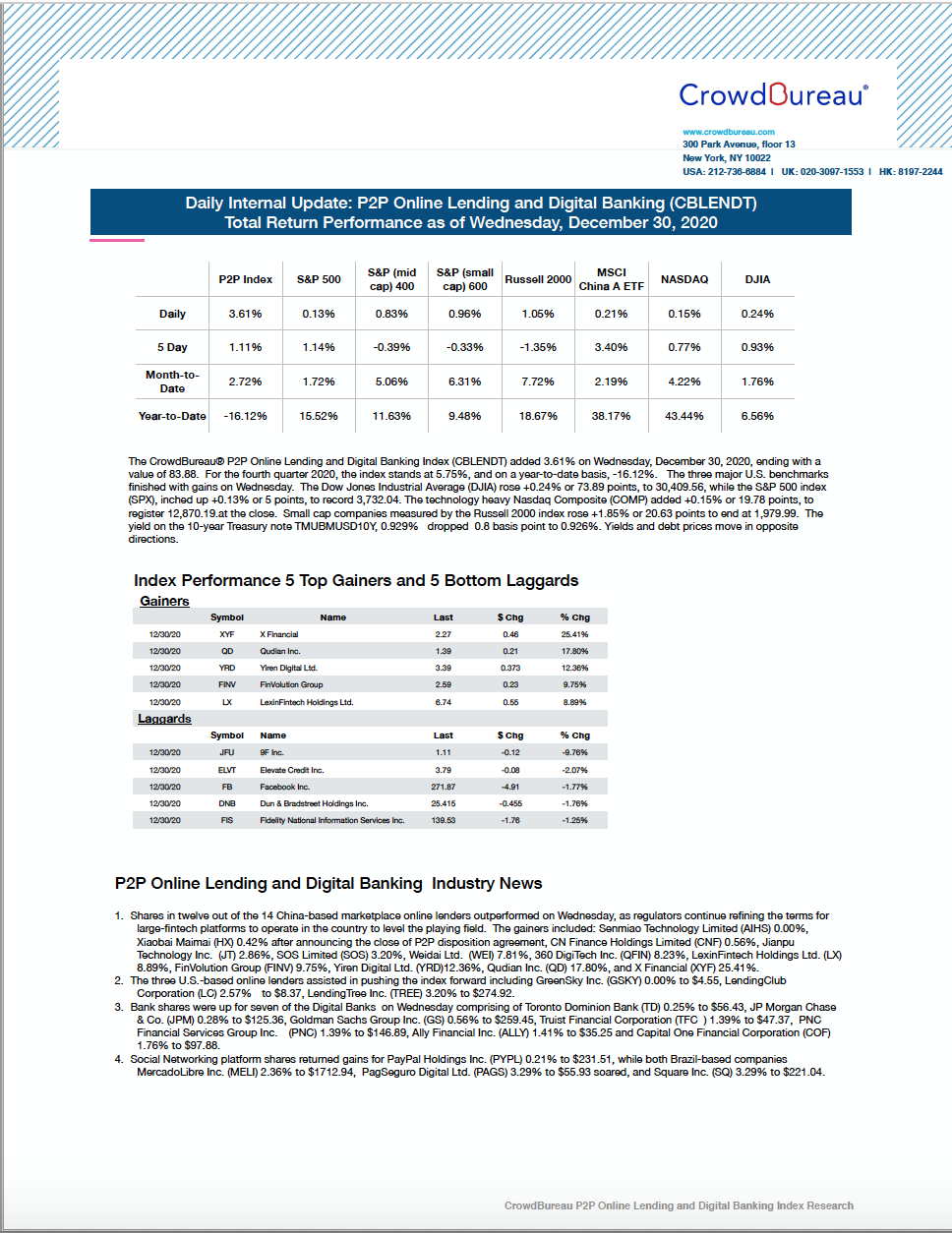

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose +3.61% ending Wednesday in positive territory

December 30, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 3.61% on Wednesday, December 30, 2020, ending with a value of 83.88. For the fourth quarter 2020, the index stands at 5.75%, and on a year-to-date basis, -16.12%. The three major U.S. benchmarks finished with gains on Wednesday.

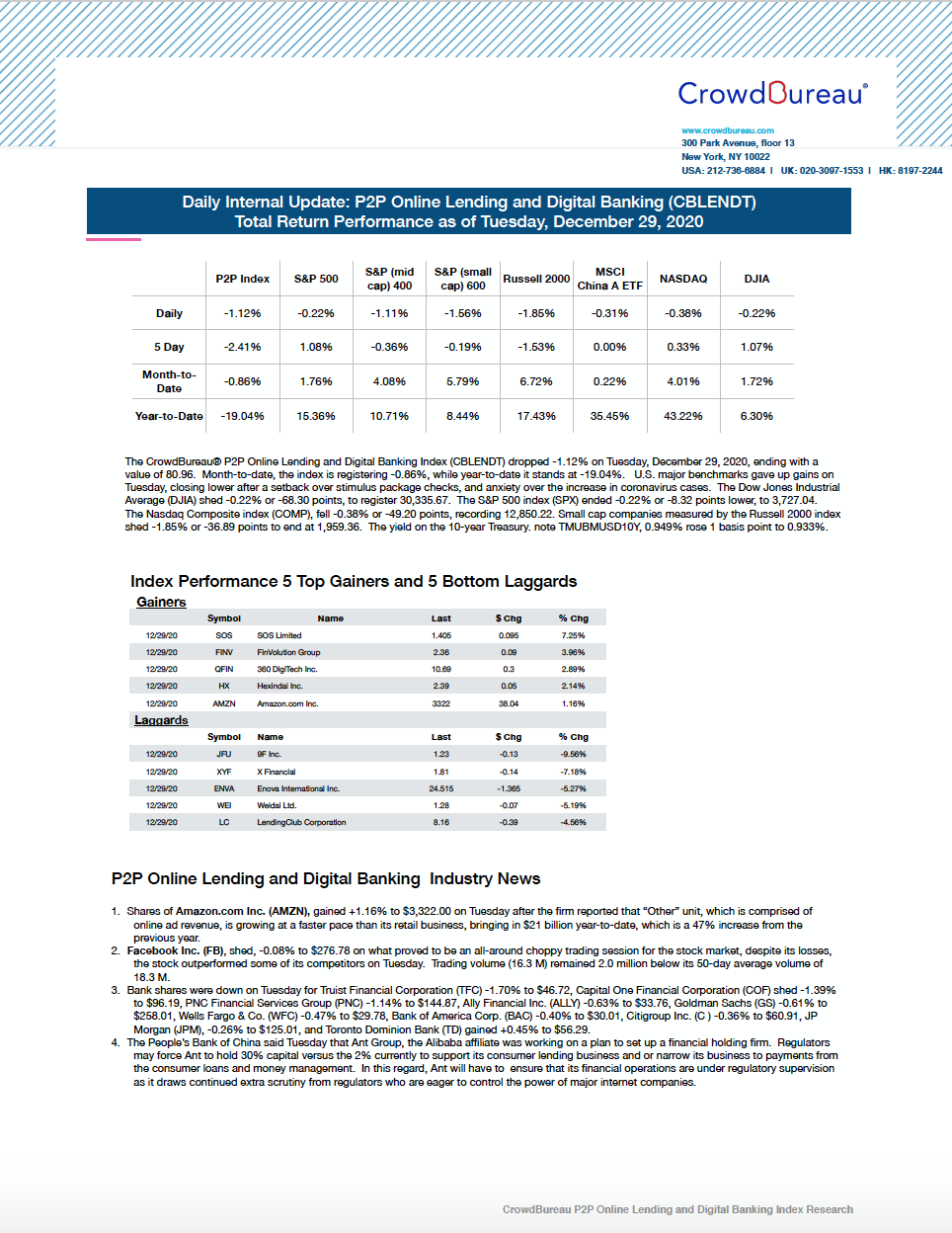

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) dropped -1.12% to finish lower

December 29, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) dropped -1.12% on Tuesday, December 29, 2020, ending with a value of 80.96. Month-to-date, the index is registering -0.86%, while year-to-date it stands at -19.04%. U.S. major benchmarks gave up gains on Tuesday, closing lower after a setback over stimulus package checks, and anxiety over the increase in coronavirus cases.

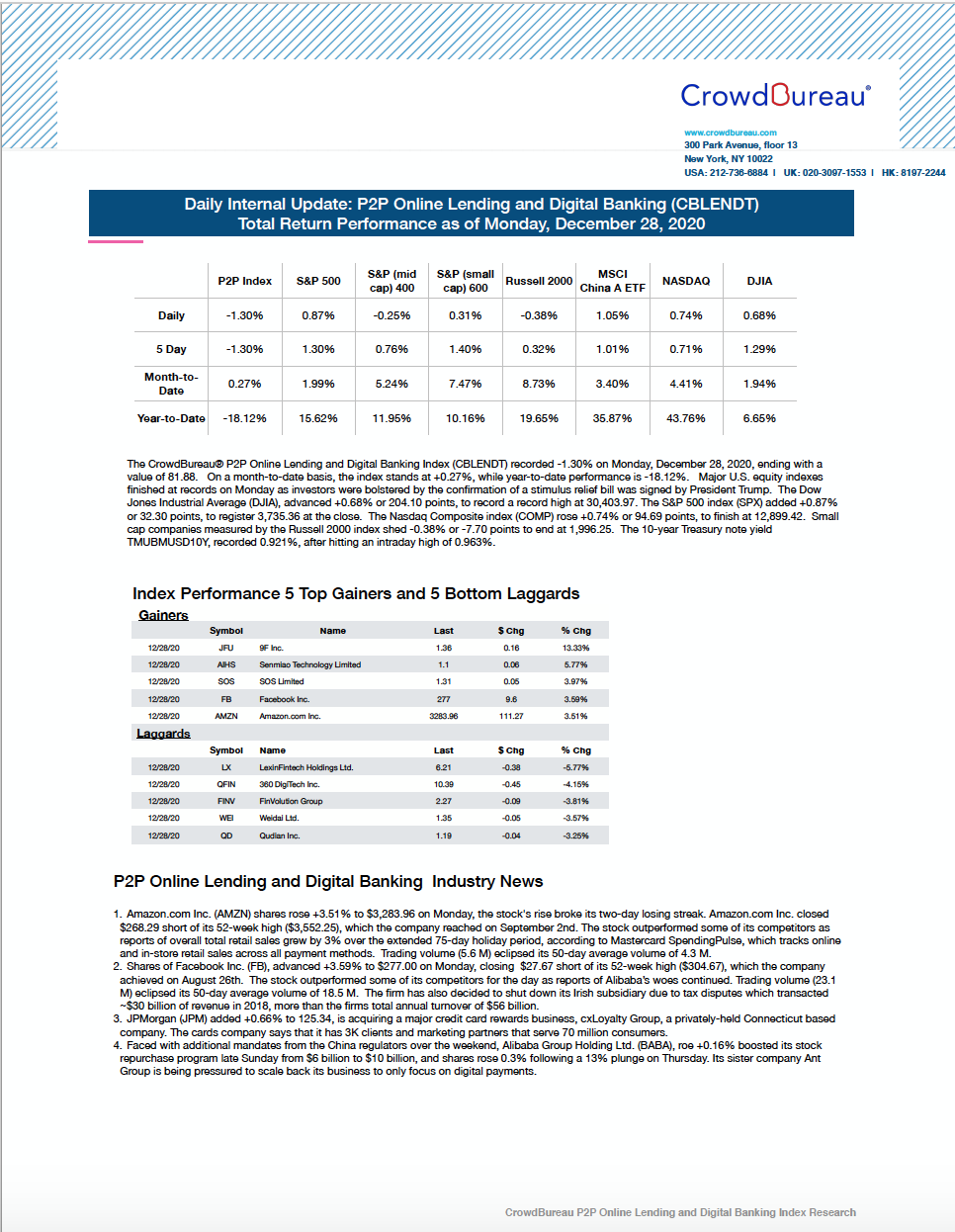

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) fell back on Monday, recording -1.30% to end trading cycle

December 28, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) recorded -1.30% on Monday, December 28, 2020, ending with a value of 81.88. On a month-to-date basis, the index stands at +0.27%, while year-to-date performance is -18.12%. Major U.S. equity indexes finished at records on Monday as investors were bolstered by the confirmation of a stimulus relief bill was signed by President Trump.

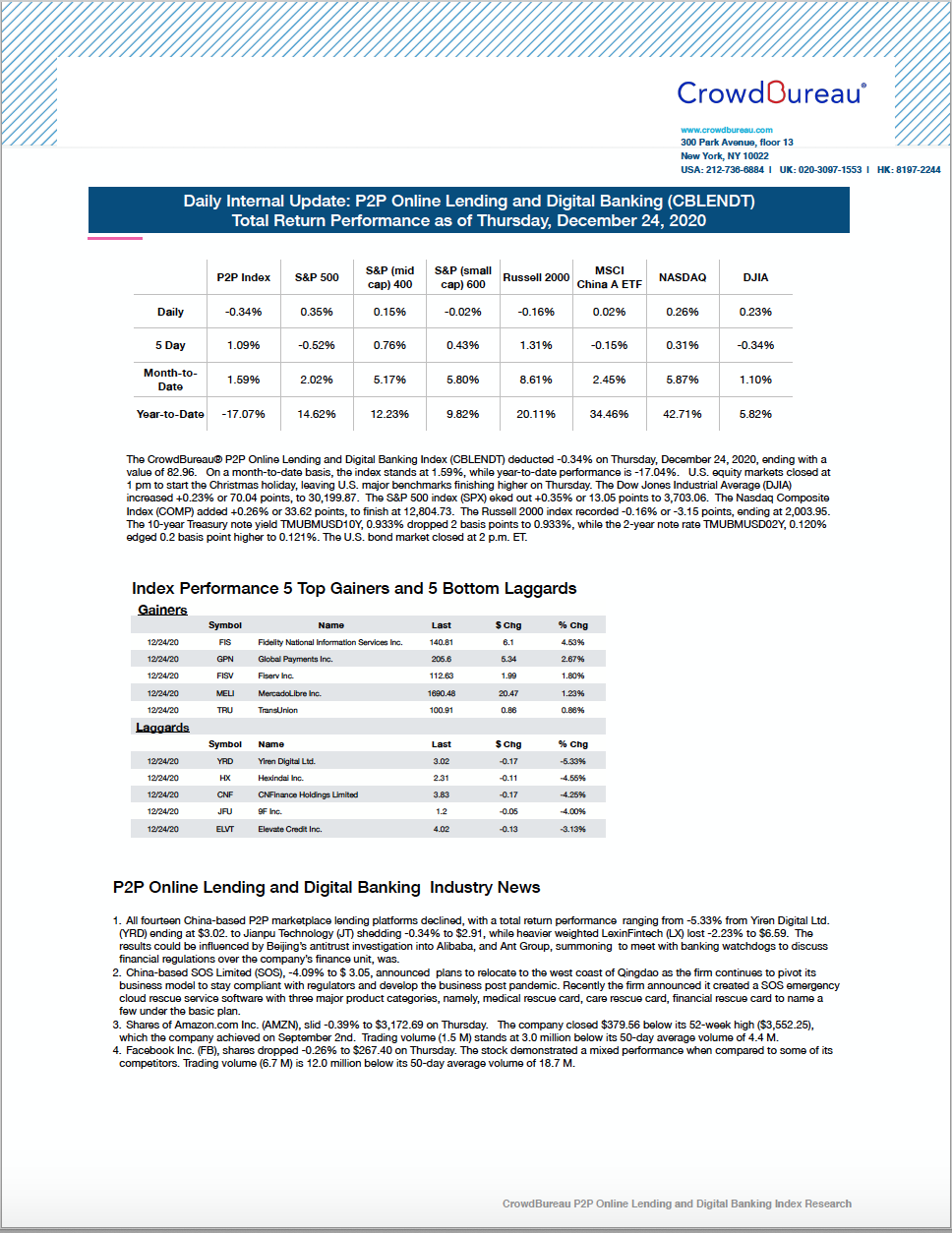

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) deducted -0.34% for the abbreviated trading session on Thursday

December 24, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) deducted -0.34% on Thursday, December 24, 2020, ending with a value of 82.96. On a month-to-date basis, the index stands at 1.59%, while year-to-date performance is -17.04%. U.S. equity markets closed at 1 pm to start the Christmas holiday, leaving U.S. major benchmarks finishing higher on Thursday.

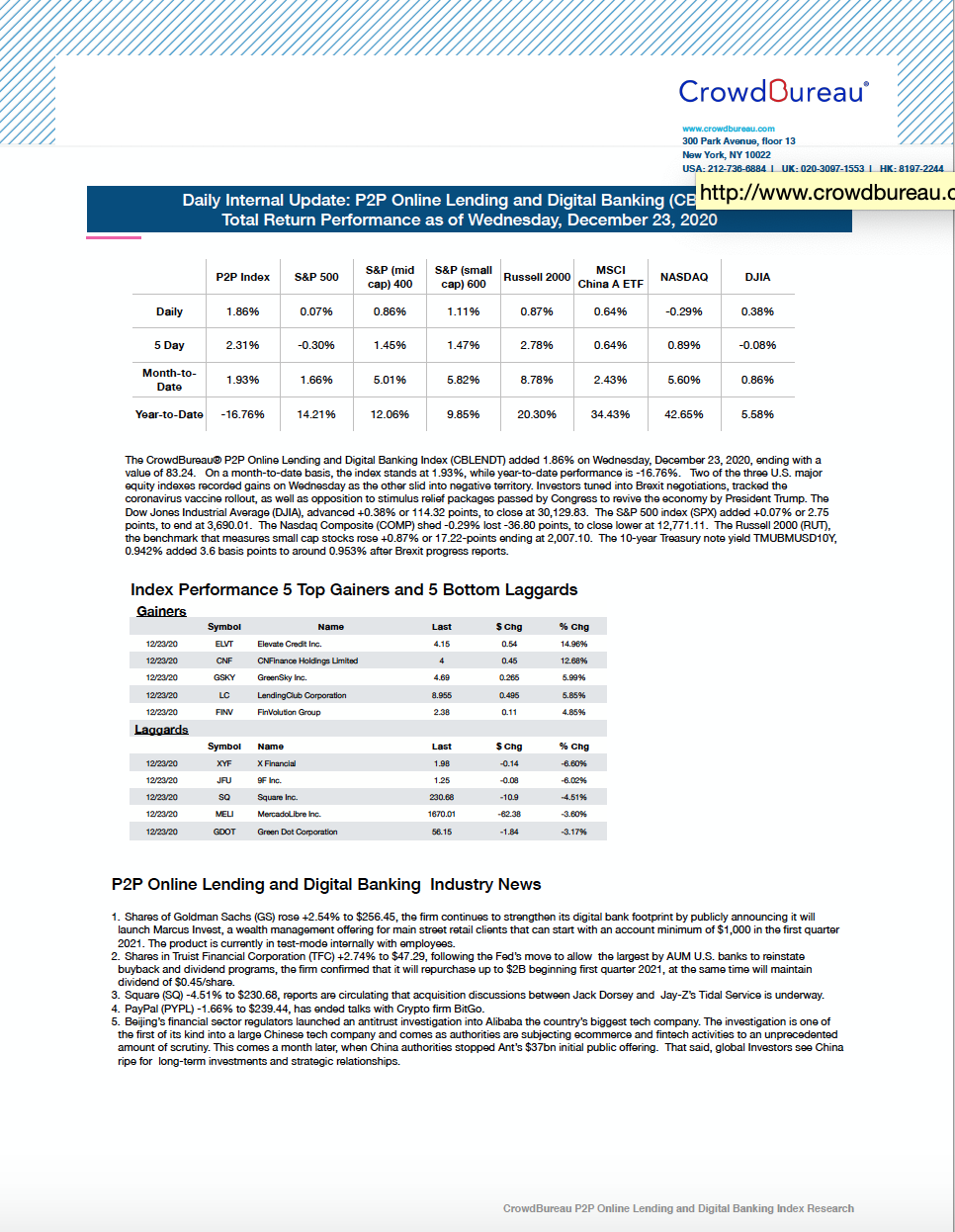

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added 1.86% finishing the Wednesday in positive territory

December 23, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 1.86% on Wednesday, December 23, 2020, ending with a value of 83.24. On a month-to-date basis, the index stands at 1.93%, while year-to-date performance is -16.76%. Two of the three U.S. major equity indexes recorded gains on Wednesday as the other slid into negative territory. Investors tuned into Brexit negotiations, tracked the coronavirus vaccine rollout, as well as opposition to stimulus relief packages passed by Congress to revive the economy by President Trump.

