CrowdBureau Peer-to-Peer Lending

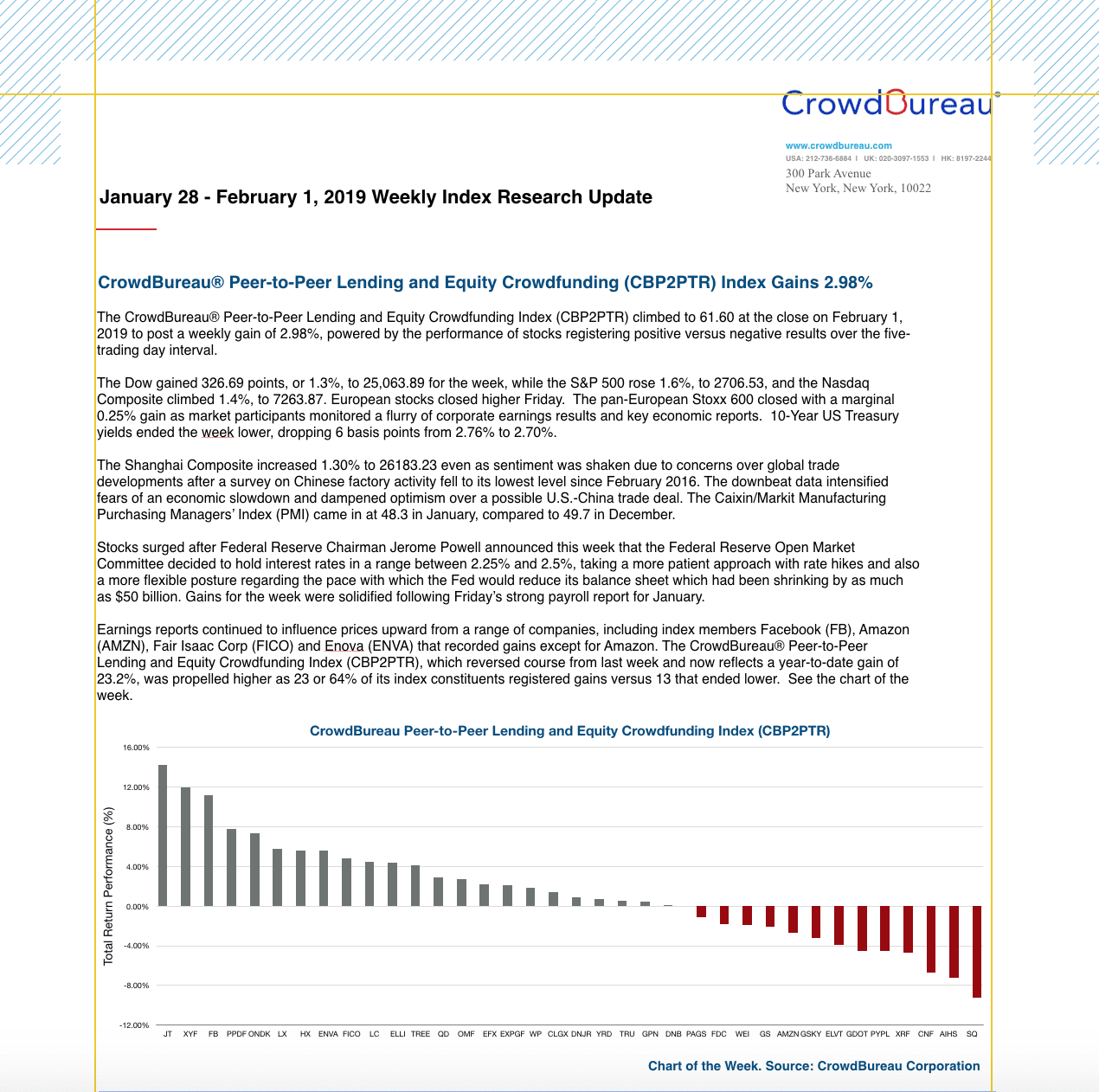

Disclosure: The information provided on this page is for illustrative purposes only and is not intended to serve as investment advice. The information provided is as of a particular time and subject to change at any time without notice.

INDEX DEFINITION

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (“Index”) seeks to capture the peer-to-peer lending and securities based crowdfunding ecosystem by tracking the price and total return performance of publicly traded firms domiciled across the globe but listed for trading in the United States (“U.S.”), including common stock, American Depository Receipts (“ADRs”), American Depositary Shares (“ADSs”) and Global Depositary Receipts (“GDRs). The Index is designed to be used as the underlying index for financial products such as exchange traded funds and managed account platforms.

The peer-to-peer lending and equity crowdfunding ecosystem consists of companies with business operations that fall into one of the following four segments: (1) Peer-to-peer lending and equity crowdfunding platforms; (2) Financial institutions with a dedicated peer-to-peer lending platform; (3) Social network(ing) platforms that offer or plan to offer peer-to-peer lending or equity crowdfunding services; and (4) Providers of technology and software solutions to the peer-to-peer lending and equity crowdfunding industry. These four segments encapsulate the peer-to-peer lending and equity crowdfunding ecosystem.

INDEX TRENDS

INDEX RESEARCH

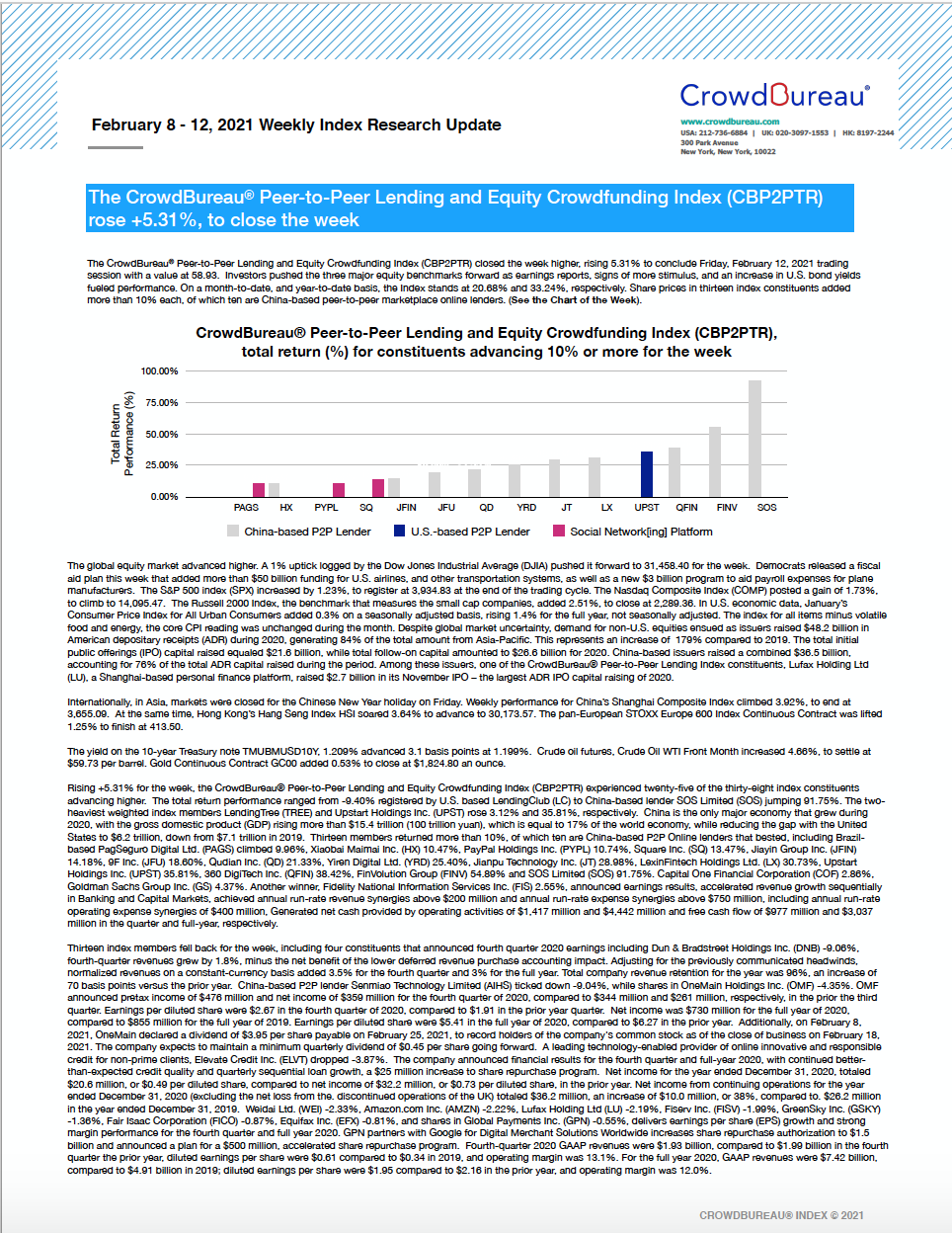

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) rose 5.31%, to close the week

February 8 – 12, 2021

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) closed the week higher, rising 5.31% to conclude Friday, February 12, 2021 trading session with a value at 58.93. Investors pushed the three major equity benchmarks forward as earnings reports, signs of more stimulus, and an increase in U.S. bond yields fueled performance. On a month-to-date, and year-to-date basis, the Index stands at 20.68% and 33.24%, respectively. Share prices in thirteen index constituents added more than 10% each, of which ten are China-based peer-to-peer marketplace online lenders. (See the Chart of the Week).

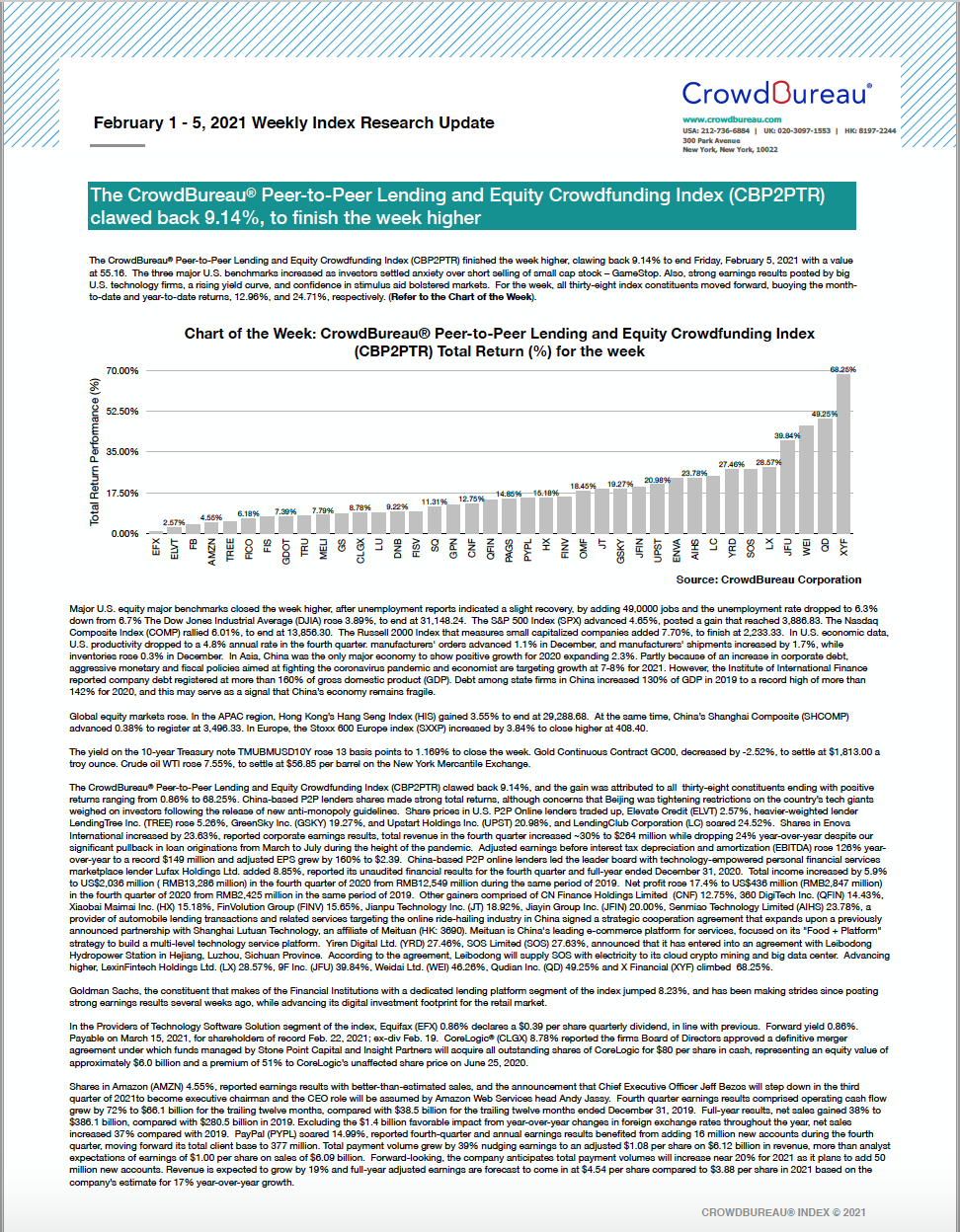

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) clawed back 9.14%, to finish the week higher

February 1 – 5, 2021

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week higher, clawing back 9.14% to end Friday, February 5, 2021 with a value at 55.16. The three major U.S. benchmarks increased as investors settled anxiety over short selling of small cap stock – GameStop. Also, strong earnings results posted by big U.S. technology firms, a rising yield curve, and confidence in stimulus aid bolstered markets. For the week, all thirty-eight index constituents moved forward, buoying the month-to-date and year-to-date returns, 12.96%, and 24.71%, respectively. (Refer to the Chart of the Week).

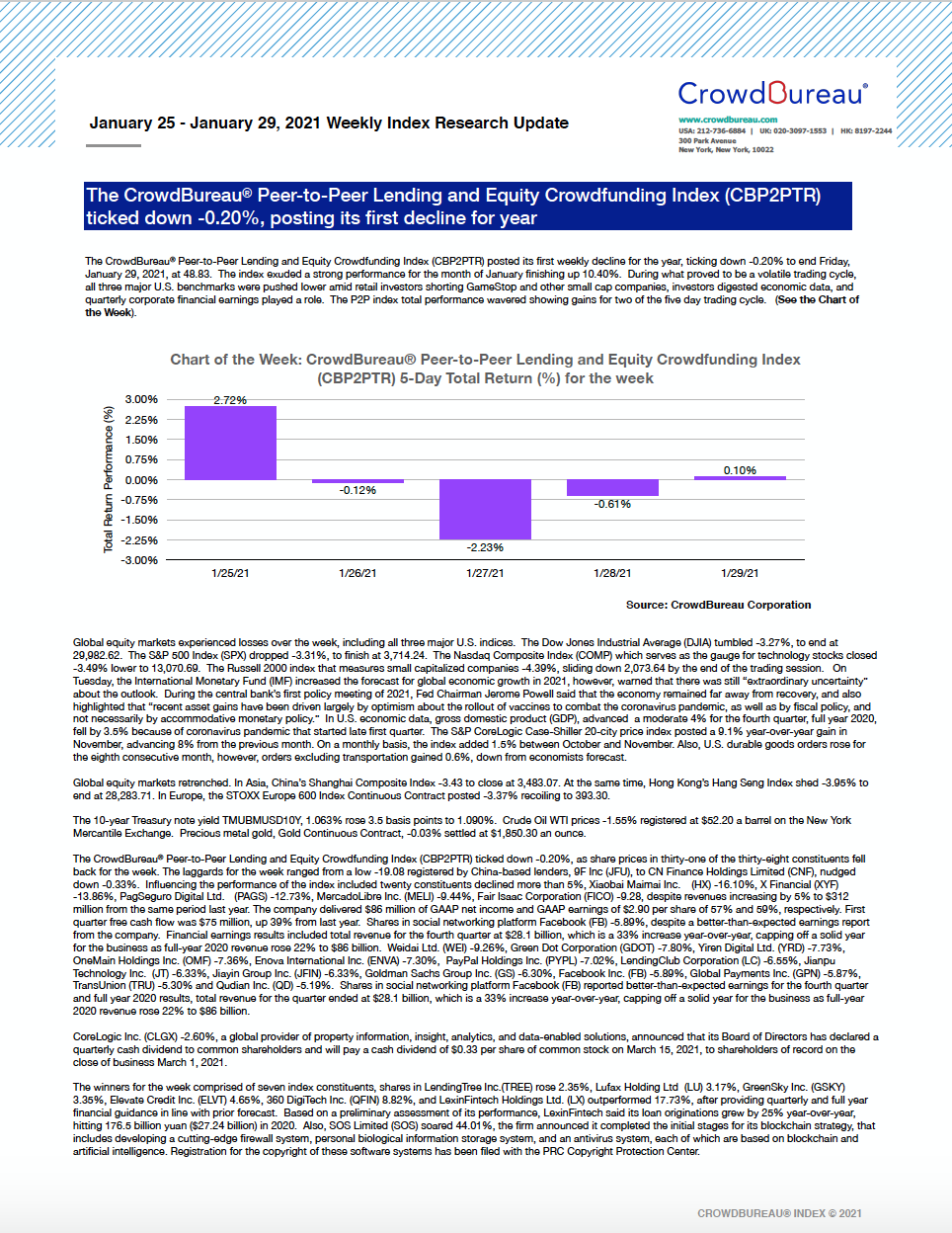

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ticked down -0.20%, posting its first decline for year

January 25 – January 29, 2021

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted its first weekly decline for the year, ticking down -0.20% to end Friday, January 29, 2021, at 48.83. The index exuded a strong performance for the month of January finishing up 10.40%. During what proved to be a volatile trading cycle, all three major U.S. benchmarks were pushed lower amid retail investors shorting GameStop and other small cap companies, investors digested economic data, and quarterly corporate financial earnings played a role. The P2P index total performance wavered showing gains for two of the five day trading cycle. (See the Chart of the Week).

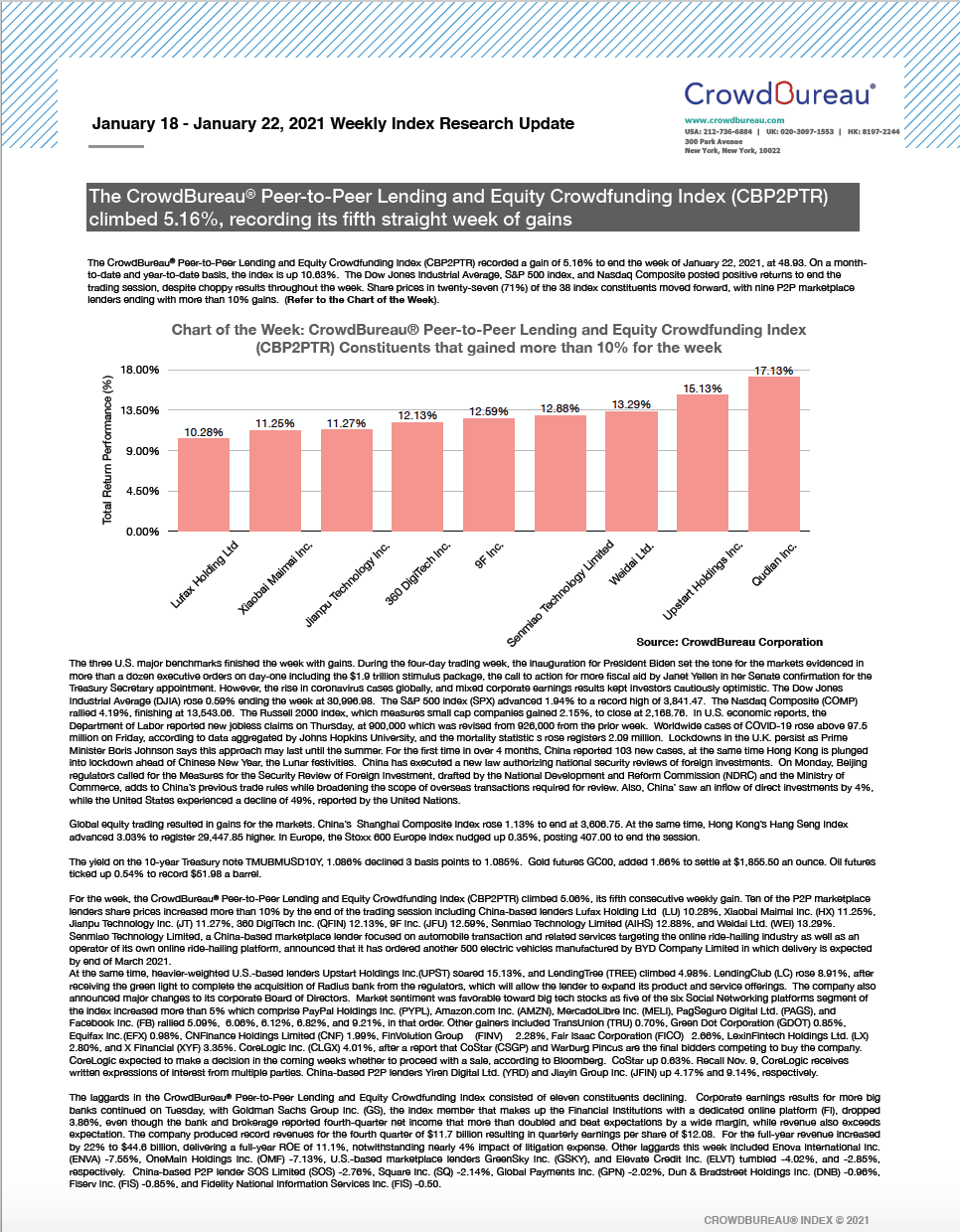

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) climbed 5.16%, recording its fifth straight week of gains

January 18 – January 22, 2021

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded a gain of 5.16% to end the week of January 22, 2021, at 48.93. On a month-to-date and year-to-date basis, the index is up 10.63%. The Dow Jones Industrial Average, S&P 500 index, and Nasdaq Composite posted positive returns to end the trading session, despite choppy results throughout the week. Share prices in twenty-seven (71%) of the 38 index constituents moved forward, with nine P2P marketplace lenders ending with more than 10% gains. (Refer to the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted an increase of 2.38% to finish the week

January 11 – January 15, 2021

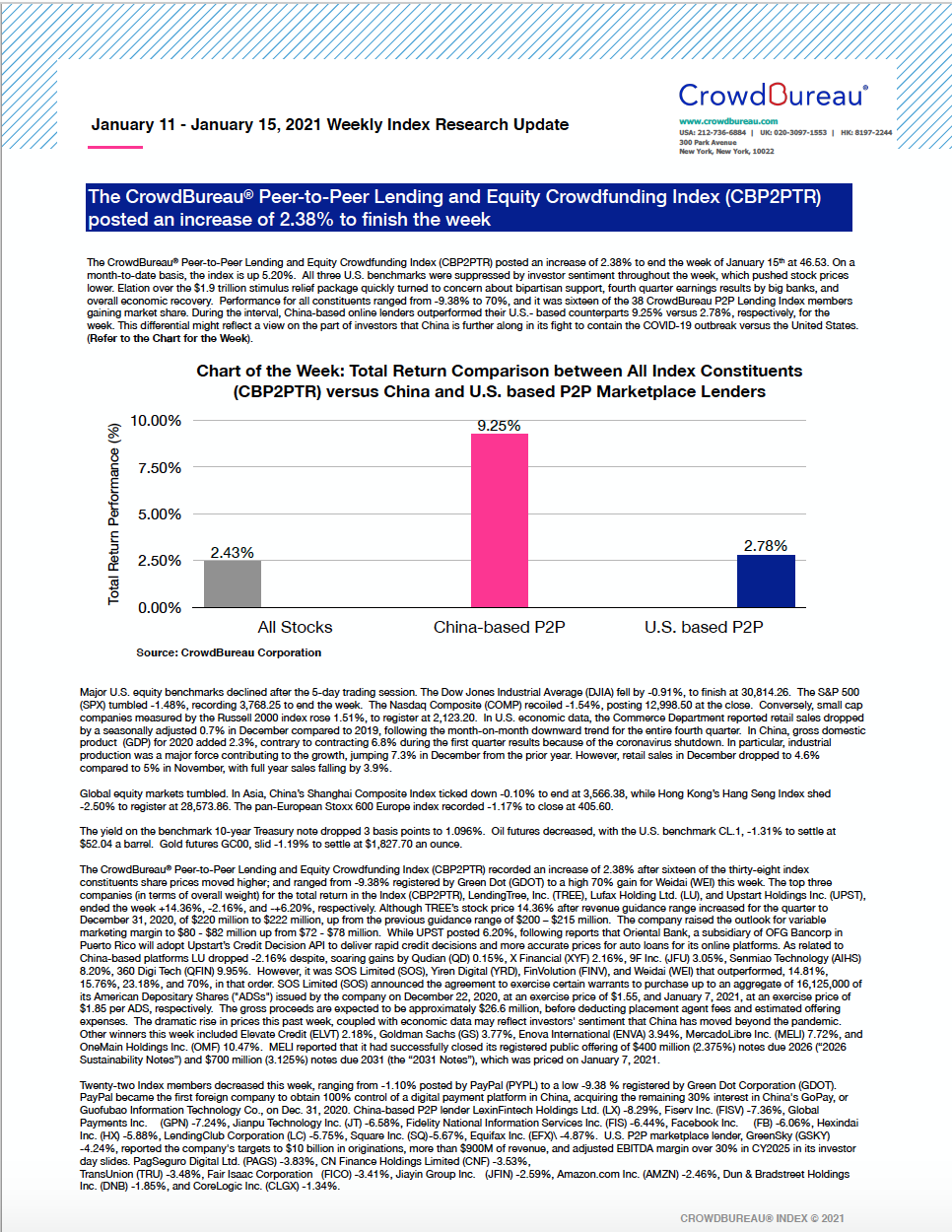

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted an increase of 2.38% to end the week of January 15th at 46.53. On a month-to-date basis, the index is up 5.20%. All three U.S. benchmarks were suppressed by investor sentiment throughout the week, which pushed stock prices lower. Elation over the $1.9 trillion stimulus relief package quickly turned to concern about bipartisan support, fourth quarter earnings results by big banks, and overall economic recovery. Performance for all constituents ranged from -9.38% to 70%, and it was sixteen of the 38 CrowdBureau P2P Lending Index members gaining market share. During the interval, China-based online lenders outperformed their U.S.- based counterparts 9.25% versus 2.78%, respectively, for the week. This differential might reflect a view on the part of investors that China is further along in its fight to contain the COVID-19 outbreak versus the United States. (Refer to the Chart for the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) advanced 2.76% after the Q4 2020 Rebalancing and Reconstitution

January 4 – January 8, 2021

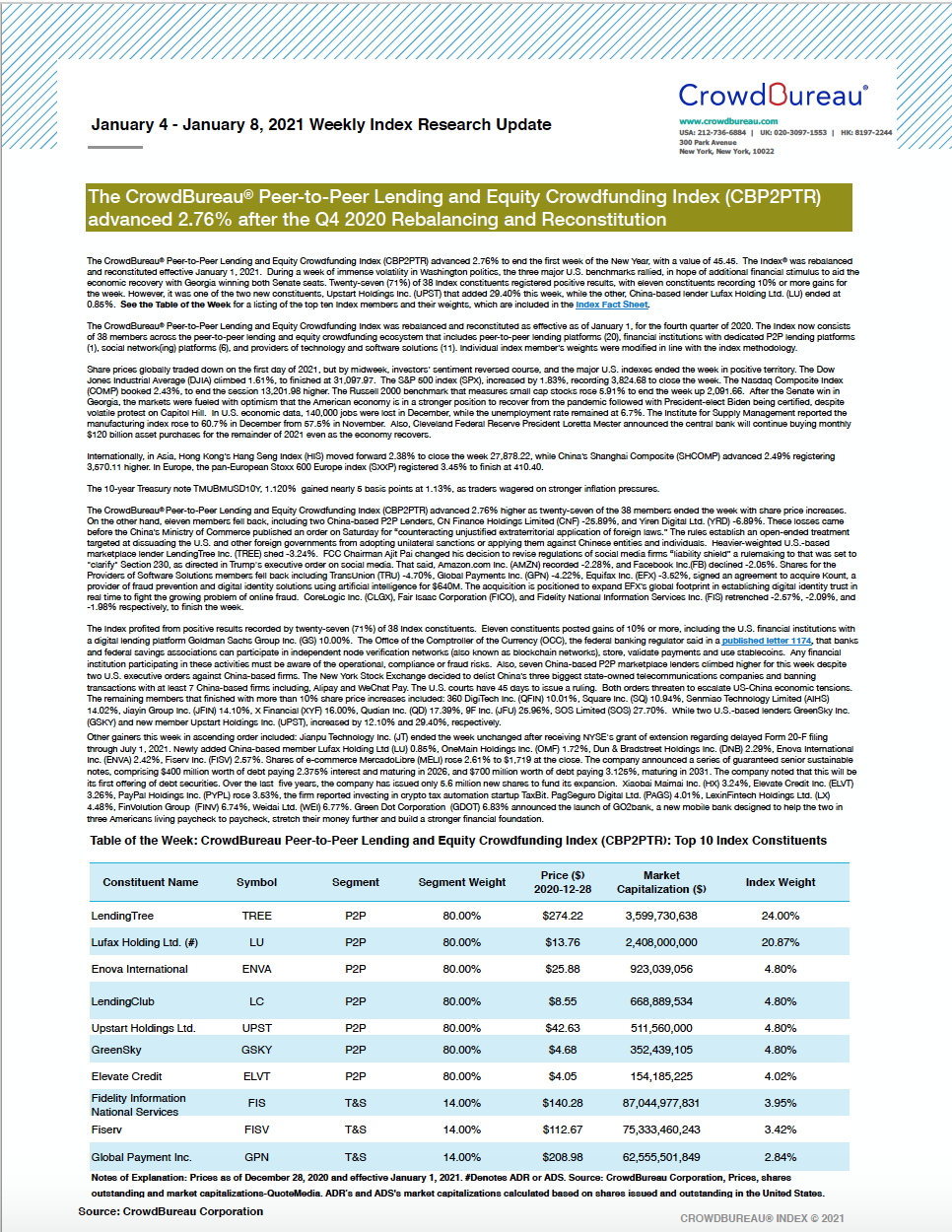

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) advanced 2.76% to end the first week of the New Year, with a value of 45.45. The Index® was rebalanced and reconstituted effective January 1, 2021. During a week of immense volatility in Washington politics, the three major U.S. benchmarks rallied, in hope of additional financial stimulus to aid the economic recovery with Georgia winning both Senate seats. Twenty-seven (71%) of 38 Index constituents registered positive results, with eleven constituents recording 10% or more gains for the week. However, it was one of the two new constituents, Upstart Holdings Inc. (UPST) that added 29.40% this week, while the other, China-based lender Lufax Holding Ltd. (LU) ended at 0.85%. See the Table of the Week for a listing of the top ten Index members and their weights, which are included in the Index Fact Sheet.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded 3.61%, to finish the week

December 28, 2020 through January 1, 2021

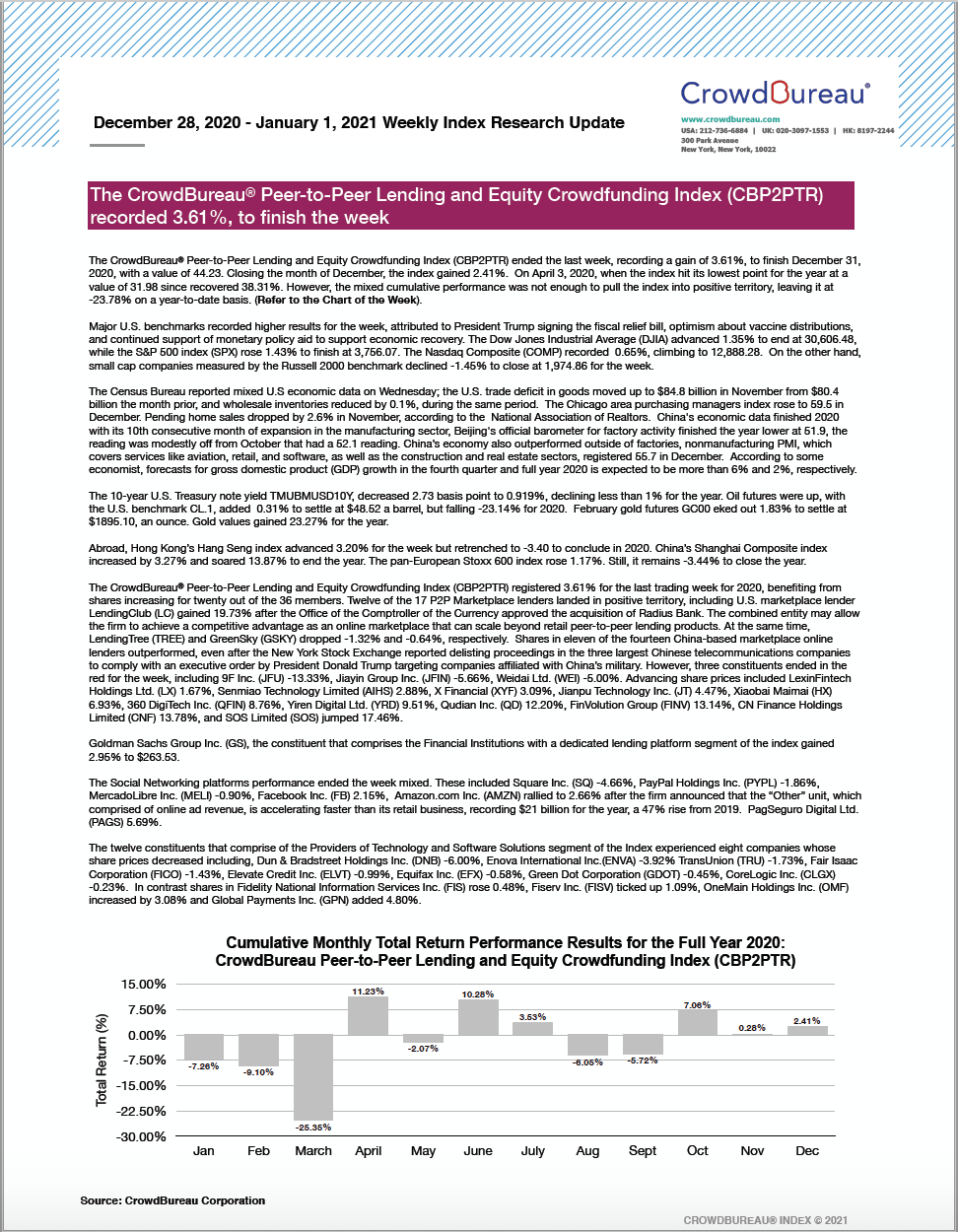

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the last week, recording a gain of 3.61%, to finish December 31, 2020, with a value of 44.23. Closing the month of December, the index gained 2.41%. On April 3, 2020, when the index hit its lowest point for the year at a value of 31.98 since recovered 38.31%. However, the mixed cumulative performance was not enough to pull the index into positive territory, leaving it at -23.78% on a year-to-date basis. (Refer to the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) eked out 1.35%, to end the four-day trading week

December 21 – December 25, 2020

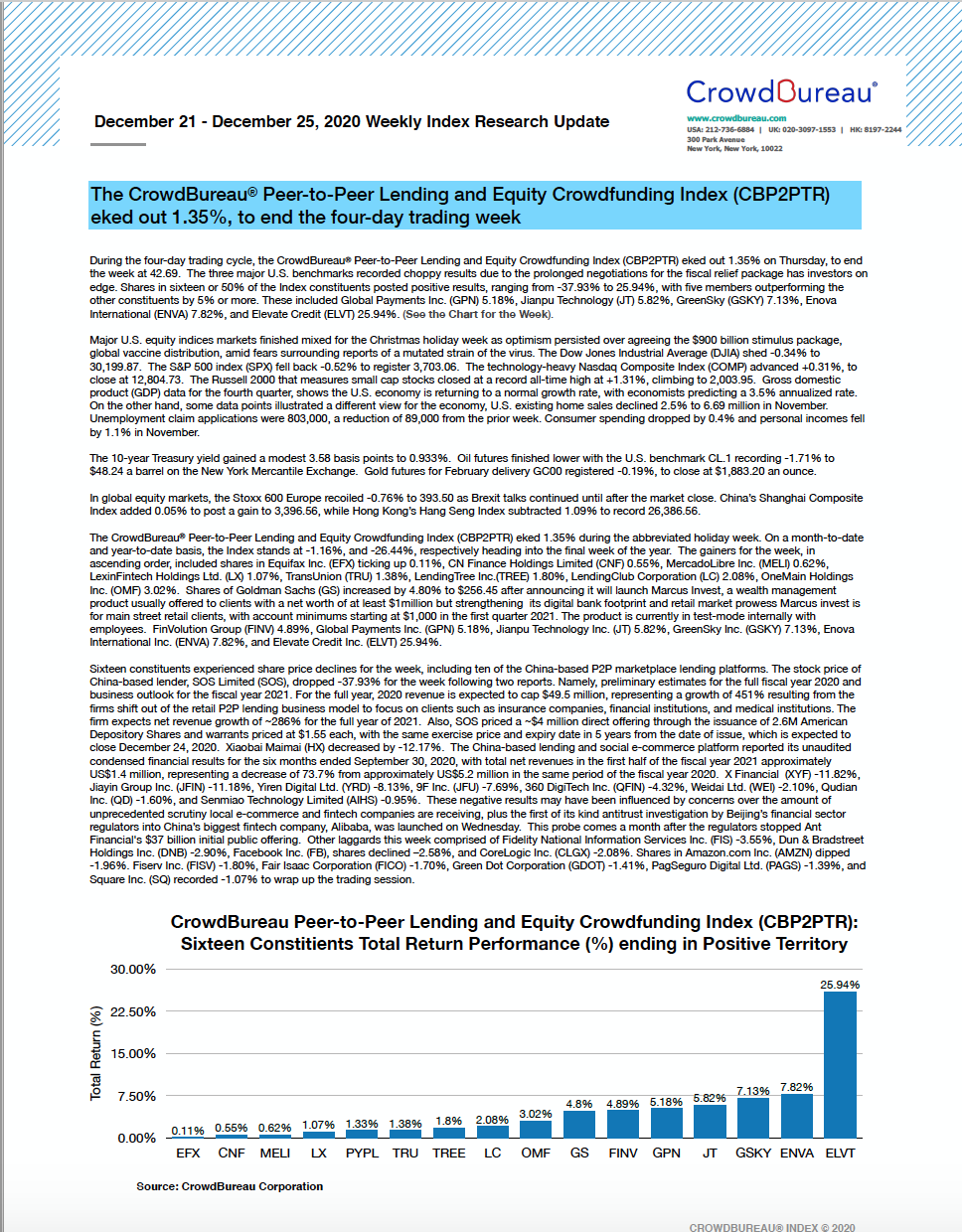

During the four-day trading cycle, the CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) eked out 1.35% on Thursday, to end the week at 42.69. The three major U.S. benchmarks recorded choppy results due to the prolonged negotiations for the fiscal relief package has investors on edge. Shares in sixteen or 50% of the Index constituents posted positive results, ranging from -37.93% to 25.94%, with five members outperforming the other constituents by 5% or more. These included Global Payments Inc. (GPN) 5.18%, Jianpu Technology (JT) 5.82%, GreenSky (GSKY) 7.13%, Enova International (ENVA) 7.82%, and Elevate Credit (ELVT) 25.94%. (See the Chart for the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted -2.02% to finish the week

December 14 – December 18, 2020

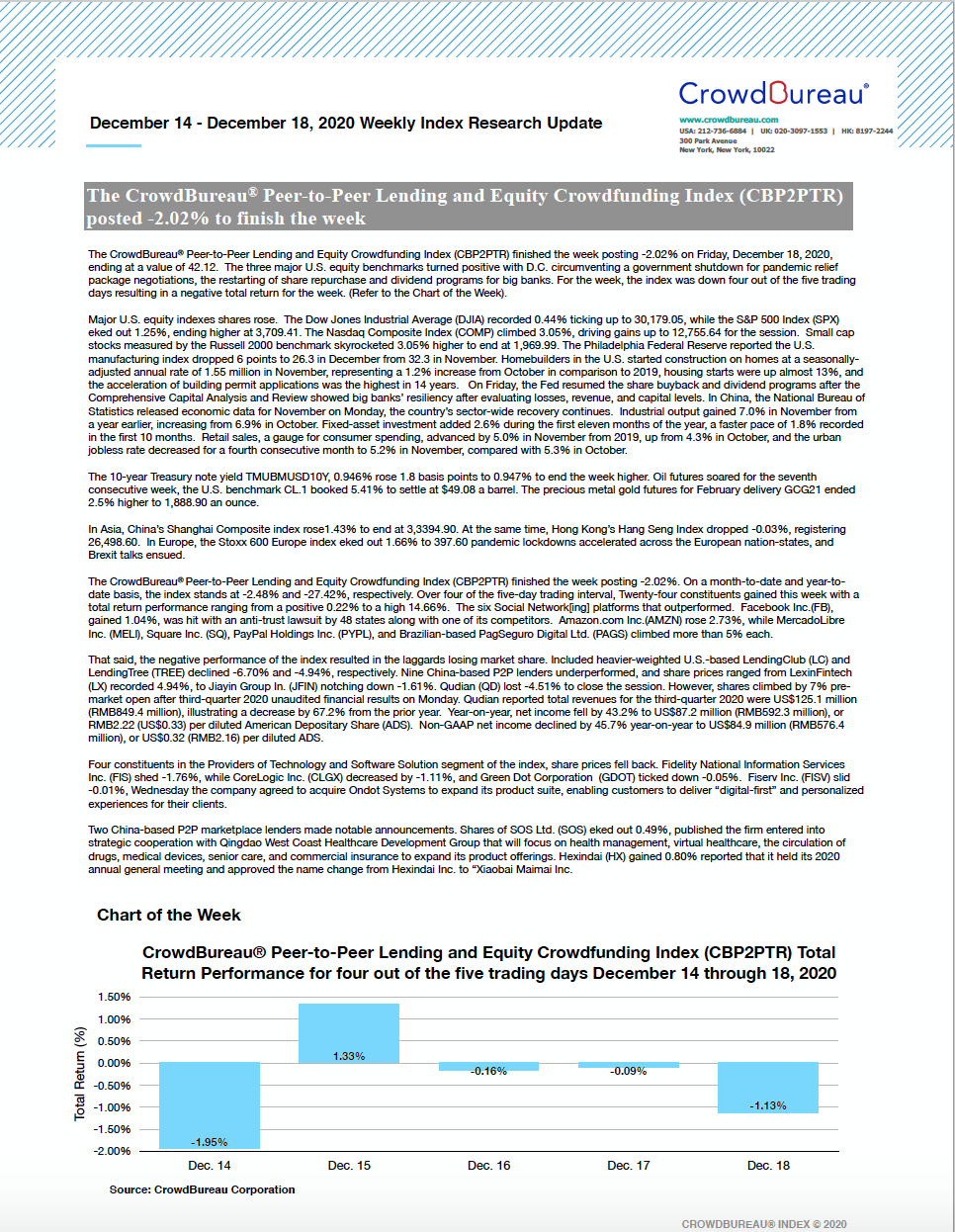

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week posting -2.02% on Friday, December 18, 2020, ending at a value of 42.12. The three major U.S. equity benchmarks turned positive with D.C. circumventing a government shutdown for pandemic relief package negotiations, the restarting of share repurchase and dividend programs for big banks. For the week, the index was down four out of the five trading days resulting in a negative total return for the week. (Refer to the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) increased 1.15% to reverse course, closing in positive territory for the week

December 7 – December 11, 2020

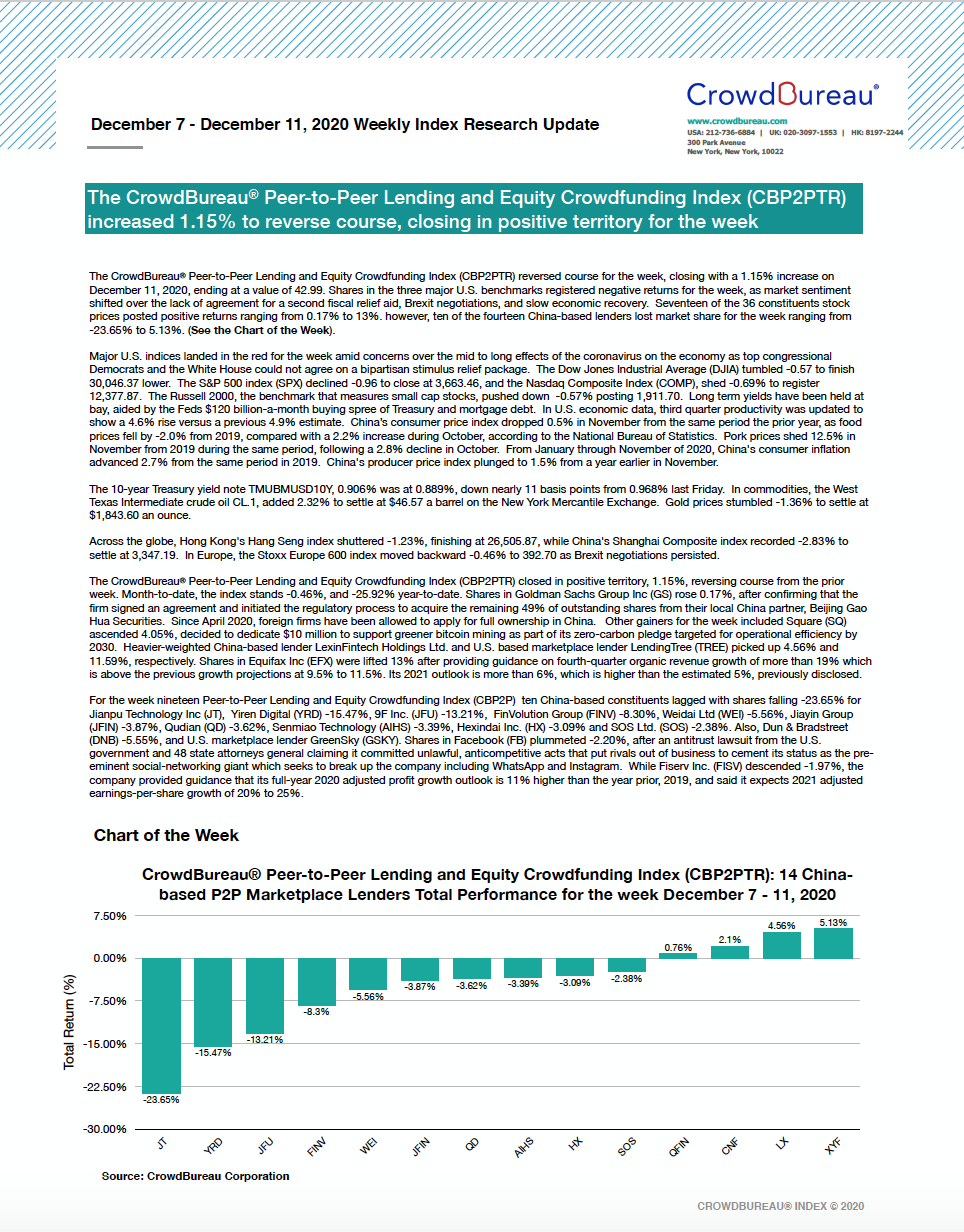

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) reversed course for the week, closing with a 1.15% increase on December 11, 2020, ending at a value of 42.99. Shares in the three major U.S. benchmarks registered negative returns for the week, as market sentiment shifted over the lack of agreement for a second fiscal relief aid, Brexit negotiations, and slow economic recovery. Seventeen of the 36 constituents stock prices posted positive returns ranging from 0.17% to 13%. however, ten of the fourteen China-based lenders lost market share for the week ranging from -23.65% to 5.13%. (See the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week lower, subtracting 1.60%

November 30 – December 4, 2020

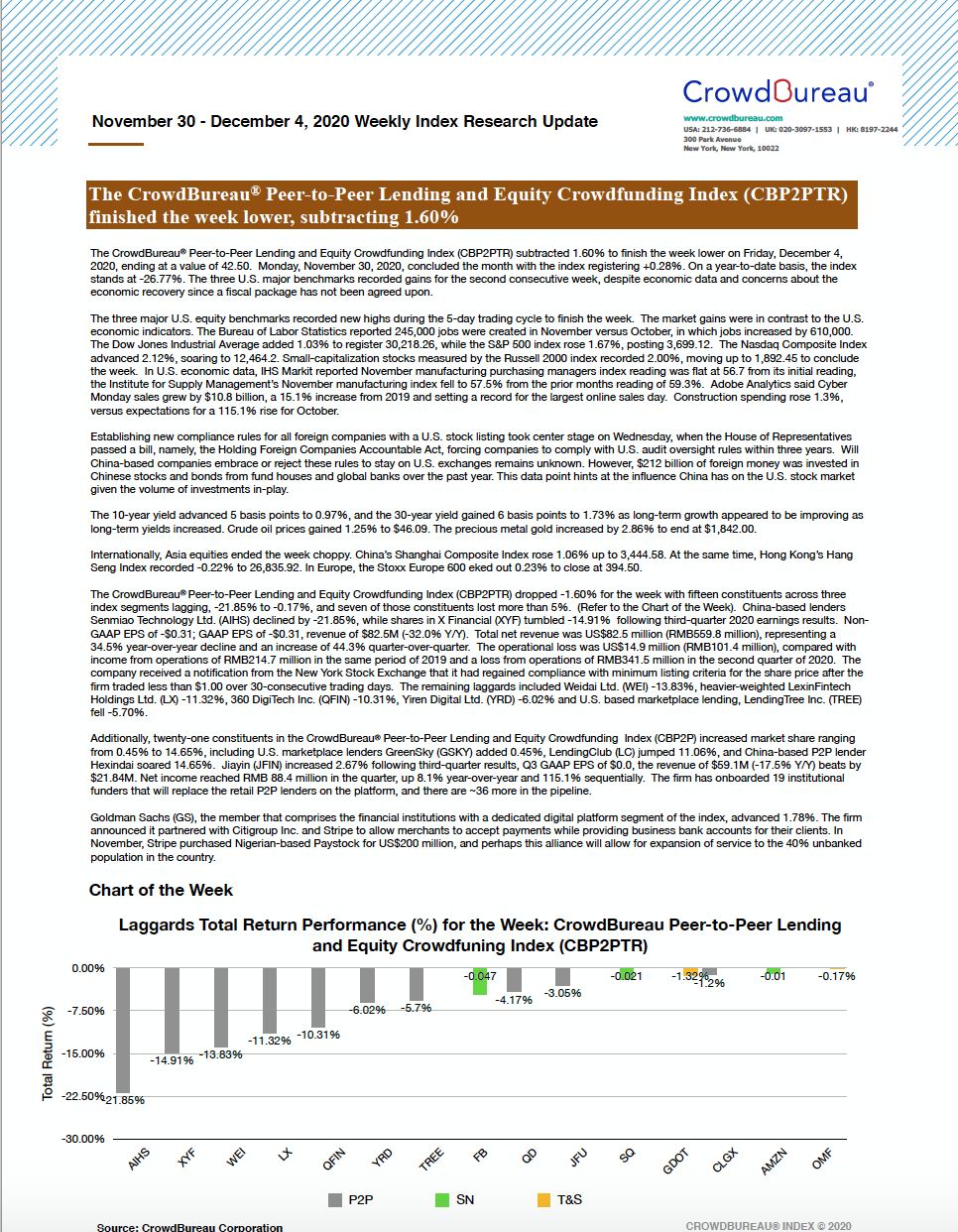

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) subtracted 1.60% to finish the week lower on Friday, December 4, 2020, ending at a value of 42.50. Monday, November 30, 2020, concluded the month with the index registering +0.28%. On a year-to-date basis, the index stands at -26.77%. The three U.S. major benchmarks recorded gains for the second consecutive week, despite economic data and concerns about the economic recovery since a fiscal package has not been agreed upon.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) reversed course, to advance 2.16% for the week

November 23 – November 27, 2020

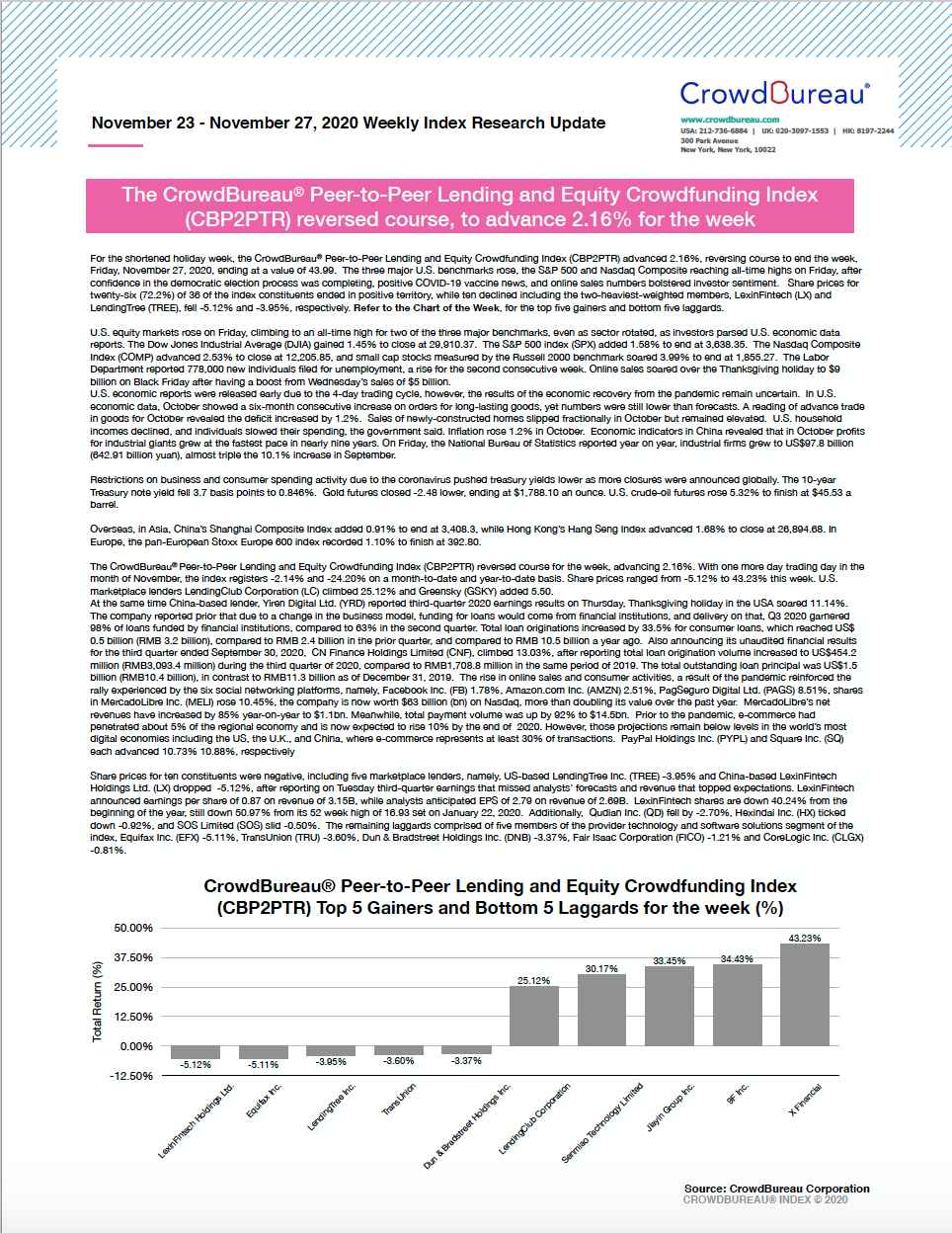

For the shortened holiday week, the CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) advanced 2.16%, reversing course to end the week, Friday, November 27, 2020, ending at a value of 43.99. The three major U.S. benchmarks rose, the S&P 500 and Nasdaq Composite reaching all-time highs on Friday, after confidence in the democratic election process was completing, positive COVID-19 vaccine news, and online sales numbers bolstered investor sentiment. Share prices for twenty-six (72.2%) of 36 of the index constituents ended in positive territory, while ten declined including the two-heaviest-weighted members, LexinFintech (LX) and LendingTree (TREE), fell -5.12% and -3.95%, respectively. Refer to the Chart of the Week, for the top five gainers and bottom five laggards.

