CrowdBureau Online Lending and

Disclosure: The information provided on this page is for illustrative purposes only and is not intended to serve as investment advice. The information provided is as of a particular time and subject to change at any time without notice.

INDEX DEFINITION

The CrowdBureau® P2P Online Lending and Digital Banking Index (“Index”) seeks to capture the peer-to-peer online lending and digital banking ecosystem by tracking the price and total return performance of publicly traded firms domiciled across the globe but listed for trading in the United States (“U.S.”), including common stock, American Depository Receipts (“ADRs”), American Depositary Shares (“ADSs”) and Global Depositary Receipts (“GDRs). The Index is designed to be used as the underlying index for financial products such as exchange traded funds and managed account platforms.

The Index is a rules-based stock index owned, developed and maintained by CrowdBureau Corporation (“CrowdBureau” or the “Index Provider”). In seeking to provide broad exposure to this emerging portion of the economy, the Index is devised to provide exposure to not only those companies that operate online lending platforms that facilitate peer-to-peer lending, but also U.S. financial institutions with a digital lending platform, social networking platforms and providers of technology and software solutions. Together these firms comprise the peer-to-peer online lending and digital banking ecosystem.

INDEX TRENDS

INDEX RESEARCH

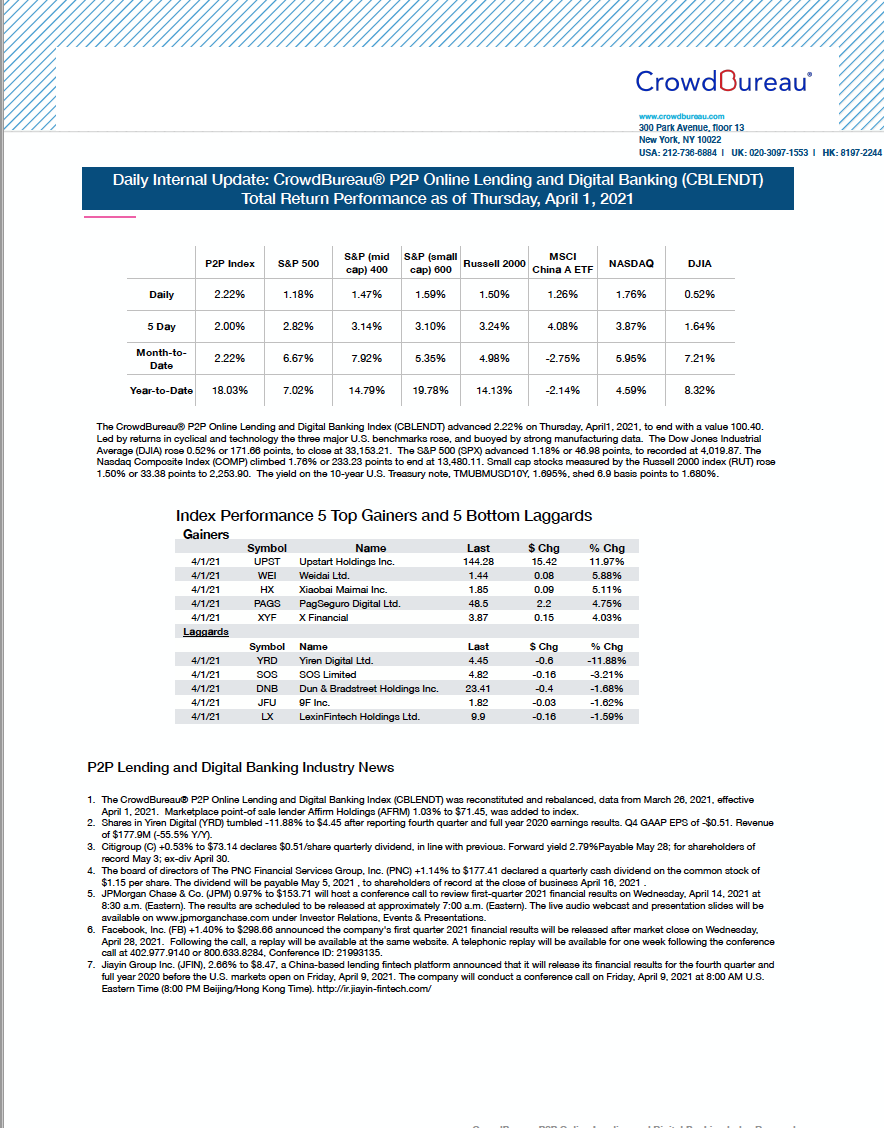

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) advanced +2.22%

April 1, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) advanced 2.22% on Thursday, April 1, 2021, to end with a value 100.40. Led by returns in cyclical and technology the three major U.S. benchmarks rose, and buoyed by strong manufacturing data.

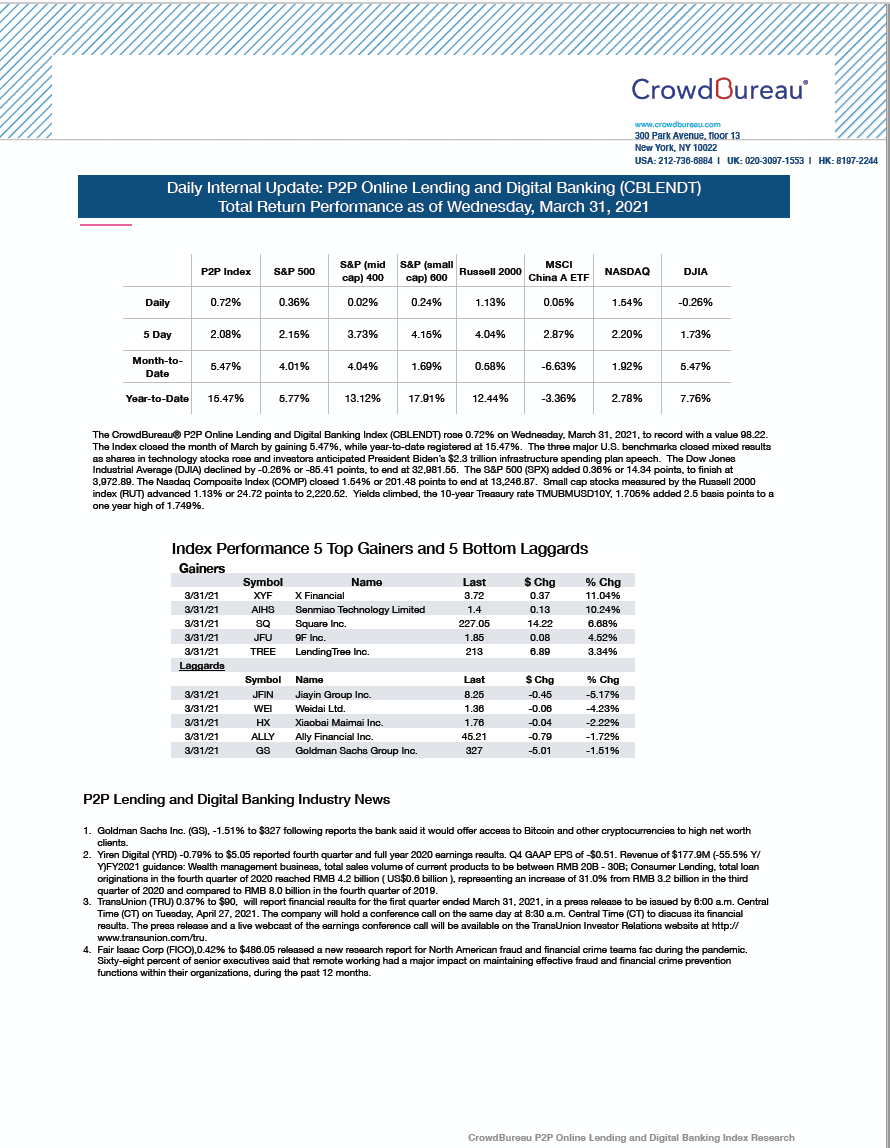

The CrowdBureau® P2P Online Lending and Digital Banking (CBLENDT) closed higher, rising +0.72% to end the session

March 31, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) rose 0.72% on Wednesday, March 31, 2021, to record with a value 98.22. The Index closed the month of March by gaining 5.47%, while year-to-date registered at 15.47%. The three major U.S. benchmarks closed mixed results as shares in technology stocks rose and investors anticipated President Biden’s $2.3 trillion infrastructure spending plan speech.