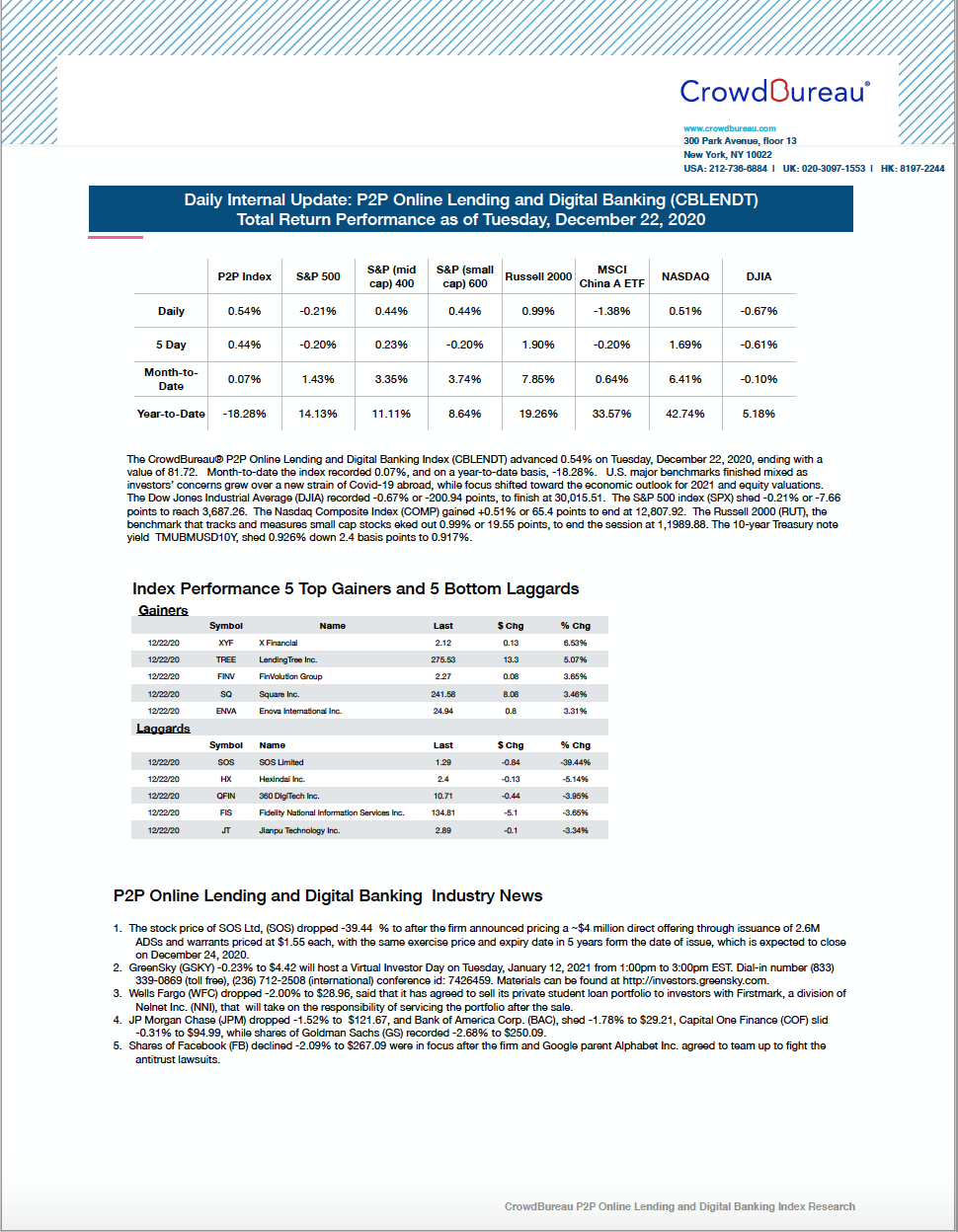

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course to eke out 0.54% at the close on Tuesday

December 22, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced 0.54% on Tuesday, December 22, 2020, ending with a value of 81.72. Month-to-date the index recorded 0.07%, and on a year-to-date basis, -18.28%. U.S. major benchmarks finished mixed as investors’ concerns grew over a new strain of Covid-19 abroad, while focus shifted toward the economic outlook for 2021 and equity valuations.

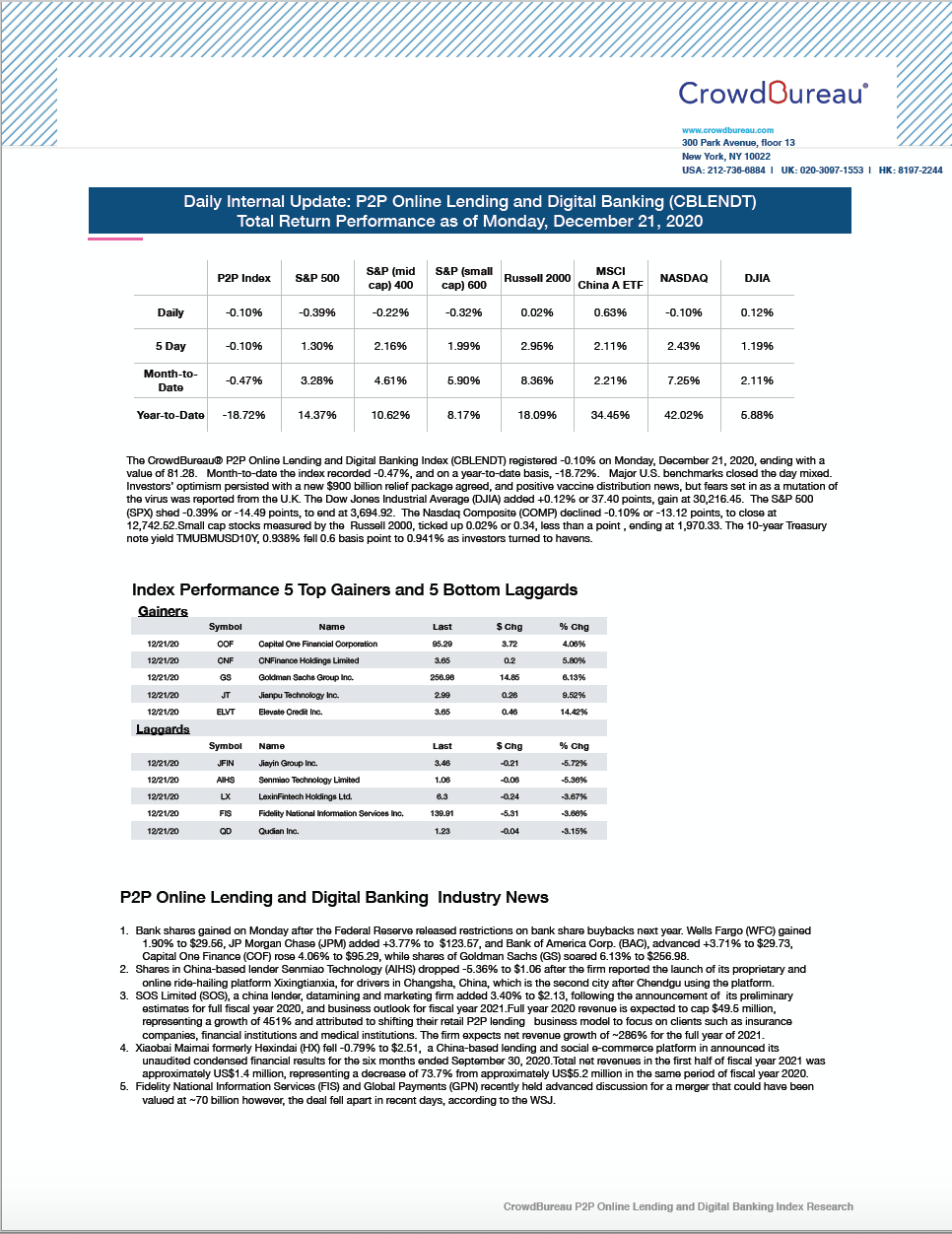

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ended Monday’s session posting -0.10%

December 21, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) registered -0.10% on Monday, December 21, 2020, ending with a value of 81.28. Month-to-date the index recorded -0.47%, and on a year-to-date basis, -18.72%. Major U.S. benchmarks closed the day mixed. Investors’ optimism persisted with a new $900 billion relief package agreed, and positive vaccine distribution news, but fears set in as a mutation of the virus was reported from the U.K.

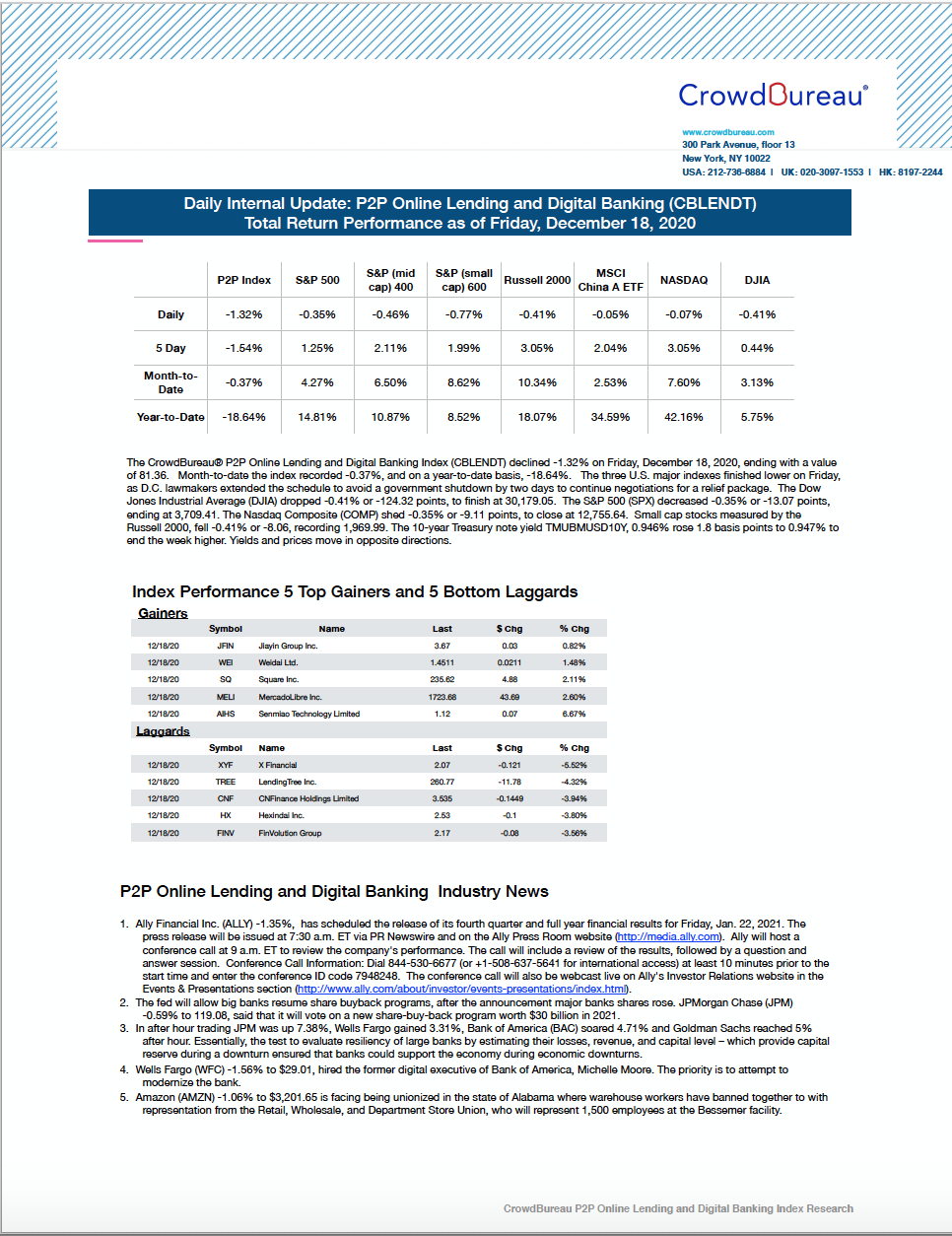

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) registered -1.32%, to on Friday

December 18, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) declined -1.32% on Friday, December 18, 2020, ending with a value of 81.36. Month-to-date the index recorded -0.37%, and on a year-to-date basis, -18.64%. The three U.S. major indexes finished lower on Friday, as D.C. lawmakers extended the schedule to avoid a government shutdown by two days to continue negotiations for a relief package.

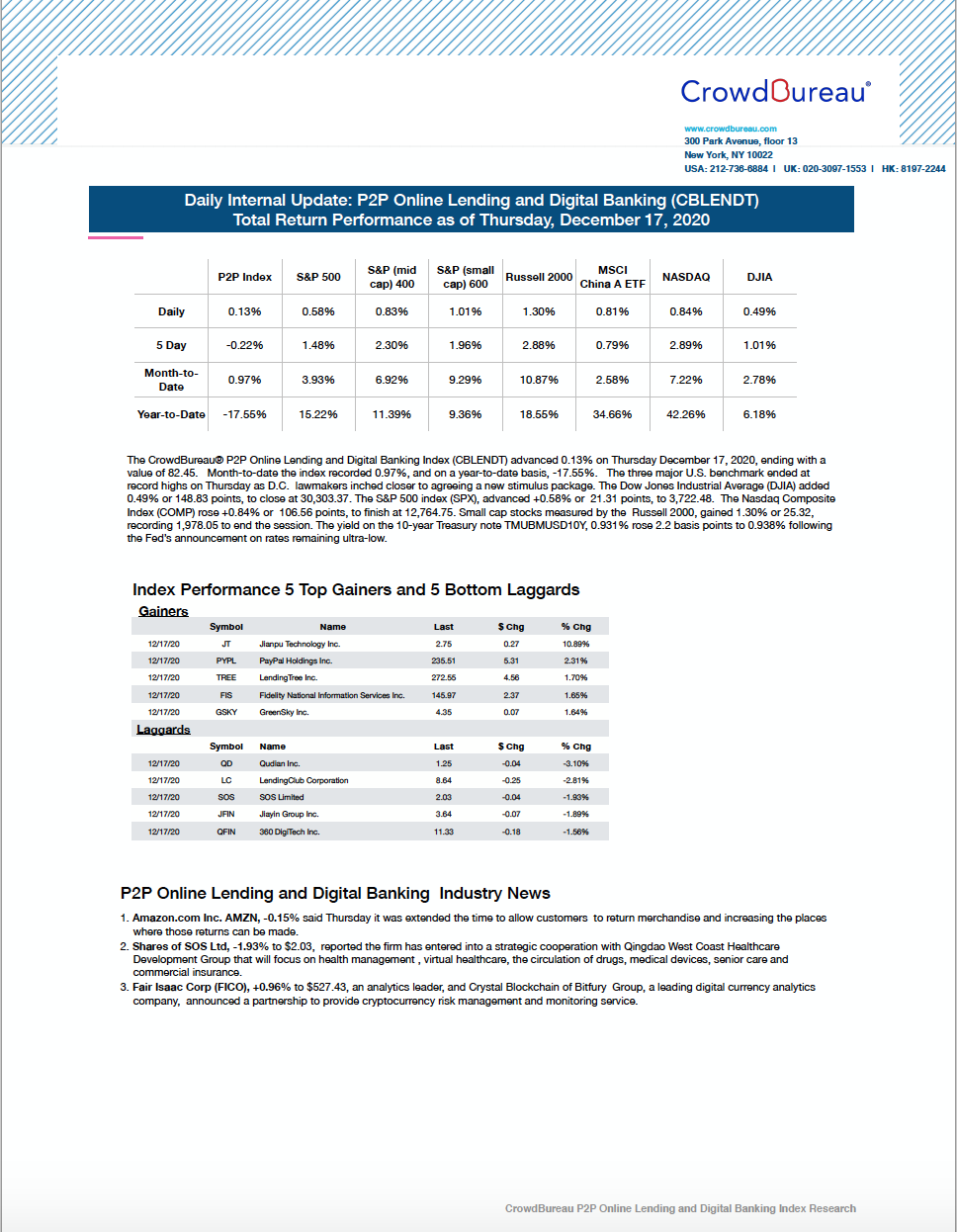

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) advanced 0.13%, to end Thursday in the black

December 17, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced 0.13% on Thursday December 17, 2020, ending with a value of 82.45. Month-to-date the index recorded 0.97%, and on a year-to-date basis, -17.55%. The three major U.S. benchmark ended at record highs on Thursday as D.C. lawmakers inched closer to agreeing a new stimulus package.

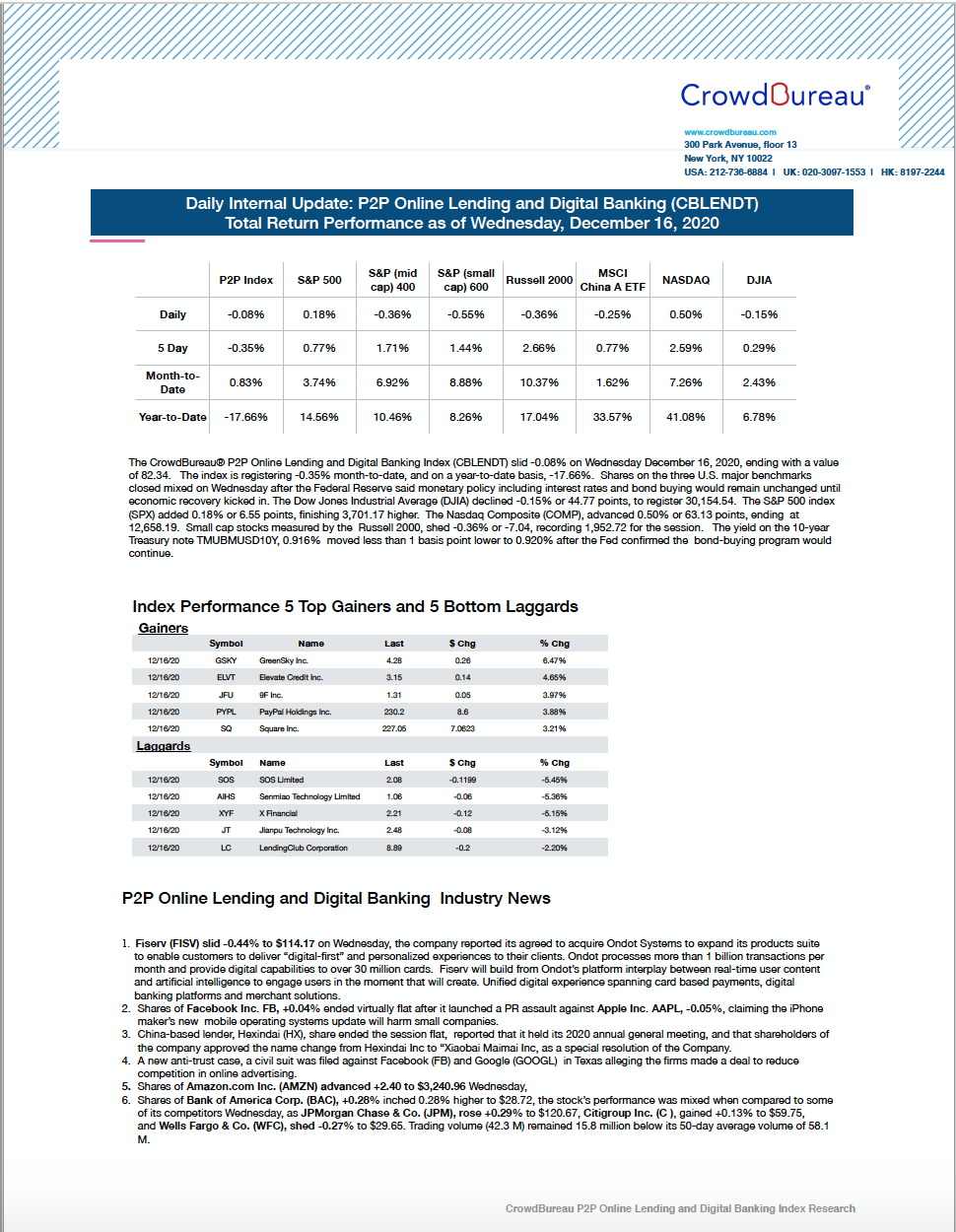

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) slid -0.08%, to finish Wednesday slightly down

December 16, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) slid -0.08% on Wednesday December 16, 2020, ending with a value of 82.34. The index is registering 0.83% month-to-date, and on a year-to-date basis, -17.66%. Shares on the three U.S. major benchmarks closed mixed on Wednesday after the Federal Reserve said monetary policy including interest rates and bond buying would remain unchanged until economic recovery kicked in.

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) added 1.43%, to finish Tuesday with a gain

December 15, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 1.43% on Tuesday, December 15, 2020, ending with a value of 82.41. On a month-to-date and year-to-date basis, the index is 0.92% and -17.59%, respectively. U.S. major benchmarks closed higher as technology stocks rallied, and investors’ optimism regarding an eminent approval for a second vaccine, a stimulus package – although it may be in two-parts, and anticipation over the Federal Reserve’s bond-buying program on Wednesday moved the markets.

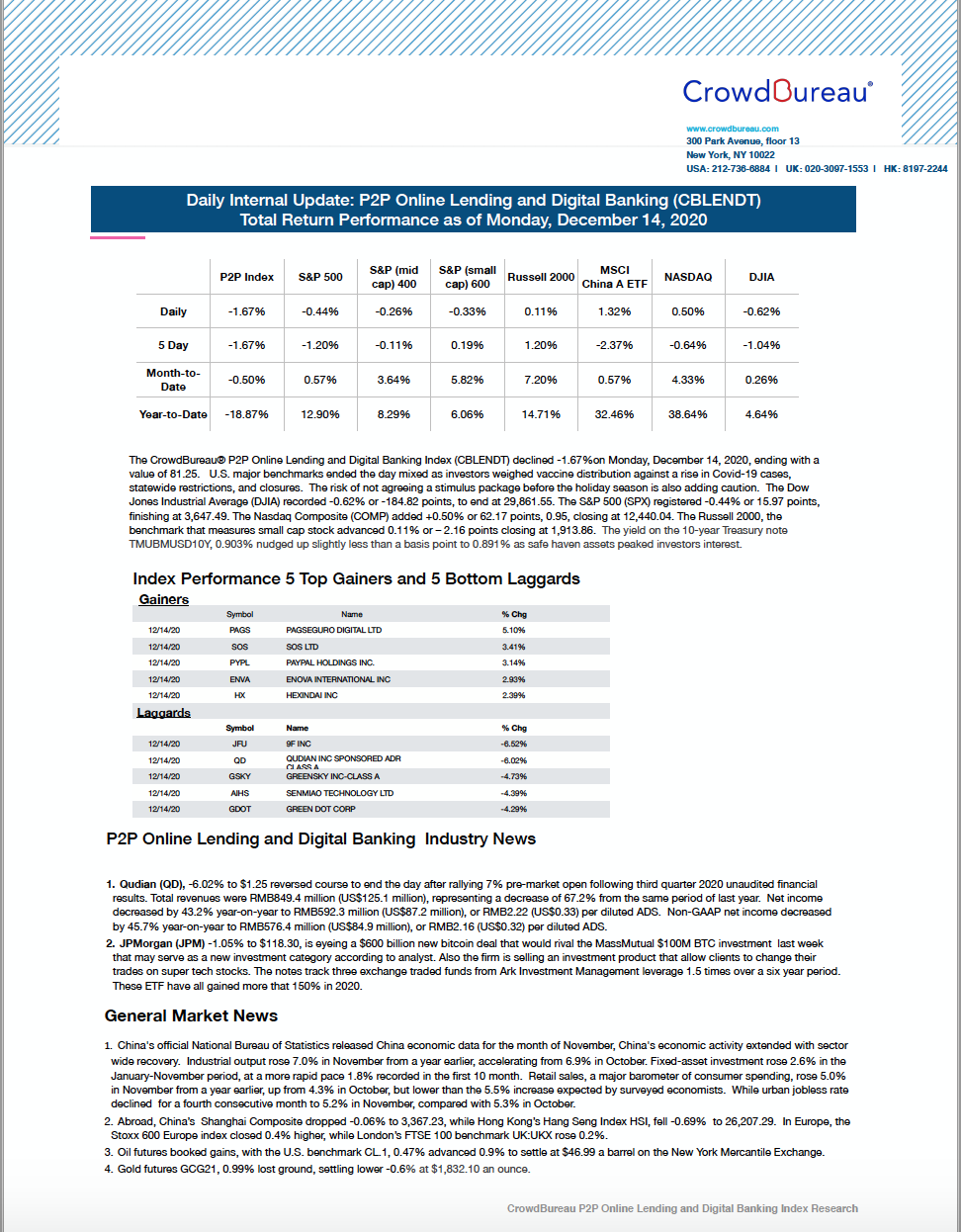

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ended Monday lower, declining -1.67%

December 14, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) declined -1.67% on Monday, December 14, 2020, ending with a value of 81.25. U.S. major benchmarks ended the day mixed as investors weighed vaccine distribution against a rise in Covid-19 cases, statewide restrictions, and closures. The risk of not agreeing a stimulus package before the holiday season is also adding caution.