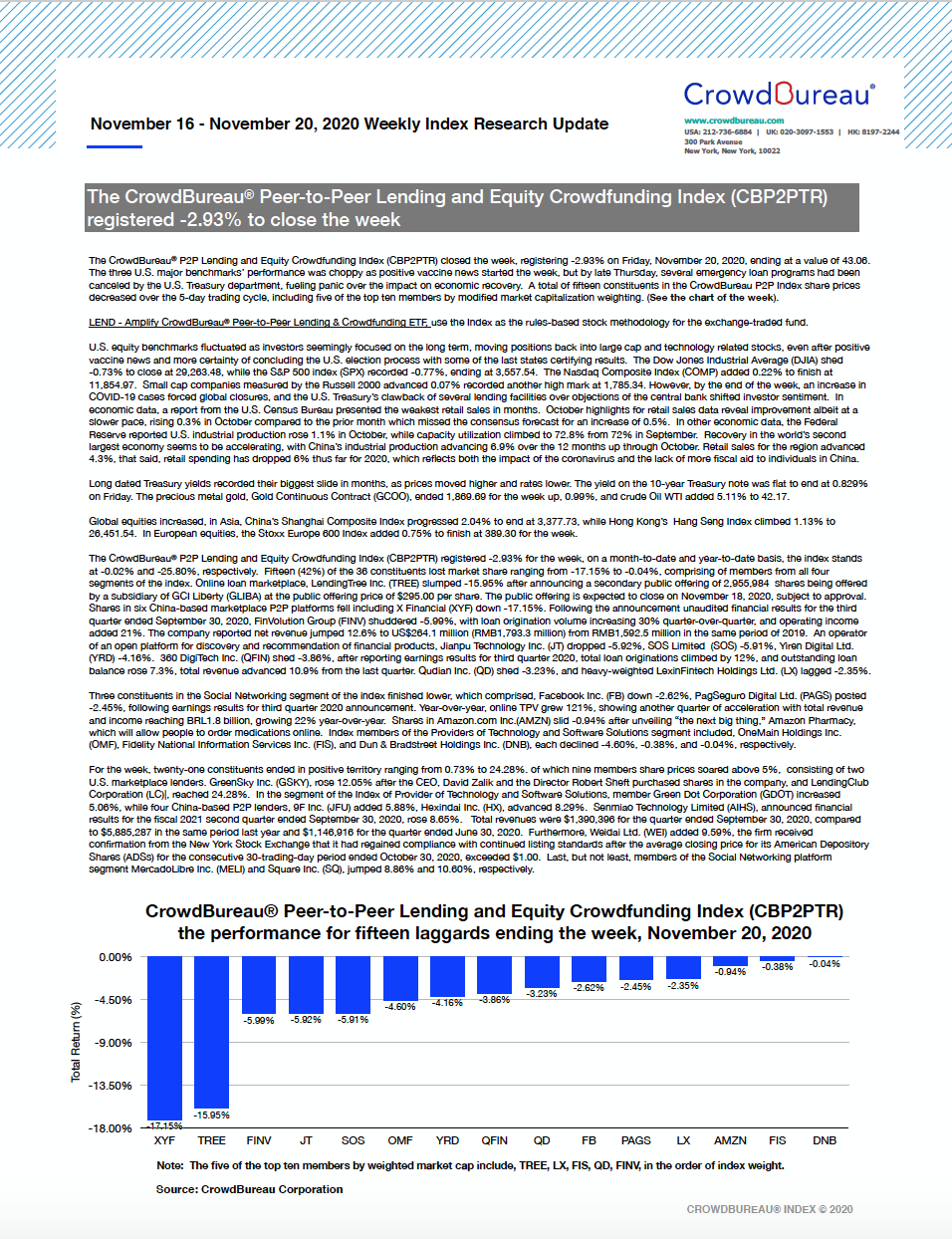

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered -2.93%, to close the week

November 16 – November 20, 2020

The CrowdBureau® P2P Lending and Equity Crowdfunding Index (CBP2PTR) closed the week, registering -2.93% on Friday, November 20, 2020, ending at a value of 43.06. The three U.S. major benchmarks’ performance was choppy as positive vaccine news started the week, but by late Thursday, several emergency loan programs had been canceled by the U.S. Treasury department, fueling panic over the impact on economic recovery. A total of fifteen constituents in the CrowdBureau P2P Index share prices decreased over the 5-day trading cycle, including five of the top ten members by modified market capitalization weighting. (See the chart of the week).

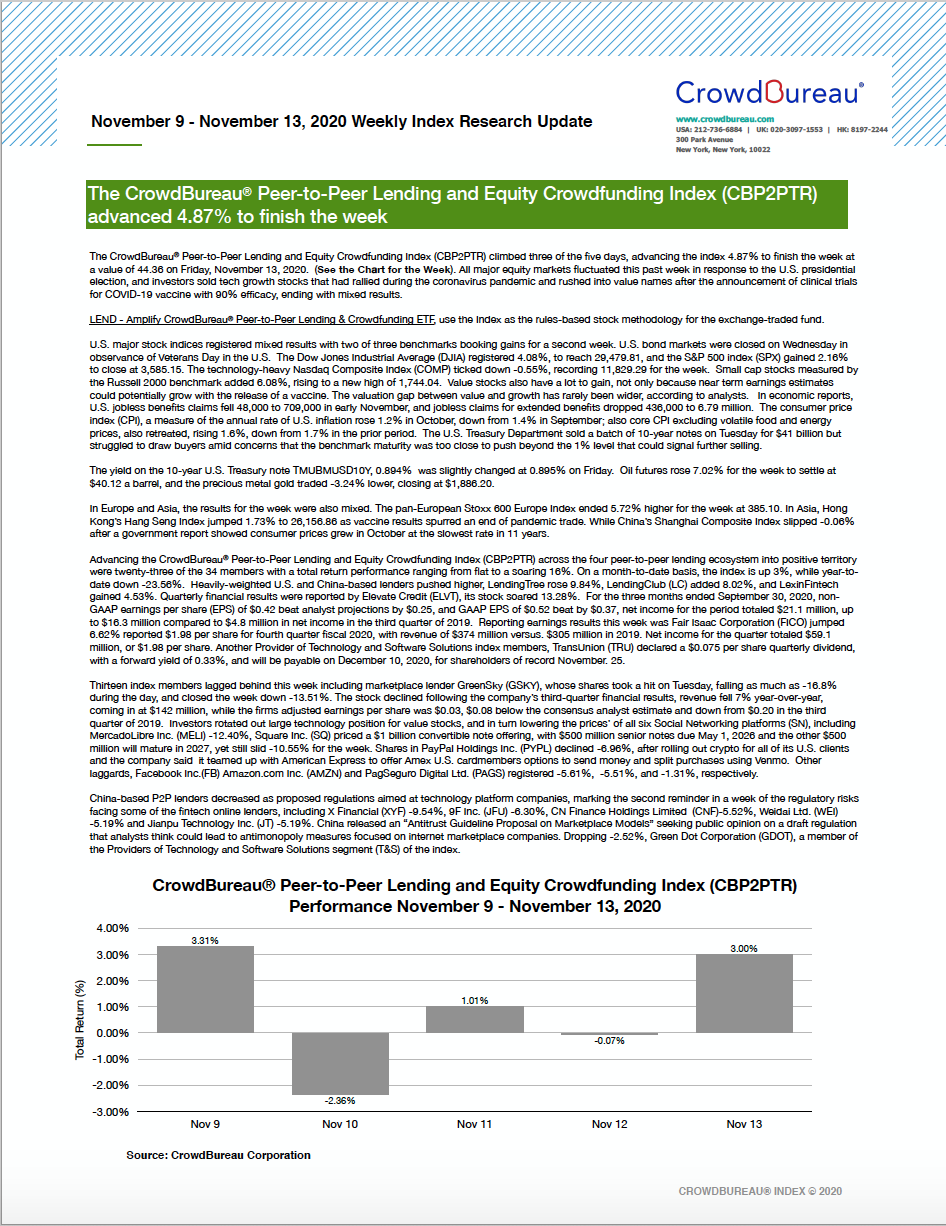

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) advanced 4.87%, to finish the week

November 9 – November 13, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) climbed three of the five days, advancing the index 4.87% to finish the week at a value of 44.36 on Friday, November 13, 2020. (See the Chart for the Week). All major equity markets fluctuated this past week in response to the U.S. presidential election, and investors sold tech growth stocks that had rallied during the coronavirus pandemic and rushed into value names after the announcement of clinical trials for COVID-19 vaccine with 90% efficacy, ending with mixed results.

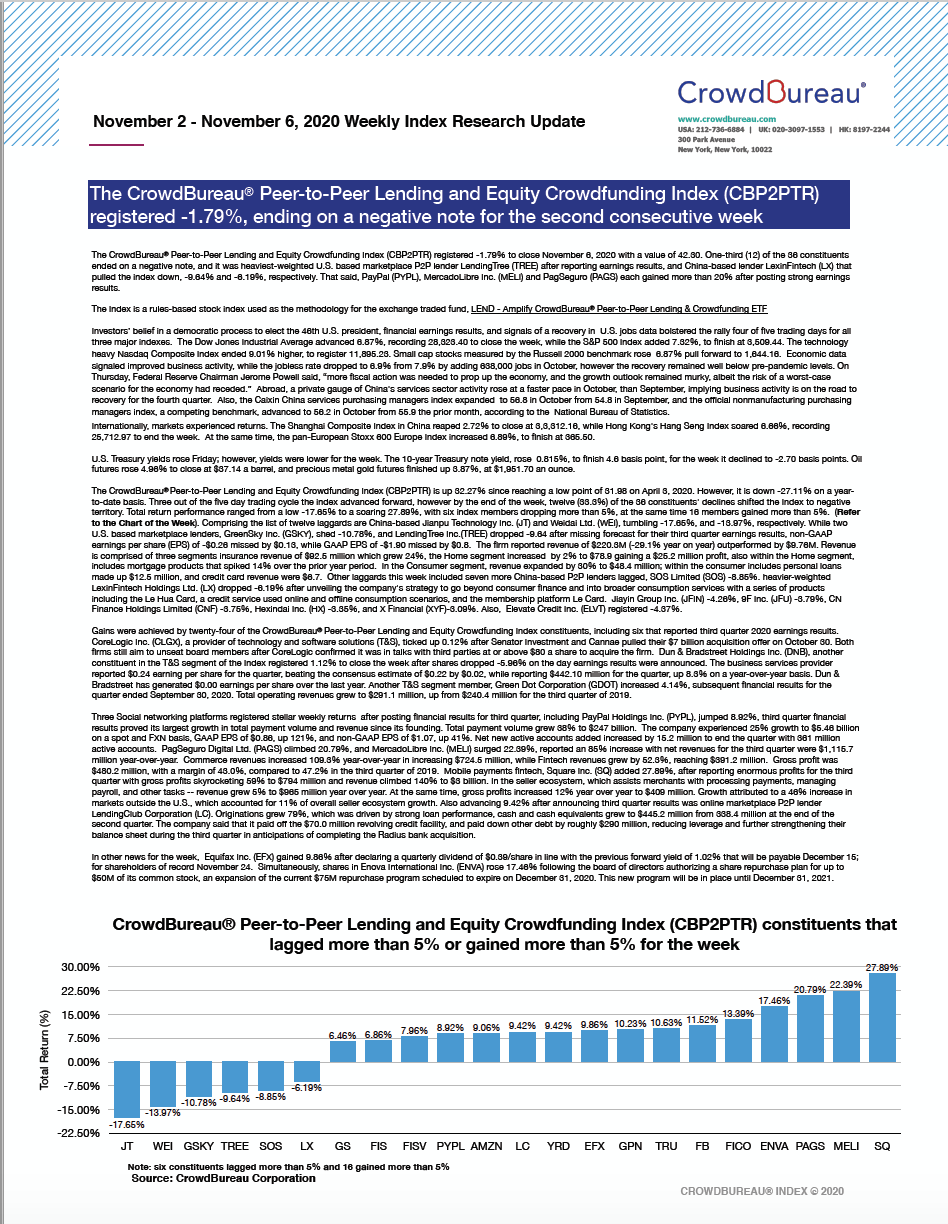

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered -1.79%, ending on a negative note for the second consecutive week

November 2 – November 6, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered -1.79% to close November 6, 2020 with a value of 42.30. One-third (12) of the 36 constituents ended on a negative note, and it was heaviest-weighted U.S. based marketplace P2P lender LendingTree (TREE) after reporting earnings results, and China-based lender LexinFintech (LX) that pulled the index down, -9.64% and -6.19%, respectively. That said, Square (SQ), MercadoLibre Inc. (MELI) and PagSeguro (PAGS) each gained more than 20% after posting strong earnings results.

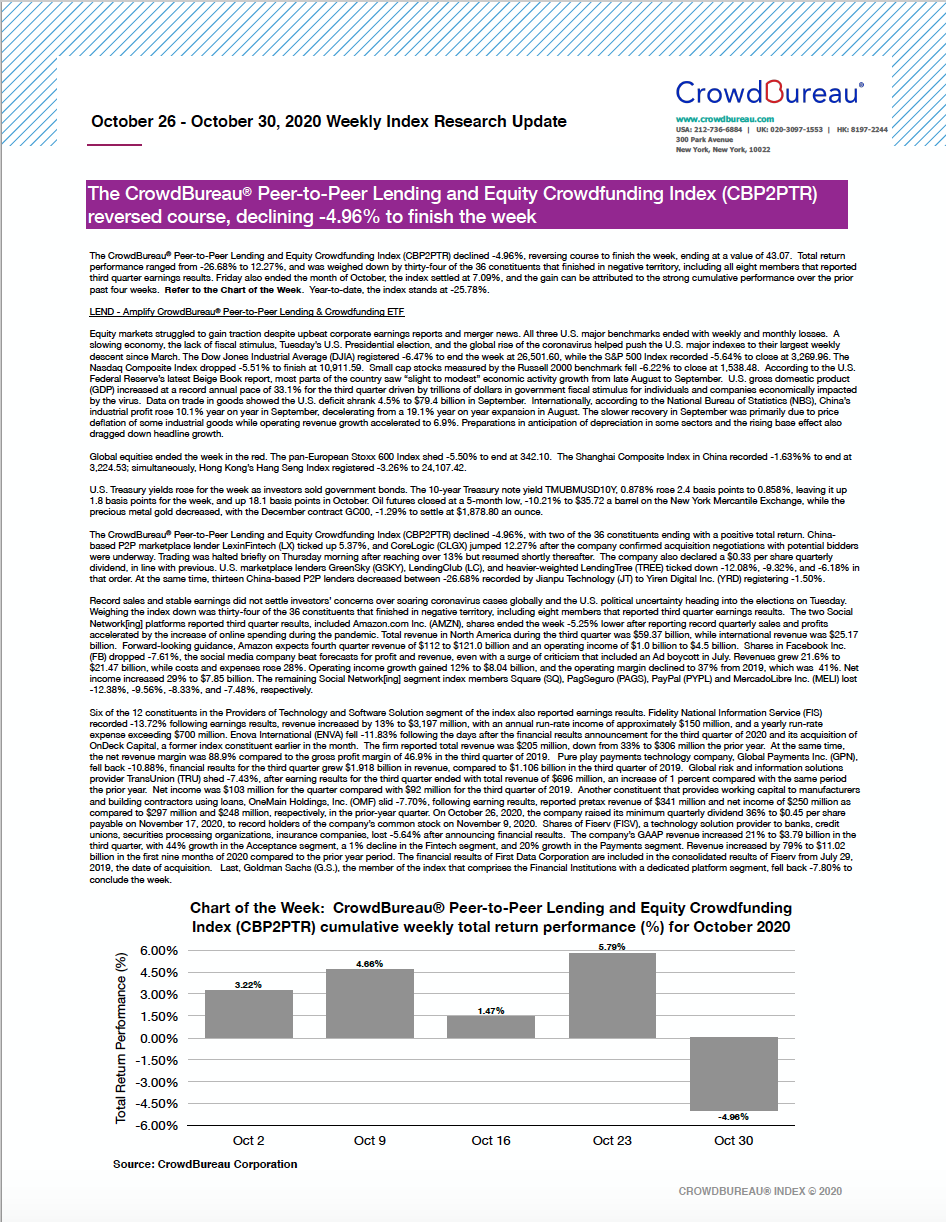

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) reversed course, declining -4.96% to finish the week

October 26 – October 30, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) declined -4.96%, reversing course to finish the week, ending at a value of 43.07. Total return performance ranged from -26.68% to 12.27%, and was weighed down by thirty-four of the 36 constituents that finished in negative territory, including all eight members that reported third quarter earnings results. Friday also ended the month of October, the index settled at 7.09%, and the gain can be attributed to the strong cumulative performance over the prior four weeks. Refer to the Chart of the Week. Year-to-date, the index stands at -25.78%.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) returned 5.79%, surging for the fourth straight week

October 19 – October 23, 2020

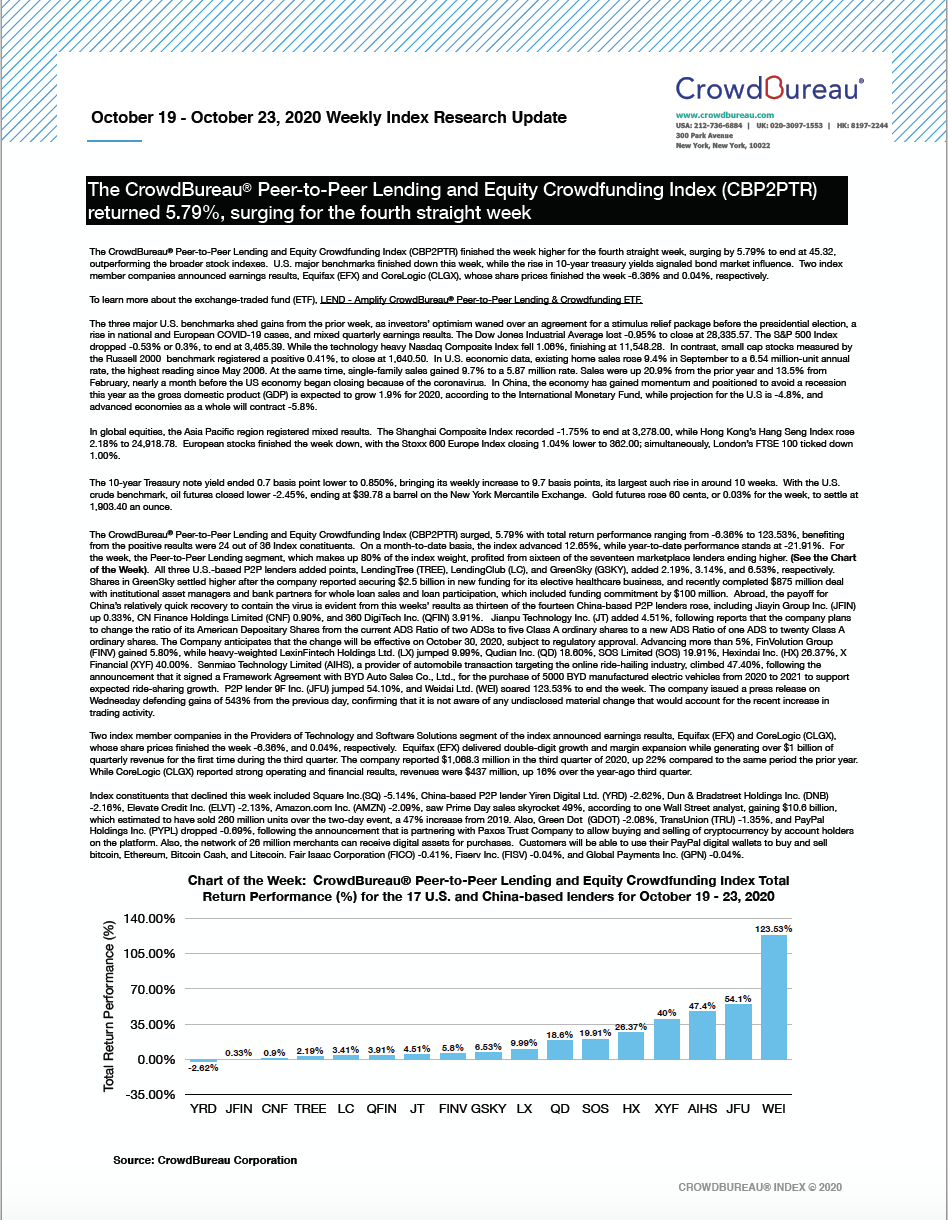

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week higher for the fourth straight week, surging by 5.79% to end at 45.32, outperforming the broader stock indexes. U.S. major benchmarks finished down this week, while the rise in 10-year treasury yields signaled bond market influence. Two index member companies announced earnings results, Equifax (EFX) and CoreLogic (CLGX), whose share prices finished the week -6.36% and 0.04%, respectively.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) increased 1.47% to close in positive territory for the third consecutive week

October 12 – October 16, 2020

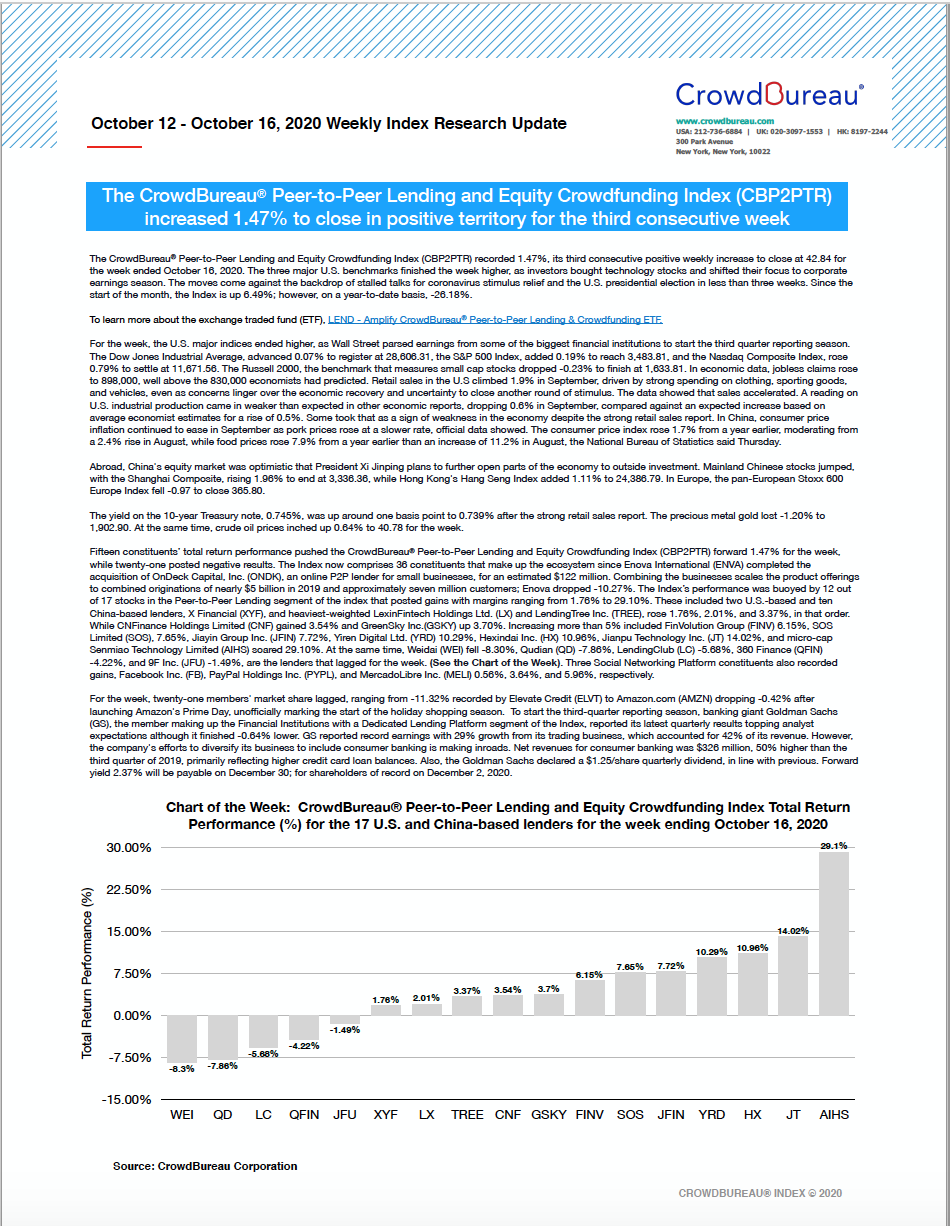

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded 1.47%, its third consecutive positive weekly increase to close at 42.84 for the week ended October 16, 2020. The three major U.S. benchmarks finished the week higher, as investors bought technology stocks and shifted their focus to corporate earnings season. The moves come against the backdrop of stalled talks for coronavirus stimulus relief and the U.S. presidential election in less than three weeks. Since the start of the month, the Index is up 6.49%; however, on a year-to-date basis, -26.18%.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) advanced 4.66% to end the week with a value of 42.22

October 5 – October 9, 2020

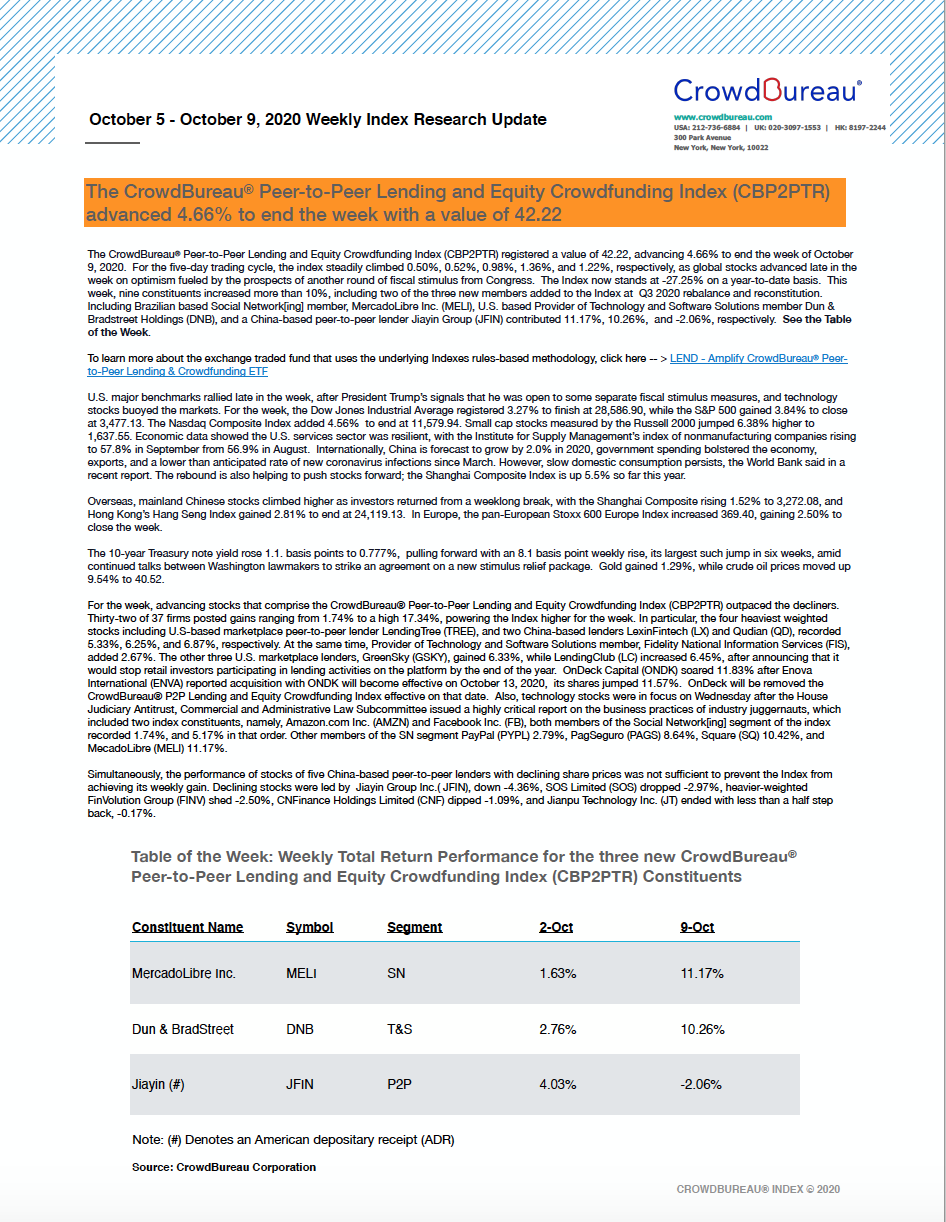

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered a value of 42.22, advancing 4.66% to end the week of October 9, 2020. For the five-day trading cycle, the index steadily climbed 0.50%, 0.52%, 0.98%, 1.36%, and 1.22%, respectively, as global stocks advanced late in the week on optimism fueled by the prospects of another round of fiscal stimulus from Congress. The Index now stands at -27.25% on a year-to-date basis. This week, nine constituents increased more than 10%, including two of the three new members added to the Index at Q3 2020 rebalance and reconstitution. Including Brazilian based Social Network[ing] member, MercadoLibre Inc. (MELI), U.S. based Provider of Technology and Software Solutions member Dun & Bradstreet Holdings (DNB), and a China-based peer-to-peer lender Jiayin Group (JFIN) contributed 11.17%, 10.26%, and -2.06%, respectively. See the Table of the Week.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered an increase of 3.22% after the Q3 2020 Rebalancing and Reconstitution

September 28 – October 2, 2020

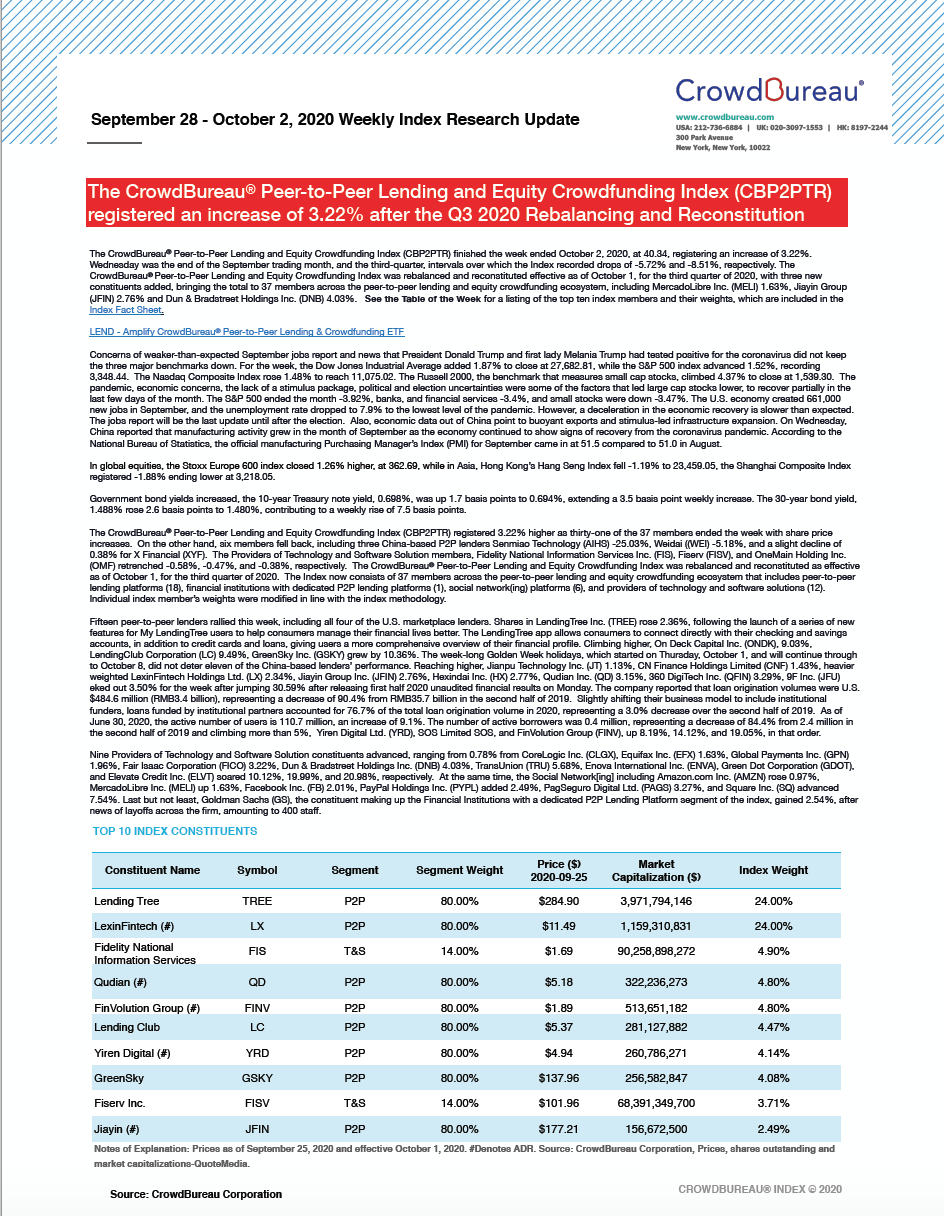

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week ended October 2, 2020, at 40.34, registering an increase of 3.22%. Wednesday was the end of the September trading month, and the third-quarter, intervals over which the Index recorded drops of -5.72% and -8.51%, respectively. The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index was rebalanced and reconstituted effective as of October 1, for the third quarter of 2020, with three new constituents added, bringing the total to 37 members across the peer-to-peer lending and equity crowdfunding ecosystem, including MercadoLibre Inc. (MELI) 1.63%, Jiayin Group (JFIN) 2.76% and Dun & Bradstreet Holdings Inc. (DNB) 4.03%. See the Table of the Week for a listing of the top ten index members and their weights, which are included in the Index Fact Sheet.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded a decline, registering -2.15% for the week

September 21 – September 25, 2020

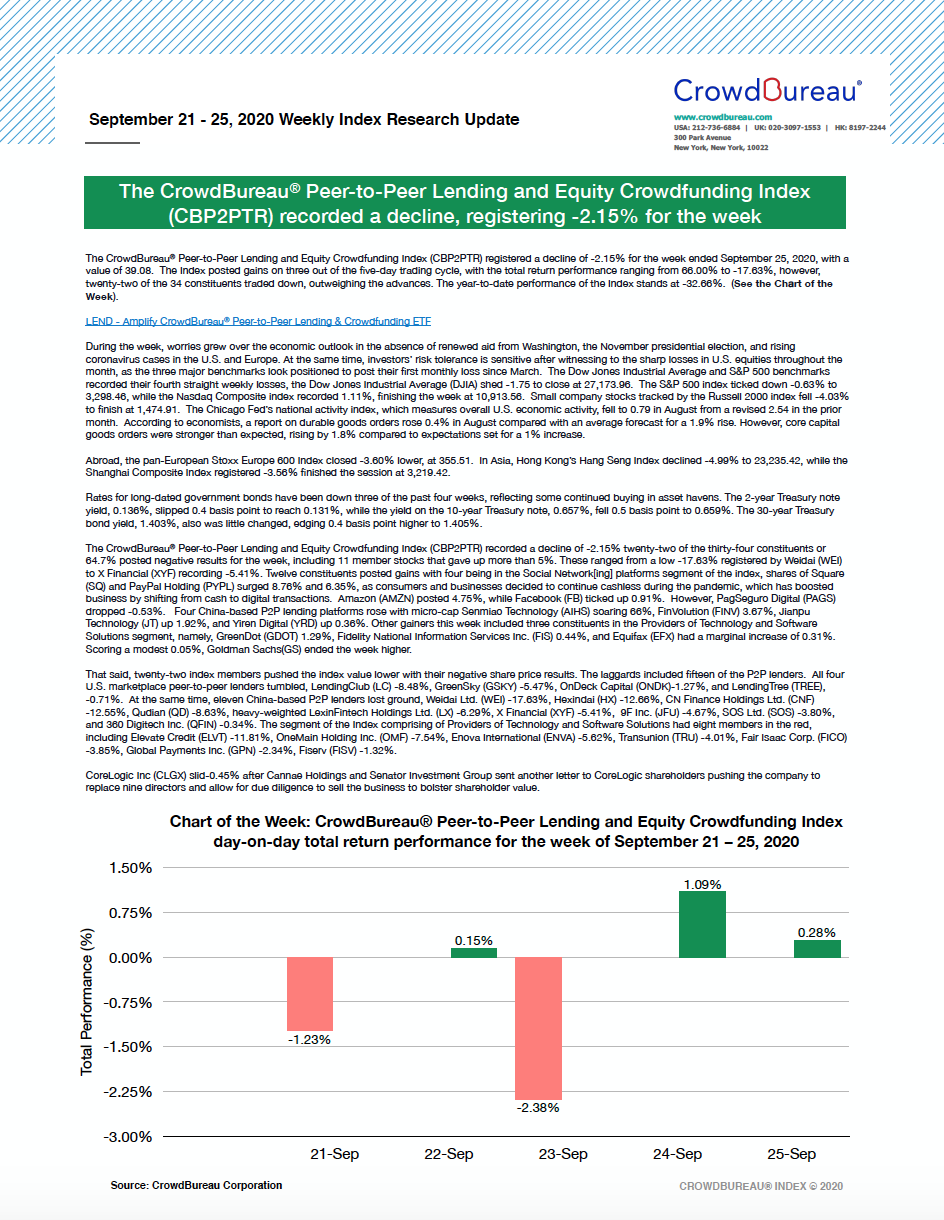

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered a decline of -2.15% for the week ended September 25, 2020, with a value of 39.08. The Index posted gains on three out of the five-day trading cycle, with the total return performance ranging from 66.00% to -17.63%, however, twenty-two of the 34 constituents traded down, outweighing the advances. The year-to-date performance of the Index stands at -32.66%. (See the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) reversed course after registering five weekly declines, recording a positive gain of 0.81%

September 14 – September 18, 2020

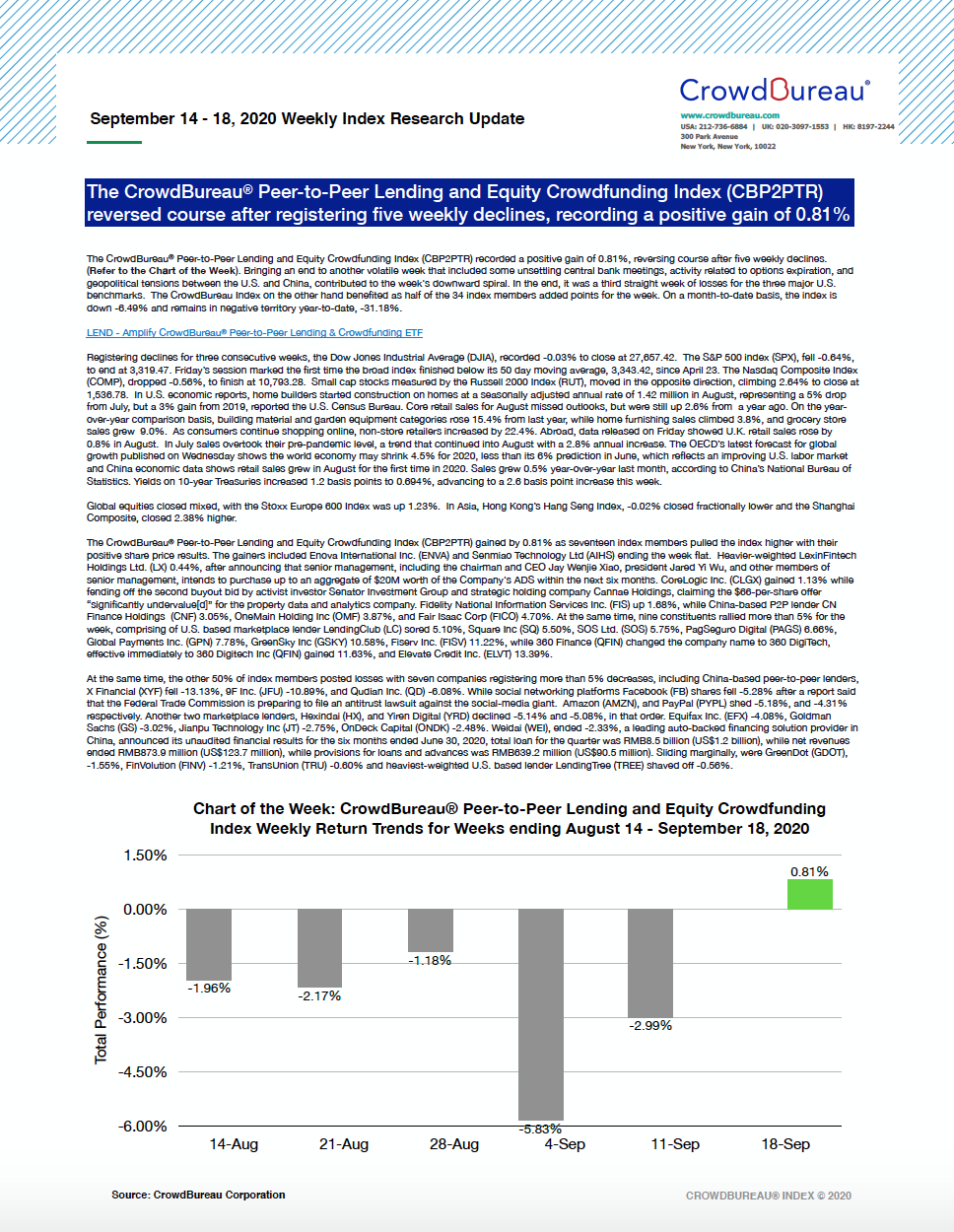

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded a positive gain of 0.81%, reversing course after five weekly declines. (Refer to the Chart of the Week). Bringing an end to another volatile week that included some unsettling central bank meetings, activity related to options expiration, and geopolitical tensions between the U.S. and China, contributed to the week’s downward spiral. In the end, it was three straight days of losses for the major U.S. benchmarks that pushed them lower. The CrowdBureau Index on the other hand benefited as half of the 34 index members added points for the week. On a month-to-date basis, the index is down -6.49% and remains in negative territory year-to-date, -31.18%.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) adds to last week’s loss, with a decrease of 2.99%

September 7 – September 11, 2020

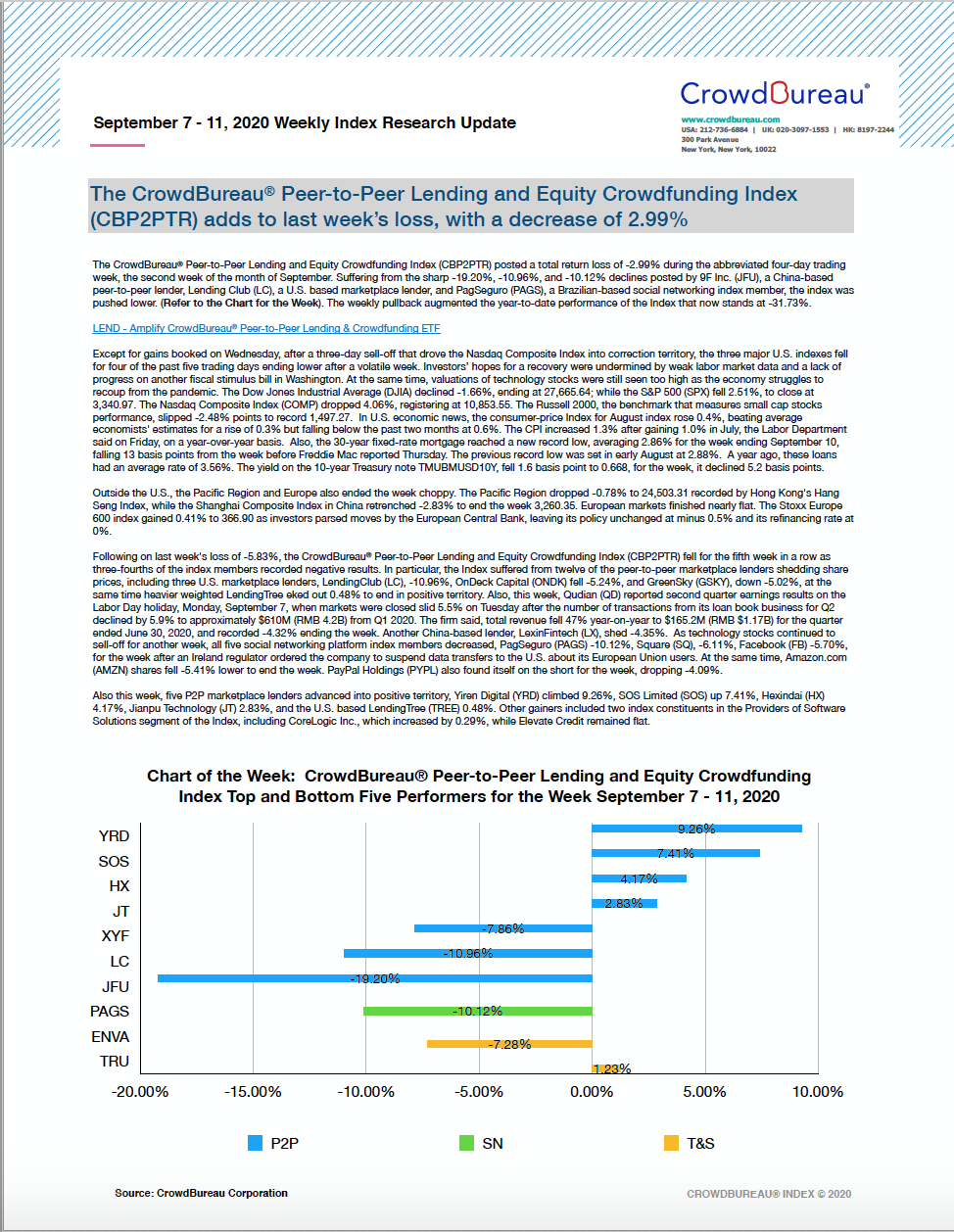

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted a total return loss of 2.99% during the abbreviated four-day trading week, the second week of the month of September. Suffering from the sharp -19.20%, -10.96%, and -10.12% declines posted by 9F Inc. (JFU), a China-based peer-to-peer lender, Lending Club (LC), a U.S. based marketplace lender, and PagSeguro (PAGS), a Brazilian-based social networking index member, the index was pushed lower. (Refer to the Chart for the Week). The weekly pullback augmented the year-to-date performance of the Index that now stands at -31.73%.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the week lower and posted -5.83%, its fourth consecutive weekly decline