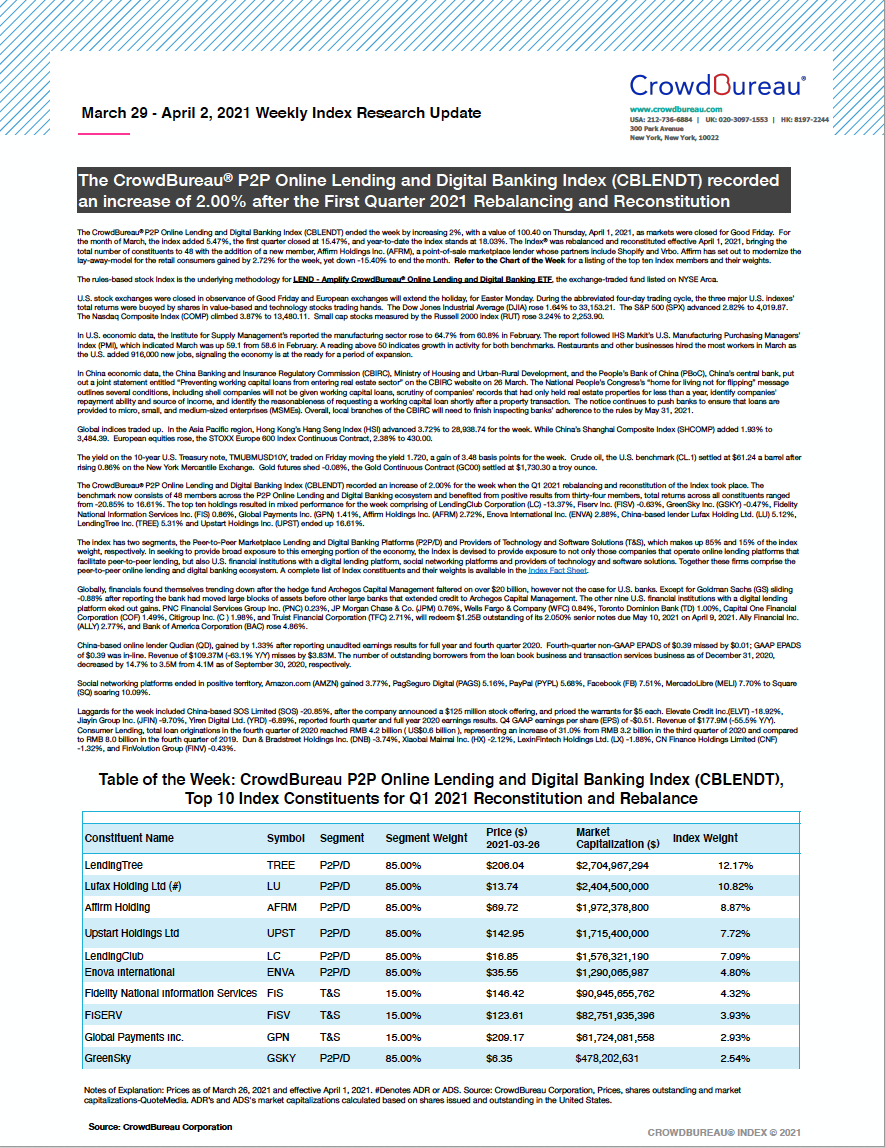

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) recorded an increase of 2.00% after the First Quarter 2021 Rebalancing and Reconstitution

March 29 – April 2, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) ended the week by increasing 2%, with a value of 100.40 on Thursday, April 1, 2021, as markets were closed for Good Friday. For the month of March, the index added 5.47%, the first quarter closed at 15.47%, and year-to-date the index stands at 18.03%. The Index® was rebalanced and reconstituted effective April 1, 2021, bringing the total number of constituents to 48 with the addition of a new member, Affirm Holdings Inc. (AFRM), a point-of-sale marketplace lender gained by 2.72% for the week, yet down -15.40% to end the month. Refer to the Chart of the Week for a listing of the top ten Index members and their weights.