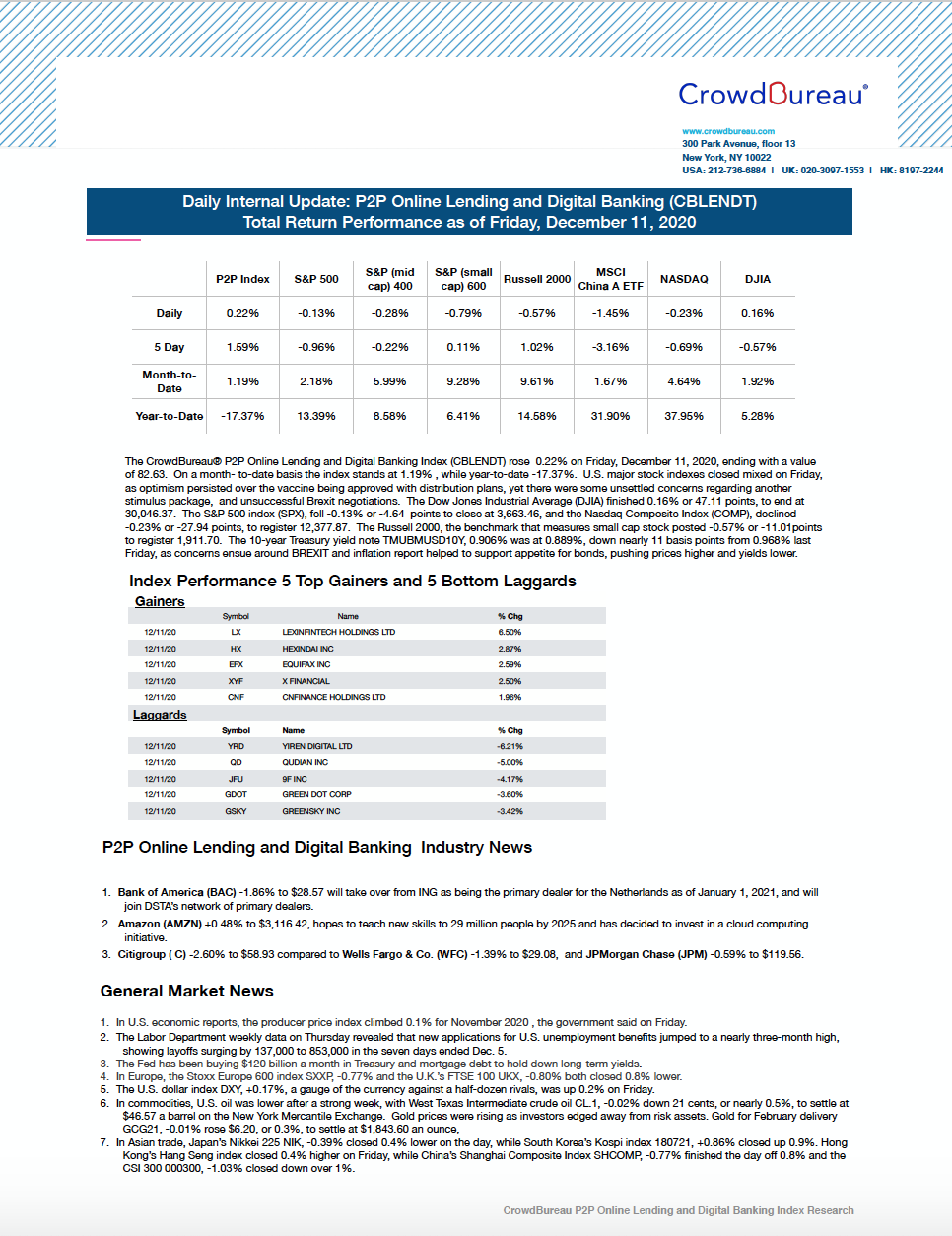

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose 0.22% on Friday, finishing the day in positive territory

December 11, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 0.22% on Friday, December 11, 2020, ending with a value of 82.63. On a month- to-date basis the index stands at 1.19% , while year-to-date -17.37%. U.S. major stock indexes closed mixed on Friday, as optimism persisted over the vaccine being approved with distribution plans, yet there were some unsettled concerns regarding another stimulus package, and unsuccessful Brexit negotiations.

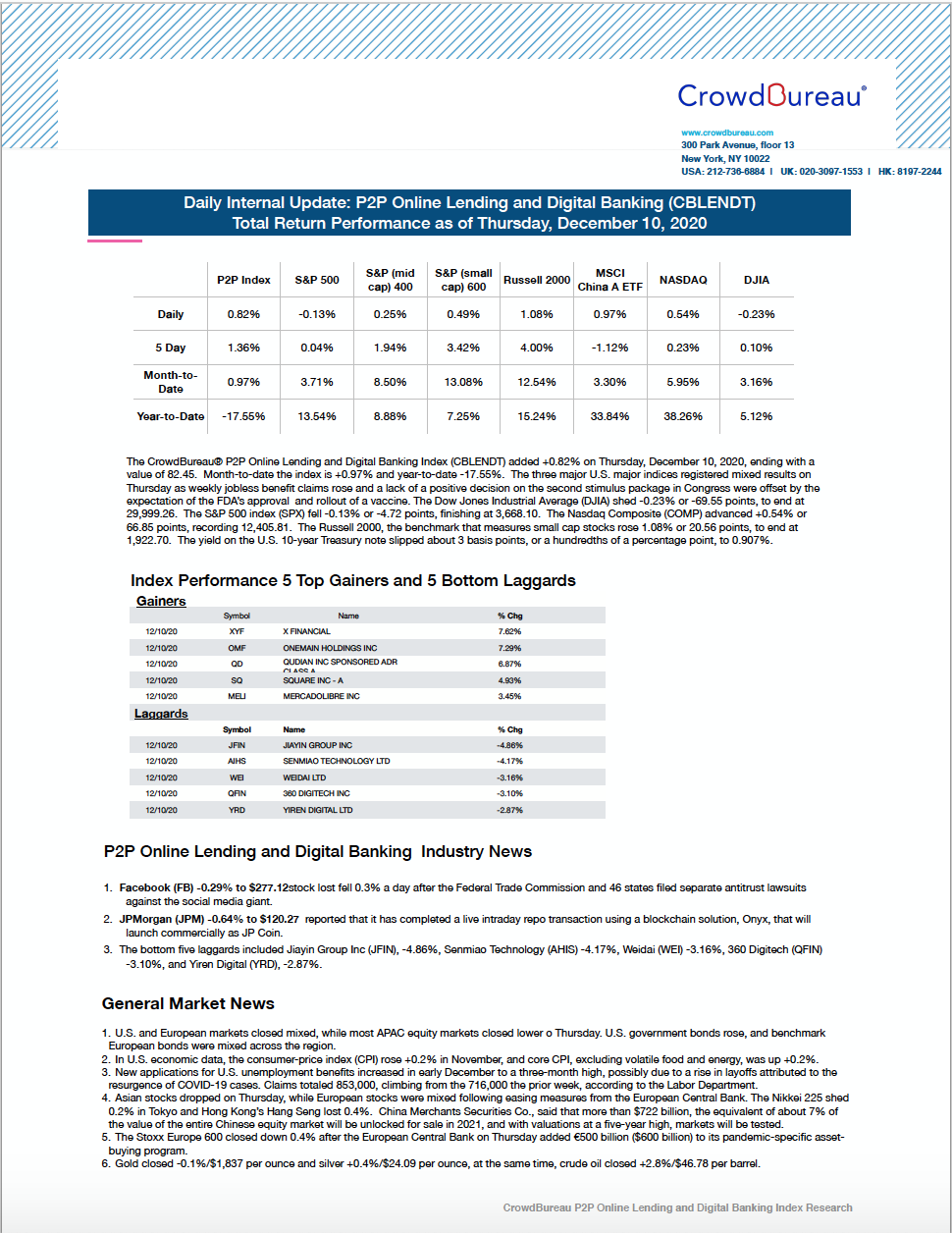

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) finished higher, adding 0.82% to end the day

December 10, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added +0.82% on Thursday, December 10, 2020, ending with a value of 82.45. Month-to-date the index is +0.97% and year-to-date -17.55%. The three major U.S. major indices registered mixed results on Thursday as weekly jobless benefit claims rose and a lack of a positive decision on the second stimulus package in Congress were offset by the expectation of the FDA’s approval and rollout of a vaccine.

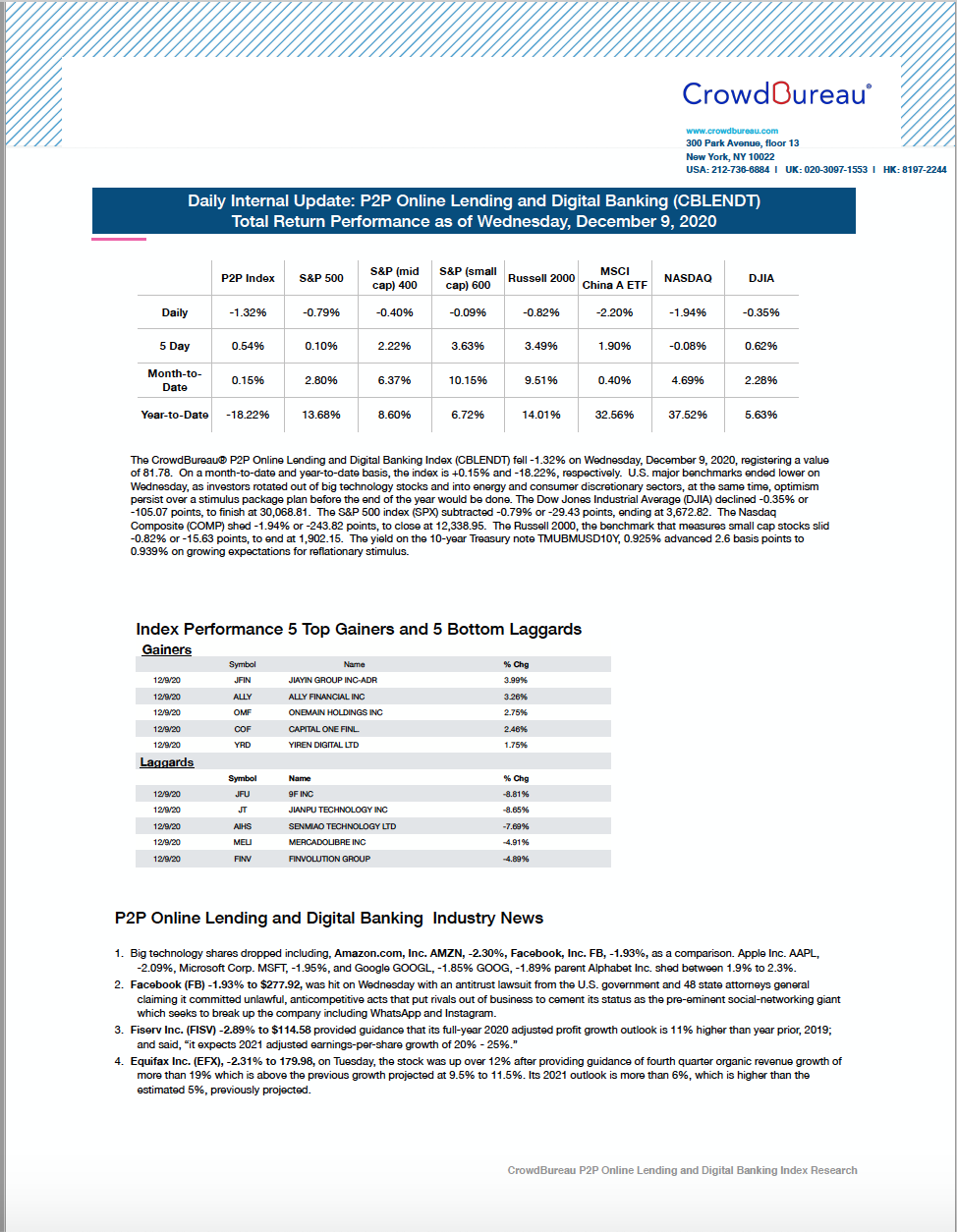

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) fell -1.32% to end in negative territory

December 9, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) fell -1.32% on Wednesday, December 9, 2020, registering a value of 81.78. On a month-to-date and year-to-date basis, the index is +0.15% and -18.22%, respectively. U.S. major benchmarks ended lower on Wednesday, as investors rotated out of big technology stocks and into energy and consumer discretionary sectors, at the same time, optimism persist over a stimulus package plan before the end of the year would be done.

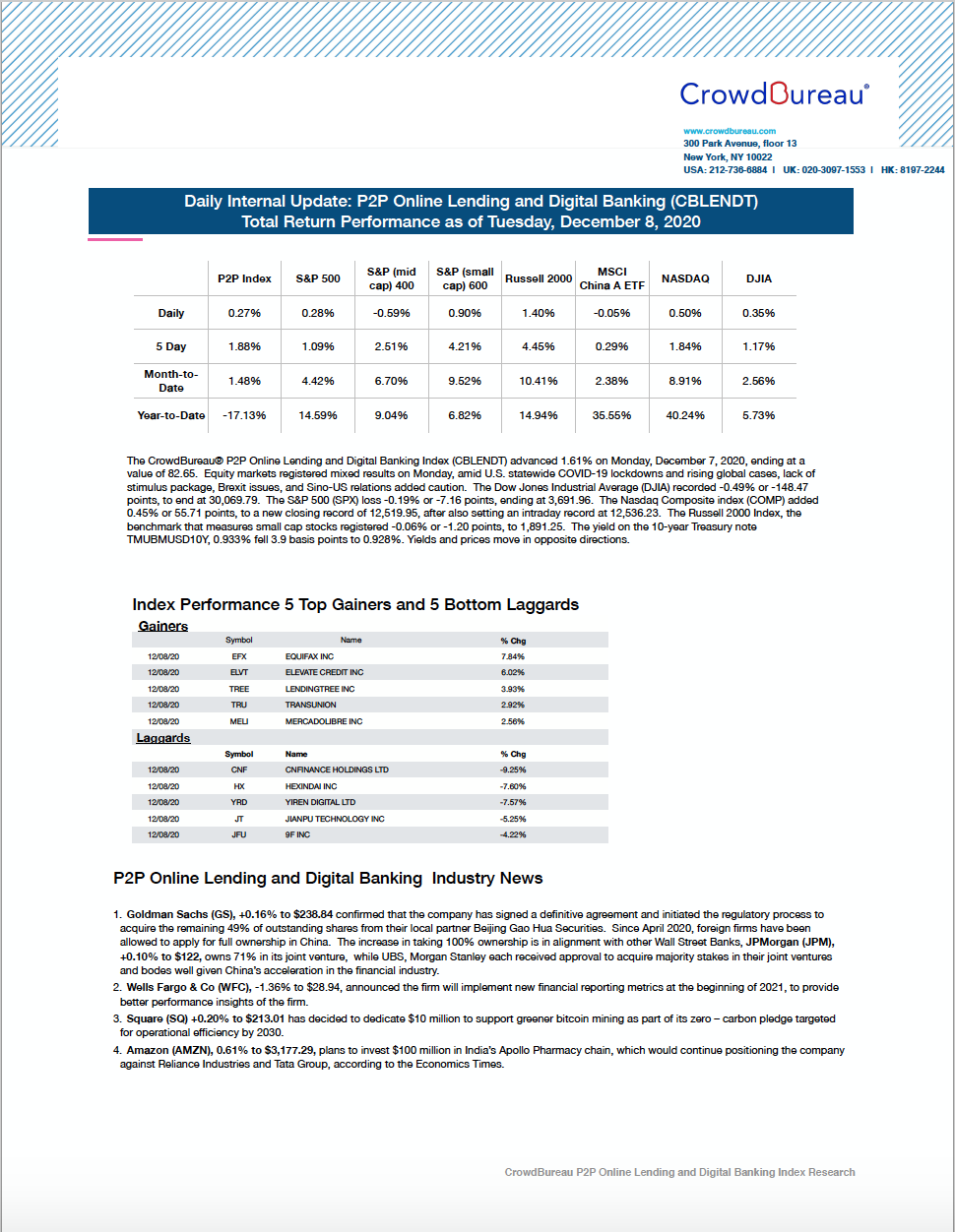

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ticked up +0.27% to end Tuesday in positive territory

December 8, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) ticked up +0.27% on Tuesday, December 8, 2020, recording a value of 82.87. On a month-to-date and year-to-date basis, the index is 1.48% and -17.13%, respectively. The three U.S. major benchmarks rose as efficacy on COVID-19 vaccines were confirmed and the White House pushed to unlock stalled talks with an offer for a $908 billion stimulus package ahead of deadlines.

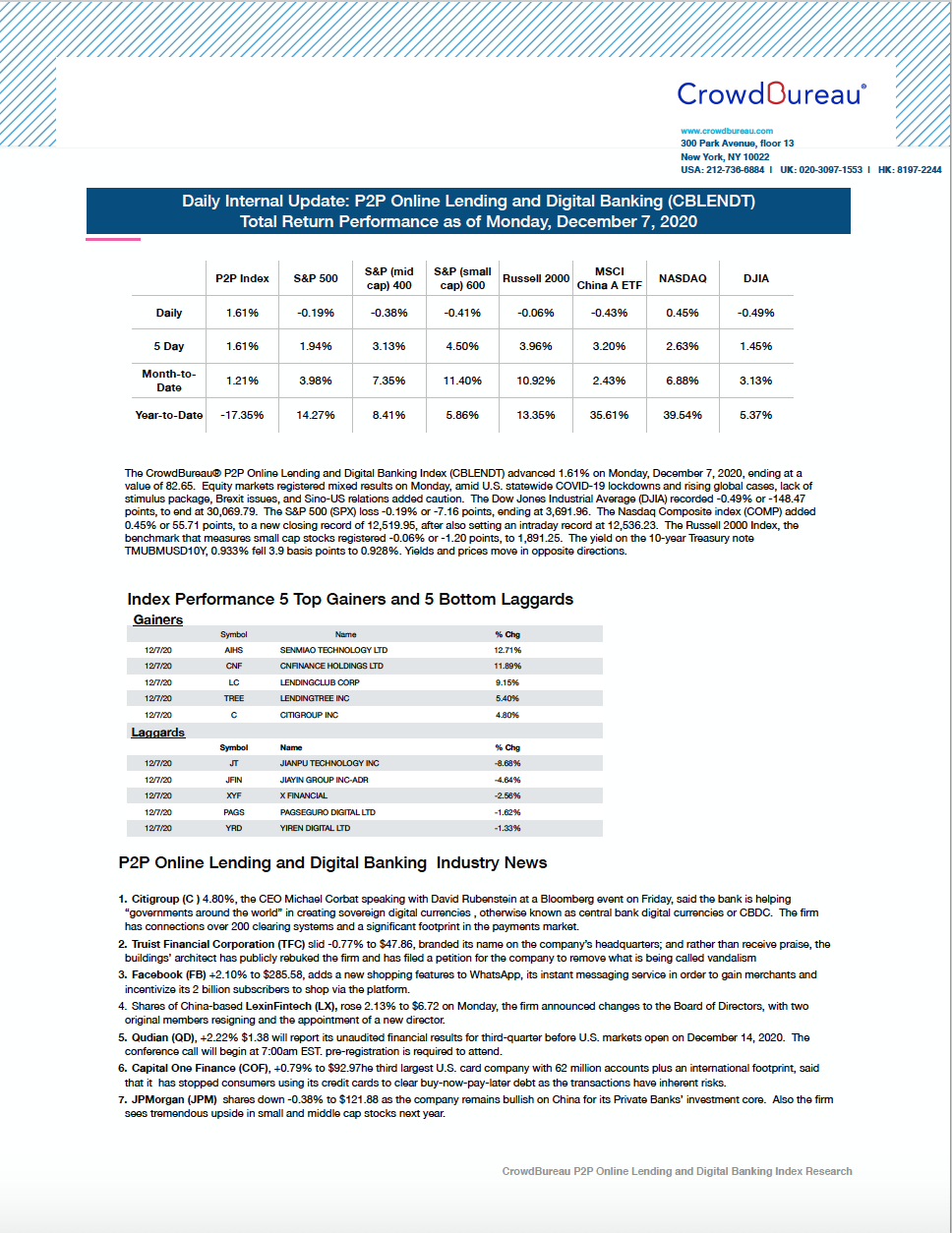

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) advanced 1.61% on Monday, December 7, 2020

December 7, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced 1.61% on Monday, December 7, 2020, ending at a value of 82.65. Equity markets registered mixed results on Monday, amid U.S. statewide COVID-19 lockdowns and rising global cases, lack of stimulus package, Brexit issues, and Sino-US relations added caution.