August 31 – September 4, 2020

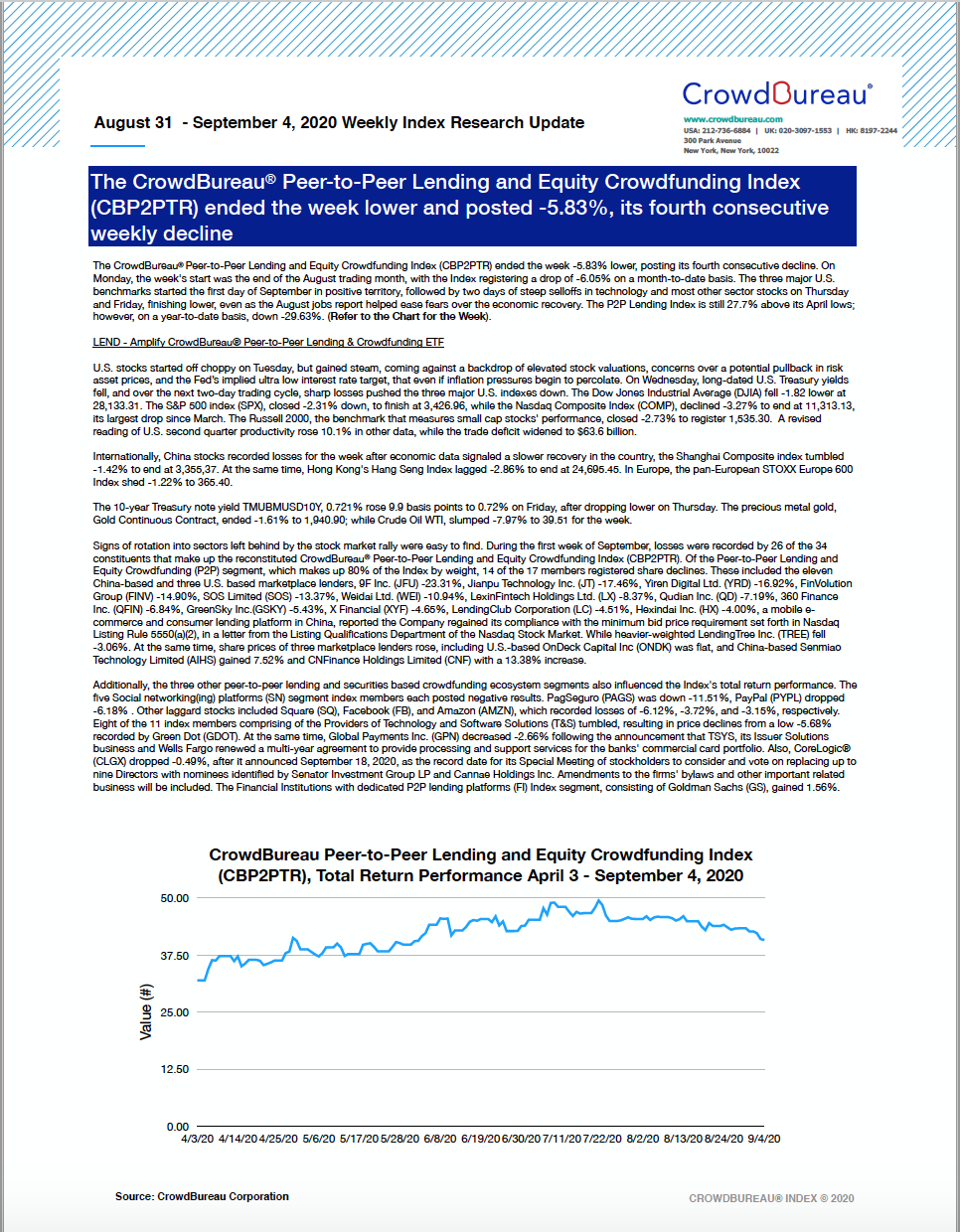

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the week -5.83% lower, posting its fourth consecutive decline. On Monday, the week’s start was the end of the August trading month, with the Index registering a drop of -6.05% on a month-to-date basis. The three major U.S. benchmarks started the first day of September in positive territory, followed by two days of steep selloffs in technology and most other sector stocks on Thursday and Friday, finishing lower, even as the August jobs report helped ease fears over the economic recovery. The P2P Lending Index is still 27.7% above its April lows; however, on a year-to-date basis, down -29.63%. (Refer to the Chart for the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted its third consecutive weekly decline, giving up 1.18%

August 24 – August 28, 2020

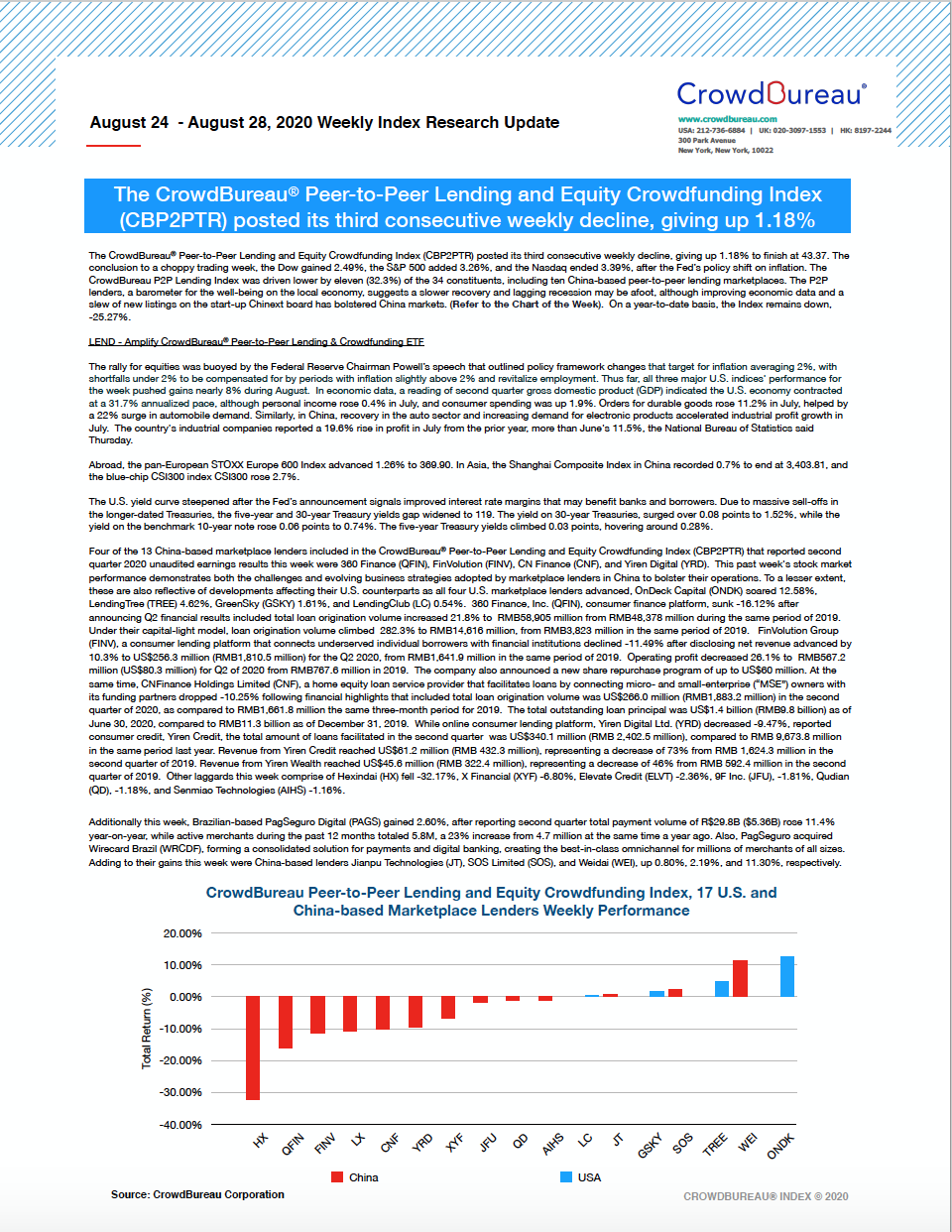

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted its third consecutive weekly decline, giving up 1.18% to finish at 43.37. The conclusion to a choppy trading week, the Dow gained 2.49%, the S&P 500 added 3.26%, and the Nasdaq ended 3.39%, after the Fed’s policy shift on inflation. The CrowdBureau P2P Lending Index was driven lower by eleven (32.3%) of the 34 constituents, including ten China-based peer-to-peer lending marketplaces. The P2P lenders, a barometer for the well-being on the local economy, suggests a slower recovery and lagging recession may be afoot, although improving economic data and a slew of new listings on the start-up Chinext board has bolstered China markets. (Refer to the Chart of the Week). On a year-to-date basis, the Index remains down, -25.27%.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) traded down -2.17%, to end the week

August 17 – August 21, 2020

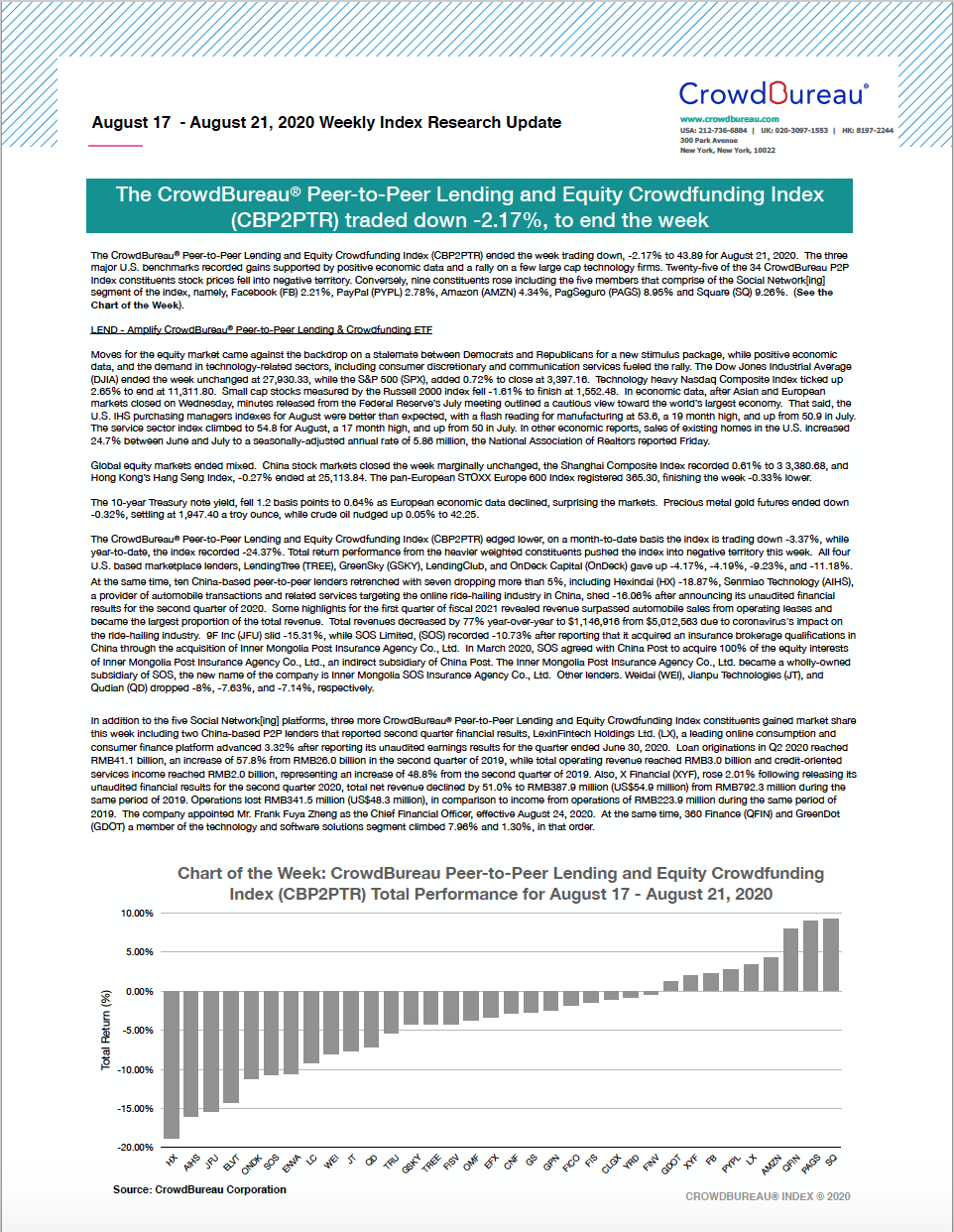

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the week trading down, -2.17% to 43.89 for August 21, 2020. The three major U.S. benchmarks recorded gains supported by positive economic data and a rally on a few large cap technology firms. Twenty-five of the 34 CrowdBureau P2P Index constituents stock prices fell into negative territory. Conversely, nine constituents rose including the five members that comprise of the Social Network[ing] segment of the index, namely, Facebook (FB) 2.21%, PayPal (PYPL) 2.78%, Amazon (AMZN) 4.34%, PagSeguro (PAGS) 8.95% and Square (SQ) 9.26%. (See the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered a negative total return for the week, dropping -1.96%

August 10 – August 14, 2020

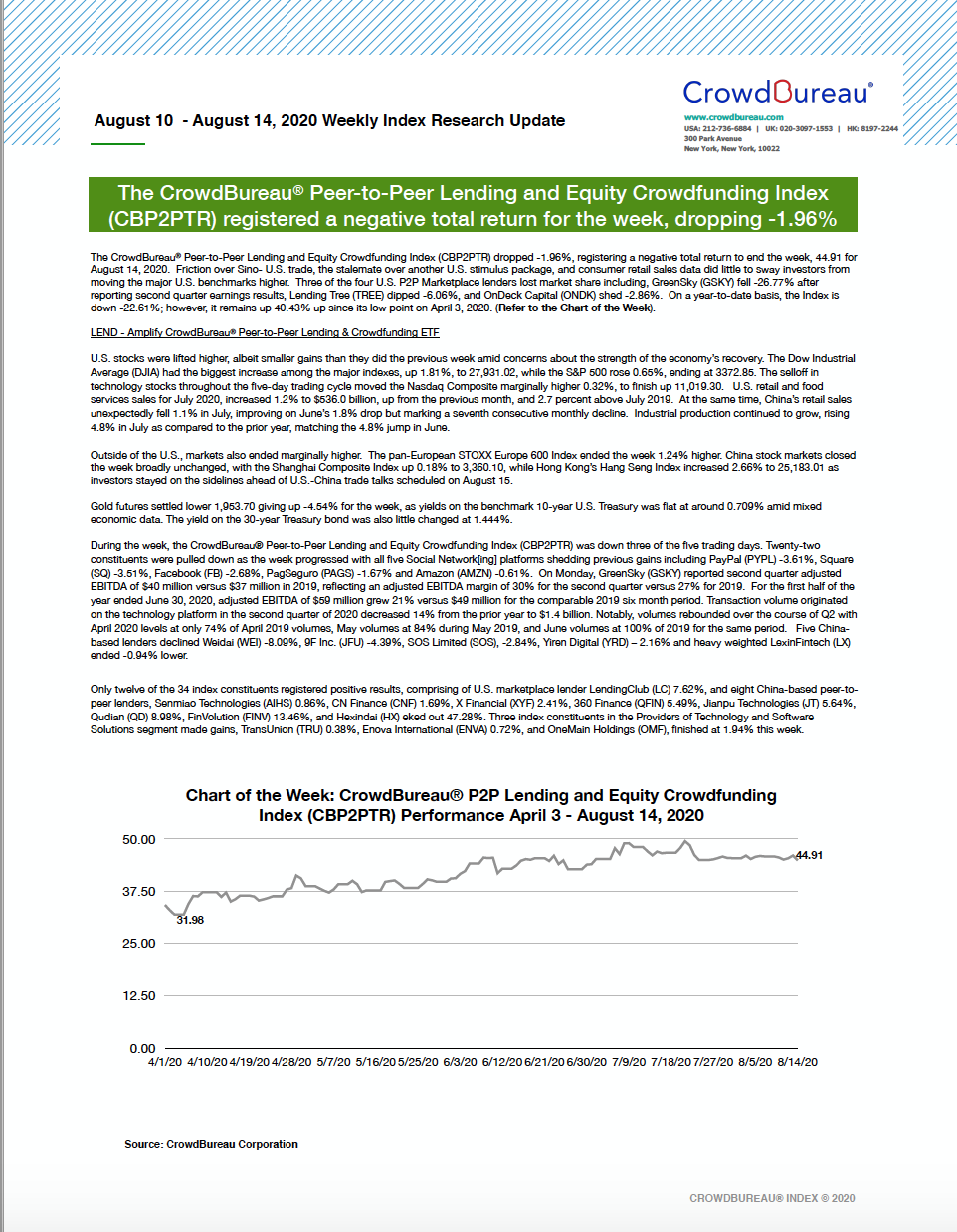

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) dropped -1.96%, registering a negative total return to end the week, 44.91 for August 14, 2020. Friction over Sino- U.S. trade, the stalemate over another U.S. stimulus package, and consumer retail sales data did little to sway investors from moving the major U.S. benchmarks higher. Three of the four U.S. P2P Marketplace lenders lost market share including, GreenSky (GSKY) fell -26.77% after reporting second quarter earnings results, Lending Tree (TREE) dipped -6.06%, and OnDeck Capital (ONDK) shed -2.86%. On a year-to-date basis, the Index is down -22.61%; however, it remains up 40.43% since its low point on April 3, 2020. (Refer to the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded a positive gain for the week, advancing 0.88%

August 3 – August 7, 2020

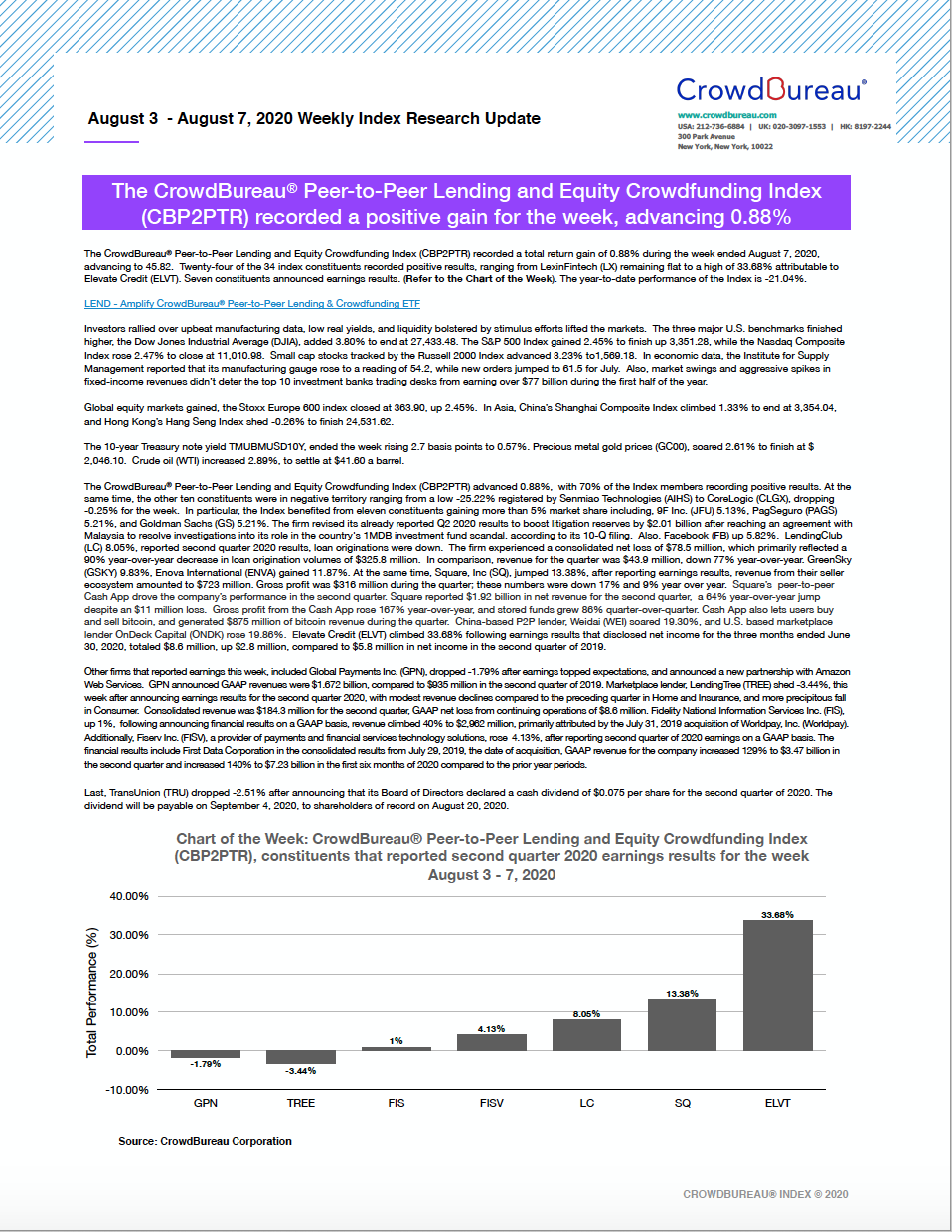

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded a total return gain of 0.88% during the week ended August 7, 2020, advancing to 45.82. Twenty-four of the 34 index constituents recorded positive results, ranging from LexinFintech (LX) remaining flat to a high of 33.68% attributable to Elevate Credit (ELVT). Seven constituents announced earnings results. (Refer to the Chart of the Week). The year-to-date performance of the Index is -21.04%.

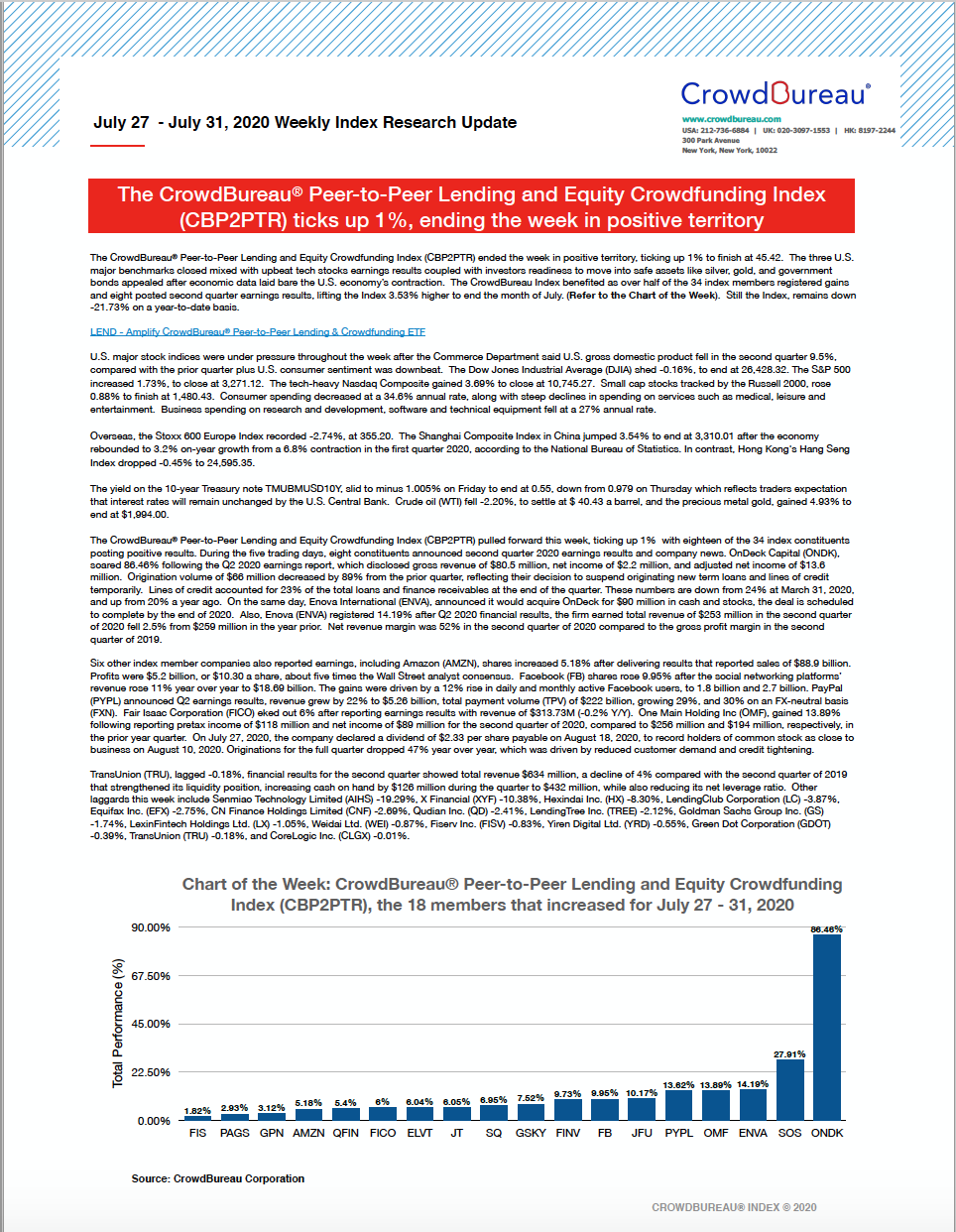

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ticked up 1%, ending the week in positive territory

July 27 – July 31, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the week in positive territory, ticking up 1% to finish at 45.42. The three U.S. major benchmarks closed mixed with upbeat tech stocks earnings results coupled with investors readiness to move into safe assets like silver, gold, and government bonds appealed after economic data laid bare the U.S. economy’s contraction. The CrowdBureau Index benefited as over half of the 34 index members registered gains and eight posted second quarter earnings results, lifting the Index 3.53% higher to end the month of July. (Refer to the Chart of the Week). Still the Index, remains down -21.73% on a year-to-date basis.

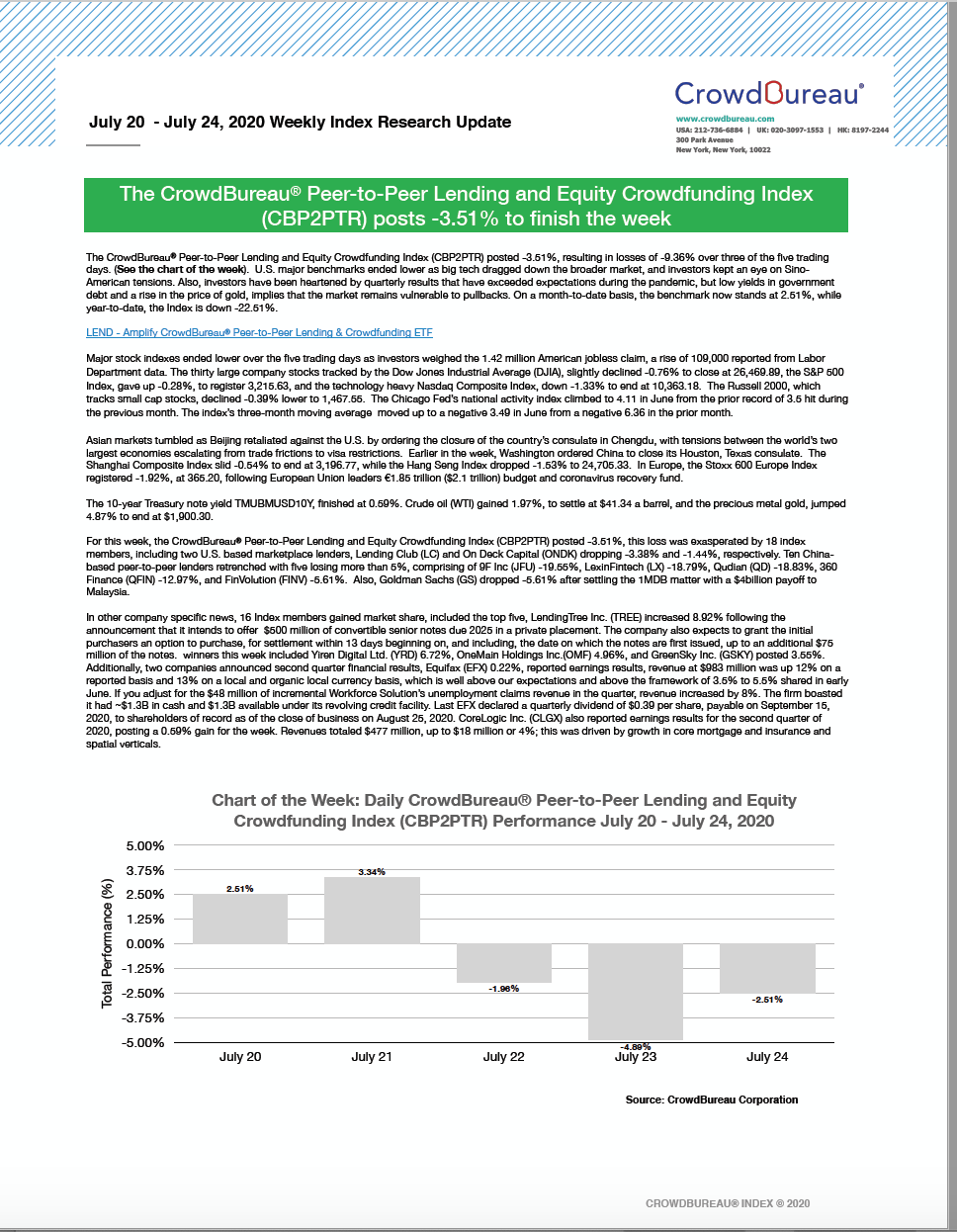

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posts -3.51 to finish the week

July 20 – July 24, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted -3.51%, resulting in losses of -9.36% over three of the five trading days. (See the chart of the week). U.S. major benchmarks ended lower as big tech dragged down the broader market, and investors kept an eye on Sino-American tensions. Also, investors have been heartened by quarterly results that have exceeded expectations during the pandemic, but low yields in government debt and a rise in the price of gold, implies that the market remains vulnerable to pullbacks. On a month-to-date basis, the benchmark now stands at 2.51%, while year-to-date, the Index is down -22.51%.

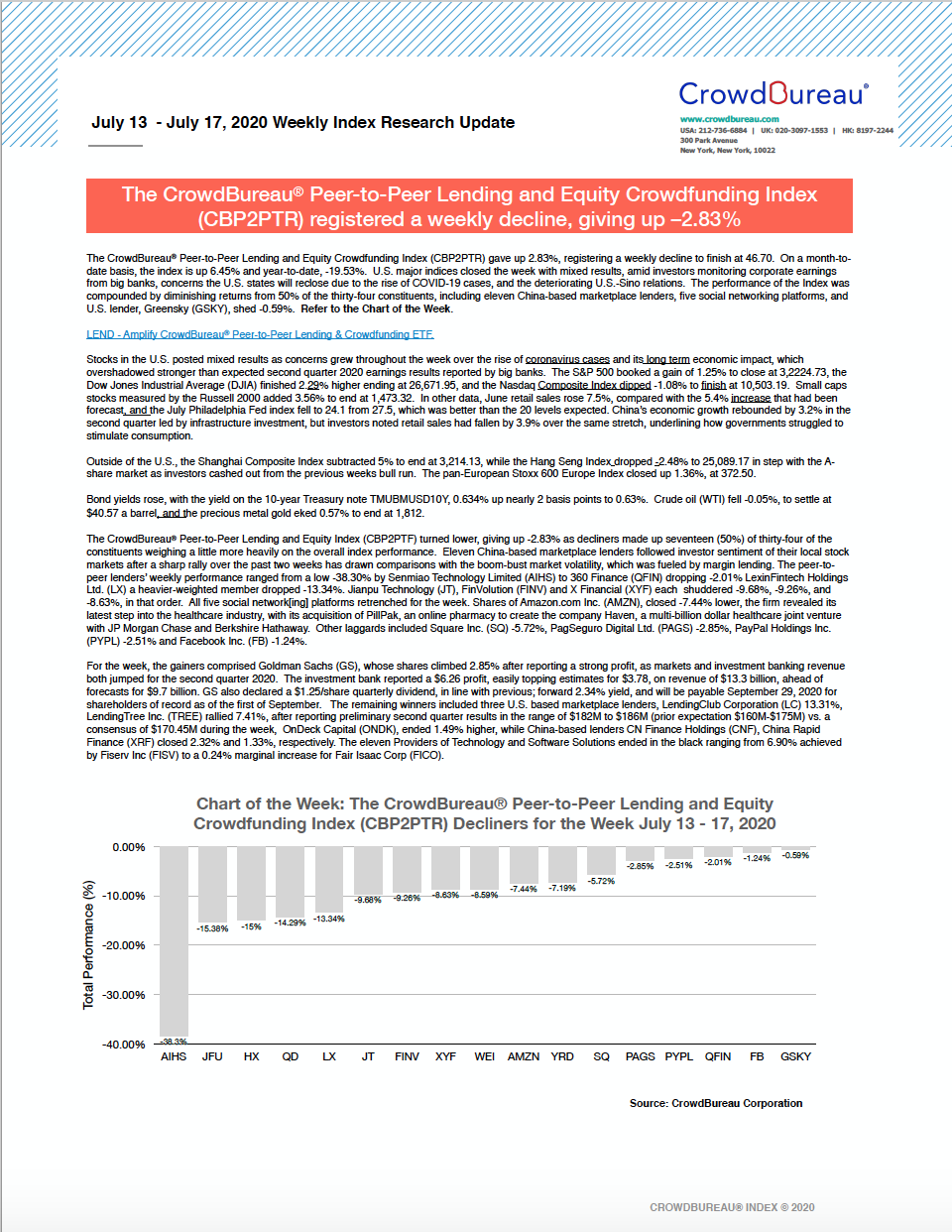

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered a weekly decline, giving up –2.83%

July 13 – July 17, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) gave up 2.83%, registering a weekly decline to finish at 46.70. On a month-to-date basis, the index is up 6.45% and year-to-date, -19.53%. U.S. major indices closed the week with mixed results, amid investors monitoring corporate earnings from big banks, how the rise of COVID-19 cases could impact the economy, and the deteriorating U.S.-Sino relations. The performance of the Index was compounded by diminishing returns from 50% of the thirty-four constituents, including eleven China-based marketplace lenders, five social networking platforms, and U.S. lender, GreenSky (GSKY), shed -0.59%. Refer to the Chart of the Week.

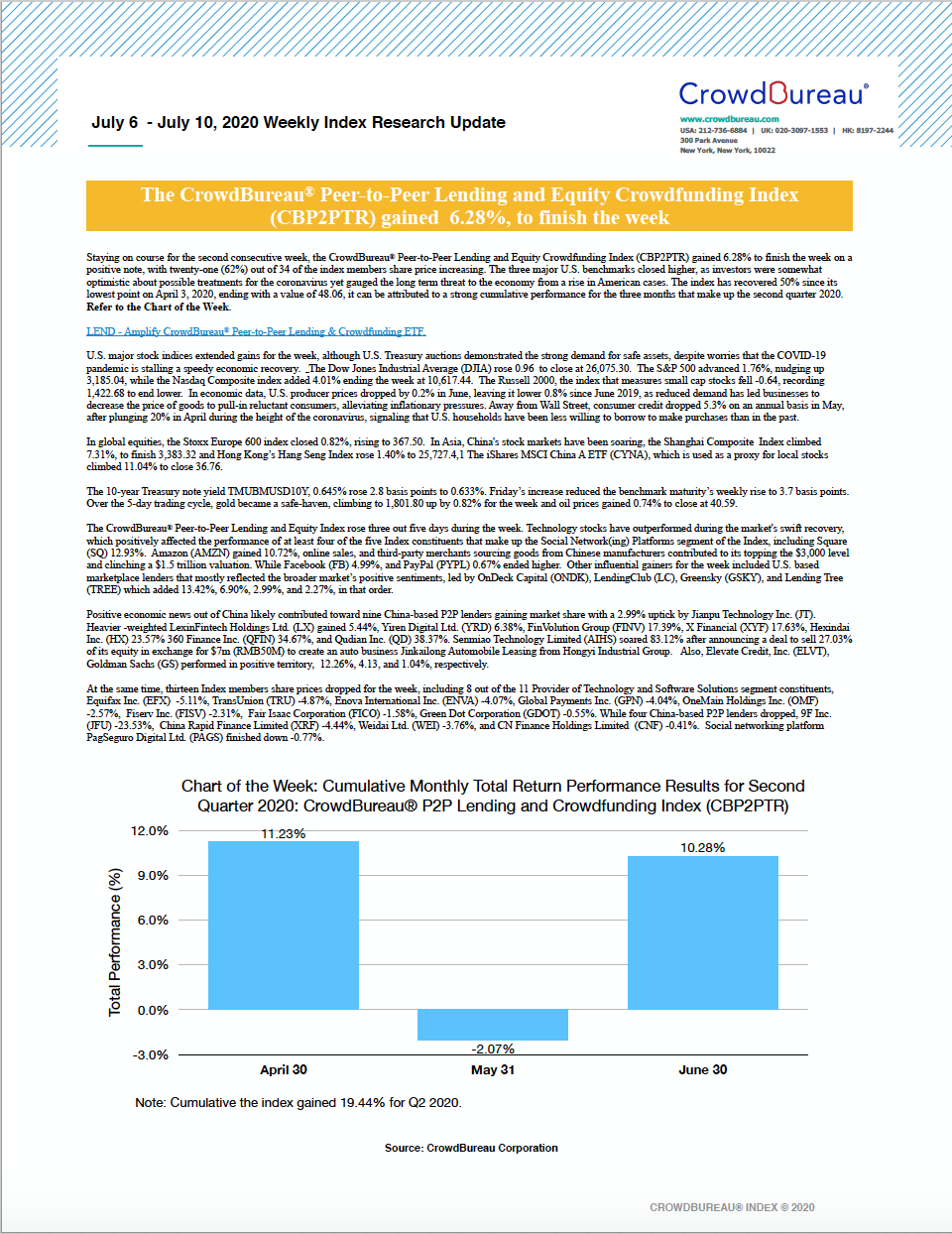

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) gained 6.28%, to finish the week

July 6 – July 10, 2020

Staying on course for the second consecutive week, the CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) gained 6.28% to finish the week on a positive note, with twenty-one (62%) out of 34 of the index members share price increasing. The three major U.S. benchmarks closed higher, as investors were somewhat optimistic about possible treatments for the coronavirus, yet gauged the long term threat to the economy from a rise in American cases. The index has recovered 50% since its lowest point on April 3, 2020, ending with a value of 48.06, it can be attributed in part to a strong cumulative performance for the three months that make up the second quarter 2020. Refer to the Chart of the Week.

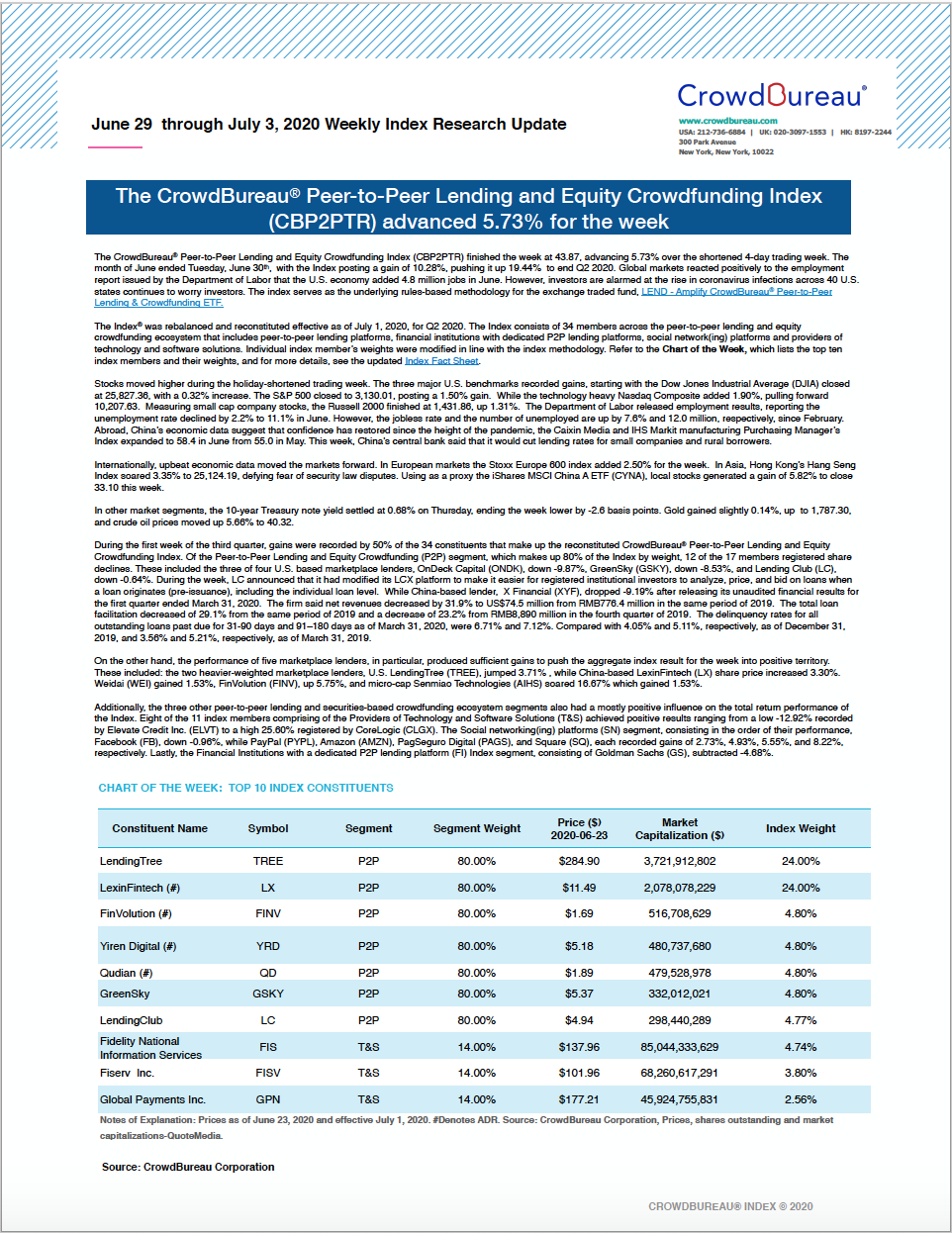

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) advanced 5.73% for the week

June 29 through July 3, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week at 43.87, advancing 5.73% over the shortened 4-day trading week. The month of June ended Tuesday, June 30th, with the Index posting a gain of 10.28%, pushing it up 19.44% to end Q2 2020. Global markets reacted positively to the employment report issued by the Department of Labor that the U.S. economy added 4.8 million jobs in June. However, investors are alarmed at the rise in coronavirus infections across 40 U.S. states. The Index serves as the underlying rules-based methodology for the exchange traded fund, LEND – Amplify CrowdBureau® Peer-to-Peer Lending & Crowdfunding ETF.

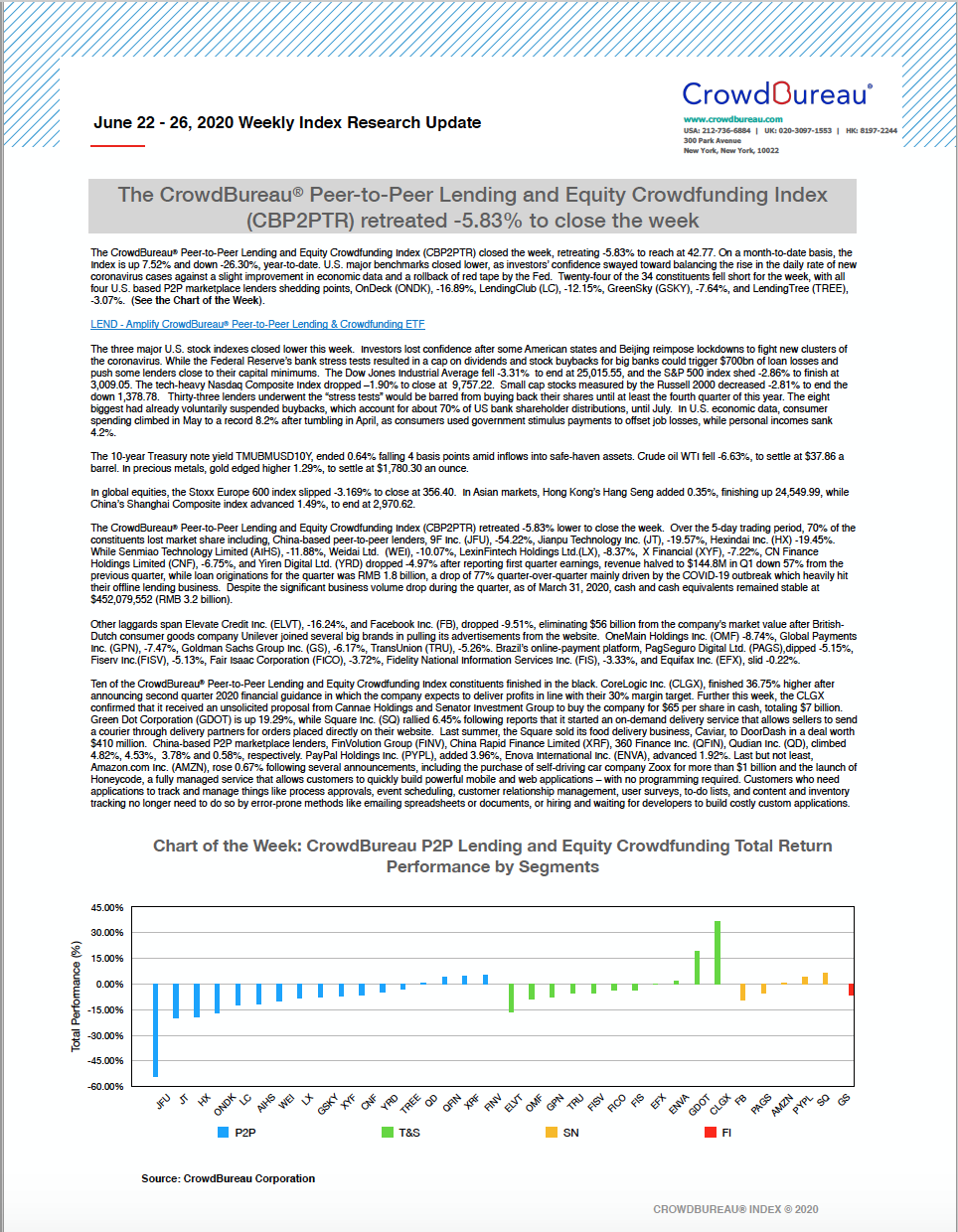

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) retreated -5.83% to close the week

June 22 – 26, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) closed the week, retreating -5.83% to reach at 42.77. On a month-to-date basis, the Index is up 7.52% and down -26.30%, year-to-date. U.S. major benchmarks closed lower, as investors’ confidence swayed toward balancing the rise in the daily rate of new coronavirus cases against a slight improvement in economic data and a rollback of red tape by the Fed. Twenty-four of the 34 constituents fell short for the week, with all four U.S. based P2P marketplace lenders shedding points, OnDeck (ONDK), -16.89%, LendingClub (LC), -12.15%, GreenSky (GSKY), -7.64%, and LendingTree (TREE), -3.07%. (See the Chart of the Week).

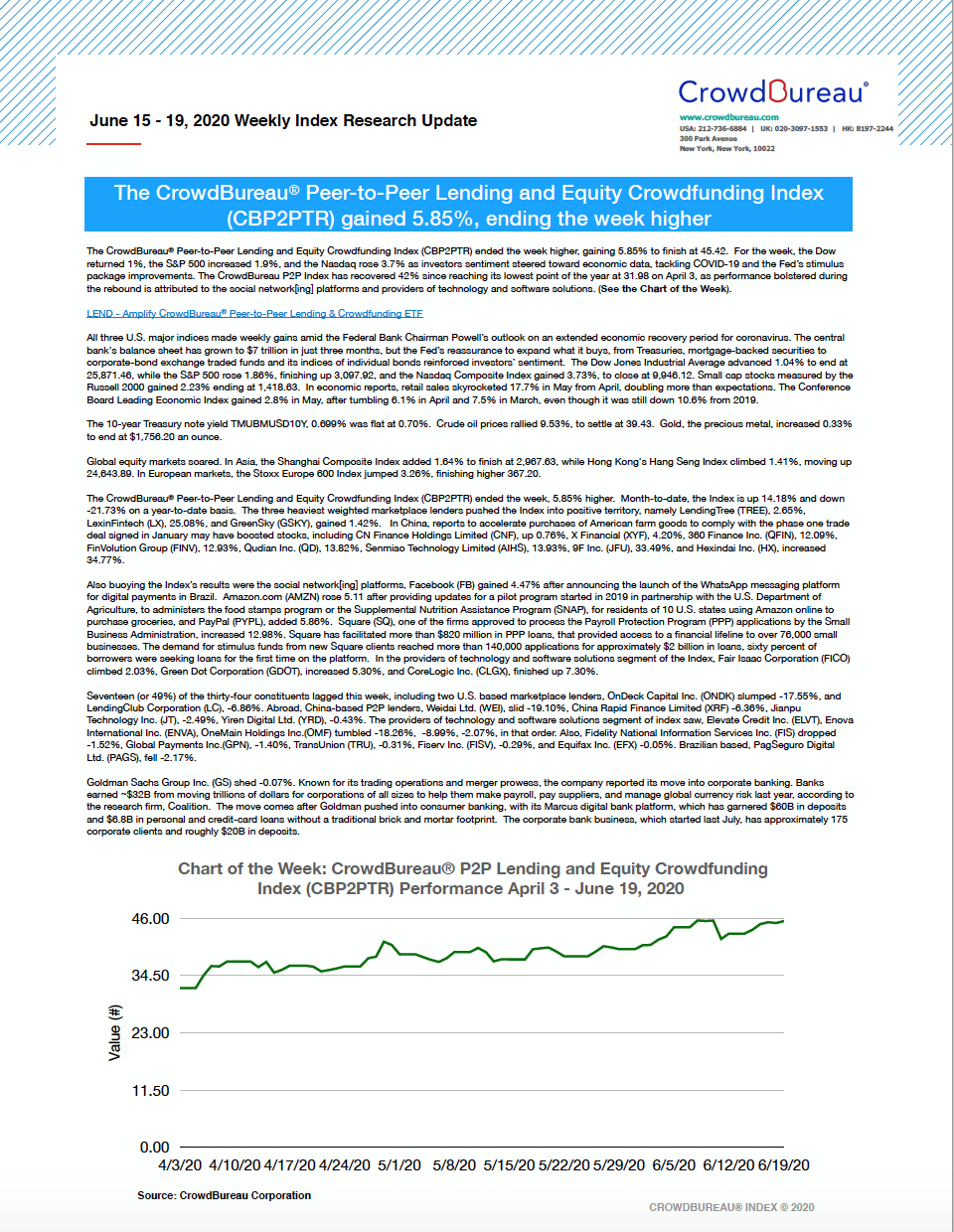

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) gained 5.85%, ending the week higher

June 15 – 19, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the week higher, gaining 5.85% to finish at 45.42. For the week, the Dow returned 1%, the S&P 500 increased 1.9%, and the Nasdaq rose 3.7% as investors sentiment steered toward economic data, tackling COVID-19 and the Fed’s stimulus package improvements. The CrowdBureau P2P Index has recovered 42% since reaching its lowest point of the year at 31.98 on April 3, as performance bolstered during the rebound is attributed to the social network[ing] platforms and providers of technology and software solutions. (See the Chart of the Week).