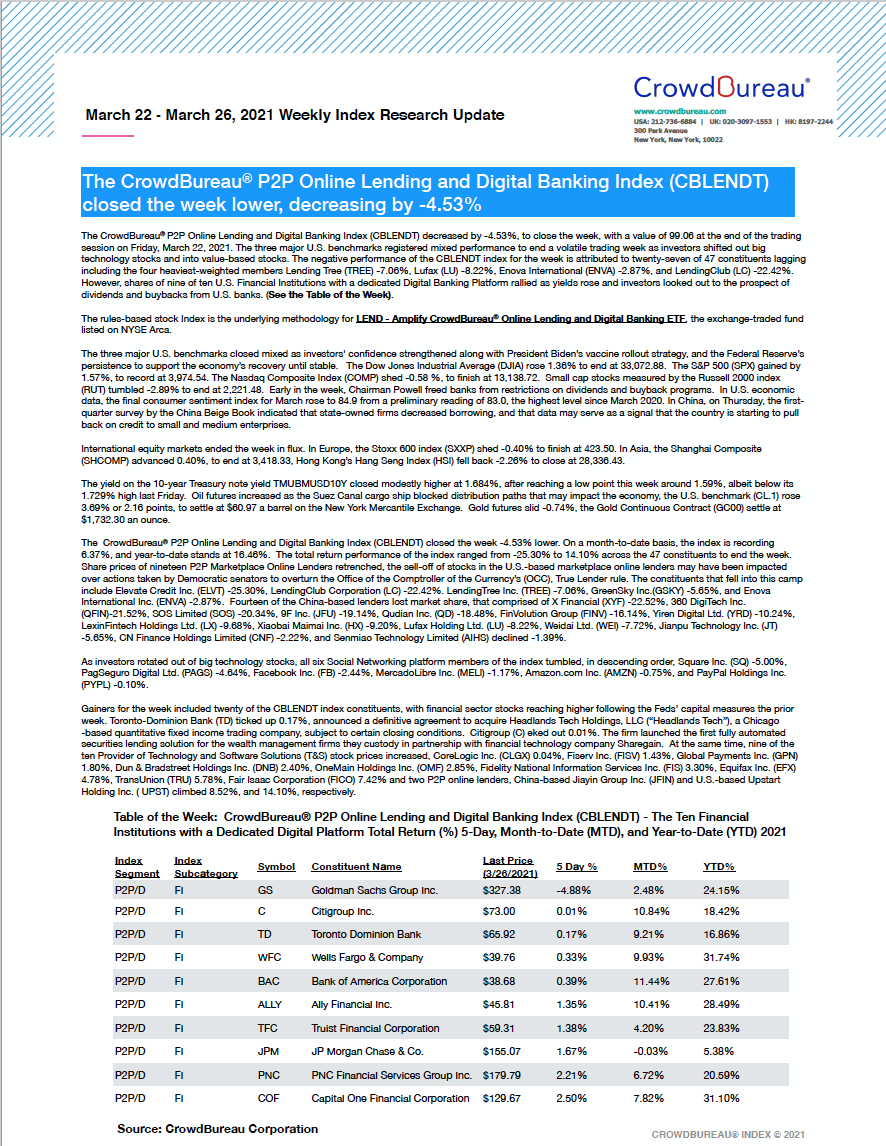

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) closed the week lower, decreasing by -4.53%

March 22 – March 26, 2021

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) decreased by -4.53%, to close the week, with a value of 99.06 at the end of the trading session on Friday, March 22, 2021. The three major U.S. benchmarks registered mixed performance to end a volatile trading week as investors shifted out big technology stocks and into value-based stocks. The negative performance of the CBLENDT index for the week is attributed to twenty-seven of 47 constituents lagging including the four heaviest-weighted members Lending Tree (TREE) -7.06%, Lufax (LU) -8.22%, Enova International (ENVA) -2.87%, and LendingClub (LC) -22.42%. However, shares of nine of ten U.S. Financial Institutions with a dedicated Digital Banking Platform rallied as yields rose and investors looked out to the prospect of dividends and buybacks from U.S. banks. (See the Table of the Week).