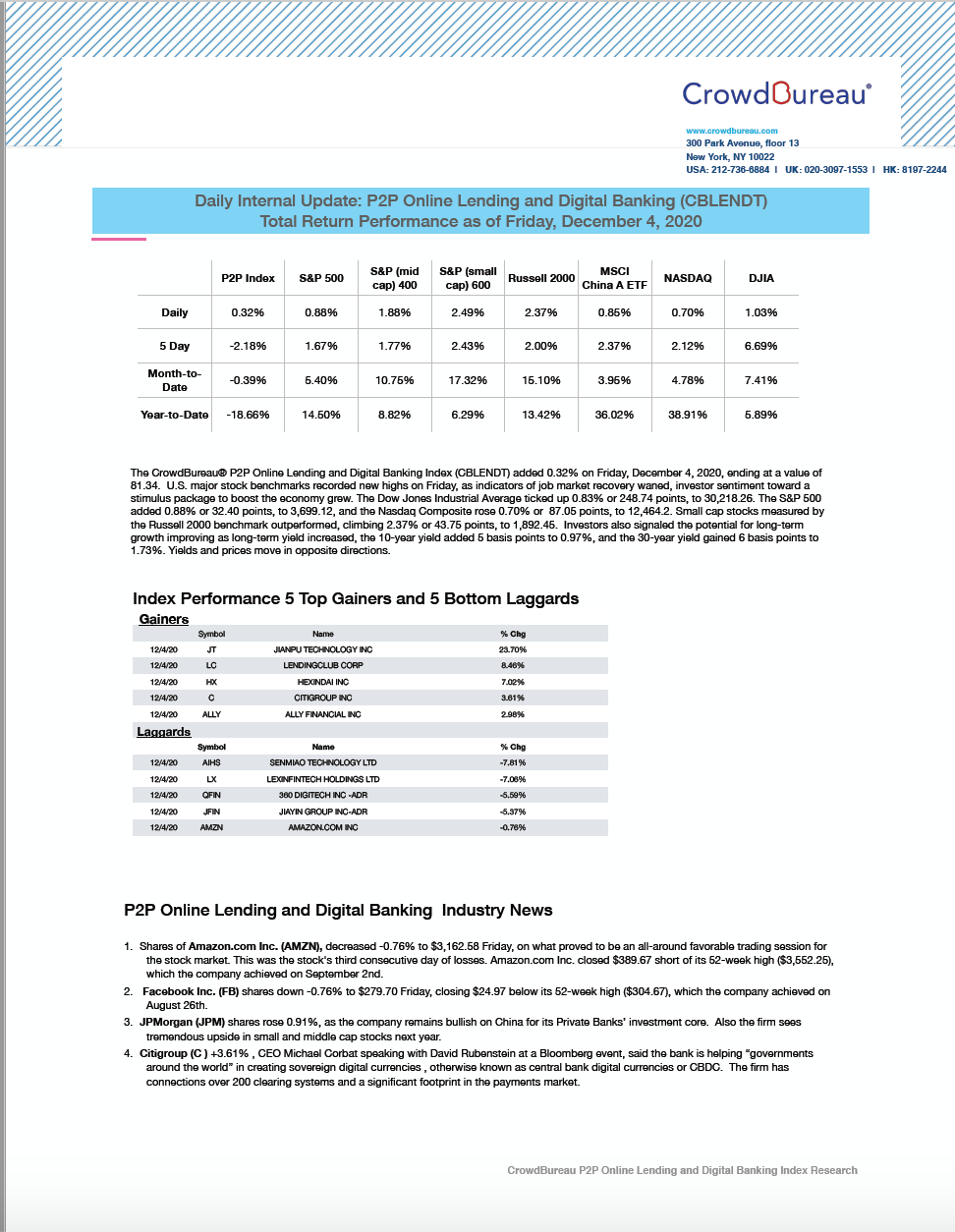

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) reversed course and added -0.32 on Friday, December 4, 2020 to end the week

December 4, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) added 0.32% on Friday, December 4, 2020, ending at a value of 81.34. U.S. major stock benchmarks recorded new highs on Friday, as indicators of job market recovery waned, investor sentiment toward a stimulus package to boost the economy grew.

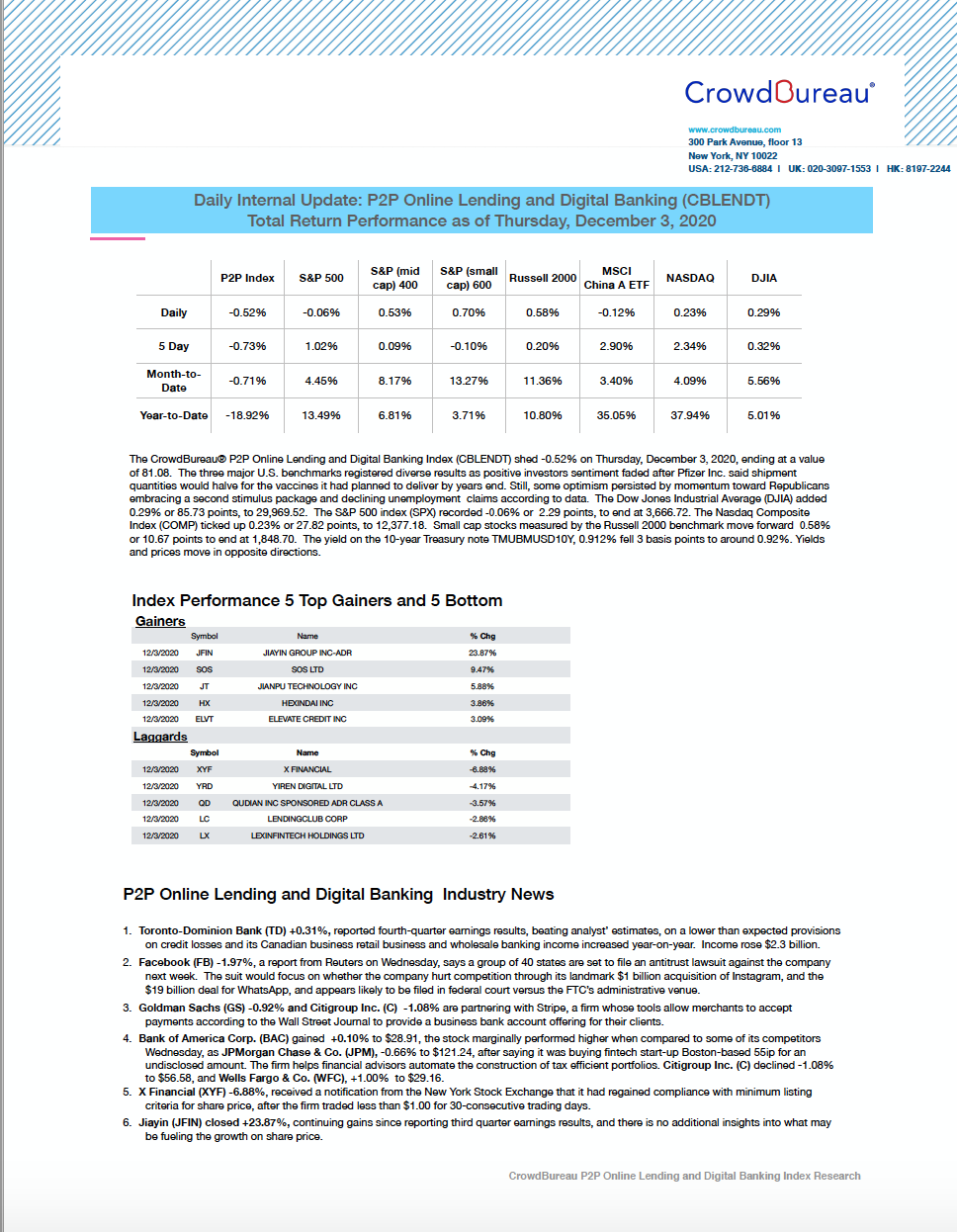

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) shed -0.52% on Thursday, December 3, 2020, finishing down for second consecutive day

December 3, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) shed -0.52% on Thursday, December 3, 2020, ending at a value of 81.08. The three major U.S. benchmarks registered diverse results as positive investors sentiment faded after Pfizer Inc. said shipment quantities would halve for the vaccines it had planned to deliver by years end.

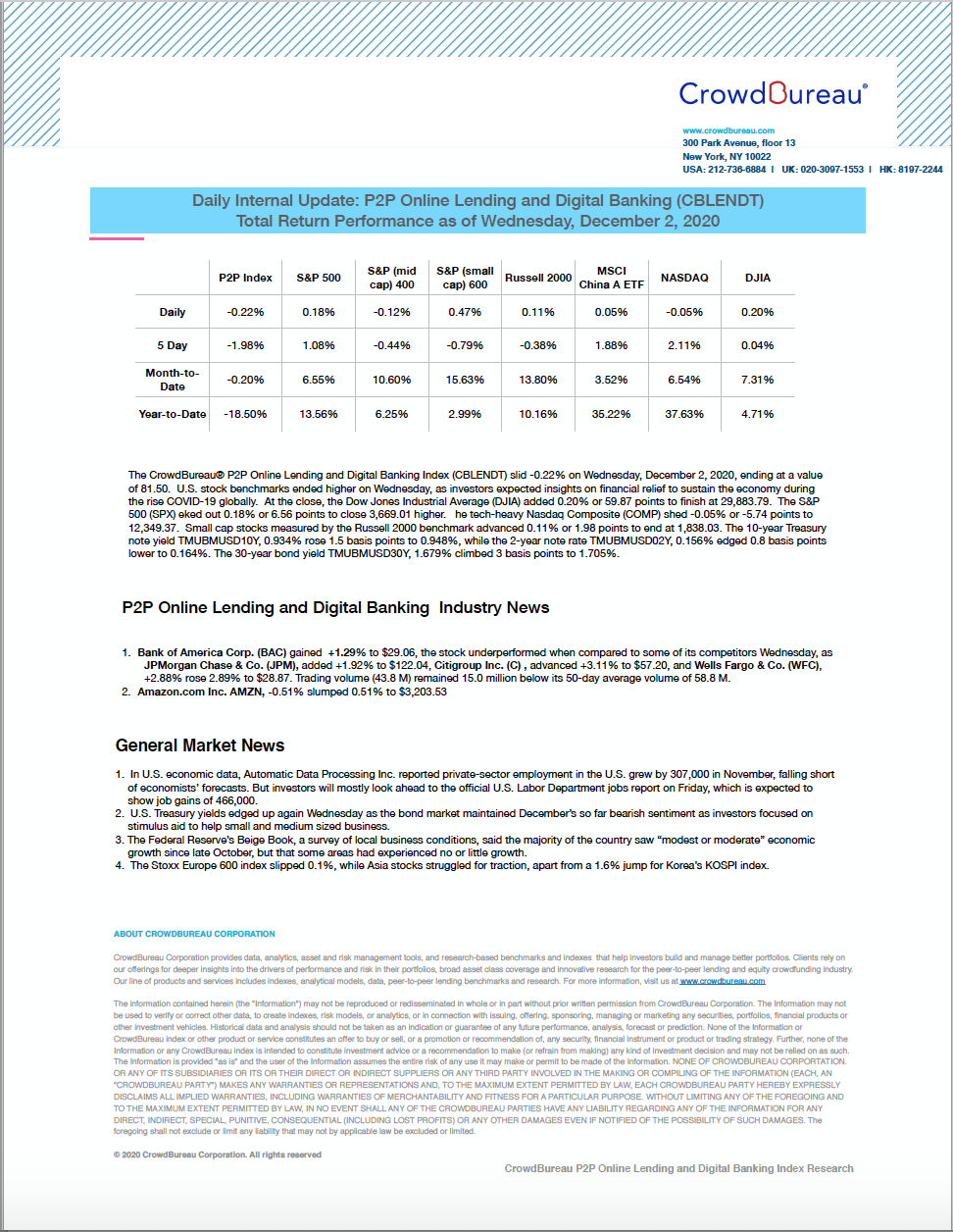

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) slid -0.22% on Wednesday, December 2, 2020, ending the day in negative territory

December 2, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) slid -0.22% on Wednesday, December 2, 2020, ending at a value of 81.50. U.S. stock benchmarks ended higher on Wednesday, as investors expected insights on financial relief to sustain the economy during the rise COVID-19 globally.

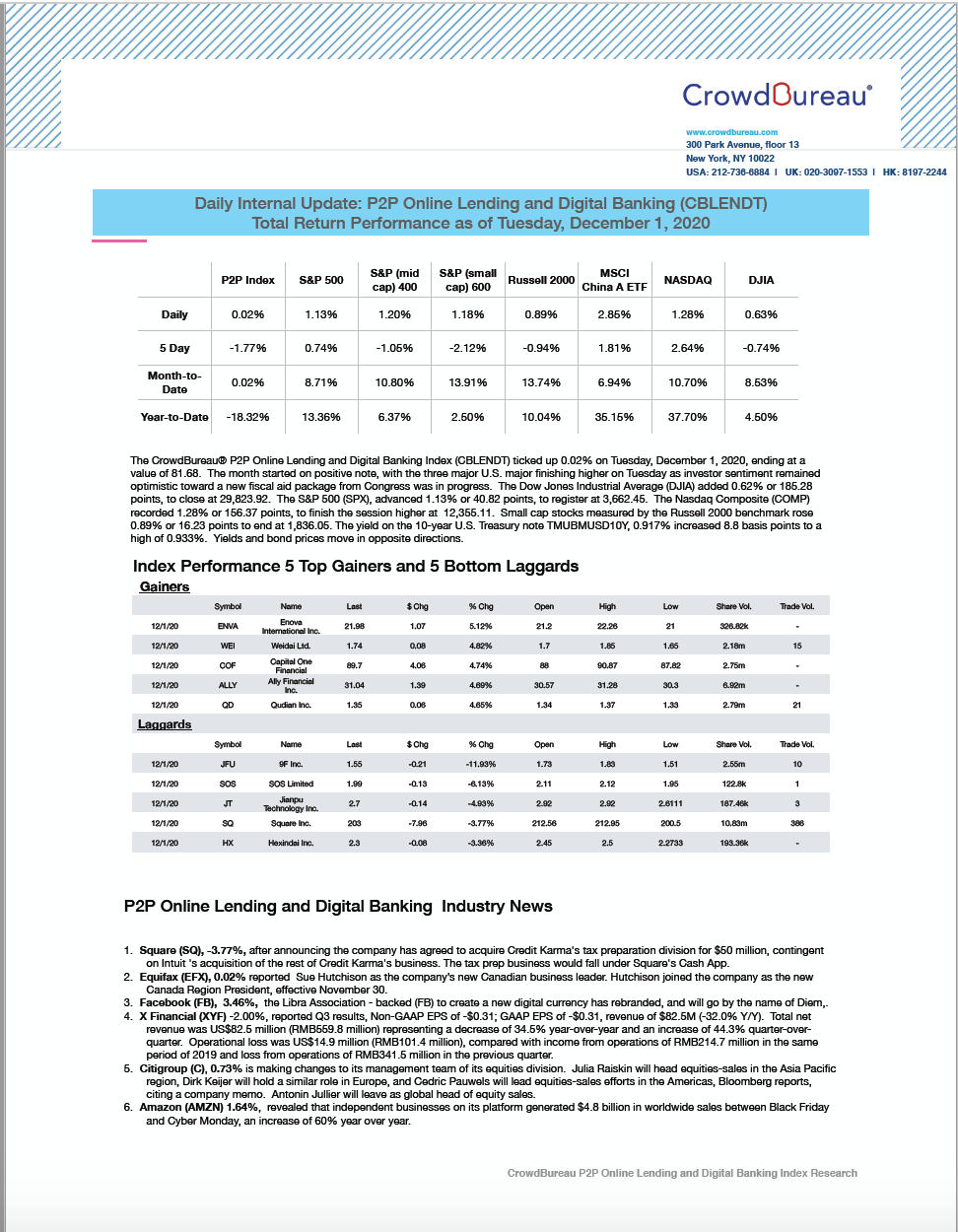

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) ticked up 0.02% on Tuesday, December 1, 2020, starting the month on a positive note

December 1, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) ticked up 0.02% on Tuesday, December 1, 2020, ending at a value of 81.68. The month started on positive note, with the three major U.S. major finishing higher on Tuesday as investor sentiment remained optimistic toward a new fiscal aid package from Congress was in progress.

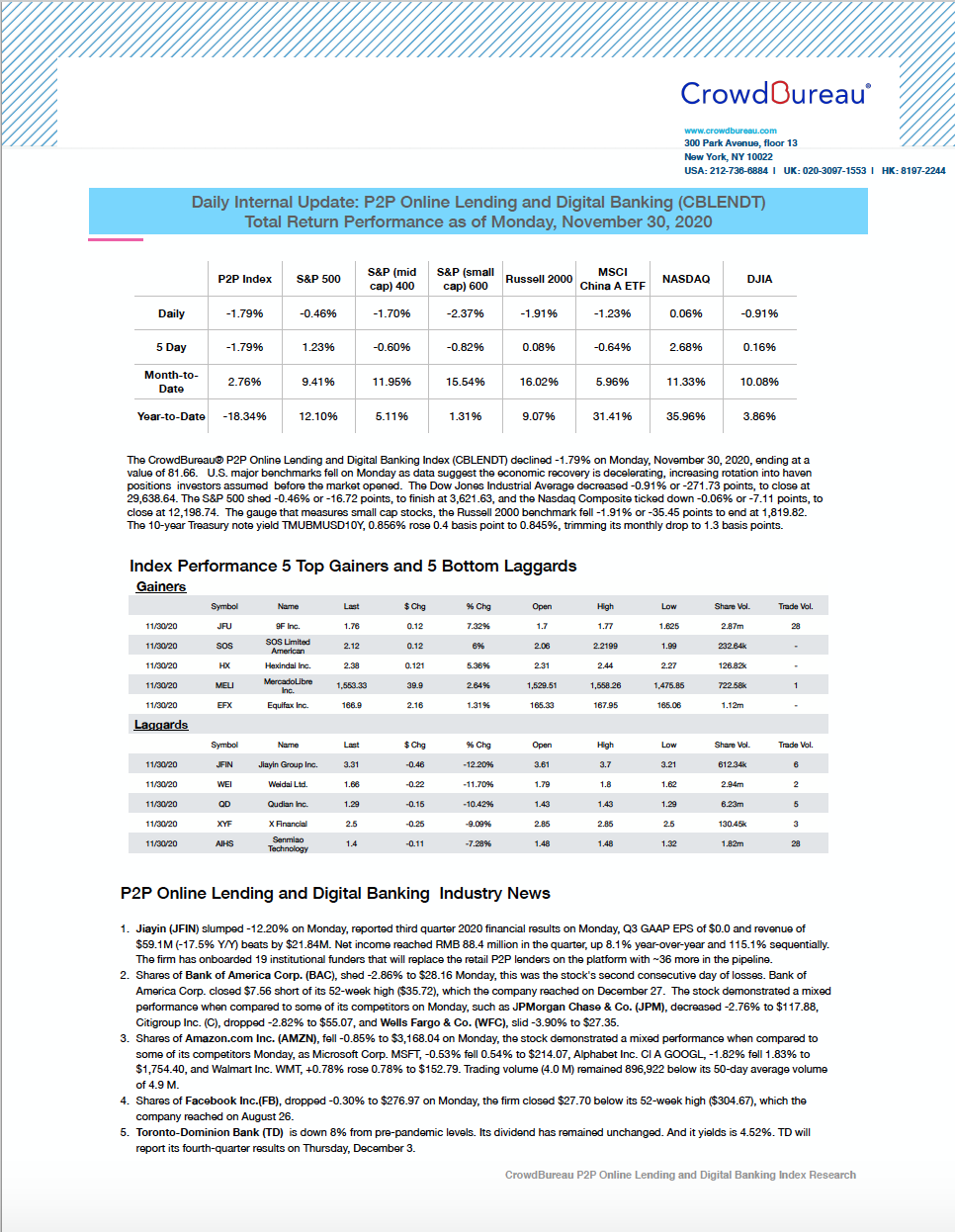

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) declined -1.79% on Monday, November 30, 2020

November 30, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) declined -1.79% on Monday, November 30, 2020, ending at a value of 81.66. On a month-to-date basis the index finished the month of November +2.76% and year-to-date, -18.34%.

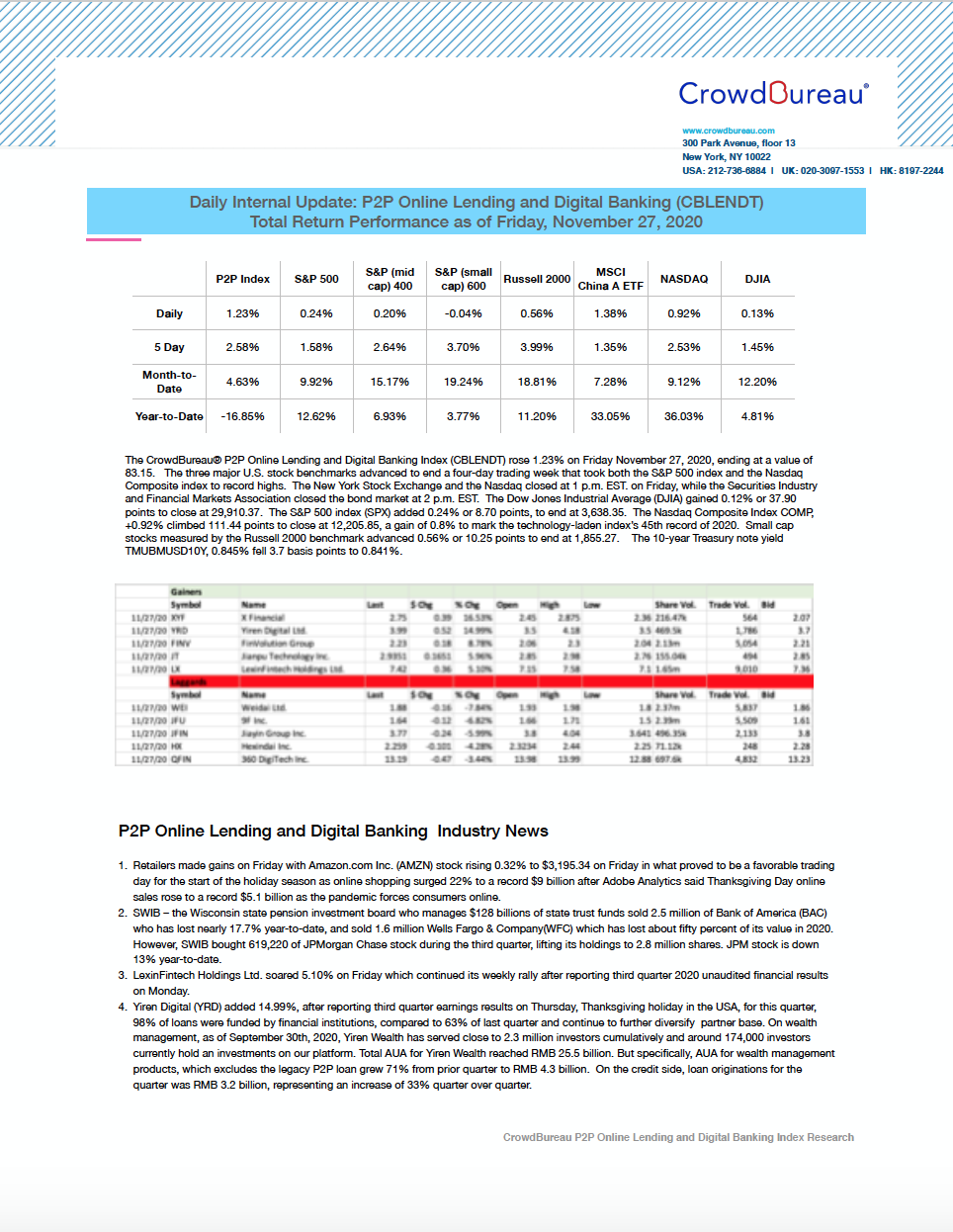

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) rose 1.23% on Friday, November 27, 2020

November 27, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 1.23% on Friday November 27, 2020, ending at a value of 83.15. The three major U.S. stock benchmarks advanced to end a four-day trading week that took both the S&P 500 index and the Nasdaq Composite index to record highs. The New York Stock Exchange and the Nasdaq closed at 1 p.m. EST. on Friday, while the Securities Industry and Financial Markets Association closed the bond market at 2 p.m. EST.