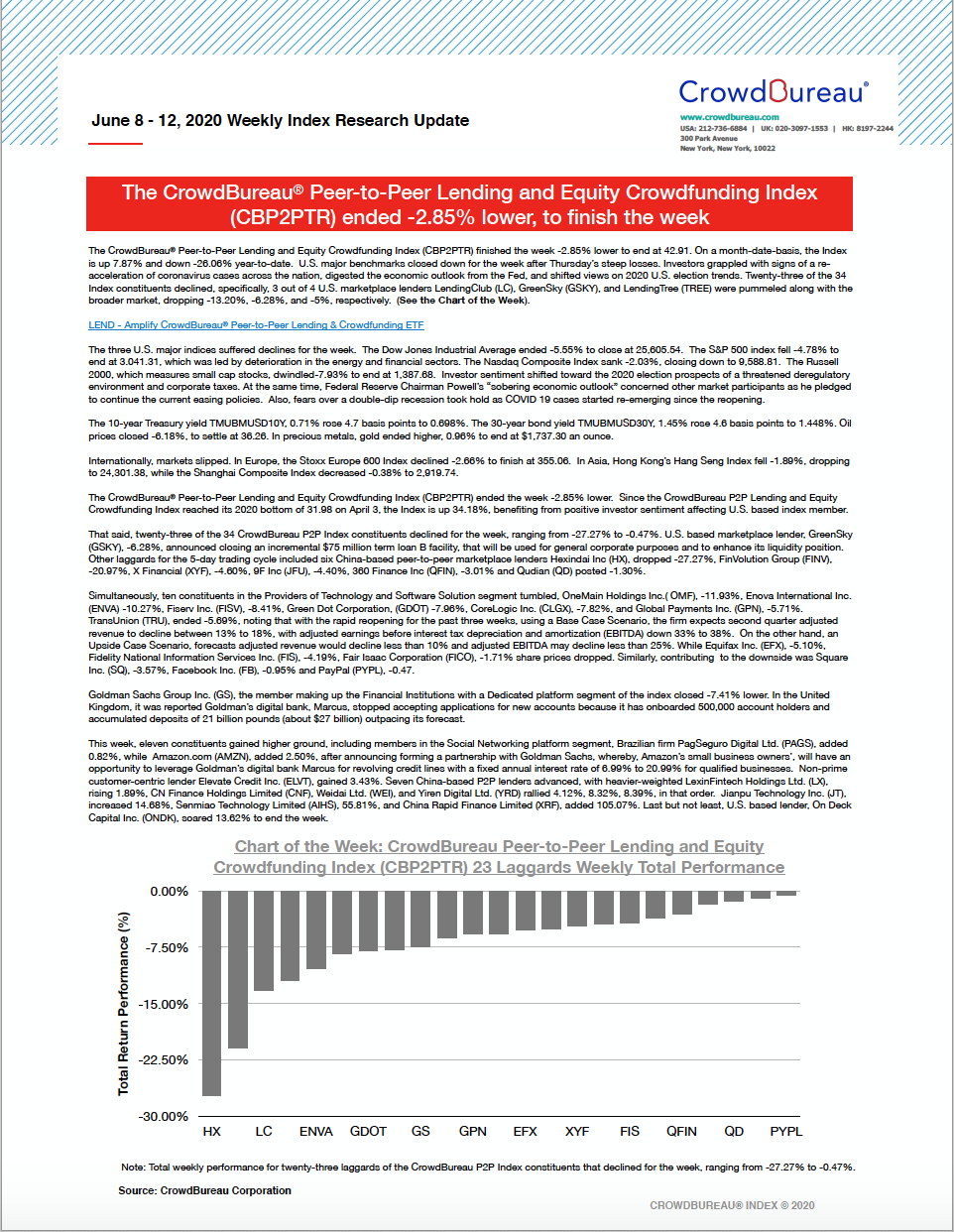

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended -2.85% lower, to finish the week

June 8 – 12, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week -2.85% lower to end at 42.91. On a month-date-basis, the Index is up 7.87% and down -26.06% year-to-date. U.S. major benchmarks closed down for the week after Thursday’s steep losses. Investors grappled with signs of a re-acceleration of coronavirus cases across the nation, digested the economic outlook from the Fed, and shifted views on 2020 U.S. election trends. Twenty-three of the 34 Index constituents declined, specifically, 3 out of 4 U.S. marketplace lenders LendingClub (LC), GreenSky (GSKY), and LendingTree (TREE) were pummeled along with the broader market, dropping -13.20%, -6.28%, and -5%, respectively. (See the Chart of the Week).

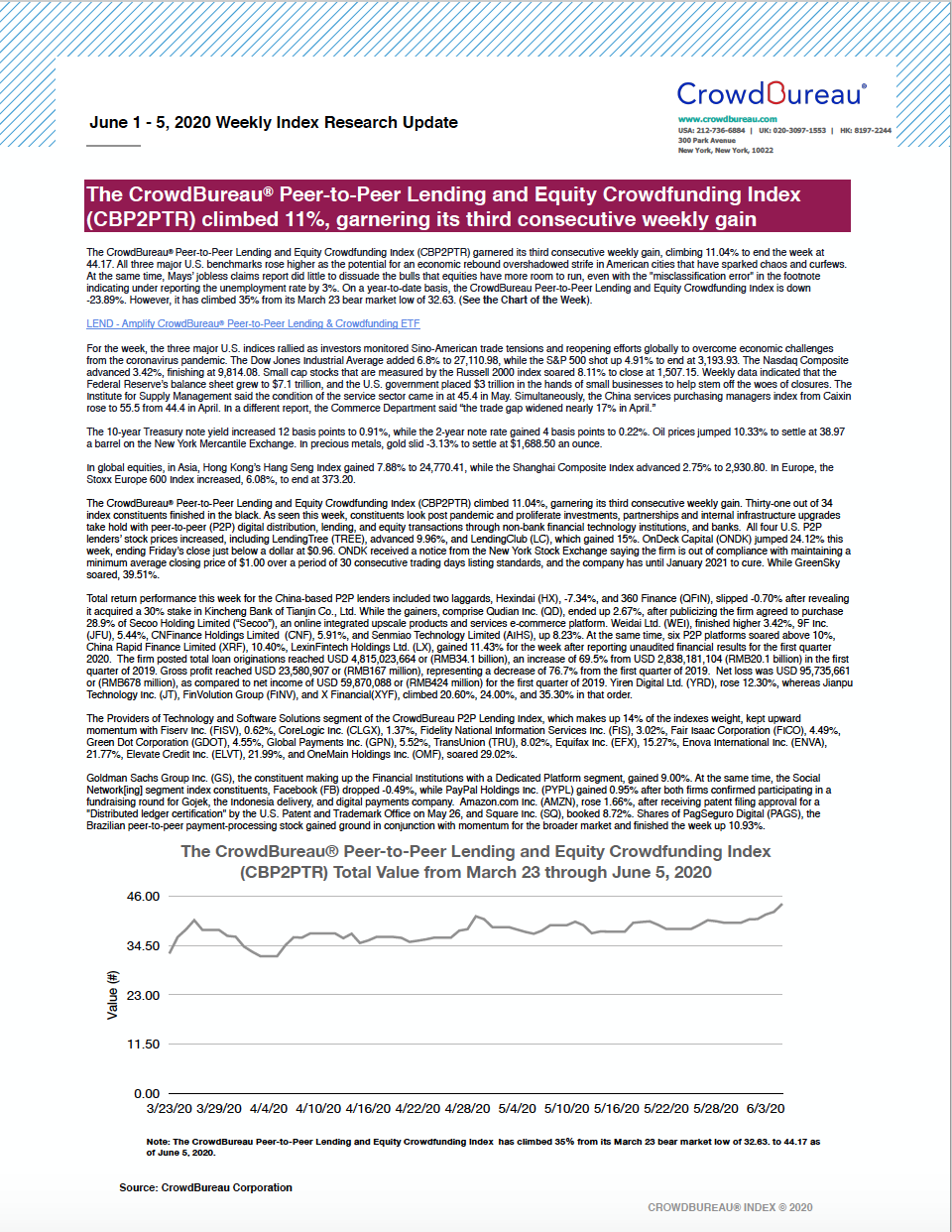

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) climbed 11%, garnering its third consecutive weekly gain

June 1 – 5, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) garnered its third consecutive weekly gain, climbing 11.04% to end the week at 44.17. All three major U.S. benchmarks rose higher as the potential for an economic rebound overshadowed strife in American cities that have sparked chaos and curfews. At the same time, Mays’ jobless claims report did little to dissuade the bulls that equities have more room to run, even with the “misclassification error” in the footnote indicating under reporting the unemployment rate by 3%. On a year-to-date basis, the CrowdBureau Peer-to-Peer Lending and Equity Crowdfunding Index is down -23.89%. However, it has climbed 35% from its March 23 bear market low of 32.63. (See the Chart of the Week).

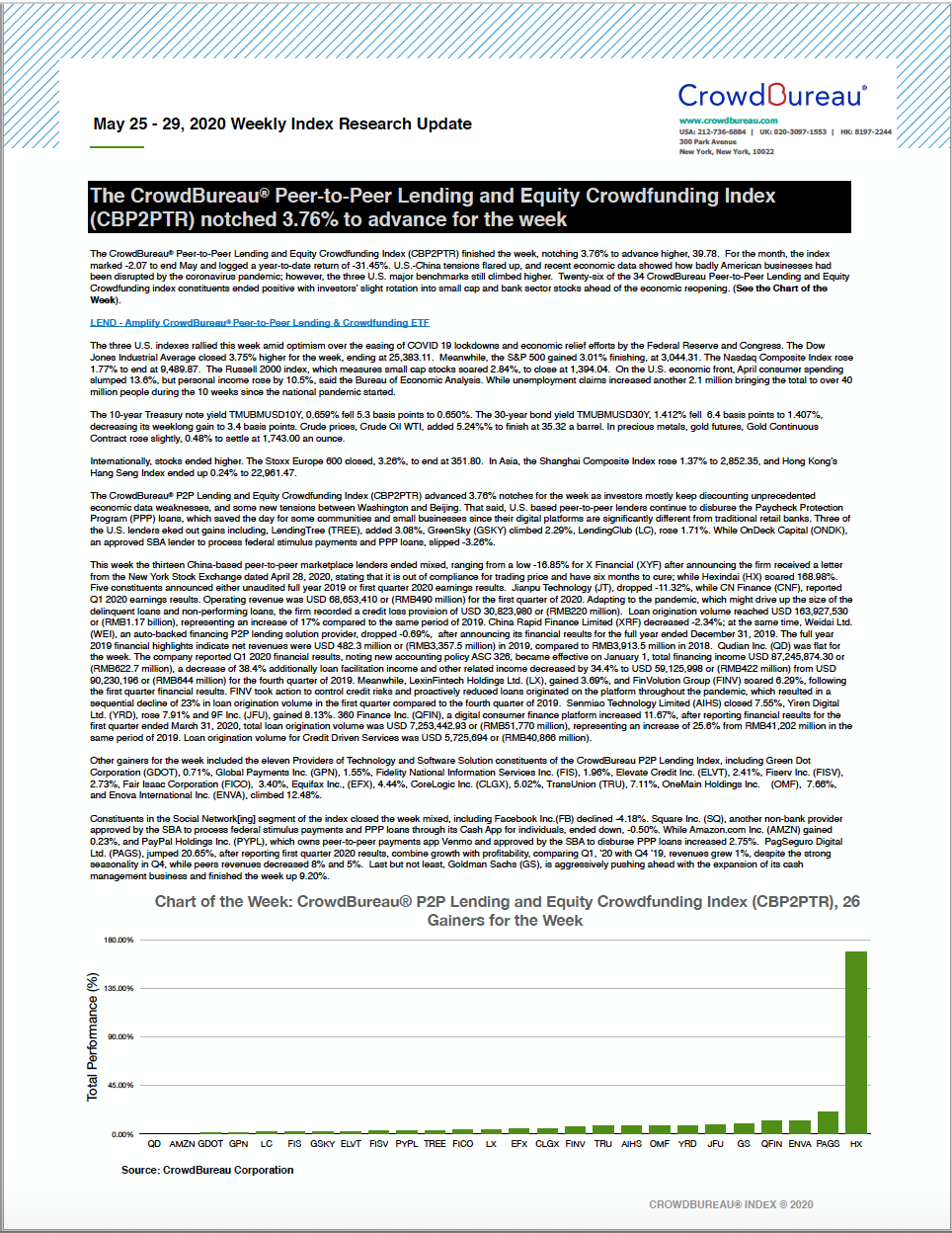

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) notched 3.76% to advance for the week

May 25 – 29, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week, notching 3.76% to advance 39.78. For the month, the index marked -2.07 to end May and logged a year-to-date return of -31.45%. U.S.-China tensions flared up, and recent economic data showed how badly American businesses had been disrupted by the coronavirus pandemic; however, the three U.S. major benchmarks still climbed higher. Twenty-six of the 34 CrowdBureau Peer-to-Peer Lending and Equity Crowdfunding Index constituents ended positive with investors’ slight rotation into small cap and bank sector stocks ahead of the economic reopening. (See the Chart of the Week).

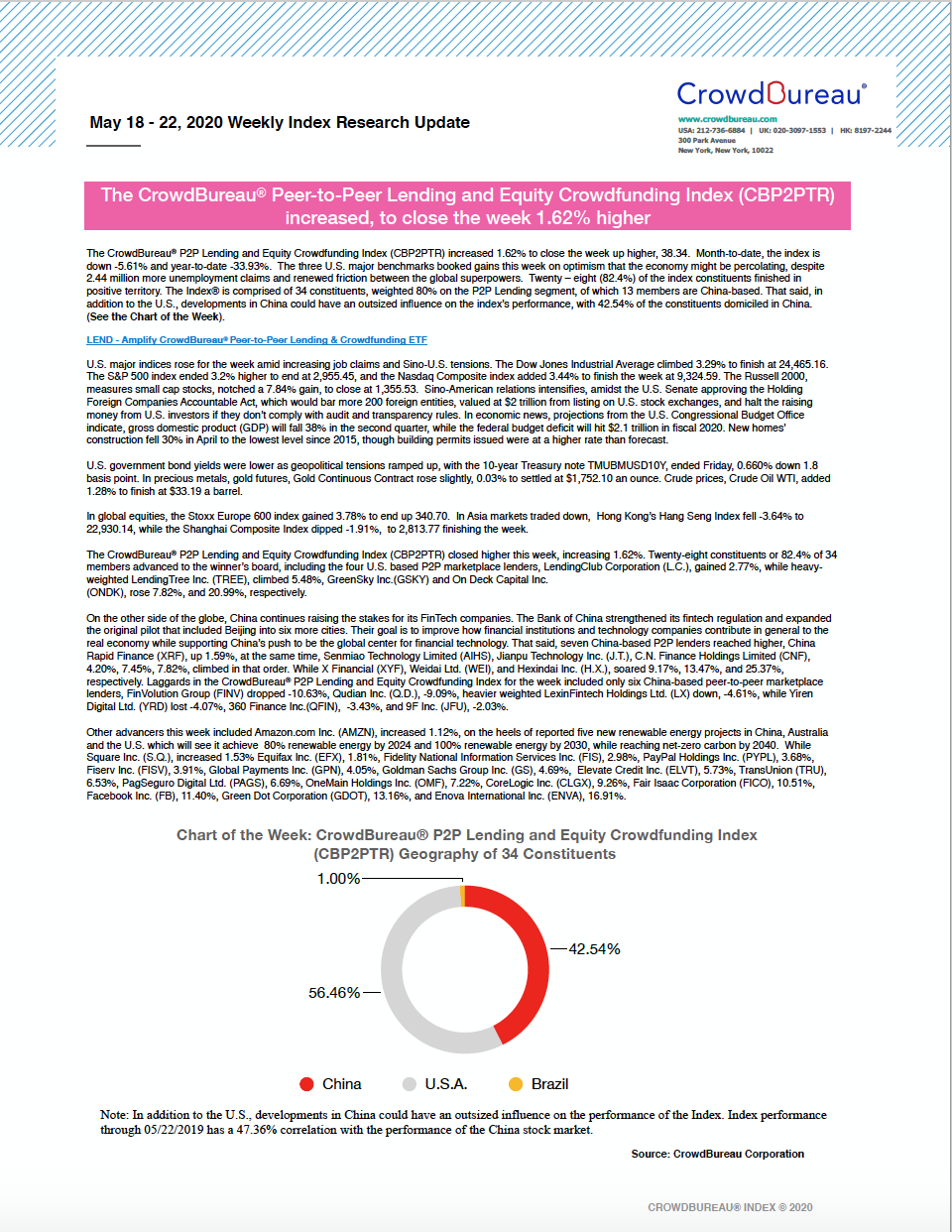

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) increased, to close the week 1.62% higher

May 18 – 22, 2020

The CrowdBureau® P2P Lending and Equity Crowdfunding Index (CBP2PTR) increased 1.62% to close the week up higher, 38.34. Month-to-date, the index is down -5.61% and year-to-date -33.93%. The three U.S. major benchmarks booked gains this week on optimism that the economy might be percolating, despite 2.44 million more unemployment claims and renewed friction between the global superpowers. Twenty – eight (82.4%) of the index constituents finished in positive territory. The Index® is comprised of 34 constituents, weighted 80% on the P2P Lending segment, of which 13 members are China-based. That said, in addition to the U.S., developments in China could have an outsized influence on the index’s performance, with 42.54% of the constituents domiciled in China. (See the Chart of the Week).

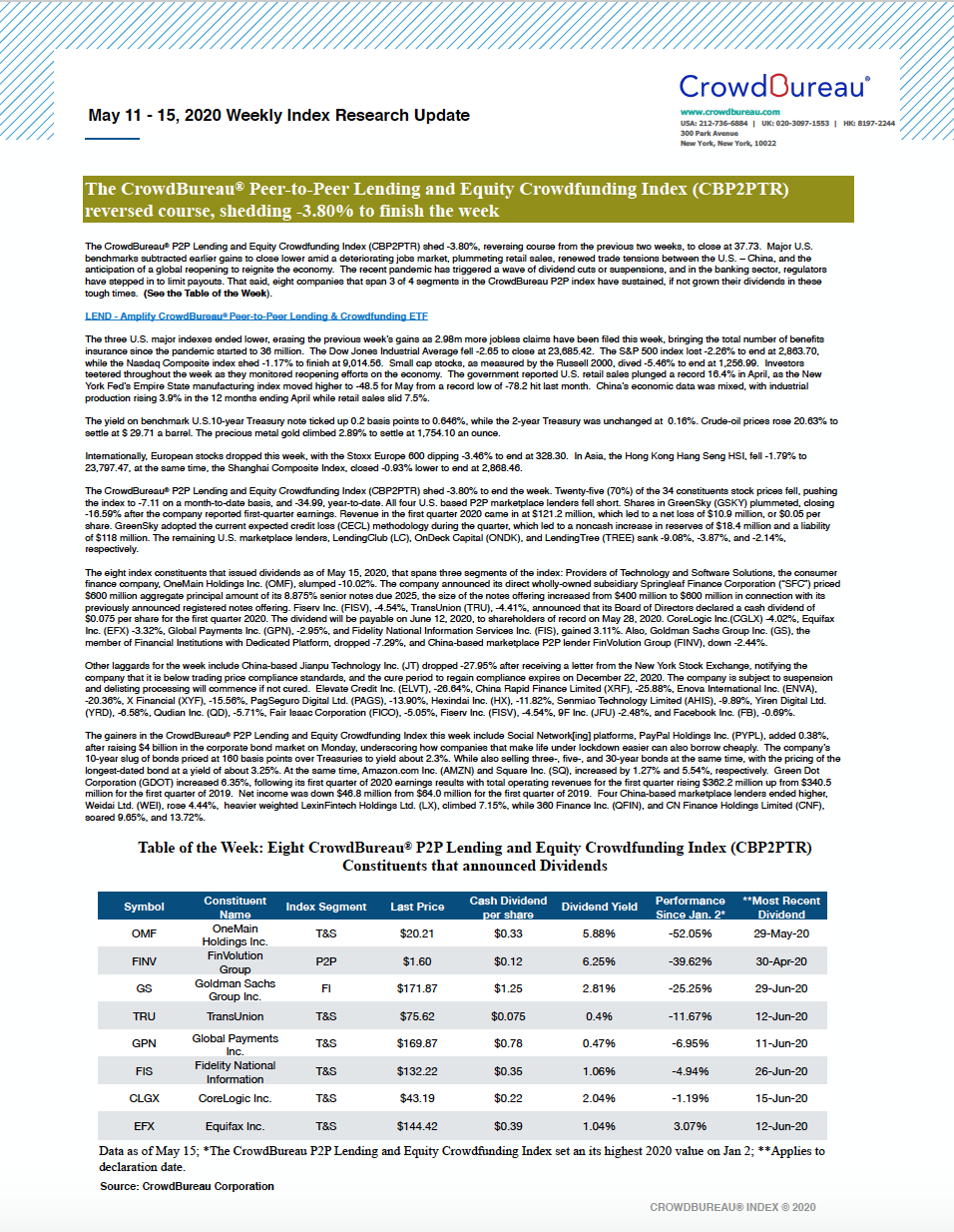

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) reversed course, shedding -3.80% to finish the week

May 11 – 15, 2020

The CrowdBureau® P2P Lending and Equity Crowdfunding Index (CBP2PTR) shed -3.80%, reversing course from the previous two weeks, to close at 37.73. Major U.S. benchmarks subtracted earlier gains to close lower amid a deteriorating jobs market, plummeting retail sales, renewed trade tensions between the U.S. – China, and the anticipation of a global reopening to reignite the economy. The recent pandemic has triggered a wave of dividend cuts or suspensions, and in the banking sector, regulators have stepped in to limit payouts. That said, eight companies that span 3 of 4 segments in the CrowdBureau P2P index have sustained, if not grown their dividends in these tough times. (See the Table of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) gained 1.19% to finish the week

May 4 – 8, 2020

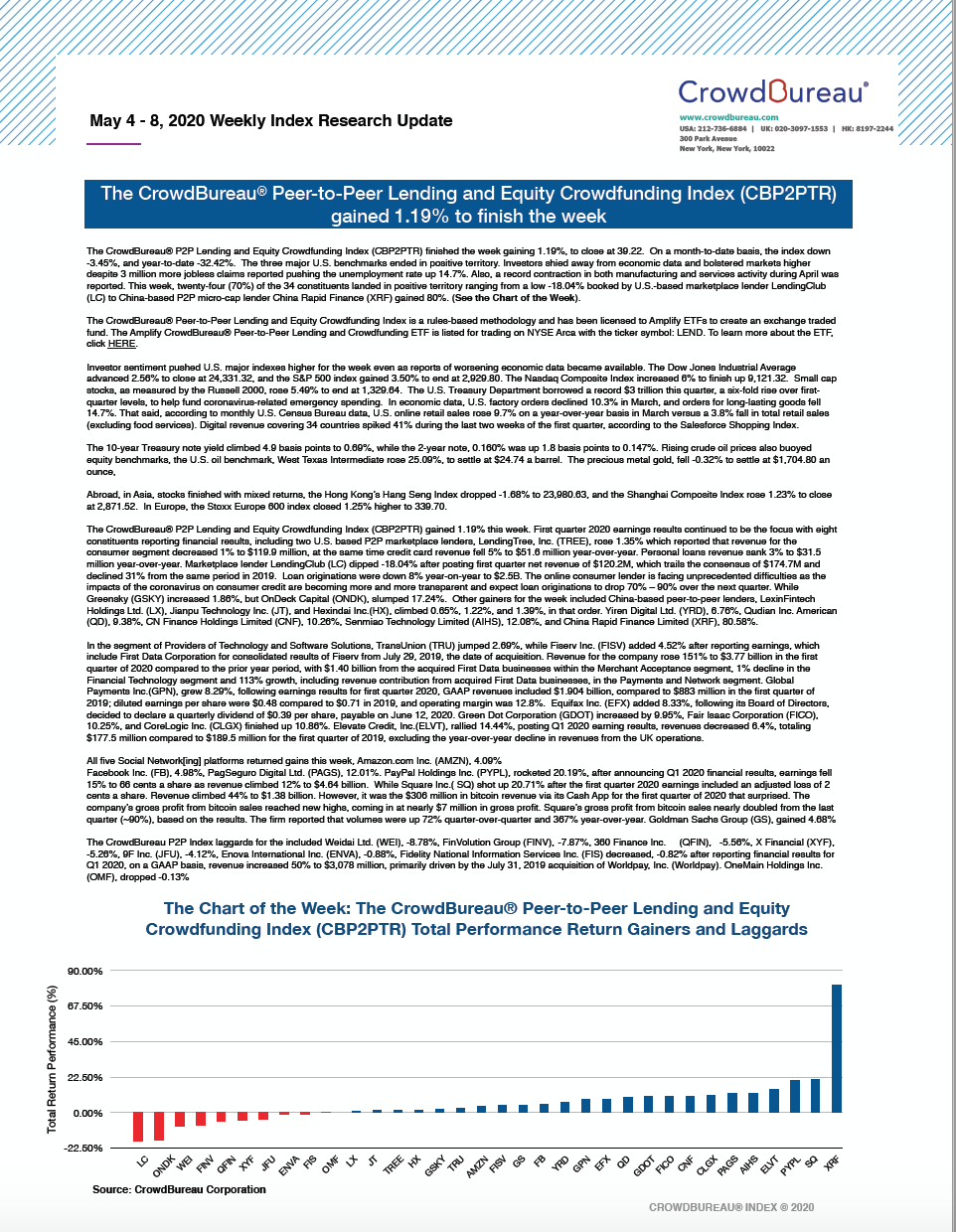

The CrowdBureau® P2P Lending and Equity Crowdfunding Index (CBP2PTR) finished the week gaining 1.19%, to close at 39.22. On a month-to-date basis, the index is down -3.45%, and year-to-date -32.42%. The three major U.S. benchmarks ended in positive territory. Investors shied away from economic data and bolstered markets higher despite 3 million more jobless claims reported pushing the unemployment rate up 14.7%. Also, a record contraction in both manufacturing and services activity during April was reported. This week, twenty-four (70%) of the 34 constituents landed in positive territory ranging from a low -18.04% booked by U.S.-based marketplace lender LendingClub (LC) to China-based P2P micro-cap lender China Rapid Finance (XRF) which gained 80%. (See the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered 6.69% higher, to finish the week

April 27 through May 1, 2020

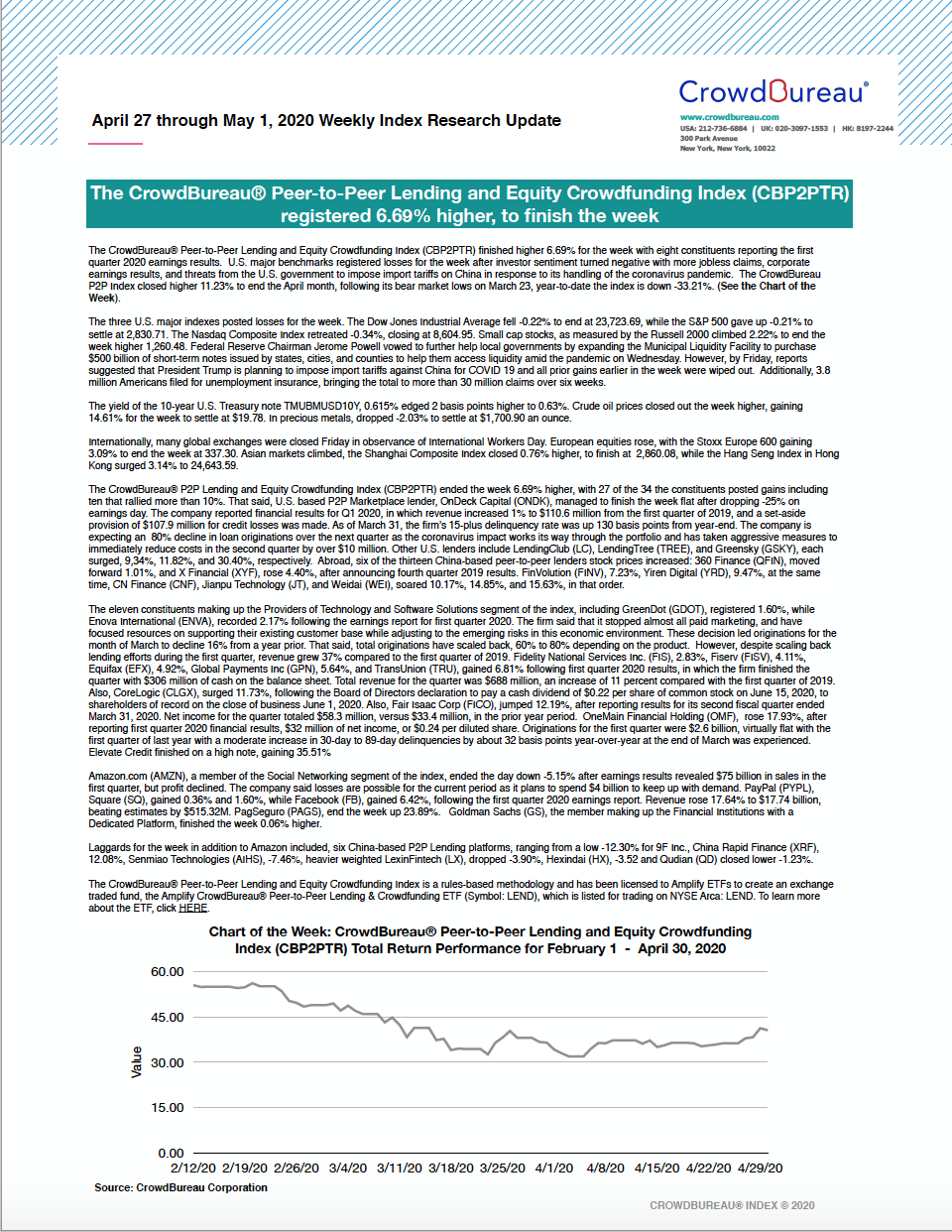

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished higher 6.69% for the week with eight constituents reporting the first quarter 2020 earnings results. U.S. major benchmarks registered losses for the week after investor sentiment turned negative with more jobless claims, corporate earnings results, and threats from the U.S. government to impose import tariffs on China in response to its handling of the coronavirus pandemic. The CrowdBureau P2P Index closed higher 11.23% to end the April month, following its bear market lows on March 23, year-to-date the index is down -33.21%. (See the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded -0.41%, ending the week lower

April 20 – 24, 2020

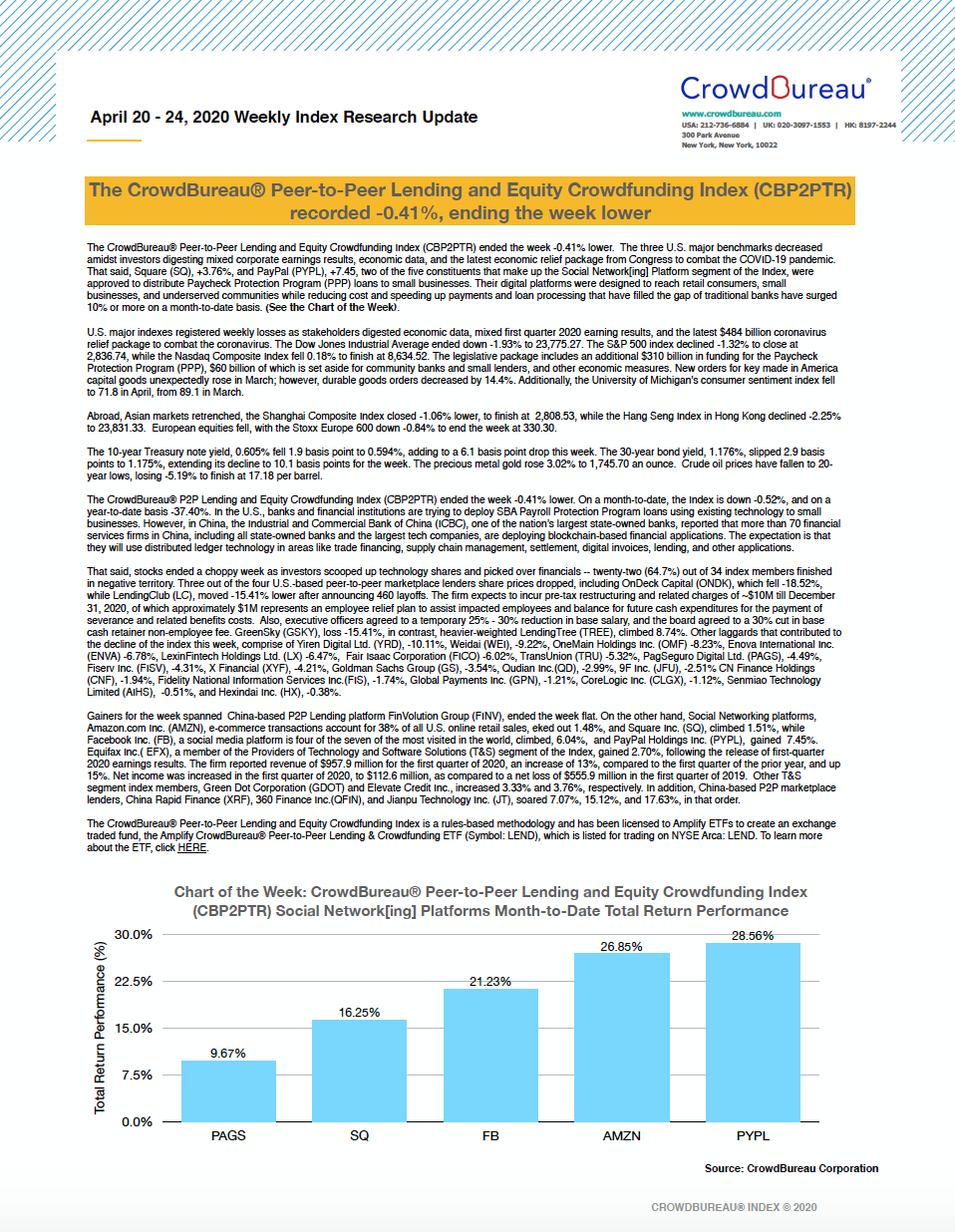

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the week -0.41% lower. The three U.S. major benchmarks decreased amidst investors digesting mixed corporate earnings results, economic data, and the latest economic relief package from Congress to combat the COVID-19 pandemic. That said, Square (SQ), +3.76% and PayPal (PYPL), +7.45, two of the five constituents that make up the Social Network[ing] Platform (SN) segment of the Index and P2P marketplace lender OnDeck Capital (ONDK), -18.52%, were approved to distribute Paycheck Protection Program (PPP) loans to small businesses. Their digital lending platforms were designed to reach retail consumers, small businesses, and underserved communities while reducing cost and speeding up payments and loan processing that have filled the gap of traditional banks. The SN segment of the index has surged 10% or more on a month-to-date basis. (See the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week down, shedding -2.20%

April 13 – 17, 2020

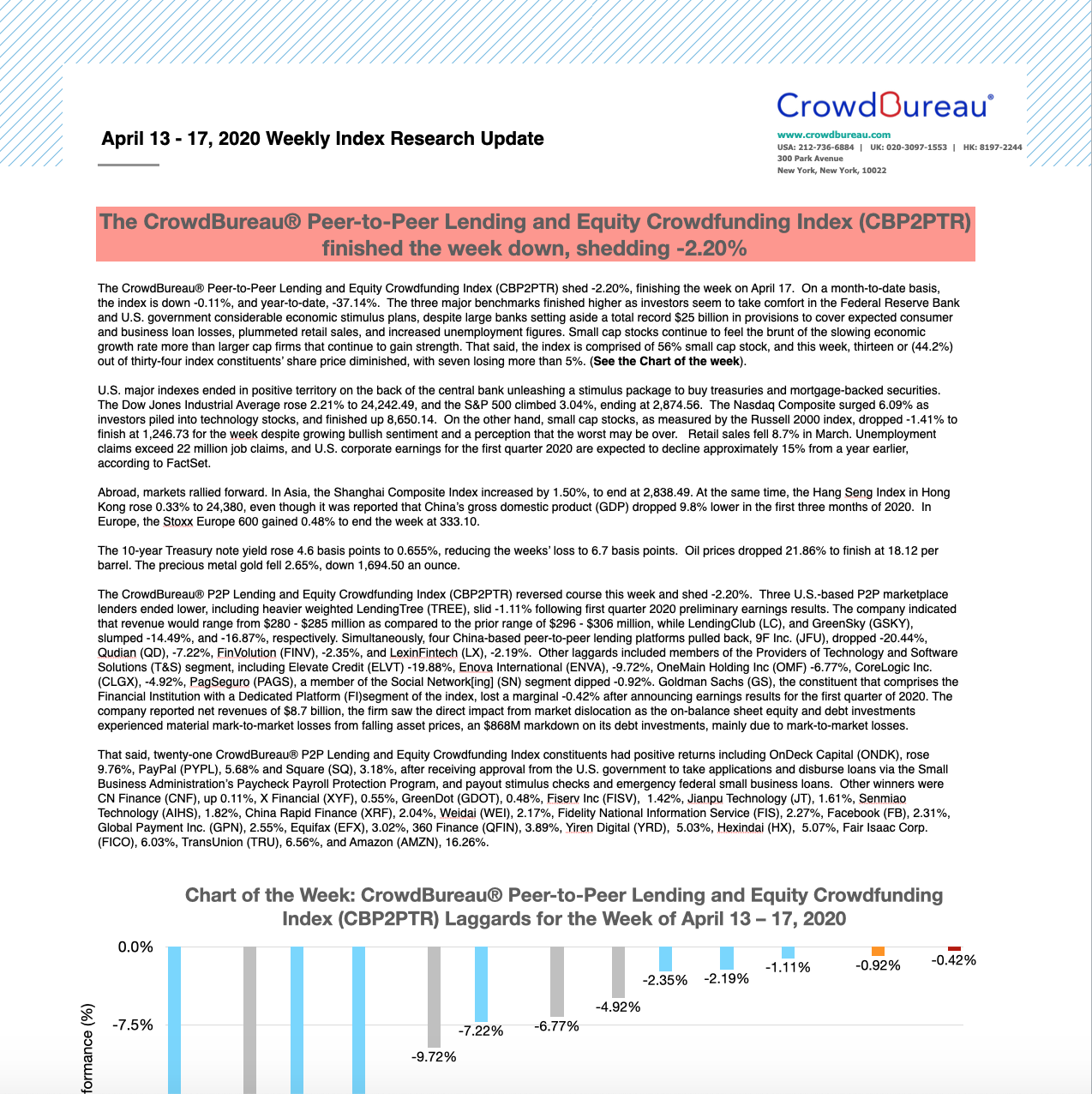

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) shed -2.20%, finishing the week on April 17. On a month-to-date basis, the index is down -0.11%, and year-to-date, -37.14%. The three major benchmarks finished higher as investors seem to take comfort in the Federal Reserve Bank and U.S. government considerable economic stimulus plans, despite large banks setting aside a total record $25 billion in provisions to cover expected consumer and business loan losses, plummeted retail sales, and increased unemployment figures. Small cap stocks continue to feel the brunt of the slowing economic growth rate more than larger cap firms that continue to gain strength. That said, the index is comprised of 56% small cap stock, and this week, thirteen or (44.2%) out of thirty-four index constituents’ share price diminished, with seven losing more than 5%. (See the Chart of the week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the four-day trading week up 16.64%

April 6 – 10, 2020

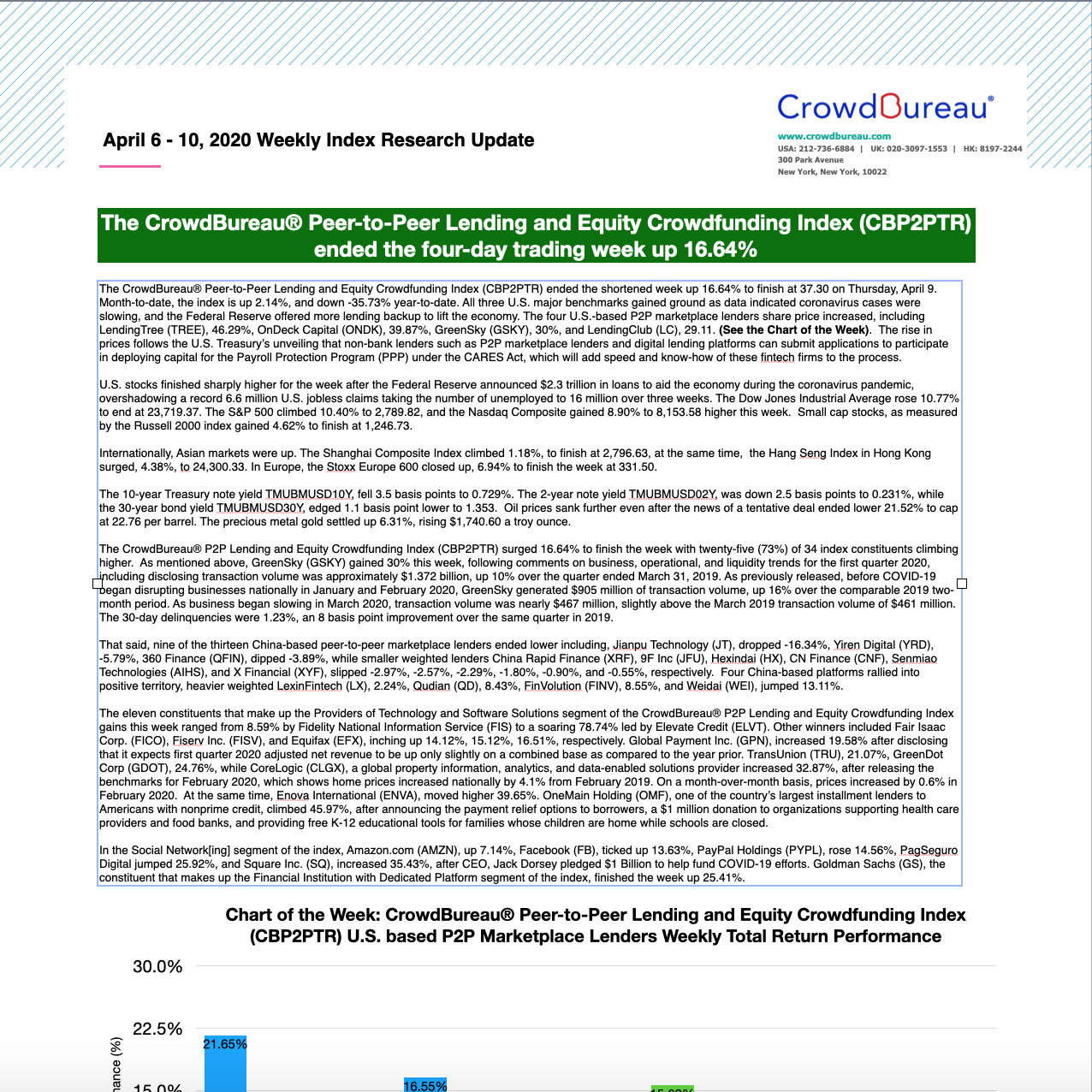

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the shortened week up 16.64% to finish at 37.30 on Thursday, April 9. Month-to-date, the index is up 2.14%, and down -35.73% year-to-date. All three U.S. major benchmarks gained ground as data indicated coronavirus cases were slowing, and the Federal Reserve offered more lending backup to lift the economy. The four U.S.-based P2P marketplace lenders share price increased, including LendingTree (TREE), 46.29%, OnDeck Capital (ONDK), 39.87%, GreenSky (GSKY), 30%, and LendingClub (LC), 29.11. (See the Chart of the Week). The rise in prices follows the U.S. Treasury’s unveiling that non-bank lenders such as P2P marketplace lenders and digital lending platforms can submit applications to participate in deploying capital for the Payroll Protection Program (PPP) under the CARES Act, which will add speed and know-how of these fintech firms to the process.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) declined -16.04% end the week

March 30 through April 3, 2020

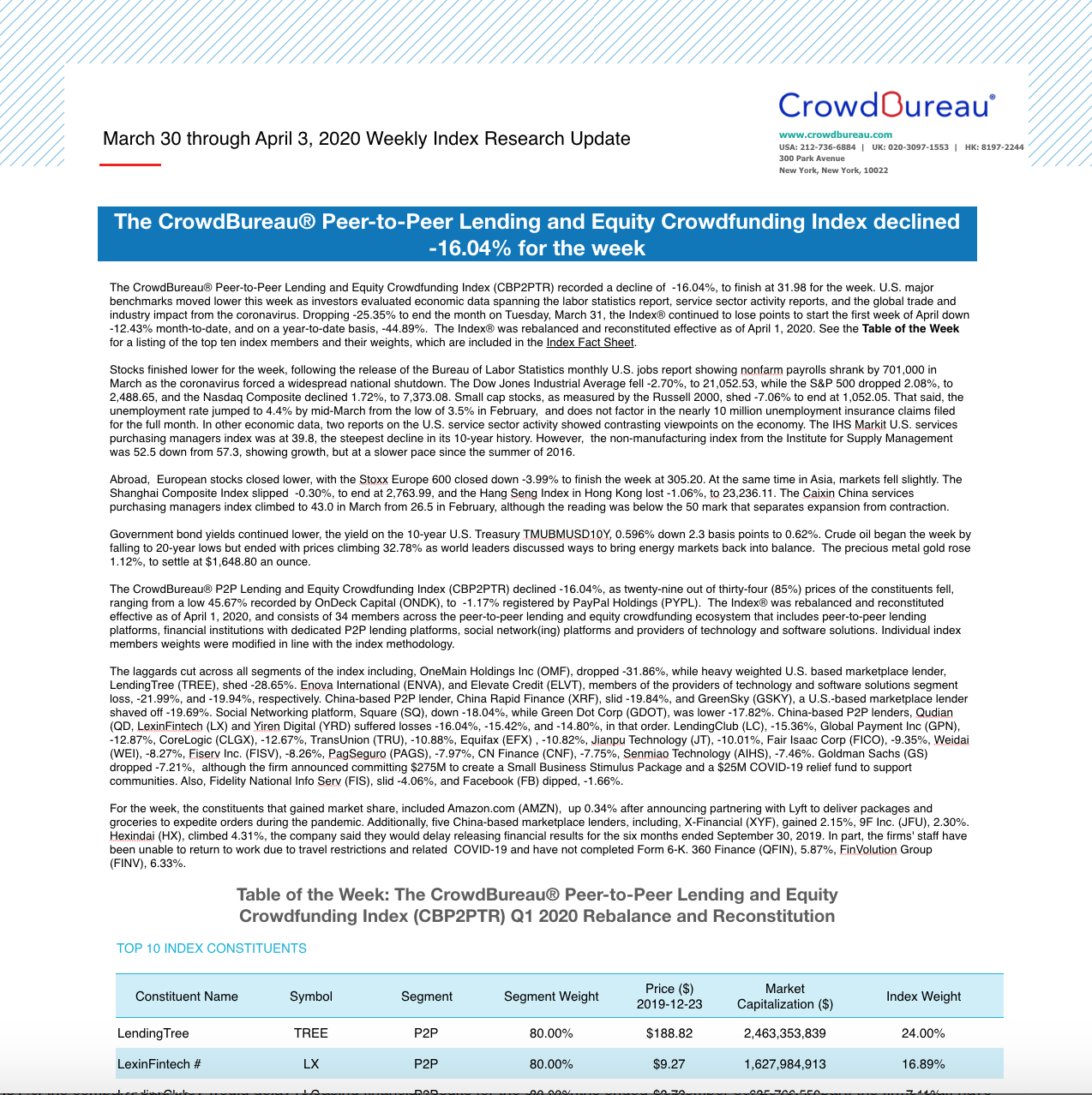

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded a decline of -16.04%, to finish at 31.98 for the week. U.S. major benchmarks moved lower this week as investors evaluated economic data spanning the labor statistics report, service sector activity reports, and the global trade and industry impact from the coronavirus. Dropping -25.35% to end the month on Tuesday, March 31, the Index® continued to lose points to start the first week of April down -12.43% month-to-date, and on a year-to-date basis, -44.89%. The Index® was rebalanced and reconstituted effective as of April 1, 2020. See the Table of the Week for a listing of the top ten index members and their weights, which are included in the Index Fact Sheet.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) reverses course, recording 10.76% to end the week

March 23 – 27, 2020

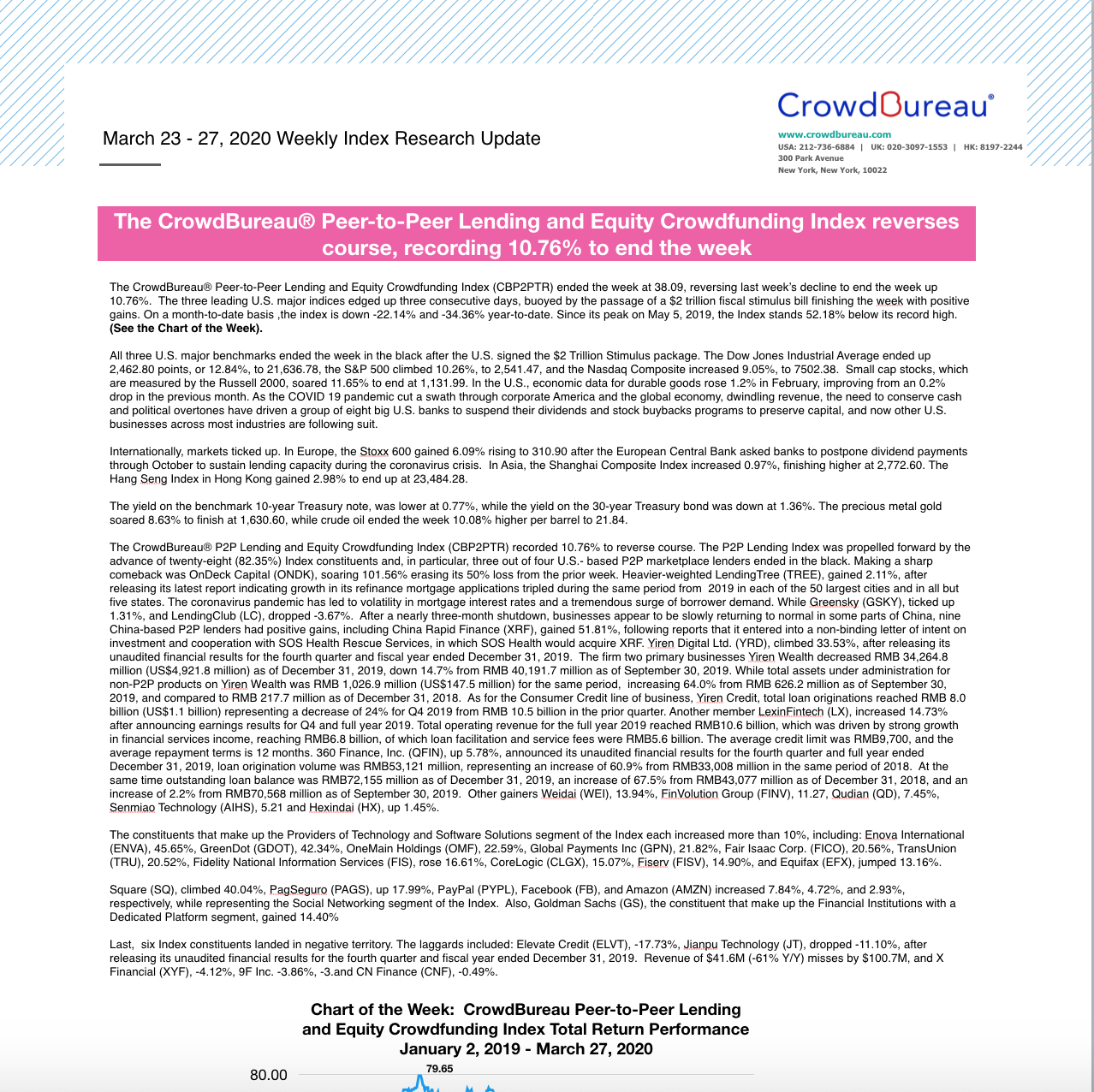

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the week at 38.09, reversing last week’s decline to end the week up 10.76%. The three leading U.S. major indices edged up three consecutive days, buoyed by the passage of a $2 trillion fiscal stimulus bill finishing the week with positive gains. On a month-to-date basis ,the index is down -22.14% and -34.36% year-to-date. Since its peak on May 5, 2019, the Index stands 52.18% below its record high. (See the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) slid -16.93%, registering its fourth consecutive weekly drop

March 16 – 20, 2020

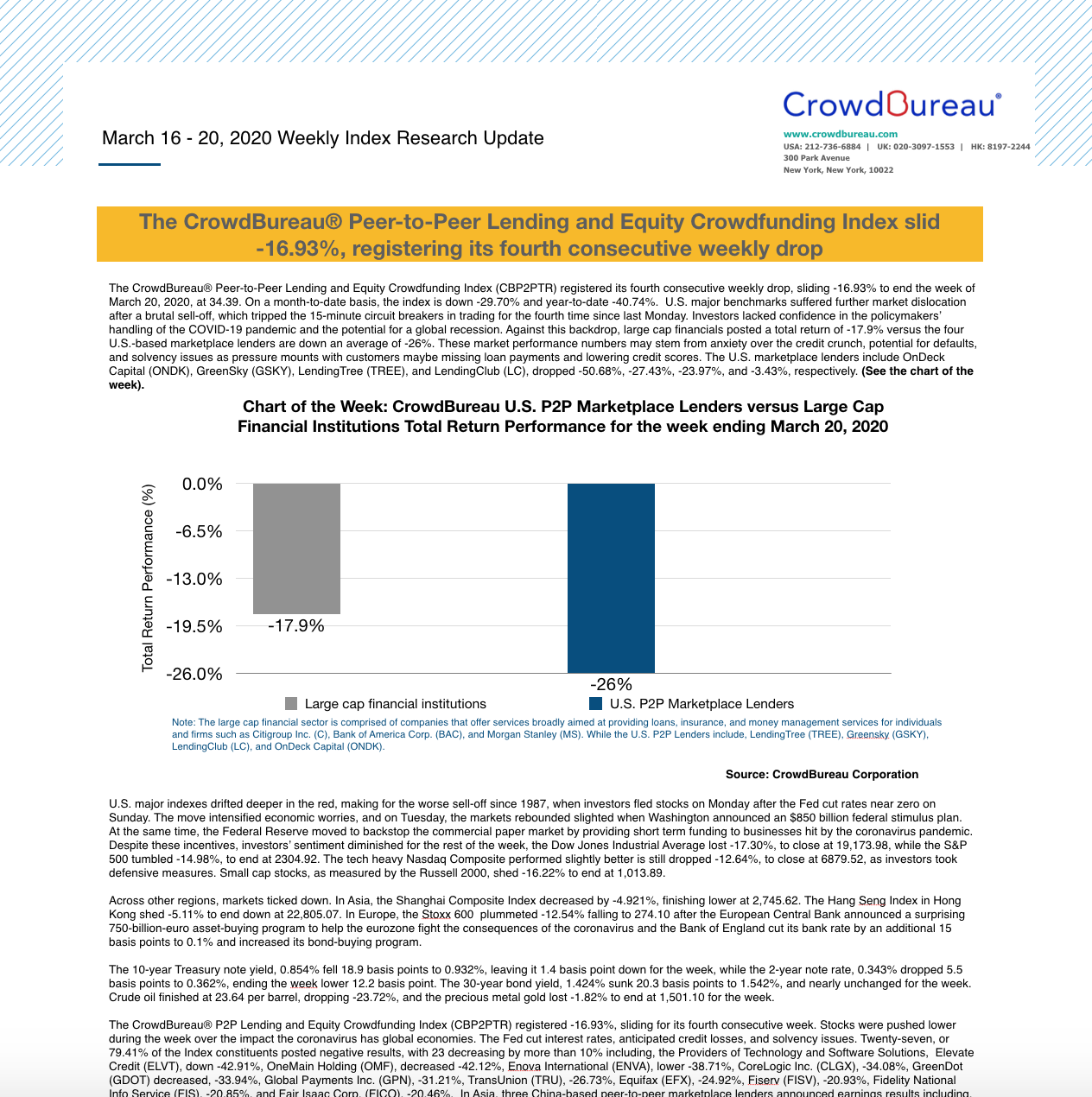

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered its fourth consecutive weekly drop, sliding -16.93% to end the week of March 20, 2020, at 34.39. On a month-to-date basis, the index is down -29.70% and year-to-date -40.74%. U.S. major benchmarks suffered further market dislocation after a brutal sell-off, which tripped the 15-minute circuit breakers in trading for the fourth time since last Monday. Investors lacked confidence in the policymakers’ handling of the COVID-19 pandemic and the potential for a global recession. Against this backdrop, large cap financials posted a total return of -17.9% versus the four U.S.-based marketplace lenders are down an average of -26%. These market performance numbers may stem from anxiety over the credit crunch, potential for defaults, and solvency issues as pressure mounts with customers maybe missing loan payments and lowering credit scores. The U.S. marketplace lenders include OnDeck Capital (ONDK), GreenSky (GSKY), LendingTree (TREE), and LendingClub (LC), dropped -50.68%, -27.43%, -23.97%, and -3.43%, respectively. (See the chart of the week).