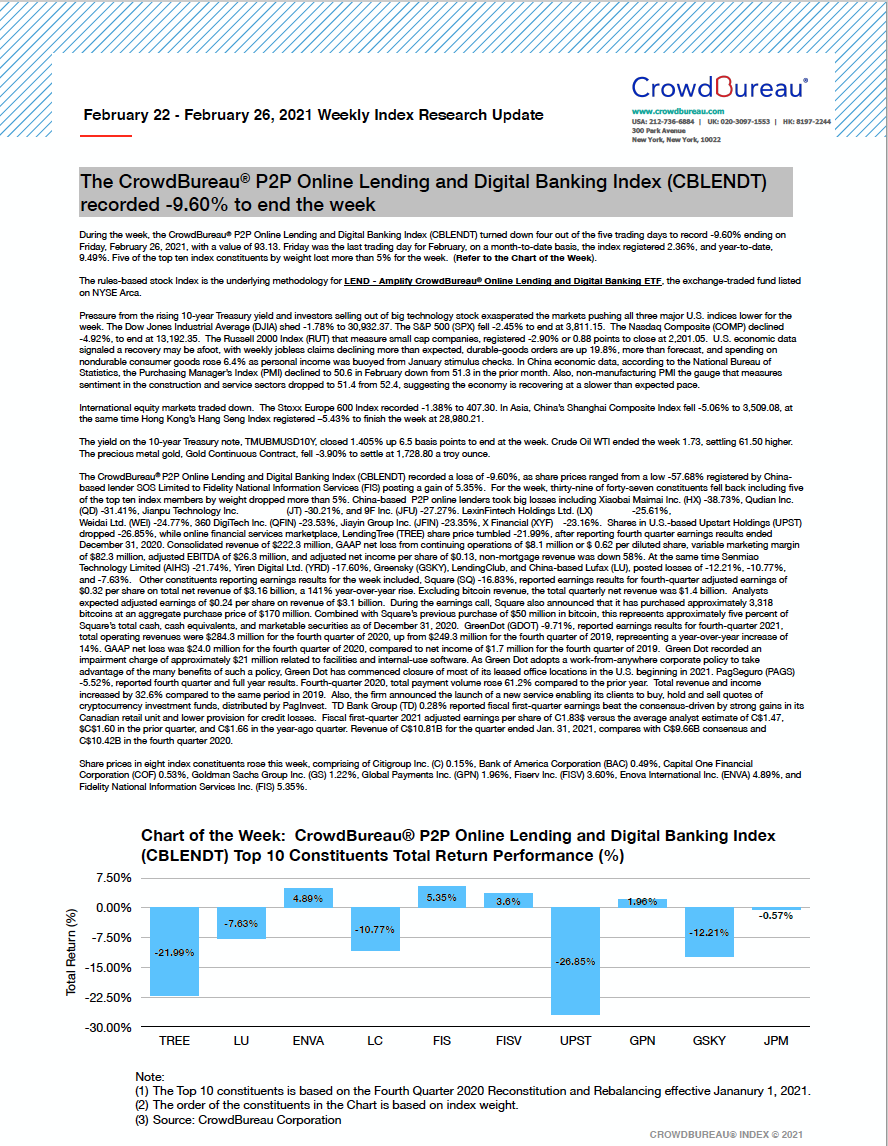

The CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) recorded -9.60% to end the week

February 22 – February 26, 2021

During the week, the CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) turned down four out of the five trading days to record -9.60% ending on Friday, February 26, 2021, with a value of 93.13. Friday was the last trading day for February, on a month-to-date basis, the index registered 2.36%, and year-to-date, 9.49%. Five of the top ten index constituents by weight lost more than 5% for the week. (Refer to the Chart of the Week).