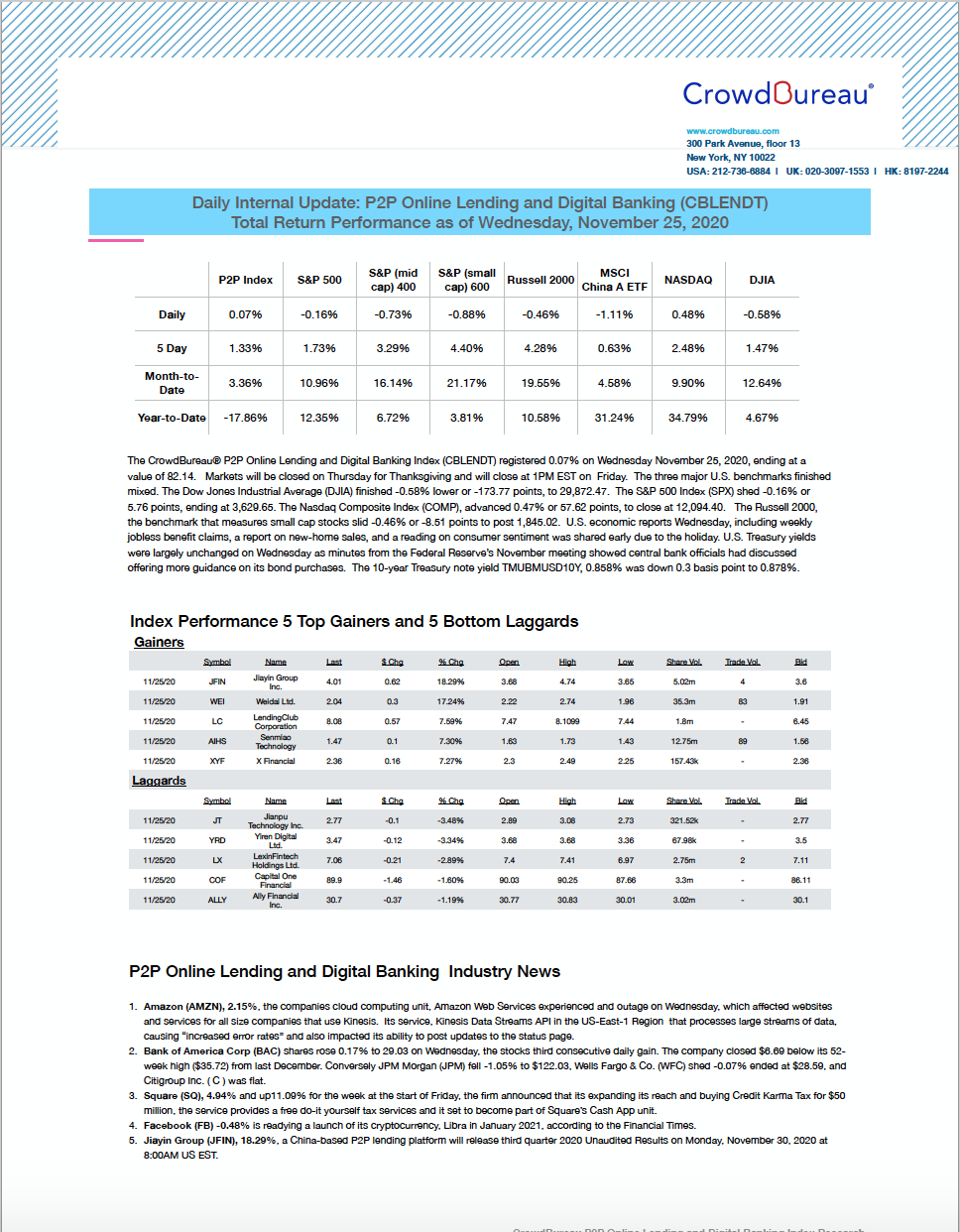

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) registered 0.07% on Wednesday November 25, 2020

November 25, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) registered 0.07% on Wednesday November 25, 2020, ending at a value of 82.14. Markets will be closed on Thursday for Thanksgiving and will close at 1PM EST on Friday.

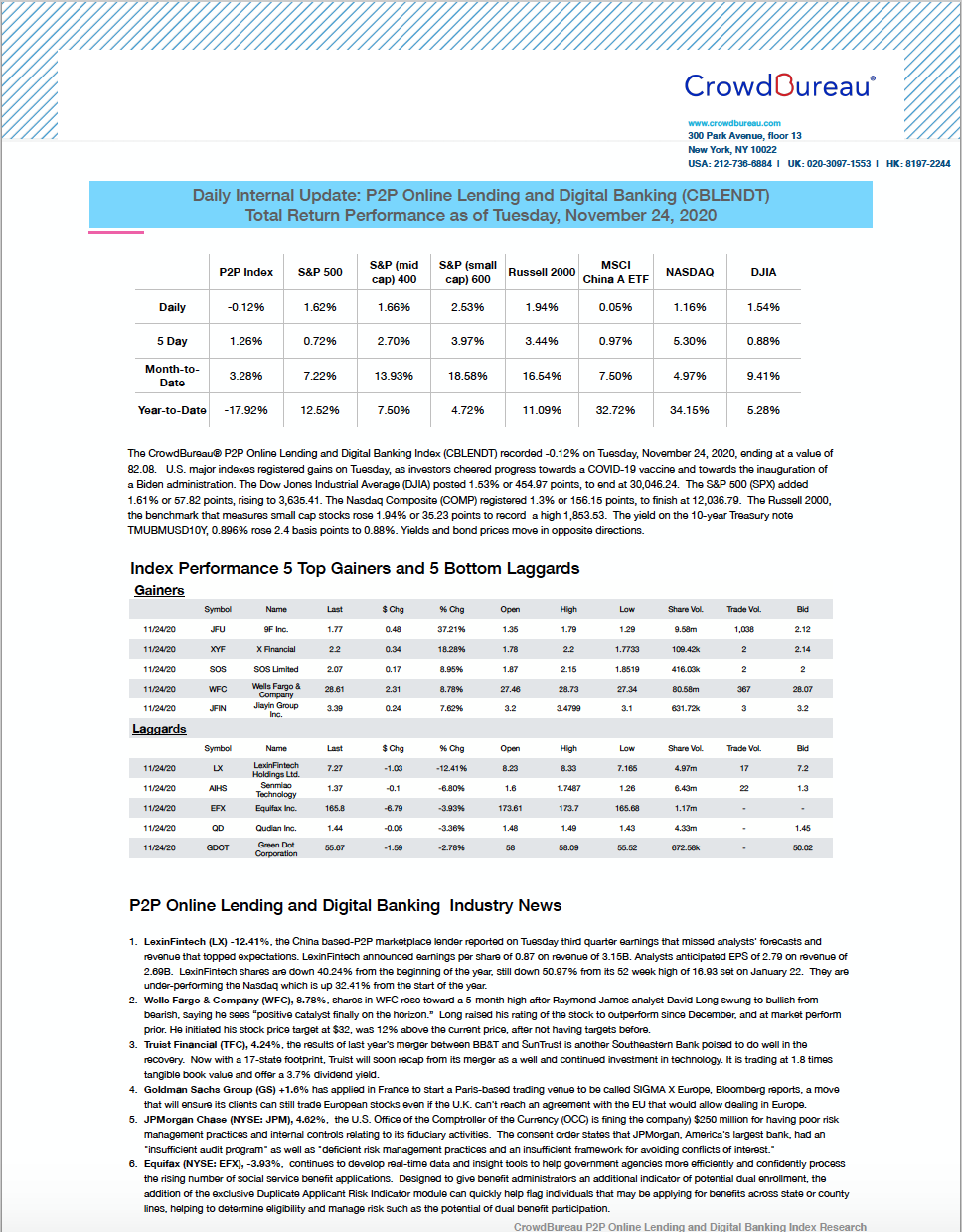

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) recorded -0.12% on Tuesday, November 24, 2020

November 24, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) recorded -0.12% on Tuesday, November 24, 2020, ending at a value of 82.08. U.S. major indexes registered gains on Tuesday, as investors cheered progress towards a COVID-19 vaccine and towards the inauguration of a Biden administration.

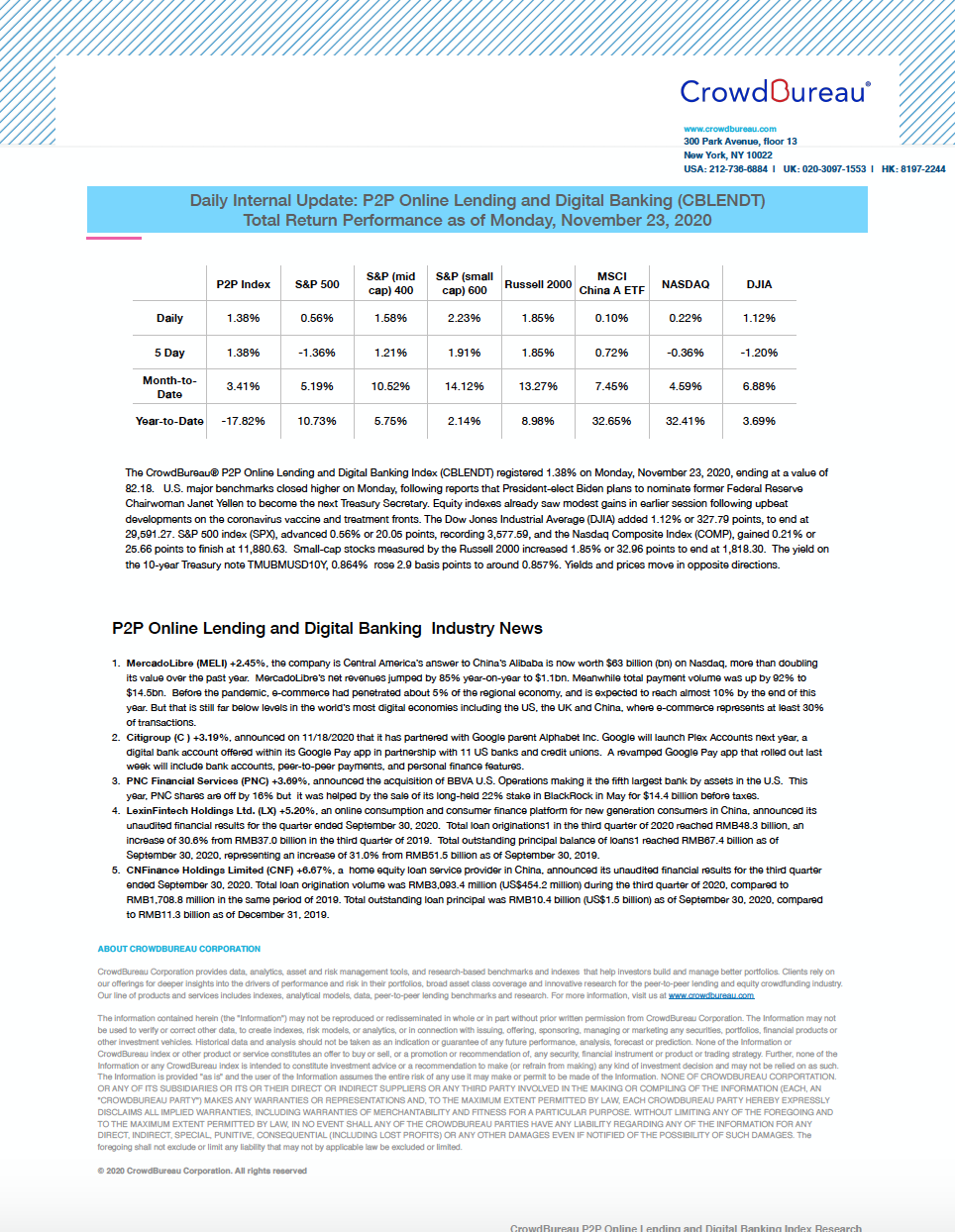

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT), ended the day 1.38% higher on Monday, November 23, 2020

November 23, 2020

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) ended the day 1.38% higher on Monday, November 23, 2020, ending at a value of 82.18. U.S. major benchmarks closed higher on Monday, following reports that President-elect Biden plans to nominate former Federal Reserve Chairwoman Janet Yellen to become the next Treasury Secretary.

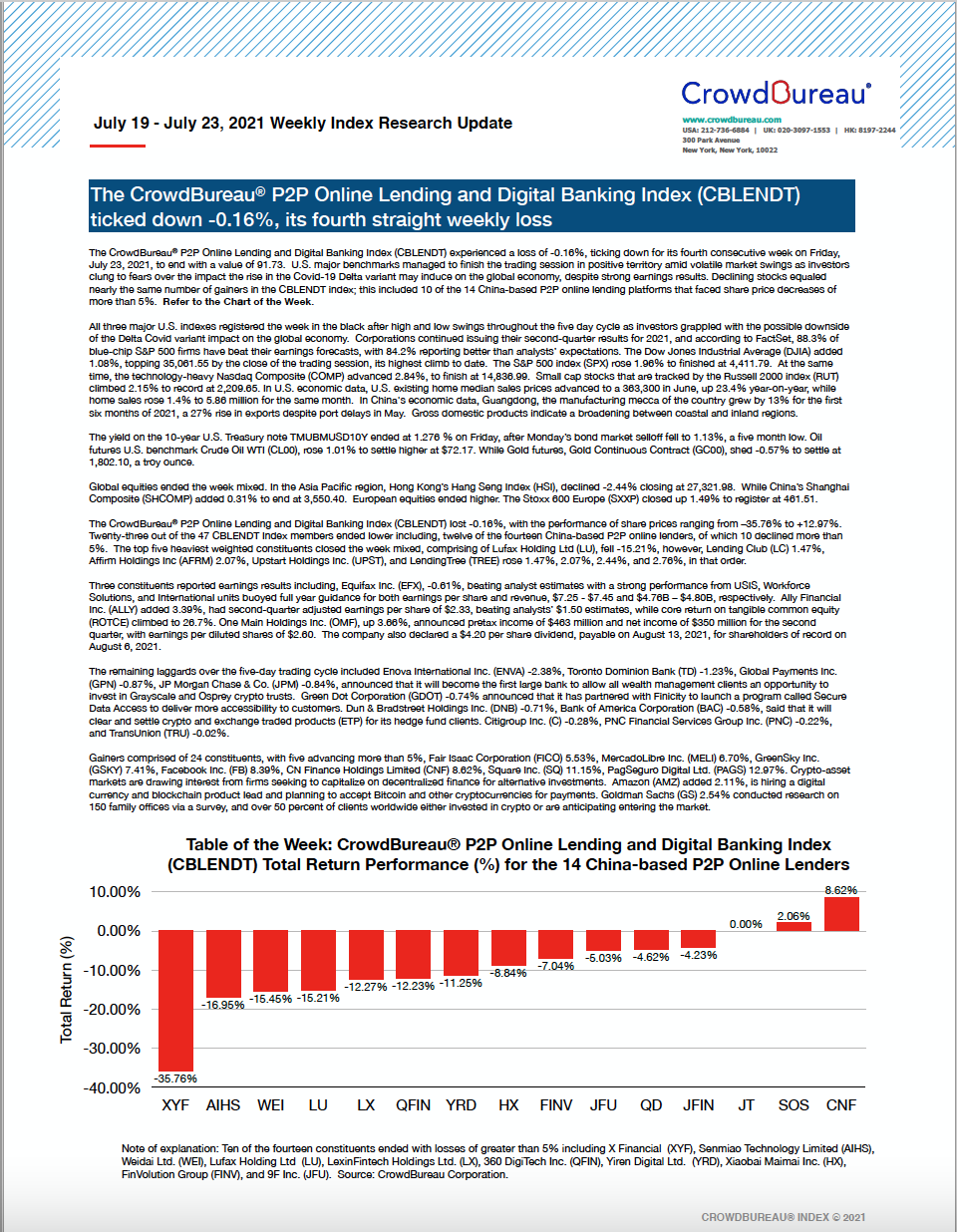

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) ticked down -0.16%, its fourth straight weekly loss

July 19 – July 23, 2021

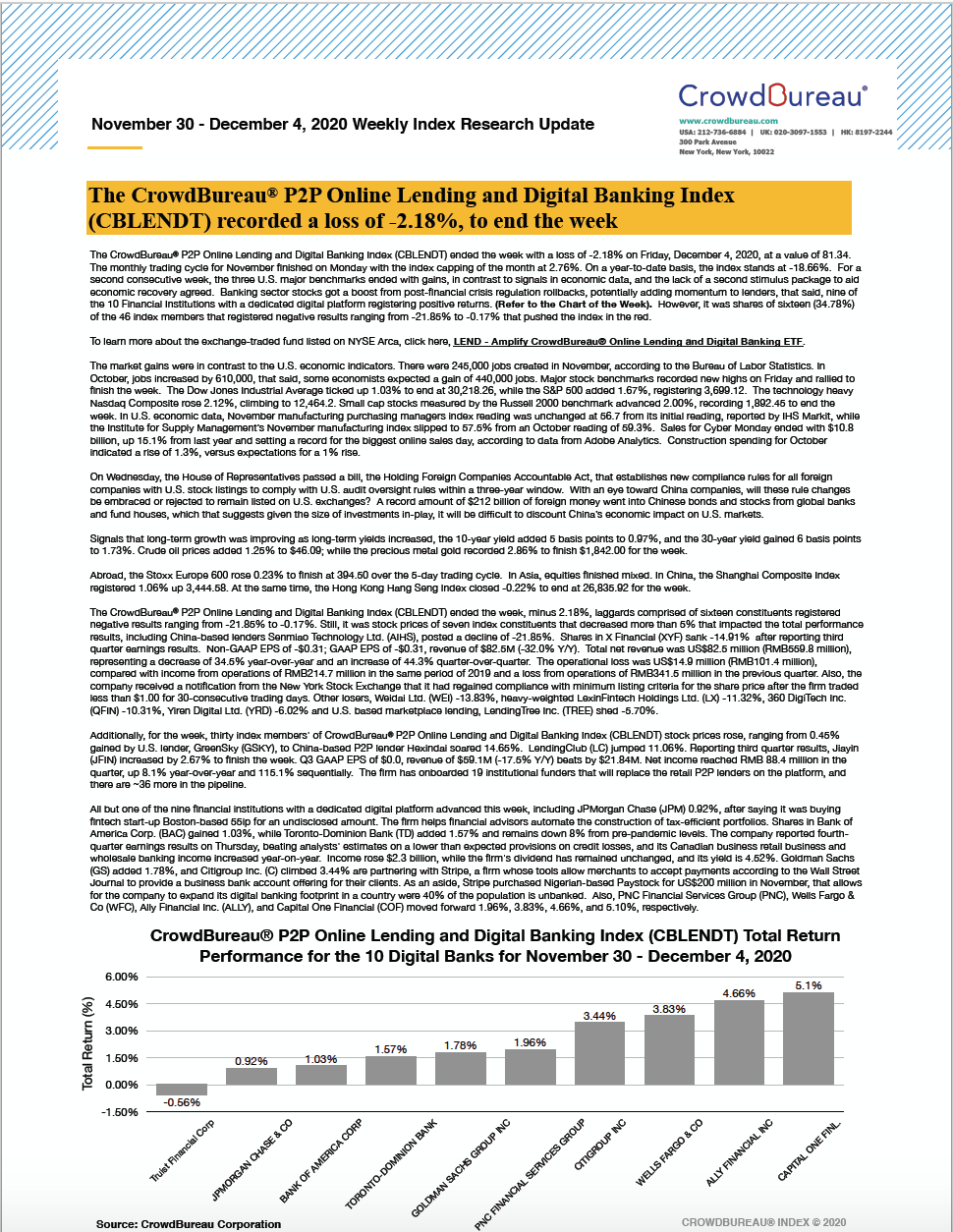

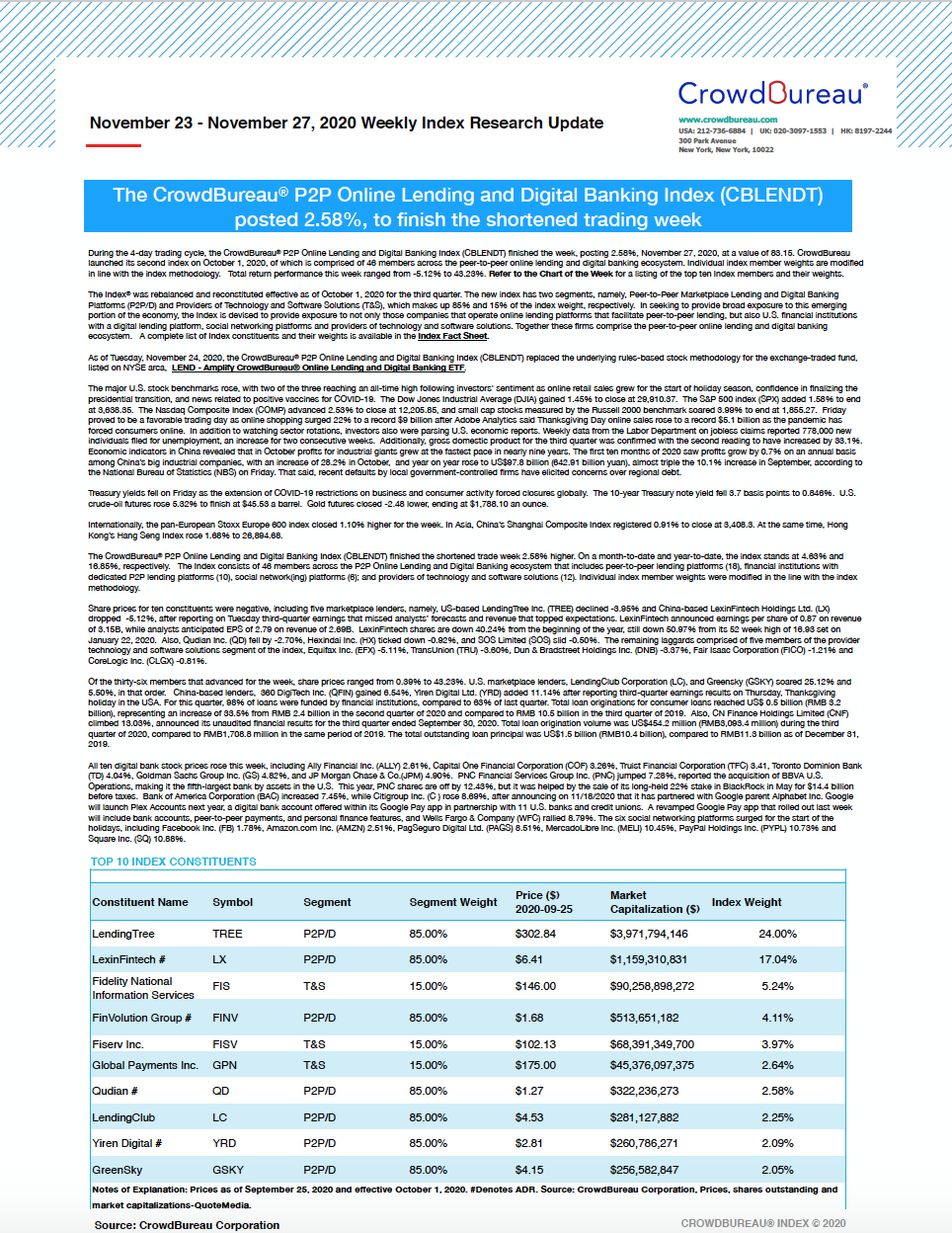

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) experienced a loss of -0.16%, ticking down for its fourth consecutive week on Friday, July 23, 2021, to end with a value of 91.73. U.S. major benchmarks managed to finish the trading session in positive territory amid volatile market swings as investors clung to fears over the impact the rise in the Covid-19 Delta variant may induce on the global economy, despite strong earnings results. Declining stocks equaled nearly the same number of gainers in the CBLENDT index; this included 10 of the 14 China-based P2P online lending platforms that faced share price decreases of more than 5%. Refer to the Chart of the Week.