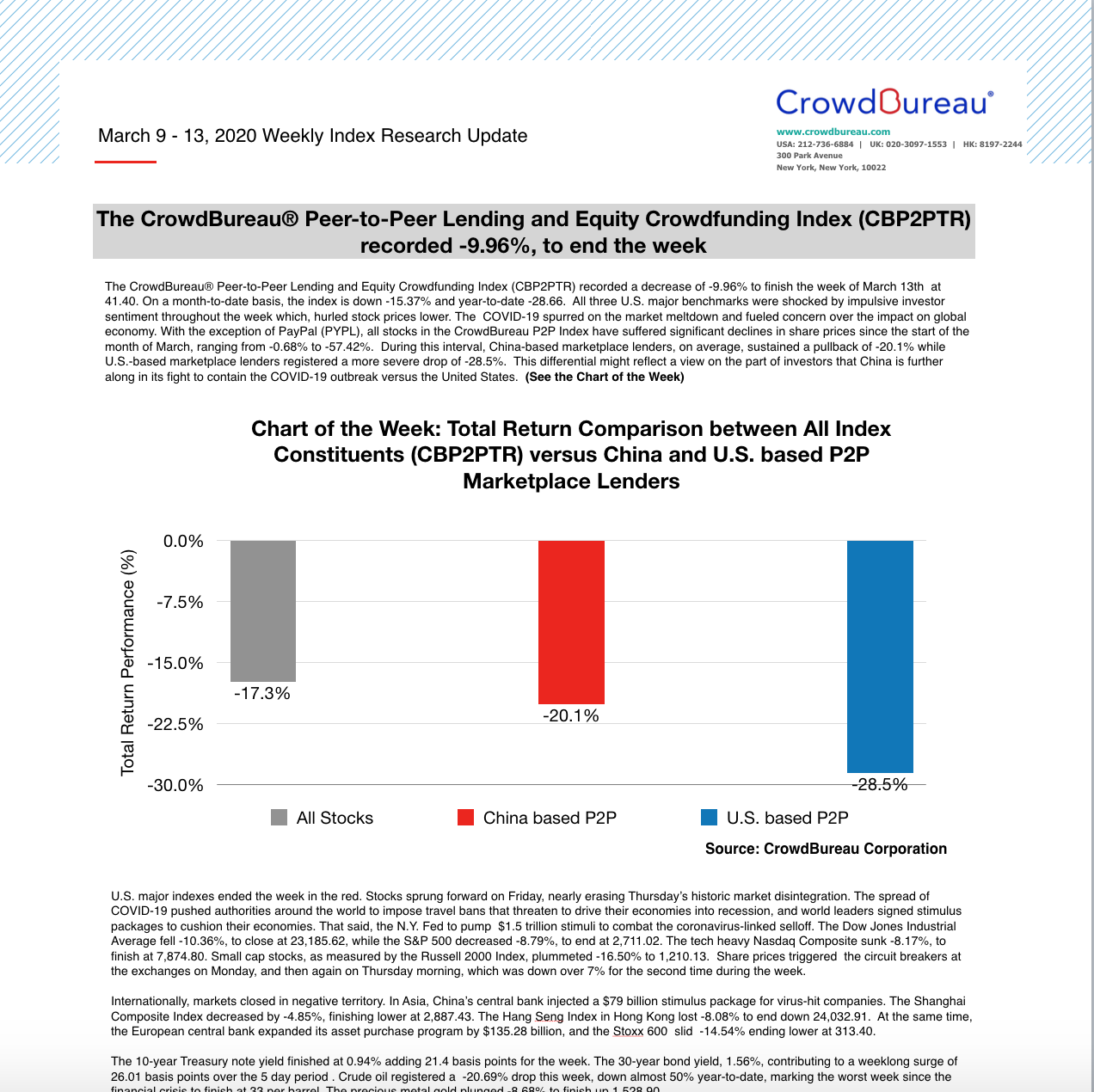

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded -9.96%, to end the week

March 9 – 13, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded a decrease of -9.96% to finish the week of March 13th at 41.40. On a month-to-date basis, the index is down -15.37% and year-to-date -28.66. All three U.S. major benchmarks were shocked by impulsive investor sentiment throughout the week, which hurled stock prices lower. The COVID-19 spurred on the market meltdown and fueled concern over the impact on the global economy. With the exception of PayPal (PYPL), all stocks in the CrowdBureau P2P Lending Index have suffered significant declines in share prices since the start of the month of March, ranging from -0.68% to -57.42%. During this interval, China-based marketplace lenders, on average, sustained a pullback of -20.1% while U.S.-based marketplace lenders registered a more severe drop of -28.5%. This differential might reflect a view on the part of investors that China is further along in its fight to contain the COVID-19 outbreak versus the United States. (See the Chart of the Week)

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) declined -6% to finish the week

March 2 – 6, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) declined -6% to finish the week at a value of 45.98. On a year-to-date basis, the Index is down -20.77%. U.S. major benchmarks managed to finish the week in positive territory amid volatile market swings as investors clung to fears over the impact on the global economy due to the coronavirus outbreak. Declining stocks outnumbered gainers in the CrowdBureau P2P Lending Index by a ratio of almost 3:1; this included six constituents, two of which are U.S.-based and four China-based P2P lending platforms that experienced share price decreases of more than 15%.

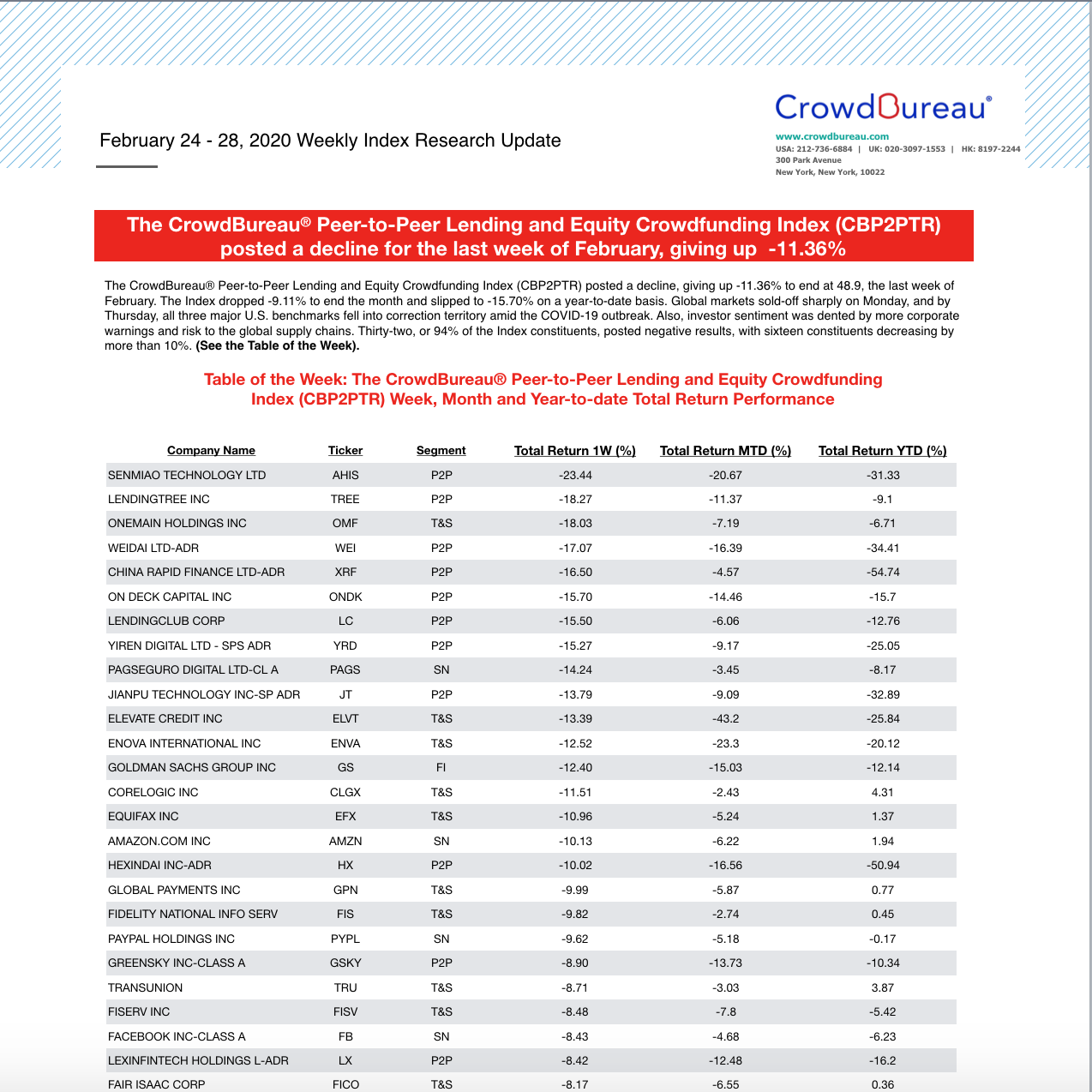

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted a decline for the last week of February, giving up -11.36%

February 24 – 28, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted a decline, giving up -11.36% to end at 48.9, the last week of February. The Index dropped -9.11% to end the month and slipped to -15.70% on a year-to-date basis. Global markets sold-off sharply on Monday, and by Thursday, all three major U.S. benchmarks fell into correction territory amid the COVID-19 outbreak. Also, investor sentiment was dented by more corporate warnings and risk to the global supply chains. Thirty-two, or 94% of the Index constituents, posted negative results, with sixteen constituents decreasing by more than 10%. (See the Table of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) increased 0.40% for the week

February 17 – 21, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted an increase of 0.40% to end the short four-day trading week at 55.19. All three U.S. major benchmarks recorded weekly declines as investors reached for safety. Weak economic data in both manufacturing and the U.S. housing markets, worrying reports about the spread of coronavirus, China’s ramp up to boost the economy with stimulus efforts, and more fourth quarter 2019 earnings results dragged down the performance of the market. The CrowdBureau P2P Index’s cumulated total return analysis for the holding period January 3, 2020, through February 21, 2020, is 4.89%. (See the Table for the Week). Month-to-date, the Index is up 2.55% and down -4.90% on a year-to-date basis.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered a gain of 1.65%, ending on a positive note for the second-consecutive week

February 10 – 14, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered a gain of 1.65%, advancing four out of five days, to end the week at 54.97. The Index has added 2.63% on a month-to-date total return basis, however, down -5.27% year-to-date. U.S. major benchmarks closed higher for another consecutive week amid solid economic data, better-than-expected earnings reports, and signals that the Fed is prepared to act when needed while putting uncertainty over the coronavirus outbreak on the back burner. Twenty-three or 68% of the Index constituents posted positive results, with nine surging more than 5%, and six announced fourth-quarter 2019 and full-year earnings results. (See the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) reversed course, and gained 0.48% to finish the week

February 3 – 7, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) gained 0.48%, reversing its losing streak to end the week, February 7, 2020. Advancers outweighed the laggards, with 21 (61.76%) of the 34 constituents moving the Index ahead to finish at 54.08. All three U.S. benchmarks finished in the black after the 5-day trading cycle when the market got a shot of confidence from China earlier in the week, saying, “it will slash tariffs on $75 billion in U.S. goods” and strong corporate quarterly earnings results also bolstered. On January 17th, the CrowdBureau P2P Index was up 57.74, when the broader markets started retrenching over the coronavirus outbreak. Since then, the Index has slid back to its low point registered on December 12, 2019 to 54.08, on February 7, 2020. (See the Chart of the Week). During this period, China’s economy was winding down for the Chinese New Year celebration when the coronavirus was reported, and productivity was scheduled to take a seasonal dip. Month-to-date the Index is up 0.48% and down -6.81% on a year-to-date basis.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded -4.95% to end the week

January 27 – 31, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded -4.95%, its fourth consecutive weekly loss. At the same time, on a month-to-date and year-to-date basis, the Index gave up -7.26% to finish January. Global stocks sold off over fears from the potential economic damage of the coronavirus, and a mix of U.S. corporate earnings reports moved the major U.S. benchmarks. While, the yield on three-month U.S. Treasury bills jumped above the benchmark 10-year note, inverting part of the yield curve. The Index finished the week lower at 53.82, five constituents reported fourth-quarter 2019 earnings results, and six constituents dropped more than 10%.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) turned lower -1.94% for the week

January 20 – 24, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the holiday shortened 4-day trading week lower -1.94% to finish at 56.62 on Friday January 24, 2020. All three major U.S. stock indexes closed the week in the red. The impact of the Wuhan coronavirus spreading outside China’s borders and the potential effect on the global economy sent fears across the markets. U.S. bank stocks fell along with the slide in long-term Treasury yields. On a month-to-date and year-to-date basis, the Index is down -2.43%.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered -1.31% for the week

January 13 – 17, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week ended January 17, 2020, at 57.74, posting a decline of -1.31%. Stocks closed higher, resuming the rally that started the previous week amid news that the U.S. will remove China from a list of currency manipulating countries and increasing investor optimism ahead of the signing of a critical trade agreement. The Index is down -0.50% month-to-date and year-to-date, respectively.

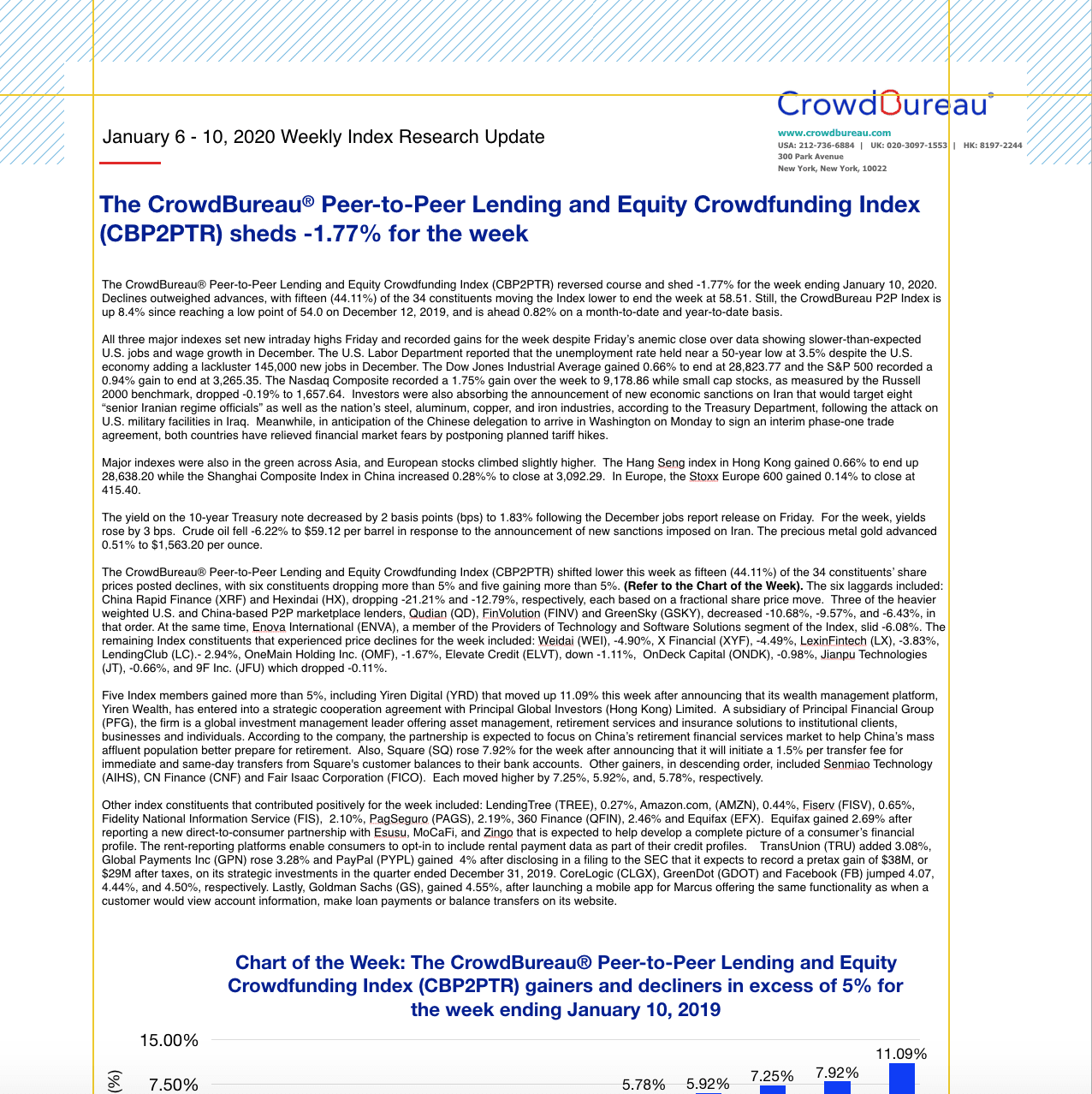

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) sheds -1.77% for the week

January 6 – 10, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) reversed course and shed -1.77% for the week ending January 10, 2020. Declines outweighed advances, with fifteen (44.11%) of the 34 constituents moving the Index lower to end the week at 58.51. Still, the CrowdBureau P2P Index is up 8.4% since reaching a low point of 54.0 on December 12, 2019, and is ahead 0.82% on a month-to-date and year-to-date basis.

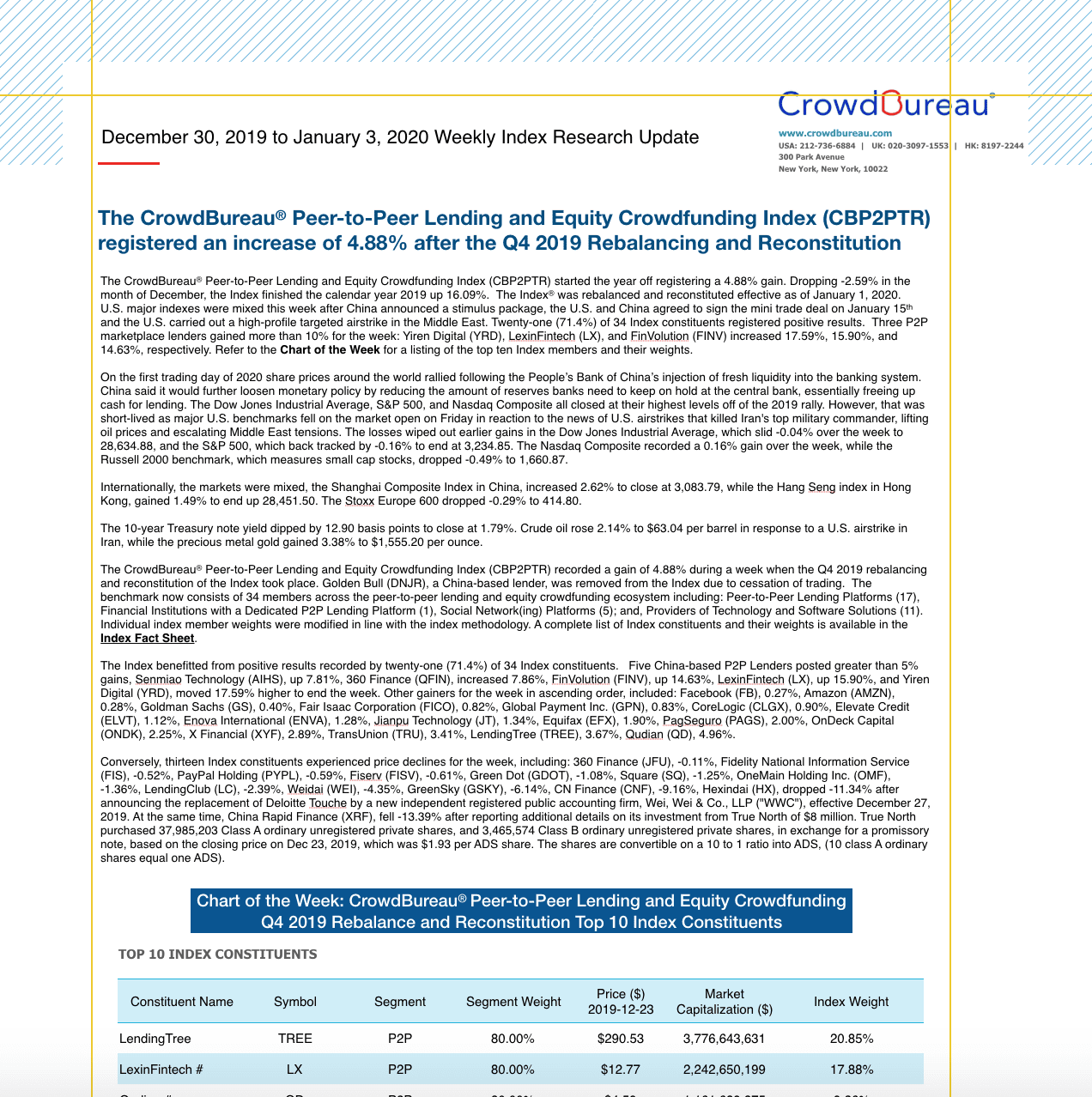

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered an increase of 4.88% after the Q4 2019 Rebalancing and Reconstitution

December 30, 2019 to January 3, 2020

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) started the year off registering a 4.88% gain. Dropping -2.59% in the month of December, the Index finished the calendar year 2019 up 16.09%. The Index® was rebalanced and reconstituted effective as of January 1, 2020. U.S. major indexes were mixed this week after China announced a stimulus package, the U.S. and China agreed to sign the mini trade deal on January 15th and the U.S. carried out a high-profile targeted airstrike in the Middle East. Twenty-one (71.4%) of 34 Index constituents registered positive results. Three P2P marketplace lenders gained more than 10% for the week: Yiren Digital (YRD), LexinFintech (LX), and FinVolution (FINV) increased 17.59%, 15.90%, and 14.63%, respectively. Refer to the Chart of the Week for a listing of the top ten Index members and their weights.

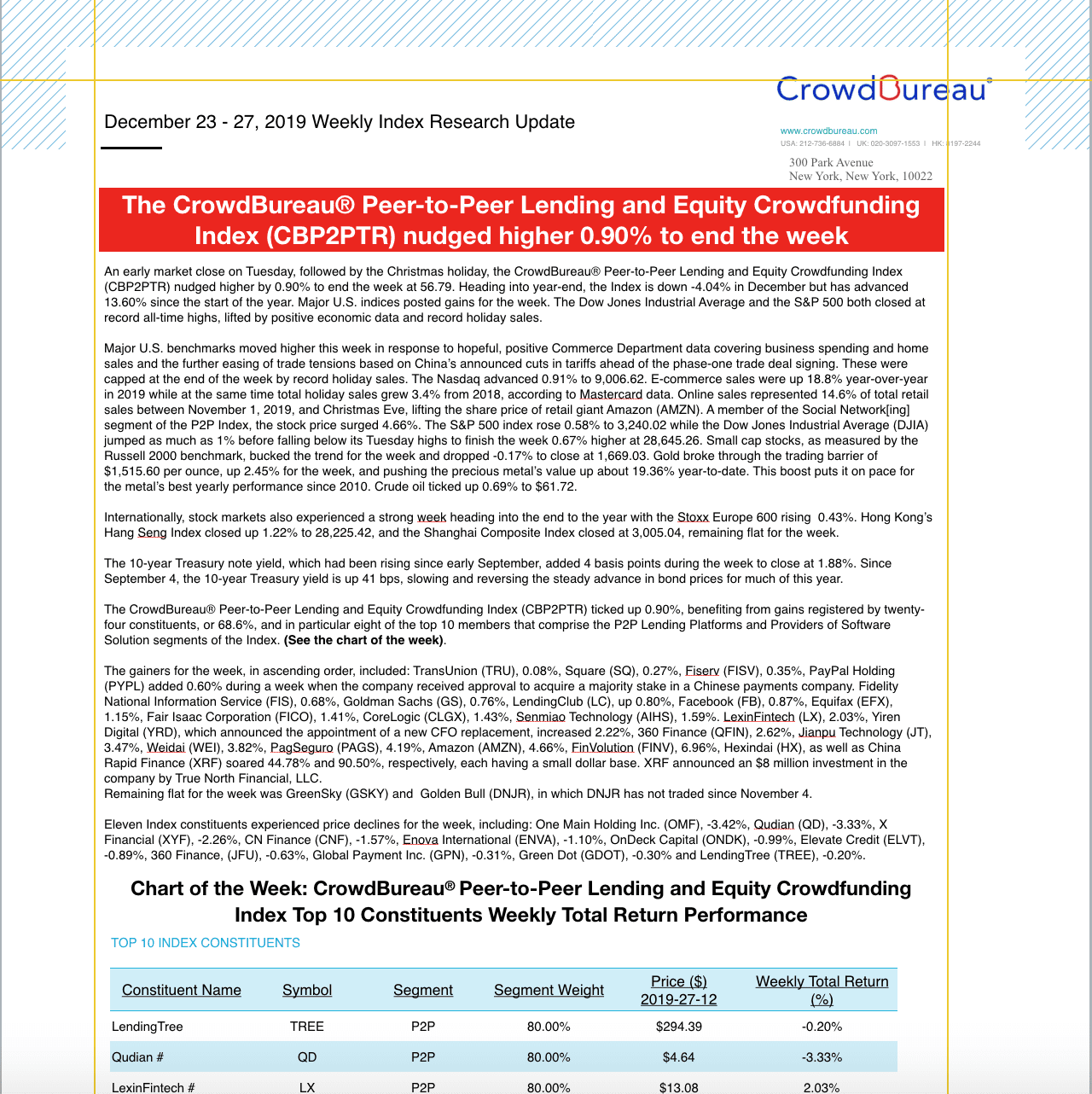

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) nudged higher 0.90% to end the week

December 23 – 27, 2019

An early market close on Tuesday, followed by the Christmas holiday, the CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) nudged higher by 0.90% to end the week at 56.79. Heading into year-end, the Index is down -4.04% in December but has advanced 13.60% since the start of the year. Major U.S. indices posted gains for the week. The Dow Jones Industrial Average and the S&P 500 both closed at record all-time highs, lifted by positive economic data and record holiday sales.

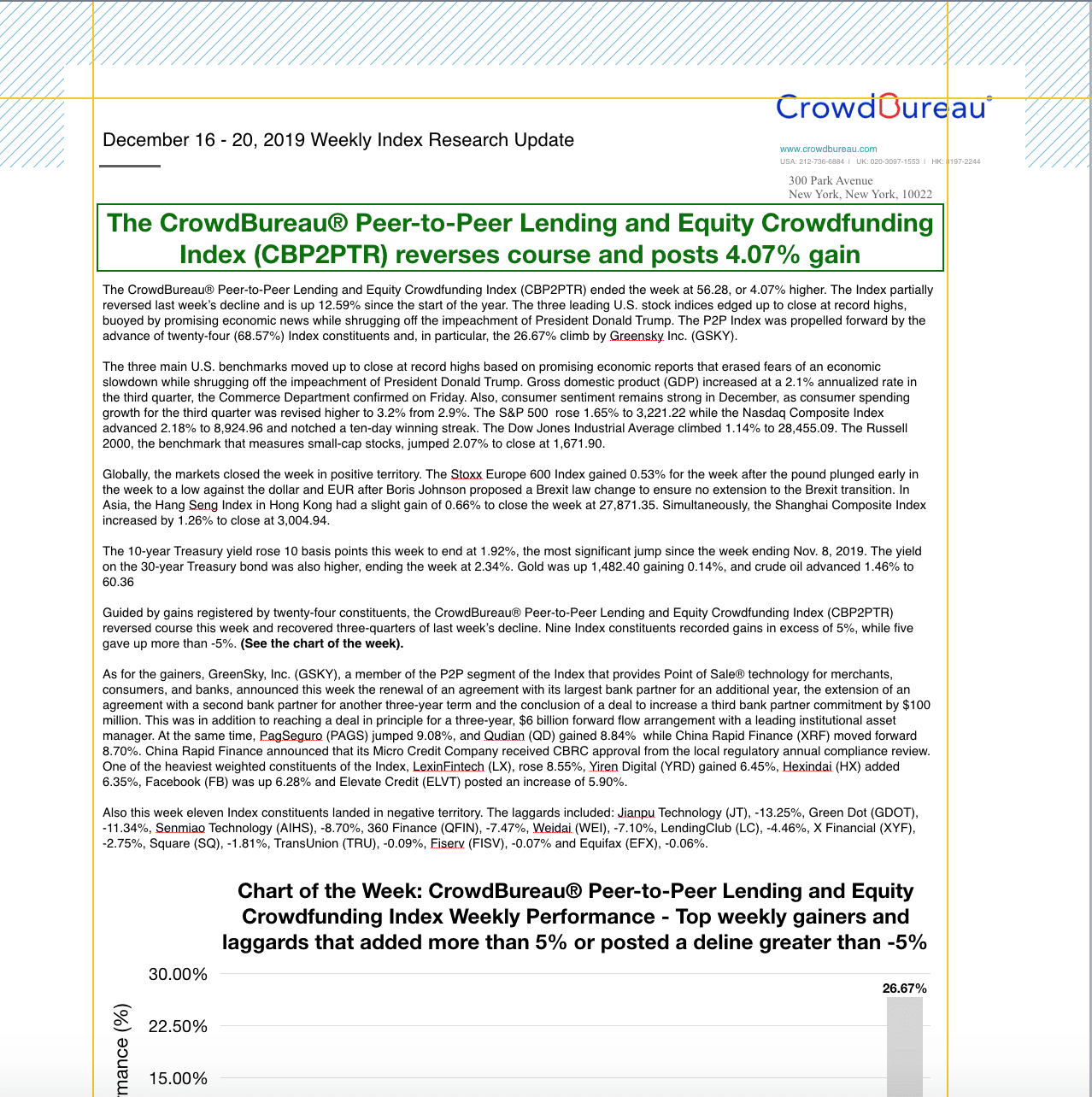

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) reverses course and posts 4.07% gain

December 16 – 20, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the week at 56.28, or 4.07% higher. The Index partially reversed last week’s decline and is up 12.59% since the start of the year. The three leading U.S. stock indices edged up to close at record highs, buoyed by promising economic news while shrugging off the impeachment of President Donald Trump. The P2P Index was propelled forward by the advance of twenty-four (68.57%) Index constituents and, in particular, the 26.67% climb by Greensky Inc. (GSKY).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index posted a second consecutive weekly decline, giving up -5.40%

December 9 – 13, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted a second consecutive weekly decline, dropping -5.40% to end the week at 54.08. Year-to-date, the Index is up 8.19% but it has now fallen -20.49% since reaching a fourth-quarter to-date interim peak on November 13, 2019. (See the Chart for the Week). The U.S. market ended the week marginally higher, however, the P2P Index was pushed into negative territory as eighteen (51.43%) Index constituents retreated and, in particular, two peer-to-peer lenders gave up more than 17% each.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index gained 3.65% in the final week of November

November 25 – 29, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the shortened holiday trading week with a 3.65% gain to end at 59.58. The Index dropped -2.70% for the month of November while increasing 19.18% on a year-to-date basis. The broad U.S. stock market performance was mixed, but indexes ended higher. In the first part of the week, all three major U.S. equity benchmarks reached new highs as economic reports showed more growth than expected. That said, by Friday, the last stock trading day for November, share prices fell on lower volumes after the U.S. signed two bills supporting Hong Kong protesters. Thirty, or 86% of the Index constituents, posted positive results, with ten constituents increasing by more than 5%. See the Chart of the Week.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index shed -10.09% for the week

November 18 – 22, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended its five-week winning streak, knocking -10.09% off its value over the 5-day trading period to close on Friday at 57.48. The Index remains in positive territory since the start of the year, having gained 14.98% through November 22, 2019. Mixed earnings announcements and wavering comments about the US-China ‘phase one’ trade deal getting done influenced the markets. Twenty-three or 65.7% of the Index constituents posted declines. These included nine constituents, eight of which are China-based P2P lending platforms that experienced share price declines greater than 10%. (See the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index recorded a fifth consecutive weekly gain, posting an increase of 0.61%

November 11 – 15, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded an increase of 0.61% to finish the week at a value of 63.93. The Index has now registered a strong gain of 17.94% since reaching a trough point so far this year on October 8, 2019 and is also up 27.89% since the start of the year. (See the Chart of the Week). U.S. stocks rallied for the sixth-consecutive week, the longest winning streak for the markets since 2017. Trade talks between the U.S. and China stayed on track with the limited scope of a phase one deal serving as a catalyst for positive market sentiment, along with fading recession fears and better than expected corporate earnings results that have benefited from lowered forecasts. Twenty-one or 60% of the Index constituents registered gains for the week, with five constituents increasing more than 5%.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index registered a gain of 1.17%, ending on a positive note for the fifth-consecutive week

November 4 – 8, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered a gain of 1.17% to end the week at 63.54. The Index has added 17.16% over five-consecutive weeks, pushing the year-to-date total return up 27.11%. Market sentiment improved this week with corporate earnings results that have generally beaten previously lowered analyst expectations, and trade optimism fueled a significant rotation out of bonds and into equities. Fourteen or 40% of the Index constituents posted positive results, with a combination of three U.S. and China-based P2P lenders outperforming the other constituents by 10% or more. These included China Rapid Finance (XRF), Jianpu Technology (JT), and LendingClub (LC) that posted gains of 10.71%, 10.50%, and 9.99% in that order. (See the Chart of the Week).

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index surged 5.89%, ending in the black for the fourth straight week

October 28 – November 1, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week higher for the fourth straight week, surging by 5.89% to end at 62.81. The Index gained 4.72% for the full month of October while increasing 15.69% since reaching its 2019 trough value on October 8. On a year-to-date total return basis, the Index is up 25.64%. See the Chart of the Week. Stocks were pushed higher during the week after the Fed cut interest rates, and a positive October jobs report signaled continued economic growth, albeit at a lower 1.9% rate. Twenty-three or 66% of the Index constituents posted positive results, with three increasing by more than 10%.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index rose for a third consecutive week, gaining 1.67%

October 21 – 25, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) gained 1.67% to end the week of October 25, 2019 at 58.34. Rising for the third consecutive week and registering an increase of 8.70% since reaching its low point this year on October 8, 2019, the Index is up 18.65% on a year-to-date basis. Stock prices were given a boost and Treasury yields climbed higher after reports that the U.S. and China made progress in trade discussions by moving closer to settling parts of a “phase one” deal even as third quarter earnings reports were mixed, and manufacturing data reflected weakness. Seven Index member companies announced earnings results with OnDeck Capital Inc, (ONDK) leading the U.S. based marketplace lenders. OnDeck’s share price soared 42.86% on Thursday after announcing higher margins that helped drive the sixth consecutive quarter of profits. The stock ended the week up 25.99%. Also reporting third quarter results were Enova International, (ENVA), PayPal (PYPL), TransUnion (TRU), Amazon.com (AMZN), Equifax (EFX), and CoreLogic (CLGX) whose share prices finished the week, 9.30%, 5.90%, 1.34%, 0.22%, -4.69%, and -13.63%, respectively. See the Chart of the Week.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index increased 0.52% for the week

October 7 – 11, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) gained 0.52%, to end the week of October 11, 2019 at 57.18. On Monday and Tuesday the index pulled back -1.59% and -1.82%, respectively, but managed to climb upward 1.22%, 0.81%, and 1.96% during the next three successive trading days as global stocks rose on optimism fueled by the prospects of a trade deal between the U.S and China. The Index now stands at 14.39% on a year-to-date basis. The three new constituents added to the Index at the Q3 2019 rebalance and reconstitution included 9F Inc, (JFU) a China based peer-to-peer lender, and two U.S. based constituents from the Technology and Software Solutions segment, Fiserv Inc. (FISV), and Fidelity National Information Services, Inc. (FIS) contributed -0.99%, -0.02% and 0.47%, respectively this week. See the Table of the Week.

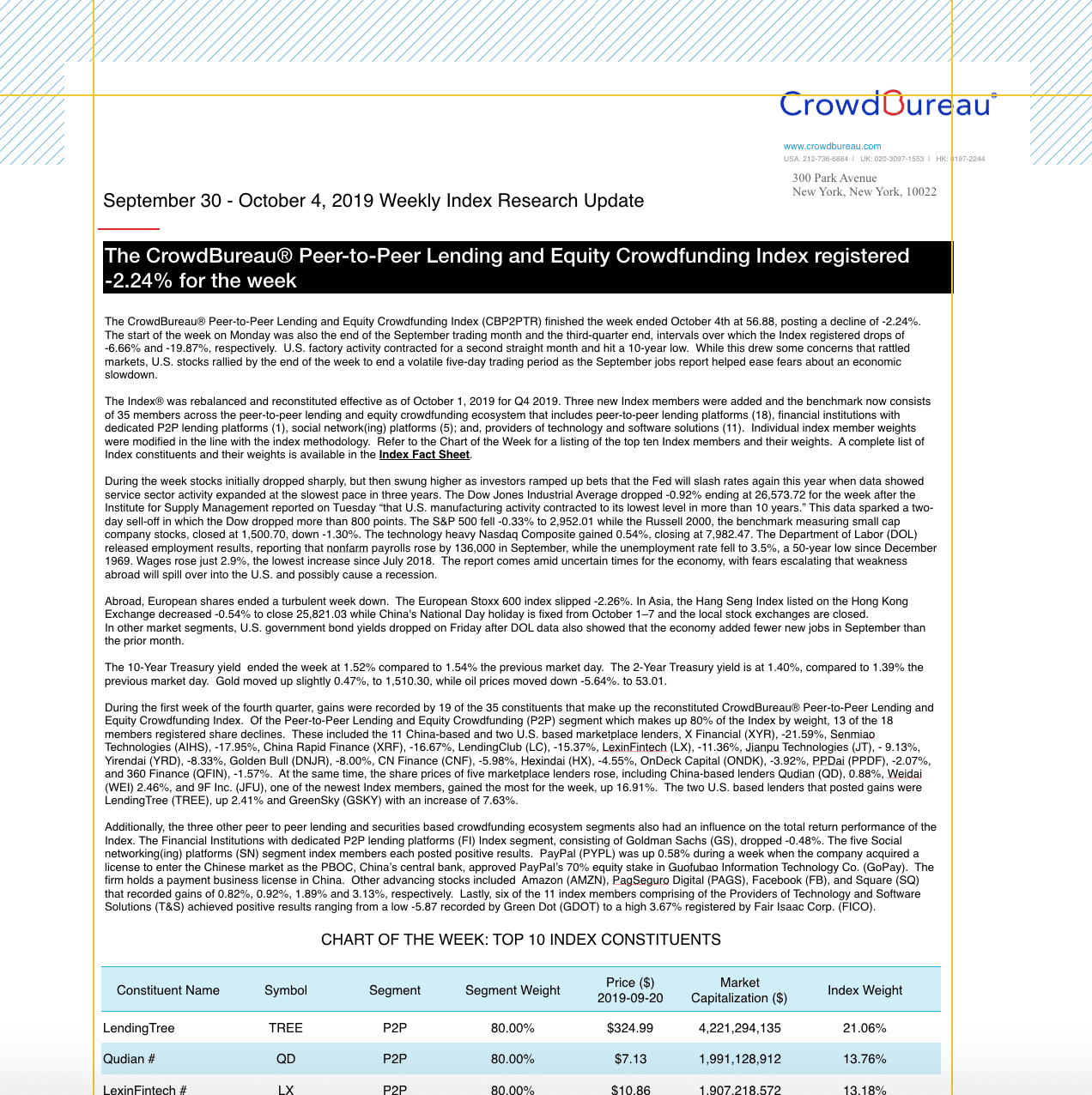

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index registered -2.24% for the week

September 30 – October 4, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week ended October 4th at 56.88, posting a decline of -2.24%. The start of the week on Monday was also the end of the September trading month and the third-quarter end, intervals over which the Index registered drops of -6.66% and -19.87%, respectively. U.S. factory activity contracted for a second straight month and hit a 10-year low. While this drew some concerns that rattled markets, U.S. stocks rallied by the end of the week to end a volatile five-day trading period as the September jobs report helped ease fears about an economic slowdown.

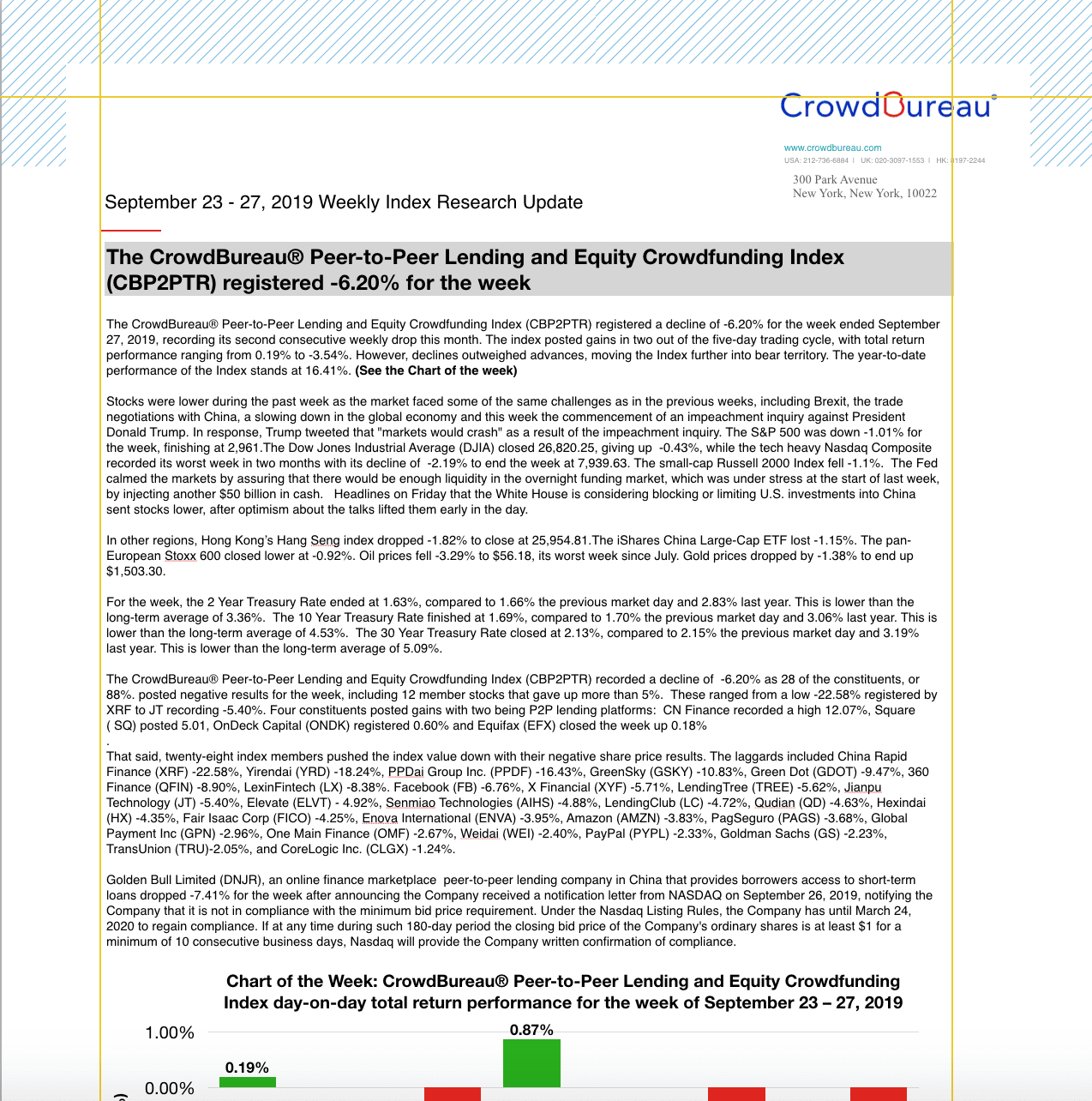

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered -6.20% for the week

September 23 – 27, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered a decline of -6.20% for the week ended September 27, 2019, recording its second consecutive weekly drop this month. The index posted gains in two out of the five-day trading cycle, with total return performance ranging from 0.19% to -3.54%. However, declines outweighed advances, moving the Index further into bear territory. The year-to-date performance of the Index stands at 16.41%. (See the Chart of the week)

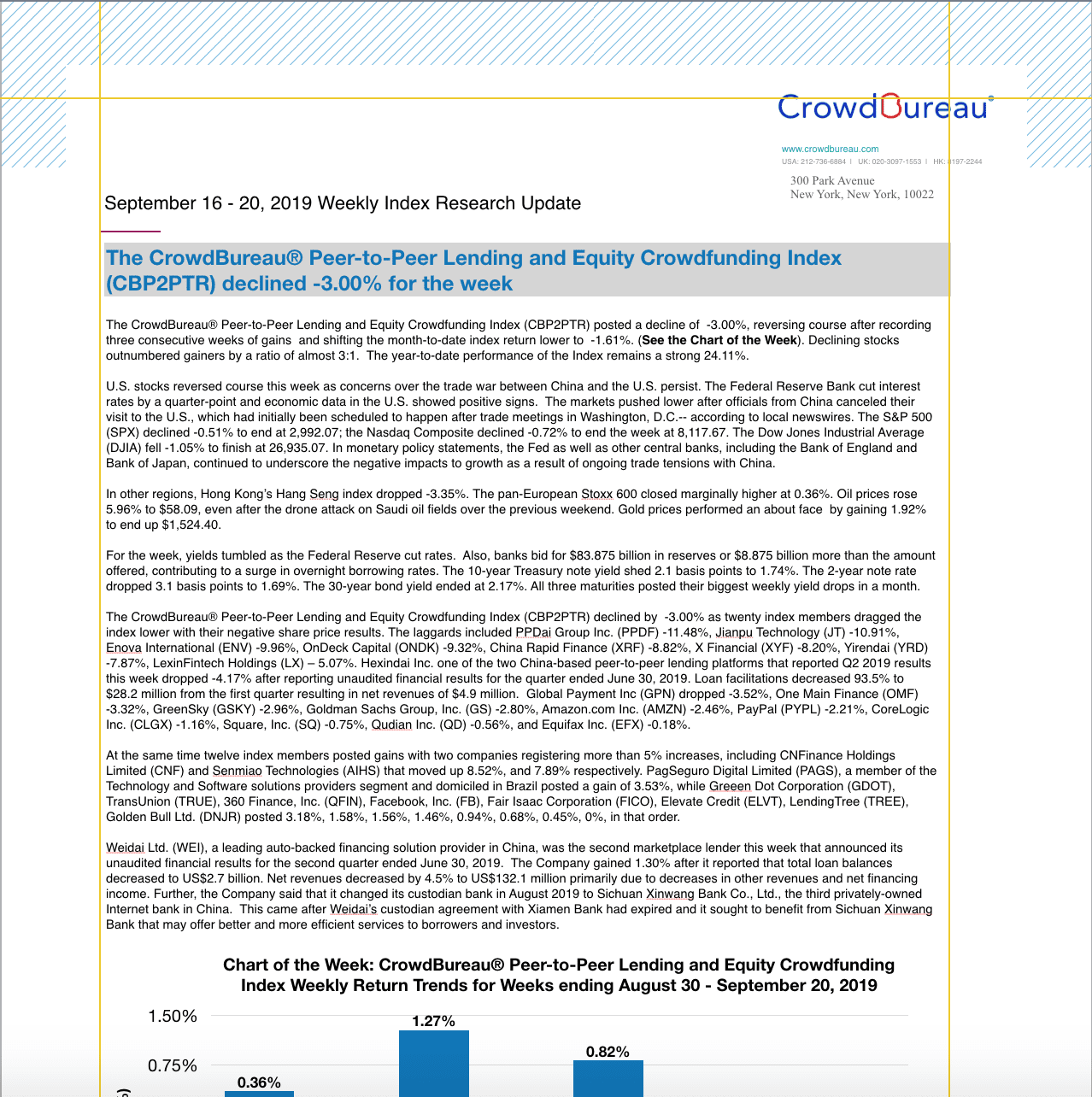

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) declined -3.00% for the week

September 16 – 20, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted a decline of -3.00%, reversing course after recording three consecutive weeks of gains and shifting the month-to-date index return lower to -1.61%. (See the Chart of the Week). Declining stocks outnumbered gainers by a ratio of almost 3:1. The year-to-date performance of the Index remains a strong 24.11%.