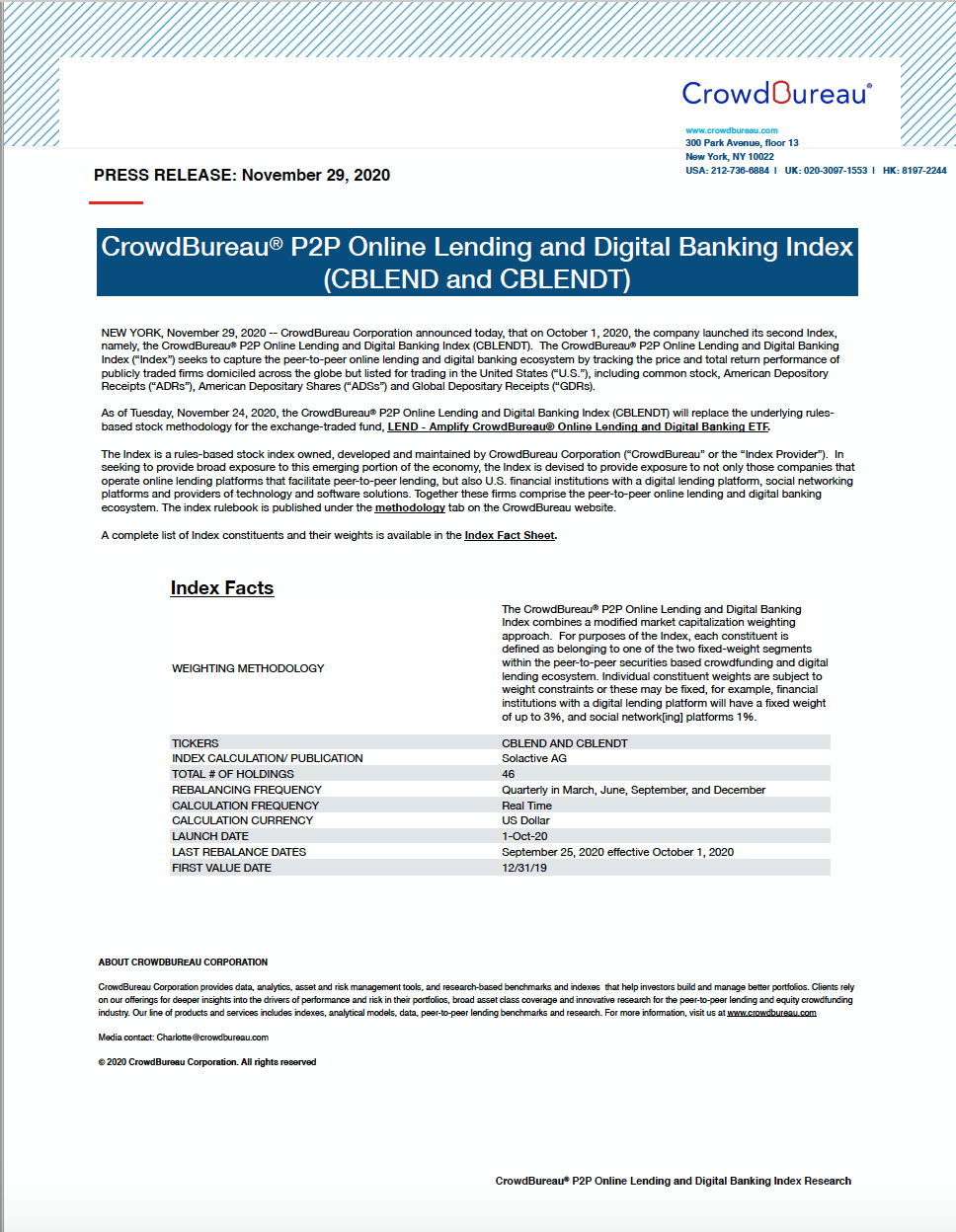

Press Release: CrowdBureau® P2P Online Lending and Digital Banking Index (CBLEND and CBLENDT)

November 29, 2020

NEW YORK, November 29, 2020 — CrowdBureau Corporation announced today, that on October 1, 2020, the company launched its second Index, namely, the CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT). As of Tuesday, November 24, 2020, the CrowdBureau® P2P Online Lending and Digital Banking Index (CBLENDT) will replace the underlying rules-based stock methodology for the exchange-traded fund, LEND – Amplify CrowdBureau® Online Lending and Digital Banking ETF.