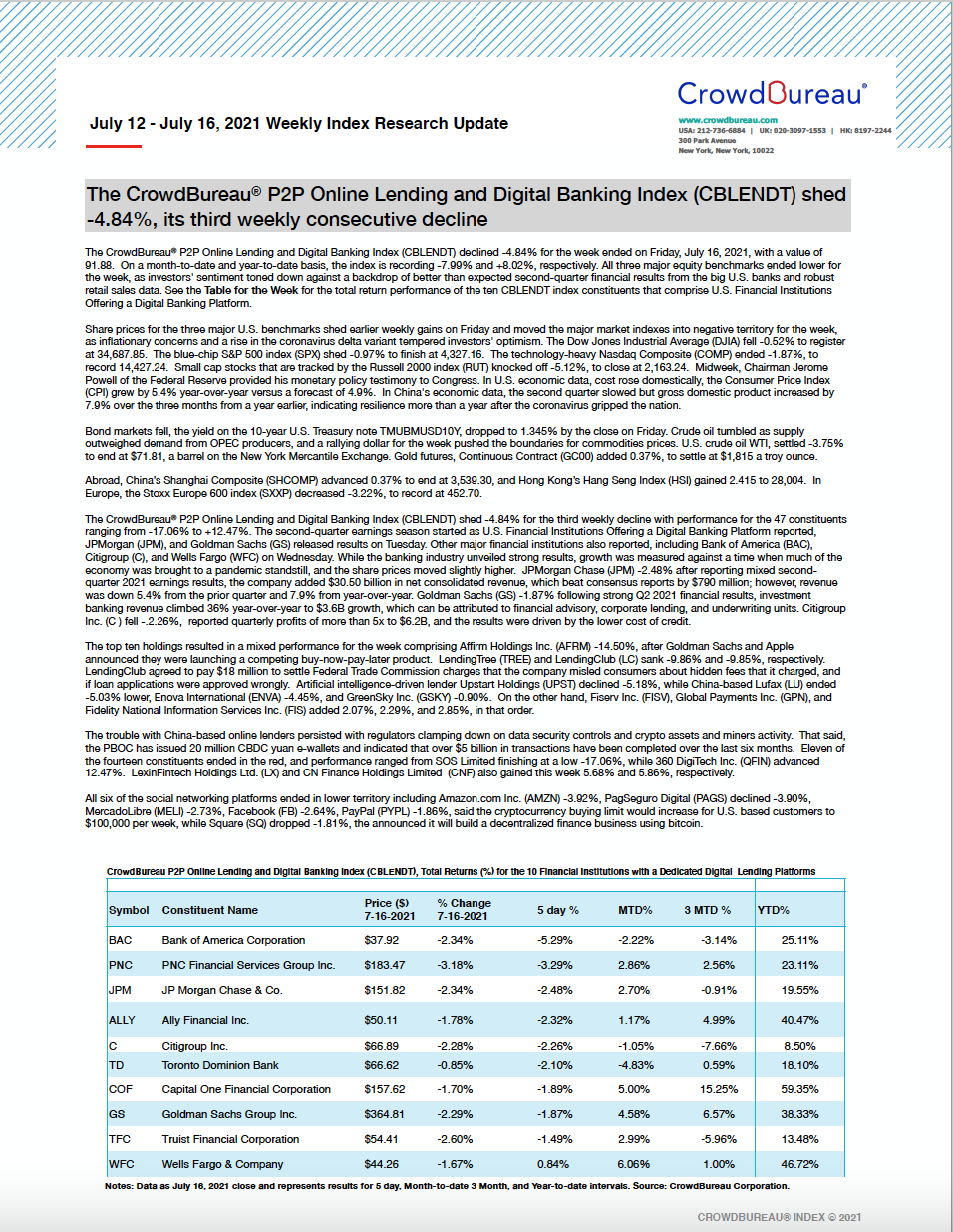

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) shed -4.84%, its third weekly consecutive decline

July 12 – July 16, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) declined -4.84% for the week on Friday, July 16, 2021, with a value of 91.88. On a month-to-date and year-to-date basis, the index is recording -7.99% and +8.02%, respectively. All three major equity benchmarks ended lower for the week, as investors’ sentiment toned down against a backdrop of better than expected second-quarter financial results from the big U.S. banks and robust retail sales data. See the Table for the Week for the total return performance of the ten CBLENDT index constituents that comprise U.S. Financial Institutions Offering a Digital Banking Platform.

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) decreased -2.41%, after the Second Quarter 2021 Rebalancing and Reconstitution