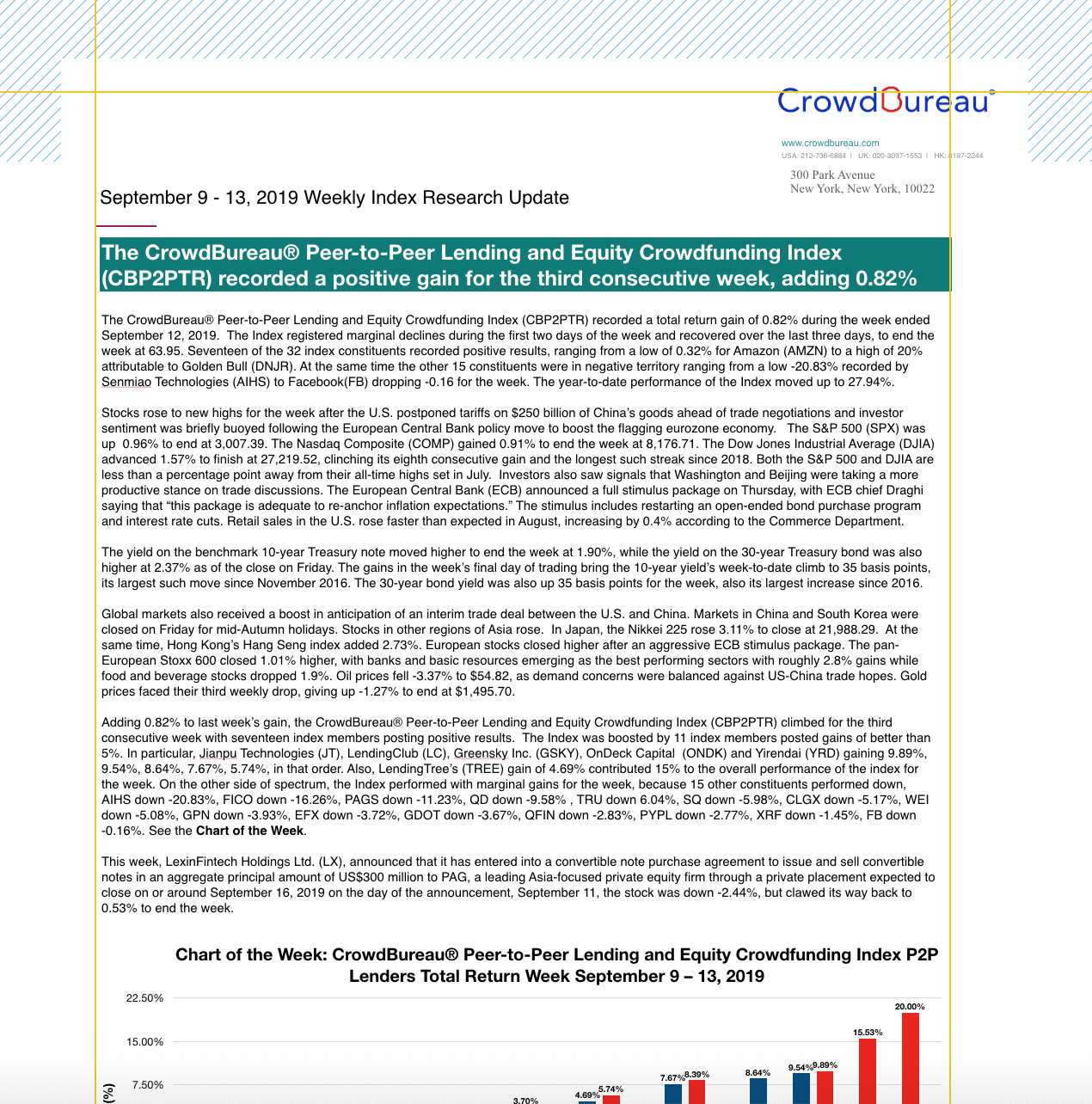

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded a positive gain for the third consecutive week, adding 0.82%

September 9 – 13, 2019

The CrowdBureau®Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded a total return gain of 0.82% during the week ended September 12, 2019. The Index registered marginal declines during the first two days of the week and recovered over the last three days, to end the week at 63.95. Seventeen of the 32 index constituents recorded positive results, ranging from a low of 0.32% for Amazon (AMZN) to a high of 20% attributable to Golden Bull (DNJR). At the same time the other 15 constituents were in negative territory ranging from a low -20.83% recorded by Senmiao Technologies (AIHS) to Facebook(FB) dropping -0.16 for the week. The year-to-date performance of the Index moved up to 27.94%.

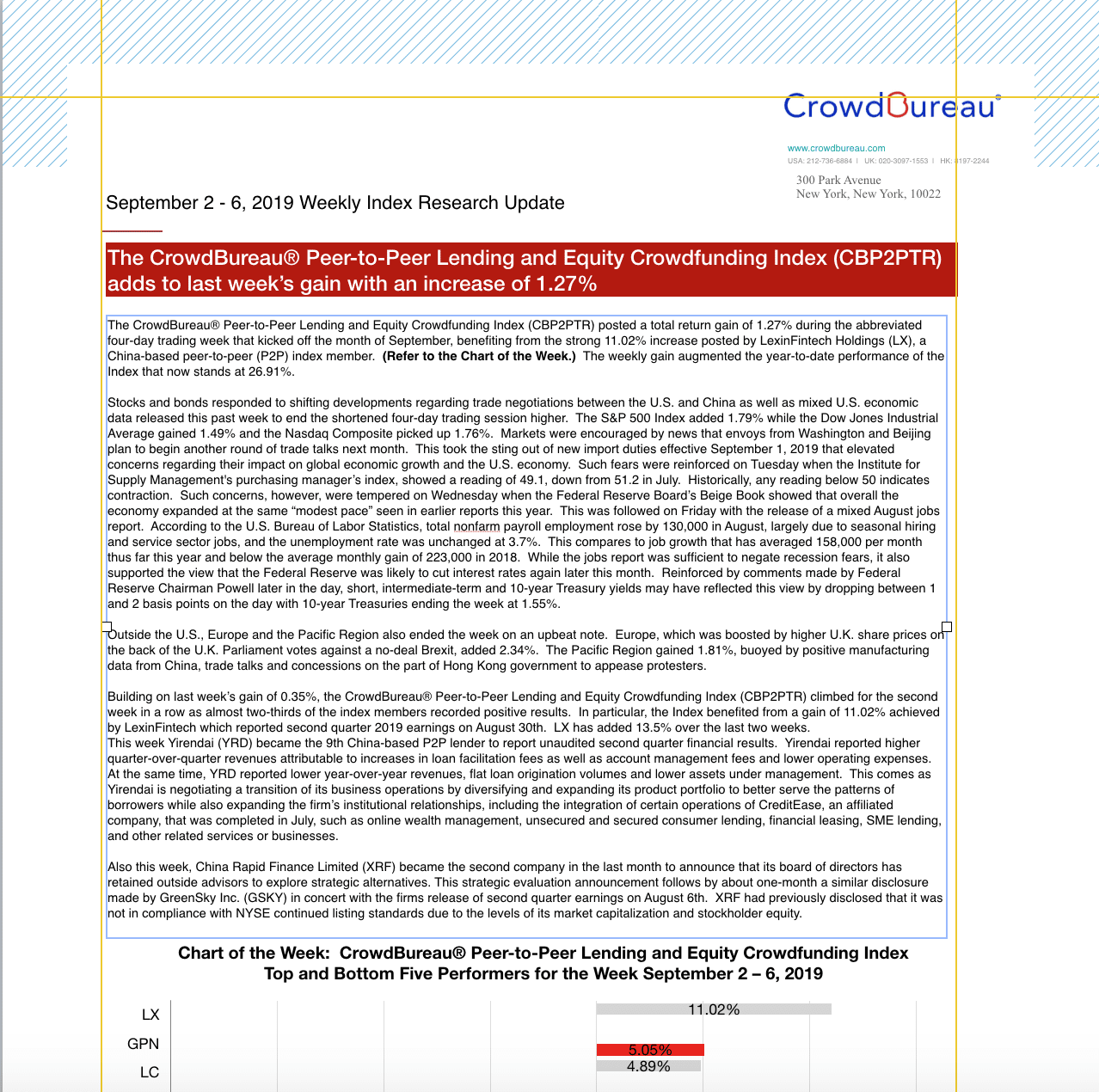

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) adds to last week’s gain with an increase of 1.27%

September 2 – 6, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted a total return gain of 1.27% during the abbreviated four-day trading week that kicked off the month of September, benefiting from the strong 11.02% increase posted by LexinFintech Holdings (LX), a China-based peer-to-peer (P2P) index member. Refer to the Chart of the Week. The weekly gain augmented the year-to-date performance of the Index that now stands at 26.91%.

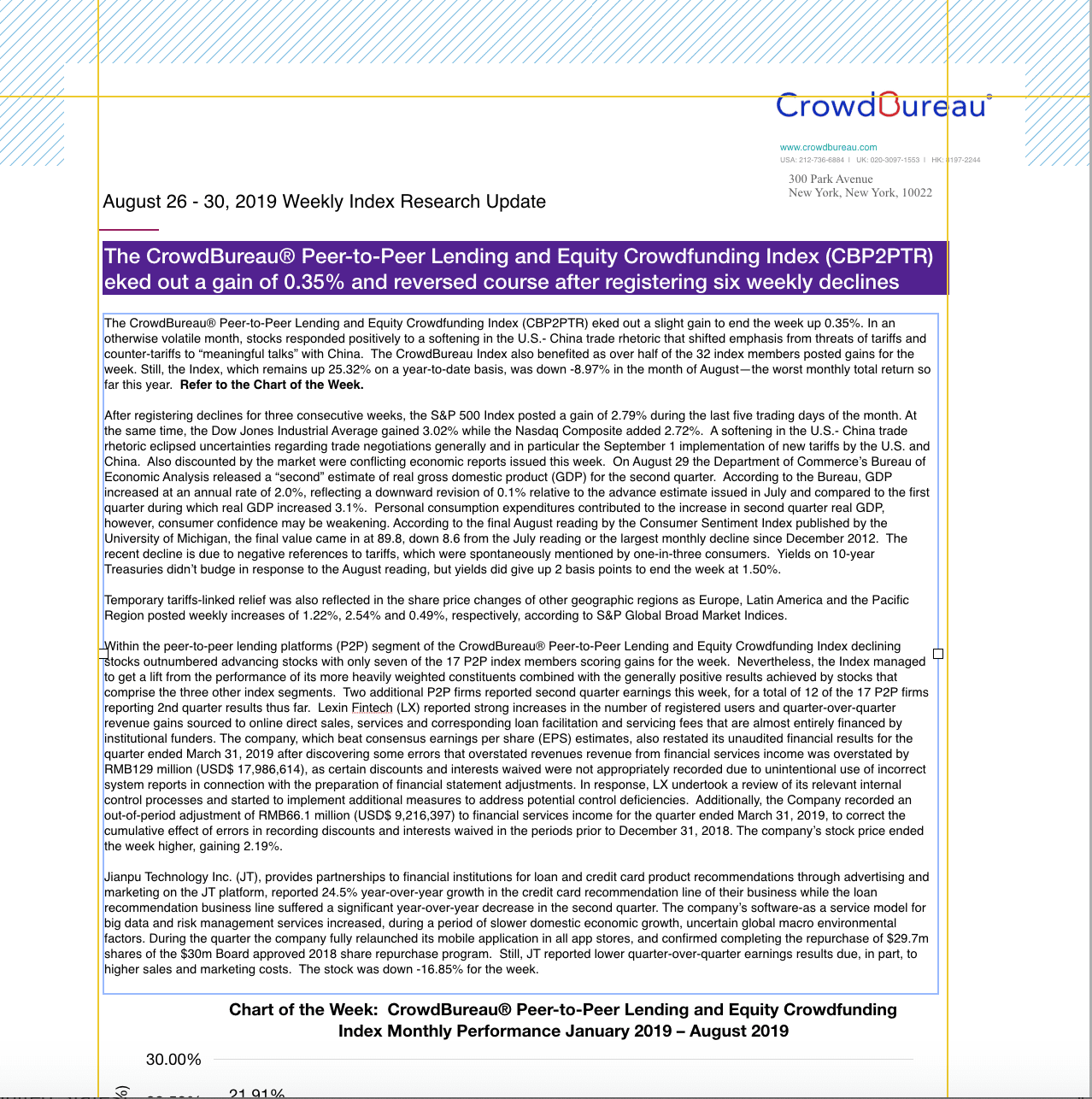

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) eked out a gain of 0.35% and reversed course after registering six weekly declines

August 26 – 30, 2019

The CrowdBureau®Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) eked out a slight gain to end the week up 0.35%. In an otherwise volatile month, stocks responded positively to a softening in the U.S.- China trade rhetoric that shifted emphasis from threats of tariffs and counter-tariffs to “meaningful talks” with China. The CrowdBureau Index also benefited as over half of the 32 index members posted gains for the week. Still, the Index, which remains up 25.32% on a year-to-date basis, was down -8.97% in the month of August—the worst monthly total return so far this year. Refer to the Chart of the Week.

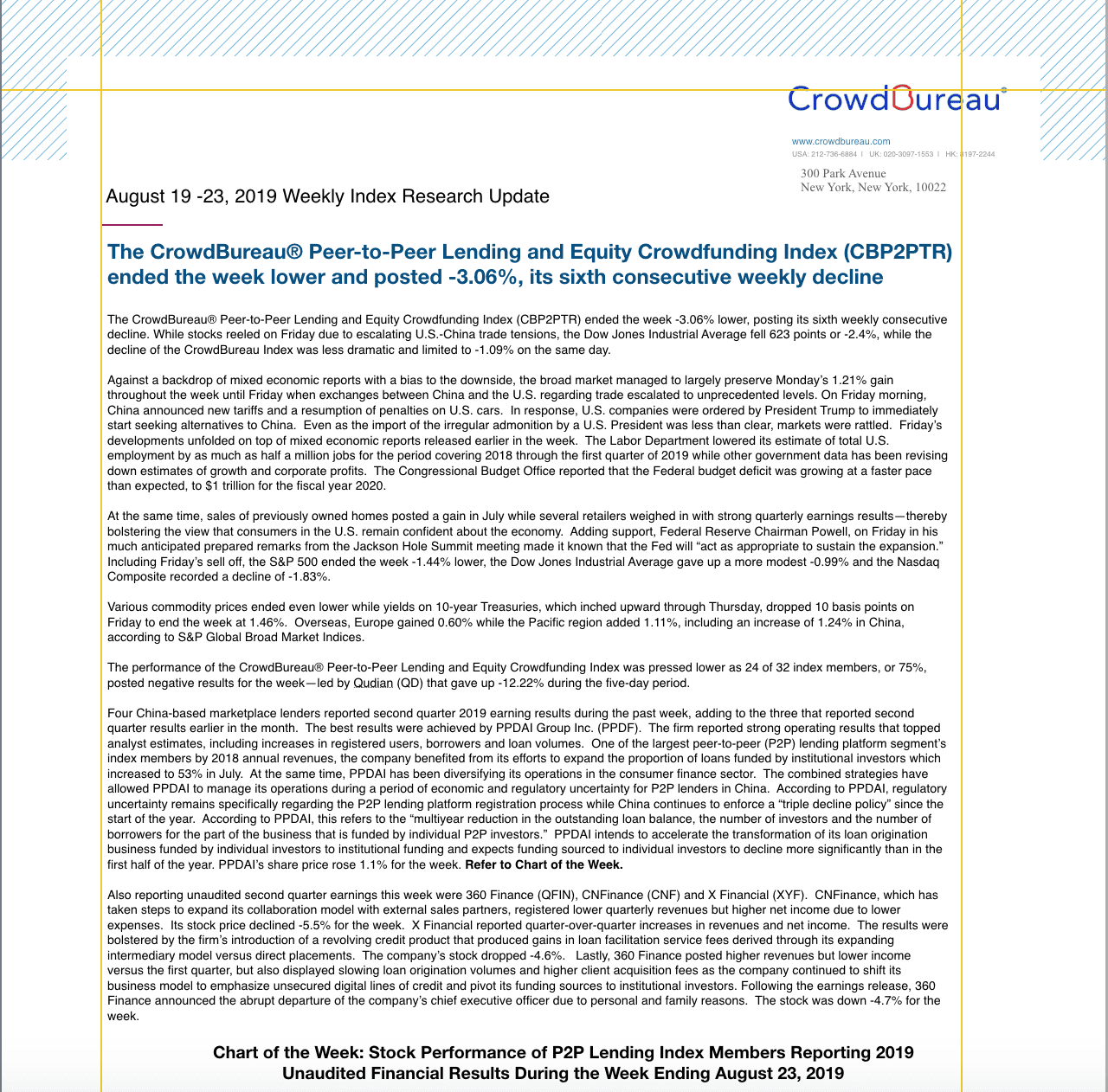

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the week lower and posted -3.06%, its sixth consecutive weekly decline

August 19 – 23, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the week -3.06% lower, posting its sixth weekly consecutive decline. While stocks reeled on Friday due to escalating U.S.-China trade tensions, the Dow Jones Industrial Average fell 623 points or -2.4%, while the decline of the CrowdBureau Index was less dramatic and limited to -1.09% on the same day.

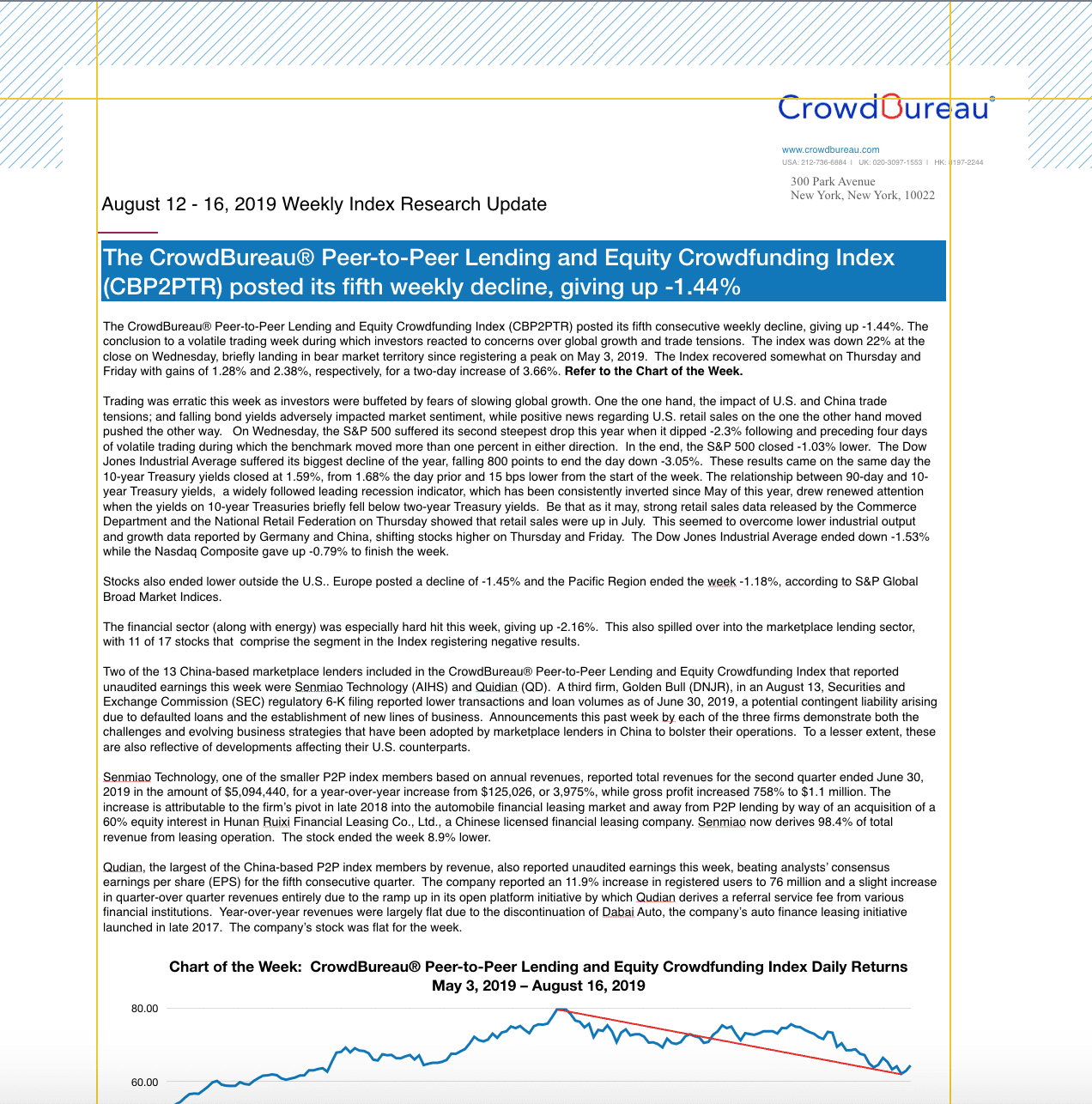

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted its fifth weekly decline, giving up -1.44%

August 12 – August 16, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) posted its fifth consecutive weekly decline, giving up -1.44%. The conclusion to a volatile trading week during which investors reacted to concerns over global growth and trade tensions. The index was down 22% at the close on Wednesday, briefly landing in bear market territory since registering a peak on May 3, 2019. The Index recovered somewhat on Thursday and Friday with gains of 1.28% and 2.38%, respectively, for a two-day increase of 3.66%. Refer to the Chart of the Week.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered a fourth consecutive weekly decline, giving up –2.80%

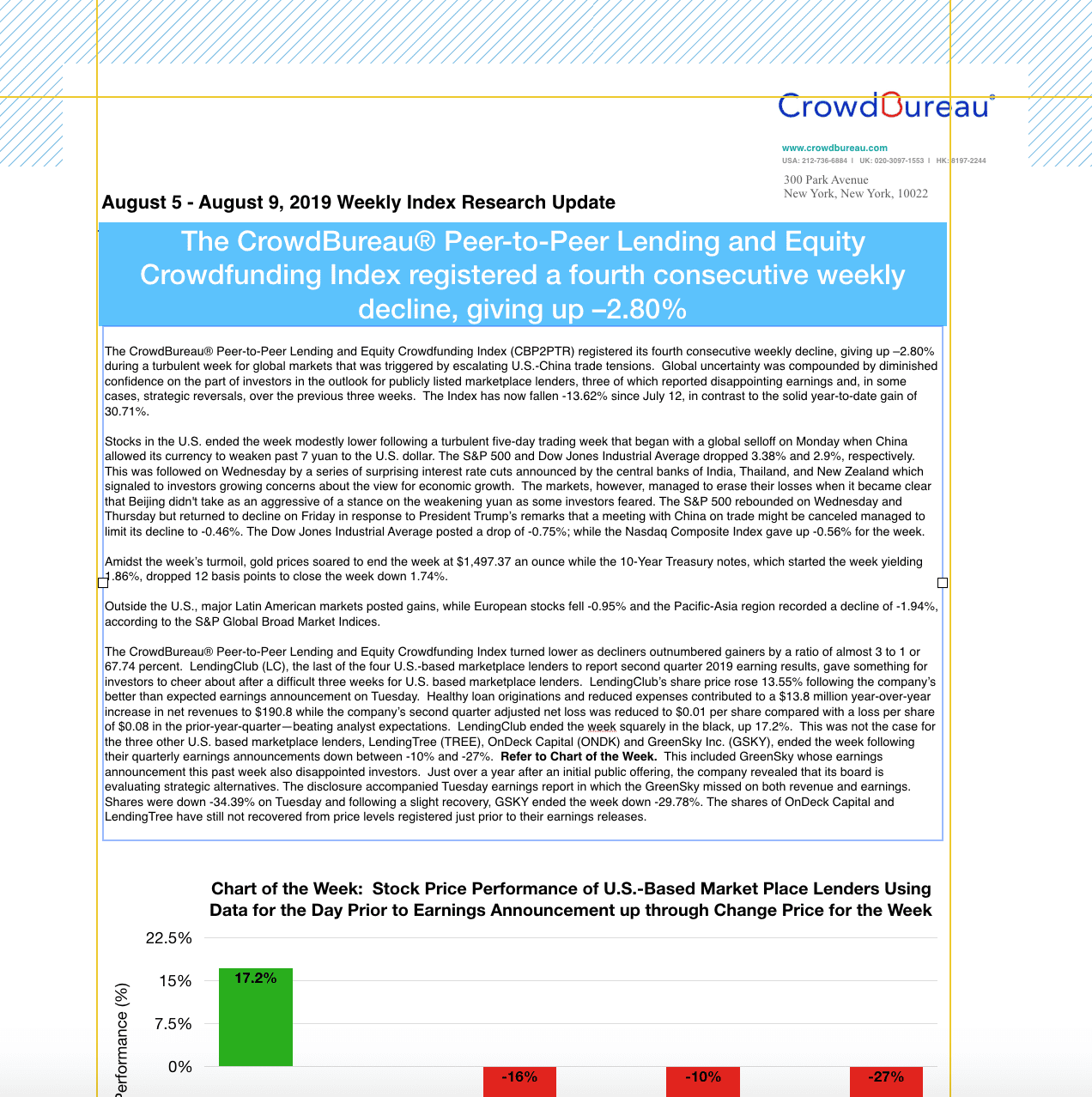

August 5 – August 9, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered a fourth consecutive weekly decline, giving up –2.80% during a turbulent week for global markets triggered by escalating US-China trade tensions. Global uncertainty was compounded by diminished confidence on the part of investors in the outlook for publicly listed marketplace lenders, three of which reported disappointing earnings and, in some cases, strategic reversals, over the previous three weeks. The Index has now fallen -13.62% since July 12, in contrast to the solid year-to-date gain of 30.71%.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index posts -4.57% decline

July 29 – August 2, 2019

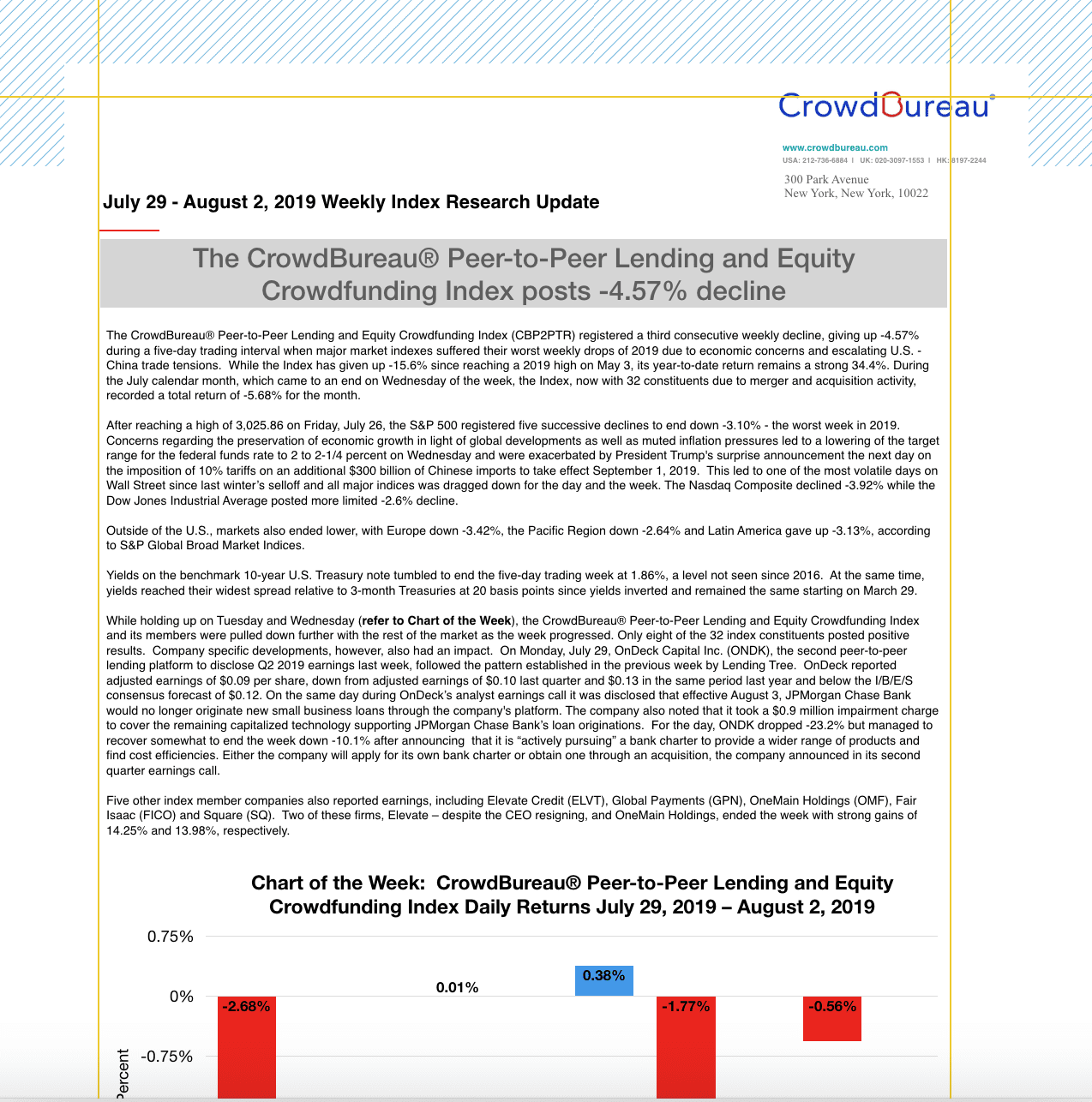

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) registered a third consecutive weekly decline, giving up -4.57% during a five-day trading interval when major market indexes suffered their worst weekly drops of 2019 due to economic concerns and escalating U.S. -China trade tensions. While the Index has given up -15.6% since reaching a 2019 high on May 3, its year-to-date return remains a strong 34.4%. During the July calendar month, which came to an end on Wednesday of the week, the Index, now with 32 constituents due to merger and acquisition activity, recorded a total return of -5.68% for the month.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index posts -2.33% decline

July 22 – 26, 2019

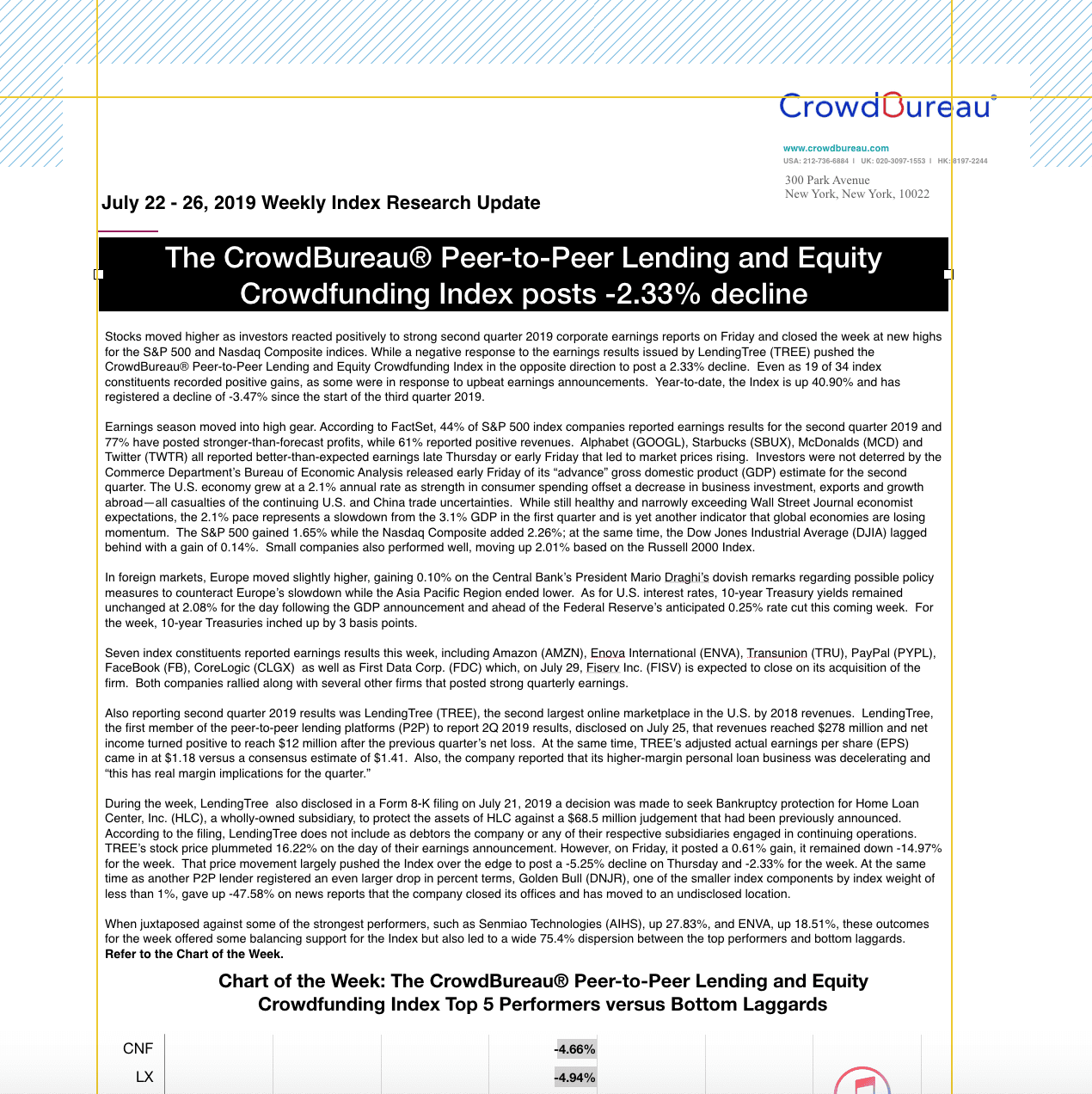

Stocks moved higher as investors reacted positively to strong second quarter 2019 corporate earnings reports on Friday and closed the week at new highs for the S&P 500 and Nasdaq Composite indices. While a negative response to the earnings results issued by LendingTree (TREE) pushed the CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index in the opposite direction to post a 2.33% decline. Even as 19 of 34 index constituents recorded positive gains, as some were in response to upbeat earnings announcements. Year-to-date, the Index is up 40.90% and has registered a decline of -3.47% since the start of the third quarter 2019.

The CrowdBureau®Peer-to-Peer Lending and Equity Crowdfunding Index closed at -3.8%

July 15 – 19, 2019

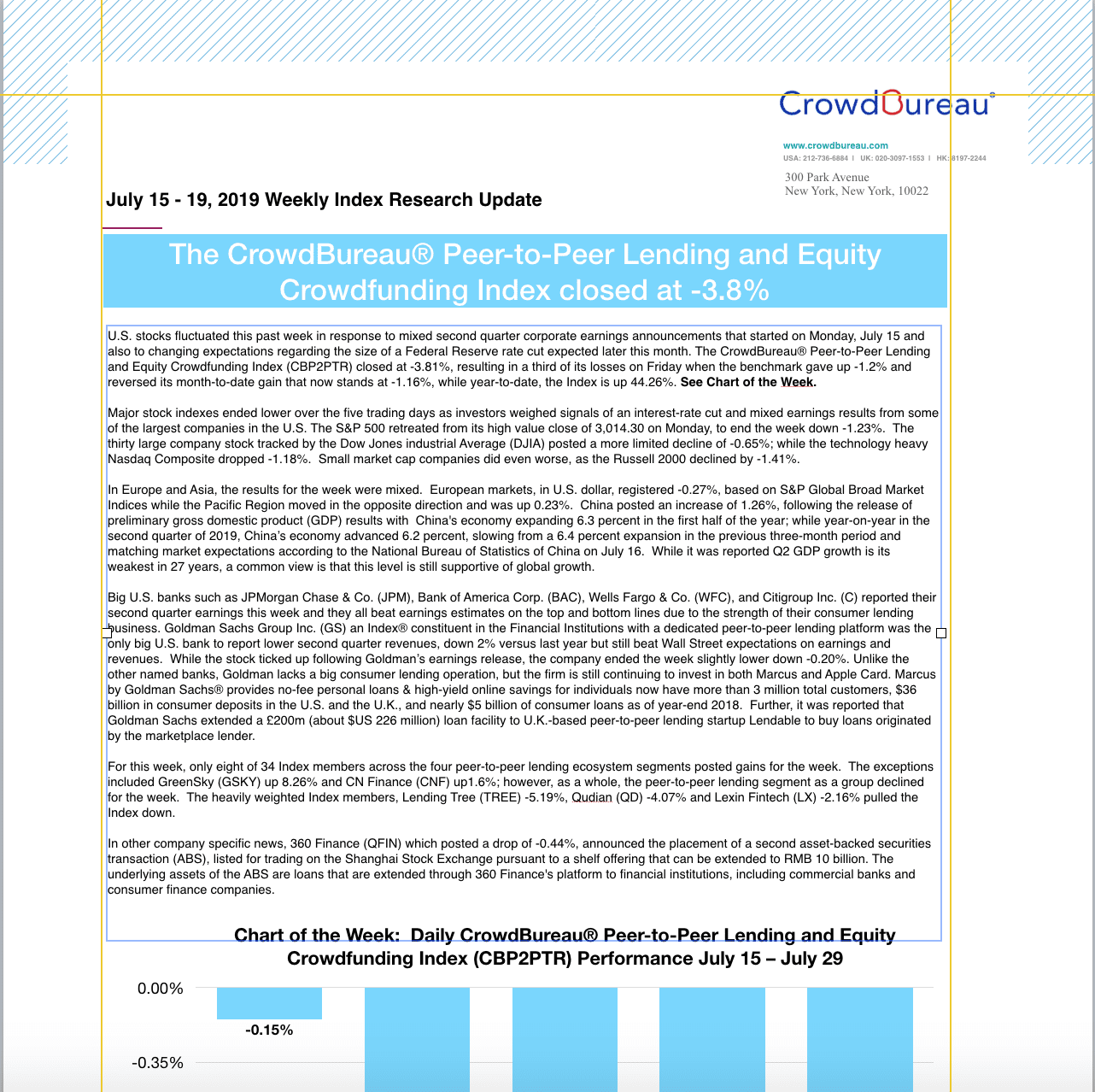

U.S. stocks fluctuated this past week in response to mixed second quarter corporate earnings announcements that started on Monday, July 15 and also to changing expectations regarding the size of a Federal Reserve rate cut expected later this month. The CrowdBureau®Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) closed at -3.81%, resulting in a third of its losses on Friday when the benchmark gave up -1.2% and reversed its month-to-date gain that now stands at -1.16%, while year-to-date, the Index is up 44.26%. See Chart of the Week.

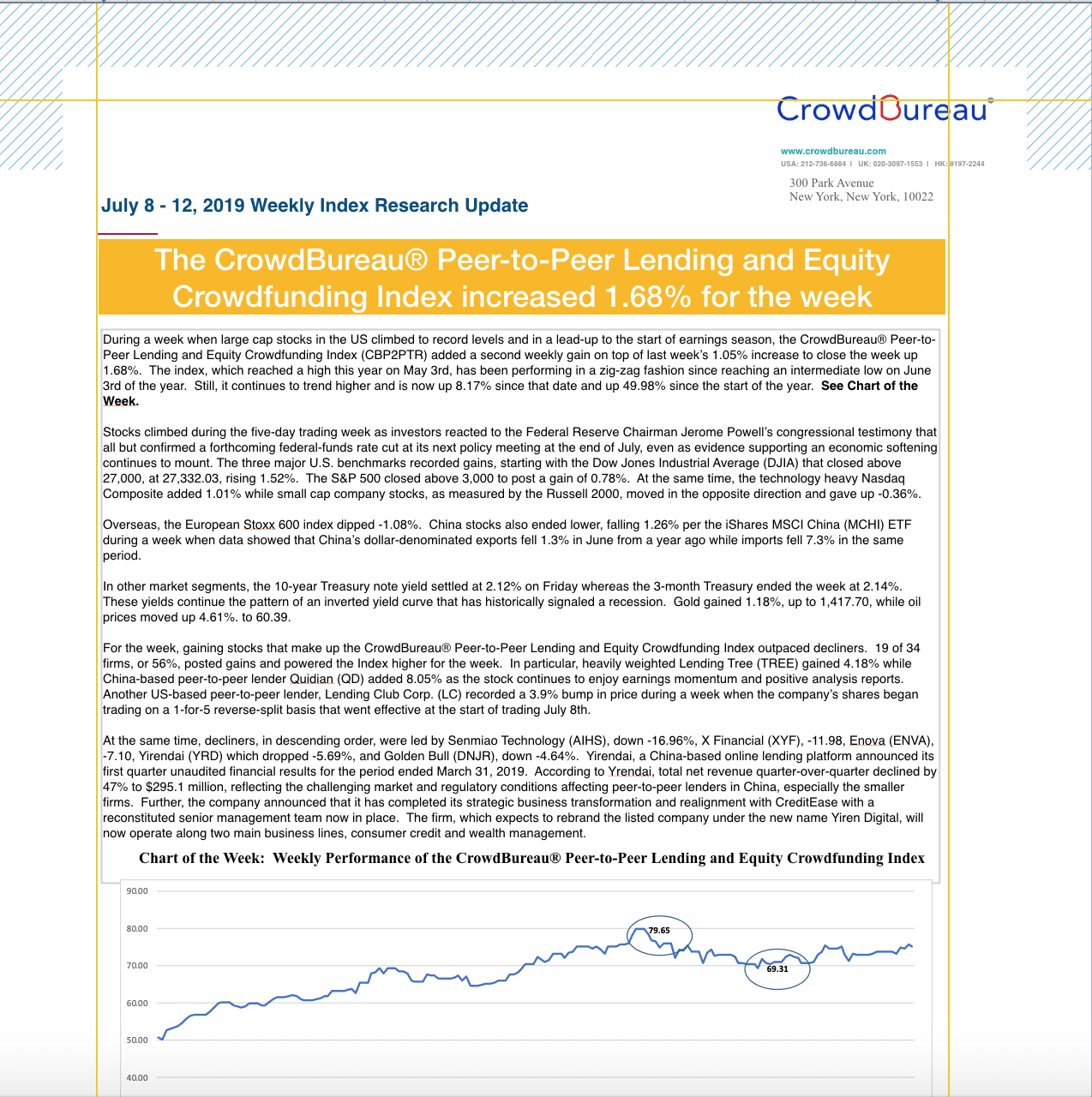

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index increased 1.68% for the week

July 8 – 12, 2019

During a week when large cap stocks in the US climbed to record levels and in a lead-up to the start of earnings season, the CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) added a second weekly gain on top of last week’s 1.05% increase to close the week up 1.68%. The index, which reached a high this year on May 3rd, has been performing in a zig-zag fashion since reaching an intermediate low on June 3rd of the year. Still, it continues to trend higher and is now up 8.17% since that date and up 49.98% since the start of the year. See Chart of the Week.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index gained 1.05% for the week

July 1 – 5, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week at 73.73, posting a gain of 1.05% over the shortened 4-day trading week, as global markets reacted positively to news that the U.S. and China restarted trade talks. At the same time, a stronger than expected June employment report issued by the Department of Labor did not set back investors who may have been anticipating a Fed rate cut.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index declined -2.17% for the week

June 24 – 28, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended the week, June 28, lower at 72.96, declining -2.17%. Investors sentiment was mixed for the week in anticipation of the G20 Summit in Japan and shifting central bank policies toward sustaining economic expansion moved the broader markets and the performance of 21 out of 35 Index members into negative territory. Month-to-date, the index is up 3.90%, and since the start of the year the benchmark remains decidedly ahead with a total return gain of 45.96%.

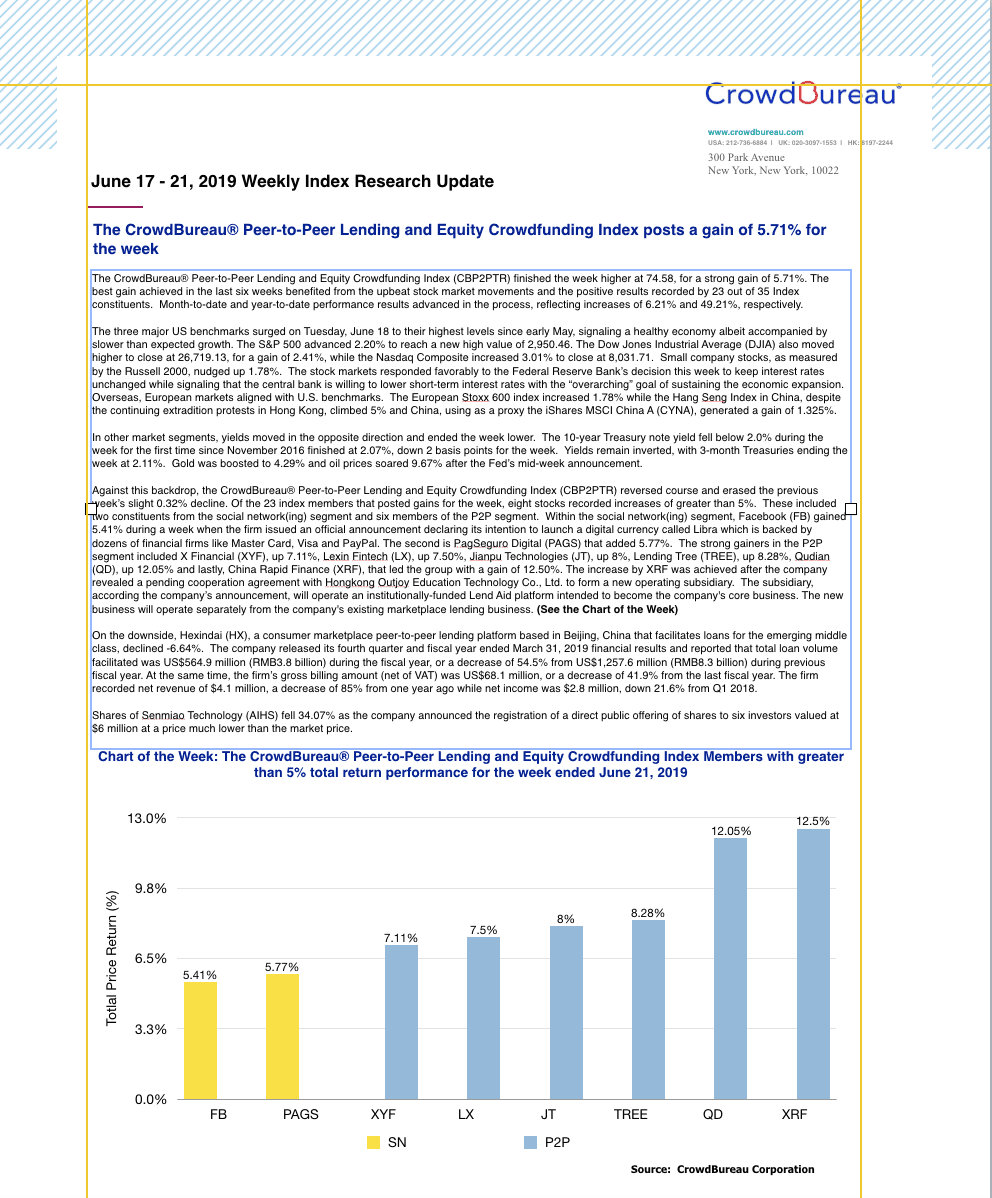

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index post a gain of 5.71% for the week

June 17 – 21, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) finished the week higher at 74.58, for a strong gain of 5.71%. The best gain achieved in the last six weeks benefited from the upbeat stock market movements and the positive results recorded by 23 out of 35 Index constituents. Month-to-date and year-to-date performance results advanced in the process, reflecting increases of 6.21% and 49.21%, respectively.

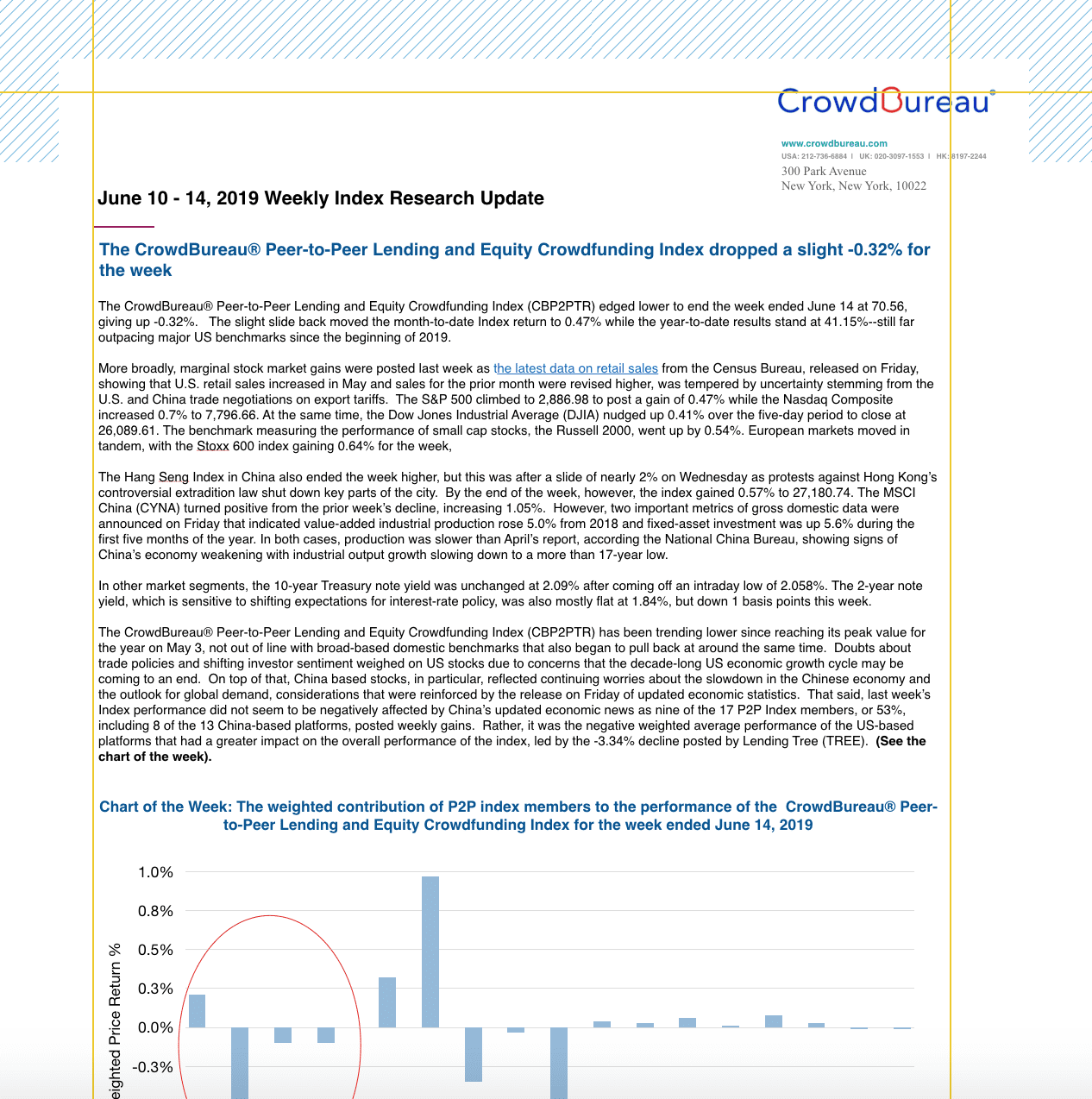

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index dropped a slight -0.32% for the week

June 10 – 14, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) edged lower to end the week ended June 14 at 70.56, giving up -0.32%. The slight slide back moved the month-to-date Index return to 0.47% while the year-to-date results stand at 41.15%–still far outpacing major US benchmarks since the beginning of 2019.

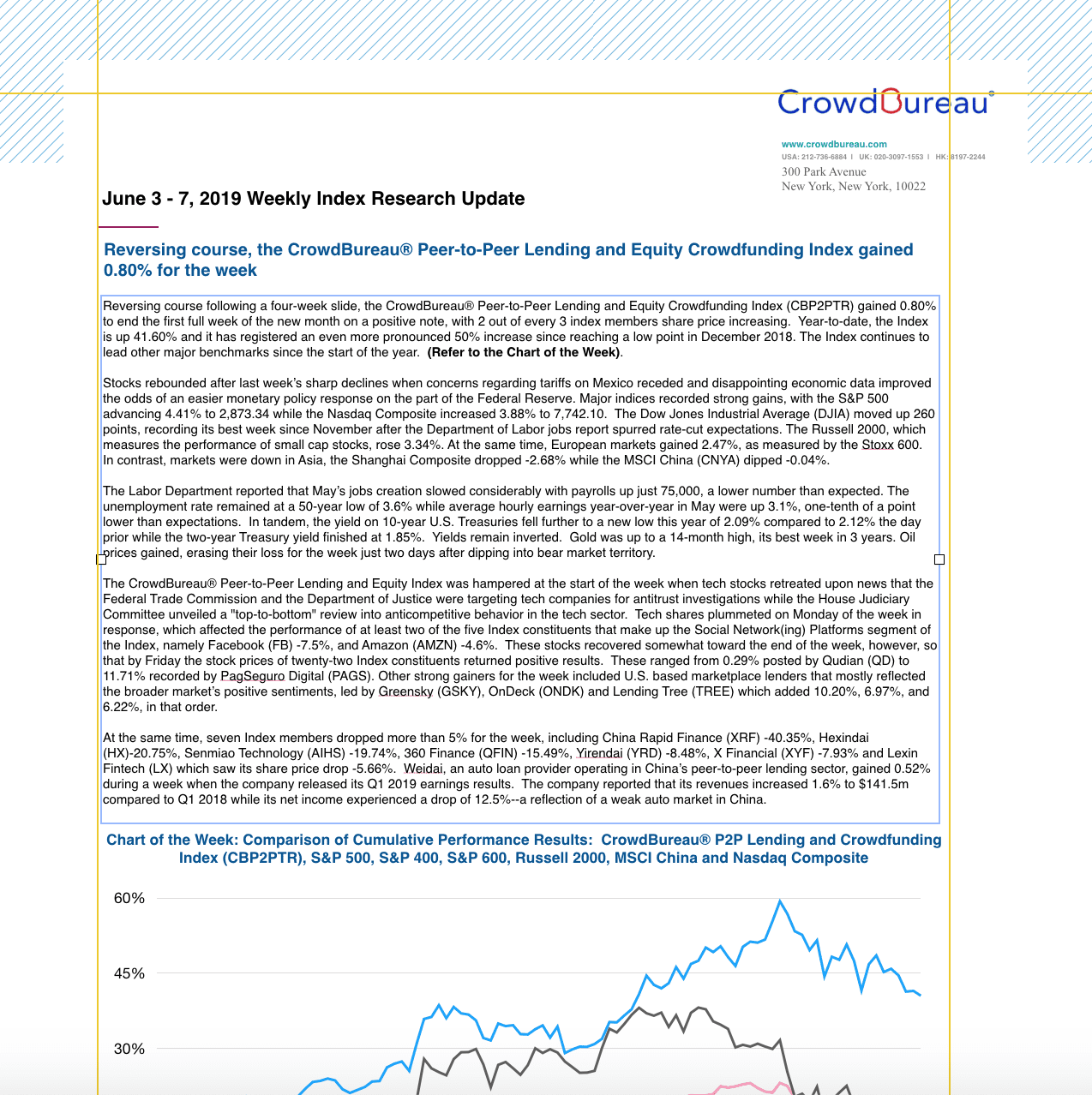

Reversing course, the CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index gained 0.80% for the week

June 3 – 7, 2019

Reversing course following a four-week slide, the CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) gained 0.80% to end the first full week of the new month on a positive note, with 2 out of every 3 index members share price increasing. Year-to-date, the Index is up 41.60% and it has registered an even more pronounced 50% increase since reaching a low point in December 2018.The Index continues to lead other major benchmarks since the start of the year. (Refer to the Chart of the Week).

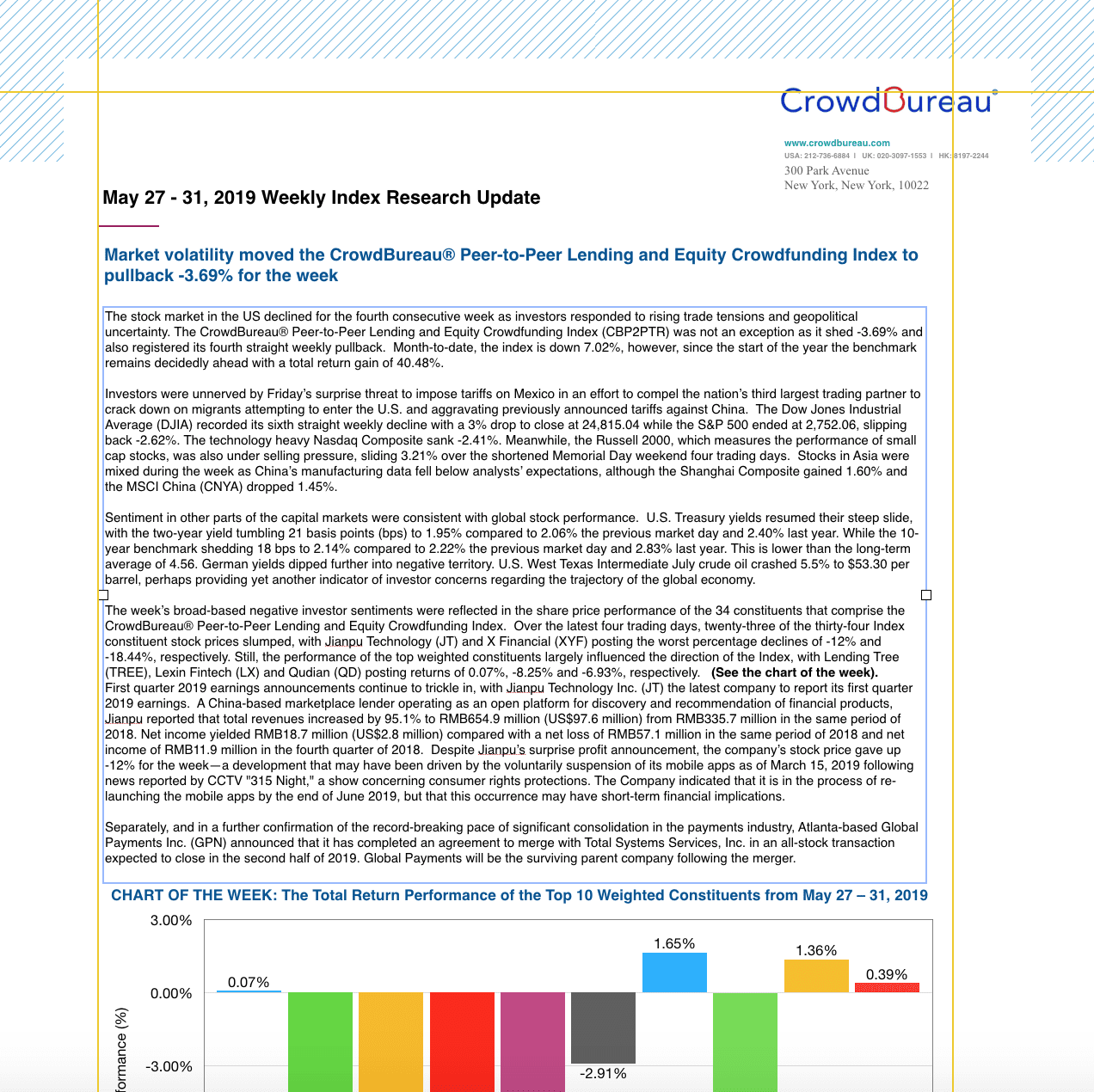

Market volatility moved the CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index to pullback -3.69% for the week

May 27 – 31, 2019

The stock market in the U.S. declined for the fourth consecutive week as investors responded to rising trade tensions and geopolitical uncertainty. The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) was not an exception as it shed -3.69% and also registered its fourth straight weekly pullback. Month-to-date, the index is down 7.02%, however, since the start of the year the benchmark remains decidedly ahead with a total return gain of 40.48%.

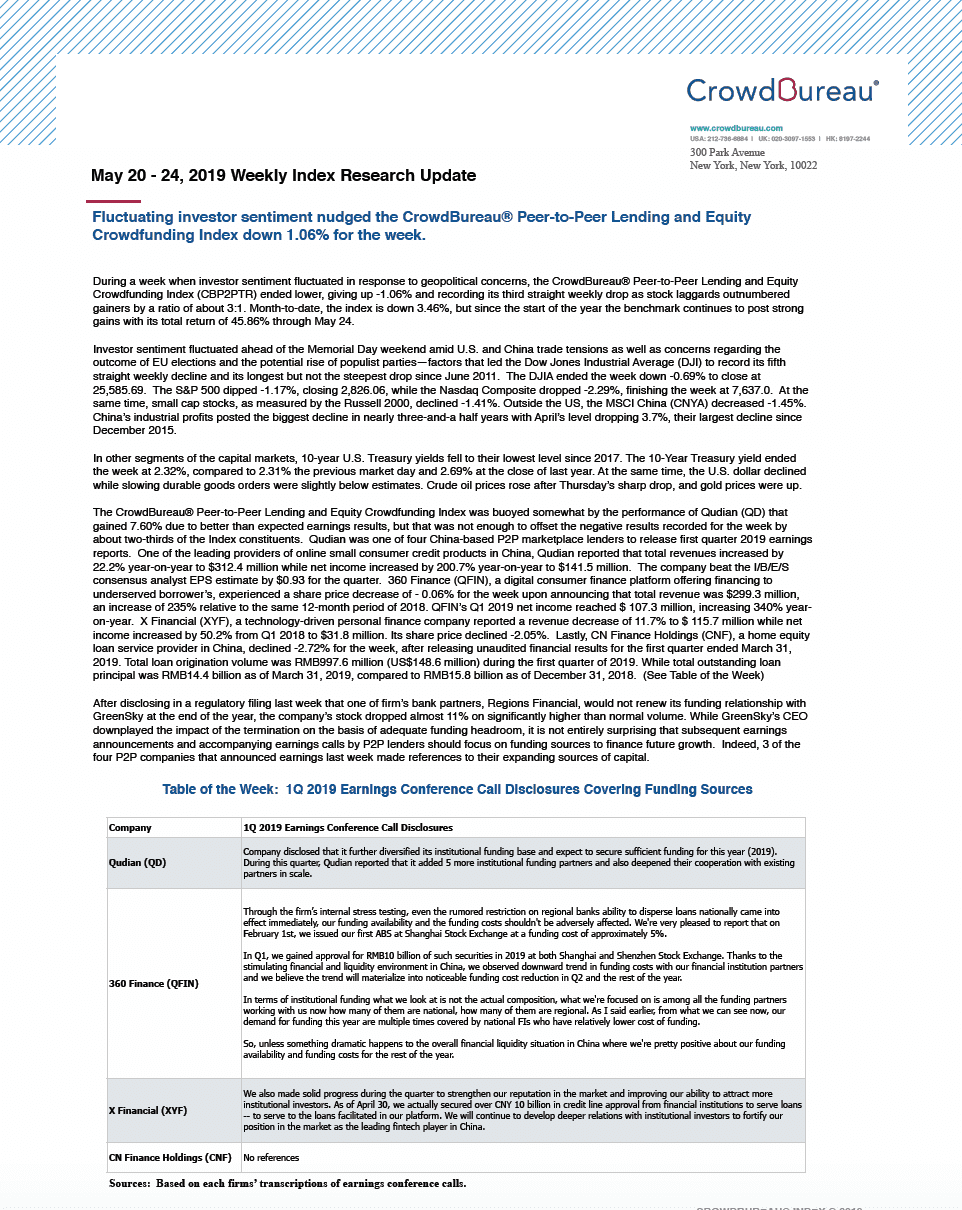

Fluctuating investor sentiment nudged the CrowdBureau®Peer-to-Peer Lending and Equity Crowdfunding Index down 1.06% for the week.

May 20 – 24, 2019

During a week when investor sentiment fluctuated in response to geopolitical concerns, the CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) ended lower, giving up -1.06% and recording its third straight weekly drop as stock laggards outnumbered gainers by a ratio of about 3:1. Month-to-date, the index is down 3.46%, but since the start of the year the benchmark continues to post strong gains with its total return of 45.86% through May 24.

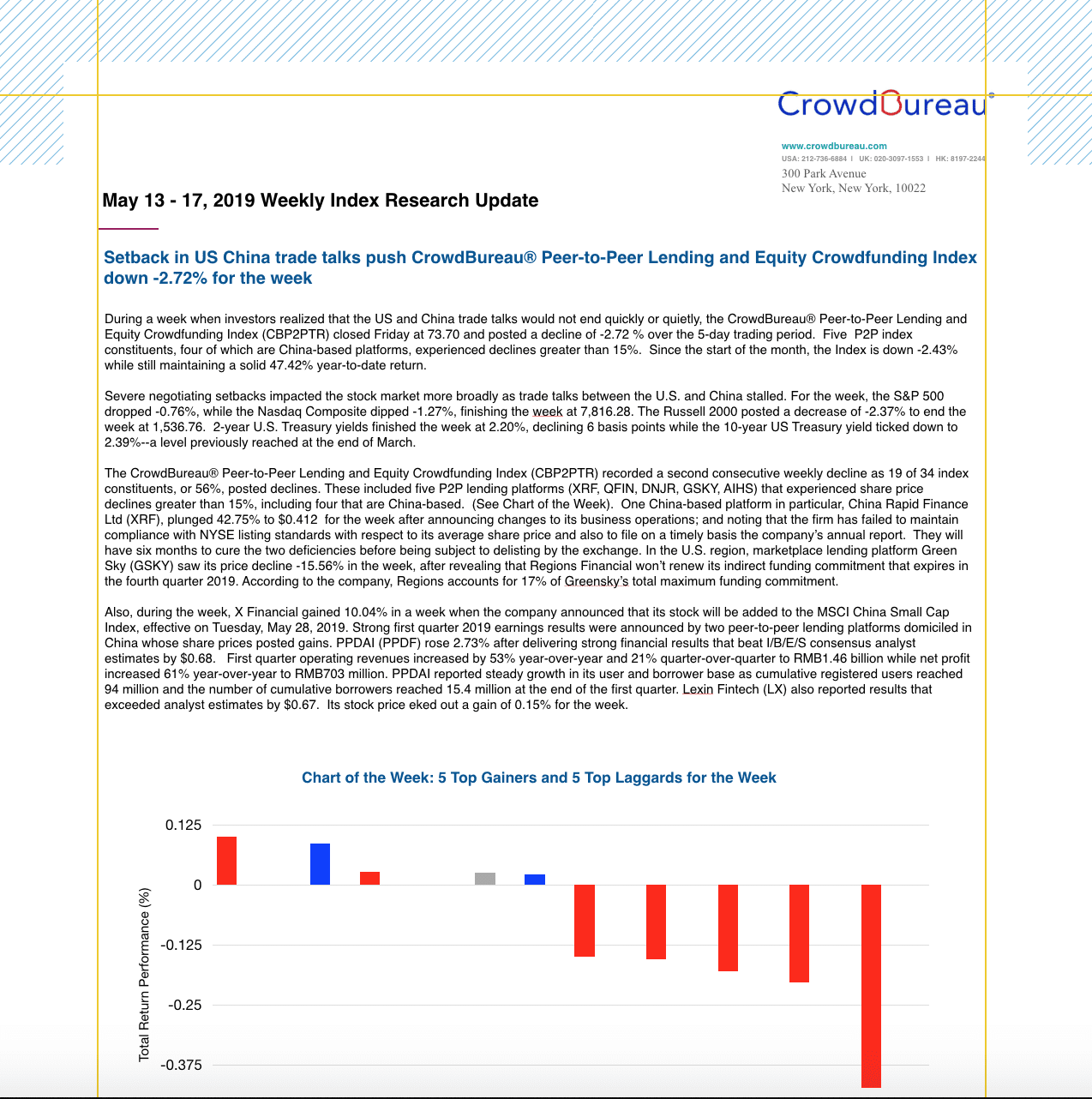

Setback in US China trade talks push CrowdBureau®Peer-to-Peer Lending and Equity Crowdfunding Index down -2.72% for the week

May 13 – 17, 2019

During a week when investors realized that the US and China trade talks would not end quickly or quietly, the CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) closed Friday at 73.70 and posted a decline of -2.72 % over the 5-day trading period. Five P2P index constituents, four of which are China-based platforms, experienced declines greater than 15%. Since the start of the month, the Index is down -2.43% while still maintaining a solid 47.42% year-to-date return.

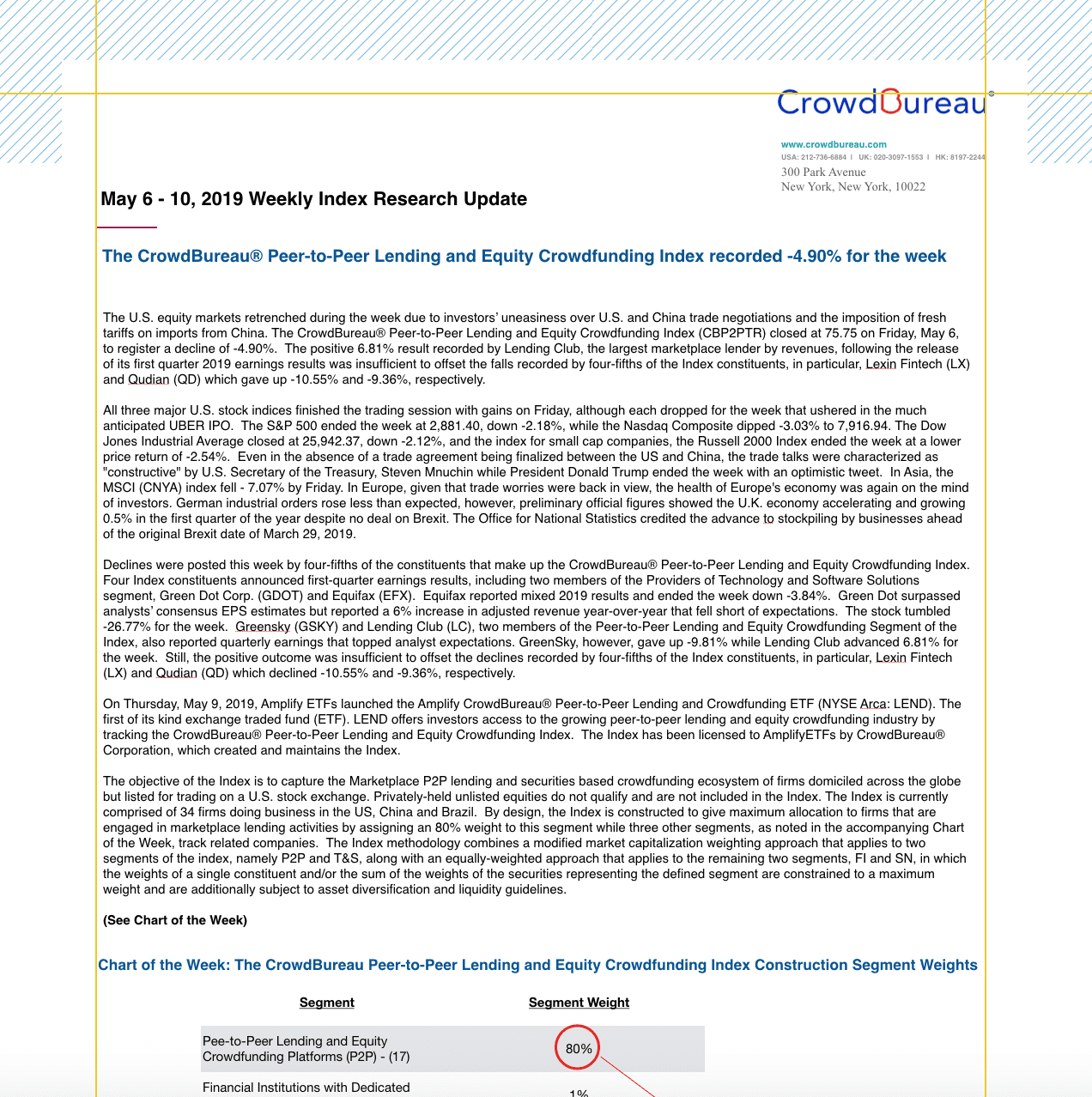

The CrowdBureau®Peer-to-Peer Lending and Equity Crowdfunding Index recorded -4.90% for the week

May 6 – 10, 2019

The U.S. equity markets retrenched during the week due to investors’ uneasiness over U.S. and China trade negotiations and the imposition of fresh tariffs on imports from China. The CrowdBureau®Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) closed at 75.75 on Friday, May 6, to register a decline of -4.90%. The positive 6.81% result recorded by Lending Club, the largest marketplace lender by revenues, following the release of its first quarter 2019 earnings results was insufficient to offset the falls recorded by four-fifths of the Index constituents, in particular, Lexin Fintech (LX) and Qudian (QD) which gave up -10.55% and -9.36%, respectively.

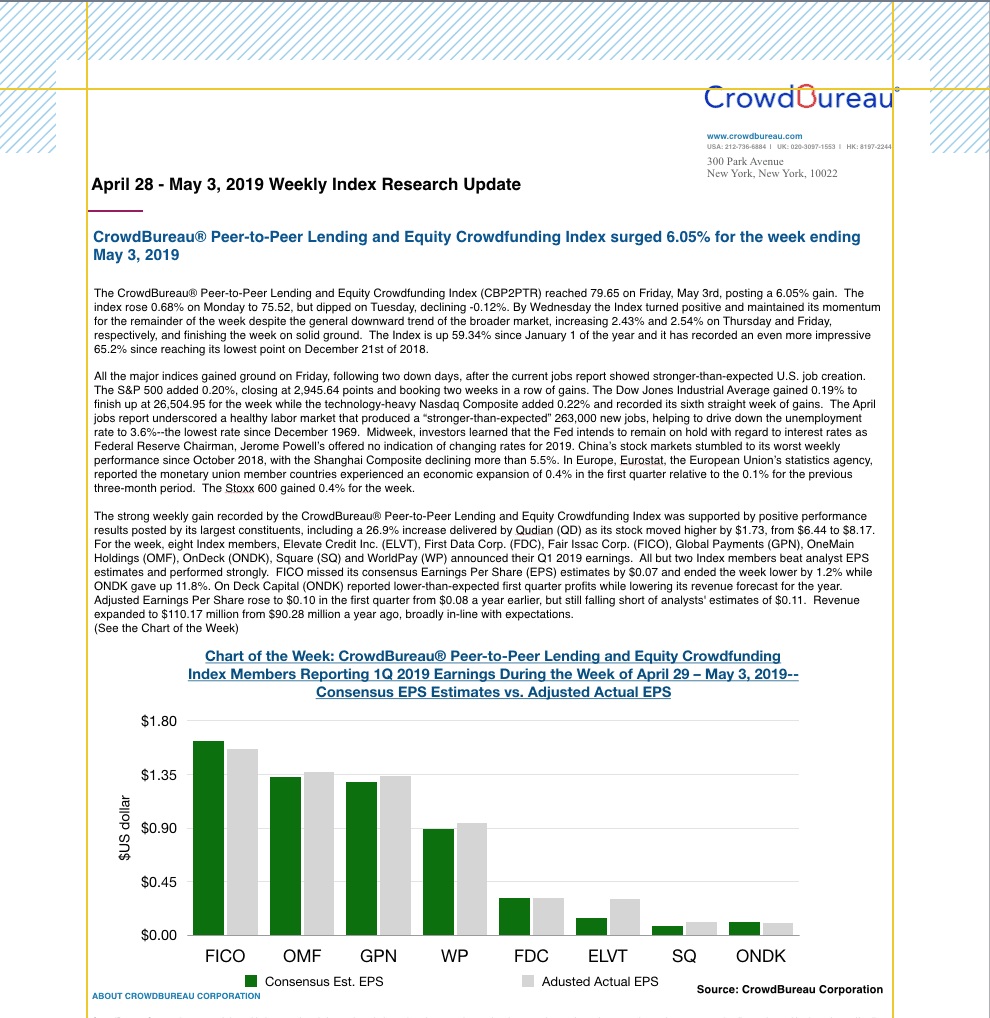

CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index surged 6.05% for the week ending May 3, 2019

April 29 – May 3, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR)reached 79.65 on Friday, May 3rd, posting a 6.05% gain. The index rose 0.68% on Monday to 75.52, but dipped on Tuesday, declining -0.12%. The Index is up 59.34% since January 1 of the year and it has recorded an even more impressive 65.2% since reaching its lowest point on December 21, 2018.

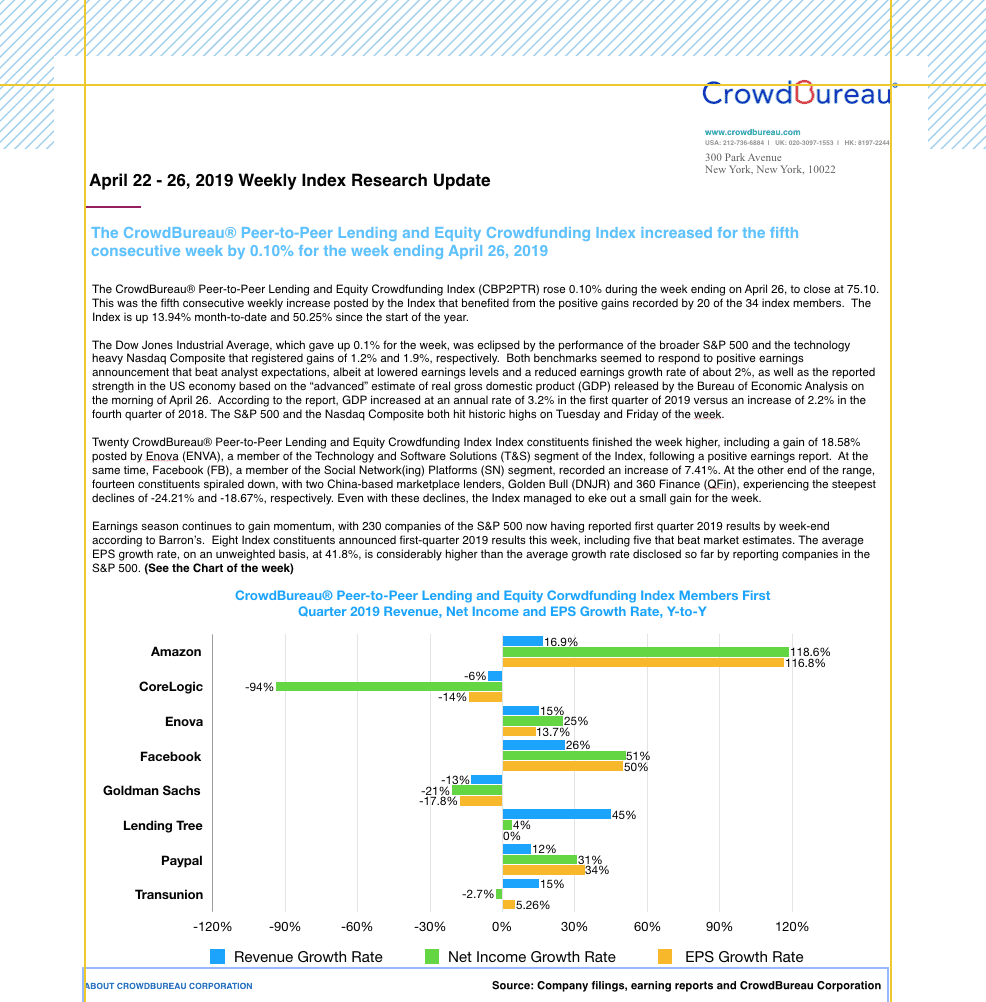

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index increased for the fifth consecutive week by 0.10% for the week ending April 26, 2019

April 22 – 26, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR)rose 0.10% during the week ending on April 26, to close at 75.10. This was the fifth consecutive weekly increase posted by the Index that benefited from the positive gains recorded by 20 of the 34 index members. The Index is up 13.94% month-to-date and 50.25% since the start of the year.

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index increased by 2.69% for the trading week ending April 18, 2019

April 15 – 18, 2019

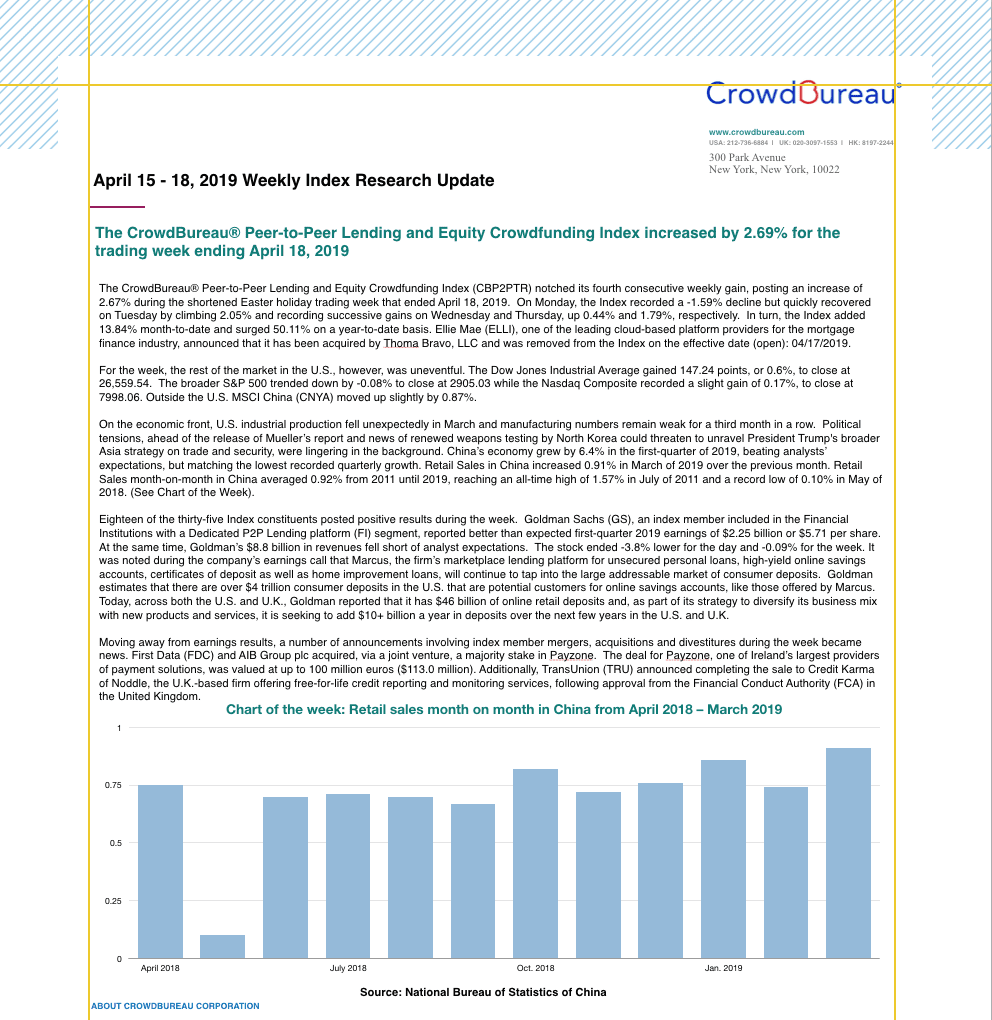

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) notched its fourth consecutive weekly gain, posting an increase of 2.67% during the shortened Easter holiday trading week that ended April 18, 2019. On Monday, the Index recorded a -1.59% decline but quickly recovered on Tuesday by climbing 2.05% and recording successive gains on Wednesday and Thursday, up 0.44% and 1.79%, respectively. In turn, the Index added 13.84% month-to-date and surged 50.11% on a year-to-date basis.

Late week optimism across the markets fueled the CrowdBureau®Peer-to-Peer Lending and Equity Crowdfunding Index performance to gain 3.83%

April 8 – 12, 2019

The CrowdBureau® Peer-to-Peer Lending and Equity Crowdfunding Index (CBP2PTR) recorded a 3.83% gain for the trading week, advancing the value of the index to 73.90 on April 12, 2019. The index started the week with positive daily returns of 2.61% on Monday, it slid back -1.27% and -0.50% through mid-week but gained forward momentum with Friday’s surge of 2.25%. The weekly gain elevated the Index month-to-date results to 10.88% while the year-to-date total return climbed higher to 46.20%.

Starting the second quarter, the CrowdBureau®Peer-to-Peer Lending and Equity Crowdfunding Index climbs steadily higher to 6.63% for the week ending April 5, 2019