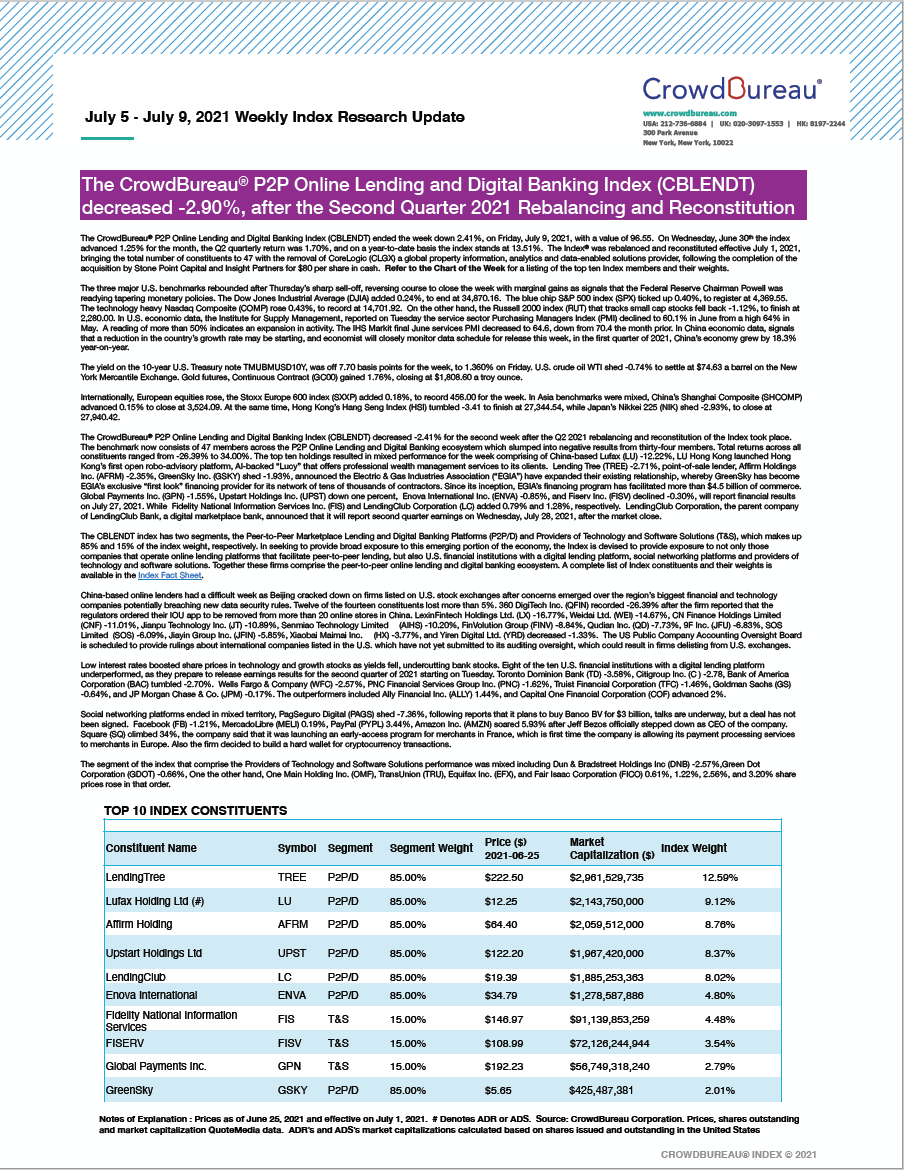

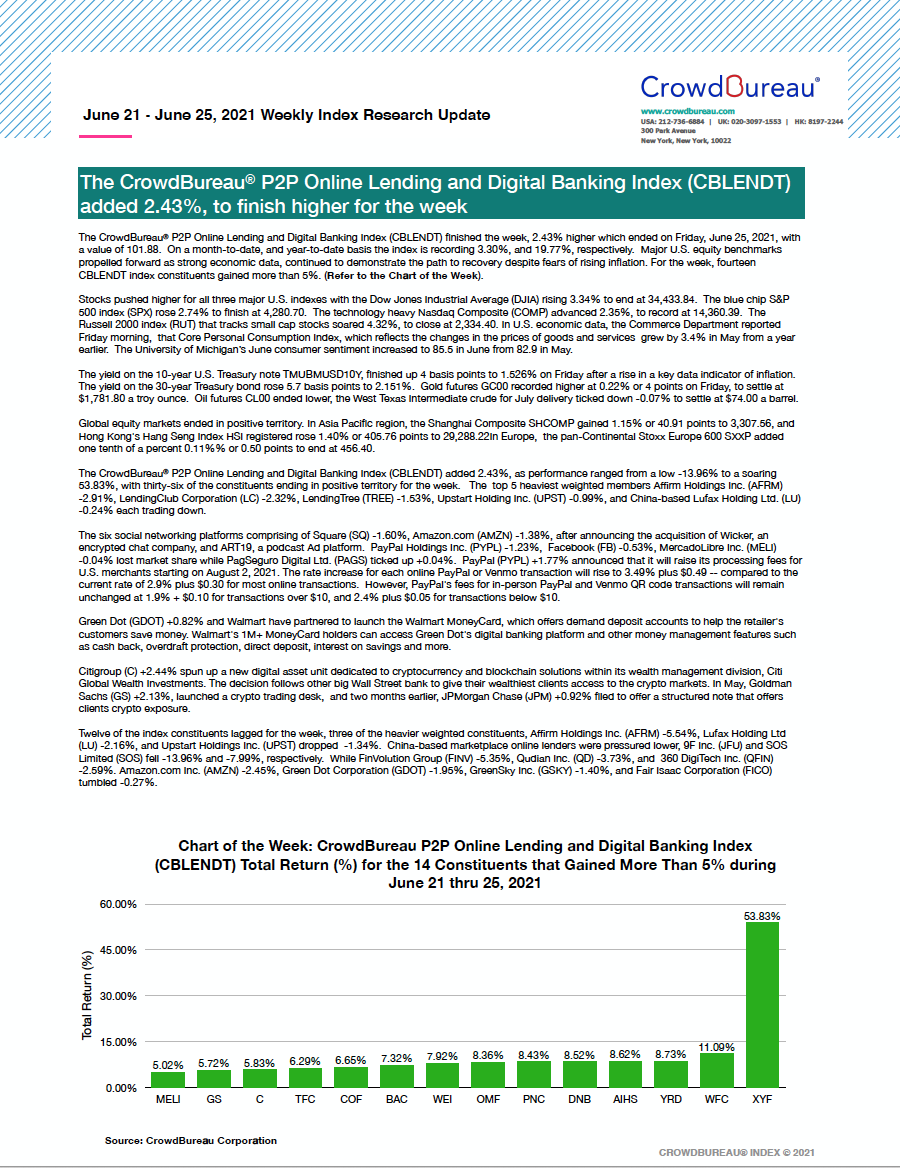

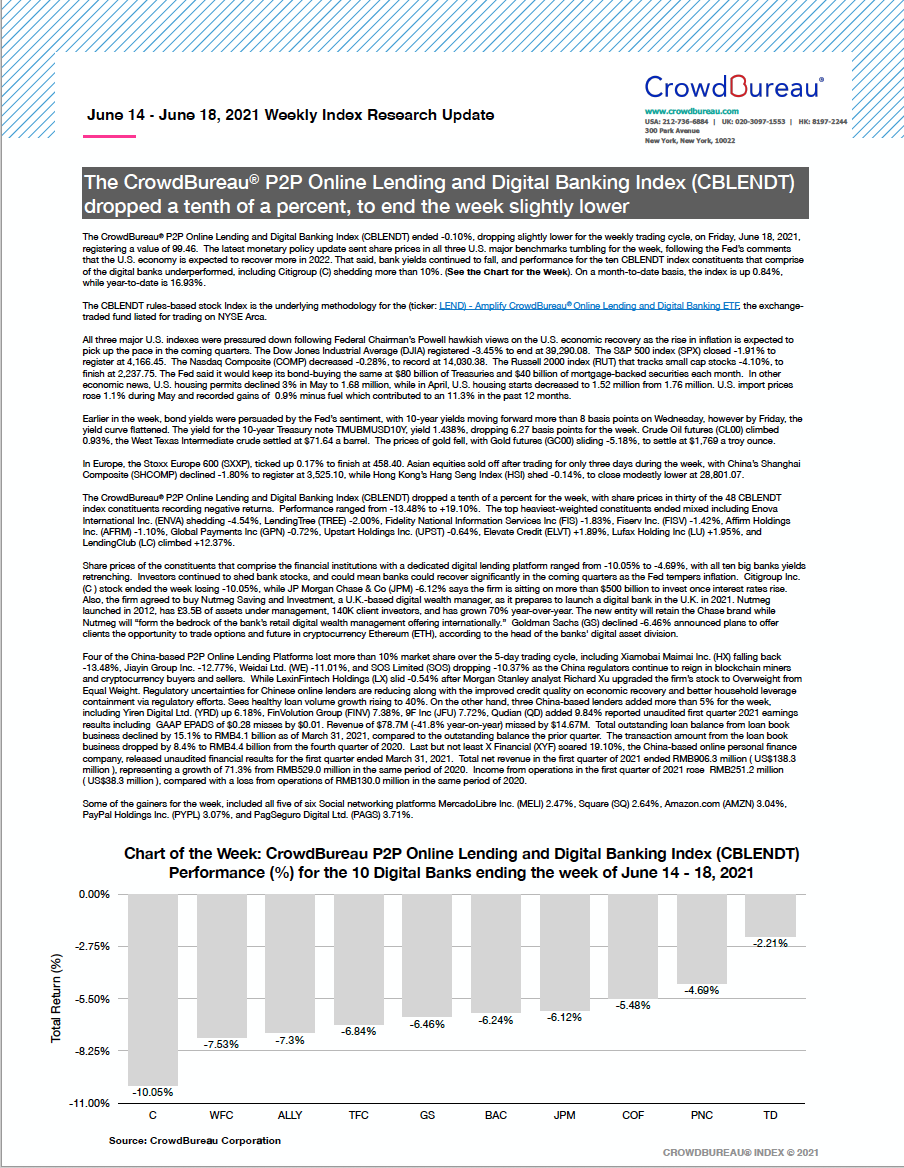

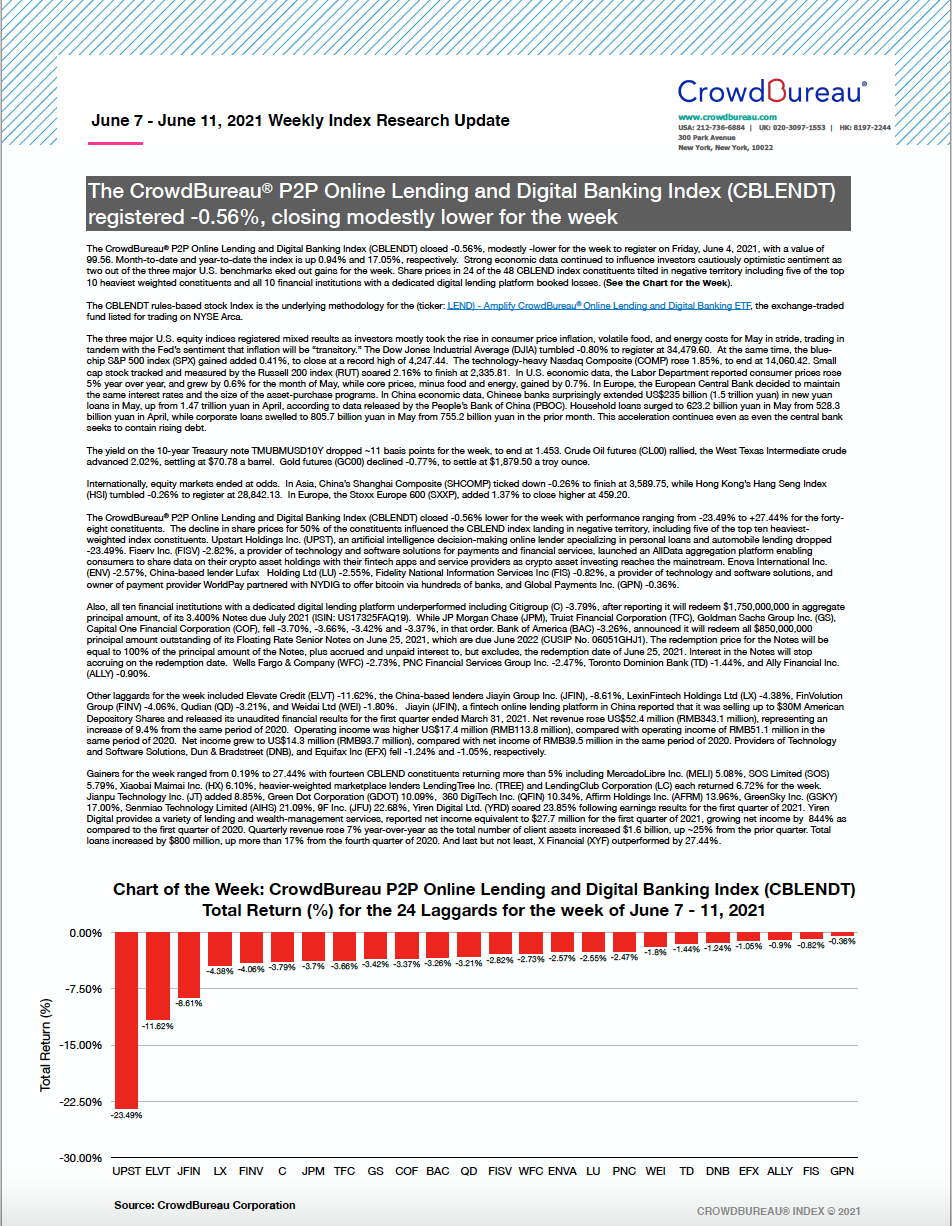

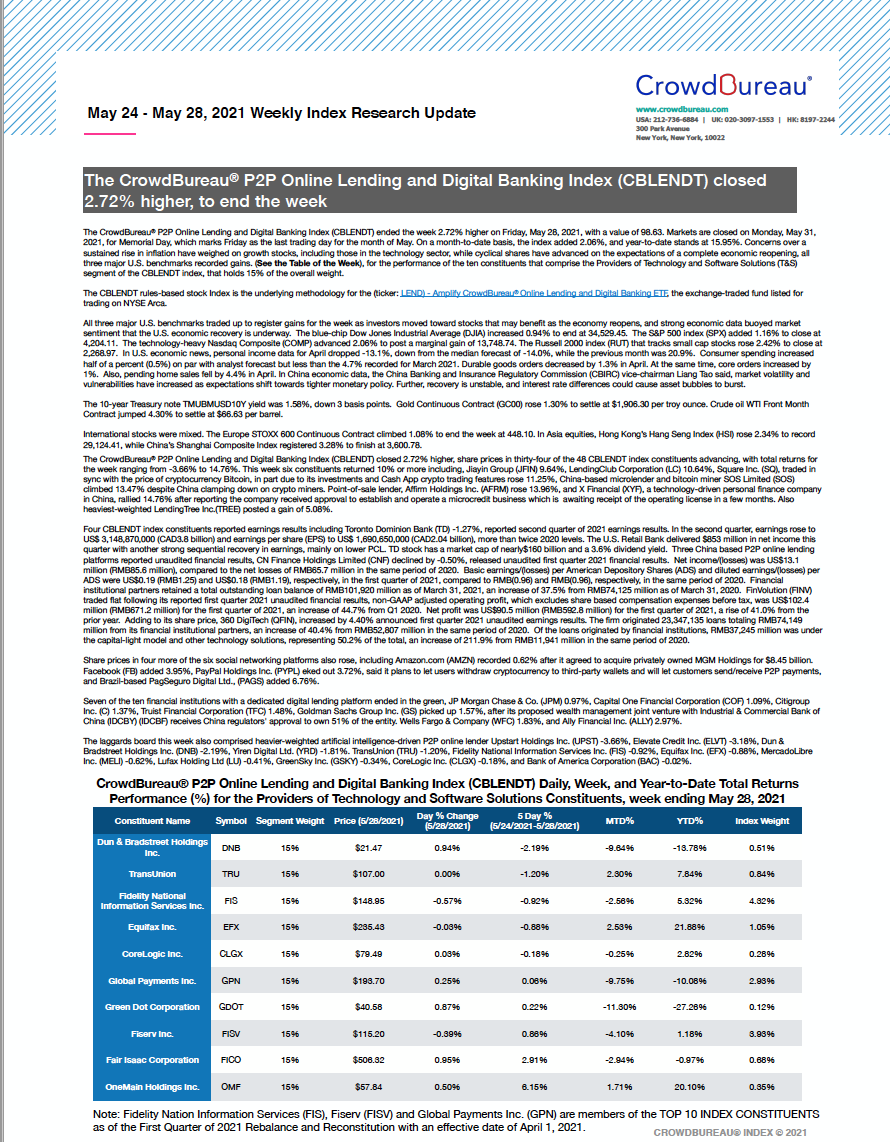

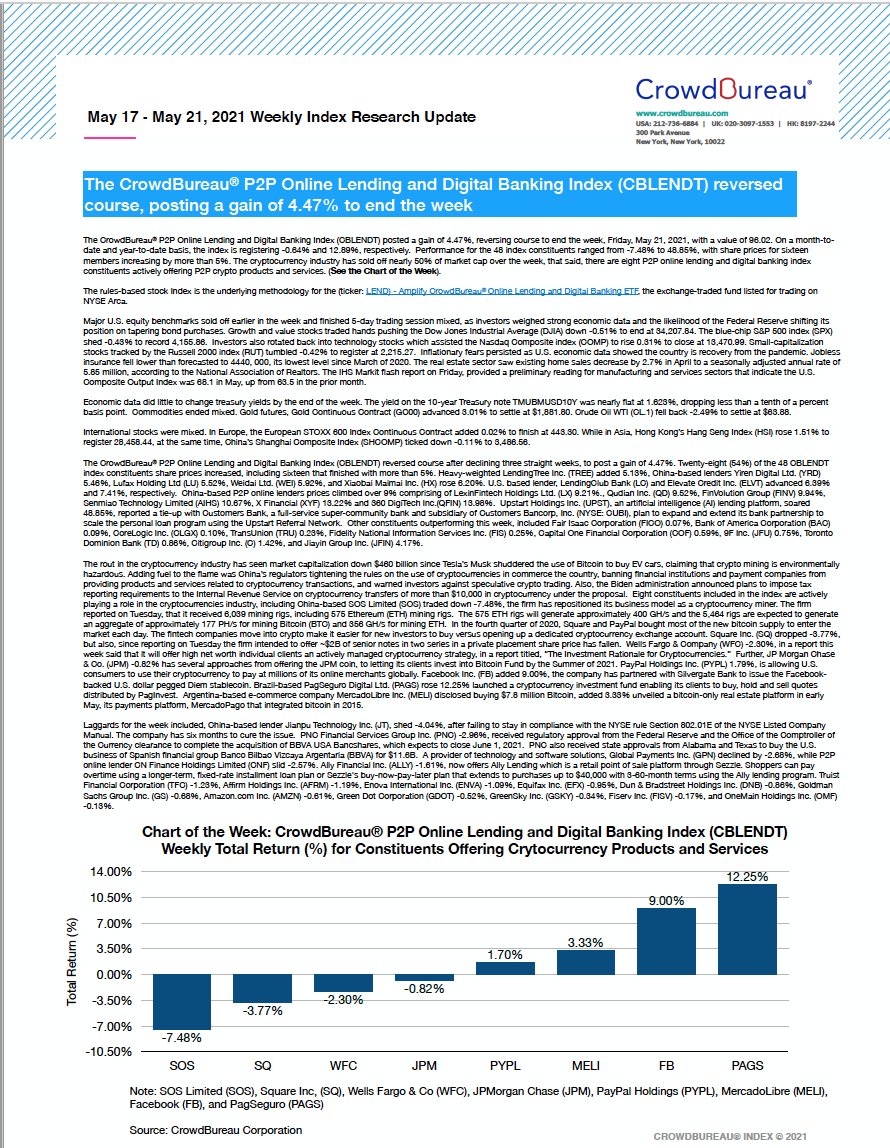

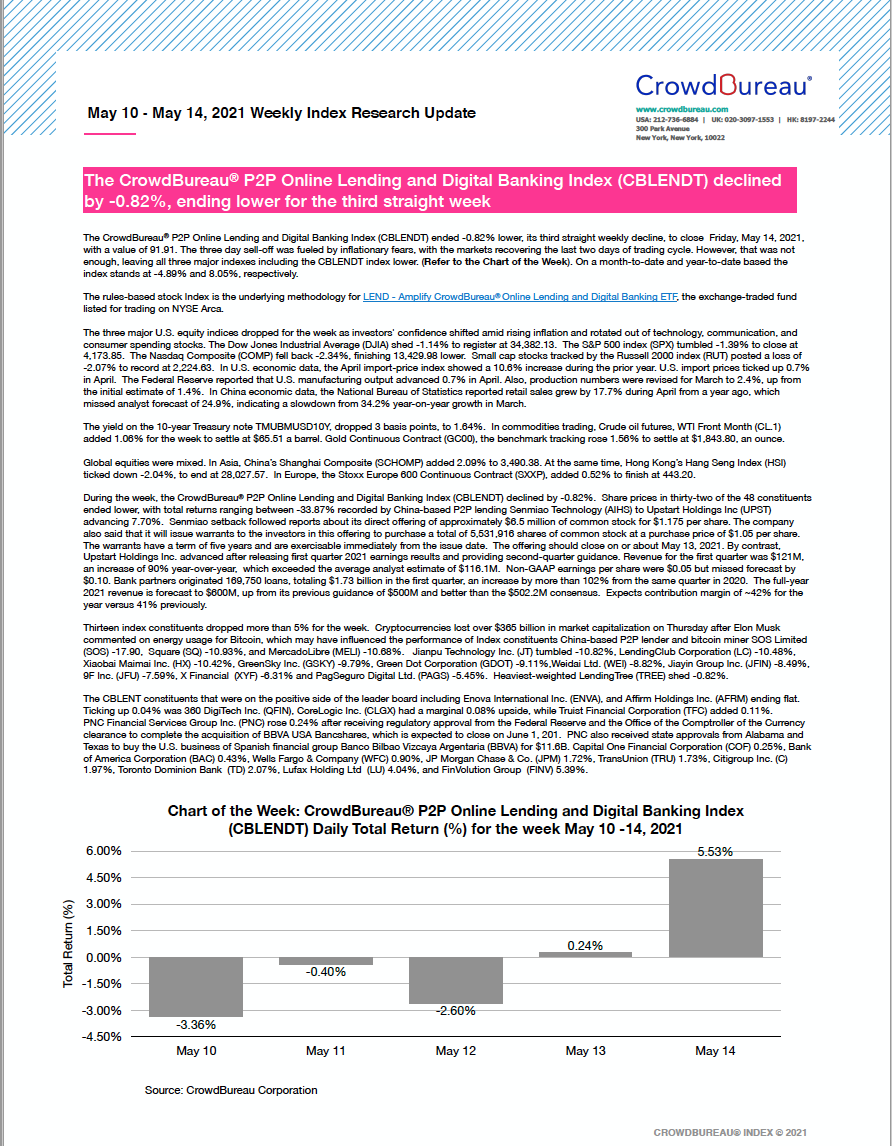

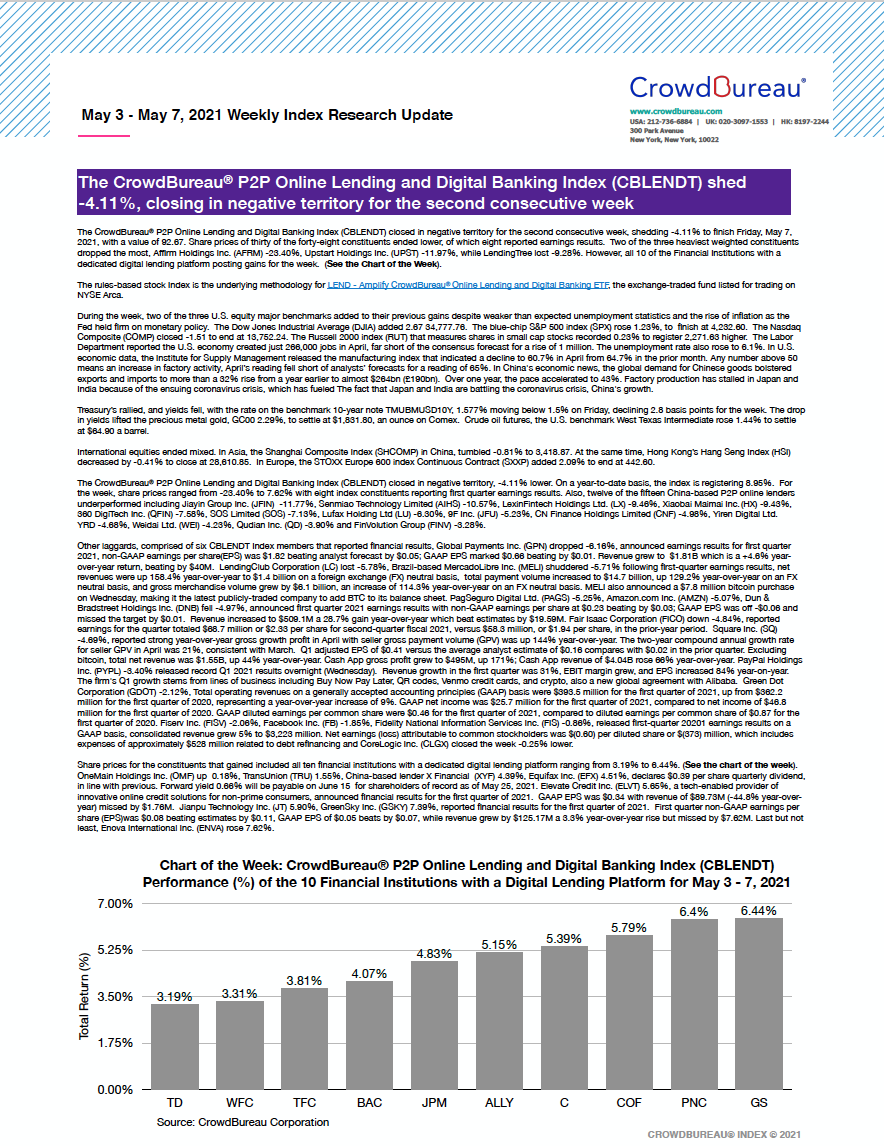

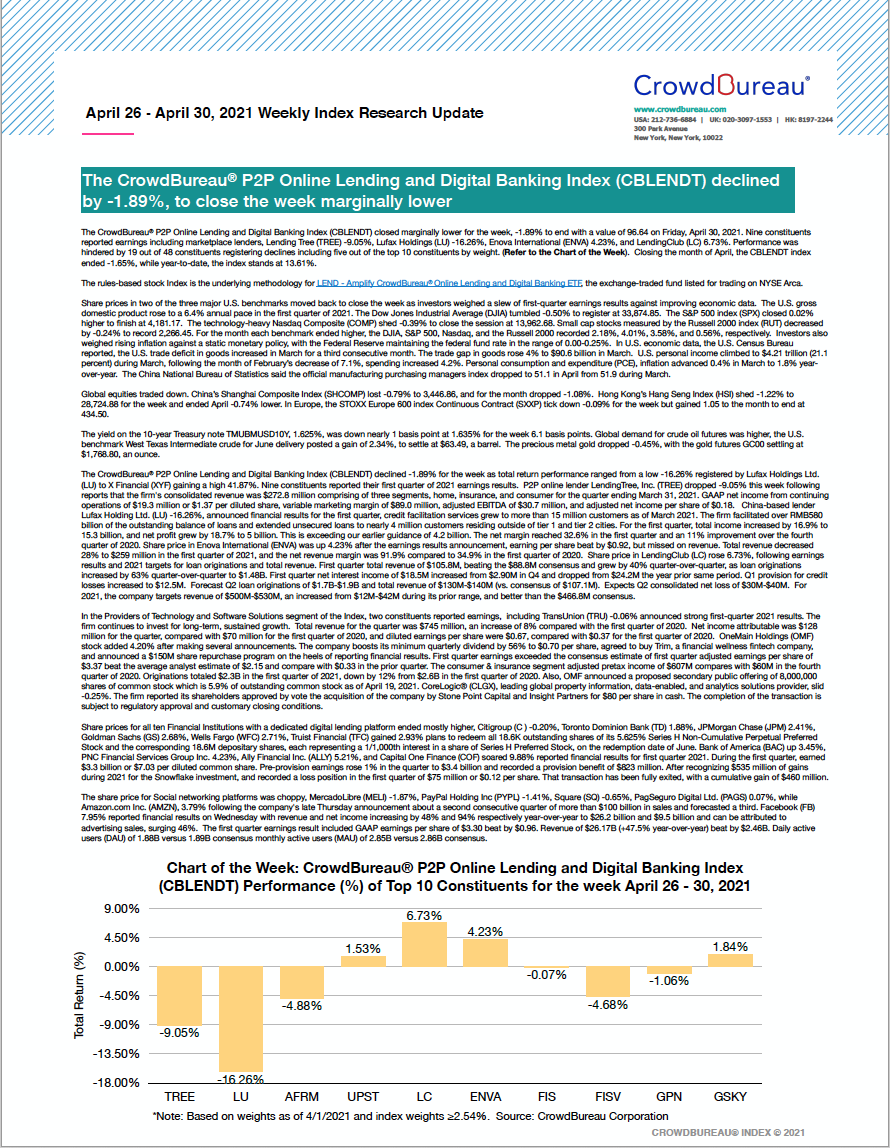