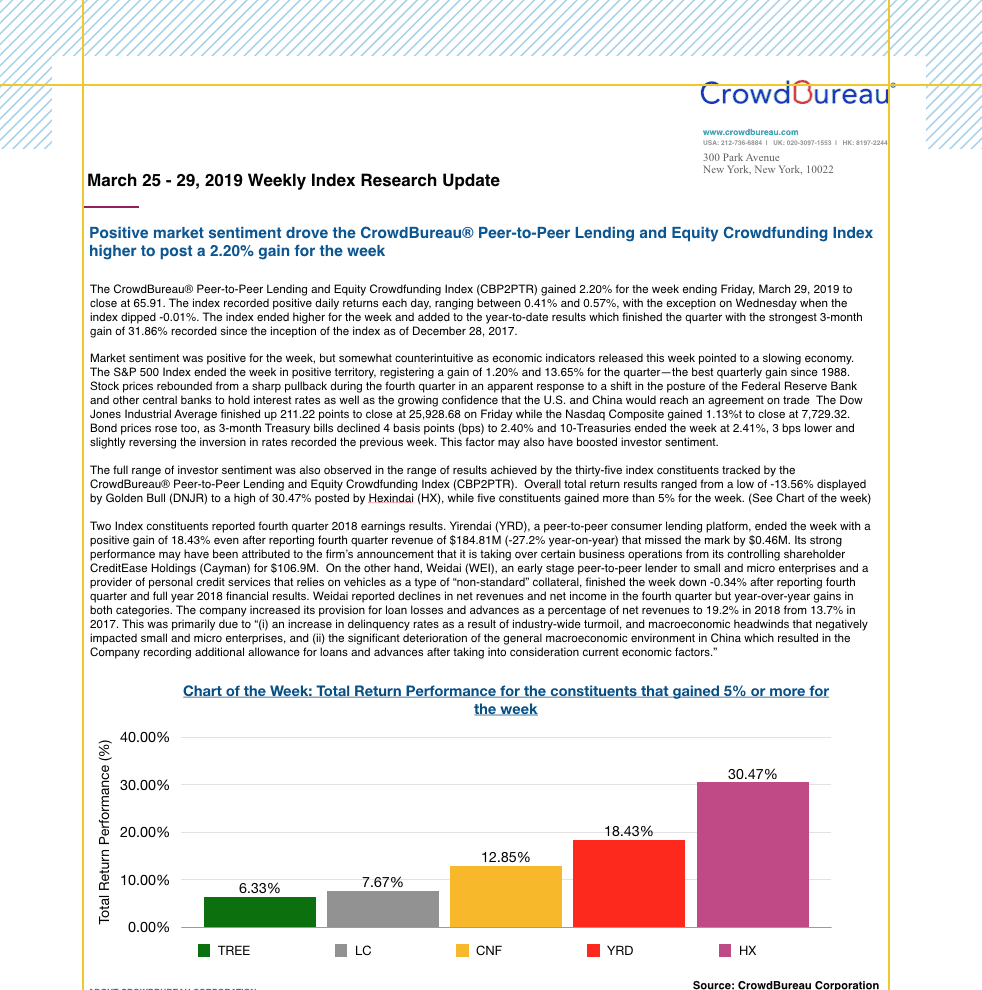

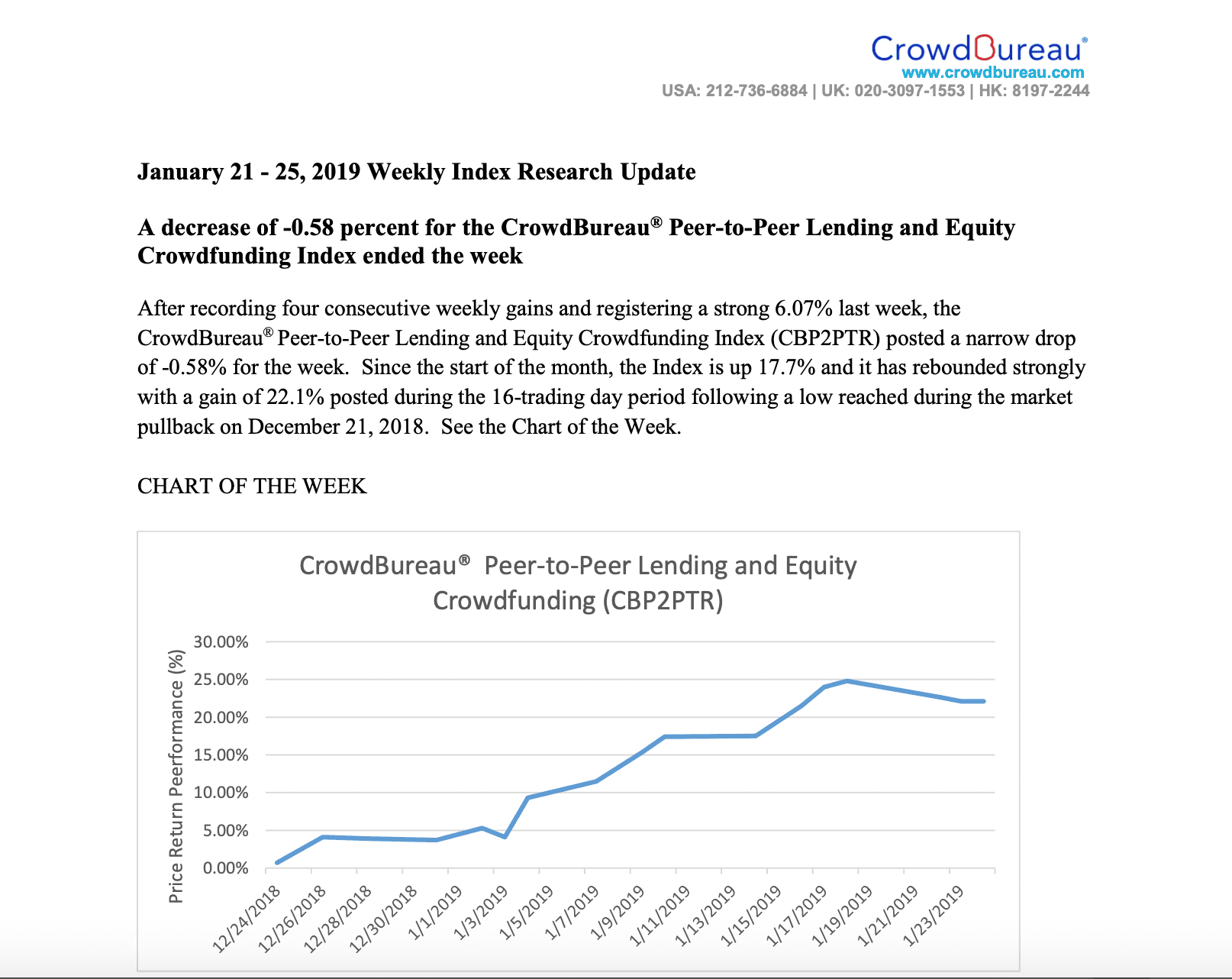

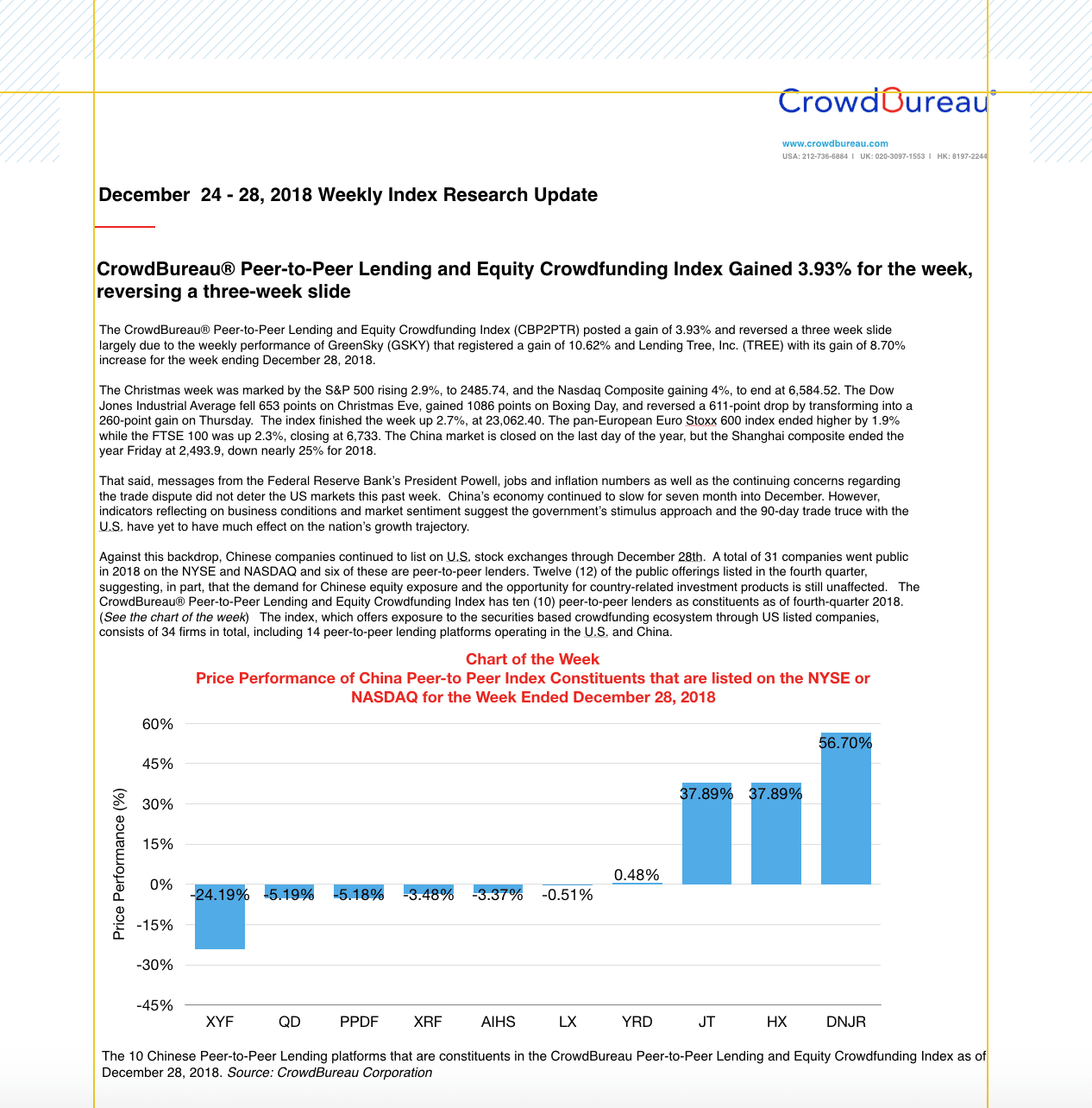

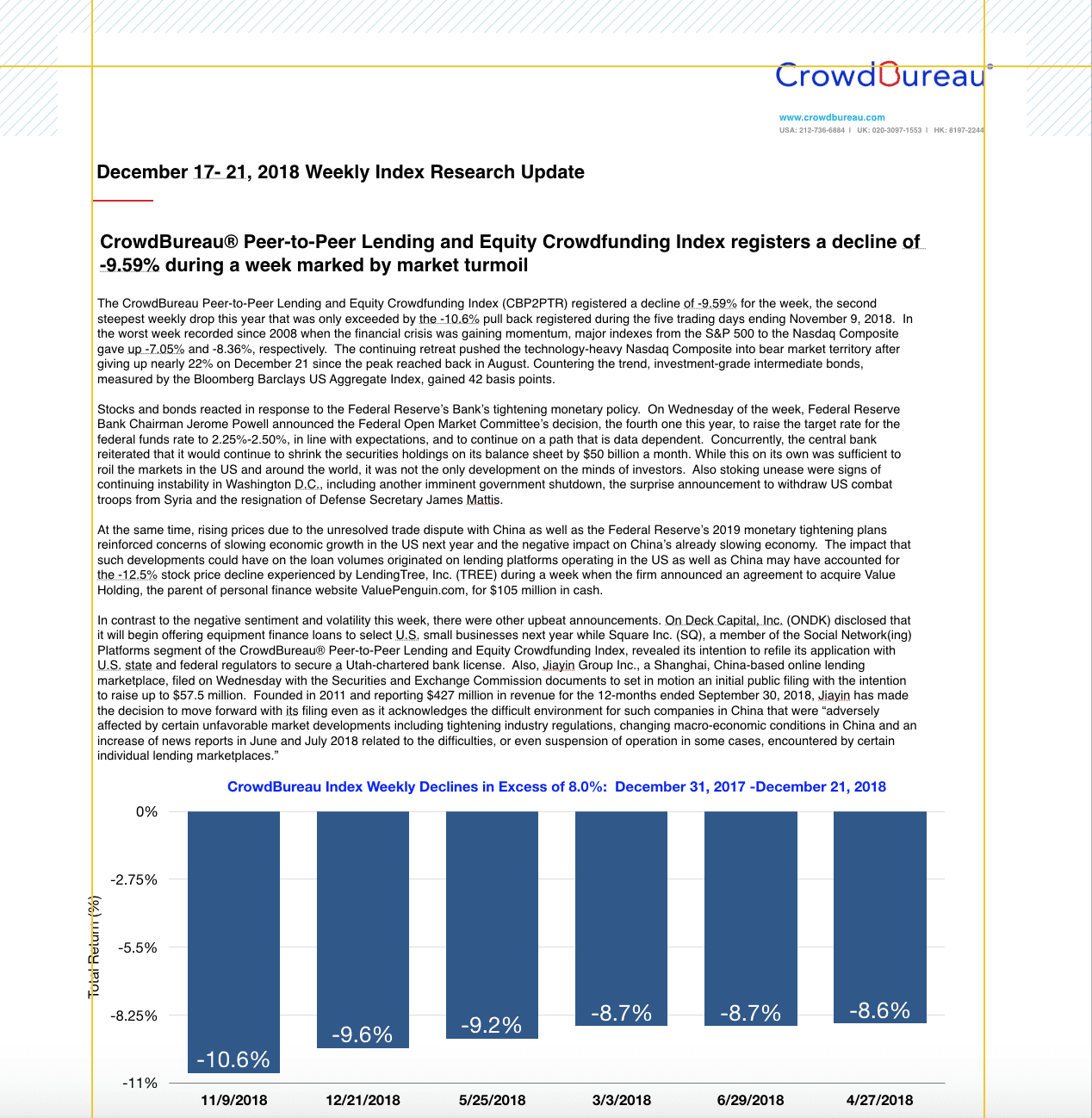

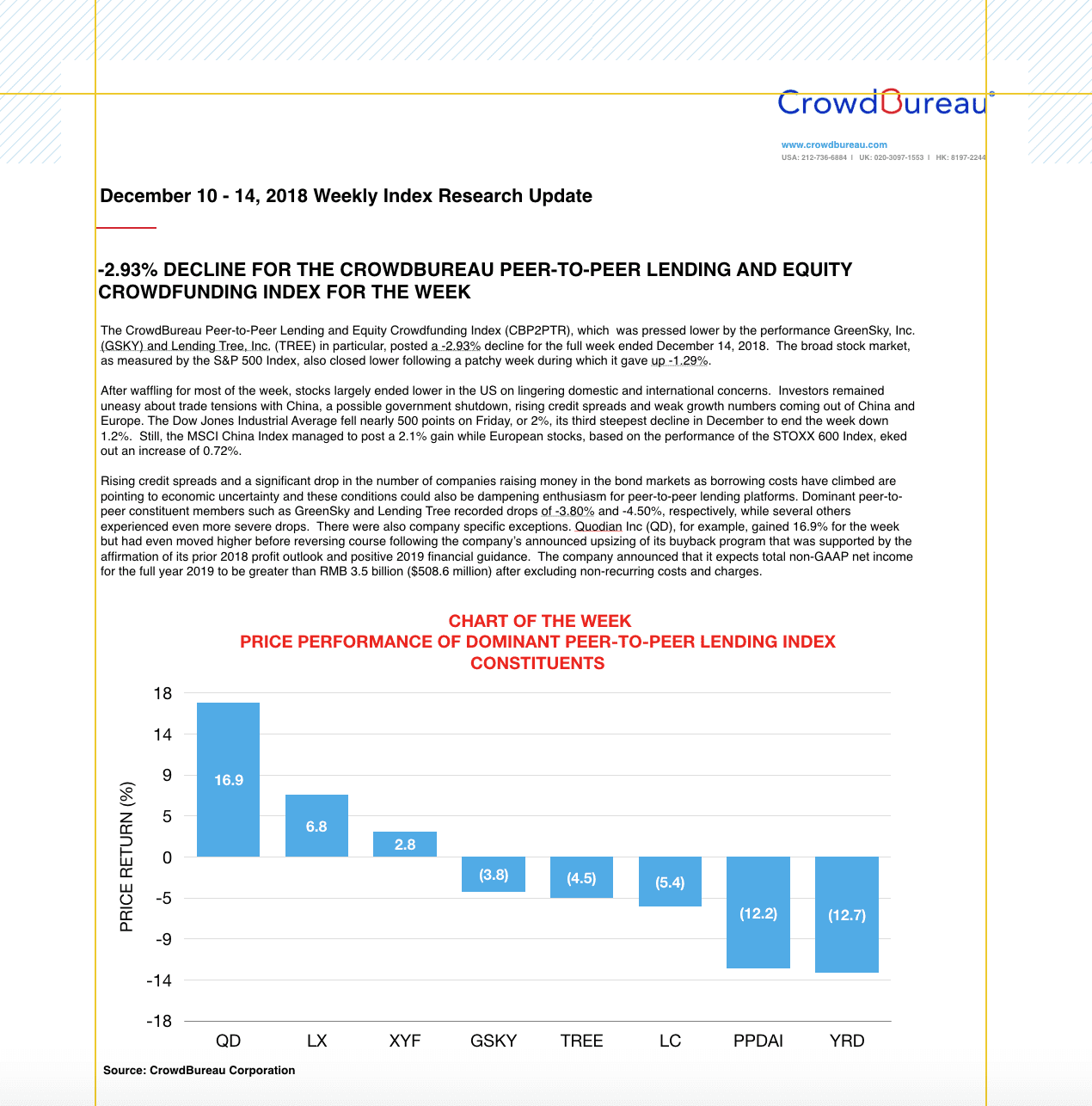

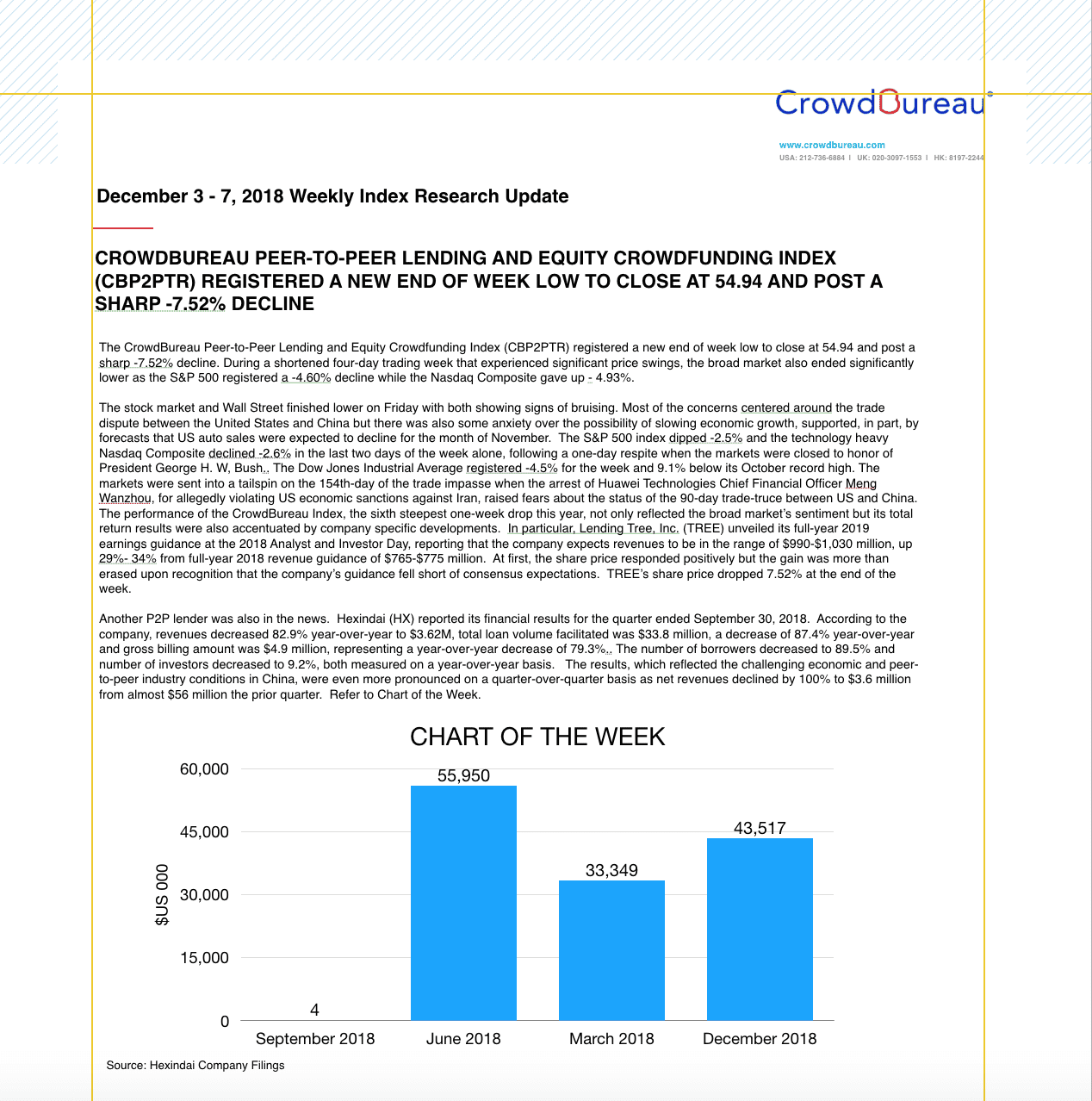

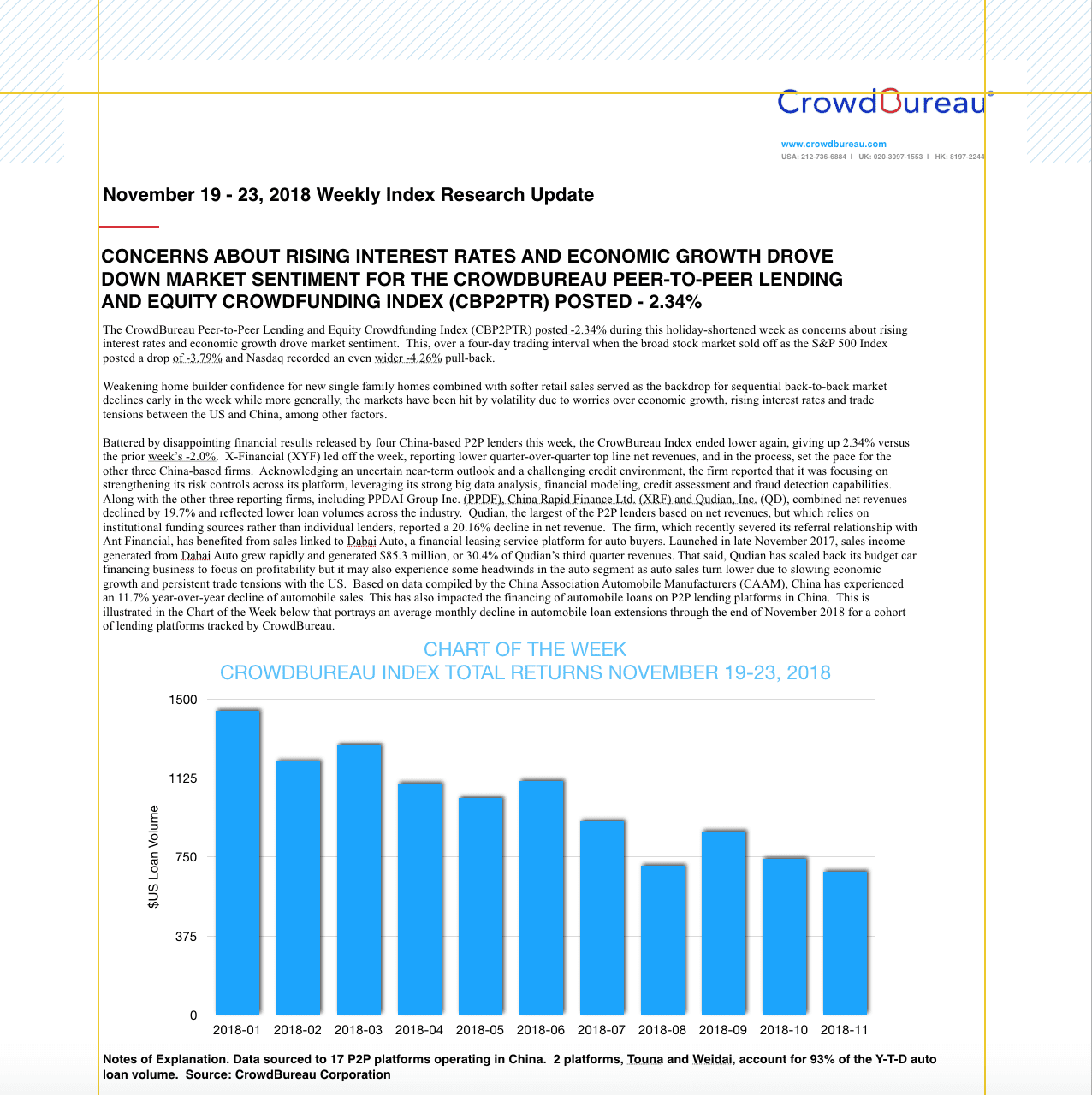

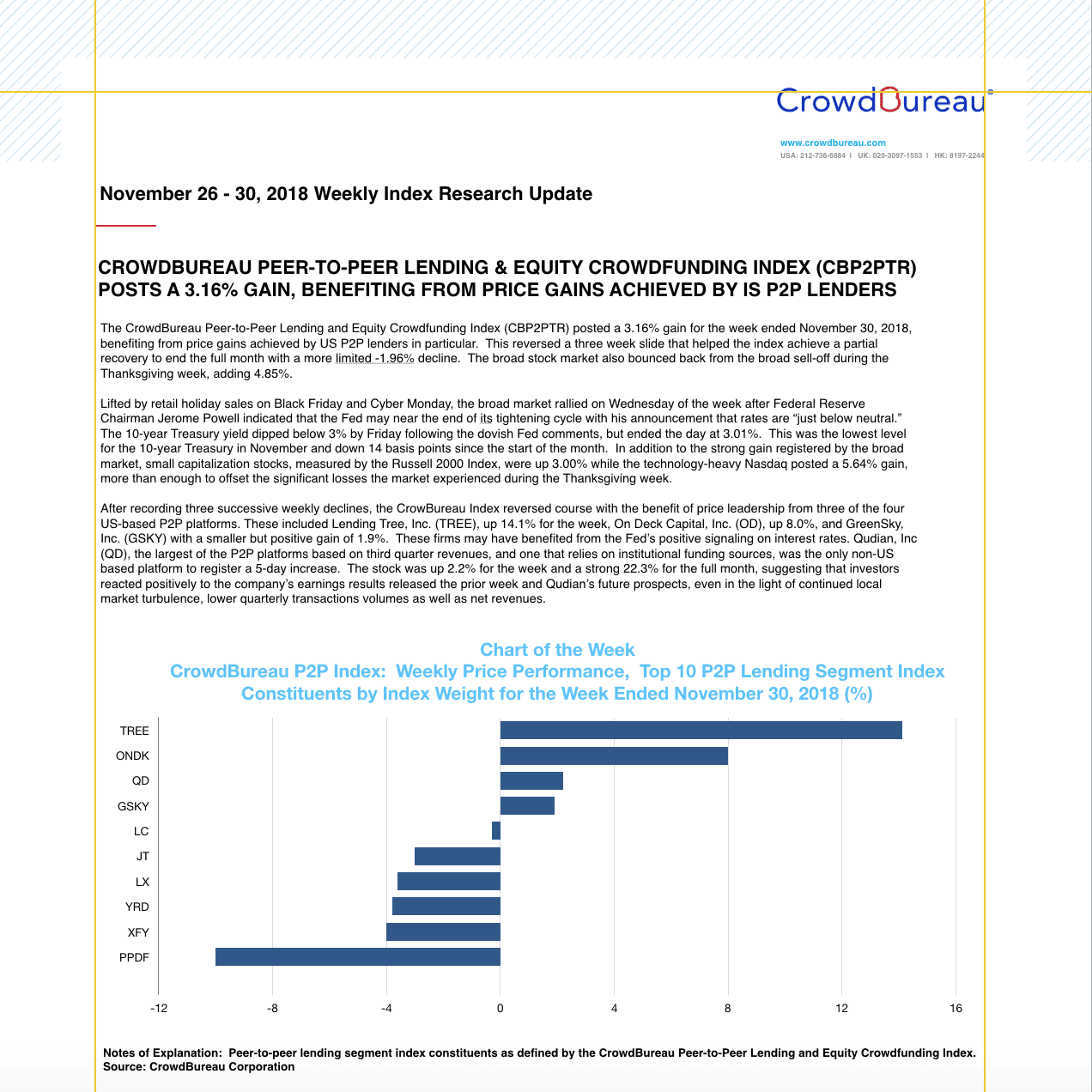

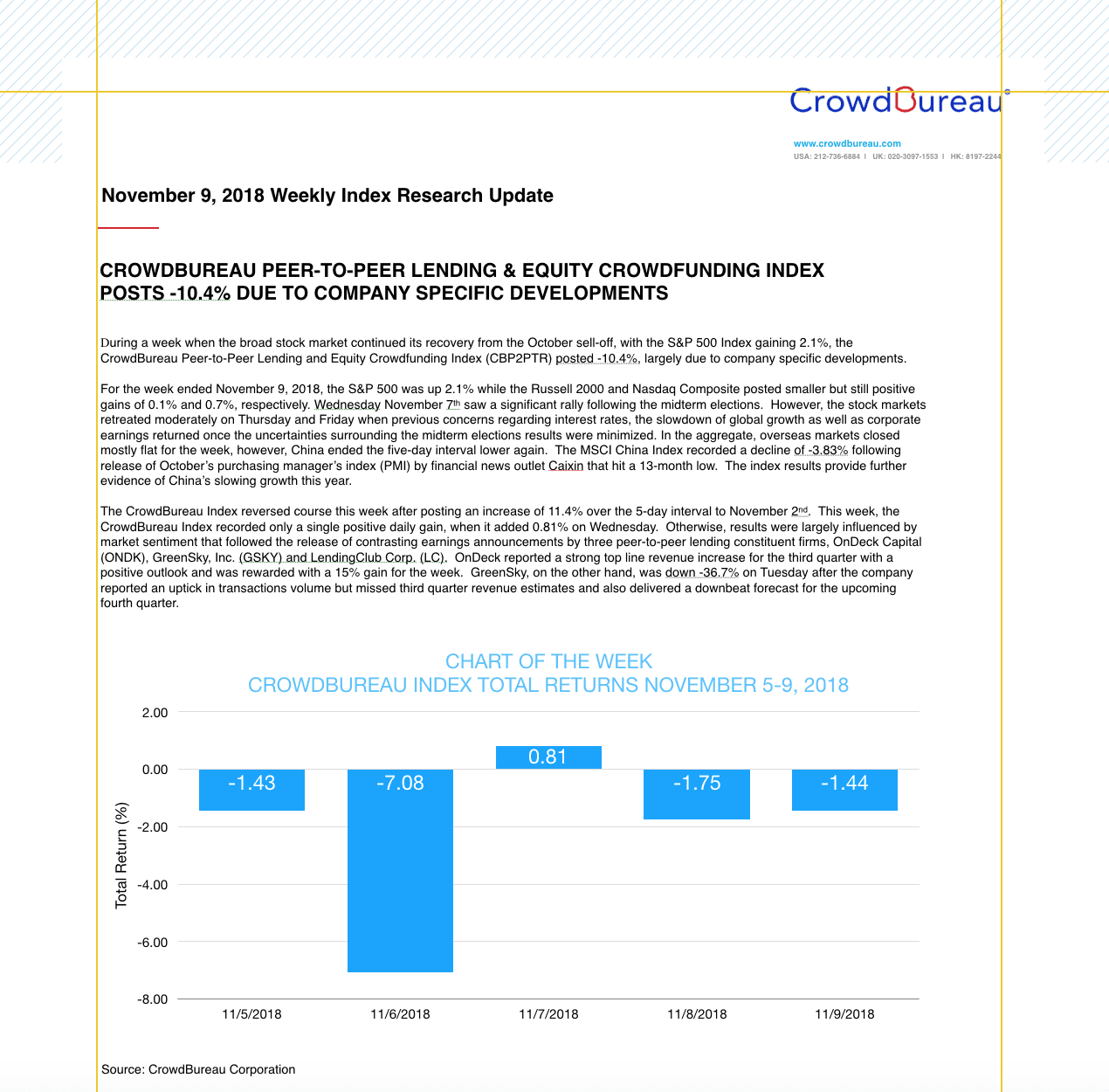

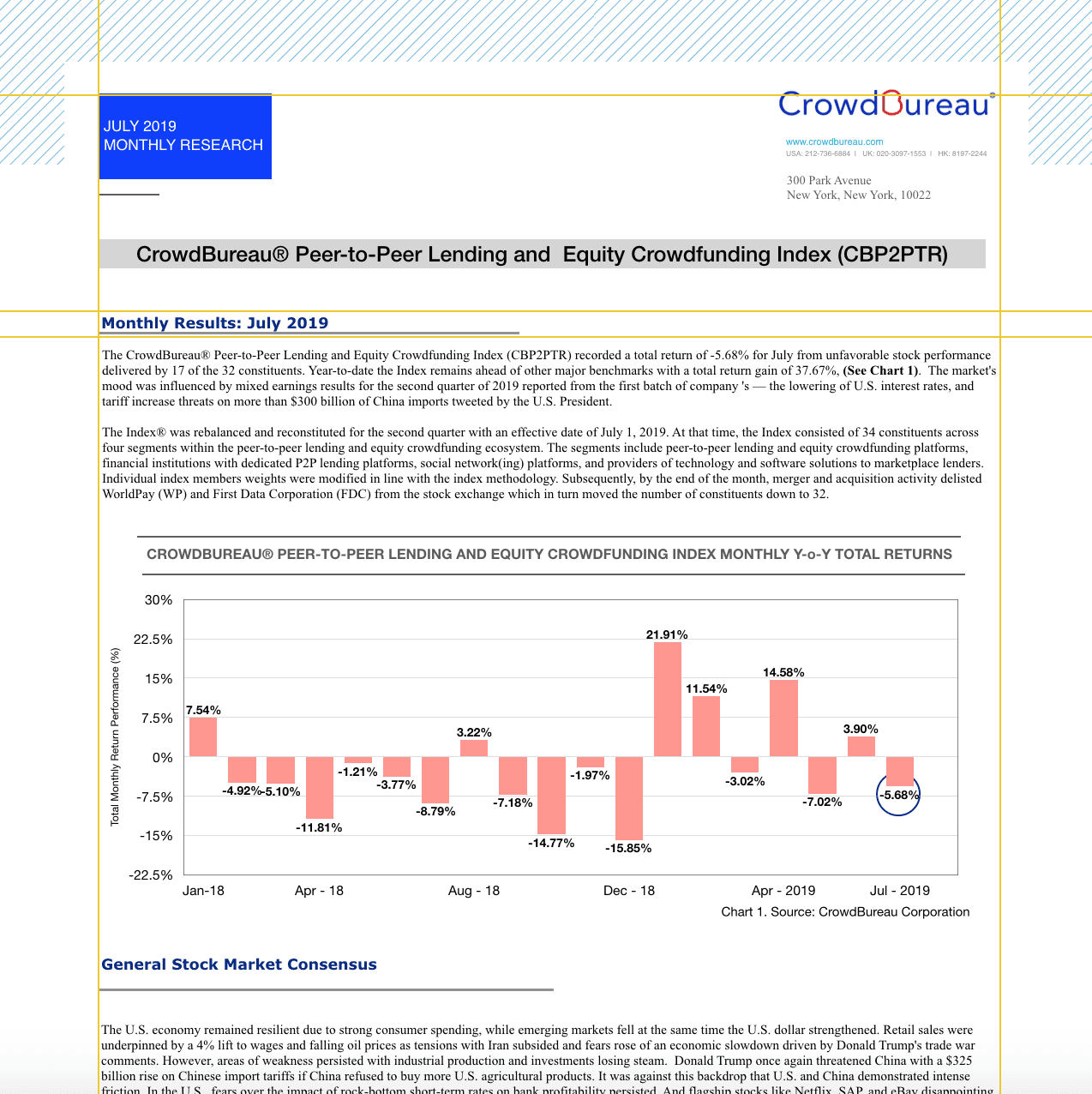

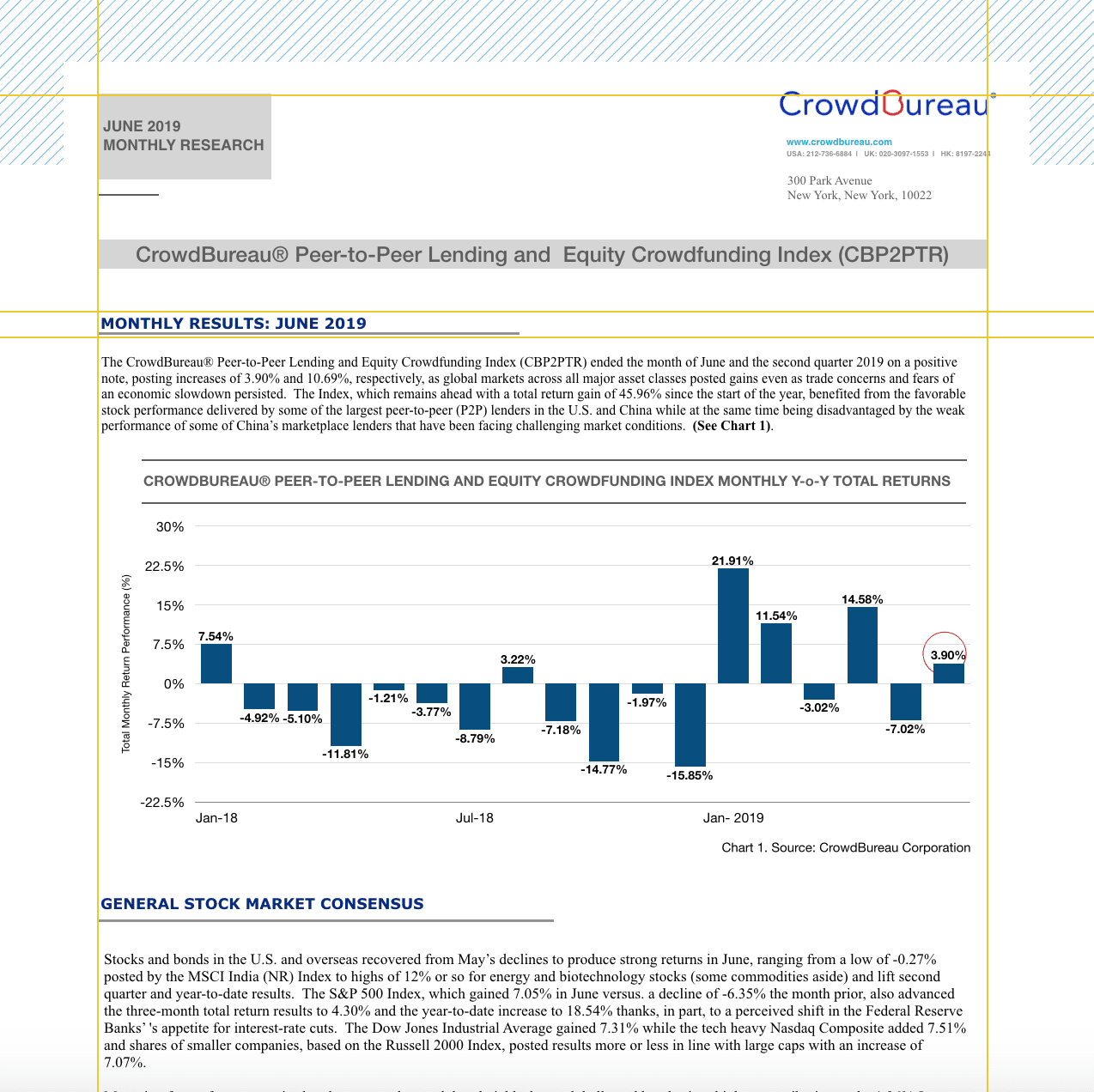

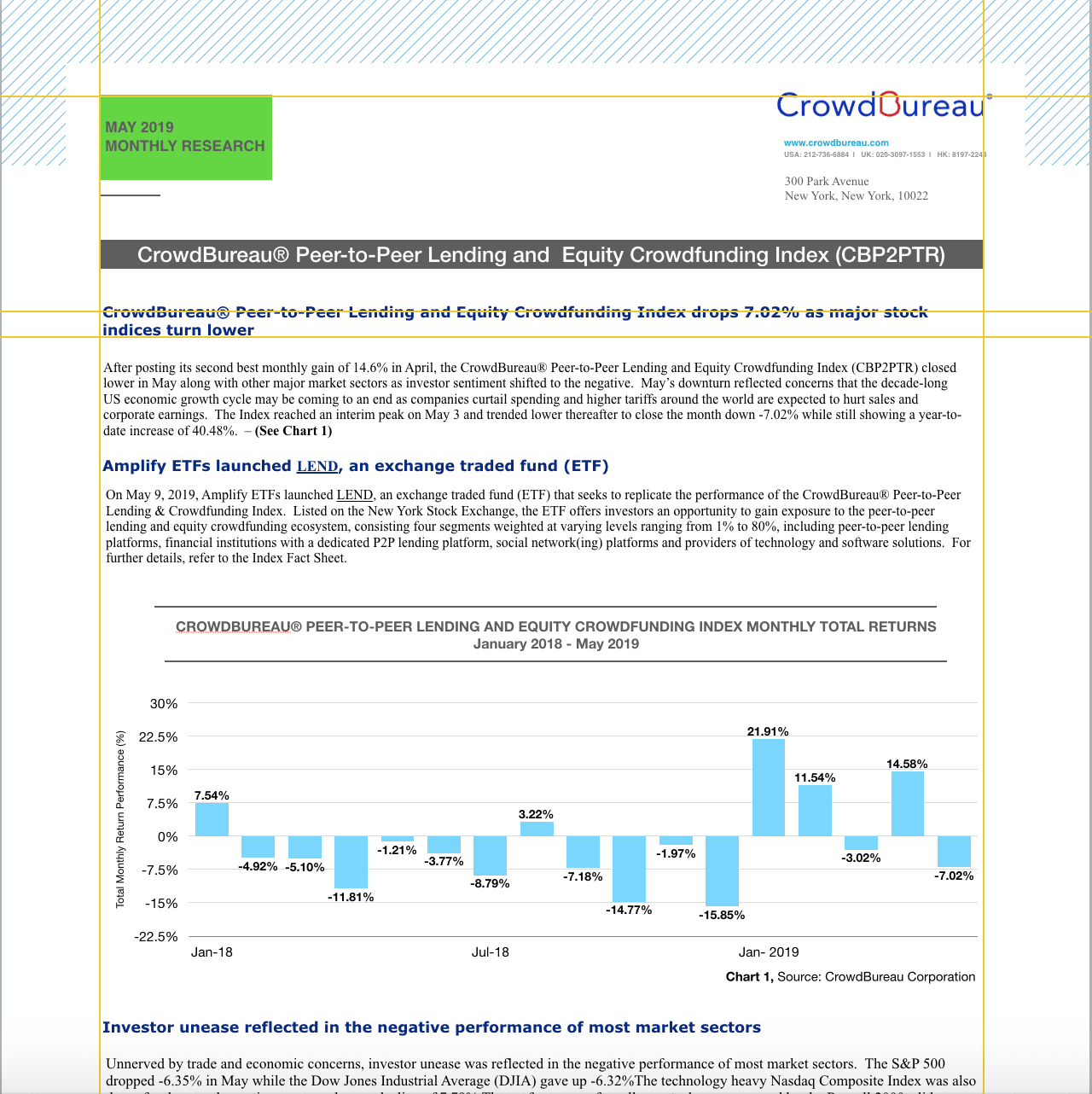

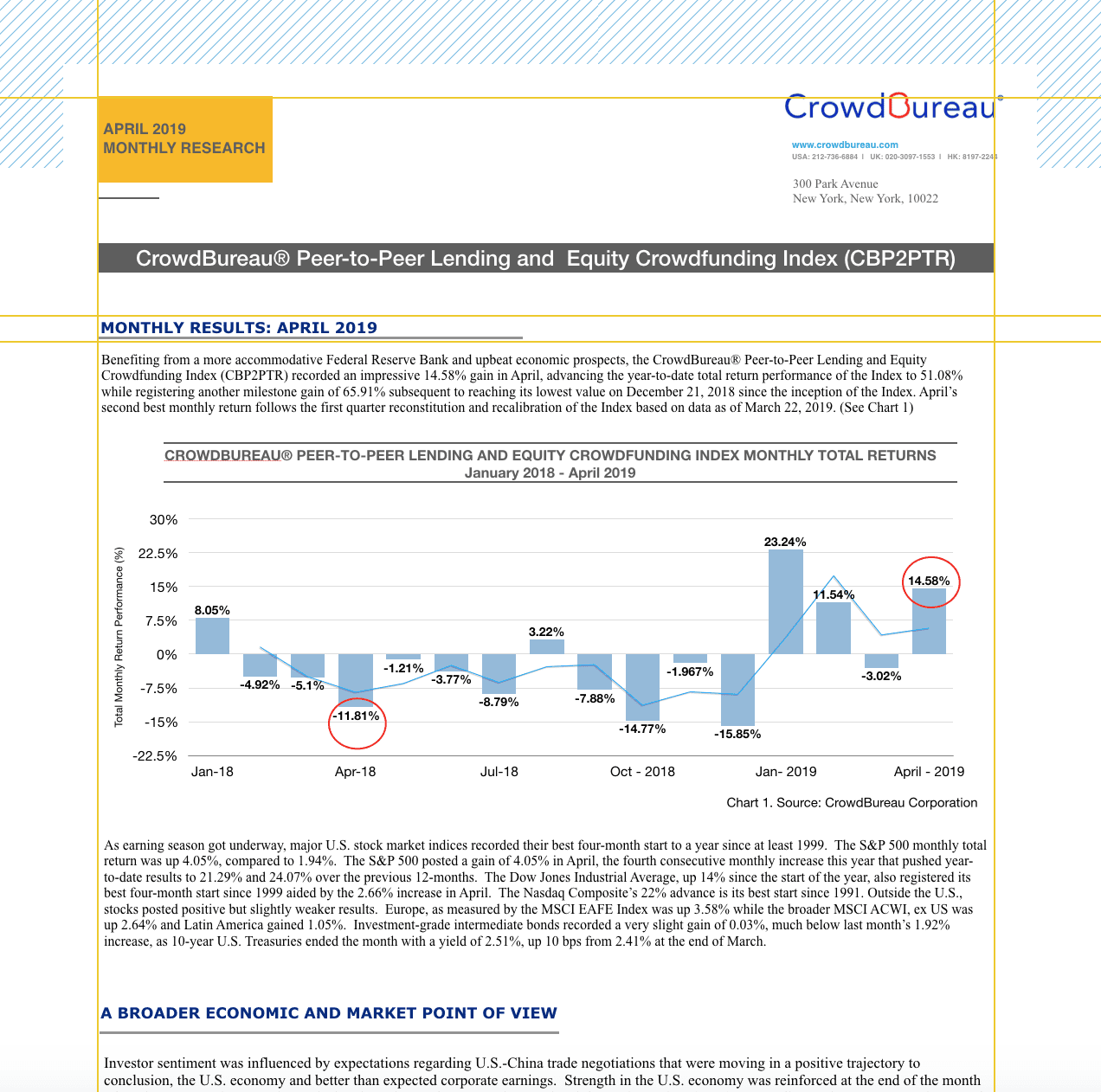

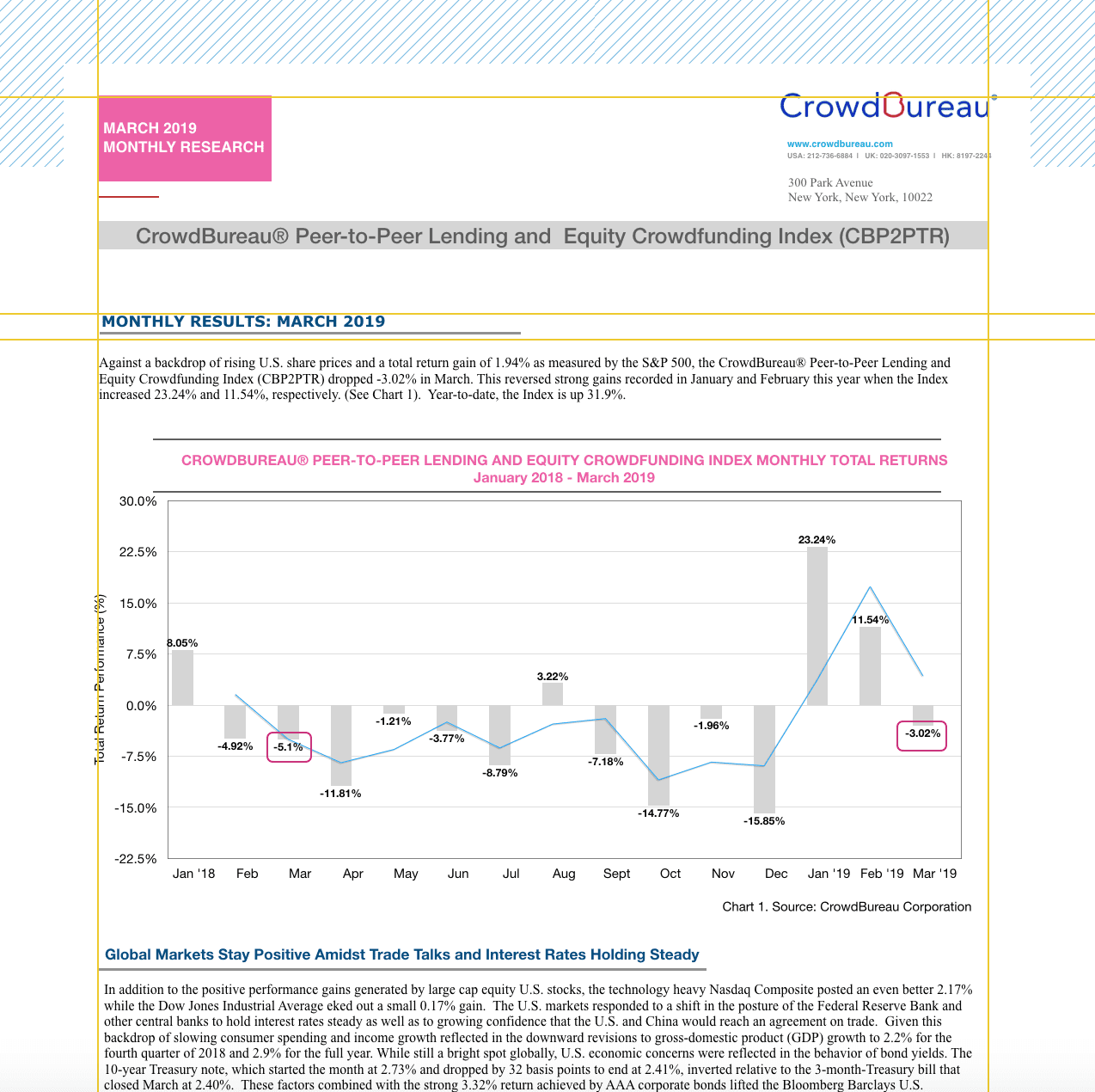

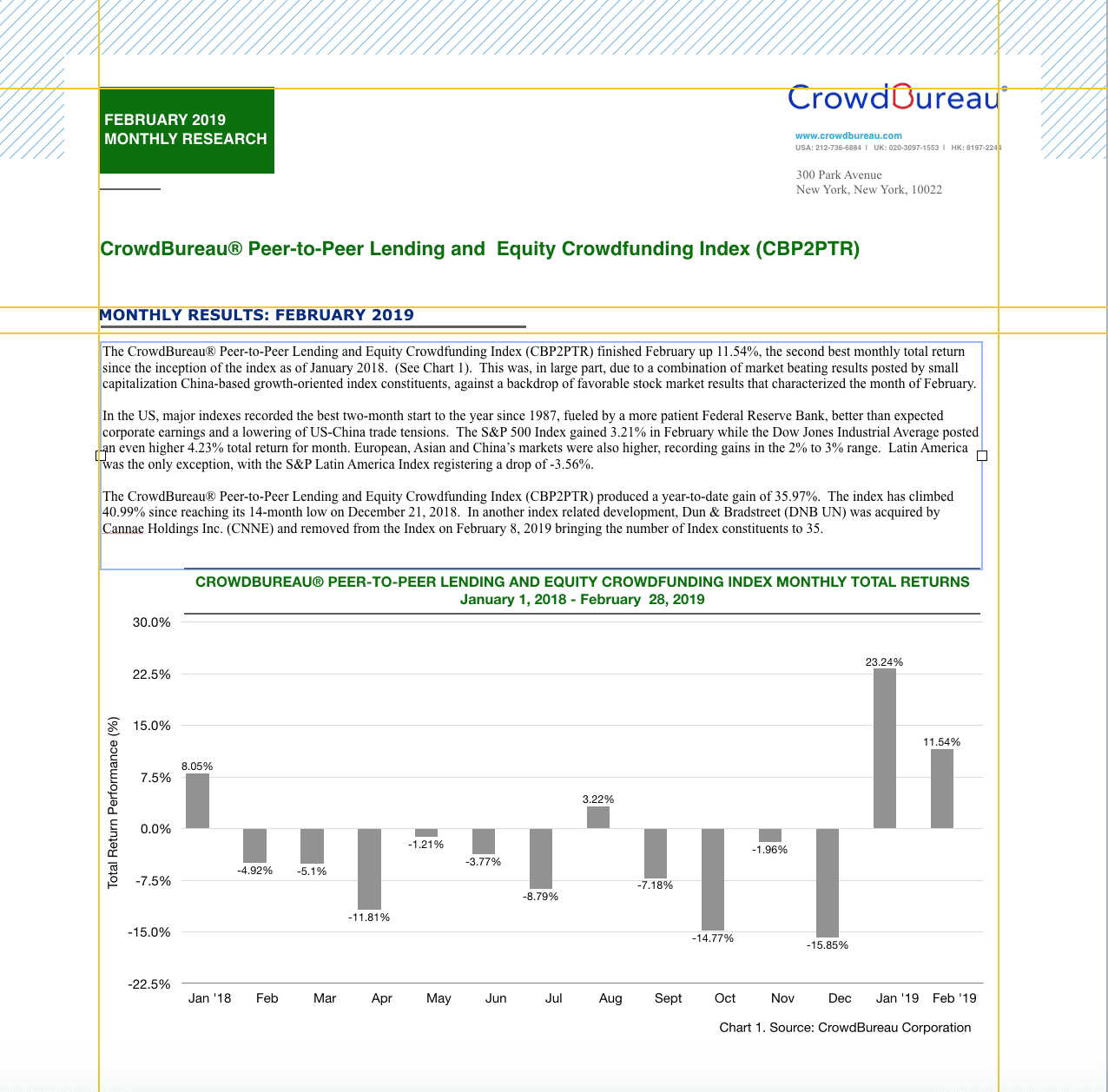

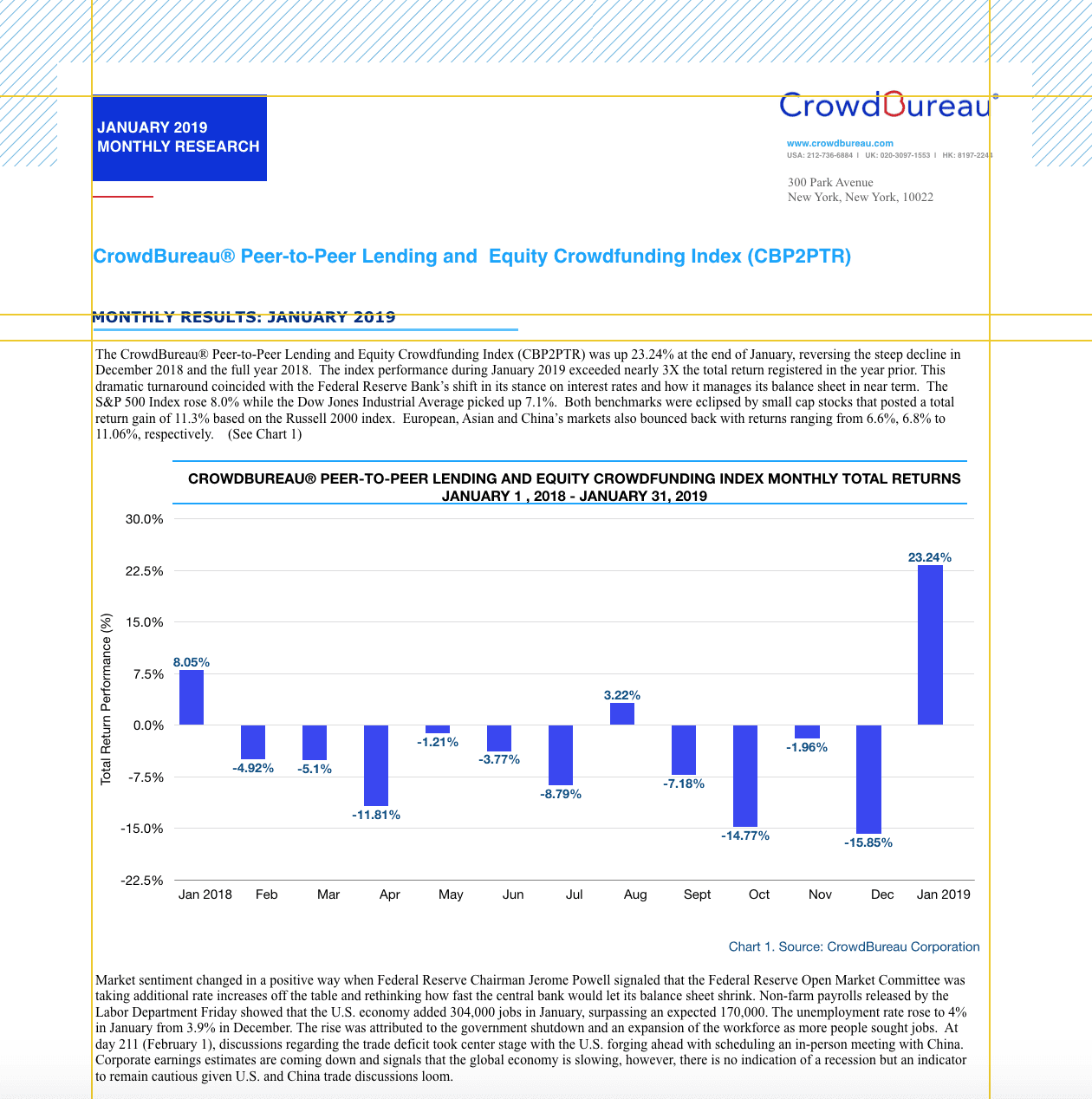

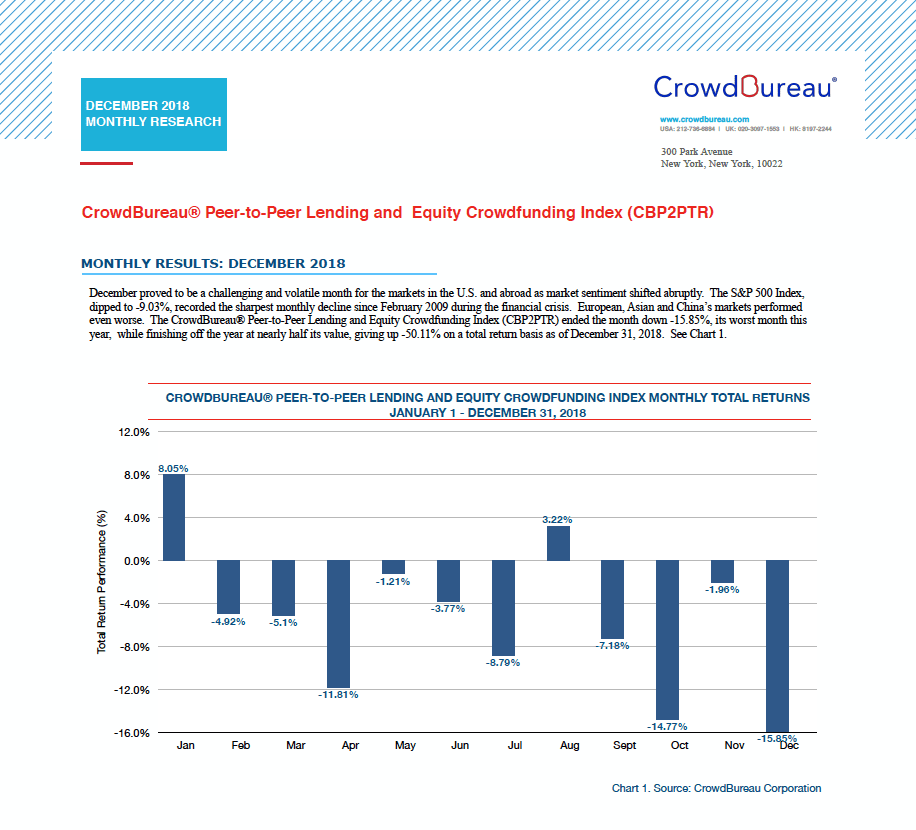

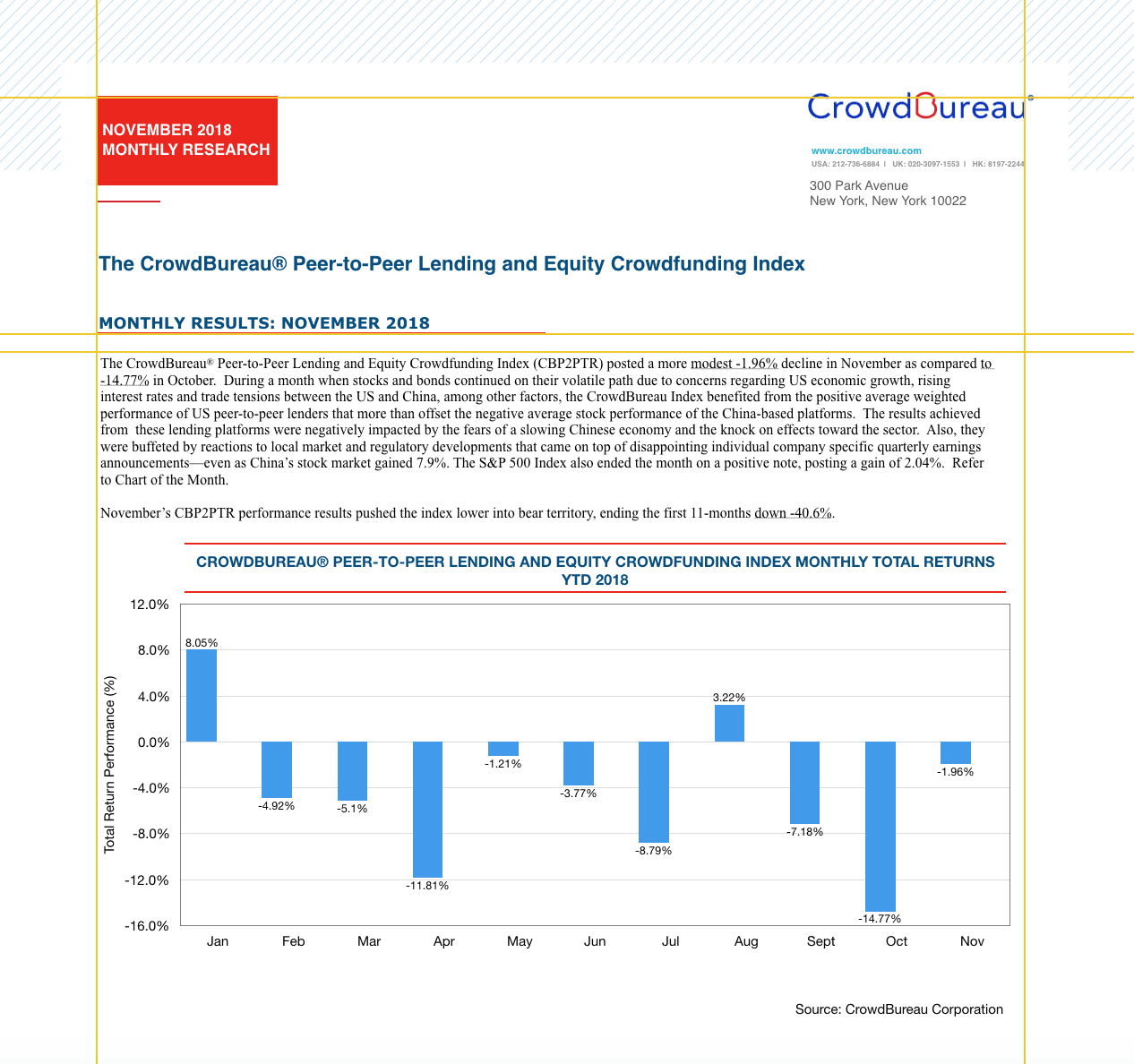

April 1 -5, 2019