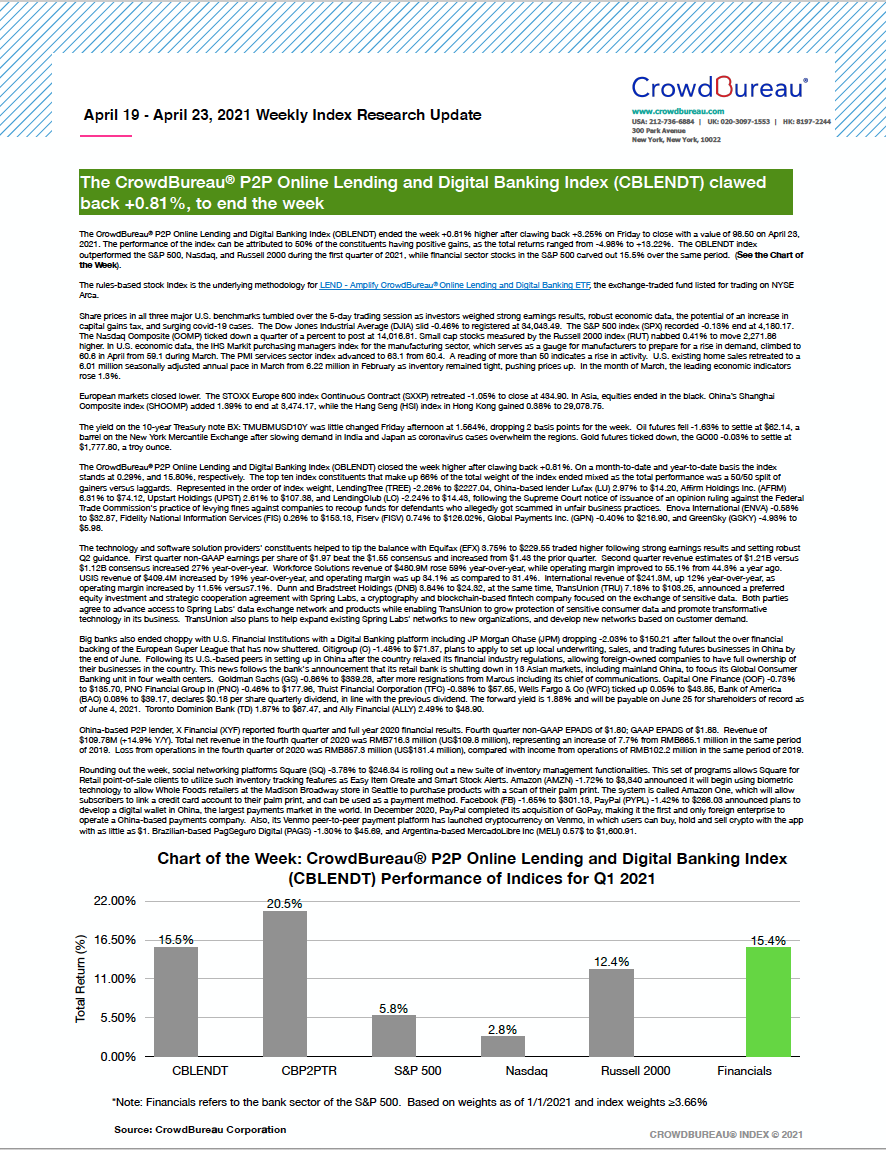

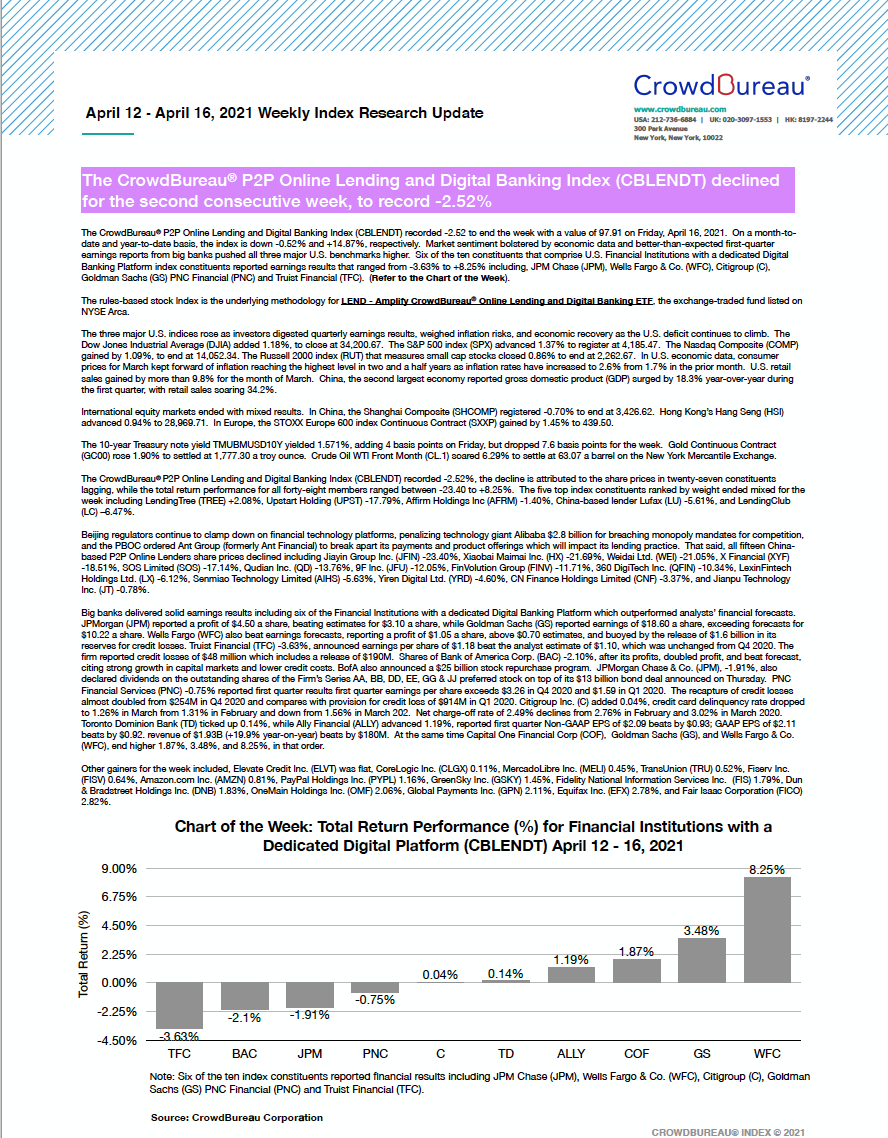

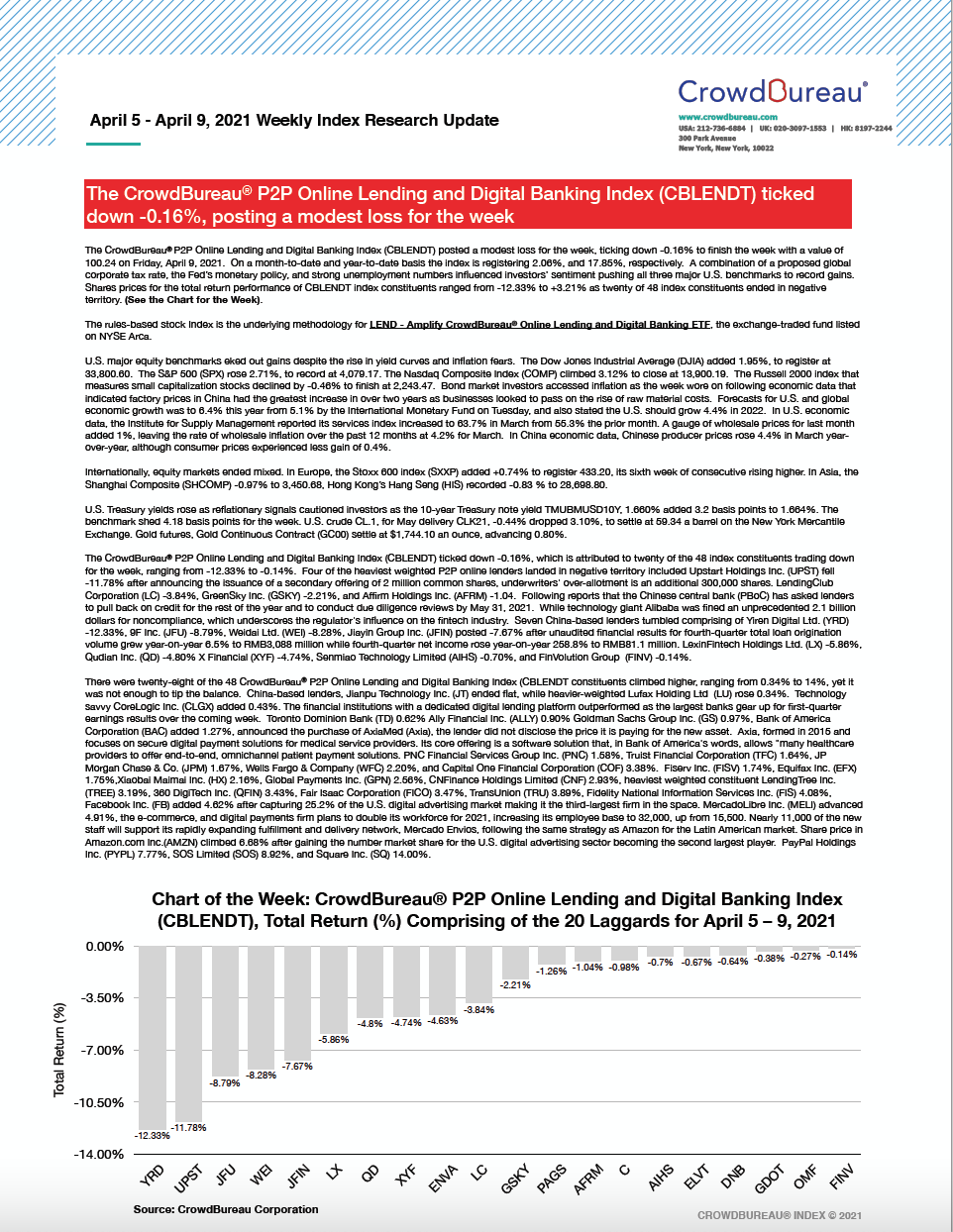

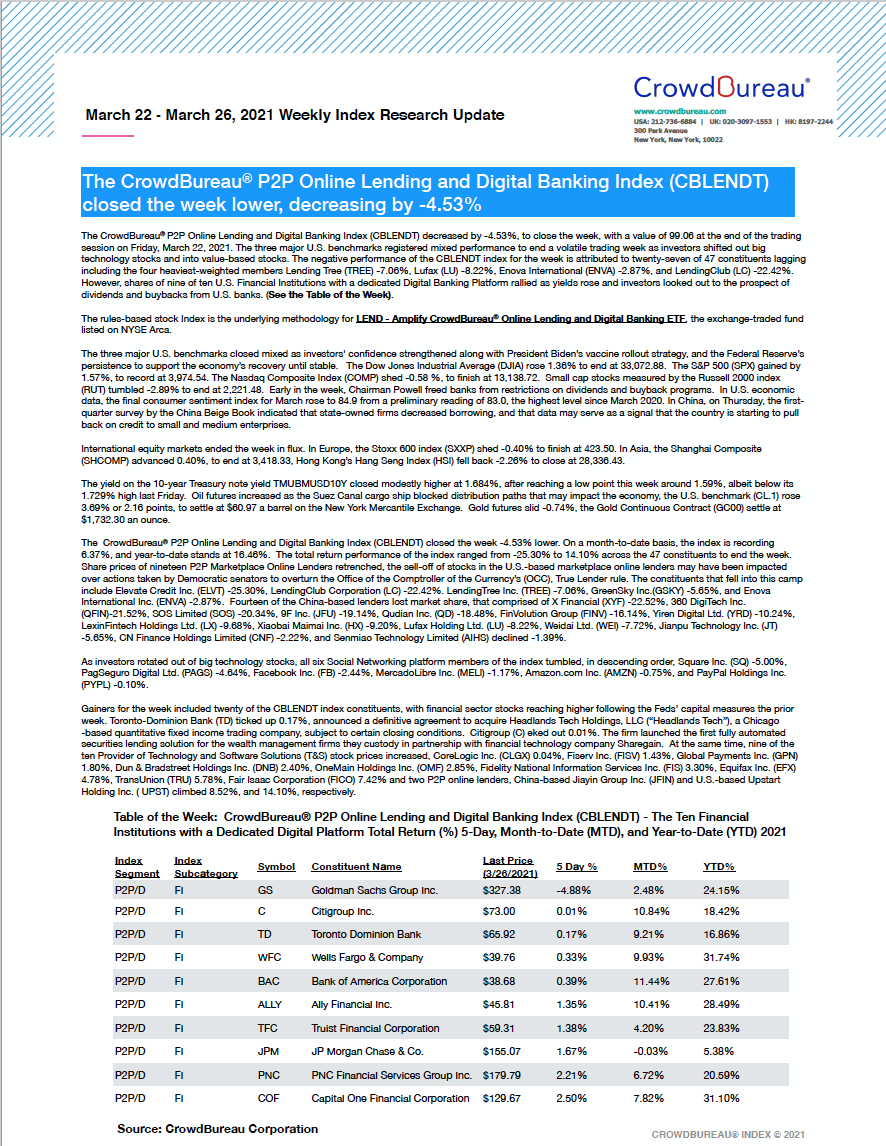

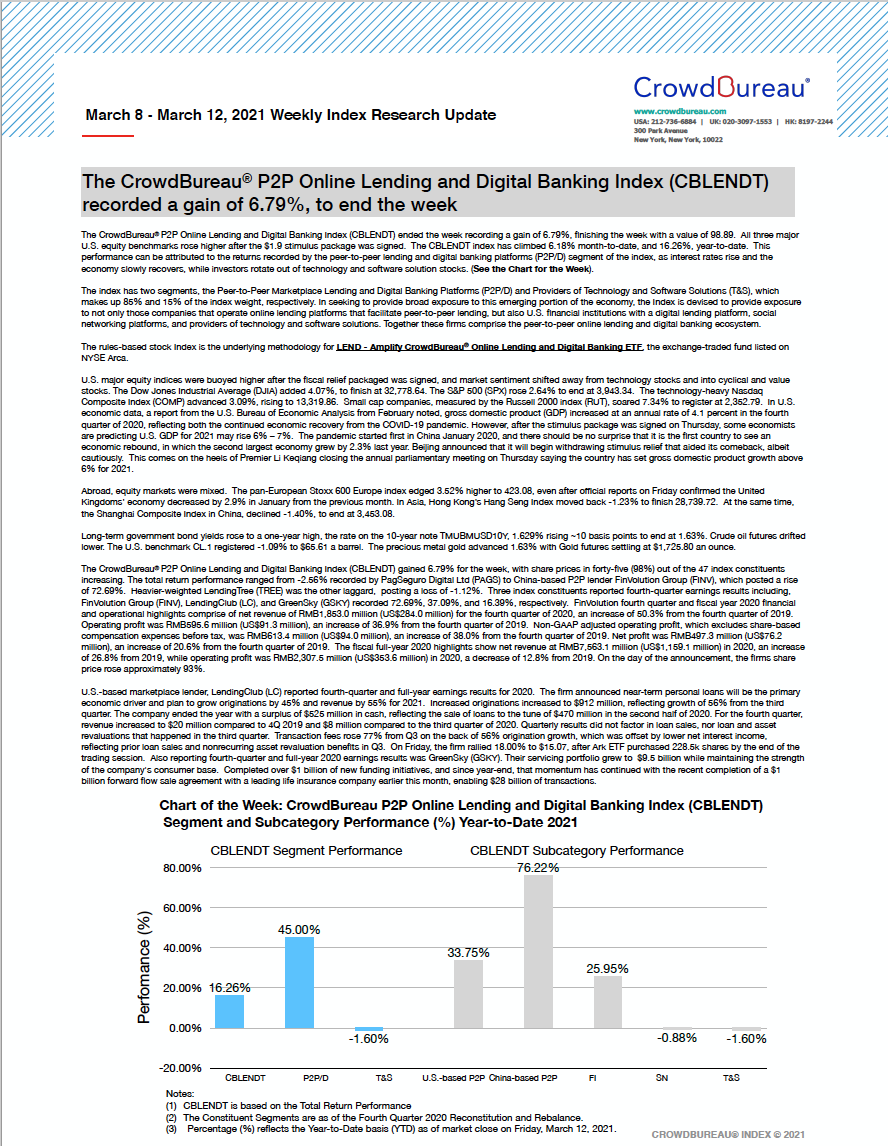

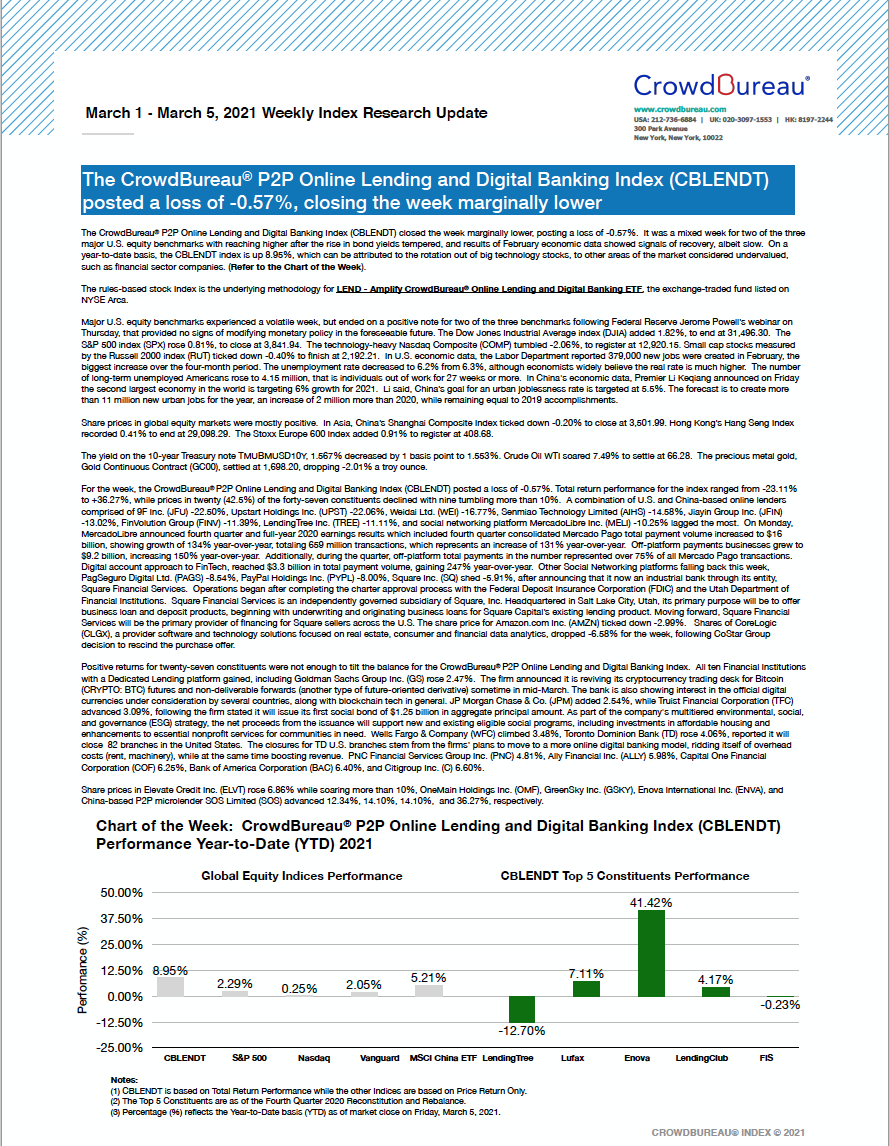

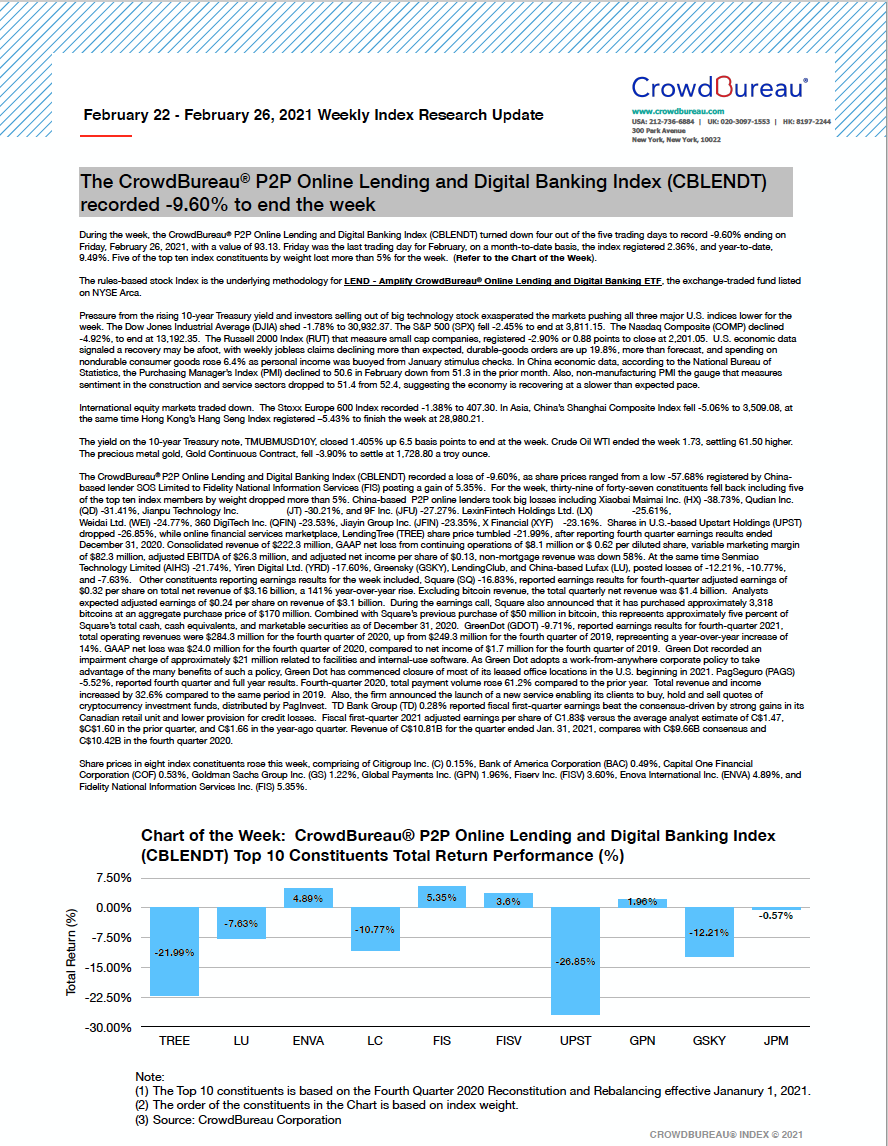

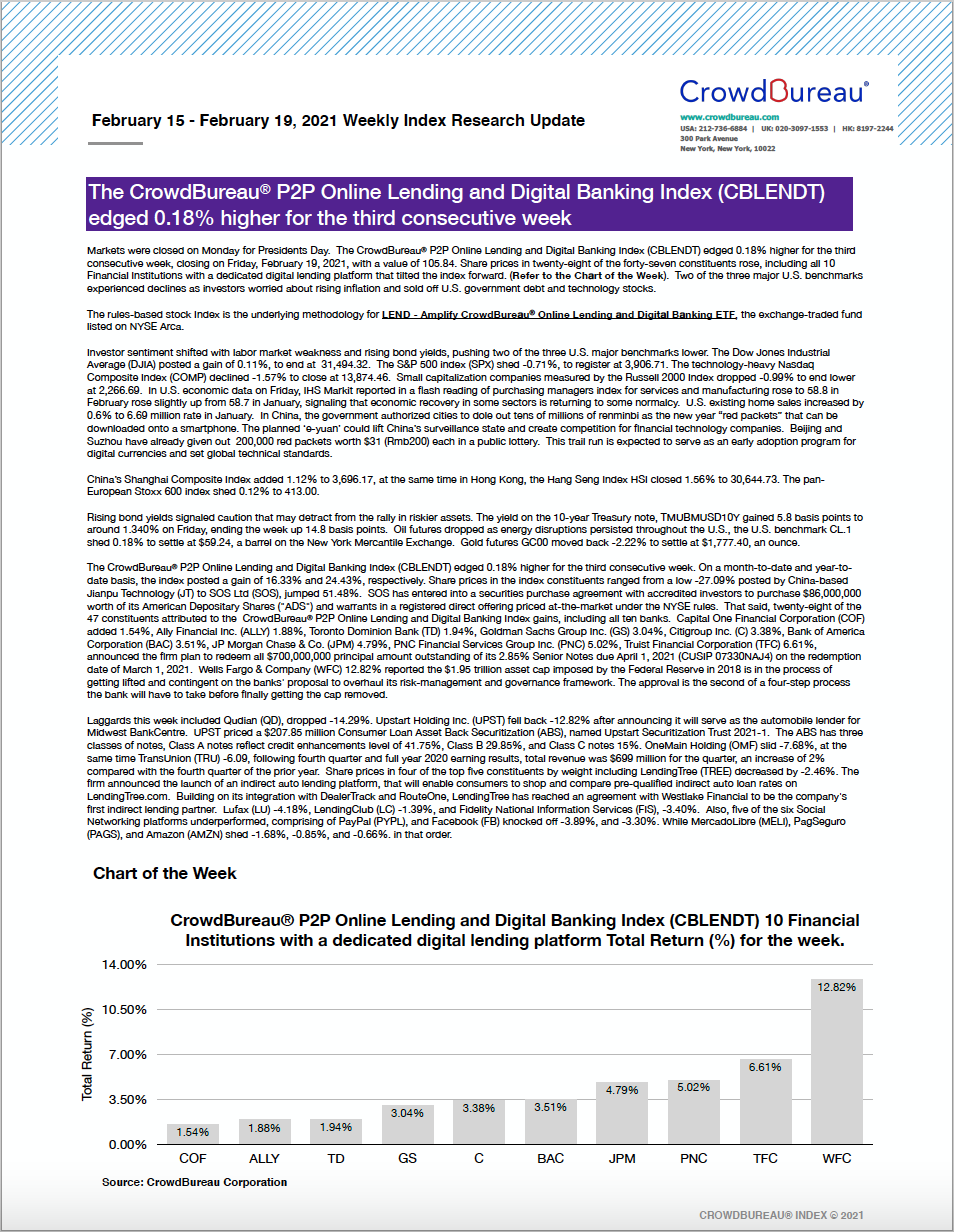

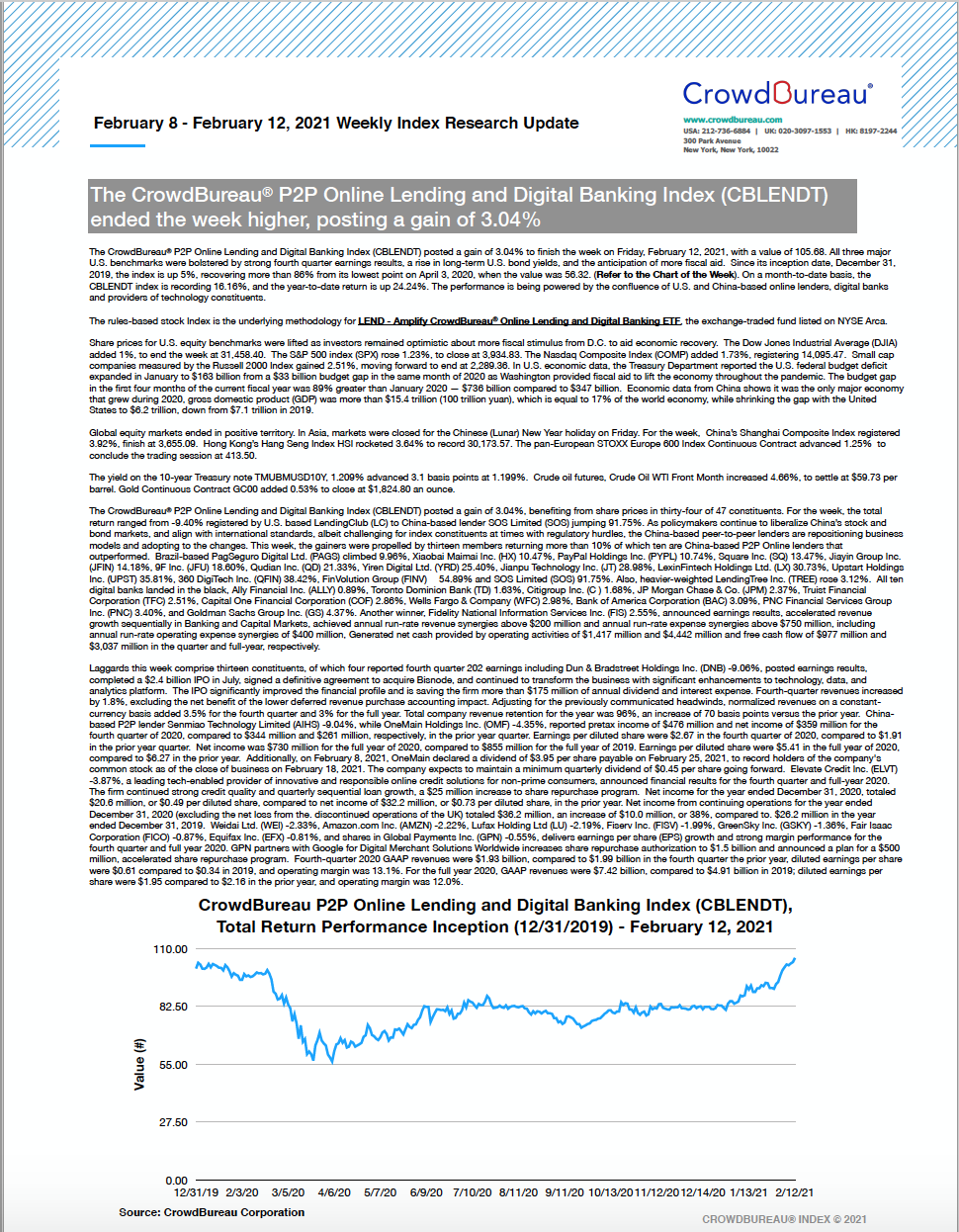

July 5 – July 9, 2021